TIDMRFX

RNS Number : 0703O

Ramsdens Holdings PLC

08 June 2022

8 June 2022

Ramsdens Holdings PLC

("Ramsdens", the "Group", the "Company")

Interim Results for the six months ended 31 March 2022

Ramsdens, the diversified financial services provider and

retailer, today announces its Interim Results for the six months

ended 31 March 2022 (the "Period").

Highlights

-- A strong performance as trading conditions started to

normalise, with Profit Before Tax of GBP2.2m (HY21: GBP0.1m

loss)

-- Gross revenue increased 51% to GBP29.3m (HY21: GBP19.3m)

-- Jewellery retail revenue up 62% to GBP13.1m (HY21: GBP8.1m).

Online jewellery retail sales increased by 48% year on year to

GBP2.0m (HY21: GBP1.3m) and now represent 15% of total jewellery

sold

-- Pawnbroking loan book at the period end was GBP7.5m (HY21:

GBP5.7m) as customers returned to normal spending habits and

required short term cash flow assistance

-- Foreign currency exchange improved as international travel

restrictions eased, driving a significant increase in gross profit

to GBP3.4m (HY21: GBP1.0m)

-- Gross profit from the purchase of precious metals increased 34% to GBP3.1m (HY21: GBP2.3m)

-- Net Assets increased GBP2.1m to GBP37.6m (HY21: GBP35.5m)

-- As a result of improving trading conditions, the Board has

approved an interim dividend of 2.7 pence per share (HY21: nil

pence per share)

-- Trading following the Period end has continued to improve.

Foreign currency volumes have increased to approximately 85% of

pre-pandemic levels, the pawnbroking loan book has continued to

grow, the weight of precious metals purchased has increased and

retail jewellery has remained strong.

Financial results for the six months ended 31 March 2022

Two prior comparable periods have been included below to

demonstrate the impact of the pandemic. The six-month period ended

31 March 2020 was substantially pre-pandemic whereas the six-month

period ended 31 March 2021 was impacted by retail lockdowns and

significant travel restrictions.

6 months 6 months ended 6 months ended

ended 31 March

2022 (unaudited)

31 March 2021 31 March 2020

(unaudited)

(unaudited)

Gross Revenue GBP29.3m GBP19.3m GBP25.3m

------------------ --------------- ---------------

Gross Profit GBP15.7m GBP10.5m GBP16.7m

------------------ --------------- ---------------

Profit/(Loss) before GBP2.2m (GBP0.1m) GBP2.3m

tax

------------------ --------------- ---------------

Basic EPS 5.6p (0.3p) 5.5p

------------------ --------------- ---------------

Peter Kenyon, Chief Executive, commented:

"We are pleased with the Group's very strong performance during

the Period, which was characterised by significant increases in

customer demand for both our jewellery proposition and our foreign

currency offer as customer behaviour continued to normalise.

Our growth strategy action plan remains on track and is working.

Of the eight new stores planned to open this financial year, three

stores were opened during the first half and have traded above

expectations.

We are also encouraged by the increased demand for Ramsdens'

foreign currency services since the Period end. We look forward to

continuing this strong momentum through the important summer

period".

S

Enquiries:

Ramsdens Holdings PLC Tel: +44 (0) 1642 579957

Peter Kenyon, CEO

Martin Clyburn, CFO

Liberum Capital Limited (Nominated Adviser) Tel: +44 (0) 20 3100 2000

Richard Crawley

Lauren Kettle

Hudson Sandler (Financial PR) Tel: +44 (0) 20 7796 4133

Alex Brennan

Lucy Wollam

Emily Brooker

About Ramsdens

Ramsdens is a growing, diversified, financial services provider

and retailer, operating in the four core business segments of

foreign currency exchange, pawnbroking loans, precious metals

buying and selling and retailing of second hand and new

jewellery.

Ramsdens does not offer unsecured high-cost short term

credit.

Headquartered in Middlesbrough, the Group operates from 156

stores within the UK (including 3 franchised stores) and has a

growing online presence.

