TIDMRBGP

RNS Number : 5217I

RBG Holdings PLC

05 December 2022

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 as retained as part of UK

law by virtue of the European Union (Withdrawal) Act 2018 (as

amended). Upon the publication of this announcement, this inside

information is now considered to be in the public domain.

5 December 2022

RBG Holdings plc

("RBG" or the "Group")

Trading & Dividend Update

RBG Holdings plc (AIM: RBGP), the professional services group,

today publishes an update on current trading and outlook.

RBG's strategy has been to deliver revenues and profit from a

diversified portfolio of professional services businesses, reducing

overall volatility of earnings and the impact of any losses from

any one business. This strategy has served the Group successfully

since its admission to AIM in 2018 with the Group achieving

profitable top line growth each year.

Professional Services - RBG Legal Services Limited ("RBGLS") and

Convex Capital Limited ("Convex")

The Group's professional services businesses RBGLS which holds

the Company's two client-facing brands ('Rosenblatt', and 'Memery

Crystal)', and Convex have had a robust performance year-to-date,

despite the market headwinds.

As a result, RBGLS is on track to exceed the Board's

expectations for the full year, whilst Convex has some transactions

which are now expected to complete in Q1 2023, with deferment of

revenue into the new financial year. Together, the professional

services businesses will be marginally ahead of the Board's

expectations for the year.

LionFish Litigation Finance Limited ("LionFish")

The Group's litigation finance subsidiary, LionFish has recently

lost two of the cases that it has invested in and following a

review, the Board has now concluded that any further appeals on

these cases are no longer viable.

As a result, LionFish will now have a non-cash write-off of

GBP4.0m in 2022 and will, therefore, miss the Board's previous

expectations of GBP2.3m profit. The actual cash loss associated

with these cases amounts to GBP1.1m over the life of the

investment.

Committed funding on the on-going Lionfish cases is GBP3.3m over

the next two years.

The Board has been reviewing its strategy with respect to third

party litigation funding through LionFish with a view to reducing

the Group's ongoing exposure to the remaining committed funding.

The Group expects to make a further announcement after the

year-end.

Dividend

As a result of the strong performance in the professional

service businesses, the Group intends to announce as planned a

second interim dividend for the twelve months to 31 December 2022

in its full year trading statement in January 2023 in line with its

policy of distributing up to 60% of retained profits.

Balance Sheet

As highlighted above, losses arising from the unsuccessful

Litigation Finance cases have no further impact on the Group's cash

position and the Group's balance sheet remains in line with the

Board's expectations. Free cash flow generation at Group level has

remained positive and strong across 2022. The Group continues to

trade within its facility agreements and retains sufficient

headroom to execute on its strategy.

Outlook

RBGLS continues to trade robustly and Convex has a strong

pipeline of deals which remain in process. As a result of the case

losses in LionFish, the Group now expects adjusted EBITDA to be

materially behind current market consensus expectations for 2022

and in a range of between GBP11.0m-GBP12.0m. The Board is confident

in the medium and long-term outlook of the business.

Commenting Group CEO Nicola Foulston, said: "I am very

disappointed with the LionFish position. We are taking steps to

address the ongoing exposure to this subsidiary. We will also look

at the efficiency of the cost base so that in 2023 we continue to

deliver strong cash generation and good yield.

"I am pleased to see the robust trading of our professional

services business, which follows a strong 2021 financial year. We

are seeing the benefits of the integration of Memery Crystal and

Rosenblatt with improved operating efficiency driving higher

margins. While there is some disruption from difficult market

conditions, Convex continues to benefit from its model of deep deal

origination around the demands of buyers for good businesses.

"As we refocus the Group on Professional Services business, we

are excited at the potential to grow the businesses organically and

drive opportunities for cross-selling.

"We are confident in the medium to long-term outlook of the

business and are looking forward to the next 12 months with

optimism, despite the ongoing economic uncertainty."

Enquiries:

RBG Holdings plc Via SEC Newgate

Nicola Foulston, CEO

Singer Capital Markets (Nomad and Broker) Tel: +44 (0)20 7496

Rick Thompson / Alex Bond / James Fischer 3000

(Corporate Finance)

Tom Salvesen (Corporate Broking)

SEC Newgate (for media enquiries) Tel: +44 (0)7540

Robin Tozer 106366

rbg@secnewgate.co.uk

About RBG Holdings plc

RBG Holdings plc is a professional services group, which

comprises the following divisions:

RBG Legal Services Limited ("RBGLS")

RBGLS is the Group's legal services division which combines the

businesses previously operated by Rosenblatt Limited and Memery

Crystal LLP.

Rosenblatt

Rosenblatt is one of the UK's pioneering legal practices and a

leader in dispute resolution. Rosenblatt provides a range of legal

services to its diversified client base, which includes companies,

banks, entrepreneurs and individuals. Complementing this is

Rosenblatt's increasingly international footprint, advising on

complex cross-jurisdictional disputes.

Memery Crystal

Memery Crystal offers legal services in a range of areas such as

corporate (including a market-leading corporate finance offering),

real estate, commercial, IP & technology (CIPT), banking &

finance, tax & wealth structuring and employment. Memery

Crystal is one of the leading legal practices in the UK to advise

the emerging cannabis sector on a wide range of business issues.

Memery Crystal offers a partner-led service to a broad range of

clients, from multinational companies, financial institutions and

owner-managed businesses to individual entrepreneurs.

Convex Capital Limited ("Convex Capital")

Convex Capital is a specialist sell-side corporate finance

boutique based in Manchester. Convex Capital is entirely focused on

helping companies, particularly owner-managed and entrepreneurial

businesses, realise their value through sales to large corporates.

Convex Capital identifies and proactively targets firms that it

believes represent attractive acquisition opportunities.

LionFish Litigation Finance Limited ("LionFish")

The Group also provides litigation finance in selected cases

through a separate arm, LionFish Litigation Finance Limited.

LionFish finances litigation matters being run by other solicitors

in return for a significant return on the outcome of those cases.

As such, the Group has two types of litigation assets -

Rosenblatt's own client matters, and litigation matters run by

third-party solicitors. LionFish is positioned to be a unique,

alternative provider to the traditional litigation funders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUSAARUOUURUA

(END) Dow Jones Newswires

December 05, 2022 02:00 ET (07:00 GMT)

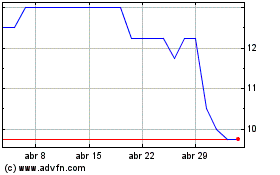

Rbg (LSE:RBGP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Rbg (LSE:RBGP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024