Ramsdens Holdings PLC Pre-Close Trading Update (2526C)

10 Octubre 2022 - 1:00AM

UK Regulatory

TIDMRFX

RNS Number : 2526C

Ramsdens Holdings PLC

10 October 2022

10 October 2022

Ramsdens Holdings PLC

("Ramsdens" or the "Group")

Pre-Close Trading Update

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Trading ahead of expectations driven by a strong recovery in

foreign currency income and growth across all business segments

Ramsdens Holdings PLC, the diversified financial services

provider and retailer, announces a pre-close trading update for the

year ended 30 September 2022 (the "Period").

During the Period, Ramsdens delivered a strong performance

across each of its four key segments. As a result of this, the

Group expects to report annual profit before tax ahead of

expectations.

Highlights

- Foreign Currency gross profit grew significantly to

approximately GBP12.6m (FY21: GBP3.3m). Income almost returned to

pre pandemic levels driven by a recovery in volumes and improved

margins.

- Revenue generated by the Group's jewellery retail segment grew

by more than 40% to approximately GBP26.2m (FY21: GBP18.3m), driven

by strategic investments in stock and improved merchandising.

- Demand for pawnbroking loans grew during the year as a result

of customer spending habits returning following the easing of

restrictions related to covid-19 and fewer alternative options for

small sum short term credit. As at 30 September 2022, the loan book

had increased by over 40% to GBP8.6m (FY21: GBP6.1m), which is

above the pre pandemic loan book of GBP7.7m at 31 March 2020.

- Precious metal buying volumes increased throughout the summer,

aided by the high gold price and increased footfall. Revenue was up

more than 50% to approximately GBP16.0m (FY21: GBP10.3m), returning

to pre pandemic levels.

Peter Kenyon, CEO of Ramsdens commented:

"We are pleased with the Group's very strong performance during

the year, which again reflects the resilience of our business model

and the strength of our value-for-money reputation amongst

customers.

We are particularly pleased with the strong rebound in our

foreign currency segment, which has been a key driver behind our

profit performance.

Our staff have continued to deliver fantastic service to our

growing customer base, and I would like to take this opportunity to

publicly thank them all for their commitment. We continue to invest

in attracting, retaining and rewarding our staff as we develop what

I believe to be the best team in the industry.

Ramsdens has recovered well from the impact of the pandemic, and

while the economic backdrop is challenging and we are not immune to

external cost pressures, the Board is confident that with our

diversified income streams, our value-for-money proposition and

growing brand awareness, we are in a good position to continue our

positive momentum into the new financial year."

The Board expects to release its Annual Financial Report in

mid-January 2023.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014 as amended by The Market Abuse

(Amendment) (EU Exit) Regulations 2019. The person responsible for

making this announcement on behalf of the Company is Peter

Kenyon.

Enquiries:

Ramsdens Holdings PLC Tel: +44 (0) 1642 579957

Peter Kenyon, CEO

Martin Clyburn, CFO

Liberum Capital Limited (Nominated Adviser) Tel: +44 (0) 20 3100 2000

Richard Crawley

Lauren Kettle

Hudson Sandler (Financial PR) Tel: +44 (0) 20 7796 4133

Alex Brennan

Lucy Wollam

Emily Brooker

About Ramsdens

Ramsdens is a growing, diversified, financial services provider

and retailer, operating in the four core business segments of

foreign currency exchange, pawnbroking loans, precious metals

buying and selling and retailing of second hand and new jewellery.

Ramsdens does not offer unsecured high cost short term credit.

Headquartered in Middlesbrough, the Group operates from 157

stores within the UK (including 3 franchised stores) and has a

growing online presence.

Ramsdens is fully FCA authorised for its pawnbroking and credit

broking activities.

www.ramsdensplc.com

www.ramsdensforcash.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUWURRUBURRAA

(END) Dow Jones Newswires

October 10, 2022 02:00 ET (06:00 GMT)

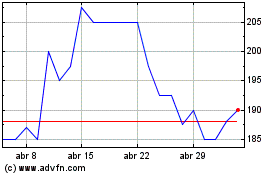

Ramsdens (LSE:RFX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ramsdens (LSE:RFX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024