TIDMRBW

RNS Number : 7912D

Rainbow Rare Earths Limited

24 October 2022

24 October 2022

Rainbow Rare Earths Limited

("Rainbow" or "the Company")

LSE: RBW

Preliminary results for the year ended 30 June 2022

Rainbow Rare Earths is pleased to announce its preliminary

results for the year ended 30 June 2022 ("FY 2022").

The financial information in this release does not constitute

the Financial Statements. The Group's Annual Report, which includes

the audit report and audited Financial Statements for the year

ended 30 June 2022, will be available on the Company's website at

www.rainbowrareearths.com .

Highlights

-- Increasing demand for magnet rare earths underpinned by

rising electric vehicle sales forecasts and mounting capacity

acceleration in the offshore wind market.

-- A major shortage of neodymium and praseodymium is predicted

by 2035 [1] due to a lack of rare earths sources and the inability

of existing producers to increase their output.

-- Rare earth prices rose substantially in FY 2022, with

Phalaborwa's basket price up 82%, and long-term supply demand

fundamentals support significant increases towards the second half

of this decade.

-- Progress made at Phalaborwa during FY 2022, culminating in

the recent publication of Phalaborwa's PEA highlighting its robust

economics and the significant opportunity provided by this project

to provide near-term production of rare earth oxides:

o Base case scenario establishes an NPV(10) of US$627 million,

an IRR of 40%, an average operating margin of 75% and a two-year

payback period.

o Using 2022 year to date average rare earth prices or long term

forecast rare earth prices, the PEA delivers an NPV(10) of c. US$1

billion, an average operating margin over 80%, an IRR of 51% and a

payback of 1.7 years.

-- By collaborating with third parties, Rainbow is working to

harness value from rare earths contained within other secondary

phosphogypsum sources.

-- Rainbow became a member of the European Raw Material Alliance

("ERMA") in FY 2022 - an essential alliance working to accelerate

the green and digital transition through securing and reinforcing

rare earths supply chains.

-- Continued constructive engagement with all stakeholders at

Gakara in Burundi, with confidence in the Company's ability to find

a resolution to allow operations to recommence.

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Market Abuse Regulation (EU) No 596/2014 ("MAR") which has been

incorporated into UK law by the European Union (Withdrawal) Act

2018 until the release of this announcement.

For further information, please contact:

Rainbow Rare Earths George Bennett

Ltd Company Pete Gardner +27 82 652 8526

SP Angel Corporate Ewan Leggat

Finance LLP Broker Charlie Bouverat +44 (0) 20 3470 0470

Matthew Armitt

Berenberg Broker Jennifer Lee +44 (0) 20 3207 7800

Tavistock Communications PR/IR Charles Vivian +44 (0) 20 7920 3150

Tara Vivian-Neal rainbowrareearths@tavistock.co.uk

Notes to Editors:

Rainbow's strategy is to identify near-term, secondary rare

earths production opportunities. Meeting escalating demand for

critical minerals needed for global decarbonisation, we are focused

on producing the magnet rare earth metals neodymium and

praseodymium ("NdPr"), dysprosium and terbium. With our strong

operating experience, proven project development experience, unique

intellectual property and diversified portfolio, Rainbow will

develop a responsible rare earths supply chain to drive the green

energy transition.

The Phalaborwa Rare Earths Project, located in South Africa,

comprises an Inferred Mineral Resource Estimate of 30.7Mt at 0.43%

TREO contained within unconsolidated gypsum stacks derived from

historic phosphate hard rock mining. High value NdPr oxide

represents 29.1% of the total contained rare earth oxides, with

economic Dysprosium and Terbium oxide credits enhancing the overall

value of the rare earth basket in the stacks. The rare earths are

contained in chemical form in the gypsum stacks, which allows high

value separated rare earth oxides to be produced in a single

processing plant at site with lower operating costs than a typical

rare earth mineral project.

Chairman's statement

From wind turbines to EVs, clean energy is dependent on

unlocking increased supplies of critical minerals, including rare

earths such as neodymium, praseodymium, dysprosium and terbium

which are fundamental components in permanent magnets.

Current geopolitical tensions and energy security risks serve to

further highlight the urgency of the clean energy transition, which

will not be possible without a reliable supply of minerals.

According to the IEA, demand for rare earth elements by 2040 may

rise between three and seven times from today's levels.

China currently dominates the global production of rare earth

magnets; however, many major governments have now implemented

critical and strategic materials policies, with a focus on creating

independent rare earth supply.

Rainbow has recently become a member of the European Raw

Material Alliance ("ERMA") - an essential alliance which is working

to accelerate the green and digital transition through securing and

reinforcing rare earths supply chains. Aiming to make Europe

economically more resilient, ERMA's goal is to diversify supply

chains, promote innovation, create jobs, and attract

investment.

With our near-term development opportunity at Phalaborwa,

alongside our unique and innovative technologies and processes, we

believe Rainbow is well positioned to contribute to a responsible,

independent supply chain, unlocking sources of critical permanent

magnet rare earths which are required to drive global

decarbonisation.

According to Adamus Intelligence, a major shortage of NdPr is

predicted by 2035 due to a lack of rare earths sources in the

market and the inability of existing producers to increase their

output. This underscores the compelling opportunity presented to

Rainbow, both at Phalaborwa and from the wider application of our

proprietary technology, to achieve near-term, responsible and

efficient rare earths production from secondary sources.

