TIDMPIP

RNS Number : 8454H

PipeHawk PLC

29 November 2022

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 (which forms

part of domestic UK law pursuant to the European Union (Withdrawal)

Act 2018) ("MAR"). With the publication of this announcement via a

Regulatory Information Service, this inside information is now

considered to be in the public domain.

29 November 2022

PipeHawk plc

("PipeHawk", "Company" or the "Group")

Final Results for the year ended 30 June 2022

Highlights

- Turnover of GBP6.2 million, a decrease of 7.5% (2021: GBP6.7 million)

- Loss before taxation for the financial year of GBP1,576,000 (2021: profit GBP79,000)

- QM Systems completed a move into a modern and far larger

facility on the Hartlebury Trading Estate, providing approx. 200%

more office space and 600% more manufacturing capacity

- TED has moved into a significantly larger premises and since

the financial year end has signed a global distribution memorandum

of understanding with Unipart Rail Limited

The Group reported an operating loss in the year ended 30 June

2022 (the "financial year" and the "2021/22 FY") of GBP1,312,000

(2021: GBP257,000), a loss before taxation for the financial year

of GBP1,576,000 (2021: profit GBP79,000) and a loss after taxation

of GBP868,000 (2021: profit GBP 522,000 ). T urnover for the

financial year reduced to GBP6.2million (2021: GBP6.7 million) .

The loss per share for the financial year was 2.42p (2021: profit

1.50p).

In line with the outlook expressed in my Chairman's Statement

last year, like others in the industry, we have been faced with

difficult market conditions this financial year. As outlined on 24

March 2022 in the Group's unaudited results for the six months

ended 31 December 2021 this has been an extremely challenging year.

Just when we thought we were getting over the vicissitudes of the

Coronavirus ("COVID-19") pandemic with its consequent delays caused

by material shortages, extended lead times and increased costs, all

suffered without the furlough buffer - then Russia invades the

Ukraine, fuel costs soar and suddenly the world realises that

energy is the key to our standard of living and economic livelihood

at all levels.

As a consequence, the Group continued to see decisions across

all levels of the chain be deferred and/or delayed throughout the

financial year. The impact of the delay in receiving contract

decisions continued to impact the Group right up to late September

2022. However, following September 2022, the Group has seen a

number of larger orders that have previously been in abeyance for

several months placed. In addition, the Group notes a shift in

market sentiment, namely, that there appears to be a general

willingness to actively re-engage and commit to forward-looking

business decisions (as opposed to remaining in tick-over mode).

Despite the disappointing results for the financial year, the

directors believe, for the reasons outlined above, that this merely

represents a temporary blip in our growth trajectory.

Notwithstanding this result, this financial year has been critical

for the Group as seen by our underlying positive direction of

travel. In addition, we have invested significantly to be able to

take advantage of the opportunities evident from our groundwork.

Not only have we expanded Thomson Engineering Design's ("TED")

footprint fourfold (we have decided to retain, and rebuild its

original premises whilst retaining its new premises, as we foresee

the need for further growth), QM Systems Limited ("QM") footprint

has increased fivefold, and a new line to QM business, contract

manufacturing, has been established. Lastly, Adien is now fully

engaged in 5G work and the integration of Utsi and PipeHawk's

technology bodes well for the future.

I am confident therefore that the future looks very

promising.

QM Systems

QM Systems has completed a challenging financial year where for

a large part of that time the orderbook has been significantly

below management expectation. This trend continued longer than

expected into the 2021/22 FY resulting in the inability of QM

Systems to pull through the expected level of revenue and profit.

It does seem as though the effect of the pandemic eventually

rippled through QM Systems later than initially anticipated. In

addition, following Russia's invasion of the Ukraine, decision

makers decided to defer making capital commitments, which

manifested into expected orders being delayed by several

months.

During the second half of the financial year, QM Systems

completed a move into a modern and far larger facility on the

Hartlebury Trading Estate. The move expands the available

facilities from approximately 8,000 sq ft to approximately 45,000

sq ft; providing approx. 200% more office space and 600% more

manufacturing capacity. The move was required to facilitate not

only the anticipated growth in the company's project business but

also the housing of the newly established contract manufacturing

business unit. In addition, QM Systems has secured two

manufacturing contracts with both expected to begin operation with

manufactured product towards the end of the current 2022/23 FY.

Both contract manufacturing projects bring the capacity for rapid

growth in a new and exciting direction for QM Systems. Inevitably a

move to a new facility of this size and scale brings commercial

challenges and has required significant investment. In this regard,

QM have invested over GBP750k in securing and fitting out the new

facility to a very high standard.

Looking ahead, I am pleased to report that as we approached the

end of the previous 2021/22 FY and entered the current FY order

enquiries have increased dramatically. A number of projects that

have been slow to gestate have now arrived resulting in an order

intake for the first four months of the current FY alone at QM

Systems being in excess of GBP3 million. Historically, this is an

unprecedented order intake in such a short period of time and

should enable QM Systems to rapidly recover the ground lost during

the 2021/22 FY. In addition to orders received the order pipeline

has again returned to a very healthy level with further significant

order intake expected through the second quarter of the current FY

and anticipated for the following quarter. It is also important to

recognise that the projects won are sizeable projects that are

expected to run across several months. This brings a further level

of stability to QM Systems project business. To support the

significant growth in the QM Systems projects business a number of

new roles have been advertised for and subsequently filled across

the engineering, projects and sales departments during the first

third of the current FY. In addition to recruitment to support the

project business the start and growth of the contract manufacturing

business will see approximately 30 new employees join the QM

Systems team over the next few months to support the production and

administration activities required across the three contract

manufacturing projects.

As a result of the above I fully expect to see QM Systems

recover to a position of significant growth in both sales and

profit during this current FY whilst securing a stable platform

from which healthy growth can continue for the foreseeable

future.

Thomson Engineering Design ("TED")

Revenue at Thomson Engineering Design ("TED") continued to grow

into this financial year, with the best quarter on record achieved

during the final quarter of the financial year. Revenue for

FY2021/22 compared with the previous financial increased from

approx. GBP1.2 million to GBP1.4 million (representing a circa16%

increase). This did not however translate through into profit with

a loss before taxation of GBP57k.

There are three key drivers within the year resulting in the

reduction in profit versus expectation. The first is the

significant upwards inflationary pressure regarding raw material

cost which skewed the material content to be considerably higher

than previous years. The second key factor was rising facility

costs and investment into the new premises required during the

2021/22 FY. The third factor is that whilst we received a rent-free

period in order to settle into and upgrade the new premises there

is an accounting standard which requires us to amortise that rent

free period over the life of the lease. The first two issues have

been addressed through re-balancing margin on material and labour

to accommodate higher material content and to provide for increased

overhead recovery. The third is a non-cash cost in the short

term.

Order intake at TED during the current 2022/23 FY continues to

be strong, predominantly focused on the UK market with some export.