Ramsdens is fully FCA authorised for its pawnbroking and credit

broking activities.

www.ramsdensplc.com

www.ramsdensforcash.co.uk

www.ramsdensjewellery.co.uk

CHIEF EXECUTIVE'S REPORT

This interim report covers the six months ended 31 March 2022

(the "Period"), which saw consumer behaviour continuing to

transition back to that seen prior to the onset of Covid-19. The

prior comparative period (six months to 31 March 2021 - HY21)

featured trading with a retail lockdown environment for a

substantial part of the six months. With that in mind to provide

additional context, this segmental analysis also presents figures

for HY20 (the six months to 31 March 2020), which saw the majority

of trading take place prior to the onset of Covid-19.

The Group has delivered a profitable performance, supported by

the marked uptick in demand for foreign currency as international

travel restrictions eased and consumers became increasingly

comfortable with travelling abroad.

We are pleased with the Group's performance and look forward to

building on this through the remainder of the year.

FINANCIAL REVIEW

The Group reported a Profit Before Tax of GBP2.2m (HY21: loss of

GBP0.1m). Gross revenue increased by 51% to GBP29.3m (HY21:

GBP19.3m) as trading activity increased in line with the easing of

Covid-19 restrictions.

Administration expenses increased by 27% to GBP13.3m (HY21:

GBP10.4m) as stores returned to standard opening hours and variable

costs increased in line with this higher level of trading. The

cessation of Government furlough support and reduction in business

rates support increased costs by c.GBP1.2m.

The Group's balance sheet remains strong, with net assets of

GBP37.6m (HY21: GBP35.5m). The Group's main assets are cash

(including foreign currency), pawnbroking loans secured on gold

jewellery and watches, and retail jewellery stock. The reduction in

net cash at 31 March 2022 to GBP9.3m (HY21 GBP15.0m) was due to the

Group investing heavily in its jewellery stock and the rebuilding

of the pawnbroking loan book.

Capital expenditure in the Period totalled GBP0.8m (HY21:

GBP0.9m) including the cost of opening two new stores and

relocating one store. In addition, the Group invested GBP0.9m

acquiring a jewellery and pawnbroking business based in

Boscombe.

The Group has the benefit of a GBP10.0m revolving credit

facility which expires in March 2024 and had drawn GBP1.5m of this

facility at the end of the Period to support currency stock

increases.

The Board is pleased to announce an interim dividend of 2.7

pence per share (HY21: nil pence per share). The dividend will be

payable on 30 September 2022 to those shareholders on the register

on 2 September 2022. The ex-dividend date will be 1 September

2022.

REVIEW

Foreign Currency Exchange

The foreign currency exchange (FX) segment primarily comprises

the sale and purchase of foreign currency notes to

holidaymakers.

HY22 HY21 YOY HY20

Total currency exchanged GBP94m GBP20m 372% GBP181m

-------- -------- ----- ---------

Gross profit GBP3.4m GBP1.0m 236 % GBP4.7m

-------- -------- ----- ---------

Online C&C orders GBP10.0m GBP1.6m 547% GBP18.5m

-------- -------- ----- ---------

% of online FX 11% 8% 10%

-------- -------- ----- ---------

Segment as a % of total gross

profit 22% 10% 28%

-------- -------- ----- ---------

The easing of travel restrictions in the UK and abroad has

increased confidence and encouraged more people to travel. As a

result, the demand for foreign currency has increased despite the

Omicron variant of Covid-19 impacting travel in Q1.

By the end of the Period, daily foreign currency exchange

volumes had increased to approximately 60% of pre-pandemic levels.

In addition, we continue to be able to manage our margin to

minimise the impact to profitability of the lower volumes.

As we look forward, the income from this service is anticipated

to grow in line with the continued growth of international travel.

We strongly believe that customers' desire to travel abroad remains

high.

Pawnbroking

Pawnbroking is a small subset of the consumer credit market in

the UK and a simple form of asset-backed lending that dates back to

the foundations of banking. In a pawnbroking transaction an item of

value, known as a pledge (in Ramsdens' case this is jewellery and

watches) is held by the pawnbroker as security against a six-month

loan. Customers pay interest on this loan, repay the capital sum

borrowed and recover their pledged item. If a customer defaults on

the loan, the pawnbroker sells the pledged item to repay the amount

owed and returns any surplus funds to the customer. Pawnbroking is

regulated by the FCA in the UK and Ramsdens is fully FCA

authorised.

