TIDMRHM

RNS Number : 8629R

Round Hill Music Royalty Fund Ltd

31 October 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

THAT JURISDICTION.

FOR IMMEDIATE RELEASE

31 October 2023

RECOMMED CASH OFFER

for

ROUND HILL MUSIC ROYALTY FUND LIMITED ("RHM")

by

CONCORD CADENCE LIMITED ("Concord Bidco")

a newly formed company directly owned by

Alchemy Copyrights, LLC, trading as Concord ("Concord")

to be effected by means of a Court-sanctioned scheme of

arrangement under Part VIII of the Companies (Guernsey) Law 2008,

as amended

SCHEME OF ARRANGEMENT BECOMES EFFECTIVE

On 30 October 2023, RHM and Concord Bidco announced that the

Court had sanctioned the Scheme at the Court Hearing.

RHM and Concord Bidco are now pleased to announce that the

Scheme Court Order has been delivered to the Guernsey Registry

today and, accordingly, the Scheme has now become effective in

accordance with its terms. The entire issued ordinary share capital

of RHM is therefore now owned by Concord Bidco. The terms of the

Scheme are set out in the scheme document published by RHM on 25

September 2023, a copy of which is available on RHM's website at

www.roundhillmusicroyaltyfund.com (the "Scheme Document").

Capitalised terms used but not defined in this announcement (the

"Announcement") have the meanings given to them in the Scheme

Document. All references to times in this Announcement are to

London times, unless otherwise stated.

Settlement

A Scheme Shareholder on the register of members of RHM at the

Scheme Record Time, being 6.00 p.m. on 30 October 2023, will be

entitled to receive US$1.15 in cash for each Scheme Share held. In

accordance with the terms of the Scheme, settlement of the Cash

Consideration to which any Scheme Shareholder is entitled will be

effected within 14 days of the Effective Date in the manner and

subject to what is set out below.

(a) Where Scheme Shares are held in certificated form

Where, at the Scheme Record Time, and subject to the remainder

of this section, a Scheme Shareholder holds Scheme Shares in

certificated form, settlement of the Cash Consideration shall be

despatched by cheque or by electronic payment to their mandated

bank or building society account as recorded by the Registrar or by

such other method as may be approved by the Panel.

Cheques will not be mailed to any Scheme Shareholder who holds

their Scheme Shares in certificated form where the Company and/or

the Registrar has identified a verification issue with the

information provided for that Scheme Shareholder or any underlying

beneficial holders, where the information is required for the

purpose of payment of the Cash Consideration to the Scheme

Shareholder, which needs to be addressed before payment of the Cash

Consideration to such Scheme Shareholder can be made. In these

circumstances, the Registrar will, where they hold validated, and

verified mandated bank or building society electronic payment

details for such Scheme Shareholder, despatch payment to them by

way of electronic payment to their mandated bank or building

society or, where they do not have such details, hold the Cash

Consideration on trust for such Scheme Shareholders and engage with

each of them to verify their identity and payment details before

payment of the Cash Consideration is made to them (whether by way

of electronic payment or, if requested, cheque). In addition, and

without prejudice to the foregoing, no electronic payment shall

be made to any Scheme Shareholder where the Company and/or the

Registrar have been unable to validate the electronic payment

details to the satisfaction of the Company and/or the Registrar.

The Registrar shall also have the power to withhold any Cash

Consideration payable to any Scheme Shareholder where either the

Company and/or the Registrar believe that there is a verification

issue with the information provided for that Scheme Shareholder or

any underlying beneficial holders, where the information is

required for the purpose of payment of the Cash Consideration to

the Scheme Shareholder. Further details of such trust arrangement

are set out in paragraph 3 of Part 3 of the Scheme Document.

Subject to the above, all deliveries of cheques required to be

made pursuant to the Scheme shall be effected by posting them no

later than 14 days after the Effective Date by post or by such

other method as may be approved by the Panel, addressed to the

persons entitled to them at their respective addresses as appearing

in the Register at the Scheme Record Time (or, in the case of joint

holders, at the address of that one of the joint holders whose name

stands first in the Register in respect of such joint holding at

such time) and neither RHM nor Concord Bidco (nor any of their

respective nominees or agents) shall be responsible for any loss or

delay in the transmission of cheques sent in this way.