Post the financial year, on 20 September 2022, TED entered into a

memorandum of understanding with Unipart Rail Limited ("Unipart

Rail"), a global retailer of Rail equipment for Unipart Rail to be

the exclusive partner for sales and distribution of TED rail

equipment into territories in Europe, Asia, New Zealand, Australia

and the Americas. This enables TED to facilitate its strategy for

global growth by utilising an established and well-respected

distribution partner. Unipart and TED jointly attended the

InnoTrans Expo in Berlin to launch the new partnership, where a

number of key TED products have been on display to premium rail

clients. Since the year end, TED has also entered into a

partnership with a key client to provide rail conversions for

Kawasaki Utility vehicles. This innovative approach allows capital

outlay and emissions to be significantly reduced and eliminates the

need to use high-cost excavators when carrying smaller loads and

tools. We expect this partnership to add substantial additional

revenue potential to TED's current portfolio over the next few

years.

Overall, having taken measures to address profitability the

future for TED both in the UK and the wider global market appears

significantly positive.

Adien

After a very promising start last year's results ended with a

disappointing loss of GBP15k due to work volumes dropping in the

last few months of the year. This was, mainly due to continually

delayed starts from the 5G telecom sector. The order lethargy

continued into July and August this year, but has picked up

dramatically since the start of September.

Adien now supplies the majority of the key contractors to the

telecom providers.

Adien's Ministry of Defence projects are also starting to come

on stream after a slow start following the renewal of the framework

contracts in April this year. Similarly, Scottish & Southern

Electricity Networks has recently put significant funding in place

which will allow us to progress with their larger sites.

Positively, clients in the construction and infrastructure

sectors are showing increased activity both in volume of the orders

placed and enquiries for new projects.

Hybrid working for staff in the Doncaster office and the

rationalisation of the Scottish operation has resulted in

efficiencies, cost reductions and reduced travel times as well as a

reduction in the carbon footprint of the business.

Recent investment in new vehicles that are more efficient, cost

effective, greener and continued investment in new hardware and

software for the computer-aided design as well as field teams

ensure Adien is able to survey and process data effectively to all

our clients' various requirements.

The outlook for the current year remains positive.

UTSI

As enquiry levels have steadily risen through the 2022 calendar

year, so too have material costs, component shortages and delivery

timescales with the resulting lengthening transition times between

enquiry, order and payment making the business of doing business,

severely challenging. Sales of our flagship products; those

manufactured and ordered in the largest quantities, have been most

disrupted by the continuing supply delays, whereas those for more

specialist, made to order products and those requiring bespoke

alteration, have been less affected. Moving from just in time

supply to just in case, namely, the increased stockholding of major

"at risk" and "long lead time" components will reduce exposure to

the worst supply chain excesses over the medium term. However, this

change in approach has had a notable immediate effect on UTSI's

cashflow and profits in the short term. While external R&D

opportunities remain in recovery, bringing forward internal R&D

timescales has offered a way towards achieving near term cost

savings as tighter integration of existing PipeHawk & UTSI's

product lines, becomes possible, whilst also offering the promise

of attractive hybrid hardware/software solutions on the near

horizon. While UTSI continues to seek out new opportunities, new

partners and new markets, the restrictions imposed by global supply

chain issues are expected to remain a significant limiting factor

into the second half of 2022 and beyond.

Financial position

The Group continues to be in a net liability position and is

still reliant on my continuing financial support.

My letter of support dated 6 September 2021 was renewed on 11

October 2022 to provide the group with financial support until 31

December 2024. Loans due to me, other than those covered by the

CULS agreement, are unsecured and accrue interest at an annual rate

of Bank of England base rate plus 2.15%.

The CULS agreement for GBP1 million, provided by myself, was

renewed on 30 June 2022 and extended on identical terms, such that

the CULS are now repayable on 13 August 2026.

In addition to the loans I have provided to the Company in

previous years, I have deferred a certain proportion of fees and

the interest due until the Company is in a suitably strong position

to make the full payments.

Historically, my fees and interest payable have been deferred.

During the year under review, the deferred element amounted to

GBP160,000. At 30 June 2022, these deferred fees and interest

amounted to approximately GBP1.8 million in total, all of which

have been recognised as a liability in the Company's accounts.

Strategy & Outlook

The Group remains committed to creating sustainable

earnings-based growth and focusing on the expansion of its business

with forward-looking products and services. PipeHawk acts

responsibly towards its shareholders, business partners, employees,

society and the environment in each of its business areas.

PipeHawk is committed to technologies and products that unite

the goals of customer value and sustainable development. In light

of market conditions, all divisions of the Group are currently

performing well and I remain optimistic in my outlook for the

Group.

Gordon Watt

Chairman

Date: 28 November 2022

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2022

30 June 30 June

Note 2022 2021

GBP'000 GBP'000

--------- ---------

Revenue 2 6,191 6,665

Staff costs 5 (3,861) (3,478)

Operating costs (3,642) (2,930)

--------- ---------

Operating (loss) / profit 4 (1,312) 257

Profit / (loss) before interest and

taxation (1,312) 257

--------- ---------

Finance costs 3 (264) (178)

--------- ---------

(Loss) / profit before taxation (1,576) 79

Taxation 7 708 443

(Loss) / profit for the year attributable

to equity holders of

the parent (868) 522

========= =========

Other comprehensive income - -

Total comprehensive (Loss) / profit for

the year attributable to

equity holder of the parent (868) 522

========= =========

(Loss) / profit per share (pence) -

basic 8 (2.42) 1.50

(Loss) / profit per share (pence) -

diluted 8 (2.42) 0.80

The notes form an integral part of these financial

statements.

Consolidated Statement of Financial Position

at 30 June 2022

30 June 30 June

Note 2022 2021

GBP'000 GBP'000

--------- ---------

Assets

Non-current assets

Property, plant and equipment 9 828 528

Right of use 10 2,549 363

Goodwill 11 1,357 1,357

--------- ---------

4,734 2,248

--------- ---------

Current assets

Inventories 13 340 373

Current tax assets 710 442

Trade and other receivables 14 2,389 1,809

Cash and cash equivalents 4 920

--------- ---------

3,443 3,544

Total assets 8,177 5,792

========= =========

Equity and liabilities

Equity

Share capital 18 363 349

Share premium 5,316 5,215

Retained earnings (8,647) (7,784)

--------- ---------

(2,968) (2,220)

--------- ---------

Non-current liabilities

Borrowings 16 5,612 3,205

5,612 3,205

--------- ---------

Current liabilities

Borrowings 16 2,674 2,156

Trade and other payables 15 2,859 2,651

5,533 4,807

Total equity and liabilities 8,177 5,792

========= =========

The notes form an integral part of these financial

statements.

Consolidated Statement of Cash Flow

For the year ended 30 June 2022

Note 30 June 30 June

2022 2021

GBP'000 GBP'000

--------- ---------

Cash flows from operating activities

(Loss) / profit from operations (1,312) 257

Adjustments for:

Depreciation 4 424 192

---------

(888) 449

Decrease / (increase) in inventories 33 (171)

Decrease / (increase) in receivables (580) (136)

Increase/(decrease) in liabilities 286 581

--------- ---------

Cash generated/(used) by operations (1,149) 723

Interest paid (124) (50)

Corporation tax received 440 394

--------- ---------

Net cash generated from / (used in)

operating activities (833) 1,067

--------- ---------

Cash flows from investing activities

Acquisition of subsidiary net of cash

acquired - 42

Purchase of plant and equipment (325) (130)

---------

Net cash used in investing activities (325) (88)

--------- ---------

Cash flows from financing activities

Proceeds / (repayments) from borrowings 286 339

Proceeds / (repayments) of loan 119 (483)

Repayment of leases (163) (165)

--------- ---------

Net cash (used in)/generated from financing

activities 242 (309)

--------- ---------

Net (decrease)/increase in cash and

cash equivalents (916) 670

Cash and cash equivalents at the beginning

of year 920 250

---------

Cash and cash equivalents at end of

year 4 920

========= =========

The notes form an integral part of these financial

statements.