000's HY22 HY21 YOY HY20

Gross profit GBP3,694 GBP3,480 6% GBP4,706

-------- -------- ----- --------

Total loan book GBP7,506 GBP5,749 31% GBP7,747

-------- -------- ----- --------

Past Due GBP567 GBP893 (37%) GBP1,115

-------- -------- ----- --------

In date loan book GBP6,939 GBP4,856 43% GBP6,632

-------- -------- ----- --------

Percentage of GP 23% 33% 28%

-------- -------- ----- --------

The pawnbroking loan book grew in line with expectations during

the Period.

The loan to value on plain gold was approximately two thirds of

the gold price at the period end. The average loan value at 31

March 2022 was GBP286 (31 March 2021: GBP265).

With restrictions in the availability of other forms of credit,

and the squeeze on household incomes, we believe that the ease and

simplicity of pawnbroking will lead to further loan book growth in

the coming year.

Jewellery Retail

The Group retails new and second-hand jewellery to customers

both in store and online. The Board continues to believe there is

further growth potential for Ramsdens in this segment which can be

achieved by leveraging the Group's store estate and e-commerce

operations, by cross-selling to existing customers and through

acquiring new customers.

Retailing of new jewellery products complements the Group's

second-hand offering, giving customers greater choice in both

breadth of products and price. In addition, the Group continues to

build its reputation for the sale of premium second-hand

watches.

000's HY22 HY21 YOY HY20

Revenue GBP13,085 GBP8,074 62% GBP7,054

--------- ---------- --- ---------

Gross Profit GBP4,923 GBP3,168 55% GBP3,113

--------- ---------- --- ---------

Margin % 38% 39% 44%

--------- ---------- --- ---------

Jewellery retail stock GBP20,070 GBP10,810 GBP8,919

--------- ---------- --- ---------

Online sales GBP1,963 GBP1,323 48% GBP654

--------- ---------- --- ---------

% of sales online 15% 16% 9%

--------- ---------- --- ---------

Percentage of GP 31% 30% 19%

--------- ---------- --- ---------

The retail segment achieved significant growth due to the

Group's continued investment during the Period. We invested in the

presentation of our jewellery with improved in-store concept design

window displays which have resulted in a wider, clearer choice for

our customers and greater stock levels all supported by

improvements in our stock replenishment systems.

The investment in our e-commerce activities continued to deliver

improved results during the Period, increasing retail revenue by

48% to GBP2.0m (HY21: GBP1.3m). Online jewellery sales now account

for 15% (HY20: 9%) of the Group's total retail sales. Further

improvements to the customer journey and how we promote and market

the website ( www.ramsdensjewellery.co.uk ) are in the planning and

early implementation stages. The e-commerce department is managed

as a separate business unit and is profitable.

Watch sales grew 176% year on year. Watch sales attract new

customers to the Group and this product offering has received

significant investment in stock, presentation and staffing levels

during the Period, which benefits buying, lending and

retailing.

As we look forward, despite the anticipated macro challenges

that higher inflation and rising interest rates will bring, we

believe there is an ongoing opportunity for improving and growing

our jewellery retail business.

Purchases of Precious Metals

Through this service, Ramsdens buys unwanted jewellery, gold and

other precious metals from customers for cash. Typically, a

customer brings unwanted jewellery into a Ramsdens store and a

price is agreed with the customer depending upon the retail

potential, weight or carat of the jewellery. The Group has

second-hand dealer licences and other permissions and adheres to

the approved "gold standard" for buying precious metals.

Once jewellery has been bought from the customer, the Group's

dedicated jewellery department decides whether or not to retail the

item through the store network or online. Income derived from

jewellery, which is purchased and then retailed, is reflected in

jewellery retail income and profits. The residual items are smelted

and sold to a bullion dealer for their intrinsic value and the

proceeds are reflected in the accounts as precious metals buying

income.

