TIDMREAT

RNS Number : 1882L

React Group PLC

12 May 2022

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

REACT Group PLC

("REACT" or the "Company")

Acquisition of LaddersFree Ltd.

H1 Trading Update

REACT (AIM: REAT), a leading specialist cleaning, hygiene and

decontamination company, is pleased to announce that it has

completed the acquisition of LaddersFree Ltd. ("LaddersFree"), an

established nationwide commercial window, gutter and cladding

cleaning business, for a total consideration of up to GBP8.5

million on a debt-free and cash-free basis (subject to working

capital adjustments) (the "Acquisition"). This is REACT's second

acquisition and represents a further step in the Company's ambition

to achieve its stated growth strategy. The Initial Cash

Consideration (as defined below) is to be funded from the net

proceeds of the placing announced by the Company on 14 April

2022.

Acquisition highlights

-- Acquisition of LaddersFree, a profitable, cash generative

commercial window cleaning business serving local, regional and

national customers

-- Consistent track record of organic revenue growth and profitability

-- High level of recurring revenue with clients typically

working with LaddersFree on a minimum 12-month rolling term

providing visibility of future revenues and income

-- The business is scalable with a very low working capital

requirement and has potential for strong organic growth

-- LaddersFree has a diverse client base across the commercial

property, retail, hospitality, leisure and automotive sectors

-- L arge competitive national ecosystem of 'local' specialist

subcontractors which the Board believes gives the sector a high

barrier to entry

-- Broadens REACT's customer base and reduces dependence on reactive and ad hoc work

-- In line with REACT's stated strategy of building a leading

industry position through organic growth and via strategic

acquisitions

-- The Directors believe the Acquisition will:

o diversify the service offering of the Company and its

subsidiaries (the "Group") through expansion into complementary

markets;

o provide nationwide partners and cross selling

opportunities;

o provide a highly scalable business model with the opportunity

to increase brand awareness through the application of additional

sales and marketing resource available within the Group ; and

o enhance earnings per share in the first full year of ownership

(FY23), before consideration of potential synergies.

Acquisition terms

-- Total consideration of up to GBP8.5 million on a debt-free

and cash-free basis (subject to working capital adjustments) ,

comprising:

o GBP4.65 million in cash ("Initial Cash Consideration") payable

on completion of the Acquisition ("Completion"), subject to any

adjustment on preparation of completion accounts;

o GBP1.0 million through the issue of 83,333,333 ordinary shares

of 0.25 pence in the capital of the Company ("Consideration

Shares") on Completion to Jason Korinek and Justin Korinek (the

"Founders") at an issue price of 1.2 pence per Consideration Share.

Half of the Consideration Shares will be subject to a 6 month lock

in period and the other half of the Consideration Shares will be

subject to a lock in period of 24 months during which, in each

case, the relevant Consideration Shares cannot be sold or

transferred. This is followed, in each case, by a 12 month orderly

market period;

o deferred cash consideration of GBP1.45 million with a 5 per

cent. coupon, to be paid in four instalments every six months

beginning on 1 December 2022; and

o performance based contingent consideration of up to GBP1.4

million, which will pay six times the increase (only) of EBITDA for

the financial year ending 30 November 2022 over and above GBP1.2

million, in three instalments with the final payment due to be made

on 1 June 2024.

About LaddersFree

Founded in 2002, LaddersFree is a commercial window cleaning

business, serving local, regional and national customers. With an

established network of over 300 approved service partners,

LaddersFree utilises local window cleaning companies to offer its

services to all areas of mainland UK. LaddersFree employs seven

individuals, with one office located in Topsham, near Exeter, in

Devon.

LaddersFree provides window cleaning services using various

methods, including traditional window cleaning, the use of

water-fed poles operated from ground level, and the use of mobile

elevated working platforms, abseiling and rope access. Whilst 90

per cent. of revenue for the financial year ended 30 November 2021

was generated from window cleaning services, LaddersFree also

offers a range of complementary services such as cladding cleaning,

gutter cleaning and jet washing.

Since its inception, LaddersFree has grown organically,

consistently expanding its client base each year. LaddersFree

services its clients both directly and indirectly, either with end

users or working on behalf of facilities management, cleaning and

property management companies. The current client base is diverse

and includes a number of well known companies in the commercial

property, retail, hospitality and leisure and automotive sectors.

Clients typically work with LaddersFree on a minimum 12-month

rolling term and approximately GBP2 million of annual revenue is

identified as being regular or recurring.

Unaudited financials for LaddersFree: For the financial year

ended 30 November 2021, LaddersFree generated revenue of GBP3.0

million (2020: GBP3.0 million) and profit before tax of GBP1.4

million (2020: GBP1.3 million). For the same period, LaddersFree

generated normalised adjusted EBITDA of GBP1.2 million (2020:

GBP1.2 million).

As at 30 November 2021, LaddersFree had unaudited net assets of

GBP2.1 million.

Background to and rationale for the Acquisition

The Acquisition, which is in line with the Group's stated

strategy of building a leading industry position through organic

growth and via strategic acquisitions, is expected to be earnings

enhancing in its first full year of ownership (FY23) , before

consideration of potential synergies.

The Board believes that the terms of the Acquisition, and the

valuation of LaddersFree, are attractive given the opportunities to

diversify the Group's service offering through expansion into

complementary markets, and to leverage existing resources to

accelerate growth. The Board considers the LaddersFree business

model to be highly scalable, and the Directors have identified the

opportunity to increase brand awareness and accelerate organic

growth through the application of additional sales and marketing

resource available within the Group.

