TIDMRNEW

RNS Number : 6620Z

Ecofin US Renewables Infrastr.Trust

16 September 2022

16 September 2022

LEI No: 2138004JUQUL9VKQWD21

ECOFIN U.S. RENEWABLES INFRASTRUCTURE TRUST PLC

(the "Company" or "RNEW")

Half-yearly report for the six months ended 30 June 2022

Objective

The Company's investment objective is to provide Shareholders

with an attractive level of current distributions by investing in a

diversified portfolio of mixed renewable energy and sustainable

infrastructure assets ("Renewable Assets") predominantly located in

the U.S. with prospects for modest capital appreciation over the

long term.

Why RNEW?

RNEW targets attractive risk-adjusted returns and a sustainable

dividend yield through a differentiated investment strategy focused

on the middle market of U.S. renewable energy:

l Fully invested portfolio: Diversified portfolio of U.S.

renewable energy assets with an attractive long-term income

stream;

l Stable income: Portfolio generating 100% contracted revenues

which together offer geographical diversification and opportunity

for both capital growth and inflation protection; and

l U.S. renewables market with promising growth outlook: $360

billion growth opportunity projected over the next decade with

historic unified government support to achieve the 2035 carbon-free

U.S. power sector goal.

Highlights

Financial

As at 30 June 2022

97.3 cents $134.3 million 103.5 cents

79.9 pence GBP110.3 million 85.0 pence

Net Asset Value ("NAV")

per share NAV Share price

1.2% (1) 7.4% (1) 2.8 cents

NAV total return for the Share price total return Dividends per share declared

Period for the Period for the Period

26.5% (2)

Leverage at project level

Operational

16.3 years (3) 62 32,900

Weighted average remaining Number of renewable energy Number of households

term of assets supplied since

revenue contracts 31 December 2021

162 MW (4) 106,800 tonnes (5) 374 GWh (4)

Portfolio generating of CO (2) e avoided since Clean electricity generated

capacity 31 December 2021 since IPO

177 GWh (4)

Clean electricity generated

since

31 December 2021

Figures reported either as at the referenced date or over the

six month period ended 30 June 2022 (the "Period"). All references

to cents and dollars ($) are to the currency of the U.S., unless

stated otherwise.

1. These are alternative performance measures. ("APMs").

Definitions of how these APMs and other performance measures used

by the Company have been calculated can be found at the last

section of this report.

2. Based on Gross Asset Value ("GAV").

3. Includes all construction-stage and committed assets.

4. Represents the Company's share of portfolio generating

capacity (including assets under construction).

5. CO(2) e based on the Company's proportionate share. CO(2) e

calculations are derived using the U.S. Environmental Protection

Agency's ("EPA") Emissions & Generation Resources Integrated

Database.

Invested and committed assets

As of 30 June 2022, RNEW's diversified renewable energy

portfolio consisted of:

l 62 assets spread across seven states with a total capacity of

162 MW that generated 177 GWh of clean electricity in the Period

and included:

o 58 operating solar assets totalling 81 MWdc

o 3 construction stage solar assets totalling 21 MWdc

o 1 operating wind asset totalling 60 MWdc

l No major health and safety incidents occurred across the

portfolio during the Period. Asset generation and availability were

largely unaffected by the COVID-19 pandemic.

l In respect of the reporting period, the Company declared

dividends of 2.8 cents per Share. The Company is targeting a

dividend of 5.25 cents to 5.75 cents for FY 2022, of which 2.8

cents has already been paid and/or declared (6) .

l The Company's NAV was $134.3 million or 97.3 cents per Share

at 30 June 2022. The NAV total return over the Period was 1.2%.

l The Company's U.S. subsidiaries at a project level had $46.3

million (7) of long-term, non-recourse debt representing

approximately 25.3% of GAV (8) and $2.1 million of short-term,

non-recourse debt representing approximately 1.2% of GAV.

As at or period to

Financial information 30 June 2022

Net assets (million) $134.3

Shares in issue (million) 138.0

NAV per share (cents) 97.3

Share price (cents) 103.5

Share price premium to NAV 6.4%

Dividends declared per share (cents) (9) 2.8

NAV total return per share (10) 1.2%

Share price total return (11) 7.4%

Cash (million) $3.9

Leverage (million) $48.4

6. The target dividends set out above are targets only and are

not profit forecasts. There can be no assurance that these targets

can or will be met and they should not be seen as an indication of

the Company's expected or actual results or returns. The Company's

ability to distribute dividends will be determined by the existence

of sufficient distributable reserves, legislative requirements and

available cash reserves.

7. Represents the Company's proportionate share of total debt at

the asset special purpose vehicle ("SPV") level across its existing

investments as at 30 June 2022.

8. GAV is the sum of the Company's NAV and proportionate share of debt.

9. Dividends declared relating to the Period.

10. Opening NAV as at 31 December 2021 of 98.9 cents per Share.

11. Total return is based on the Share price in U.S. Dollars and

assumes dividends paid for the Period are immediately

reinvested.

Chair's Statement

On behalf of the Board, I am pleased to present the Company's

half-yearly report for the six months ended 30 June 2022 (the

"Half-yearly Report"). Your Company continues to grow, having

raised $13.1 million (before costs) in new equity capital in May at

a share price of 101.5 cents per share through a placing and a

retail offer. The net proceeds have been deployed into new

investments and paying down debt drawn on the Company's revolving

credit facility.

During the first half of the year, authorities in both the U.S.

and the UK lifted most of the remaining COVID-19 restrictions. The

Company and its advisers have coped well with the effects of the

pandemic and there were no material impacts on asset operations or

the investment portfolio.

Investment Manager

On 19 July 2022, the Company announced that portfolio managers

Jerry Polacek, Matthew Ordway and Prashanth Prakash had resigned

from their roles at Ecofin to pursue a new venture. The Board was

very disappointed by these resignations. In an ideal world, we

would have had more notice, and, working together with Ecofin,

would have been able to effect a smooth transition to a new team.

However, this was not possible principally because notice periods

in the U.S. are typically much shorter than in the UK.

Since the announcement, the Board's priorities have been to

ensure that Ecofin concentrates on:

(i) management of the existing asset portfolio, the ongoing

performance of which enabled the Company to declare a dividend for

the second quarter of 1.4 cents per share on 28 July 2022,

consistent with the dividend yield target for the year ending 31

December 2022 of 5.25 cents - 5.75 cents as set out in the November

2020 IPO prospectus; and

(ii) recruitment of a new leadership team. The Board has

stressed to Ecofin's senior management that this needs to happen

without delay and has been assured that it is an absolute priority.

The Board has been receiving regular updates from Ecofin.

In our view, focusing on these priorities is the best way to

protect value for RNEW's shareholders. However, as a Board, we are

very conscious of our duties to shareholders and, while we are

strong believers in the U.S. renewable energy story and the

Company's investment strategy, we are open to exploring all options

for the future of RNEW consistent with good governance.

It should be noted that Ecofin has confirmed to the Board that

the ongoing management of the existing portfolio is unaffected by

the resignations, and the Board will continue to work with Ecofin

to ensure that this remains the case going forward. Ed Russell,

Senior Managing Director of Ecofin, continues to be responsible for

overall leadership of the Ecofin team and the origination group

continues to be managed by Jason Benson, Director of Private

Renewable Energy. Earlier in the year and prior to the departure of

the investment team, Ecofin recruited two new resources dedicated

to asset management and project controllership with over 17 years'

experience in the energy industry.

Portfolio overview

RNEW's shareholders benefit from a high-quality portfolio of 62

solar and wind assets with a combined capacity of 162 MW across

seven states: California, Connecticut, Massachusetts, Minnesota,

New Jersey, Texas and Virginia. Since 30 June 2022, the portfolio

has expanded further with the closing of three additional assets

within the Echo Solar Portfolio at sites in Delaware and Virginia.

The new assets are ground mounted solar projects and benefit from

long term contracted revenues with investment grade electric

utilities. The overall weighted average remaining contract term of

the overall portfolio is 16.3 years.

