TIDMRHM

RNS Number : 8440P

Round Hill Music Royalty Fund Ltd

12 October 2023

12 October 2023

ROUND HILL MUSIC ROYALTY FUND LIMITED

(the "Company")

Registration number 68002

Legal Entity Identifier: 213800752UO1CJTV8C39

Special Dividend

On 8 September 2023, the board of directors of each of Round

Hill Music Royalty Fund Limited (the "Company" or "RHM") and

Alchemy Copyrights, LLC, trading as Concord ("Concord") announced

that they had reached agreement on the terms of a recommended cash

offer pursuant to which Concord Bidco, a wholly-owned subsidiary of

Concord, will acquire the entire issued and to be issued share

capital of RHM (the "Acquisition"). The Acquisition is intended to

be effected by means of a Court-sanctioned scheme of arrangement

under Part VIII of the Companies Law (the "Scheme").

As noted in the Scheme Document published by the Company on 25

September 2023 in connection with the Acquisition (the "Scheme

Document"), the Company is pleased to announce that the Board of

Directors has declared a special dividend of US$0.005 per RHM Share

for the quarter ended 30 September 2023 (the "Special

Dividend").

The Special Dividend is in addition to the quarterly dividend of

US$0.01125 per RHM Share paid in respect of the quarter ended 30

June 2023 which has already been received by Shareholders (as

announced on 31 August 2023).

The Company has elected, under the provisions of UK Statutory

Instrument 2009/2034, to designate all of the dividend for the 3

month period to 30 September 2023 (including the Special Dividend)

as an interest distribution to RHM Shareholders.

The dividend will be paid gross on 27 October 2023 to holders of

RHM Shares of record on 20 October 2023. The ex-dividend date is 19

October 2023.

Capitalised terms used but not otherwise defined in this

announcement (the "Announcement") have the meanings given to them

in the Scheme Document.

FOR FURTHER INFORMATION

Round Hill

Josh Gruss, Founder and CEO Via Fourth Pillar below

Steve Clark, COO

Cavendish

Sales:

Justin Zawoda-Martin +44 20 7397 1923

Daniel Balabanoff +44 20 7397 1909

Andrew Worne +44 20 7397 1912

Corporate:

James King +44 20 7397 1913

Will Talkington +44 20 7397 1910

Fourth Pillar (Financial PR)

Claire Turvey +44 7850 548 198 / claire@thefourthpillar.co.uk

Lynne Best +44 7763 619709 / lynne@thefourthpillar.co.uk

Tomas Nevrkla +44 7963 548865 / tomas@thefourthpillar.co.uk

JTC

Mariana Enevoldsen +44 1481 702 485

Important notices

Cavendish Securities PLC (formerly Cenkos Securities PLC)

("Cavendish") which is authorised and regulated in the United

Kingdom by the FCA, is acting as Rule 3 financial adviser,

financial adviser and corporate broker exclusively to RHM and no

one else in connection with the Acquisition and the matters set out

in this Announcement and shall not be responsible to anyone other

than RHM for providing the protections afforded to clients of

Cavendish, nor for providing advice in connection with the

Acquisition or any matter referred to herein. Neither Cavendish nor

any of its subsidiaries, affiliates or branches owes or accepts any

duty or liability or responsibility whatsoever (whether direct,

indirect, consequential, whether in contract, in tort, under

statute or otherwise) to any person who is not a client of

Cavendish in connection with this Announcement, any statement or

other matter or arrangement referred to herein or otherwise.

No profit forecast, estimate or quantified benefits

statements

No statement in this Announcement or incorporated by reference

into this Announcement is intended to constitute a profit forecast,

profit estimate or quantified benefits statements for RHM or

Concord Bidco for any period, nor should any statement in this

announcement or incorporated by reference into this announcement be

interpreted to mean that earnings or earnings per RHM Share for the

current or future financial years would necessarily match or exceed

the historical published earnings or earnings per RHM Share.