The acquisition of a well-established cleaning business has the

advantage of an existing network of service partners and an

established client base, whilst expanding the Group's service

offering and providing opportunities for sustained growth through

marketing efforts, additional nationwide partners and

cross-selling. The Group is gaining a reputable name, a resilient

business model and an opportunity to drive profitable growth.

The Founders will retain roles with LaddersFree after

Completion, initially on a full time basis, to ensure optimum

integration.

In addition to an increased service offering and growth

opportunities, the Acquisition is expected to reduce the Group's

dependence on reactive and ad hoc work going forwards, with an

opportunity to broaden REACT's customer base and generate an

increased proportion of recurring revenue.

H1 trading update and outlook

REACT provides the following update regarding the Company's

trading performance for the six month period ended 31 March 2022

("H1") and outlook following the completion of the Acquisition.

The Company has made good progress during H1 achieving revenue

of approximately GBP5.1 million (unaudited) (six months ended 31

March 2021: GBP2.5 million) and adjusted EBITDA of approximately

GBP130k (unaudited) (six months ended 31 March 2021: GBP369k),

which reflects a higher proportion of contract maintenance work, a

lower level of higher margin reactive work and the cost of

mobilising incremental new contracts. During H1, REACT closed a

number of new customer contracts which have either been mobilised

or are in the process of being mobilised and are expected to add

material incremental revenue and profit within their contracted

revenue business during the six month period ending 30 September

2022 ("H2"). These new contract wins underpin management's

confidence in the outlook for H2 and the full year.

During H1, the Company made further investment in its sales team

which is starting to yield results, with the influence of newly

hired sales resource contributing to the recent contract wins,

including the GBP0.7 million, three year contract announced on 11

April 2022. In addition to smaller contract work that is bid and

won on a regular basis, the team has also closed a number of

additional opportunities over the past two weeks:

-- a second 3-month contract extension, following the success of

an initial pilot, with revenues of c.GBP140k to carry out the

periodic deep cleaning of train carriages serving the rail network,

with the potential to extend this to an annual contract;

-- a separate 1-month pilot with revenues of GBP40k carrying out

similar periodic deep cleaning work on train carriages operating on

another part of the rail network. This too has the potential to

develop into an annual contract;

-- a new annual contract for contract maintenance in the Midlands worth c.GBP40k per year; and

-- two new customers for deep cleaning projects one valued at GBP35k and the other at GBP40k.

As previously stated by the Board, the Company's strategy is to

focus on building out the contract maintenance business, both

organically and through targeted acquisitions. Given the recurring

nature of contract maintenance work, the Board believes this should

lead to a more predictable business going forward. Following the

Acquisition, the Board is proposing to concentrate sales effort on

contracted work, including targeting an increase in revenue

generation within LaddersFree. To achieve this, some of the

existing sales team previously assigned to reactive and ad hoc work

will shift to focus primarily on generating contract maintenance

revenue within both the existing business and LaddersFree. As a

result of the shift in sales focus, the Board expects this to

reduce the proportion of reactive and ad hoc revenue within the

overall Group and, over time, to increase the proportion of

contract maintenance revenue.

Following completion of the Acquisition and the mobilisation of

a number of new contracts won during H1, the Board expects to

deliver adjusted EBITDA for the financial year ending 30 September

2022 of approximately GBP1.3 million.

Notice of half year results

The Company expects to publish its unaudited half year results

for the six month period ended 31 March 2022 in the second half of

June 2022.

Mello 2022

REACT will also be presenting at the Mello 2022 investor forum

on Thursday 26 May 2022. The event will be held at the Clayton

Hotel, Chiswick, London W4. For more information go to:

https://melloevents.com/mello2022exinfo/ .

Admission of Consideration Shares and total voting rights

It is expected that Admission of the 83,333,333 Consideration

Shares to AIM ("Admission") will occur and that dealings will

commence at 8.00 a.m. on 18 May 2022. The Consideration Shares will

rank pari passu with the existing ordinary shares of 0.25 pence

each in the capital of the Company ("Ordinary Shares").

Following Admission of the Consideration Shares, the Company

will have 1,049,672,691 Ordinary Shares in issue and no Ordinary

Shares in treasury. Therefore, the total voting rights in the

Company will be 1,049,672,691.

This figure may be used by shareholders as the denominator for

the calculation by which they may determine if they are required to

notify their interest in, or any change to their interest in, the

Company under the Disclosure Guidance and Transparency Rules of the

Financial Conduct Authority.

Shaun Doak, Chief Executive Officer of REACT, said: " We are

delighted to welcome Jason, Justin and the team at LaddersFree into

the REACT family. Over the last 20 years they have established a

very strong reputation for consistently delivering high-quality

services greatly valued by local, regional and national

customers.

The LaddersFree value proposition to both customers and their

network of specialist service providers is incredibly attractive to

our business. Combined with the team's focus and customer-centric

service culture, they fit perfectly within the Group.

We are excited by the opportunities that lay ahead as we

continue to invest in profitable growth and offer our increasingly

unique brand of services across the broadening customer base of the

business."

For further information:

REACT Group PLC

Shaun Doak, Chief Executive Officer Tel: +44 (0) 12

Andrea Pankhurst, Chief Financial Officer 8355 0503

Mark Braund, Chairman

Singer Capital Markets (Nominated Adviser

and Broker)

Will Goode, Amanda Gray, Oliver Platts Tel: +44 (0) 20

(Investment Banking) 7496 3000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQBCGDUDSBDGDB

(END) Dow Jones Newswires

May 12, 2022 02:01 ET (06:01 GMT)

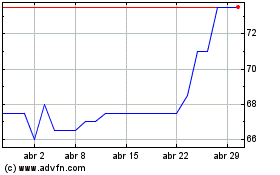

React (LSE:REAT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

React (LSE:REAT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024