Statement of Changes in Equity

For the year ended 30 June 2022

Share premium Retained

Share capital account earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------------- ---------- --------

As at 1 July 2020 349 5,215 (8,301) (2,737)

Profit / (loss) for the

year - - 522 522

Total comprehensive income - - 522 522

Issue of shares - - - -

---------------- -------------- ---------- --------

As at 30 June 2021 349 5,215 (7,779) (2,215)

================ ============== ========== ========

Profit / (loss) for the

year - - (868) (868)

Total comprehensive income (868) (868)

Issue of shares 14 101 - 115

As at 30 June 2022 363 5,316 (8,647) (2,968)

================ ============== ========== ========

The share premium account reserve arises on the issuing of

shares. Where shares are issued at a value that exceeds their

nominal value, a sum equal to the difference between the issue

value and the nominal value is transferred to the share premium

account reserve.

The notes form an integral part of these financial

statements.

1 Summary of significant accounting policies

1.1. General information

PipeHawk plc (the Company) is a limited company incorporated in

the United Kingdom under the Companies Act 2006. The addresses of

its registered office and principal place of business are disclosed

in the company information on page 3 of the Report and Accounts.

The principal activities of the Company and its subsidiaries (the

Group) are described on page 9 of the Report and Accounts.

The financial statements are presented in pounds sterling, the

functional currency of all companies in the Group. In accordance

with section 408 of the Companies Act 2006 a separate statement of

comprehensive income for the parent Company has not been presented.

For the year to 30 June 2022 the Company recorded a net loss after

taxation of GBP282,000 (2021: GBP236,000).

1.2. Basis of preparation

The financial statements have been prepared in accordance with

UK-adopted international accounting standards (IAS) The principal

accounting policies are set out below.

1.3. Basis of preparation - Going concern

The directors have reviewed the Parent Company and Group's

funding requirements for the next twelve months which show positive

anticipated cash flow generation, prior to any repayment of loans

advanced by the Executive Chairman. The directors have furthermore

obtained a renewed pledge from G G Watt to provide ongoing

financial support for a period of at least twelve months from the

approval date of the Group and Parent Company statement of

financial positions. The directors therefore have a reasonable

expectation that the entity has adequate resources to continue in

its operational exercises for the foreseeable future. It is on this

basis that the directors consider it appropriate to adopt the going

concern basis of preparation within these financial statements.

However a material uncertainty exists regarding the ability of the

Group and Parent Company to

remain a going concern without the continuing financial support of the Executive Chairman.

1.4. Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(its subsidiaries). Control is achieved where the Company has the

power to govern the financial and operating policies of an entity

so as to obtain benefits from its activities.

The results of subsidiaries acquired or disposed of during the

year are included in the consolidated statement of comprehensive

income from the effective date of acquisition or up to the

effective date of disposal, as appropriate. Where necessary,

adjustments are made to the financial statements of subsidiaries to

bring their accounting policies into line with those used by other

members of the Group. All intra-group transactions, balances,

income and expenses are eliminated in full on consolidation.

1.5. Business combinations

Acquisitions of subsidiaries and businesses are accounted for

using the acquisition method. The cost of the business combination

is measured as the aggregate of the fair values (at the date of

exchange) of assets given, liabilities incurred or assumed, and

equity instruments issued by the Group in exchange for control of

the acquiree. The acquiree's identifiable assets, liabilities and

contingent liabilities that meet the conditions for recognition

under IFRS 3 Business Combinations (revised) are recognised at

their fair values at the acquisition date, except for non-current

assets (or disposal groups) that are classified as held for sale in

accordance with IFRS 5 Non-current Assets Held for Sale and

Discontinued Operations, which are recognised and measured at fair

value less costs to sell.

Goodwill arising on acquisition is recognised as an asset and

initially measured at cost, being the excess of the cost of the

business combination over the Group's interest in the net fair

value of the identifiable assets, liabilities and contingent

liabilities recognised.

1.6. Goodwill

Goodwill is initially recognised as an asset at cost and is

subsequently measured at cost less any accumulated impairment

losses.

For the purpose of impairment testing, goodwill is allocated to

each of the Group's cash-generating units expected to benefit from

the synergies of the combination. Cash-generating units to which

goodwill has been allocated are tested for impairment annually, or

more frequently when there is an indication that the unit may be

impaired. If the recoverable amount of the cash-generating unit is

less than the carrying amount of the unit, the impairment loss is

allocated first to reduce the carrying amount of any goodwill

allocated to the unit and then to the other assets of the unit

pro-rata on the basis of the carrying amount of each asset in the

unit. An impairment loss recognised for goodwill is not reversed in

a subsequent period.

On disposal of a subsidiary, the attributable amount of goodwill

is included in the determination of the profit or loss on

disposal.

1.7. Revenue recognition

For the year ended 30 June 2022 the Group used the five-step

model as prescribed under IFRS 15 on the Group's revenue

transactions. This included the identification of the contract,

identification of the performance obligations under the same,

determination of the transaction price, allocation of the

transaction price to performance obligations and recognition of

revenue.

The point of recognition arises when the Group satisfies a

performance obligation by transferring control of a promised good

or service to the customer, which could occur over time or at a

point in time.

1.8. Sale of goods

Revenue generated from the sale of goods is recognised on

delivery of the goods to the customer. On this basis revenue is

recognised at a point in time.

1.9. Sale of services

In relation to the design and manufacture of complete software

and hardware test solutions and the provision of specialist

surveying, revenue is recognised through a review of the man-hours

completed on the project at the year-end compared to the total

man-hours required to complete the projects. Provision is made for

all foreseeable losses if a contract is assessed as

unprofitable.

Revenue represents the amount of consideration to which the

Group expects to be entitled in exchange for transferring promised

goods or services to a customer, excluding amounts collected on

behalf of third parties.

Revenue from goods and services provided to customers not

invoiced as at the reporting date is recognised as a contract asset

and disclosed as accrued income within trade and other

receivables.

Although payment terms vary from contract to contract invoices

are in general raised in advance of services performed. Where

billing has exceeded the revenue recognised in a period a contract

liability is recognised and this is disclosed as payments received

on account in trade and other payables.

1.10. Property, plant and equipment

Property, plant and equipment are stated at cost less

accumulated depreciation and accumulated impairment losses.

Depreciation is charged so as to write off the cost of assets over

their estimated useful lives, using the straight-line method. The

estimated useful lives, residual values and depreciation method are

reviewed at each year end, with the effect of any changes in

estimate accounted for on a prospective basis. Assets held under

leases are depreciated over their expected useful lives on the same

basis as owned assets or, where shorter, the term of the relevant

lease. Gains and losses on disposals are determined by comparing

the proceeds with the carrying amount and are recognised within the

Statement of Comprehensive Income.