000's HY22 HY21 YOY HY20

Revenue GBP7,779 GBP5,623 38% GBP7,499

-------- --------- --- ---------

Gross Profit GBP3,112 GBP2,330 34% GBP3,214

-------- --------- --- ---------

Average gold price in GBP GBP16.44 GBP16.45 GBP14.41

-------- --------- --- ---------

Percentage of GP 20% 22% 19%

-------- --------- --- ---------

As customer behaviour and spending patterns have normalised,

more people have sold their unwanted jewellery. As the Group's

foreign currency volumes have improved, so too has the opportunity

to cross sell this service, leading to improved gold buying volumes

during the Period.

The Sterling gold price has remained high as a result of the

Ukraine / Russia war and the strength of the US dollar. This is

also encouraging more customers to sell unwanted jewellery as the

selling price is more favourable.

In the short to medium term, we expect the gold price to remain

high and as a result to benefit this area of the business.

Other services

In addition to the four core business segments, the Group also

provides additional services in cheque cashing, Western Union money

transfer, credit broking and receives franchise fees.

000's HY22 HY21 YOY HY20

Revenue GBP557 GBP540 3% GBP1,029

------ ------- --- ---------

Gross Profit GBP557 GBP540 3% GBP937

------ ------- --- ---------

Percentage of GP 4% 5% 6%

------ ------- --- ---------

This remains a steady source of income to the Group.

OPERATIONAL REVIEW

Our retail estate continues to be actively managed. Lease

renewals have generally resulted in rent reductions, greater

flexibility or sometimes both. On occasion it has been necessary to

relocate to take advantage of lower rents in a much better footfall

location. Our store in Carlisle was relocated in the Period, with

two further stores, in Newcastle and Durham, relocated in May. A

further four stores are in the legal and planning process for

relocating later in 2022.

During the Period, new stores were opened in Chatham and Glasgow

and a new store was acquired in Boscombe. We anticipate opening

five new stores in the second half of the financial year and have a

healthy pipeline of targeted new stores for FY23 and beyond.

The Group has, like other businesses, experienced staffing

challenges with higher-than-normal staff turnover and challenges in

recruitment. The Ramsdens team is happy and engaged, as evidenced

by our staff survey results, but the impact of Covid-19 has caused

many to review their lifestyle choices. While Ramsdens' head office

staff have greater flexibility in their working arrangements, high

street retail presents challenges in this regard, with relatively

fixed opening hours and a need to be in-store. We have awarded

significant pay rises to reward loyal staff and to retain Ramsdens'

position as an attractive place to come and work.

I would like to take this opportunity to thank each and every

staff member for their dedication, commitment, willingness to

strive for continuous improvement, and their steadfast focus on

delivering fantastic service to our customers every day.

OUTLOOK

We believe that FY22 is a transitional year, with an expected

return to substantially normal trading conditions by the end of the

financial year, albeit against a trading environment that is

experiencing a number of wider global macroeconomic events. Despite

these challenges, the Board is confident in the Group's ability to

withstand the inflationary impact to the cost base and anticipates

delivering growth across all of the Group's income streams over the

medium term.

The Board is confident that Ramsdens is well-placed to continue

to grow and deliver our strategy to create value for all

stakeholders.

Peter Kenyon

Chief Executive Officer

Interim Condensed Financial Statements

Unaudited condensed consolidated statement of comprehensive

income

For the six months ended 31 March 2022

6 months 6 months 12 months

Ended ended ended

31 March 31 March 30 September

2022 2021 (restated) 2021

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Revenue 2 29,265 19,326 40,677

Cost of sales (13,532) (8,781) (18,415)

---------- ------------------- --------------

Gross profit 2 15,733 10,545 22,262

Other income - - 284

Administrative expenses (13,287) (10,446) (21,510)

---------- ------------------- --------------

Operating profit 2,446 99 1,036

Finance costs 3 (230) (232) (472)

---------- ------------------- --------------

Profit / (loss) before tax 2,216 (133) 564

Income tax expense (465) 29 (198)