As at 30 June 2022, 90% of the portfolio NAV was represented by

operating assets. Further, as at 30 June 2022, 59 assets were in

operation and three assets were under construction. Total

generation from the Company's assets during the period to 30 June

2022 was 177 GWh, 2% below budget, as strong solar and wind

resource during Q2 was offset by low wind resource relative to

budget during Q1.

Details of each asset and its performance are set out in the

Investment Manager's Report.

Results

NAV as at 30 June 2022 was 97.3 cents per share compared to 97.6

cents per share as at 31 March 2022 and 98.9 cents per share at 31

December 2021. During the first half of 2022, NAV per share

decreased by 1.6% as described further in the Portfolio Valuation

section of the Investment Manager's Report, largely due to

dividends paid of $3.7 million or 2.8 cents per share.

The valuation of the portfolio at 30 June 2022 is supported by

an independent valuation firm, Marshall & Stevens, and is based

on an underlying blended weighted average pre-tax discount rate of

7.5%. This reflects a small increase in discount rates as at 30

June 2022 due to expectations of interest rate increases and rising

bond yields.

RNEW's profit before tax for the six months to 30 June 2022 was

$1.5 million and earnings per share, based on revenue received by

way of dividends from the Company's unconsolidated subsidiary, RNEW

Holdco LLC ("Holdco") (which indirectly holds RNEW's investments

through underlying subsidiaries), were 1.2 cents per share.

Dividends

During the period, the Board declared two quarterly interim

dividends of 1.4 cents per share each, in respect of the quarters

ended 31 March 2022 and 31 December 2021. These dividends were

consistent with the Company's IPO target dividend range of 5.25% to

5.75% per ordinary share referred to above and, on 28 July 2022,

after the period end, the Board declared a further interim dividend

of 1.4 cents per share for the quarter ended 30 June 2022.

Dividend cover for the twelve months ended 30 June 2022 was 1.0

times. We expect the stability of trailing twelve month dividend

cover to be supported by the fact that income generated from the

portfolio has historically been and is expected to continue to be

higher in Q3 and Q4 due to energy production and cash collection

seasonality; in addition, several assets within the portfolio are

expected to move from the construction phase to the operational

phase.

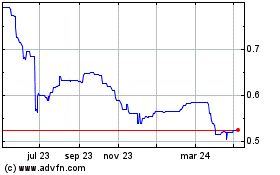

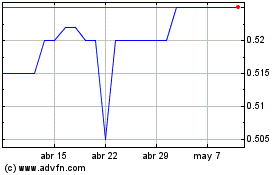

Share price

As at 31 December 2021, the share price was 99 cents per share,

a very slight 0.1% premium to NAV of 98.9 cents per share at the

same date. As stated in the 2021 Annual Report, both the Board and

the Investment Manager believe that the strong fundamentals of the

Company, its portfolio, and the depth of the middle market U.S.

renewable energy market opportunity justify the basis for the share

price to trade at a premium to NAV. This was the case throughout

much of the first half and at 30 June 2022, the share price was

103.5 cents per share, a 6.4% premium to NAV. Since announcement of

the Ecofin management resignations referred to above, the share

price had declined to 90 cents per share as at 9 September 2022.

This is a 7.5% discount to the NAV of 97.3 cents as at 30 June

2022. The share price in sterling (RNEP - 78p as at 9 September

2022) represents a 7.0% discount to NAV (based on an exchange rate

of US $1.16 = GBP1.) Notwithstanding the recent decline in share

price, RNEW's portfolio of predominantly operating assets with cash

flows supported by long-term revenue contracts with investment

grade quality counterparties continues to perform in line with

expectations.

Board

The Board continues to work well together and with Ecofin. The

Investment Management team and one of the Directors are based in

the U.S. and as a result Board meetings include video conferencing

as a matter of course, but, within applicable COVID-19 guidelines,

Board members and advisers based in the UK meet in person.

Outlook

As addressed in detail in the Investment Manager's report, the

U.S. renewable energy sector continues to offer strong prospects

for ongoing investment and growth, even while facing near-term

challenges of supply chain constraints, inflation, and potential

trade policy risks on certain imported solar components. In the

first half of 2022, the American Clean Power ("ACP") association

reported that 9.8 GW of wind, utility-scale solar and battery

storage capacity had been installed in the U.S., representing more

than $10.0 billion in capital investment. Looking to the near

future, the ACP reports that the U.S. renewable energy pipeline

totalled 128.9 GW as of 30 June 2022, providing a robust

opportunity set for future investment. The passage of the Inflation

Reduction Act ("IRA") in August represents an unprecedented long

term policy boost for U.S. renewable energy with approximately $369

billion allocated towards climate infrastructure and energy

security. The IRA includes provisions for extending tax credits for

solar and wind through 2035 and introduces a new tax credit for

standalone battery storage, which provides strong alignment with

RNEW's investment strategy.

While the pipeline remains strong, given the announced personnel

departures, in the near term, Ecofin is focused on diligently

managing RNEW's portfolio and closing additional assets comprising

the Echo Solar Portfolio. Since 30 June 2022, the portfolio

expanded with the closing of three assets within the Echo Solar

Portfolio at sites in Delaware and Virginia.

I would like to thank my fellow Directors, the Ecofin team and

all our advisers for their input during the first half and for the

Company's performance to date.

Patrick O'D Bourke

Chair

15 September 2022

Investment Manager's Report

Six months ended 30 June 2022

Investment activity

8 investments - full deployment of proceeds

Since the IPO on 22 December 2020, the Company has closed and

funded eight investments adding 62 assets totalling 162 MWdc across

seven U.S. states. The initial three investments in 55 assets ("SED

Solar Portfolio", "Ellis Road Solar", and "Oliver Solar") totalled

$36.3 million and closed by 31 December 2020.

2022 Year To Date ("YTD")

On 7 January 2022, the Company obtained a $15.9 million

non-recourse construction loan from Seminole Financial Services,

LLC, a U.S. specialist renewable lender, for the construction of

the Echo Solar - MN project.

On 28 January 2022, the Company closed a tax equity partnership

for the Skillman Solar project.

On 23 March 2022, the Company finalized a negotiation for a

buyout wherein the Company sold one 41 kWdc asset within the SED

Solar Portfolio, as per the terms of the Power Purchase Agreement

("PPA"), reducing the total number of assets remaining in said

portfolio to 52 (11.3 MWdc) and the Company's total assets to

60.

On 25 March 2022, the Company declared mechanical completion of

the Skillman Solar project and completed a major milestone tax

equity funding. The project declared commercial operation as of 15

August 2022.

On 28 June 2022, the Company closed on the acquisition of two

ground mount solar projects in Virginia ("VA") at construction

stage in the Echo Solar Portfolio, comprising the 2.7 MWdc Monroe

Solar Partners, LLC project (i.e., Echo Solar - VA 1) and the 4.2

MWdc Randolf Solar Partners, LLC project (i.e., Echo Solar - VA 2)

with an aggregate closing value of $2.6 million bringing the

Company's total assets to 62.

As of 30 June 2022, the Company had approximately $11.2 1

million of outstanding net commitments on closed assets and

approximately $34.0 2 million of outstanding net commitments on

assets it has committed to buy but has not yet closed.

2021

On 2 February 2021, the Company completed its fourth investment

(56th and 57th assets) to acquire a 49.5% equity interest in Beacon

Solar 2 & 5, two operating utility scale solar photovoltaic

("solar PV") assets in California, collectively totalling $24.8

million.

On 4 May 2021, the Company announced its fifth investment (58th

asset), a commitment to acquire a 100% interest in a commercial

solar PV asset in New Jersey for $6.2 million, comprising

approximately $4.2 million of equity value ("Skillman Solar"). The

Skillman Solar acquisition closed on 30 September 2021.