All Cash Consideration due to Scheme Shareholders shall be paid

in US dollars and, in the case of a cheque, drawn on a US clearing

bank or by electronic payment to their mandated bank or building

society account as recorded by the Registrar.

All cheques shall be made payable to the holder (except that, in

the case of joint holders, Concord Bidco reserves the right to make

cheques payable to the joint holder whose name stands first in the

Register in respect of such joint holding at the Scheme Record

Time) and the encashment of any such cheque shall be a complete

discharge to Concord Bidco for the obligation to pay the monies

represented thereby. As noted above, no cheques will be issued or

paid to any Scheme Shareholder who holds their shares in

certificated form where the Company and/or the Registrar has

identified a verification issue. The Cash Consideration due to such

Scheme Shareholders will be held in trust by the Registrar on

behalf of such Scheme Shareholder for a period of twelve years from

the Effective Date, after which time if it remains unclaimed for

any reason the Cash Consideration will be forfeited and cease to

remain owing by Concord Bidco or RHM (or the Registrar) and shall

thenceforth belong to Concord Bidco (with any interest accruing

being for the benefit of Concord Bidco). For the avoidance of

doubt, no interest will accrue for the benefit of Scheme

Shareholders on the Cash Consideration.

(b) Where Scheme Shares are held in uncertificated or

dematerialised form (that is, in CREST)

Where, at the Scheme Record Time, a Scheme Shareholder holds

Scheme Shares in uncertificated form, the payment of Cash

Consideration to which CREST Scheme Shareholders are entitled,

shall be effected through CREST by Concord Bidco instructing (or

procuring the instruction of) Euroclear to create a CREST assured

payment obligation in accordance with the CREST assured payment

arrangements in favour of the appropriate CREST account through

which the relevant Scheme Shareholder holds those uncertificated

Scheme Shares in respect of the Cash Consideration due to that

Scheme Shareholder. Each Scheme Shareholder who holds Scheme Shares

in uncertificated form at the Scheme Record Time must ensure that

an active USD Cash Memorandum Account is in place in CREST by no

later than the Scheme Record Time. In the absence of a USD Cash

Memorandum Account, the payment of the Cash Consideration in USD

will not settle, resulting in a delay and the settlement of the

Cash Consideration outside of CREST.

The instruction by (or on behalf of) Concord Bidco to create an

assured payment arrangement shall be a complete discharge of

Concord Bidco's obligations under the Scheme with reference to

payments through CREST.

The CREST payment obligations set out above will be created

within 14 days after the Effective Date. As from the Effective

Date, each holding of Scheme Shares credited to any stock account

in CREST will be disabled and all Scheme Shares will be removed

from CREST in due course thereafter.

Concord Bidco reserves the right to pay Cash Consideration to

all or any relevant CREST Scheme Shareholders at the Scheme Record

Time by cheque or electronic payment to their mandated bank or

building society account as recorded by the Registrar as set out

above if for any reason it wishes to do so.

(c) For all Scheme Shareholders

No electronic payment shall be made to any Scheme Shareholder

where the Company and/or the Registrar have been unable to validate

the electronic payment details to the satisfaction of the Company

and/or the Registrar. The Registrar shall also have the power to

withhold any Cash Consideration payable to any Scheme Shareholder

where either the Company and/or the Registrar believe that there is

a verification issue with the information provided for that Scheme

Shareholder or any underlying beneficial holders, where the

information is required for the purpose of payment of the Cash

Consideration to the Scheme Shareholder. Further details of such

trust arrangement are set out in paragraph 3 of Part 3 of the

Scheme Document.

Suspension and cancellation of listing and trading of RHM

Shares

The listing of RHM Shares on the premium listing segment of the

Official List of the Financial Conduct Authority ("FCA") and the

admission to trading of RHM Shares on the London Stock Exchange's

("LSE") main market for listed securities were suspended with

effect from 7.30 a.m. (London time) today, 31 October 2023.

Applications have been made to the FCA and the LSE in relation

to the de-listing of RHM Shares from the premium listing segment of

the Official List and the cancellation of the admission to trading

of RHM Shares on the LSE's main market for listed securities, which

is expected to take place by 8.00 a.m. (London time) on 1 November

2023.