Total comprehensive income

/ (loss) for the period 1,751 (104) 366

---------- ------------------- --------------

Basic earnings per share in

pence 4 5.6 (0.3) 1.2

Diluted earnings per share

in pence 4 5.6 (0.3) 1.2

Unaudited condensed consolidated statement of changes in

equity

For the six months ended 31 March 2022

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

2022 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Opening total equity 36,143 35,555 35,555

Total comprehensive income

for the period 1,751 (104) 366

---------- ---------- -------------

Transactions with shareholders:

Share capital issued 2 6 6

Dividends paid (377) - -

Share based payments 155 103 254

Deferred tax on share based

payments (51) (42) (38)

---------- ---------- -------------

Total transactions with

shareholders (271) 67 222

---------- -------------

Closing total equity 37,623 35,518 36,143

---------- ---------- -------------

Unaudited condensed consolidated statement of financial

position

At 31 March 2022

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

2022 2021 (restated) 2021

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 5,343 5,207 5,195

Intangible assets 850 807 714

Investments - - -

Right-of-use assets 9,055 8,286 8,164

Deferred tax assets - 76 80

---------- ----------------- --------------

15,248 14,376 14,153

Current Assets

Inventories 21,279 11,576 15,151

Trade and other receivables 11,853 9,797 10,379

Cash and short term deposits 10,718 14,996 13,032

---------- ----------------- --------------

43,850 36,369 38,562

---------- ----------------- --------------

Total assets 59,098 50,745 52,715

---------- ----------------- --------------

Current liabilities

Trade and other payables 9,885 6,169 7,673

Lease liability 2,206 1,745 2,159

Interest bearing loans 1,423 - -

and borrowings

Income tax payable 403 70 61

---------- ----------------- --------------

13,917 7,984 9,893

---------- ----------------- --------------

Net current assets 29,933 28,385 28,669

---------- ----------------- --------------

Non-current liabilities

Lease liability 7,313 7,049 6,442

Accruals and deferred

income 93 133 119

Deferred tax liabilities 152 61 118

---------- ----------------- --------------

7,558 7,243 6,679

---------- ----------------- --------------

Total liabilities 21,475 15,227 16,572

---------- ----------------- --------------

Net assets 37,623 35,518 36,143

---------- ----------------- --------------

Equity

Issued capital 5 316 314 314

Share premium 4,892 4,892 4,892

Retained earnings 32,415 30,312 30,937

---------- ----------------- --------------

Total equity 37,623 35,518 36,143

---------- ----------------- --------------

Unaudited condensed consolidated statement of cash flows

For the six months ended 31 March 2022

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

2022 2021 (restated) 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Operating activities

Profit / (loss) before tax 2,216 (133) 564

---------- ----------------- -------------

Adjustments to reconcile profit

before tax to net cash flows:

Depreciation and impairment

of property, plant & equipment 655 506 1,074

Depreciation of right-of-use

assets 1,116 1,080 2,223

Profit on disposal of right-of-use

assets - - (45)

Amortisation and impairment

of intangible assets 64 76 218

Loss on disposal of property,

plant and equipment 10 10 140

Share based payments 155 103 254

Finance costs 230 232 472

Working capital adjustments:

Movement in trade and other receivables

and prepayments (1,249) 1,257 565

Movement in inventories (5,736) (417) (3,992)

Movement in trade and other

payables 2,186 (273) 1,217

---------- ----------------- -------------

(353) 2,441 2,690

Interest paid (230) (232) (472)

Income tax paid (60) (1,066) (1,135)

---------- ----------------- -------------

Net cash flows from operating

activities (643) 1,143 1,083

---------- ----------------- -------------

Investing activities

Proceeds from sales of property,

plant and equipment - 10 10

Purchase of property, plant

and equipment (798) (888) (1,574)

Purchase of intangible assets - (13) (62)

Acquisitions (909) - -

---------- ----------------- -------------

Net cash flows used in investing

activities (1,707) (891) (1,626)

Financing Activities

Dividends paid (377) - -

Share capital issued 2 6 6

Payment of lease liabilities (1,089) (1,135) (2,304)