On 22 July 2021, the Company announced its sixth investment with

the signing of a purchase agreement to acquire twelve solar PV

assets at construction stage ("Echo Solar Portfolio"), subject to

customary closing conditions. Since the announcement, one solar

asset within the Echo Solar Portfolio has been released from

commitment due to development delays (without any investment having

been made) and will be reconsidered by RNEW for future investment

upon achieving its milestones. The released asset had no impact on

the economics of the remaining Echo Solar Portfolio.

On 17 September 2021, the Company closed the acquisition of its

59th asset, Westside Solar Partners, LLC (i.e., "Echo Solar - MN"),

a 13.7 MW solar asset in Minnesota. Construction is underway and

the project is expected to begin operations in Q4 2022.

On 12 October 2021, the Company completed its seventh investment

(60th asset) to acquire a 100% interest in a further operating

commercial solar asset in New Jersey for $2.8 million ("Delran

Solar").

On 26 October 2021, the Company completed its eighth investment

(61st asset) to acquire its first wind asset, through a $49 million

acquisition to acquire a 100% interest in an operating wind asset

in Texas ("Whirlwind).

Events following the Period end

On 29 July 2022, the Company declared mechanical completion of

the Echo Solar - MN project, and future funding will coincide with

draws on the non-recourse construction loan in the near-term, with

tax equity financing and the Company's Revolving Credit Facility

("RCF") able to support the repayment of the construction loan at

its term.

On 22 August 2022, the Company closed on the acquisitions of

three additional ground mount solar projects at construction stage

in the Echo Solar Portfolio, comprising the 6.5 MWdc Hemings Solar

Partners, LLC project in Virginia (Echo Solar - VA 3), the 2.9 MWdc

Small Mouth Bass Solar Partners, LLC project in Virginia (i.e.,

Echo Solar - VA 4), and the 5.9 MWdc Heimlich Solar Partners, LLC

project in Delaware ("DE") (Echo Solar - DE 1) and with an

aggregate asset value of approximately $5.5 million. This deployed

the balance of the $12.9 million net proceeds from the secondary

equity offering completed in May 2022.

1. Figure is shown net of anticipated tax equity financing of $10.5 million.

2. Figure is shown net of anticipated tax equity financing of $17.2 million.

Cumulative Invested Capital and Commitments at Each Period Since

IPO (millions)

Q4 Q1 Q2 Q3 Q4 Q1

2020 2021 2021 2021 2021 2022

Closed/ Funding in Construction

Assets $11 $4 - $9 - $5

Closed/ Funding in Operating

Assets $21 $25 - - $52 -

Closed/ Funded in Prior

Periods - $32 $61 $61 $69 $121

Closed/ Remaining Commitments $4 - - $12 $5 $1

Signed/ Future Commitments - - $5 $40 $40 $40

$36 $61 $66 $122 $166.0 $167.0

Details of each asset held or committed to as at 30 June 2022

are set out in the table below:

Remaining

revenue

Number contract

Investment Capacity of term

Name Sector (MW)(1) assets State Ownership(2) Phase Status (years)(3)

SED Solar Commercial

Portfolio Solar 11.3 52 Massachusetts, 100% Operational Closed 14.1

Connecticut

Ellis Road Commercial

Solar Solar 7.1 1 Massachusetts 100% Operational Closed 19.0

Commercial

Oliver Solar Solar 4.8 1 California 100% Operational Closed 13.4

Utility-Scale

Beacon 2 Solar 29.5 1 California 49.5% Operational Closed 20.5

Utility-Scale

Beacon 5 Solar 23.9 1 California 49.5% Operational Closed 20.5

Skillman Commercial

Solar Solar 2.6 1 New Jersey 100% Operational Closed 15.0

Commercial

Delran Solar Solar 2.0 1 New Jersey 100% Operational Closed 13.0

Whirlwind Wind 59.8 1 Texas 100% Operational Closed 5.5

Echo Solar Commercial

- MN Solar 13.7 1 Minnesota 100% Construction Closed 25.0

Echo Solar Commercial

- VA 1 Solar 2.7 1 Virginia 100% Construction Closed 25.0

Echo Solar Commercial

- VA 2 Solar 4.2 1 Virginia 100% Construction Closed 25.0

Subtotal (Closed) 161.6 62 14.2(3)

Echo Solar Commercial

- VA 3 Solar 6.5 1 Virginia 100% Construction Committed 25.0

Echo Solar Commercial

- VA 4 Solar 2.9 1 Virginia 100% Construction Committed 25.0

Echo Solar Commercial

- DE 1 Solar 5.9 1 Delaware 100% Construction Committed 25.0

Echo Solar

Portfolio - Commercial Virginia,

VA/DE Solar 25.4 5 Delaware 100% Construction Committed 25.0

Total (Closed

and Committed) 202.3 70 16.3(3)

1. Capacity reflects RNEW's proportionate ownership interest in the assets.

2. Cash equity ownership.

3. Average remaining revenue contract term (years).

Ecofin update

On 19 July 2022 Ecofin announced that portfolio managers Jerry

Polacek, Matthew Ordway, and Prashanth Prakash had resigned from

their roles at Ecofin to pursue a new venture. The three managers

subsequently departed Ecofin on 19 August 2022 and, while we are

disappointed with their departure, they left RNEW fully invested in

high quality wind and solar assets.

Ecofin has started the process of securing replacements for the

departing members of the origination team and early-stage

discussions with candidates are underway. We are confident that new

leadership team members can be found in a reasonable time

frame.

Meanwhile, Jason Benson, Director of Private Renewable Energy,

who has been heavily involved with RNEW's portfolio management and

deal origination since IPO, is managing the construction and

funding the six projects across Minnesota, Virginia, and Delaware

totalling 35.9 MW that comprise the currently closed Echo Solar

Portfolio. Our funding strategy for the Echo Solar Portfolio

includes drawing upon the RCF during the construction period. We

are also working with an experienced investor to complete a tax

equity funding for the Echo Solar Portfolio. In parallel, we are

actively engaged with project lenders to put in place a long-term

term loan facility for the Echo Solar Portfolio in the coming

months as the underlying projects achieve commercial operation.

When completed, the Echo Solar Portfolio is expected to contribute

additional geographic and revenue contract diversity through its

PPAs with two separate investment grade electric utility

purchasers.

The asset management and project controllership group has over

17 years of combined experience in the energy industry.

Additionally, prior to the end of the third quarter, an offer was

extended to an additional resource that will bring another 15 years

of energy experience to the company.

Working very closely with the origination team to onboard new

assets seamlessly, the asset management and project controllership

team strives to attain operational excellence for each of the

renewable energy assets in order to maximize profitability for

shareholders. The team interfaces with engineers and plant

operators to ensure plant optimization. Strong relationships and

constant communication with our outsourced, top-tier asset

management and O&M service providers are key to smooth

operations, and have remained unchanged since the IPO. Continuous

process improvement is at the forefront for the team to steadily

advance the effectiveness of data analytics. Additionally, the

asset management and project controllership team is focussed on

keeping current with new accounting guidance and reporting

requirements that impact the portfolio.

Further, while the status of the near-term new project pipeline

remains strong, until recruitment is completed, Ecofin will

maintain its focus on managing RNEW's existing assets and near-term

funding obligations.

Ecofin's leadership is committed to providing the RNEW Board and

shareholders with timely updates on the progress in recruiting new

personnel. We believe RNEW is positioned to take advantage of a

robust U.S. market that has been further strengthened by the

passing of the Inflation Reduction Act, which provides billions of

dollars for U.S. wind and solar investments.

Portfolio overview

As at 30 June 2022, the portfolio was heavily weighted towards

operating assets with 90% of NAV invested in operating assets held

at fair market value ("FMV") (68% of total invested and committed

net equity capital (1) ), reflecting the completion of construction

at Ellis Road Solar, Oliver Solar and Skillman Solar and the

operating asset acquisitions of Delran Solar and Whirlwind. The

portfolio benefits from geographic diversification spanning seven

states to provide risk mitigation against regulatory and resource

exposures. Furthermore, RNEW's portfolio reflects diversification

across three renewable energy sectors of: utility scale solar

(15%), commercial solar (57%), and wind (28%) to mitigate resource,

regulatory, technology and market risks.