Rare earth prices rose substantially in FY 2022, with

Phalaborwa's basket price up 82% to US$173.91 per kg of magnet rare

earth oxides. Whilst prices fell back after the end of the

financial year, they have since moved upwards again and the

long-term supply demand fundamentals support significant increases

towards the second half of this decade.

We have made significant strides forward in 2022 with a number

of interesting collaborations and opportunities which we believe

will be central to harnessing value from rare earths contained

within secondary sources. Rainbow continues to work closely with

K-Technologies Inc. ("K-Tech") and is planning on jointly patenting

the rare earths extraction technology we have together developed.

We are also collaborating with OCP S.A. ("OCP"), the Moroccan world

leading producer of phosphate products, and Mohammed VI Polytechnic

University ("UM6P"), a Moroccan university, by signing a Master

Agreement in August 2022 on rare earths extraction from

phosphogypsum. In addition to this, we signed a Memorandum of

Understanding with a major chemicals company in South Africa in

June, as part of which we are investigating the opportunity to

extract rare earth elements from a nitro phosphate process stream

and identifying further global opportunities for our unique rare

earth extraction technology.

At our Gakara project in Burundi, which has been on care and

maintenance since June 2021, we continue to engage constructively

with all stakeholders and remain confident in our ability to

resolve the issue and allow operations to recommence.

On behalf of the Board of Directors, I would like to extend our

gratitude to our shareholders for their steadfast support, and to

Rainbow's management team, employees and contractors for their

unwavering commitment to the business' success. We also thank our

host governments for their continued productive engagement. Having

contributed a considerable amount of value to the Board since we

founded the Company in 2011, Robert Sinclair resigned as a

Non-Executive Director due to health reasons in January 2022. The

Board joins me in thanking Robert for the considerable contribution

he has made to Rainbow.

Our purpose is to produce the critical rare earth products

required to progress the global green technology revolution in an

efficient and responsible manner and thanks to the good progress at

Phalaborwa, I believe we are working well towards achieving this

goal.

I am encouraged by additional opportunities to leverage our

intellectual property and technology to extract rare earths from

phosphogypsum. Through our processing projects, which have

fundamentally different risk profiles to traditional rare earth

mining projects, we see enormous potential to facilitate near-term

access to sources of critical permanent magnet rare earths, which

are required to decarbonise energy systems in an environmentally

responsible way.

CEO's statement

This has been a year of notable progress for Rainbow, enabling

us to unlock a valuable, near-term source of the rare earth

permanent magnet metals required so urgently to drive the global

green energy revolution. This has involved carrying out a programme

of detailed test work at Phalaborwa to better understand the

exciting opportunity presented by this asset, leading to the

development of an economic flowsheet and the recent publication of

the preliminary economic assessment ("PEA").

By concentrating on phosphogypsum opportunities, the usual,

extensive resource definition period is removed, significantly

reducing the long lead time and risks associated with bringing a

traditional mine into production. In addition, we benefit from

considerable reductions in capital ("capex") and operating costs

("opex") compared to a traditional mine, due to the absence of hard

rock mining, mine waste disposal, ore crushing and milling within

the overall project cost base. Because the rare earth elements are

present in a 'cracked' chemical form in the phosphogypsum,

Rainbow's process will deliver separated rare earth oxides in a

single process flowsheet at site. This replaces the multiple stages

of reagent intensive processing usually required to crack a rare

earth mineral concentrate and separate out the rare earth oxides

from a mixed rare earth carbonate. Rainbow's process is also

expected to have a number of environmental benefits.

Phalaborwa's PEA, which establishes an NPV(10) [2] of US$627

million, an IRR [3] of 40%, an average operating margin of 75% and

a payback period of only 2 years, corroborates our long-held view

of the operation's enormous potential as a low capital intensity,

high margin, near-term rare earths development project. The base

case financial model presented, using near-term rare earth price

forecasts well below 2022 averages, demonstrates a robust project

with low sensitivity to changes in both rare earth prices and

costs.

The work carried out to date at this asset demonstrates

Rainbow's ability to overcome the historical technical,

environmental, and economic challenges related to extracting rare

earths from phosphogypsum. Importantly, whilst the configuration of

the process flowsheet is innovative, each individual stage is well

tested on a commercial basis, with the required equipment and

reagents being readily available.

The successful completion of this PEA represents not only a

breakthrough step in the development of Phalaborwa, demonstrating

the viability of this opportunity, but also underscores the broader

potential to use our unique IP and technology to extract rare

earths from other phosphogypsum sources on a global scale. We now

intend to advance to feasibility study, identify all permits

required for Phalaborwa's development, engage with the relevant

authorities to expedite permitting and undertake further process

optimisation tests culminating in an extensive process pilot plant

operation.

We are committed to responsible business practices from an

environmental, social and governance perspective. As a brownfield

site, the development of Phalaborwa provides us with a significant

opportunity to make positive environmental, social and economic

impacts. Effective stakeholder engagement will be a fundamental

part of project development, concentrating on understanding key

risks and integrating stakeholder considerations into project

development decisions to create long-term value.

I believe Phalaborwa's PEA accurately reflects the rigour and

expertise we apply to project assessment. As a team, we have led

numerous projects through development and have significant

experience throughout the asset lifecycle from optimisation and

feasibility to plant construction and commissioning. I am

exceptionally proud of the progress we have made over the past few

years and am confident that we have the right people in place to

take Phalaborwa's development forward. With our proven operating

experience, unique phosphogypsum processing intellectual property

and portfolio of opportunities, I believe that Rainbow is well

positioned to develop a responsible rare earths supply chain to

drive the green energy transition.

