TIDMPPC

RNS Number : 5116B

President Energy PLC

14 February 2022

14 February 2022

PRESIDENT ENERGY PLC

("President", "the Company" or "the Group")

2021 Unaudited Key Trading Highlights

New Argentine Reserves Report as at 31 December 2021

President Energy (AIM: PPC), the energy company with a diverse

portfolio of production and exploration energy assets currently

focused primarily in South America, announces unaudited 2021

trading highlights together with an updated Argentine reserves

report as at 31 December 2021.

2021 Unaudited Trading Highlights

-- Turnover of approximately US$34.2 million, without any

consistent contribution from the Louisiana assets

-- Average Group production of 2,473 boepd (2020: 2,714 boepd)

with no material contribution from Louisiana

-- Estimated adjusted EBITDA in Argentina of US$9.5 million

(calculated on the basis of Group financial reporting)

-- US$14.5 million of free cash generation from operations

(after workovers) and treasury income

-- Group results are expected to include a benefit of US$13

million to the profit and loss account arising from the spin out of

Atome Energy PLC and dividend distribution to shareholders of

President which represented a yield of approximately 20 per

cent

-- The Company retains a 27.9% holding in Atome Energy PLC which

at 31 December had a market value of US$9.8 million

Argentine Reserves as at 31 December 2021

-- President's 2P reserves in Argentina as at the year end have

been assessed at a robust 24.4 MMboe

-- Argentina reserves and contingent resources have been

independently certified according to Argentinian Law as at 31

December 2021, after taking into account production in the year

-- Group net 2P Reserves of over 24 MMboe limited to current

life remaining of concessions taking no account of any future

extension of such contracts

-- Significant contingent resources in producing areas awaiting

conversion to reserves after contract terms are prolonged

-- The reserves reported exclude the internally estimated

Paraguay exploration PMean of 536 MMbo unrisked oil-in-place that

are in addition to the figures reported today; drilling of a

complex estimated to contain 230 MMbo of that total will be

undertaken in 2022 in a joint venture with CPC, the state energy

company of Taiwan.

YE2021 Reserves YE2020 Reserves

(MMboe) (MMboe)

1P 2P 3P 1P 2P 3P

------ ----- ----- ------ ----- -----

Puesto Guardian,

Salta 6.2 11.7 19.4 5.7 12.7 20.8

------ ----- ----- ------ ----- -----

Rio Negro,

Neuquen Basin 7.3 12.7 15.3 7.6 10.9 13.2

------ ----- ----- ------ ----- -----

Total Argentina 13.5 24.4 34.7 13.3 23.6 34.0

------ ----- ----- ------ ----- -----

Peter Levine , Chairman, commented

"Whilst trading in 2021 was solid, despite the static production

taking into account the loss in all material respects of

Louisiana's contribution in the year, we still showed a healthy,

operationally profitable business

"On a strategic level, we produced material returns for our

shareholders through the spin out and IPO of Atome Energy and

successfully, notwithstanding the pandemic, farmed out our Paraguay

exploration prospect to the state energy company of Taiwan

"It is important to ensure that going forward we leave no stone

unturned to achieve optimum performance and delivery for our

capital expenditure

"With one new well in Salta on stream and still stabilising, the

second to be online at the end of this week and the third to be

drilled this month, Salta commercial oil production is already

increasing and is expected to continue as the other new wells come

on. The waterflood secondary recovery project in Rio Negro

scheduled to start within 6 months is very promising for both

stabilising natural decline and increasing the amount of

recoverable oil. Work is progressing to prepare for the high impact

exploration well in Paraguay to be drilled this year targeting,

based on internal estimates, 230 million barrels of unrisked oil in

place

"We therefore look forward to an improved performance this year

with regular newsflow keeping the market updated".

Glossary:

1P means proven reserves

2P means proven and probable reserves

3P means proven, probable and possible reserves

Adjusted EBITDA is Earnings before interest, tax, depreciation,

amortisation and impairment

Law means sections 35 and 58bis of the Argentine Hydrocarbons

Law 17,319 (as amended by Law 27,007)

MMboe means million barrels of oil and oil equivalent (gas)

Oil in place means the total content of a potential oil

reservoir

Pmean means the expected average value of all possible

outcomes

Contact:

President Energy PLC +44 (0) 207 016 7950

Rob Shepherd, Group FD

Nikita Levine, Investor Relations info@presidentpc.com

finnCap (Nominated Advisor and broker)

Christopher Raggett, Tim Harper +44 (0) 207 220 0500

Notes to Editors

President Energy is an oil and gas company listed on the AIM

market of the London Stock Exchange (PPC.L) primarily focused in

Argentina, with a diverse portfolio of operated onshore producing

and exploration assets.

The Company has operated interests in the Puesto Flores,

Estancia Vieja, Puesto Prado and Las Bases Concessions, and

Angostura exploration contract, all of which are situated in the

Río Negro Province in the Neuquén Basin of Argentina and in the

Puesto Guardian Concession, in the Noroeste Basin in NW Argentina.

Alongside this, President Energy has cash generative production

assets in Louisiana, USA and further significant exploration and

development opportunities through its acreage in Paraguay and

Argentina.

With a strong strategic and institutional base of support,

including the international commodity trader and logistics company

Trafigura, an in-country management team as well as the Chairman

whose interests as the largest shareholder are aligned to those of

its shareholders, President Energy gives UK investors access to an

energy growth story combined with world class standards of

corporate governance, environmental and social responsibility.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR"). The person who arranged for the release of this

announcement on behalf of the Company was Peter Levine,

Chairman.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTMZGMZZFMGZZZ

(END) Dow Jones Newswires

February 14, 2022 02:00 ET (07:00 GMT)

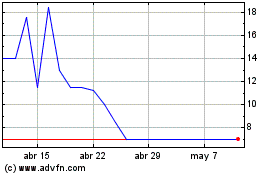

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024