Portfolio summary charts (1) :

Asset Name

Asset Name Portfolio %

Beacon 2&5 15%

------------

SED Solar Portfolio 11%

------------

Oliver Solar 5%

------------

Ellis Road Solar 5%

------------

Skillman Solar 3%

------------

Delran Solar 2%

------------

Whirlwind 28%

------------

Echo Solar - MN 9%

------------

Echo Solar - VA/DE 22%

------------

Sector FMV

Sector Portfolio %

Utility Scale Solar 15%

------------

Commercial Solar 57%

------------

Wind 28%

------------

Asset Status

Operating 69%

Construction 31%

-----

(1) Includes closed and committed assets based on equity

exposure at FMV

Operating performance for six months ended 30 June 2022:

During the six months ended 30 June 2022, the portfolio

generated 177.6 GWh of clean energy, 1.9% below budget. Of the

total, solar assets generated 78.3 GWh, 0.6% above budget (see

project variances and explanations below) and wind assets generated

99.3 GWh, 3.9% below budget (principally due to low wind resource

in Q1 2022 relative to budget).

The performance of the underlying operating portfolio combined

with its 100% contracted revenue structure generated revenues of

$4.5 million for the Company. Cash flows were below budget

partially due to lower than expected cash distributions from Beacon

2 & 5 due to higher than expected operating expenses in the

Period, combined with delays in operations from Skillman Solar.

This was partially offset by higher than expected cash flow from

the SED Solar Portfolio as a result of higher than expected energy

production during Q2 2022, combined with higher than expected cash

flow from Whirlwind as a result of strong wind resource during Q2

2022 and favourable operating expenses relative to budget.

Net Production Variance vs. Budget (GWh)

Actual Budget

Q1 2022 72.6 81.7

------- -------

Q2 2022 105.0 99.4

------- -------

H1 2022 177.6 181.1

------- -------

% Above

Actual Budget GWh Above (Below)

Investment

Name Sector State (GWh) (GWh) (Below) Budget Budget

Utility-Scale

Beacon 2 Solar California 34.4 (1) 34.1 (1) 0.3 0.9% (a)

Utility-Scale

Beacon 5 Solar California 27.4 (1) 26.3 (1) 1.1 4.2% (b)

Commercial Massachusetts,

SED Solar Portfolio Solar Connecticut 6.9 6.4 0.5 7.8% (c)

Commercial

Ellis Road Solar Solar Massachusetts 4.4 4.4 - -

Commercial

Oliver Solar Solar California 3.9 (2) 3.9 (2) - -

Commercial

Delran Solar Solar New Jersey 1.3 1.3 - -

Commercial

Skillman Solar Solar New Jersey - 1.4 (1.4) (100%)

Solar Subtotal 78.3 77.8 0.5 0.6%

Whirlwind Wind Texas 99.3 103.3 (4.0) (3.9%) (d)

Wind Subtotal 99.3 103.3 (4.0) (3.9%)

Total 177.6 181.1 (3.5) (1.9%)

Values and totals have been rounded to the nearest decimal.

1. Reflects RNEW's pro forma share of production based on ownership.

2. Oliver Solar reached its Commercial Operation Date ("COD") on

29 November 2021 and has been earning PPA revenue from the offtaker

based on P50 modelled production since that date. However, due to

some commissioning and testing delays with its offtaker, a global

commerce company, the system was not yet energised as at 30 June

2022.

Production variance summary:

a Flat performance primarily due to the need for fuseholder

replacements in combiner boxes, which have been delayed in receipt

due to supply chain constraints.

b Overperformance primarily due to near 100% availability and higher insolation.

c Overperformance primarily due to lower insolation caused by

greater than anticipated snowfall in the greater Boston area during

January/February which was more than offset by outperformance in

March-June due to higher insolation.

d Underperformance primarily due to force majeure weather event

in Q1 partially offset by stronger wind resource in Q2.

Revenues

As at 30 June 2022, RNEW's portfolio had 100% of its revenue

contracted with a weighted average remaining term of 16.3 years;

this includes all construction and committed assets. Approximately

99% of the portfolio benefits from fixed-price revenues, many with

annual escalators of 1-2%, through PPAs, contracted solar renewable

energy credits ("SREC"), and fixed rents under leases. These fixed

price contracts mitigate market price risk for the term of the

contracts. Less than 1% of the portfolio has a variable form of

revenue contract. These contracts are set at a fixed discount to a

defined Massachusetts utility electric rate, which provides an

ongoing economic benefit to the customer (i.e., the

offtaker/rooftop owner), as opposed to receiving the higher utility

electric rate when consuming electricity from the grid. While the

variable rate contract introduces an element of price volatility,

it also offers the potential to hedge inflation risk as utility

rates in Massachusetts have appreciated 3.0% on average per annum

from 1990-2022.

The revenue profile reported below represents a snapshot of

RNEW's existing revenue contracts as at 30 June 2022 and does not

assume any replacement revenue contracts following the expiry of

these contracts. With increased adoption of renewable energy in the

U.S. and rising natural gas prices (which tend to result in higher

power prices in U.S. markets where natural gas is the marginal

fuel), we believe that RNEW's prospects for re-contracting at the

end of revenue contract terms remain positive.

Portfolio revenue breakdown (1)(2)

Contracted

Contracted Contracted - Fixed Price

- Fixed Price - Variable Incentive Uncontracted

Year Revenue Price Revenue Revenue - Market Revenue

2021 76.2 0.7 23.1 -

--------------- --------------- --------------- ------------------

2022 85.8 0.4 13.8 -

--------------- --------------- --------------- ------------------

2023 88.6 0.9 10.5 -

--------------- --------------- --------------- ------------------

2024 90.5 0.9 8.6 -

--------------- --------------- --------------- ------------------

2025 90.3 2.0 7.7 -

--------------- --------------- --------------- ------------------

2026 89.8 2.0 8.2 -

--------------- --------------- --------------- ------------------

2027 91.9 2.1 6.0 -

--------------- --------------- --------------- ------------------

2028 57.1 2.6 2.8 37.5

--------------- --------------- --------------- ------------------

2029 56.5 2.6 2.5 38.4

--------------- --------------- --------------- ------------------

2030 55.7 2.6 2.5 39.2

--------------- --------------- --------------- ------------------

2031 55.2 2.7 2.4 39.7

--------------- --------------- --------------- ------------------

2032 55.1 2.7 2.5 39.7

--------------- --------------- --------------- ------------------

2033 54.7 2.7 2.4 40.2

--------------- --------------- --------------- ------------------

2034 54.1 2.8 2.3 40.8

--------------- --------------- --------------- ------------------

2035 53.9 2.7 1.7 41.7

--------------- --------------- --------------- ------------------

2036 50.8 2.6 1.2 45.4

--------------- --------------- --------------- ------------------

2037 49.6 2.5 0.3 47.6

--------------- --------------- --------------- ------------------

2038 85.9 3.0 - 11.1

--------------- --------------- --------------- ------------------

2039 86.3 0.2 - 13.5

--------------- --------------- --------------- ------------------

2040 86.4 - - 13.6

--------------- --------------- --------------- ------------------

2041 82.7 - - 17.3

--------------- --------------- --------------- ------------------

2042 78.9 - - 21.1

--------------- --------------- --------------- ------------------

(1) The increase in uncontracted market revenue from 2028

onwards is due to the maturity of the Whirlwind PPA.

(2) The decrease in uncontracted market revenue from 2038

onwards is due to Whirlwind reaching the conclusion of its

technical useful life.

Active management

Ecofin maintains an active approach to managing RNEW's

portfolio. For operating assets, our process involves actively

monitoring production through direct, real-time system access,

review of monthly O&M and asset management reports, and meeting

at least monthly with project operators and asset managers to

review and enhance performance. For construction stage assets, the

process is appropriately structured for more frequent engagement

with the relevant engineering, procurement and construction ("EPC")

contractor to review project milestones, troubleshoot issues, and

review and approve payments in accordance with contracts.