Operational review

Phalaborwa

Rainbow's Phalaborwa rare earths project in South Africa

presents the Company with an exciting near-term opportunity to

extract rare earths from a secondary source. Contained in

phosphogypsum in two unconsolidated stacks derived from historic

phosphate hard rock mining, the rare earths are in a 'cracked'

chemical form allowing separated rare earth oxides to be produced

at site. With no significant costs associated with mining, crushing

and grinding ore, or with chemical cracking of the underlying rare

earth minerals, the project economics are exceptionally strong.

Phalaborwa has an inferred mineral resource estimate of 30.7Mt

at 0.43% TREO, with a rare earth basket that is weighted towards

high value NdPr oxide, a critical building block for the global

energy transition, which represents 29.1% of the total contained

rare earth oxides. Economic Dysprosium (Dy) and Terbium (Tb) oxide

credits further enhance its overall value. Phalaborwa's NdPr grade

is substantially higher than a typical low-cost ionic clay rare

earth project, much closer to traditional hard rock style

deposits.

Fundamental to unlocking the rare earths contained within the

phosphogypsum at Phalaborwa (and more widely) is the innovative

processing flowsheet developed by Rainbow in parallel with K-Tech.

It represents a breakthrough in allowing for the economic

extraction of rare earth elements from phosphogypsum, which has

historically proven to be challenging. The flowsheet will comprise

the following steps:

-- Phosphogypsum will be reclaimed hydraulically from the

existing stacks and pumped to the processing facility removing

soluble impurities prior to the leach process.

-- A pre-leach regime will be employed to remove fluoride from

the gypsum stream, allowing rare earth grades in the pregnant leach

solution to be maximised. The extracted fluoride will produce

reagents for use elsewhere in the processing circuit, reducing

operating costs.

-- The fluoride leached phosphogypsum progresses to a rare earth

counter current sulphuric acid leach system for the extraction of

the target rare earth elements. This allows for successful

recycling of the various acid streams to optimise the overall

processing costs.

-- A rapid consolidation process for the rare earths in the

pregnant leach solution allows the rare earths to be concentrated

with primary impurity rejection. This process replaces the

originally anticipated nano filtration system, which significantly

improves the overall acid recycling, thereby reducing operating

costs.

-- The rapid consolidation process feeds the downstream

continuous ion exchange and continuous ion chromatography processes

to deliver separated rare earth oxides. The flow rates to these

processes are considerably lower than originally anticipated using

nano filtration techniques resulting in significant capital and

operating cost savings.

Phalaborwa PEA

Rainbow is earning a 70% interest in the Phalaborwa project by

delivering a pre-feasibility study, which is now in planning having

published the strong economic outcome from the PEA.

Robust base case economics

The PEA was based on processing 2.2 million tonnes per annum of

phosphogypsum over a 15-year project life to deliver 26,208 tonnes

of separated rare earth magnet oxides at an average cost of

US$33.86/kg. This delivers an exceptional 75% operating margin at

the base case basket price of US$137.92 per kg for the rare earth

oxides, based on near term forecasts well below both 2022 year to

date average prices and long-term market forecasts.

The base case financial model set out in the PEA delivered

exceptionally robust economic returns including:

-- Post-tax NPV(10) of US$627.4 million, representing 212% of

the US$295.5 million total capital cost1;

-- Post-tax IRR of 40%; and

-- Post-tax payback of upfront capital costs after 2.0 years of operations.

NPV upside using year-to-date prices

Using 2022 year to date average rare earth prices or long term

forecast rare earth prices the PEA delivers an EBITDA operating

margin over 80%, with an NPV(10) of c. US$1 billion and a payback

of 1.7 years.

Minimal sensitivities to cost

The project is insensitive to changes in costs, including an

overall low energy intensity at just 20% of annual operating costs.

Against a backdrop of the expected demand strength and supply

constraints for permanent magnet rare earths forecast over the next

decade and beyond, Phalaborwa is expected to deliver an independent

source of responsibly sourced rare earth oxides for the green

revolution.

Environmental benefits

Studies at Phalaborwa have highlighted the environmental

benefits of the project, which include very low levels of

radioactivity (exempting Phalaborwa from radioactivity regulation)

and the ability to neutralise the existing water from the stacks

for reuse in a closed circuit as plant process water. In processing

material from the existing gypsum stacks at Phalaborwa, we aim to

remove existing environmental liabilities and redeposit benign

gypsum on a new stack, built according to International Finance

Corporation ("IFC") Performance Standards and Equator

Principles.

Next steps

Following the publication of the PEA Rainbow intends to advance

the project to feasibility study, identify all permits required for

the Project to be developed, engage with the relevant authorities

to expedite permitting and undertake further process optimisation

tests culminating in an extensive process pilot plant operation. A

resource update is also expected for Phalaborwa following drilling

work undertaken in June 2022.

Gakara

The Gakara rare earths project is located in Western Burundi

covering an area of approximately 135km(2). The project benefits

from good infrastructure, with road links to Dar es Salaam,

Tanzania and Mombasa, Kenya. Trial mining and processing has

demonstrated that a high-grade rare earth mineral concentrate, with

a 19-20% NdPr content, can be consistently produced via simple

gravity separation from the narrow high-grade rare earth veins

found across the Gakara license area.