Bank loans drawn down 1,500 - -

Repayment of bank borrowings - - -

---------- ----------------- -------------

Net cash flows from financing

activities 36 (1,129) (2,298)

---------- ----------------- -------------

Net (decrease) in cash and

cash equivalents (2,314) (877) (2,841)

Cash and cash equivalents

at start of period 13,032 15,873 15,873

---------- ----------------- -------------

Cash and cash equivalents

at end of period 10,718 14,996 13,032

---------- ----------------- -------------

Unaudited notes to the interim condensed financial

statements

For the six months ended 31 March 2022

1. Basis of preparation

The interim condensed financial statements of the group for the

six months ended 31 March 2022, which are neither audited or

reviewed, have been prepared in accordance with the International

Financial Reporting Standards ('IFRS') accounting policies adopted

by the group and set out in the annual report and accounts for the

year ended 30 September 2021. As permitted, this interim report has

been prepared in accordance with the AIM rules and not in

accordance with IAS 34 "Interim financial reporting". While the

financial figures included in this preliminary interim earnings

announcement have been computed in accordance with IFRS's

applicable to interim periods, this announcement does not contain

sufficient information to constitute an interim financial report as

that term is defined in IFRS's.

The financial information contained in the interim report also

does not constitute statutory accounts for the purpose of section

434 of the Companies Act 2006. The financial information for the

period ended 30 September 2021 is based on the statutory accounts

for period ended 30 September 2021 which have been filed with the

Registrar of Companies and are available on the group's website

www.ramsdensplc.com. The auditors, Grant Thornton UK LLP, reported

on those accounts: their report was unqualified, did not draw

attention to any matters by way of emphasis and did not contain a

statement under section 498 (2) or (3) of the Companies Act 2006.

The financial information for the 6 months ended 31 March 2021 is

based on the unaudited interim financial information for that

period. Due to a change in accounting policy for pawnbroking loans

in the course of realisation, certain figures have been restated

for this period as detailed in note 7.

The Board have conducted an extensive review of forecast

earnings and cash over the next twelve months, considering various

scenarios and sensitivities given the Covid-19 situation and

uncertainty around the future economic environment. At 31 March

2022 the Group had cash resources of cGBP11m and a GBP10m RCF

facility expiring in March 2024, of which GBP1.5m was drawn.

The Group's activities include services deemed essential

services by the government and therefore the Group's stores are

likely to be able to open in the event of a further lockdown. The

Group's essential services include pawnbroking, foreign currency,

money transfer and cheque cashing. The Group has a strong asset

base and the ability to generate cash quickly through the sale of

jewellery stock for its intrinsic value or by restricting new

pawnbroking lending. The Group has shown resilient trading through

the last year of Covid-19 restrictions, assisted by government

support.

The Board have a reasonable expectation that the Company and

Group have adequate resources to continue in operational existence

for the foreseeable future. Accordingly, they continue to adopt the

going concern basis in preparing the interim condensed financial

statements.

Unaudited notes to the interim condensed financial statements

(continued)

For the six months ended 31 March 2022

2. Segmental Reporting

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

2022 2021 (restated) 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue

Pawnbroking 4,248 4,062 7,526

Purchases of precious metals 7,779 5,623 10,369

Retail Jewellery sales 13,085 8,074 18,252

Foreign currency margin 3,596 1,027 3,408

Income from other financial

services 557 540 1,122

---------- ------------------ -------------

Total revenue 29,265 19,326 40,677

---------- ------------------ -------------

Gross profit

Pawnbroking 3,694 3,480 6,678

Purchases of precious metals 3,112 2,330 4,240

Retail Jewellery sales 4,923 3,168 6,965

Foreign currency margin 3,447 1,027 3,257

Income from other financial

services 557 540 1,122

---------- ------------------ -------------

Total gross profit 15,733 10,545 22,262

---------- ------------------ -------------

Other income - - 284

Administrative expenses (13,287) (10,446) (21,510)

Finance costs (230) (232) (472)

---------- ------------------ -------------

Profit / (loss) before tax 2,216 (133) 564

---------- ------------------ -------------

Income from other financial services comprises of cheque cashing

fees, agency commissions on miscellaneous financial products and

franchise fees.