Financing

As at 30 June 2022, the Company's U.S. subsidiaries at a project

level had debt balances of $48.4 million, with no funds drawn down

under the RCF. This total debt balance corresponds to approximately

26.5% of GAV, and compares to the maximum limit of 65% in the

Company's Investment Policy, as further detailed in the table

below. Given that the Company's portfolio primarily comprises

operating assets that have long-term fixed-price revenue contracts

with investment grade counterparties, construction and term loan

financing opportunities at both a project and group level are

widely available on attractive terms. With that in mind, the

Company's Investment Manager and Board favour a measured approach

to using leverage to mitigate interest rate and default risk. The

Company has proactively and successfully put in place both a RCF

and non-recourse construction loan at its U.S. subsidiaries as

described below:

l On 19 October 2021, RNEW Capital, LLC, entered into a $65.0

million secured RCF with KeyBank, one of the premier lenders to the

U.S. renewable energy industry. The RCF comprises a $50.0 million,

two-year tranche priced at LIBOR plus 1.75% and a $15.0 million,

three-year tranche priced at LIBOR plus 2.00%. The RCF is secured

upon certain of the Company's investment assets and offers the

ability to substitute reference assets. The RCF also includes an

accordion option which provides access to an additional $20.0

million of capital which can be accessed subject to certain

conditions. This substantial commitment with attractive pricing and

terms reflects the high quality of RNEW's portfolio. As at 30 June

2022, this RCF was undrawn.

l On 7 January 2022, a wholly-owned U.S. subsidiary of RNEW,

Westside Solar Partners, LLC (i.e. "Echo Solar - MN"), entered into

a $15.9 million non-recourse construction loan related to and

secured by the 13.7 MW Minnesota commercial solar asset within the

Echo Solar Portfolio. As of 30 June 2022, $2.1 million was drawn on

the facility.

Through the 49.5% acquisition of the Beacon 2 and 5 operating

solar assets, the Company assumed its share of amortising project

term loans that totalled $46.3 million, as referred to above.

On 30 June 2022, the Company had GAV of $182.7 million, and

total recourse and non-recourse debt of $48.4 million, resulting in

total leverage of 26.5% as described above.

The borrowing facilities available to the Company and its

subsidiaries at 30 June 2022 were as set out in the table

below:

Facility Amount

amount drawn Applicable

Loan type Provider Borrower ($m) ($m) Maturity rate

--------------------- --------- --------------- -------- ------ -------- -----------

$50.0 $NIL Oct-23 LIBOR+1.75%

Revolving credit RNEW Capital,

facility KeyBank LLC $15.0 $NIL Oct-24 LIBOR+2.00%

Project construction Westside Solar

loan Seminole Partners, LLC $15.9 $2.1 Nov-22 5.0%

Beacon Solar

Term loan KeyBank 2 $25.6 $25.6 May-26 LIBOR+1.25%

Beacon Solar

Term loan KeyBank 5 $20.7 $20.7 May-26 LIBOR+1.25%

--------------------- --------- --------------- -------- ------ -------- -----------

Total Debt $127.2 $48.4

------------------------------------------------- -------- ------ -------- -----------

Portfolio valuation

Valuation of the Company's portfolio is performed on a quarterly

basis. A discounted cash flow ("DCF") valuation methodology is

applied which is customary for valuing privately owned renewable

energy assets. The valuation is performed by Ecofin at 31 March and

30 September, and by a third-party valuation firm at 30 June and 31

December.

Fair value for each investment is derived from the present value

of the investment's expected future cash flows, using reasonable

assumptions and forecasts for revenues and operating costs, and an

appropriate discount rate. More specifically, such assumptions

include annual energy production, curtailment, merchant power

prices, useful life of the assets, and various operating expenses

and associated annual escalation rates often tied to inflation,

including O&M, asset management, balance of plant, land leases,

insurance, property and other taxes, decommissioning bonds, among

other items.

At IPO on 22 December 2020, the Company raised $125.0 million

(before costs) by issuing 125,000,000 Shares. Subsequently, on 10

May 2022, the Company announced a placing and retail offer of new

ordinary shares ("New Ordinary Shares") of $0.01 each in the

capital of the Company at an issue price of $1.015 per New Ordinary

Share. The Company raised $13.1 million (before costs) by issuing a

total of 12,927,617 New Ordinary Shares. Admission of these New

Ordinary Shares to the London Stock Exchange became effective on 24

May 2022.

Portfolio NAV Bridge for the six month period

NAV 31 Dec 2021 $123.7

Capital Raised $12.9

-------

Change in ProjectCo DCF - DCF Depreciation ($0.2)

-------

Change in ProjectCo DCF - discount

rates ($3.5)

-------

Change in ProjectCo DCF - Merchant

Curves $3.8

-------

Distributions from ProjectCos to

RNEW $4.5

-------

Dividend to Shareholders ($3.7)

-------

Expenses Paid ($1.4)

-------

Change in Financial Assets ($1.5)

-------

Change in Deferred Tax ($0.3)

-------

NAV 30 June 2022 $134.3

-------

Capital raised: Represents proceeds raised from the May 2022

placing and retail offer net of commissions retained by brokers,

fees to intermediaries, REX fees, and other transaction

expenses.

Change in projectCo DCF: Represents the impact on RNEW NAV from

changes to DCF depreciation and quarterly cashflow roll-forward and

change in project-level debt outstanding balances, including

principal amortization.

Change in projectCo DCF Discount Rates: Represents the impact on

RNEW NAV from changes to the discount rates applied to the DCF

models of each ProjectCo. As at 30 June 2022, the weighted average

pre-tax discount rate was 7.5%, an increase from 7.2% at 31

December 2021 principally related to the rise in inflation and

interest rates.

Change in projectCo DCF merchant curves: Represents the impact

on RNEW NAV from changes to the forward merchant price curves used

in the DCF models of each ProjectCo. The increase was principally

due to the update of the DCF models with the most recently

published regional market forward prices by the U.S. Energy

Information Administration ("EIA").

Distributions from projectCos to RNEW: Represents cash generated

by project companies, which was distributed up to RNEW during the

Period for purposes of paying dividends to shareholders.

Dividends to shareholders: Dividends for Q4 2021 and Q1 2022 of

$3.7 million (2.8 cents per share) were paid during the Period.

After the Period end, the Company declared a further dividend of

1.4 cents per share in respect of the quarter ended 30 June 2022.

Over the twelve-month period ended 30 June 2022, the portfolio

generated net revenue sufficient to cover the dividend

approximately 1.0 times.

Expenses paid: Represents the impact on RNEW NAV due to

management fees and expenses paid during the Period.

Change in financial assets: Represents the impact on RNEW NAV

due to increases or decreases in cash, receivables, payables and

other net working capital account balances.

Deferred tax liability: Represents the impact on RNEW NAV due to

accruals arising from operations in the Period and from a project

level prior period adjustment at RNEW Holdco, LLC, the Company's

wholly-owned U.S. subsidiary, which is subject to U.S. income

taxes.

Portfolio valuation sensitivities

The figure below shows the impact on the portfolio valuation of

changes to the key input valuation assumptions ("sensitivities")

with the horizontal x-axis reflecting the impact on NAV per Share.

The valuation sensitivities are based on the portfolio of assets as

at 30 June 2022. For each sensitivity illustrated, it is assumed

that potential changes occur independently with no effect on any

other assumption. It should be noted that the relatively moderate

impact of a change in forecast merchant power prices reflects the

long-term fixed price contracted revenues of the Company's

portfolio, with a weighted average remaining contracted term of

16.3 years as at 30 June 2022. Similarly, the moderate impacts due

to variations in operational expenses reflect a number of the

Company's assets having fixed price, long-term operating expenses

including O&M, property leases, and payments in lieu of

taxes.

