TIDMPLUS

RNS Number : 4065C

Plus500 Limited

11 October 2022

11 October 2022

Plus500 Ltd.

("Plus500", the "Company" or together with its subsidiaries the

"Group")

Q3 2022 Trading Update

Further outstanding financial and operational performance, with

on-going strategic progress delivered

Plus500, a global multi-asset fintech group operating

proprietary technology-based trading platforms, issues the

following trading update for the nine months ended 30 September

2022[1].

Financial Highlights (unaudited):

YTD[2] YTD 2021 Change

2022 %

$7 05

Revenue . 9 m $557.6m 27%

---------- -------- ------

EBITDA $4 0 7.1m $316.2m 29%

---------- -------- ------

EBITDA Margin % 58% 57% 2%

---------- -------- ------

Q3 2022 Q3 2021 Change

%

$19 4

Revenue . 5 m $211.4m (8%)

-------- ------- ------

$10 1

EBITDA .8m $128.6m (21%)

-------- ------- ------

EBITDA Margin % 52% 61% (15%)

-------- ------- ------

Operational Highlights (unaudited):

YTD 2022 YTD 2021 Change

%

$2,81

ARPU ([3]) 7 $1,517 86%

--------- -------- ------

$1,48

AUAC ([4]) 7 $750 9 8 %

--------- -------- ------

New Customers [5] 81, 022 163,149 (50%)

--------- -------- ------

Active Customers [6] 250,553 367,573 (32%)

--------- -------- ------

Q3 2022 Q3 2021 Change

%

$ 1 ,

ARPU 44 5 $1,271 14%

--------- ------- ------

AUAC $1,5 98 $1,416 1 3 %

--------- ------- ------

New Customers 23 , 747 26,169 ( 9 %)

--------- ------- ------

Active Customers 134,657 166,310 (19%)

--------- ------- ------

Key Headlines :

-- Outstanding results achieved during the first nine months of FY 2022:

o S trong levels of Customer Income ([7]) helped to drive an

excellent revenue performance

o The Group's lean and flexible cost base supported a robust

EBITDA performance

o Plus500 remains in an extremely strong financial position,

with cash balances above $9 50 m as at 30 September 2022

-- Continued success in attracting and retaining high value, long-term customers:

o Driven by the Group's on-going focus on customer engagement

and further investment in customer retention, activation

initiatives and product development

o Customer confidence in Plus500 evidenced by consistently high

levels of customer deposits

-- Further progress made in entering new markets and launching

new products, in line with the Group's strategic roadmap :

o Excellent traction achieved in the US Futures market:

-- To activate the significant retail trading opportunity,

TradeSniper, Plus500's intuitive new proprietary Futures trading

platform tailored for US retail market, launched on iOS and

Android

-- Strategic position further developed as a market

infrastructure provider, supporting institutional clients with

brokerage-execution and clearing services

-- Additional investment in building Plus500's brand globally,

including the new sponsorship partnership signed with the NBA

Chicago Bulls

o Integration plans for the acquisition in Japan, which took

place earlier in 2022 to enable the Group ' s offering within the

Japanese market, are progressing well and remain on track

-- The Board remains confident about the Group's prospects in FY 2022 and beyond:

o The Board anticipates that revenue and EBITDA for FY 2022 will

be ahead of current market expectations [8]

o Plus500 expects to produce sustainable growth over the medium

to long term

Trading overview

Plus500 achieved continued outstanding financial and operational

performance during the first nine months of FY 2022, driven by the

power of the Group's market-leading proprietary technology and its

consistent ability to attract and retain higher value customers

over the long term, across a diverse range of geographic markets,

products and financial instruments.

As a result, revenue during the first nine months of FY 2022 was

$705. 9 m (YTD 2021: $557.6m) including $194.5m in Q3 2022 (Q3

2021: $211.4m).

Customer Income, a key measure of the Group's underlying

performance, remained robust at $489.2m in the first nine months of

FY 2022 (YTD 2021: $536.1m) including $149.4m in Q3 2022 (Q3 2021:

$156.9m). This consistent performance highlights the Group's

on-going focus on customer engagement and its continued investment

in product development.

Customer Trading Performance[9] in the first nine months of FY

2022 stood at $216.7m (YTD 2021: $21.5m) including $45.1m in Q3

2022 (Q3 2021: $54.5m). The Company continues to expect that the

contribution from Customer Trading Performance will be broadly

neutral over time.

Despite continued significant investments by the Group in

various marketing initiatives during the period, EBITDA in the

first nine months of FY 2022 was $407.1m, with EBITDA margin of 58%

(YTD 2021: $316.2m and 57%, respectively). This included EBITDA of

$101.8m and EBITDA margin of 52% in Q3 2022 (Q3 2021: $128.6m and

61%, respectively).