The principal annual rates used to depreciate property, plant

and equipment are:

Equipment, fixtures and fittings 25%

Motor vehicles 25%

1.11. Inventories and work in progress

Inventories are stated at the lower of cost and net realisable

value. Costs, including an appropriate portion of fixed and

variable overhead expenses, are assigned to inventories by the

method most appropriate to the particular class of inventory, with

the majority being valued on a first-in-first-out basis. Net

realisable value represents the estimated selling price for

inventories less all estimated costs of completion and costs

necessary to make the sale.

Work in progress is valued at cost, which includes expenses

incurred on behalf of clients and an appropriate proportion of

directly attributable costs on incomplete assignments. Provision is

made for irrecoverable costs where appropriate .

1.12. Financial assets

The Group's financial assets consist of cash and cash

equivalents and trade and other receivables. The Group's accounting

policy for each category of financial asset is as follows:

Financial assets held at amortised cost

Trade receivables and other receivables are classified as

financial assets held at amortised cost. They are initially

recognised at fair value plus transaction costs that are directly

attributable to their acquisition or issue and are subsequently

carried at amortised cost using the effective interest rate method,

less provision for impairment.

Impairment provisions are recognised based on its historical

credit loss experience, adjusted for forward-looking factors

specific to the debtors and the economic environment, the amount of

such a provision being the difference between the net carrying

amount and the present value of the future expected cash flows

associated with the impaired receivable. For receivables, which are

reported net, such provisions are recorded in a separate allowance

account with the loss being recognised within administrative

expenses in the statement of comprehensive income. On confirmation

that the receivable will not be collectable, the gross carrying

value of the asset is written off against the associated

provision.

The Group's financial assets held at amortised cost comprise

other receivables and cash and cash equivalents in the statement of

financial position.

Derecognition of financial assets

The Group derecognises a financial asset only when the

contractual rights to the cash flows from the asset expire; or it

transfers the financial asset and substantially all the risks and

rewards of ownership of the asset to another entity.

Equity instruments

An equity instrument is any contract that evidences a residual

interest in the assets of an entity after deducting all of its

liabilities. Equity instruments issued by the Group are recorded at

the proceeds received, net of direct issue costs.

Financial liabilities

Financial liabilities, including borrowings, are initially

measured at fair value, net of transaction costs. Financial

liabilities are subsequently measured at amortised cost using the

effective interest method, with interest expense recognised on an

effective yield basis.

The effective interest method is a method of calculating the

amortised cost of a financial liability and of allocating interest

expense over the relevant period. The effective interest rate is

the rate that exactly discounts estimated future cash payments

through the expected life of the financial liability, or, where

appropriate, a shorter period.

Derecognition of financial liabilities

The Group derecognises financial liabilities when, and only

when, the Group's obligations are discharged, cancelled or they

expire.

1.13. Leased/Right of Use assets

The leases liability is initially measured at the present value

of the remaining lease payments, discounted using the individual

entities incremental borrowing rate. The lease term comprises the

non-cancellable period of the contract, together with periods

covered by an option to extend the lease where the Group is

reasonably certain to exercise that option based on operational

needs and contractual terms. Subsequently, the lease liability is

measured at amortised cost by increasing the carrying amount to

reflect interest on the lease liability, and reducing it by the

lease payments made. The lease liability is remeasured when the

Group changes its assessment of whether it will exercise an

extension or termination option.

Right-of-use assets are initially measured at cost, comprising

the initial measurement of the lease liability adjusted for any

lease payments made at or before the commencement date, lease

incentives received and initial direct costs. Subsequently,

right-of-use assets are measured at cost, less any accumulated

depreciation and any accumulated impairment losses, and are

adjusted for certain remeasurement of the lease liability.

Depreciation is calculated on a straight-line basis over the

length of the lease. The Group has elected to apply exemptions for

short-term leases and leases for which the underlying asset is of

low value. For these leases, payments are charged to the income

statement on a straight-line basis over the term of the relevant

lease. Right-of-use assets are presented within non-current assets

on the face of the statement of financial position, and lease

liabilities are shown separately on the statement of financial

position in current liabilities and non-current liabilities

depending on the maturity of the lease payments.

Under IFRS16, right-of-use assets will be tested for impairment

in accordance with IAS36 Impairment of Assets.

Payments associated with short-term leases are recognised on a

straight-line basis as an expense in the profit or loss. Short term

leases are leases with a lease term of 12 months or less.

1.14. Pension scheme contributions

Pension contributions are charged to the statement of

comprehensive income in the period in which they fall due. All

pension costs are in relation to defined contribution schemes.

1.15. Share based payments

Equity-settled share-based payments to employees and others

providing similar services are measured at the fair value of the

equity instruments at the grant date. Details regarding the

determination of the fair value of equity-settled share-based

transactions are set out in note 18.

The fair value determined at the grant date of the

equity-settled share-based payments is expensed on a straight-line

basis over the vesting period, based on the Group's estimate of

equity instruments that will eventually vest. At each statement of

financial position date, the Group revises its estimate of the

number of equity instruments expected to vest. The impact of the

revision of the original estimates, if any, is recognised in profit

or loss over the remaining vesting period, with a corresponding

adjustment to reserves.

1.16. Foreign currencies

Monetary assets and liabilities denominated in foreign

currencies are translated into sterling at the rates of exchange

ruling at 30 June. Transactions in foreign currencies are recorded

at the rates ruling at the date of the transactions.

1.17. Taxation

Income tax expense represents the sum of the tax currently

payable and deferred tax.

Current tax

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from profit as reported in the

consolidated statement of comprehensive income because it excludes

items of income or expense that are taxable or deductible in other

years and it further excludes items that are never taxable or

deductible. The Group's liability for current tax is calculated

using tax rates that have been enacted or substantively enacted by

the year end date.

Deferred tax

Deferred tax is recognised on differences between the carrying

amounts of assets and liabilities in the financial statements and

the corresponding tax bases used in the computation of taxable

profit, and is accounted for using the statement of financial

position liability method. Deferred tax liabilities are generally

recognised for all taxable temporary differences, and deferred tax

assets are generally recognised for all deductible temporary

differences to the extent that it is probable that taxable profits

will be available against which those deductible temporary

differences can be utilised. Such assets and liabilities are not

recognised if the temporary difference arises from goodwill or from

the initial recognition (other than in a business combination) of

other assets and liabilities in a transaction that affects neither

the taxable profit nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary

differences associated with investments in subsidiaries and

associates, and interests in joint ventures, except where the Group

is able to control the reversal of the temporary difference and it

is probable that the temporary difference will not reverse in the

foreseeable future. Deferred tax assets arising from deductible

temporary differences associated with such investments and

interests are only recognised to the extent that it is probable

that there will be sufficient taxable profits against which to

utilise the benefits of the temporary differences and they are

expected to reverse in the foreseeable future.

The carrying amount of deferred tax assets is reviewed at each

statement of financial position date and reduced to the extent that

it is no longer probable that sufficient taxable profits will be

available to allow all or part of the asset to be recovered.