Gakara was placed on care and maintenance in June 2021 at the

request of the Government of Burundi, with the majority of staff

placed on suspension and short-term cash requirements minimised.

Rainbow continues to engage constructively with all stakeholders to

resolve the issue and allow trial mining to recommence. On the

expected restart of operations, Rainbow will assess the available

options to move the project to commercial production

Developing sources of phosphogypsum

The successful global transition to clean energy is reliant on a

considerable increase in supply of critical materials. Rainbow is

focused on identifying the optimal way of producing rare earths

responsibly from secondary sources, removing significant time, risk

and cost from the overall project timeline.

Phosphate rock is mined all over the world, with over three

quarters of global reserves located in Northern Africa. Given the

prevalence of phosphate mining, phosphogypsum is available

throughout the world in large volumes. This makes it an attractive

secondary source of rare earth elements.

Recognising this enormous potential, our team is concentrated on

securing opportunities for both collaboration and expertise

sharing, as well as gaining access to new supply.

In June, Rainbow entered into a Memorandum of Understanding with

a diversified chemicals group based in South Africa to investigate

the opportunity of extracting rare earth elements from a nitro

phosphate process stream at its phosphoric acid production plant

near Johannesburg in South Africa.

Under the terms of the MoU, Rainbow is conducting a rare earths

extraction pilot study with the chemicals group, involving initial

grade test work on processing stream material. This will be

followed by a technical programme to confirm a flowsheet using

Rainbow's unique knowledge and IP.

The feedstock for the phosphoric acid production plant

originates from the same ore originally mined by Foskor that

generated the two gypsum stacks at Phalaborwa. Preliminary sampling

of the processing stream indicates a grade of 0.81% TREO, with a

circa 27% weighting to high-value NdPr, alongside economic levels

of terbium and dysprosium, similar to Phalaborwa.

Direct costs associated with the pilot study utilising Rainbow's

exclusive IP and technology will be financed by the chemicals

group. Subject to a successful outcome, the parties intend to

negotiate terms for a potential joint venture agreement to extract

value from the rare earths present in the phosphoric acid

processing stream.

Post Year-end, in August 2022, Rainbow entered into a Master

Agreement with OCP, the Moroccan world leading producer of

phosphate products, and UM6P, a Moroccan university with a strong

focus on science, technology and innovation, to further investigate

and develop the optimal technique for the extraction of rare earth

elements from phosphogypsum.

Together with the innovative research carried out by UM6P, OCP

has built up significant IP assets and expertise in the field of

phosphogypsum processing. This provides a synergistic opportunity

for joint development with Rainbow, given Rainbow's expertise and

intellectual property on rare earths extraction and processing

gained from work carried out to date at Phalaborwa. OCP and UM6P

will contribute with their respective expertise, including adapted

complementary separation technologies. The Parties intend to

develop the optimal route for the extraction of rare earths from

phosphogypsum, and the development of pilot and industrial-scale

extraction of rare earths from phosphogypsum.

The recovery of rare earths from phosphogypsum arising as a

residue from phosphoric acid production has been the subject of

international research for many years. However, the process has

proven technically, environmentally and economically

challenging.

In 2022, following a robust international test work programme,

Rainbow confirmed the successful development of a process flowsheet

to extract rare earth elements efficiently from the phosphogypsum

stacks at Phalaborwa using an innovative process developed in

collaboration with K-Tech. Rainbow and K-Tech and are now in the

process of jointly patenting this breakthrough.

The process flowsheet utilises existing technology, proven at a

commercial scale across a number of industries, in a novel way to

overcome the technical challenges associated with economically

recovering the rare earth elements from the phosphogypsum. The

process includes a number of simple steps to remove impurities from

the phosphogypsum before leaching the rare earth elements into a

high-grade pregnant leach solution. Efficient recycling of leach

streams ensures reagent costs are optimised.

The high grade mixed rare earth solution is ultimately fed into

a patented continuous ion exchange and continuous ion

chromatography system to allow for the recovery of high purity

separated magnet rare earth oxides with far fewer steps than a

traditional solvent exchange process. Unlike traditional separation

techniques, the process does not require the costly separation of

low value products, such as cerium and lanthanum, before the high

value magnet rare earth oxides can be targeted.

The production of separated magnet rare earth oxides in a single

processing facility, without the need to ship significant volumes

of low value or waste material between a mine, cracking plant and

separation facility, also provide significant environmental and

cost benefits when compared to traditional methods.

Financial Review

PROFIT AND LOSS

With Rainbow's strategic focus on processing rare earths from

secondary sources, predominantly at Phalaborwa in South Africa, and

the Gakara project remaining on care and maintenance throughout the

year, the income statement represents the administrative costs for

the Group for the year.

Income statement costs associated with maintaining the Gakara

project on care and maintenance totalled US$1.3 million (FY 2021:

US$0.8 million). The increase is due to the change in treatment of

costs previously capitalised within exploration and evaluation

assets. In FY 2021 a total of US$1.9 million was spent at Gakara,

of which US$1.1 million was capitalised comprising US$0.4 million

of net costs associated with trial mining and processing, US$0.3

million of depreciation on the mining fleet and US$0.4 million of

direct exploration costs. With the project on care and maintenance

throughout FY 2022, all costs associated with Gakara are recognised

within the income statement as they do represent costs incurred to

evaluate the commercial viability of extracting the mineral

resource at the Gakara project. The reduced overall cost base at

Gakara in FY 2022 includes costs associated with suspending staff

contracts up to 31 December 2021, following which the team was

reduced to a core of 22 staff to safeguard the assets and maintain

the administration in country. All staff with terminated employment

contracts received redundancy payments in accordance with Burundi

law.