Sensitivity Impact on NAV per

Share

Energy Production P75/P25 (6.4%) to 6.3%

------------------

Discount Rates +/- 50bps (5.0%) to 5.4%

------------------

Merchant power prices +/-10% (4.9%) to 4.9%

------------------

Operating Expenses +/-10% (4.1%) to 4.1%

------------------

Curtailment (Wind) +/- 50% (3.8%) to 3.5%

------------------

Market outlook

During the first half of 2022, the U.S. renewable energy market

continued to grow despite several challenges most notably including

trade policy, supply chain issues, and inflation. U.S. renewable

energy, comprising wind, solar, and battery storage, had

installations of 9.8 GW in the first half of this year, which is

estimated to represent over $10 billion of capital investments.

With these additions, there is now 211.1 GW of operating U.S.

renewable energy assets covering all 50 states, enough to power 58

million American homes.

Operating U.S. Renewable Energy (in MW) as of 30 June 2022

Onshore Wind 139,143 MW 66%

Offshore Wind 42 MW 0%

------------ ----

Utility Solar 65,479 MW 31%

------------ ----

Battery Storage 6,471 MW 3%

------------ ----

The U.S. renewable energy pipeline of projects in construction

and advanced development totals a further 128.9 GW (as of 30 June

2022), which represents year-to-date growth of approximately 4%

compared to 12% in 2021 and represents a $360 billion growth

opportunity over the next decade. International trade policy and

supply chain constraints have dampened the near-term growth

prospects of U.S. renewable energy with more than 32 GW of capacity

delayed from achieving commercial operations. While these near-term

challenges persist, the underlying resiliency of the U.S. renewable

energy industry continues to be driven by strong corporate demand

with 14.8 GW of new PPAs from corporates and utilities announced in

the first half of 2022.

U.S. Renewable Energy Pipeline (in MW) as of 30 June 2022

Onshore Wind 23,185 MW 18%

Offshore Wind 17,502 MW 14%

----------- ----

Utility Solar 73,703 MW 57%

----------- ----

Battery Storage 14,499 MW 11%

----------- ----

In a historic development, Senators Chuck Schumer and Joe

Manchin reached agreement in July 2022 on a $430 billion bill

covering climate, healthcare, and taxes called the Inflation

Reduction Act ("IRA"). With $369 billion allocated towards climate

infrastructure and energy security it represents the largest ever

government investment in U.S. renewable energy. The IRA passed the

U.S. Senate in August and it was approved by Congress and signed by

President Biden on 16 August 2022. The IRA provides an

unprecedented level of long-term policy certainty to directly

benefit the growth of the U.S. renewable energy industry. Notably,

it extends the term for claiming investment tax credits ("ITC") and

production tax credits ("PTC") for solar, wind and certain other

renewable energy projects for facilities that begin construction

before 1 January 2035. It also qualifies interconnection costs for

projects less than 5 MWac as ITC-eligible, even if the

interconnection facilities are owned by the utility, so long as

they were paid for by the taxpayer. The tax credits are designed to

stimulate growth of U.S. manufacturing and related industries

through increased credit values for projects using domestic content

and paying prevailing wages.

The IRA offers a new tax credit for standalone battery storage.

Additionally, the IRA provides various tax credits for new and used

electric vehicles ("EVs") which are expected to stimulate demand

for EVs and their supportive infrastructure, and lead to a

resulting increase in electricity demand. As a result of the IRA,

we believe that the growth of the U.S. renewable energy industry is

going to continue for many years to come and this will provide a

robust set of opportunities for RNEW on a long-term basis.

Solar

The U.S. solar industry had more than 5.5 GW of installations

during the first half of 2022 . Utility scale solar installations

in the second quarter of 2022 totalled 1.6 GW, which was down

materially from prior periods principally due to the uncertainty

caused by the U.S. Commerce Department's initiation in late March

2022 of an antidumping and countervailing duty investigation

relating to solar cells and modules imported from Vietnam,

Cambodia, Thailand and Malaysia. These four countries combined

account for approximately 80% of U.S. imported solar modules. On 6

July 2022, the Biden administration initiated an executive action

that directs the Commerce Secretary to implement regulations that

would preclude imposing any new tariffs on imported solar cells and

modules from those four countries for 24 months. If the Commerce

Department determines that tariffs on imported solar products from

those four countries are warranted, no duties will be due over the

24 month period covered in the executive action. While a legal

challenge cannot be ruled out, President Biden's executive action

is widely being viewed as providing a safe harbour to U.S. solar

installers and developers to procure modules from a reliable source

and resume sustained industry growth.

Another trade policy development impacting the U.S. solar

industry is the Uyghur Forced Labor Prevention Act ("UFLPA"), which

took effect on 21 June 2022. The UFLPA requires the U.S. government

to rapidly develop a new enforcement strategy to strengthen the

prohibition of imported goods made through forced labour into the

U.S. Specifically, it creates a rebuttable presumption that any

goods mined, produced, or manufactured wholly or in part in the

Xinjiang Uyghur Autonomous Region (XUAR) of China, are produced

with forced labour and therefore prohibited from importation.

Importers and U.S. solar industry participants will be adapting

their procurement practices to mitigate risks associated with the

UFLPA.

Looking ahead, the U.S. solar pipeline remains robust with 22.8

GW under construction and 50.9 GW in advanced development as of 30

June 2022. Ecofin observes that the vast majority of solar projects

stalled by the Commerce Department investigation will take several

months to resume as contracts are renegotiated and construction

crews are mobilised. These delays can be expected to have a

dampening effect on asset level acquisitions of construction ready

projects through at least the third quarter of 2022.

Notwithstanding the policy and supply chain related impacts on the

first half of 2022 U.S. solar industry investment activity, we

believe the underlying growth potential of addressable U.S. solar

projects for RNEW to invest remains substantial for years to

come.

Wind

U.S. wind represents the largest source of operating U.S.

renewable energy generating capacity totalling 139.2 GW as of 30

June 2022. In the first half of 2022, 3.5 GW of wind power was

installed. Year to date installations declined relative to 2021 due

to the expiration of the PTC and supply chain related delays.

Despite the decline in installations, the outlook for U.S. wind

power remains bright with 23.2 GW of onshore wind and 17.5 GW of

offshore wind in either construction or advanced development.

Texas, where RNEW's Whirlwind project is located, continues to

see growing demand for electricity driven by its business-friendly

environment attracting people and businesses to relocate from other

states. Texas also hosts the most wind capacity in development,

with 3,478 MW in advanced development and 3,655 MW under

construction. Texas had the largest amount of land-based wind

capacity enter the pipeline in Q2 at 531 MW. Wyoming has the second

most land-based wind capacity in the pipeline at 3,000 MW, followed

by Illinois (2,247 MW), and New York (1,538 MW). Additionally,

power prices in Texas are heavily influenced by the cost of natural

gas given that natural gas power plants comprise 44% of power

generating capacity. Since January 2020, prices of natural gas have

more than quadrupled, rising from $2.12 per million British thermal

units (MMBtu) to $8.70 per MMBtu as of 1 June 2022. Not only are

the market fundamentals contributing to rising prices, climate

change is contributing to record summer heat which triggered the

Texas power market regulator in July 2022 to issue a request for

consumers to conserve energy amid record energy demand. We believe

that these factors should place Whirlwind in a good position to

recontract its capacity on attractive terms in the coming

years.

In summary, we see a vastly improving growth outlook for the

U.S. renewable energy industry driven by the passage of the IRA and

broad based energy consumer demand for renewable energy. RNEW's

diversified portfolio of predominantly operating U.S. solar and

wind assets with long-term revenue contracts continues to provide

investors with direct access to the growing U.S. renewable energy

market and is capable of generating a stable source of dividends

during these uncertain times.

Ecofin Advisors, LLC

15 September 2022

ESG Integration and Impact

Impact goal: Allocate capital using an ESG integrated investment

process to build and operate a diversified portfolio of renewable

energy assets that achieves RNEW's investment objective

The Company's emphasis on ESG comes from the top: its Board of

Directors is diverse and has substantial and relevant investment

experience to provide strong corporate governance.