Deferred tax assets and liabilities are measured at the tax rates

that are expected to apply in the year in which the liability is

settled or the asset realised, based on tax rates (and tax laws)

that have been enacted or substantively enacted by the year end

date. The measurement of deferred tax liabilities and assets

reflects the tax consequences that would follow from the manner in

which the Group expects, at the reporting date, to recover or

settle the carrying amount of its assets and liabilities.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off current tax assets against

current tax liabilities and when they relate to income taxes levied

by the same taxation authority and the Group intends to settle its

current tax assets and liabilities on a net basis.

Current and deferred tax for the year

Current and deferred tax are recognised as an expense or income

in the statement of comprehensive income, except when they relate

to items credited or debited directly to equity, in which case the

tax is also recognised directly in equity.

1.18. Impairment of property, plant and equipment

At each year end date, the Group reviews the carrying amounts of

its property, plant and equipment to determine whether there is any

indication that those assets have suffered an impairment loss. If

any such indication exists, the recoverable amount of the asset is

estimated in order to determine the extent of the impairment loss

(if any). Where it is not possible to estimate the recoverable

amount of an individual asset, the Group estimates the recoverable

amount of the cash-generating unit to which the asset belongs.

Where a reasonable and consistent basis of allocation can be

identified, corporate assets are also allocated to individual

cash-generating units, or otherwise they are allocated to the

smallest group of cash-generating units for which a reasonable and

consistent allocation basis can be identified.

Recoverable amount is the higher of fair value less costs to

sell and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset for

which the estimates of future cash flows have not been

adjusted.

If the recoverable amount of an asset (or cash-generating unit)

is estimated to be less than its carrying amount, the carrying

amount of the asset (or cash-generating unit) is reduced to its

recoverable amount. An impairment loss is recognised immediately in

profit or loss.

Where an impairment loss subsequently reverses, the carrying

amount of the asset (or cash-generating unit) is increased to the

revised estimate of its recoverable amount, but so that the

increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised

for the asset (or cash-generating unit) in prior years. A reversal

of an impairment loss is recognised immediately in the statement of

comprehensive income.

1.19. Research and development

The Group undertakes research and development to expand its

activity in technology and innovation to develop new products that

will begin directly generating revenue in the future. Expenditure

on research is expensed as incurred, development expenditure is

capitalised only if the criteria for capitalisation are recognised

in IAS 38. The Company claims tax credits on its research and

development activity and recognises the income in current tax.

1.20. Government grants

During the period, the Group received benefits from Government

grants. Revenue based Government grants are recognised through the

consolidated statement of comprehensive income by netting off

against the costs to which they relate. Where the grant is not

directly associated with costs incurred during the period, it is

recognised as 'other income'.

1.21. Critical judgement in applying accounting policies and key

sources of estimation uncertainty

The following are the critical judgements and key sources of

estimation uncertainty that the directors have made in the process

of applying the entity's accounting policies and that have the most

significant effect on the amounts recognised in these financial

statements.

Impairment of goodwill

Determining whether goodwill is impaired requires an estimation

of the value in use of the cash-generating units to which goodwill

has been allocated. A similar exercise is performed in respect of

investment and long term loans in subsidiary.

The value in use calculation requires the directors to estimate

the future cash flows expected to arise from the cash-generating

unit and a suitable discount rate in order to calculate present

value, see note 11 for further details.

The carrying amount of goodwill at the year-end date was

GBP1,357,000 (2021: GBP1,357,000). The investment in subsidiaries

at the year-end was GBP1,903,000 (2021: GBP1,903,000).

The methodology adopted in assessing impairment of Goodwill is

set out in note 11 as is the sensitivity analysis applied in

relation to the outcomes of the assessment.

Impairment investment in subsidiaries and inter-company

receivables

As set out in note 12, an impairment assessment of the carrying

value of investments in subsidiaries and inter-company receivables

is in line with the methodologies adopted in the assessment of

impairment of goodwill.

2 Segmental analysis

2022 2021

GBP'000 GBP'000

--------- ---------

Turnover by geographical market

United Kingdom 5,627 6,103

Europe 243 172

Other 321 390

--------- ---------

6,191 6,665

========= =========

The Group operates out of one geographical location being the

UK. Accordingly the primary segmental disclosure is based on

activity. Per IFRS 8 operating segments are based on internal

reports about components of the Group, which are regularly reviewed

and used by Chief Operating Decision Maker ("CODM") for strategic

decision making and resource allocation, in order to allocate

resources to the segment and to assess its performance. The Group's

reportable operating segments are as follows :

* Adien Limited - Utility detection and mapping

services - Sale of services

* PipeHawk Limited and Utsi Electronics Limited -

Development, assembly and sale of GPR equipment -

Sale of goods

* QM Systems - Test system solutions - Sale of services

* TED Limited - Rail trackside solutions (included in

the test system solutions segment) - Sale of services

* Wessex Precision Instruments Limited - Non trading

The CODM monitors the operating results of each segment for the

purpose of performance assessments and making decisions on resource

allocation. Performance is based on revenue generations and profit

before tax, which the CODM believes are the most relevant in

evaluating the results relative to other entities in the industry.

Information regarding each of the operations of each reportable

segment is included below, all non-current assets owned by the

Group are held in the UK.

Utility Development, Automation

detection assembly and test

and mapping and sale system

services of GPR equipment solutions Total

GBP'000 GBP'000 GBP'000 GBP'000

------------- ------------------ ----------- --------

Year ended 30 June 2022

Total segmental revenue 1,453 246 4,492 6,191

------------- ------------------ ----------- --------

Operating profit/(loss) 21 (323) (1,010) (1,312)

Finance costs (36) (171) (57) (264)

(Loss) / profit before

taxation (15) (494) (1,067) (1,576)

------------- ------------------ ----------- --------

Segment assets 655 1,924 5,598 8,177

Segment liabilities 628 5,226 5,442 11,296

Non-current asset additions 17 55 2,941 3,013

Depreciation and amortisation 106 3 316 425

============= ================== =========== ========

Utility Development, Automation

detection assembly and test

and mapping and sale system

services of GPR equipment solutions Total

GBP'000 GBP'000 GBP'000 GBP'000

------------- ------------------ ----------- --------

Year ended 30 June 2021

Total segmental revenue 1,395 150 5,120 6,665

------------- ------------------ ----------- --------

Operating profit/(loss) 130 (218) 345 257

Finance costs (29) (130) (19) (178)

Profit /(loss) before

taxation 101 (348) 326 79

------------- ------------------ ----------- --------

Segment assets 696 2,196 2,754 5,646

Segment liabilities 624 4,841 2,521 7,986

Non-current asset additions 50 4 77 131

Depreciation and amortisation 100 1 91 192

============= ================== =========== ========

3 Finance costs

2022 2021

GBP'000 GBP'000

--------- ---------

Interest payable 264 178

--------- ---------

264 178

========= =========

Interest payable comprises interest on:

Leases 69 25

Directors' loans 140 129

Other 55 24

--------- ---------

264 178

========= =========

4 Operating profit for the year

This is arrived at after charging for the Group:

2022 2021

GBP'000 GBP'000

--------- ---------

Research and development costs not capitalised 2,333 2,285

Depreciation 424 192

Auditor's remuneration

Fees payable to the Company's auditor for the

audit of the Group's financial statements 45 45

Fees payable to the Company's auditor and its

subsidiaries for the provision of tax services 7 7

Lease rentals

Other including land and buildings 352 156

========= =========

The Company audit fee is GBP9,000 (2021: GBP9,000).