The Group's corporate costs grew in FY 2022. With the expected

fast track development of Phalaborwa, the administrative structures

for the Group are being strengthened, and a new administrative hub

has been established in South Africa. FY 2022 costs totalled US$2.3

million, increasing from US$1.9 million in FY 2021, predominantly

driven by staff costs.

Net finance costs of US$0.3 million (FY 2021: US$Nil) relate

primarily to foreign exchange differences. Gains on movements

between the Burundian Franc ('BIF') and US dollars, the functional

currency of the Group, were offset in FY 2022 by losses on

movements between GB Pounds, which the Group holds to match future

expected costs, and US dollars. Finance costs also include US$0.1

million (FY 2021: US$0.1 million) associated with the FinBank loan

in Burundi.

The corporation tax rate in Burundi is 30%. In the absence of

taxable profit, a minimum tax is charged calculated as 1% of

revenue. The tax charge in the year represents an adjustment to

minimum tax from prior periods.

BALANCE SHEET

The Group balance sheet includes US$9.8 million of non-current

assets at 30 June 2022 relating to Gakara, including US$8.6 million

of exploration and evaluation costs and tangible fixed assets with

a net book value of US$1.0 million. The Gakara cash generating unit

also includes US$0.9 million of inventory, carried at cost,

primarily relating to the stock of available for sale rare earth

concentrate in Burundi. Whilst the Gakara project remains on care

and maintenance, the Directors are confident that the issues with

the Government of Burundi will be resolved, allowing the asset to

recommence operations.

A total of US$0.8 million of exploration and evaluation assets

were capitalised in the year relating to Phalaborwa, leaving a

closing capitalised cost of US$1.9 million. The Group is earning a

70% interest in the Phalaborwa project by completing a

pre-feasibility study and at the balance sheet date has no tangible

fixed assets and no obligations for environmental closure at the

Phalaborwa site.

The Group balance sheet includes US$0.3 million of tax

receivables relating to the historic overpayment of royalties and

VAT recoverable in Burundi, both measured at expected recoverable

value. There are also US$0.5 million of tax and government

liabilities in Burundi.

During the year, the Group significantly strengthened its

balance sheet, raising US$8.5 million, net of costs, at a price of

15 pence per new Ordinary Share in October 2021. This funding

allowed the Pipestone loan to be fully repaid, including accrued

interest, via US$0.9 million cash and US$0.2 million equity at 15p

per new Ordinary Share. The sole remaining long-term financial

liability is the US$0.6 million FinBank loan in Burundi, on which

capital repayments are currently being deferred. At 30 June 2022,

the Group has US$4.1 million of cash which is predominantly held

with Barclays Bank in London.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30 June 2022

Year ended Year ended

30 June 30 June

Notes 2022 2021

US$'000 US$'000

Revenue - 639

Cost of sales - (639)

---------- ----------

Gross profit - -

Administration expenses (3,654) (2,707)

Loss from operating activities (3,654) (2,707)

---------- ----------

Finance income 216 433

Finance costs (543) (466)

Loss before tax (3,981) (2,740)

---------- ----------

Income tax expense (4) (2)

Total loss after tax and comprehensive expense for the year (3,985) (2,742)

========== ==========

Total loss after tax and comprehensive expense for the year is attributable to:

Non-controlling interest (105) (52)

Owners of parent (3,880) (2,690)

---------- ----------

(3,985) (2,742)

========== ==========

The results of each year are derived from continuing operations

Loss per share (cents)

Basic 3 (0.76) (0.60)

Diluted 3 (0.76) (0.60)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2022

Year ended Year ended

Notes 30 June 30 June

2022 2021

US$'000 US$'000

Non-current assets

Exploration and evaluation assets 4 10,588 9,751

Property, plant and equipment 5 1,043 1,354

Right of use assets 108 70

Total non-current assets 11,739 11,175

----------- -----------

Current assets

Inventory 858 863

Trade and other receivables 401 441

Cash and cash equivalents 4,134 573

----------- -----------

Total current assets 5,393 1,877

----------- -----------

Total assets 17,132 13,052

----------- -----------

Current liabilities

Trade and other payables (909) (1,009)

Borrowings (235) (1,231)

Lease liabilities (32) (14)

Total current liabilities (1,176) (2,254)

Non-current liabilities

Borrowings (518) (662)

Lease liabilities (81) (69)

Provisions (61) (61)

----------- -----------

Total non-current liabilities (660) (792)

Total liabilities (1,836) (3,046)

----------- -----------

NET ASSETS 15,296 10,006

Equity

Share capital 6 41,442 32,465

Share-based payment reserve 1,467 1,295

Other reserves - 60

Retained loss (26,572) (22,878)

----------- -----------

Equity attributable to the parent 16,337 10,942

Non-controlling interest (1,041) (936)

TOTAL EQUITY 15,296 10,006

=========== ===========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 30 June 2022

Share- Share Attributable

Share based warrant Other Accumulated to the Non-controlling

capital Payments reserve reserves losses parent interest Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Balance at 1

July 2020 28,132 1,099 40 60 (20,542) 8,789 (884) 7,905

Total

comprehensive

expense

Loss and total

comprehensive

loss for year - - - - (2,690) (2,690) (52) (2,742)