Publication on website

A copy of this Announcement (together with any document

incorporated by reference) and the documents required to be

published pursuant to Rule 26 of the Takeover Code will be made

available, free of charge, subject to certain restrictions relating

to persons resident in Restricted Jurisdictions, on RHM's website

at www.roundhillmusicroyaltyfund.com by no later than 12.00 pm

London time) on the date following the publication of this

announcement. Save as expressly referred to in this announcement,

neither the contents of RHM's website, Concord's website nor the

content of any other website accessible from hyperlinks on such

websites is incorporated into, or forms part of, this

announcement.

Requesting hard copy documents

In accordance with Rule 30.3 of the Takeover Code, any person

entitled to receive a copy of documents, announcements and

information relating to the Acquisition is entitled to receive such

documents (including information incorporated by reference into

such documents by reference to another source) in hard copy

form.

RHM Shareholders may request hard copies of this document by

contacting the Registrar, JTC Registrars Limited, at c/o JTC Group,

The Scalpel, 18(th) Floor, 52 Lime Street, London, United Kingdom

EC3M 7AF or by calling 01481 711 301 or from overseas +44 1481 711

301. Calls are charged at the standard geographical rate and will

vary by provider. Calls outside the United Kingdom or Guernsey will

be charged at the applicable international rate. Lines are open

between 9.00 a.m. and 5.00 p.m. (London time) Monday to Friday

(except public holidays in the UK and Guernsey). Please note that

JTC Registrars Limited cannot provide any financial, legal or tax

advice. Calls may be recorded and monitored for security and

training purposes.

Such persons may also request that all future documents,

announcements and information to be sent to them in relation to the

Acquisition should be in hard copy form.

Dealing disclosure requirements

Under Rule 8.3(a) of the Takeover Code, any person who is

interested in 1 per cent. or more of any class of relevant

securities of an offeree company or of any securities exchange

offeror (being any offeror other than an offeror in respect of

which it has been announced that its offer is, or is likely to be,

solely in cash) must make an Opening Position Disclosure following

the commencement of the Offer Period and, if later, following the

announcement in which any securities exchange offeror is first

identified.

An Opening Position Disclosure must contain details of the

person's interests and short positions in, and rights to subscribe

for, any relevant securities of each of (i) the offeree company and

(ii) any securities exchange offeror(s). An Opening Position

Disclosure by a person to whom Rule 8.3(a) of the Takeover Code

applies must be made by no later than 3.30 pm (London time) on the

10th business day following the commencement of the Offer Period

and, if appropriate, by no later than 3.30 pm (London time) on the

10th business day following the announcement in which any

securities exchange offeror is first identified. Relevant persons

who deal in the relevant securities of the offeree company or of a

securities exchange offeror prior to the deadline for making an

Opening Position Disclosure must instead make a Dealing

Disclosure.

Under Rule 8.3(b) of the Takeover Code, any person who is, or

becomes, interested in 1 per cent. or more of any class of relevant

securities of the offeree company or of any securities exchange

offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any securities

exchange offeror. A Dealing Disclosure must contain details of the

dealing concerned and of the person's interests and short positions

in, and rights to subscribe for, any relevant securities of each of

(i) the offeree company and (ii) any securities exchange offeror,

save to the extent that these details have previously been

disclosed under Rule 8 of the Takeover Code. A Dealing Disclosure

by a person to whom Rule 8.3(b) of the Takeover Code applies must

be made by no later than 3.30 pm (London time) on the business day

following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3 of the Takeover Code.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and 8.4 of

the Takeover Code).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the disclosure table on

the Panel's website at www.TheTakeoverPanel.org.uk , including

details of the number of relevant securities in issue, when the

Offer Period commenced and when any offeror was first identified.

You should contact the Panel's Market Surveillance Unit on +44

(0)20 7638 0129 if you are in any doubt as to whether you are

required to make an Opening Position Disclosure or a Dealing

Disclosure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVBLBDGRUBDGXB

(END) Dow Jones Newswires

October 12, 2023 02:00 ET (06:00 GMT)

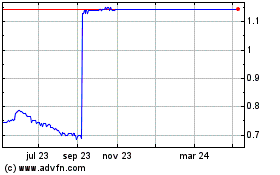

Round Hill Music Royalty (LSE:RHM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Round Hill Music Royalty (LSE:RHM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024