5 Staff costs

2022 2021

No. No.

----- -----

Average monthly number of employees,

including directors:

Production and research 79 78

Selling and research 9 10

Administration 7 5

-----

95 93

===== =====

2022 2021

GBP'000 GBP'000

-------- --------

Staff costs, including directors:

Wages and salaries 3,387 3,032

Social security costs 361 350

Other pension costs 113 96

--------

3,861 3,478

======== ========

6 Directors' remuneration

Salary Benefits 2022 2021

and fees in kind Total Total

GBP'000 GBP'000 GBP'000 GBP'000

---------- --------- -------- --------

G G Watt 71 - 71 71

S P Padmanathan 58 8 66 72

R MacDonnell 2 - 2 2

---------- --------- -------- --------

Aggregate emoluments 131 8 139 145

========== ========= ======== ========

Directors' pensions 2022 2021

No. No.

----- -----

The number of directors who are accruing

retirement benefits under:

Defined contributions policies 1 1

===== =====

The directors represent key management personnel.

Refer to note 18 for details of directors share options.

7 Taxation

2022 2021

GBP'000 GBP'000

--------------- --------------

United Kingdom Corporation Tax

Current taxation (708) (435)

Adjustments in respect of prior years - (8)

--------------- --------------

(708) (443)

Deferred taxation - -

--------------- --------------

Tax on profit / (loss) (708) (443)

--------------- --------------

Current tax reconciliation

Taxable profit / (loss) for the year (1,576) 79

--------------- --------------

Theoretical tax at UK corporation

tax rate 19% (2021: 19%) (289) 15

Effects of:

R&D tax credit adjustments (350) (428)

Fixed asset timing differences (101) -

Not deductible for tax purposes 2 (12)

Deferred tax not recognised 45 28

Adjustments in respect of prior

years 1 (18)

Utilisation of losses - (27)

Short term timing differences (16) (1)

--------------- --------------

Total income tax credit (708) (443)

=============== ==============

The Group has tax losses amounting to approximately GBP3,033,706

(2021: GBP3,008,408), available for carry forward to set off

against future trading profits . No deferred tax assets have

been recognised in these financial statements due to the uncertainty

regarding future taxable profits.

Potential deferred tax assets not recognised are approximately

GBP576,404 (2021: GBP541,065).

8 Loss / profit per share

Basic (pence per share) 2022 - Loss 2.42 profit per share; 2021

- 1.50 profit per share

This has been calculated on a loss of GBP868,000 (2021: Profit

GBP522,000) and the number of shares used was 35,812,823 (2021:

34,860,515) being the weighted average number of shares in issue

during the year.

Diluted (pence per share) 2022 - 2.42 loss per share; 2021 -

0.80 profit per share

In the current year the potential ordinary shares included in

the weighted average of shares are anti-dilutive and therefore

diluted earnings per share is equal to basic earnings per share.

The prior year calculation used earnings of GBP442,000 being

the profit for the year plus the interest paid on the convertible

loan note (net of 20% tax) of GBP80,000 and the number of shares

used was 55,344,987 being the weighted average number of shares

outstanding during the year of 34,860,515 adjusted for shares

deemed to be issued for no consideration relating to options

and warrants and the impact of the convertible instrument.

9 Property, plant and equipment

Equipment,

fixtures Leasehold Motor

Freehold and fittings improvements vehicles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------- -------------- --------------- ----------- --------

Cost

At 1 July 2021 426 1,233 143 268 2,070

Additions - 97 331 - 428

Disposals - - - (31) (31)

Write off - (10) - - (10)

At 30 June 2022 426 1,320 474 237 2,457

----------- -------------- --------------- ----------- --------

Depreciation

At 1 July 2021 40 1,091 143 268 1,542

Charged in year 5 94 25 - 124

Disposals - - - (31) (31)

Write off - (6) - - (6)

At 30 June 2022 45 1,179 168 237 1,629

----------- -------------- --------------- ----------- --------

Net book value

At 30 June 2022 381 141 306 - 828

=========== ============== =============== =========== ========

At 30 June 2021 386 142 - - 528

=========== ============== =============== =========== ========

The net book value of the property, plant and equipment includes

GBP2,549,000 (2021: GBP363,000) in respect of assets held under

lease agreements. These assets have been offered as security

in respect of these lease agreements. Depreciation charged in

the period on those assets amounted to GBP314,000 (2021: GBP138,000)

- see note 10.

10 Right of use

Equipment,

fixtures Leasehold Motor

Freehold and fittings improvements vehicles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------- -------------- --------------- ----------- --------

Cost

At 1 July 2021 248 250 - 147 645

Additions 2,416 - 168 - 2,584

Disposal (84) (14) (98)

At 30 June 2022 2,580 236 168 147 3,131

----------- -------------- --------------- ----------- --------

Depreciation

At 1 July 2021 101 109 - 73 283

Charged in year 198 47 12 42 299

Disposal - - - - -

At 30 June 2022 299 156 12 115 582

----------- -------------- --------------- ----------- --------

Net book value

At 30 June 2022 2,281 80 156 32 2,549

=========== ============== =============== =========== ========

At 30 June 2021 147 142 - 74 363

=========== ============== =============== =========== ========

11 Goodwill

Goodwill Total

GBP'000 GBP'000

--------- ---------

Cost

At 1 July 2021 1,357 1,357

Additions - -

--------- ---------

At 30 June 2022 1,357 1,357

========= =========

Impairment

As at 30 June 2021 and 30 - -

June 2022

========= =========

Net book value

At 30 June 2022 1,357 1,357

========= =========

At 30 June 2021 1,357 1,357

========= =========

The goodwill carried in the statement of financial position of

GBP1,357,000 arose on the acquisitions of Adien Limited in 2002

(GBP212,000), QM Systems Limited in 2006 (GBP849,000), TED Limited

in 2017 (GBP129,000), Wessex Precision Equipment Limited in 2019

(GBP155,000) and Utsi Electronics Limited in 2021 (GBP12,000)

- see note 21.

Adien Limited represents the segment utility detection and mapping

services and QM Systems Limited represents the segment test system

solutions.

QM Systems Limited, TED, Wessex and Utsi are involved in projects

surrounding:

* The creation of innovative automated assembly systems

for the manufacturing, food and pharmaceutical

sectors.

* The provision of inspection systems for the

automotive, aerospace, rail and pharmaceutical

sectors.

* Slippage testing

* Assembly and sale of GPR equipment

* Automated test systems

The Group tests goodwill annually for impairment or more frequently

if there are indicators that it might be impaired.

The recoverable amounts are determined from value in use calculations

which use cash flow projections based on financial budgets approved

by the directors covering a five year period. The key assumptions

are those regarding the discount rates, growth rates and expected

changes to sales and direct costs during the period. Management

estimates discount rates using pre-tax rates that reflect current

market assessments of the time value of money and the risks specific

to the business. This has been estimated at 10% per annum reflecting

the prevailing pre-tax cost of capital in the Company.

The growth rate assumptions are based on forecasts and historic

margins.

* Adien these have been assessed as 22% growth for

revenue in years 1 and 5% for years 2 and 3, 2.5%

thereafter.

