TIDMRBGP

RNS Number : 8662G

RBG Holdings PLC

01 April 2022

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR"). Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

1 April 2022

RBG Holdings plc

("RBG", the "Group", or the "Company")

Executive Incentive Plan & Growth Share Schemes

Grant of Options and PDMR Dealings

RBG Holdings plc (AIM: RBGP), the professional services group,

today announces the introduction of a new Executive Incentive Plan

("EIP") and new Growth Share Schemes.

Since the Group's admission to AIM in 2018, RBG has delivered

significant growth through a combination of organic and

acquisition-led performance. Given the growth and evolution of the

Group, the Board believes a new remuneration structure is needed to

retain and motivate the senior management team and key performing

employees while focusing them on long-term value creation and

aligning their interests directly with shareholders.

The EIP will replace the Group's existing senior executive bonus

scheme, and the two new forms of growth share schemes will be

introduced to replace the Convex Capital Limited ("Convex Capital")

flexible commission scheme announced on 3 February 2021, and

introduce, for the first time, a share based incentive scheme for

RBG Legal Services Limited ("RBGLS") .

EIP

The EIP will cover a five-year performance period from 1 January

2022 to 31 December 2026 ("the Performance Period"). The EIP

participants, being the Group CEO, Group CFO and Group HR director,

will be granted an award of options ("EIP Options") that will be

capable of converting into new ordinary shares in the Company.

The EIP is subject to performance criteria and EIP Options can

only be exercised provided a hurdle calculated by reference to a

10% annualised growth in the Company's share price from the start

of the Performance Period on 1 January 2022 (based on an opening

share price of GBP1.23 per share) (the "Threshold Hurdle") has been

achieved.

Providing the Threshold Hurdle has been achieved by the end of

the Performance Period, the EIP participants will be entitled to

receive, in aggregate, 8% of the value created for shareholders

above the Threshold Hurdle via the EIP Options. This value sharing

percentage will apply only to the ordinary shares in issue on 1

January 2022, being 95,331,236 shares, and is capped at a maximum

aggregate award of 10% of this number of shares.

As part of the implementation of the EIP, Nicola Foulston and

Robert Parker have agreed they will forgo an annual bonus and will

not receive further incentives for the duration of the EIP.

The allocation of options under the EIP will be as follows:

Name and Position Allocation of options

Nicola Foulston (CEO) 50%

----------------------

Robert Parker (CFO) 45%

----------------------

Roma Marlin (HR Director) 5%

----------------------

A further announcement will be made at the time EIP Options are

issued.

Growth Share Schemes - Convex Capital & RBGLS

Furthermore, the Group will implement two Growth Share Schemes

to incentivise key employees at Convex Capital and RBGLS. The

Growth Share Schemes are designed to drive the continued growth of

the individual businesses and will form the cornerstone of the

Company's Long Term Remuneration structure in Convex Capital and

RBGLS to retain and motivate key employees. The schemes will focus

key employees on long-term value creation and further align their

interests directly with shareholders.

All of the Group's share schemes are subject to restrictions

such that the number of shares over which options are in issue in

any ten year rolling period shall not exceed 10% of the Company's

issued share capital. In the event that this limit is likely to be

exceeded the number of options available under the EIP will be

subject to an appropriate limitation.

The EIP and Growth Share Schemes have been approved by the

Company's Remuneration Committee and discussed with the Company's

largest shareholders.

Further details of the EIP and Growth Share Schemes will be set

out in the Group's 2021 Annual Report and Accounts.

Grant of Options and PDMR dealings

The Company further announces that it has today, 1 April 2022,

granted 1,000,000 nil-cost options over ordinary shares of 0.2

pence each in the Company to Robert Parker, Chief Financial

Officer. The options will vest over two years and be subject to no

further conditions other than for Robert Parker to remain employed

by the Group, and are awarded in recognition of his three years'

service with no prior equity allocation.