The levels of customer engagement and activity on Plus500's

trading platforms remained strong, supported by the Group's

on-going investments in its proprietary technological solutions for

customer retention, monetisation and activation.

As evidence of the success of these initiatives and the Group's

on-going customer-centric approach, the longevity of customer usage

on Plus500's trading platforms remained strong, with the Group also

on-boarding 81, 022 New Customers during the first nine months of

FY 2022 (YTD 2021: 163,149), including 2 3 , 747 New Customers

on-boarded during Q3 2022 (Q3 2021: 26,169) . This was driven by

the Group's diversified marketing approach and targeted

technological marketing investment strategy.

The number of Active Customers remained robust during the first

nine months of FY 2022 at 250, 553 (YTD 2021: 367,573), driven by

the Plus500 's focus on customer engagement initiatives and

investments in product development. ARPU was very strong at $2,817

during the first nine months of FY 2022 (YTD 2021: $1,517), driven

by the Group's excellent revenue performance.

AUAC during the first nine months of FY 2022 was $1,4 8 7 (YTD

2021: $750), driven by the Group's continued significant

investments to attract high value, long term customers, through

various marketing and retention initiatives. With further

investments expected to be made going forward, to help deliver

consistent future returns, the Group continues to expect that AUAC

will rise steadily over time.

Average client deposits increased significantly by 58% to a

level of approximately $6,800 during the first nine months of FY

2022 (YTD 2021: approximately $4,300) and approximately $ 3,900 in

Q 3 2022 (Q 3 2021: approximately $2,750), highlighting customers'

on-going loyalty and confidence in Plus500's technology and diverse

product portfolio.

The Group remains in a very strong financial position, with cash

balances above $950m as at 30 September 2022 (31 December 2021:

$749.5m).

Strategic progress

Plus500 made further strategic progress in entering new markets

and launching new products during the first nine months of FY 2022,

thereby further diversifying the Group's revenue streams and

business model.

During the period, excellent traction was made in the

substantial US Futures market where the Group targets a number of

major growth opportunities.

To activate the significant retail trading opportunity, Plus500

recently launched TradeSniper, an intuitive new proprietary Futures

trading platform specifically tailored for the US retail market,

both on iOS and Android. This will enable the Group to benefit from

the continued increase in accessibility to the Futures market for

the retail trading community.

In addition, the Group continued to develop its strategic

position in the US as a market infrastructure provider during the

period, supporting institutional clients with brokerage-execution

and clearing services. This will be driven by the Group's healthy

balance sheet, its highly differentiated technological capabilities

and its position as a full clearing member of the CME Group

exchanges.

The Group's strategic positioning in the US was further

developed by continued investment in Plus500's global brand, in

particular through a new sponsorship partnership signed recently

with the NBA Chicago Bulls.

Integration plans for the regulated entity acquired in Japan

earlier this year, are progressing well and remain on track. This

will broaden the Group's geographic footprint into the substantial

Japanese trading market, where Plus500 will apply its financial and

technological strength to scale and develop its market position

over time.

The Company continues to invest in product development to

further deepen customer engagement, including through the on-going

recruitment at the Company's R&D centres in Israel. With these

investments in technology and people, the Group will continue to

leverage the latent base of over 23 million customers registered on

its platforms since inception.

On Tuesday 20 September, the Group held its first ever Capital

Markets Day, hosted by Plus500's management team. The event was

attended by a wide range of analysts and investors and has received

positive feedback from shareholders, who appreciated the details

disclosed at the event on the key elements of Plus500's investment

case, business model and major growth opportunities for the Group.

A recording of the event is available on the Group's Investor

Relations site: https://investors.plus500.com/Reports/Presentation

.

Plus500 will continue to pursue additional growth opportunities,

through organic investments and by actively targeting acquisitions,

in order to further develop its strategic position as a global

multi-asset fintech group.

Outlook

The Board remains confident about the Group's prospects for FY

2022 and beyond, as a result of the significant operational

progress and financial momentum achieved by Plus500 over recent

years.

The Board anticipates that revenue and EBITDA for FY 2022 will

be ahead of current market expectations and continues to expect

that Plus500 will deliver sustainable growth over the medium to

long term.

David Zruia, Chief Executive Officer of Plus500, commented:

"Plus500 has continued to outperform in 2022, driven by the

power of our market-leading proprietary technology and our on-going

ability to attract and retain higher value, long-term customers. We

have made further traction in delivering against our strategic

priorities, in particular in starting to access the major growth

opportunities available in the US. Supported by continued

investment in growth, we continue to diversify and develop the

business as a global multi-asset fintech group, ensuring Plus500

remains well-positioned to deliver sustainable growth over the

medium to long-term."

For further details

Plus500 Ltd.