* UTSI and PipeHawk combined these have been assessed

as 15% for growth for revenue in year 1 and 55.2% for

year 2, 65.9% for year 3, 35% for year 4, 8% year 5.

* QM have been assessed largely based on the current

orderbook, in addition to the expected orderbook. The

business has seen significant growth in order intake

and has received confirmed orders in the first four

months exceeding GBP3million. Management is expecting

to convert a strong pipeline into orders which would

see a 300% increase in year 1, a 183% increase in

year 2. This is followed by an expected 10 % in year

3 and 4 and 5% for years 5.

* TED these have been assessed as 26% growth for

revenue in year 1, 10% growth in years 2 and 3 and 5%

thereafter. The reason for the significant Year 1

revenue growth in Adien, QM and TED is an expectation

based on current trading and the expected order

pipeline.

12 Non-current investments

Parent and

Group interest

in ordinary Country of

Subsidiary shares and incorporation Principal activity

voting rights

----------------------------- ---------------- ---------------- ----------------------

Adien Ltd 100% England & Wales Specialist surveying

QM Systems Ltd 100% England & Wales Test solutions

Thomson Engineering 100% England & Wales Specialist in railway

Design Ltd equipment

Wessex Precision Instruments 100% England & Wales Slip test solutions

Ltd

Utsi Electronics Ltd 100% England & Wales GPR equipment

Wessex Test Equipment 100% England & Wales Dormant

Ltd (formerly Tech Sales

Services Ltd)

Minehawk Ltd 100% England & Wales Dormant

An impairment assessment was performed in line with the assessment

of goodwill, see note 11 for further details. On the basis of

this assessment no impairment of the investment was required

at 30 June 2022.

The registered office of all of the above named subsidiaries,

except Thomson Engineering Design Ltd and Utsi Electronics Ltd

is Manor Park Industrial Estate, Wyndham Street, Aldershot, Hampshire,

GU12 4NZ.

The registered office of Thomson Engineering Design Ltd is Units

2a & 3 Crabtree Road, Forest Vale Industrial Estate

Cinderford, Gloucestershire, United Kingdom, GL14 2YQ

The registered office of Utsi Electronics Ltd is Unit 26, Glenmore

Business Park, Ely Road, Waterbeach, Cambridge, Cambridgeshire,

CB25 9PG.

13 Inventories

2022 2021

GBP'000 GBP'000

--------- ---------

Raw materials 150 287

Finished goods 190 86

340 373

========= =========

The replacement cost of the above inventories would not be significantly

different from the values stated.

The cost of inventories recognised as an expense during the year

amounted to GBP1,886,000 (2021: GBP2,078,000). For the Parent

company this was GBP41,612 (2021: GBP16,024).

14 Trade and other receivables

2022 2021

GBP'000 GBP'000

--------- ---------

Current

Trade receivables 1,261 1,066

Amounts owed by Group undertakings - -

Other Debtors 522 4 64

Accrued income 332 3

Prepayments 274 2 76

2,389 1,809

========= =========

15 Trade and other payables

2022 2021

GBP'000 GBP'000

--------- ---------

Current

Trade payables 972 581

Other taxation and social security 447 5 01

Payments received on account 839 786

Accruals and other creditors 601 783

2 ,859 2 ,651

========= =========

2022 2021

GBP'000 GBP'000

--------- ---------

Non-current

Amounts owed to Group undertakings - -

Other creditors - -

- -

========= =========

The performance obligations of the IFRS 15 contract liabilities

(payments received on account) are expected to be met

within the next financial year.

16 Borrowing analysis

2022 2021

GBP'000 GBP'000

--------- ---------

Due within one year

Bank and other loans 708 269

Directors' loan 1,644 1,748

Obligations under lease agreements 322 139

--------- ---------

2,674 2,156

========= =========

Due after more than one year

Bank and other loans 491 628

Directors' loan 2,751 2,392

Obligations under lease agreements 2,370 185

------ ------

5,612 3,205

====== ======

Repayable

Due within 1 year 2,729 2,156

Over 1 year but less than 2 years 3,249 2,576

Over 2 years but less than 5

years 2,361 629

--------- --------

8,339 5,361

========= ========

Directors' loans

Included with Directors' loans and borrowings due within one

year are accrued fees and interest owing to G G Watt of

GBP1,644,000 (2021: GBP1,643,000). The accrued fees and interest is

repayable on demand and no interest accrues on the balance.

The director's loan due in more than one year is a loan of

GBP2,750,000 from G G Watt. Directors' loans comprise of two

elements. A loan attracting interest at 2.15% over Bank of England

base rate. At the year end GBP1,750,000 (2021: GBP1,339,000) was

outstanding in relation to this loan. During the year to 30 June

2022 GBP200,000 (2021: GBP130,000) was repaid. The Company has the

right to defer payment for a period of 366 days.

On 13 August 2010 the Company issued GBP1 million of Convertible

Unsecured Loan Stock ("CULS") to G G Watt, the Chairman of the

Company. The CULS were issued to replace loans made by G G Watt to

the Company amounting to GBP1million and has been recognised in

non-current liabilities of GBP2,750,000.

Pursuant to amendments made on 13 November 2014 and 9 November

2018, and 30 June 2022 the principal terms of the CULS are as

follows:

- The CULS may be converted at the option of Gordon Watt at a

price of 3p per share at any time prior to 13 August 2026;

- Interest is payable at a rate of 10 per cent per annum on the

principal amount outstanding until converted, prepaid or repaid,

calculated and compounded on each anniversary of the issue of the

CULS. On conversion of any CULS, any unpaid interest shall be paid

within 20 days of such conversion;

- The CULS are repayable, together with accrued interest on 13

August 2026 ("the Repayment Date").

No equity element of the convertible loan stock was recognised

on issue of the instrument as it was not considered to be

material.

Leases

The future minimum lease payments under lease agreements at the

year end date was GBP206,033 (2021: GBP123,382). The difference

between the minimum lease payments and the present value is wholly

attributable to future finance charges.

2022 Non-cash:

Bought Non-cash: Accrued Carried

forward Cash flows New leases fees/interests forward

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------- ------------- ------------- ---------------- ----------

Director loan 4,140 119 - 187 4,446

Leases 324 (163) 2,584 (53) 2,692

Other 897 286 - 18 1,201

---------- ------------- ------------- ---------------- ----------

Loans and borrowings 5,361 242 2,584 152 8,339

========== ============= ============= ================ ==========

2021 Non-cash:

Bought Non-cash: Accrued Carried

forward Cash flows New leases fees/interests forward

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------- ------------- ------------- ---------------- ----------

Director loan 4,121 (180) - 199 4,140

Leases 420 (165) 63 6 324

Other 851 36 - 10 897

---------- ------------- ------------- ---------------- ----------

Loans and borrowings 5,392 (309) 63 215 5,361

========== ============= ============= ================ ==========

17 Financial instruments

The Group uses financial instruments, which comprise cash and

various items, such as trade receivables and trade payables

that arise from its operations. The main purpose of these financial

instruments is to finance the Group's operations.

The main risks arising from the Group's financial instruments

are credit risk, liquidity risk and interest rate risk. A number

of procedures are in place to enable these risks to be controlled.

For liquidity risk these include profit/cash forecasts by business

segment, quarterly management accounts and comparison against

forecast. The board reviews and agrees policies for managing

this risk on a regular basis.

