TIDMSCIR

RNS Number : 3776A

Scirocco Energy PLC

02 February 2022

2 February 2022

Scirocco Energy plc

("Scirocco Energy" or "the Company")

Operations Update

Scirocco Energy (AIM: SCIR), the AIM investing company targeting

attractive assets within the European sustainable energy and

circular economy markets is pleased to provide the following update

on its operations:

EAG Joint Venture

The Company recently supported Energy Acquisitions Group Ltd

("EAG"), the specialist acquisition and operating vehicle in the

sustainable energy sector, to acquire its first cash generative

anaerobic digestion asset, Greenan Generation Limited ("GGL"), in

which Scirocco Energy holds a 50% interest:

Financial

In Q4 2021 the revenue received for the quarter by GGL totalled

GBP300,352 (unaudited) supported by high power prices through the

period. This compares to the same period in 2020 where revenue was

GBP232,968 (unaudited). At current power price levels EBITDA for

the first 12 months of EAG ownership is estimated to exceed

GBP600,000 rather than the GBP470,000 guidance previously

issued.

Operational

Q4 2021 was the first complete quarter of EAG's ownership of

GGL. During the quarter the following upgrades were initiated to

ensure biological, mechanical, and financial stability going

forward.

-- Engagement and retention of a consultant biologist to

commence a medium-term biological analysis of the plant to support

optimisation of feedstock and process.

-- A number of equipment upgrades including the installation of

an automated radar system to remove the requirement for operator

intervention on digester recirculation and level monitoring.

-- Extended equipment support contracts and upgraded control

software systems to ensure operational efficiency and mechanical

stability.

-- Recalibration and replacement of gas monitoring and treatment

equipment to ensure accurate recording of methane and associated

gas values.

-- Replaced a number of the mixers due to normal wear and tear

experienced over the plant's six-year operational life. This will

ensure good mixing and support optimal operational performance

going forward.

Furthermore, the EAG team is currently reviewing options for a

feedstock optimisation programme.

Business Development

From a business development perspective, EAG is currently

carrying out due diligence on two additional AD plants. Under the

arrangement with SEM (announced by Scirocco in an RNS dated 9

December 2021) the Company and EAG gained exclusive access to a

technical solution for the processing of digestate into a nutrient

dense organic fertiliser. The EAG team is engaged in discussions

regarding two merchant installations of the SEM equipment on third

party AD plants.

Tom Reynolds, Scirocco Energy CEO commented "We are delighted to

see excellent operational performance supported by the current high

wholesale power prices. EAG's experienced team have begun investing

to automate and future proof the asset and are making clear headway

with an attractive pipeline of opportunities to support further

investment. Scirocco's 50% interest in EAG represents a robust,

scalable platform primed for growth and we look forward to working

with the team going forward."

Tanzania Operations

Operational activities under the Ruvuma PSA in Tanzania, where

Scirocco Energy owns a legacy 25% working interest, have progressed

under the supervision of operator, ARA Petroleum Tanzania

("APT"):

-- Seismic camp fully constructed, and the contractor Africa

Geophysical Services Limited ("AGS") is completing the mobilisation

of all necessary equipment to site. This work is expected to be

completed by mid-February;

-- Acquisition of the 338km(2) 3D seismic survey will commence upon full equipment mobilisation;

-- The 3D seismic survey is an integral step in progressing and

de-risking the Ntorya gas discovery ahead of the drilling of the

Chikumbi-1 ("CH-1") well;

-- The seismic acquisition and subsequent interpretation will

seek to refine and confirm the exploitable gas resources of the

Ntorya field. Additionally the survey will provide greater clarity

of the potential upside of the discovery as identified by the

operator APT, through a re-interpretation of the existing 2D

seismic dataset. APT's revised mapping and internal management

estimates suggest a risked prospective gas in place ("GIIP") for

the Ntorya accumulation of 3,024 Bcf (gross basis, mean case), in

multiple lobes to be tested, and a prospective, risked recoverable

gas resource of 1,990 Bcf (gross basis, mean case); and

-- APT continue to progress with well planning for the CH-1 well

with key contracting now being undertaken. The operator continues

to target a Q3 spud.

Commenting on the update, Tom Reynolds said "Ruvuma Operator,

ARA Petroleum Tanzania, has injected energy into the operational

programme and we are seeing the benefit of this engagement now.

Following the award of the seismic contract in Q4 2021 and the

ongoing mobilisation of the equipment to site, the Joint Venture

expects to commence shooting seismic imminently. This will provide

the high quality 3D definition of the subsurface in preparation for

the appraisal well to be drilled in Q3 this year. An exciting time

on the licence which has the potential to prove up substantial gas

volumes. As Scirocco moves towards these key operational milestones

we are continuing with our ongoing discussions regarding possible

farm-down and divestment options, while simultaneously progressing

our funding options in the event that we retain 25% interest in

Ruvuma at the time of the CH-1 well."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation No. 596/2014, which forms part of

United Kingdom domestic law by virtue of the European (Withdrawal)

Act 2018.

For further information:

Scirocco Energy plc

Tom Reynolds, CEO +44 (0) 20 7466

Doug Rycroft, COO 5000

Strand Hanson Limited, Nominated Adviser +44 (0) 20 7409

Ritchie Balmer / James Spinney / Rory Murphy 3494

WH Ireland Limited, Broker +44 (0) 207 220

Harry Ansell / Katy Mitchell 1666

Buchanan, Financial PR +44 (0) 20 7466

Ben Romney / Jon Krinks / James Husband 5000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBLGDDBUGDGDB

(END) Dow Jones Newswires

February 02, 2022 01:59 ET (06:59 GMT)

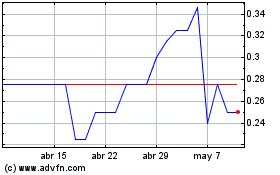

Scirocco Energy (LSE:SCIR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Scirocco Energy (LSE:SCIR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024