RM Infrastructure Income PLC Net Asset Value(s) (6573Z)

16 Septiembre 2022 - 1:00AM

UK Regulatory

TIDMRMII TIDMTTM

RNS Number : 6573Z

RM Infrastructure Income PLC

16 September 2022

RM Infrastructure Income Plc

("RMII" or the "Company")

LEI: 213800RBRIYICC2QC958

Net Asset Value

NAV

The NAV % Total Return for the month was +0.49%, which takes

the NAV % Total Return to +3.27% over the past six months, and

+3.76% over the past 12 months.

The NAV as of 31(st) August 2022 was 94.70 pence per Ordinary

Share, which was 0.46 pence higher than at 31(st) July 2022.

This overall gain comprised interest income net of expenses of

+0.60 pence per Ordinary Share and a decrease in portfolio valuations

of 0.14 pence per Ordinary Share Summary for August 2022 (pence

per share)

Net interest income +0.60p

Change in portfolio

valuations -0.15p

Net NAV Movement +0.46p

------------------------ --------

Portfolio Activity

At 31(st) August 2022, the Company's invested portfolio had an

aggregate valuation of GBP135 million across 37 investments.

The average yield was 8.75%, with a weighted average loan life

remaining of 1.82 years. Overall, the portfolio is 94% invested

in private market assets and 6% in public bonds. The Investment

Manager's focus on creating a portfolio of high yielding and

short duration loans that do not hold significant exposure to

interest rate movements, ensures the portfolio remains well positioned

against any further interest rate increases by global central

banks.

The month of August 2022 was relatively quiet in terms of new

investments with one drawdown:

* Loan Reference 95, Social Infrastructure - Childcare:

c.GBP3m drawdown under a senior secured committed

facility within the childcare care sub-sector.

Update on Loan Reference 68, Student Accommodation Coventry.

The building obtained its approvals for occupation and students

have started to enter the building. Post month-end a legal claim

was lodged against the former main contractor for more than GBP3m,

to recover costs spent to rectify the property's defects and

the associated loss of income.

The Company also announces that the Monthly Report for the period

to 31 August 2022 is now available to be viewed on the Company

website:

https://rm-funds.co.uk/rm-infrastructure-income/rm-funds-investor-monthly-fact-sheets-2/

END

For further information, please contact:

RM Capital Markets Limited - Investment Manager

James Robson

Thomas Le Grix De La Salle

Tel: 0131 603 7060

Sanne Fund Management (Guernsey) Limited - AIFM

Chris Hickling

Shaun Robert

Tel: 01481 737600

Tulchan Group - Financial PR

Elizabeth Snow

Oliver Norgate

Tel: 0207 353 4200

Sanne Fund Services (UK) Limited - Administrator and Company

Secretary

Brian Smith

Ciara McKillop

Tel: 020 3327 9720

Singer Capital Markers Advisory LLP - Financial Adviser and

Broker

James Maxwell

Asha Chotai

Tel: 020 7496 3000

Peel Hunt LLP - Financial Adviser and Broker

Luke Simpson

Liz Yong

Tel: 020 7418 8900

About RM Infrastructure Income

RM Infrastructure Income Plc ("RMII" or the "Company") is a closed-ended

investment trust established to invest in a portfolio of secured

debt instruments.

The Company aims to generate attractive and regular dividends

through loans sourced or originated by the Investment Manager

with a degree of inflation protection through index-linked returns

where appropriate. Loans in which the Company invests are predominantly

secured against assets such as real estate or plant and machinery

and/or income streams such as account receivables.

For more information, please see

https://rm-funds.co.uk/rm-infrastructure-income/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVDELFFLKLBBBZ

(END) Dow Jones Newswires

September 16, 2022 02:00 ET (06:00 GMT)

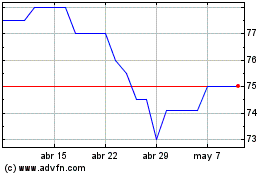

Rm Infrastructure Income (LSE:RMII)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Rm Infrastructure Income (LSE:RMII)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024