RNEW is focused on allocating capital using an investment

process which fully integrates ESG considerations and analysis to

build and operate a diversified portfolio of renewable energy

assets consistent with RNEW's investment objective. The Company has

selected Ecofin as its investment manager which aligns with its

investment and impact objectives.

Ecofin, through its parent company, is a signatory to the

Principles for Responsible Investment (PRI) and incorporates ESG

analysis into its investment and reporting process. All of Ecofin's

investment strategies for renewables infrastructure are designed to

provide investors with attractive long-term returns and a level of

impact that aligns with United Nations Sustainable Development

Goals:

This strategy seeks to achieve positive impacts that align with

the following UN Sustainable Development Goals

v 7 Affordable and Clean Energy

v 8 Decent Work and Economic Growth

v 9 Industry, Innovation and Infrastructure

v 11 Sustainable Cities and Communities

v 13 Climate Action

The Investment Manager's sustainability and impact policy is

further described in the Sustainability & Impact section of its

website ecofininvest.com/sustainability-impact.

ESG integration

The Company offers investors direct exposure to renewable energy

and sustainable infrastructure assets including solar, wind, and

battery storage that reduce greenhouse gas ("GHG") emissions and

promote a positive environmental impact. The Investment Manager

integrates analysis of ESG issues throughout the lifecycle of its

investment activities spanning due diligence, investment approval,

and ongoing portfolio management. Environmental criteria analysis

considers how an investment performs as a steward of nature; social

criteria analysis examines its impact and relationships with

employees, suppliers, customers and the communities in which it

operates; and governance analysis examines internal controls,

business ethics, compliance and regulatory status associated with

each investment.

Ecofin has developed a proprietary ESG due diligence risk

assessment framework (ESG Risk Assessment) that combines both

qualitative and quantitative data. This ESG Risk Assessment is

embedded in Ecofin's investment memoranda and systematically

applied by the investment team to all opportunities prior to

investment authorisation by Ecofin's Investment Committee. Each of

the Company's closed and committed investments spanning 70 assets

was analysed through Ecofin's ESG Risk Assessment prior to

investment commitment. Ecofin believes this approach to assessing

ESG issues serves to mitigate risk and enhance RNEW's impact:

l Environmental factors affecting climate risk are reviewed to

determine an investment's impact and ability to reduce GHG

emissions, air pollution and water consumption.

l Analysis of environmental issues also considers the impact

that the investment will have on land use and considers mitigation

plans when issues are identified.

l Analysis of social issues may encompass an investment's impact

on the local community and consider health and safety together with

the counterparties to be engaged to construct and operate the

assets.

l Governance is reviewed in partnership with qualified

third-party legal counsel to ensure compliance with all laws and

regulations, strong ongoing corporate governance through strict

reporting protocols with qualified operators and project asset

managers and annual independent financial statement audits.

Ecofin applies a systematic approach to ESG monitoring once

acquisitions are closed. Through Ecofin's engagement with third

party O&M and asset management service providers, Ecofin

reviews asset-level reporting on health and safety metrics,

environmental matters, and compliance. Issues identified are

reviewed and addressed with service providers through periodic

meetings such as monthly operations meetings. Importantly, ESG

factors are analysed and reported in a transparent manner so that

investors and key stakeholders can measure their impact.

Impact

RNEW's portfolio, in the six month period to 30 June 2022,

produced approximately 177 GWh of clean electricity, enough to

power approximately 32,900 homes, offsetting approximately 106,800

tonnes of CO(2) e and avoiding the consumption of approximately

22,300 million litres of water.

RNEW focuses on investments that have a positive environmental

impact by reducing GHG emissions, air pollution and water

consumption. Ecofin seeks to analyse and report on ESG factors on a

consistent basis to maximise the impact of its investment

activities. To assess environmental impact, Ecofin measures CO (2)

e , going beyond measuring only CO (2) emissions avoided and

quantifying other GHG emissions, such as methane and nitrous oxide,

and also measuring the contribution that investments make to save

water consumption. Water is consumed by thermoelectric (i.e. coal

and gas) power plants in the cooling process associated with steam

turbine generators. Water savings occur in the same way that

renewable energy generation offsets CO (2) emissions from

thermoelectric generators. Ecofin calculates estimated water

savings by reference to the EIA thermoelectric cooling water data

by location and applying it to the production from RNEW's

portfolio. Ecofin's methodology for calculating the environmental

impact of investments relies on trusted data sources including the

U.S. EPA and the EIA.

Portfolio impact for the six months ended 30 June 2022

106,800 22,300M

Tonnes of CO(2) e Reduction Litres of water savings

= =

32.900 8,900

Households supplied Olympic size swimming pools

Investment Policy

The Company's investment objective and investment policy

(including defined terms) are as set out in its IPO prospectus:

"Investment objective

The Company's investment objective is to provide Shareholders

with an attractive level of current distributions by investing in a

diversified portfolio of mixed renewable energy and sustainable

infrastructure assets ("Renewable Assets") predominantly located in

the United States with prospects for modest capital appreciation

over the long term.

Investment policy and strategy

The Company intends to execute its investment objective by

investing in a diversified portfolio of Renewable Assets

predominantly in the United States, but it may also invest in other

OECD countries.

Whilst the principal focus of the Company will be on investment

in Renewable Assets that are solar and wind energy assets ("Solar

Assets" and "Wind Assets" respectively), sectors eligible for

investment by the Company will also include different types of

renewable energy (including battery storage, biomass, hydroelectric

and microgrids) as well as other sustainable infrastructure assets

such as water and waste water.

The Company will seek to invest primarily through

privately-negotiated middle market acquisitions of long-life

Renewable Assets which are construction-ready, in-construction

and/or currently in operation with long-term PPAs or comparable

offtake contracts with investment grade quality counterparties,

including utilities, municipalities, universities, schools,

hospitals, foundations, corporations and others. Long-life

Renewable Assets are those which are typically expected by Ecofin

to generate revenue from inception for at least 10 years.

The Company intends to hold the Portfolio over the long term,

provided that it may dispose of individual Renewable Assets from

time to time.

Investment restrictions

The Company will invest in a diversified portfolio of Renewable

Assets subject to the following investment limitations which, other

than as specified below, shall be measured at the time of the

investment:

l once the Net Initial Proceeds are substantially fully

invested, a minimum of 20 per cent. of Gross Assets will be

invested in Solar Assets;

l once the Net Initial Proceeds are substantially fully

invested, a minimum of 20 per cent. of Gross Assets will be

invested in Wind Assets;

l a maximum of 10 per cent. of Gross Assets will be invested in

Renewable Assets that are not Wind Assets or Solar Assets;

l exposure to any single Renewable Asset will not exceed 25 per cent. of Gross Assets;

l exposure to any single Offtaker will not exceed 25 per cent. of Gross Assets;

l once the Net Initial Proceeds are substantially fully

invested, investment in Renewable Assets that are in the

construction phase will not exceed 50 per cent. of Gross Assets,

but prior to such time investment in such Renewable Assets will not

ex-ceed 75 per cent. of Gross Assets. The Company expects that

construction will be primarily focussed on Solar Assets in the

shorter term until the Portfolio is more substantially invested and

may thereafter include Wind Assets in the construction phase;

l exposure to Renewable Assets that are in the development

(namely pre-construction) phase will not exceed 5 per cent. of

Gross Assets;

l exposure to any single developer in the development phase will

not exceed 2.5 per cent. of Gross Assets;

l the Company will not typically provide Forward Funding for

development projects. Such Forward Funding will, in any event, not

exceed 5 per cent. of Gross Assets in aggregate and 2.5 per cent.

of Gross Assets per development project and would only be

undertaken when supported by customary security;

l Future Commitments and Developer Liquidity Payments, when

aggregated with Forward Funding (if any), will not exceed 25 per

cent. of Gross Assets;

l once the Net Initial Proceeds are substantially fully

invested, Renewable Assets in the United States will represent at

least 85 per cent. of Gross Assets; and

l any Renewable Assets that are located outside of the United

States will only be located in other OECD countries. Such Renewable

Assets will represent not more than 15 per cent. of Gross

Assets.