Transactions

with owners

Shares placed

during the year

for cash

consideration 3,423 - - - - 3,423 - 3,423

Share placing

transaction

costs (85) - - - - (85) - (85)

Non-cash issue

of shares

during the

period 250 250 - 250

Share warrants

expired in the

year - - (40) - 40 - - -

Fair value of

employee share

options in year - 510 - - - 510 - 510

Share options

exercised in

the year, net

of costs 745 (314) - - 314 745 - 745

Balance at 30

June 2021 32,465 1,295 - 60 (22,878) 10,942 (936) 10,006

---------- --------- ---------- ---------- ----------- ------------ --------------- -------

Total

comprehensive

expense

Loss and total

comprehensive

loss for year - - - - (3,880) (3,880) (105) (3,985)

Transactions

with owners

Shares placed

during the year

for cash

consideration 8,779 - - - - 8,779 - 8,779

Share placing

transaction

costs (240) - - - - (240) - (240)

Non-cash issue

of shares

during the

period, net of

costs 157 - - - - 157 - 157

Eliminate

historic

discount on

extinguishment

of interest

free bridge

loan - - - (60) 60 - - -

Fair value of

employee share

options in year - 298 - - - 298 - 298

Share options

exercised in

the year, net

of costs 281 (126) - - 126 281 - 281

Balance at 30

June 2022 41,442 1,467 - - (26,572) 16,337 (1,041) 15,296

---------- --------- ---------- ---------- ----------- ------------ --------------- -------

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 30 June 2022

For year ended For year ended

30 June 30 June

2022 2021

US$'000 US$'000

Cash flow from operating activities

Loss from operating activities (3,654) (2,707)

Adjustments for:

Depreciation 380 37

Impairment of royalties receivable 69 128

Share-based payment charge 297 510

Operating loss before working capital changes (2,908) (2,032)

Net decrease/(increase) in inventory 5 (121)

Net increase in trade and other receivables (29) (190)

Net(decrease)/increase in trade and other payables (100) 136

--------------- ---------------

Cash used by operations (3,032) (2,207)

Realised foreign exchange gains 186 359

Finance income - -

Finance costs - (23)

Taxes paid (2) -

--------------- ---------------

Net cash used in operating activities (2,848) (1,871)

--------------- ---------------

Cash flow from investing activities

Purchase of property, plant & equipment (42) (690)

Exploration and evaluation costs (837) (2,024)

Net cash used in investing activities (879) (2,714)

--------------- ---------------

Cash flow from financing activities

Proceeds of new borrowings - 275

Repayment of borrowings (1,009) (438)

Interest payments on borrowings (138) (104)

Payment of lease liabilities (24) (56)

Proceeds from the issuance of ordinary shares 9,077 4,727

Transaction costs of issuing new equity (275) (85)

Net cash generated by financing activities 7,631 4,319

--------------- ---------------

Net increase/(decrease) in cash and cash equivalents 3,904 (266)

--------------- ---------------

Cash & cash equivalents at the beginning of the year 573 788

Foreign exchange (loss)/gains on cash and cash equivalents (343) 51

Cash & cash equivalents at the end of the year 4,134 573

=============== ===============

NOTES:

1. BASIS OF PREPARATION

The financial information set out herein does not constitute the

Group's statutory financial statements for the year ended 30 June

2022, but is derived from the Group's audited financial statements.

The auditors have reported on the FY 2022 financial statements and

their reports were unqualified. The financial information in this

statement is audited but does not have the status of statutory

accounts.

The financial statements and the information contained in this

announcement have been prepared in accordance with International

Financial Reporting Standards (IFRS) as adopted by the European

Union (EU), including International Accounting Standards and

Interpretations issued by the International Financial Reporting

Interpretations Committee (IFRIC). This is consistent with the

accounting policies in the 30 June 2021 financial statements.

2. GOING CONCERN

As at 30 September 2022, the Group had total cash of US$2.9

million.

The Board have reviewed a range of potential cash flow forecasts

for the period to 31 December 2023, including reasonable possible

downside scenarios. This has included the following

assumptions:

Corporate:

The forecast includes US$2.5 million of ongoing general and

administrative costs of the Group over the 18-month period from 1

July 2022 to 31 December 2023, based on the current administrative

costs of the Group. The budget excludes any significant expenditure

on new business opportunities beyond early costs totalling US$39k

over the 18-month period.

Management's reasonably plausible downside scenario includes a

10% contingency for unexpected costs plus a further US$500k for

business development costs.

Phalaborwa:

This forecast includes all costs required for the completion of

the Phalaborwa PEA (announced in October 2022) and the ongoing

resource update, estimated at US$583k. The forecast also includes

salary and consultant costs of US$623k for the core project team

tasked with advancing the project. A budget for the further work

required to deliver a feasibility study at Phalaborwa, including

pilot test work, has not yet been defined. Management's reasonably

plausible downside scenario includes US$7.6 million for further

work at Phalaborwa during the 18-month forecast period.

Gakara:

The cash flow forecasts assume ongoing care and maintenance

costs totalling US$746k. Further, in the event that the Gakara

project returns to operations, stock of rare earth concentrates

with an estimated gross sales value of US$1.6 million would be sold

to provide the funds to re-commence operations. The forecasts show

that, with the current productive capacity of the operations, the

Gakara project would not require additional financial support from

Rainbow Rare Earths Limited at current rare earth prices. At 30

June 2022 the Group has US$557k of undiscounted financing

liabilities relating to a term loan from FinBank in Burundi.