Credit risk

The credit risk exposure is the carrying amount of the financial

assets as shown in note 14 (with the exception of prepayments

which are not financial assets) and the exposure to the cash

balances. Of the amounts owed to the Group at 30 June 2022,

the top 3 customers comprised 34% (2021: 43.00%) of total trade

receivables.

The Group has adopted a policy of only dealing with creditworthy

counterparties and the Group uses its own trading records to

rate its major customers, also the Group invoices in advance

where possible. The Group's exposure and the credit ratings

of its counterparties are continuously monitored and the aggregate

value of transactions concluded is spread amongst approved counterparties.

Having regard to the credit worthiness of the Groups significant

customers the directors believe that the Group does not have

any significant credit risk exposure to any single counterparty.

An analysis of trade and other receivables:

2022 Weighted Gross carrying Impairment

average loss value loss allowance

rate

GBP'000 GBP'000 GBP'000

-------------- --------------- ----------------

Performing 0.00% 1,809 -

2021 Weighted Gross carrying Impairment

average loss value loss allowance

rate

GBP'000 GBP'000

--------------- --------------- ----------------

Performing 0.00% 1,861 -

Interest rate risk

The Group finances its operations through a mixture of shareholders'

funds and borrowings. The Group borrows exclusively in Sterling

and principally at fixed and floating rates of interest and

are disclosed at note 16.

As disclosed in note 16 the Group is exposed to changes in interest

rates on its borrowings with a variable element of interest.

If interest rates were to increase by one percentage point the

interest charge would be GBP15,000 higher. An equivalent decrease

would be incurred if interest rates were reduced by one percentage

point.

Liquidity risk

As stated in note 1 the Executive Chairman, G G Watt, has pledged

to provide ongoing financial support for a period of at least

twelve months from the approval date of the Group statement

of financial position. It is on this basis that the directors

consider that neither the Group nor the Company is exposed to

a significant liquidity risk.

Contractual maturity analysis for financial liabilities:

2022 Less than Due between Due between

1 year 1-2 years 2 - 5+ years Total

GBP'000 GBP'000 GBP'000 GBP'000

---------- ------------ -------------- --------

Trade and other

payables 1,876 - - 1,576

Borrowings 2,405 2,887 355 5,647

Lease liability 322 363 2,007 2,692

---------- ------------ -------------- --------

4,603 3,250 2,362 10,215

========== ============ ============== ========

2021 Due or Due between Due between Due between

due in 1-3 months 3 months-1 1-5 years+

less than year Total

1 month

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------- ------------ ------------ ------------ --------

Trade and other

payables 997 197 170 - 1,364

Borrowings 164 95 1,897 3,205 5,361

----------- ------------ ------------ ------------ --------

1,161 292 2,067 3,205 6,725

=========== ============ ============ ============ ========

Financial liabilities of the Company are all due within less than

three month with the exception of the intercompany balances that

are due between 1 and 5 years.

Fair value of financial instruments

Loans and receivables are measured at amortised cost. Financial

liabilities are measured at amortised cost using the effective

interest method. The directors consider that the fair value of

financial instruments are not materially different to their carrying

values.

Capital risk management

The Group's objectives when managing capital are to safeguard

the Group's ability to continue as a going concern in order to

be able to move to a position of providing returns for shareholders

and benefits for other stakeholders and to maintain an optimal

capital structure to reduce the cost of capital.

The Group manages trade debtors, trade creditors and borrowings

and cash as capital. The entity is meeting its objective for managing

capital through continued support from G G Watt as described per

note 1.

18 Share capital

2022 2022 2021 2021

No. GBP'000 No. GBP'000

----------- -------- ----------- --------

Authorised

Ordinary shares of 1p each 40,000,000 400 40,000,000 400

=========== ======== =========== ========

Allotted and fully paid

Brought forward 34,860,515 349 34,360,515 344

Issued during the year 1,452,308 14 500,000 5

Carried forward 36,312,823 363 34,860,515 349

=========== ======== =========== ========

Fully paid ordinary shares carry one vote per share and carry

a right to dividends.

11,773,703 (2021: 12,773,703) share options were outstanding

at the year end, comprising the 1.12m employee options and the

10,653,703 share options and warrants held by directors disclosed

below.

Share based payments have been included in the financial statements

where they are material. No share based payment expense has been

recognised.

No deferred tax asset has been recognised in relation to share

options due to the uncertainty of future available profits.

The director and employee share options were issued as part of

the Group's strategy on key employee remuneration, they lapse

if the employee ceases to be an employee of the Group during

the vesting period.

Employee options

Date options exercisable Number of Exercise price

shares

Between July 2016 and July

2023 80,000 3.00p

Between November 2019 and 400,000 3.875p

November 2026

Between November 2020 and 300,000 3.75p

November 2027

Between March 2024 and March

2031 1,290,000 8.00p

Directors' share options

Number of options

--------- -------------------------------- --------- ------------

Directors' Granted Lapsed Date from

share options At during during At end Exercise which

start the year the year of year price exercisable

of year

-------- --------- ---------- ---------- --------- ------------

18 Mar

G G Watt 750,000 - 750,000 8.0p 2024

S P Padmanathan 200,000 (200,000) - 3.9p

S P Padmanathan 300,000 (300,000) - 8.0p

18 Mar

R MacDonnell 200,000 - 200,000 8.0p 2024

The Company's share price at 30 June 2022 was 16.5p. The high

and low during the period under review were 37p and 5.6p respectively.

In addition to the above, in consideration of loans made to the

Company, G G Watt has warrants over 3,703,703 ordinary shares

at an exercise price of 13.5p and a further 6,000,000 ordinary

shares at an exercise price of 3.0p.

The weighted average contractual life of share options outstanding

at the year end is 7.09 years (2021: 6.87 years).

19 Related party transactions

Directors' loan disclosures are given in note 16. The interest

payable to directors in respect of their loans during the year

was:

G G Watt - GBP140,005

The directors are considered the key management personnel of

the Company. Remuneration to directors is disclosed in note 6.

There is no ultimate controlling party of PipeHawk plc.

20 Government grants

In addition to the Government assistance disclosed in note 16,

the following Government grants were received and has been recognised

during the period:

2022 2021

GBP'000 GBP'000

--------- ---------

Coronavirus Job Retention Scheme

grants 48 340

48 340

========= =========

21 Copies of Report and Accounts

Copies of the Report and Accounts will be posted to shareholders

later today and will be available from the Company's registered

office, Manor Park Industrial Estate, Wyndham Street, Aldershot,

Hampshire GU12 4NZ and from the Company's website www.pipehawk.com

.

22 Notice of Annual General Meeting

The Report and Accounts will include a notice that the annual

general meeting will be held at the offices of Allenby Capital

Limited, 5 St Helen's Place, London, EC3A 6AB at 11:30 am. on 22

December 2022.

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPGQWGUPPGRR

(END) Dow Jones Newswires

November 29, 2022 02:00 ET (07:00 GMT)

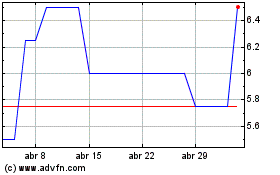

Pipehawk (LSE:PIP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Pipehawk (LSE:PIP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024