Director changes

As the Scheme has now become Effective, RHM announces that, as

of today's date, Robert Naylor, Caroline Chan, Audrey McNair and

Francis Keeling have tendered their resignations and have stepped

down from the RHM Board.

Full details of the Acquisition are set out in the Scheme

Document.

Timetable

The expected timetable of principal events for the

implementation of the Scheme remains as set out in the Scheme

Document and is also set out below. The dates are indicative only

and are subject to change. If any of the dates and/or times in the

expected timetable change, the revised dates and/or times will be

notified by announcement through a Regulatory Information Service

with such announcement being made available on RHM's website at

www.roundhillmusicroyaltyfund.com.

EVENT TIME AND/OR DATE

Cancellation of listing of RHM By 8.00 a.m. on Wednesday 1

Shares on London Stock Exchange November 2023

Latest date for despatch of 14 November 2023

cheques, electronic payment

and/or settlement through CREST

to RHM Shareholders in respect

of the Cash Consideration

Enquiries

RHM Via Cavendish

Robert Naylor (Chairman)

Cavendish (Rule 3 Adviser,

Financial Adviser and Corporate

Broker to RHM)

James King +44 207 397 1913

William Talkington +44 207 397 1910

JTC (Company Secretary and

Administrator to RHM) +44 1481 702 485

Mariana Enevoldsen

Fourth Pillar (Financial PR

Advisers to RHM)

Claire Turvey +44 7850 548 198

Lynne Best +44 7763 619 709

Concord +1 629 401 3906

Kelly Voigt (SVP, Corporate

Communications

J.P. Morgan Cazenove (Sole

Financial Adviser to Concord

Bidco and Concord) +44 203 493 8000

Jonty Edwards

Brent Ballard

Rupert Budge

Edward Hatter

H/Advisors Maitland (PR Adviser

to Concord Bidco)

Neil Bennett +44 7900 000777

Sam Cartwright +44 7827 254561

Gowling WLG (UK) LLP is retained as legal adviser to RHM and

Reed Smith LLP is retained as legal adviser to Concord Bidco and

Concord.

Important notices

Cavendish Securities PLC (formerly Cenkos Securities PLC)

("Cavendish") which is authorised and regulated in the United

Kingdom by the FCA, is acting as Rule 3 financial adviser,

financial adviser and corporate broker exclusively to RHM and no

one else in connection with the Acquisition and the matters set out

in this Announcement and shall not be responsible to anyone other

than RHM for providing the protections afforded to clients of

Cavendish, nor for providing advice in connection with the

Acquisition or any matter referred to herein. Neither Cavendish nor

any of its subsidiaries, affiliates or branches owes or accepts any

duty or liability or responsibility whatsoever (whether direct,

indirect, consequential, whether in contract, in tort, under

statute or otherwise) to any person who is not a client of

Cavendish in connection with this Announcement, any statement or

other matter or arrangement referred to herein or otherwise.

J.P. Morgan Securities LLC, together with its affiliate J.P.

Morgan Securities plc (which conducts its UK investment banking

business as J.P. Morgan Cazenove and which is authorised in the

United Kingdom by the Prudential Regulation Authority (the "PRA")

and regulated in the United Kingdom by the PRA and the FCA)

(together "J.P. Morgan Cazenove"), is acting as financial adviser

exclusively to Concord Bidco and Concord and no one else in

connection with the Acquisition and will not be responsible to

anyone other than Concord Bidco and Concord for providing the

protections afforded to clients of J.P. Morgan Cazenove or its

affiliates, nor for providing advice in relation to the Acquisition

or any other matter or arrangement referred to herein.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

SOAKFLBXXBLZFBK

(END) Dow Jones Newswires

October 31, 2023 05:53 ET (09:53 GMT)

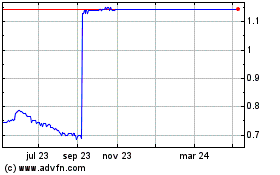

Round Hill Music Royalty (LSE:RHM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Round Hill Music Royalty (LSE:RHM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024