Capital repayment of this loan is formally suspended until 31

December 2022, with interest of US$7k per month being paid in cash.

Whilst operations at Gakara remain suspended management expect the

repayment of principal to remain suspended. Notwithstanding, the

forecast includes repayment at a rate of US$21k per month from 1

January 2023, including interest, within the care and maintenance

costs for the Gakara project.

Conclusion

The base case forecast includes a total cash outflow over the

Period of US$4,735k, compared to a cash balance at 1 July 2022 of

US$4,134k, which confirms that the Group will need to raise

additional finance before 31 December 2023. Management's reasonably

plausible downside scenario, which includes the discretionary costs

to progress a feasibility study at the Phalaborwa project and an

allowance for other business development opportunities, suggests

that a total of US$9.2 million will need to be raised.

The Board is confident that this funding will be secured, based

on its history of successful fundraising. However, it also

acknowledges that this funding is not, at the present time, in

place. Accordingly, the Board acknowledges that the need for

additional funding represents a material uncertainty which may cast

significant doubt on the ability of the Company to continue as a

going concern and, therefore, that it may be unable to realise its

assets and discharge its liabilities in the normal course of

business. The financial statements do not include any adjustments

that would result if the Group was unable to continue as a going

concern.

3. LOSS PER SHARE

The earnings per share calculations for 30 June 2022 reflect the

changes to the number of ordinary shares during the period.

At the start of the year, 476,411,434 shares were in issue.

During the year, a total of 9,598,875 new shares were allotted (see

note 6 Share Capital) and on 30 June 2022, 524,405,810 shares were

in issue. The weighted average of shares in issue in the year was

508,566,911.

The loss per share has been calculated using the weighted

average number of ordinary shares in issue. The Company was loss

making for all periods presented, therefore the dilutive effect of

share options has not been accounted for in the calculation of

diluted earnings per share, since this would decrease the loss per

share for each reporting period.

Basic and diluted

2022 2021

----------------- --------------

Loss for the year (US$'000) attributable to ordinary equity holders (3,880) (2,690)

Weighted average number of ordinary shares in issue during the year 508,566, 911 450,749,572

Loss per share (cents) (0.76) (0.60)

----------------- --------------

4. EXPLORATION AND EVALUATION ASSETS

Gakara Phalaborwa Total

US$'000 US$'000 US$'000

At 1 July 2020 7,572 - 7,572

Additions 1,102 1,116 2,218

Adjustment of rehabilitation provision (39) - (39)

----------------------------------------- ------- ---------- -------

At 30 June 2021 8,635 1,116 9,751

Additions - 837 837

At 30 June 2022 8,635 1,953 10,588

----------------------------------------- ------- ---------- -------

Only costs relating to the Phalaborwa Project were capitalised

during the financial year. The Burundi Project has been under care

& maintenance throughout the year and, accordingly, none of the

costs meet the requirements under the Group's accounting policy for

capitalisation.

The Phalaborwa project represents an opportunity to extract rare

earth elements from the chemical re-treatment of gypsum stacks. A

JORC compliant rare earth resource was declared on 17 June 2021 and

the costs of establishing the commercial viability of development

for the project are being capitalised as exploration and evaluation

assets under IFRS 6. Additions in the year include costs associated

with process development to deliver an economic and technically

viable route to recovering rare earths. Additions in 2021 included

US$750k consideration payable under the earn-in agreement payable

in cash and shares together with costs associated with the

definition of the inferred mineral resource, metallurgical test

work and technical support.

On 12 April 2021 RMB received notification from the Ministry of

Hydraulics, Energy and Mines of the Republic of Burundi of a

temporary suspension on the export of concentrate produced from the

trial mining and processing operations at the Gakara Project. On 29

June 2021 a further notification was received suspending all trial

mining and processing operations pending negotiations on the terms

of the Gakara mining convention signed in 2015.

Following face to face meetings in Burundi in April 2022 the

Company presented a detailed plan to the Government for the export

of the current stock of rare earth concentrate along with responses

to all questions raised by the Government relating to the Company's

operations in Burundi. The Company is awaiting a formal response to

this export plan, noting increased engagement following significant

changes in the political landscape in Burundi in September 2022.

The Directors have also received confirmation from independent

legal advisors that the mining convention in place between RMB and

the Government of Burundi remains legally binding on both parties,

and that the actions of the Government of Burundi have not been in

accordance with that legally binding agreement.

Based on an assessment of both the legal and political position,

the Directors have a reasonable expectation that the current

temporary suspension does not represent a threat to the licence and

activities will be allowed to re-start. Accordingly, the Directors

do not believe this uncertainty represents an indication of

impairment of the exploration and evaluation assets at Gakara, or

the associated property, plant and equipment or inventory within

the Gakara cash generating unit. The royalty recoverable, which

also forms part of the Gakara cash generating unit, is considered

separately. The Directors do not consider there to be any

indicators of impairment for the Gakara cash generating unit,

however they note that the current suspension of activities could

result in future losses for the Group if it is not resolved as

anticipated.

FinBank SA hold security over the fixed and floating assets of

Rainbow Mining Burundi SM ('RMB') which include US$7.3 million of

exploration and evaluation assets associated with the Gakara mining

permit in Burundi.