Enquiries:

RBG Holdings plc Via SEC Newgate

Nicola Foulston, CEO

Singer Capital Markets (Nomad and Broker) Tel: +44 (0)20 7496

Rick Thompson / Alex Bond / James Fischer (Corporate 3000

Finance)

Tom Salvesen (Corporate Broking)

SEC Newgate (for media enquiries) Tel: +44 (0)7540

Robin Tozer/Richard Bicknell 106366 rbg@secnewgate.co.uk

About RBG Holdings plc

RBG Holdings plc is a professional services group, which

comprises the following divisions:

RBG Legal Services Limited ("RBGLS")

RBGLS is the Group's legal services division which combines the

businesses previously operated by Rosenblatt Limited and Memery

Crystal LLP.

Rosenblatt

Rosenblatt is one of the UK's pioneering legal practices and a

leader in dispute resolution. Rosenblatt provides a range of legal

services to its diversified client base, which includes companies,

banks, entrepreneurs and individuals. Complementing this is

Rosenblatt's increasingly international footprint, advising on

complex cross-jurisdictional disputes.

Memery Crystal

Memery Crystal offers legal services in a range of areas such as

corporate (including a market-leading corporate finance offering),

real estate, commercial, IP & technology (CIPT), banking &

finance, tax & wealth structuring and employment. Memery

Crystal is one of the leading legal practices in the UK to advise

the emerging cannabis sector on a wide range of business issues.

Memery Crystal offers a partner-led service to a broad range of

clients, from multinational companies, financial institutions and

owner-managed businesses to individual entrepreneurs.

LionFish Litigation Finance Limited ("LionFish")

The Group also provides litigation finance in selected cases

through a separate arm, LionFish Litigation Finance Limited.

LionFish finances litigation matters being run by other solicitors

in return for a significant return on the outcome of those cases.

As such, the Group has two types of litigation assets -

Rosenblatt's own client matters, and litigation matters run by

third-party solicitors. LionFish is positioned to be a unique,

alternative provider to the traditional litigation funders.

Convex Capital Limited ("Convex Capital")

Convex Capital is a specialist sell-side corporate finance

boutique based in Manchester. Convex Capital is entirely focused on

helping companies, particularly owner-managed and entrepreneurial

businesses, realise their value through sales to large corporates.

Convex Capital identifies and proactively targets firms that it

believes represent attractive acquisition opportunities.

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Robert Parker

--------------------------------------- ----------------------------------------

2 Reason for the notification

---------------------------------------------------------------------------------

a) Position/status Chief Financial Officer (PDMR)

--------------------------------------- ----------------------------------------

b) Initial notification Initial Notification

/Amendment

--------------------------------------- ----------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

---------------------------------------------------------------------------------

a) Name RBG Holdings plc

--------------------------------------- ----------------------------------------

b) LEI 213800MJO31M84UMFL64

--------------------------------------- ----------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

---------------------------------------------------------------------------------

a) Description of the Ordinary Shares of 0.2 pence each

financial instrument,

type of instrument

Identification code ISIN: GB00BFM6WL52

b) Nature of the transaction Grant of options

--------------------------------------- ----------------------------------------

c) Price(s) and volume(s)

------------------ -----------------

Price(s) Volume(s)

------------------ -----------------

nil 1,000,000

--------------------------------------------------------------- -----------------

d) Aggregated information N/A - single transaction

- Aggregated volume

- Price

e) Date of the transaction 1 April 2022

--------------------------------------- ----------------------------------------

f) Place of the transaction Outside a trading venue

--------------------------------------- ----------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHUAVRRUKUOOUR

(END) Dow Jones Newswires

April 01, 2022 02:01 ET (06:01 GMT)

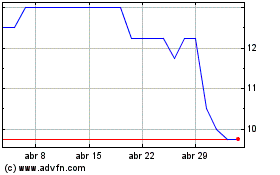

Rbg (LSE:RBGP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Rbg (LSE:RBGP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024