References in the investment restrictions detailed above to

"investments in" or "exposure to" shall relate to the Company's

interests held through its Investment Interests.

For the purposes of this Prospectus, the Net Initial Proceeds

will be deemed to have been substantially fully invested when at

least 75 per cent. of the Net Initial Proceeds have been invested

in (or have been committed in accordance with binding agreements to

investments in) Renewable Assets.

The Company will not be required to dispose of any investment or

to rebalance the Portfolio as a result of a change in the

respective valuations of its assets. The investment limits detailed

above will apply to the Group as a whole on a look-through basis,

namely, where assets are held through a Project SPV or other

intermediate holding entities or special purpose vehicles, and the

Company will look through the holding vehicle to the underlying

assets when applying the investment limits.

Gearing policy

The Group primarily intends to use long-term debt to provide

leverage for investment in Renewable Assets and may utilise

short--term debt, including, but not limited to, a revolving credit

facility, to assist with the acquisition of investments.

Long-term debt shall not exceed 50 per cent. of Gross Assets and

short-term debt shall not exceed 25 per cent. of Gross Assets,

provided that total debt of the Group shall not exceed 65 per cent.

of Gross Assets, in each case, measured at the point of entry into

or acquiring such debt.

The Company may employ gearing either at the level of the

relevant Project SPV or at the level of any intermediate subsidiary

of the Company. Gearing may also be employed at the Company level,

and any limits set out in this Prospectus shall apply on a

consolidated basis across the Company, the Project SPVs and any

such intermediate holding entities (but will not count any

intra--Group debt). The Company expects debt to be denominated

primarily in U.S. Dollars.

For the avoidance of doubt, financing provided by tax equity

investors and any investments by the Company in its Project SPVs or

intermediate holding companies which are structured as debt are not

considered gearing for this purpose and are not subject to the

restrictions in the Company's gearing policy.

Currency and hedging policy

The Group may use derivatives for the purposes of hedging,

partially or fully:

l electricity price risk relating to any electricity or other

benefit including renewable energy credits or incentives, generated

from Renewable Assets not sold under a PPA, as further described

below;

l currency risk in relation to any Sterling (or other non-U.S.

Dollar) denominated operational expenses of the Company;

l other project risks that can be cost-effectively managed

through derivatives (including, without limitation, weather risk);

and

l interest rate risk associated with the Company's debt facilities.

In order to hedge electricity price risk, the Company may enter

into specialised derivatives, such as contracts for difference or

other hedging arrangements, which may be part of a tripartite or

other PPA arrangement in certain wholesale markets where such

arrangements are required to provide an effective fixed price under

the PPA.

Members of the Group will only enter into hedging or other

derivative contracts when they reasonably expect to have an

exposure to a price or rate risk that is the subject of the

hedge.

Cash management policy

Until the Company is fully invested the Company will invest in

cash, cash equivalents, near cash instruments and money market

instruments and treasury notes ("Near Cash Instruments"). Pending

re-investment or distribution of cash receipts, the Company may

also invest in Near Cash Instruments as well as Investment Grade

Bonds and exchange traded funds or similar ("Liquid Securities"),

provided that the Company's aggregate holding in Liquid Securities

shall not exceed 10 per cent. of Gross Assets measured at the point

of time of acquiring such securities.

Amendments to the investment objective, policy and investment

restrictions

In the event that the Board considers it appropriate to amend

materially the investment objective, investment policy or

investment restrictions of the Company, Shareholder approval to any

such amendment will be sought by way of an ordinary resolution

proposed at an annual or other general meeting of the Company."

Interim Management Report

The Directors are required to provide an Interim Management

Report in accordance with the Financial Conduct Authority ("FCA")

Disclosure Guidance and Transparency Rules. They consider that the

Chair's Statement and the Investment Manager's Report in this

half-yearly report provide details of the important events which

have occurred during the Period and their impact on the financial

statements. The following statements on related party transactions,

going concern and the Directors' Responsibility Statement below,

together with the Chair's Statement and Investment Manager's

Report, constitute the Interim Management Report for the Company

for the six months ended 30 June 2022.

The Directors have identified the following as the Company's

principal risks and uncertainties. These are described in the

Company's Annual Report for the period ended 31 December 2021

(pages 36 - 38):

1. Cyber risk

2. Electricity price risk

3. Interest rate, currency and inflation risk

4. Investment performance risk

5. Investment valuation risk

6. Political and regulatory risk

7. Premium/discount risk

8. Service provider risk (including the Investment Manager)

9. COVID-19 risk

10. Counterparty risk

11. Climate and ESG risk

The Directors have identified as an emerging risk, Chinese solar

materials tied to forced labour.

Description

In June 2022, the White House announced the UFLPA which

addresses forced labour in the supply chain for solar panels in

China, including a ban on imports from several polysilicon

producers operating in Xinjiang. A significant portion of the

world's polysilicon, which is used to make solar panels, comes from

China.

Mitigation

l The Company works with reputable EPC firms to reduce the risk

that any materials sourced from vendors employing the use of forced

labour end up in the Company's projects and will actively monitor

developments on this issue to mitigate its impacts.

l The Investment Manager will make inquiries of vendors

regarding future procurement and their compliance with the

UFLPA.

The Annual Report contains more detail on the Company's

principal risks and uncertainties, including the Board's ongoing

process to identify, and where possible mitigate, emerging risks

(pages 36 to 38). The Annual Report can be found on the Company's

website.

The Board is of the opinion that these principal risks are

equally applicable to the remaining six months of the financial

year as they were to the six months being reported on.

The Company is a member of the Association of Investment

Companies ("AIC"), which provides regular technical updates as well

as drawing members' attention to forthcoming industry/ regulatory

issues and advising on compliance obligations.

When required, experts are employed to provide information and

technical advice, including legal advisers, tax advisers and other

advisers.

Related Party Transactions

The Company's Investment Manager, Ecofin, is considered a

related party under the Listing Rules. Details of the amounts paid

to the Company's Investment Manager and the Directors during the

Period are detailed in Note 10 to the Financial Statements.

Going Concern

The Directors have adopted the going concern basis in preparing

the interim financial statements. The following is a summary of the

Directors' assessment of the going concern status of the

Company.

The Directors have a reasonable expectation that the Company has

adequate resources to continue in operational existence for at

least twelve months from the date of this report. In reaching their

conclusion, the Directors considered the Company's cash flow

forecasts, cash position, income and expense flows and available

borrowing facilities. The Company's net assets at 30 June 2022 were

$134,324,000 million. As at 30 June 2022, the Company held

$3,859,000 million in cash and was undrawn on its RCF. The Company

continues to meet its day-to-day liquidity needs through its cash

resources. The total expenses for the six months ended 30 June 2022

were $1,196,000 million, which represented approximately 0.94% of

average net assets during the Period. At the date of approval of

this half-yearly report, based on the aggregate of investments and

cash held, the Company had substantial cover for its operating

expenses.

The Directors also considered the impacts of both the secondary

effects of the COVID-19 pandemic and the Russian invasion of

Ukraine on the Company's portfolio of investments. The Directors do

not foresee any immediate material risk to the Company's portfolio

and the income from underlying SPVs. A prolonged and deep market

decline could lead to falling values in the underlying investments

or interruptions to cashflow, however the Company currently has

sufficient liquidity available to meet its future obligations. The

Directors are also satisfied that the Company would continue to

remain viable under downside scenarios, including decreasing

government regulated tax credits and a decline in long term power

price forecasts.

Underlying SPV revenues are derived primarily from the sale of

electricity by project companies through PPAs in place with

creditworthy counterparties such as utilities, municipalities, and

corporations. Most of these PPAs are contracted over a long period

with a weighted average as at 30 June 2022 of 16.3 years.

During the Period and up to the date of this Report, there has