5. PROPERTY, PLANT AND EQUIPMENT

US$'000 Mine development costs Plant & machinery Vehicles Office equipment Total

--------------------------------- ---------------------- ----------------- -------- ---------------- -----

Cost

---------------------- ----------------- -------- ---------------- -----

At 1 July 2020 183 2,665 1,074 45 3,967

Additions - 182 508 - 690

At 30 June 2021 183 2,847 1,582 45 4,657

Additions - 42 - - 42

--------------------------------- ---------------------- ----------------- -------- ---------------- -----

At 30 June 2022 183 2,889 1,582 45 4,699

--------------------------------- ---------------------- ----------------- -------- ---------------- -----

Depreciation

At 1 July 2020 47 2,665 298 15 3,025

Charge for year 26 2 241 9 278

---------------------- ----------------- -------- ---------------- -----

At 30 June 2021 73 2,667 539 24 3,303

Charge for the year 26 1 316 10 353

--------------------------------- ---------------------- ----------------- -------- ---------------- -----

At 30 June 2022 99 2,668 855 34 3,656

--------------------------------- ---------------------- ----------------- -------- ---------------- -----

Net Book Value at 30 June 2022 84 221 727 11 1,043

--------------------------------- ---------------------- ----------------- -------- ---------------- -----

Net Book Value at 30 June 2021 110 180 1,043 21 1,354

--------------------------------- ---------------------- ----------------- -------- ---------------- -----

Net Book Value at 30 June 2020 136 - 776 30 942

--------------------------------- ---------------------- ----------------- -------- ---------------- -----

Depreciation of US$Nil (2021: US$269k) relating to mining

vehicles, plant & machinery and site infrastructure was

capitalised in the year as part of Exploration and Evaluation

costs.

FinBank SA hold security over the fixed and floating assets of

Rainbow Mining Burundi SA which include US$1,042k (2021: US$1,353k)

of property, plant, and equipment in Burundi.

As set out in note 4 the Directors recognise the uncertainty

relating to the temporary suspension of trial mining and processing

activities in Burundi which could impact the carrying value of the

property, plant and equipment within the Gakara cash generating

unit, which comprises US$1,042k of the net book value at the

balance sheet date.

6. SHARE CAPITAL

Year Ended Year Ended

30 June 2022 30 June 2021

US$'000 US$'000

Share Capital 41,442 32,465

------------- -------------

Issued Share Capital 41,442 32,465

------------- -------------

The table below shows a reconciliation of share capital

movements:

Number of shares US$'000

At 30 June 2020 421,981,551 28,132

November 2020 - Share placing - Cash receipts net of costs 42,700,000 3,338

December 2020 - Exercise of share options (cash receipts) 3,000,000 215

January 2021 - Exercise of share options (cash receipts) 4,000,000 290

February 2021 - Exercise of share options (cash receipts) 2,700,000 200

April 2021 - Exercise of share options (cash receipts) 800,000 58

Costs associated with exercise of share options - (18)

June 2021 - Phalaborwa consideration shares 1,229,883 250

---------------- --------

At 30 June 2021 476,411,434 32,465

July 2021 - Exercise of share options (cash receipts) 2,500,000 182

October 2021 - Share placing - Cash receipts net of costs 32,900,000 6,557

November 2021 - Share placing - Cash receipts net of costs 10,000,000 1,982

December 2021 - Pipestone Loan repayment shares 875,389 175

April 2022 - Exercise of share options (cash receipts) 1,718,987 116

Costs associated with exercise of share options and loan settlement - (35)

524,405,810 41,442

---------------- --------

On 27 November 2020 the Company issued 42.7 million new ordinary

shares at a price of 6 pence per share, raising gross cash proceeds

of US$3.4 million (before costs of $85k).

Between December 2020 and April 2021 Australian Special

Opportunity Fund, LP exercised options over 10.5 million shares at

an exercise price of 5.28p per share, raising gross cash proceeds

of US$763k (before costs of US$18k).

On 25 June 2021 1,229,882 shares were issued to Bosveld

Phosphates (Pty) Limited to settle US$250,000 consideration due

under the Phalaborwa co-development agreement originally announced

on 3 November 2020.

On 13 July 2021 Australian Special Opportunity Fund, LP

exercised options over 2.5 million shares at an exercise price of

5.28p per share, raising gross cash proceeds of US$182k.

On 13 October 2021 the Company issued 32.9 million shares at a

price of 15 pence per share, raising gross cash proceeds of US$6.8

million (before costs of $221k).

On 15 November 2021 the Company issued a further 10.0 million

shares at a price of 15 pence per share, raising gross cash

proceeds of US$2.0 million (before costs of $18k).

On 25 April 2022 Australian Special Opportunity Fund, LP

exercised options over 1,718,987 million shares at an exercise

price of 5.28p per share, raising gross cash proceeds of

US$116k.

7. POST BALANCE SHEET EVENTS

No events after the reporting date were identified that would

affect the group of companies significantly or cause its financial

results to be materially misstated.

[1] Adamus Intelligence

[2] Net present value using a 10% forward discount rate

[3] Internal rate of return

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR VXLFLLBLFFBE

(END) Dow Jones Newswires

October 24, 2022 02:00 ET (06:00 GMT)

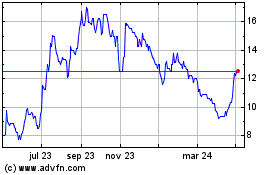

Rainbow Rare Earths (LSE:RBW)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

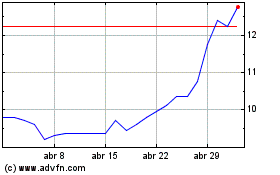

Rainbow Rare Earths (LSE:RBW)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024