The Group is unable to meaningfully allocate administrative

expenses or financing costs between the segments because these

expenses include the cost of staff and stores which undertake all

services. Accordingly, the Group is unable to disclose an

allocation of items included in the Consolidated Statement of

Comprehensive Income below Gross profit, which represents the

reported segmental results.

Unaudited notes to the interim condensed financial statements

(continued)

For the six months ended 31 March 2022

2. Segmental Reporting (continued)

6 months 6 months 12 months

ended Ended ended

31 March 31 March 30 September

2022 2021 2021

Unaudited Unaudited Audited

Other information GBP'000 GBP'000 GBP'000

Capital additions (*) 1,013 1,742 1,636

Depreciation and amortisation

(*) 1,845 1,672 3,515

Assets

Pawnbroking 10,837 8,557 9,173

Purchases of precious metals 120 768 1,172

Retail Jewellery sales 21,590 11,005 14,306

Foreign currency margin 5,903 3,345 5,314

Income from other financial

services 150 175 139

Unallocated (*) 20,498 26,895 22,611

---------- -------------

59,098 50,745 52,715

---------- ---------- -------------

Liabilities

Pawnbroking 531 434 492

Purchases of precious metals 1 3 21

Retail Jewellery sales 4,845 3,061 3,433

Foreign currency margin 1,626 70 1,335

Income from other financial

services 357 469 541

Unallocated (*) 14,115 11,190 10,750

---------- -------------

21,475 15,227 16,572

---------- ---------- -------------

(*) The Group is unable to meaningfully allocate this

information by segment because all segments operate from the same

stores and the assets and liabilities are common to all

segments.

Fixed assets are therefore included in unallocated assets and

lease liabilities are included in unallocated liabilities.

Unaudited notes to the interim condensed financial statements

(continued)

For the six months ended 31 March 2022

3. Finance costs

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

2022 2021 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Interest on debts and borrowings 42 42 84

Interest on right-of-use assets 188 190 388

Total finance costs 230 232 472

---------- ---------- --------------

4. Earnings per share

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

2022 2021 2021

Unaudited Unaudited Audited

Profit for the period (GBP'000) 1,751 (104) 366

Weighted average number of shares

in issue 31,476,540 30,930,245 31,161,762

Earnings per share (pence) 5.6 (0.3) 1.2

Fully diluted earnings per share

(pence) 5.6 (0.3) 1.2

5. Issued capital and reserves

Ordinary shares issued and fully paid No. GBP'000

At 30 September 2021 31,393,207 314

Share capital issued 250,000 2

At 31 March 2022 31,643,207 316

During the period 250,000 (2021: 555,554) ordinary 1p shares

were issued at par pursuant to the Group's Long Term Incentive Plan

(LTIP).

Unaudited notes to the interim condensed financial statements

(continued)

For the six months ended 31 March 2022

6. Dividends

The final dividend for the year ended 30 September 2021 of 1.2p

per share was paid 10 March 2022 totaling GBP377,000.

7. Change in accounting policy

As detailed in notes 2 & 28 in the Annual Report for the

year ended 30 September 2021 the Group changed its accounting

policy for the treatment of pawnbroking loans in the course of

realisation. This change was made after the publication of the

interim results to 31 March 2021, therefore certain figures for

that period, shown as a comparative period in these financial

statements, have been restated under the new accounting policy. The

main impact is a reduction in both revenue and cost of sales for

the pawnbroking segment, however this change has no effect on gross

profit or net assets. Pawnbroking loans in the course of

realisation are recognised in the statement of financial position

as trade receivables rather than as inventories under the previous

accounting policy.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VDLFBLQLXBBV

(END) Dow Jones Newswires

June 08, 2022 02:01 ET (06:01 GMT)

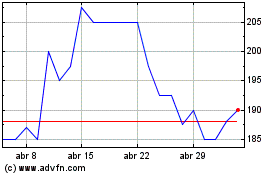

Ramsdens (LSE:RFX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ramsdens (LSE:RFX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024