Elad Even-Chen, Chief Financial +972 4 8189503

Officer +44 7825 189088

Rob Gurner, Head of Investor ir@Plus500.com

Relations

Brunswick

Charles Pretzlik, Partner +44 20 3128 8549

Paul Durman, Partner Plus500@mhpc.com

About Plus500

Plus500 is a global multi-asset fintech group operating

proprietary technology-based trading platforms. Plus500 offers

customers a range of trading products, including OTC

("Over-the-Counter" products, namely Contracts for Difference

(CFDs)), share dealing, as well as futures and options on

futures.

The Group retains operating licences and is regulated in the

United Kingdom, Australia, Cyprus, Israel, New Zealand, South

Africa, Singapore, the Seychelles, the United States, Estonia and

Japan and through its OTC product portfolio, offers more than 2,500

different underlying global financial instruments, comprising

equities, indices, commodities, options, ETFs, foreign exchange and

cryptocurrencies. Customers of the Group can trade its OTC products

in more than 50 countries and in 30 languages. Plus500 does not

permit customers located in the US to trade its OTC products.

Plus500 does not utilise cold calling techniques and does not

offer binary options. Plus500's trading platforms are accessible

from multiple operating systems (Windows, iOS and Android) and web

browsers. Customer care is and has always been integral to Plus500,

as such, OTC customers cannot be subject to negative balances. A

free demo account is available on an unlimited basis for OTC

trading platform users and sophisticated risk management tools are

provided free of charge to manage leveraged exposure, and stop

losses to help customers protect profits, while limiting capital

losses.

Plus500 shares have a premium listing on the Main Market of the

London Stock Exchange (symbol: PLUS) and are a constituent of the

FTSE 250 index. www.plus500.com .

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation ("MAR"). Upon the publication of this

announcement via Regulatory Information Service ("RIS"), this

inside information is now considered to be in the public

domain.

Forward looking statements

This announcement contains statements that are or may be

forward-looking statements. All statements other than statements of

historical facts included in this announcement may be

forward-looking statements, including statements that relate to the

Group's future prospects, developments and strategies. The Company

does not accept any responsibility for the accuracy or completeness

of any information reported by the press or other media, nor the

fairness or appropriateness of any forecasts, views or opinions

express by the press or other media regarding the Group. The

Company makes no representation as to the appropriateness,

accuracy, completeness or reliability of any such information or

publication.

Forward-looking statements are identified by their use of terms

and phrases such as "believe", "targets", "expects", "aim",

"anticipate", "project", "would", "could", "envisage", "estimate",

"intend", "may", "plan", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. The forward-looking statements in this announcement

are based on current expectations and are subject to known and

unknown risks and uncertainties that could cause actual results,

performance and achievements to differ materially from any results,

performance or achievements expressed or implied by such

forward-looking statements. Factors that may cause actual results

to differ materially from those expressed or implied by such

forward looking statements include, but are not limited to, those

described in the Risk Management Framework section of the Company's

most recent Annual Report. These forward-looking statements are

based on numerous assumptions regarding the present and future

business strategies of the Group and the environment in which it is

and will operate in the future. All subsequent oral or written

forward-looking statements attributed to the Company or any persons

acting on its behalf are expressly qualified in their entirety by

the cautionary statement above. Each forward-looking statement

speaks only as at the date of this announcement. Except as required

by law, regulatory requirement, the Listing Rules and the

Disclosure Guidance and Transparency Rules, neither the Company nor

any other party intends to update or revise these forward-looking

statements, whether as a result of new information, future events

or otherwise.

1 All figures for the period ended 30 September 2022 and 30

September 2021 included in this announcement are unaudited

[2] YTD - "Year to Date" refers to first nine months of the

year, from 1 January to 30 September

[3] ARPU - Average Revenue Per User

[4] AUAC - Average User Acquisition Cost

[5] New Customers - Customers depositing for the first time

[6] Active Customers - Customers who made at least one real

money trade during the period

[7] Customer Income - Revenue from OTC Customer Income (customer

spreads and overnight charges) and Non-OTC Customer Income

(commissions from the Group's futures and options on futures

operation and from Plus500 Invest, the Group's share dealing

platform)

[8] Market expectations based on compiled analysts' consensus

forecasts, which can be found on the Investor Relations section of

the Company's website

[9] Customer Trading Performance - gains/losses on customers'

trading positions

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFSFASEESEDS

(END) Dow Jones Newswires

October 11, 2022 02:00 ET (06:00 GMT)

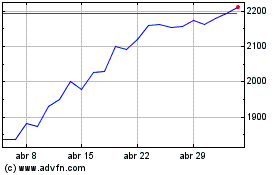

Plus500 (LSE:PLUS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Plus500 (LSE:PLUS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024