Scirocco Energy PLC Corporate Update & Investor Event (8253I)

07 Diciembre 2022 - 1:00AM

UK Regulatory

TIDMSCIR

RNS Number : 8253I

Scirocco Energy PLC

07 December 2022

7 December 2022

Scirocco Energy plc

("Scirocco" or the "Company")

Corporate Update & Investor Event

Scirocco (AIM: SCIR), the AIM investing company targeting

attractive assets within the European sustainable energy and

circular economy markets, is pleased to provide a corporate update

ahead of the Investor Event that it is hosting later today. The

update includes various strategic targets as well as the

announcement of an exclusivity agreement for the acquisition of an

additional bio-gas plant.

The new Corporate Presentation that is being used for the

Investor Event will be made available on the website via the

following link:

https://www.sciroccoenergy.com/investors/presentations/

Strategy Update

At the Investor Event, the Board will provide an update on its

strategic progress as it seeks to construct a portfolio capable of

supporting attractive dividend yield and further growth through

re-investment. To date, through the establishment of its Joint

Venture with EAG (SCIR 50%), EAG has completed the acquisition of

100% of Greenan Generation Limited (GGL) and its 0.5 MWe Anaerobic

Digestion (AD) plant in Northern Ireland. Since completing that

acquisition in October 2021, GGL has performed strongly, generating

for EAG a 12 month EBITDA estimate to 30 September 2022 of

GBP602,000 (unaudited), after c. GBP375,000 of costs associated

with operating investments and business development.

Since establishing the joint venture, EAG has developed a

pipeline of Biogas acquisitions in line with the stated strategy to

acquire "bitesize" plants in the value range of GBP3-4m each. The

goal is to acquire individual plants using EAG's "cookie cutter"

approach whereby target assets are acquired as SPVs through a

combination of debt and equity, the assets are then optimised

through operating techniques and investments to grow profitability

and enhance the value of each asset and the portfolio as a whole. A

typical SPV is forecast to generate c. GBP850k EBITDA with

enterprise value in the range of GBP7.5-GBP8.5m per plant, thereby

demonstrating the appealing value proposition of the strategy.

Based on the strategic objectives and current deal flow pipeline

being progressed by EAG, it is the intention that EAG will, subject

to securing the necessary funding, acquire two plants through 2023

and a further two plants in 2024. Should EAG be successful in

converting these opportunities as guided then EAG would create a

business generating over GBP5 million EBITDA per annum with an

implied cash on cash multiple of c. 2.5x accruing to EAG

investors.

Exclusivity Agreement for target plant

Consistent with the stated strategy, Scirocco is pleased to

announce that EAG has entered into an exclusivity agreement to

acquire 100% of the share capital in a target SPV which has been

delivering consistent operational and financial results over the

past 7 years, generating an EBITDA of GBP567k for its last

financial year. It is EAG's expectation that its plans to optimise

performance can increase EBITDA at the plant to GBP725k in its

first year of ownership.

EAG has completed phase 1 of its DD process using its internal

resources and, following signing of exclusivity, will move into

Phase 2 which includes drafting of the SPA and associated project

documents. The acquisition requires GBP3.8m of acquisition capital

as well as approximately GBP200k in closing costs, and will be debt

funded to approximately 70% of the total. Assuming all progresses

as planned, including sourcing of the necessary finance, then EAG

is targeting a completion date at the end of February 2023. Further

updates will be provided as and when appropriate.

Tom Reynolds, Scirocco's CEO commented:

"We're pleased to provide investors with a deeper dive into our

strategy and the market drivers that support our strategic focus.

Our JV with EAG gives Scirocco unique access to a compelling

opportunity pipeline that can be converted on highly attractive and

value accretive terms. The JV's initial acquisition of GGL last

year demonstrates the low-risk and high-margin profitability of

these assets and the value uplift that EAG provides upon

completion. In that regard, we are pleased to provide the market

with strategic targets that we believe can be comfortably delivered

by EAG based on the pipeline being progressed. As detailed in the

presentation we provide today, subject to financing being available

as expected, the team is confident of building an asset base with

enterprise value of up to GBP100 million by 2027.

In the context of this update, we are also pleased to announce

the Exclusivity Agreement that EAG has signed with a target SPV.

The team's extensive internal DD on the target indicates that this

SPV benefits from all the factors consistent with EAG's investment

model and represents a compelling opportunity for EAG and Scirocco.

While this process is still relatively early stage and formal DD is

required, we are hopeful that EAG will progress this opportunity to

SPA in the coming months with a view to adding a second plant to

the portfolio in Q1'23. In parallel with the DD process, EAG is

also progressing funding discussions and is confident that the

implied multiples of these targets and the compelling market

drivers that support investment into this sector in pursuit of UK's

net-zero targets will ensure the most appropriate form of funding

can be secured to complete any subsequent transaction."

For further information:

Scirocco Energy plc

Tom Reynolds, CEO +44 (0) 20 7466

Doug Rycroft, COO 5000

Strand Hanson Limited, Nominated Adviser

Ritchie Balmer / James Spinney / Robert +44 (0) 20 7409

Collins 3494

WH Ireland Limited, Broker +44 (0) 0207 220

Harry Ansell / Katy Mitchell 1666

Buchanan, Financial PR +44 (0) 20 7466

Ben Romney / Jon Krinks 5000

Inside Information

The information contained within this announcement is deemed by

Scirocco to constitute inside information as stipulated under the

Market Abuse Regulation (EU) no. 596/2014 ("MAR"). On the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFSAFUMEESEFE

(END) Dow Jones Newswires

December 07, 2022 02:00 ET (07:00 GMT)

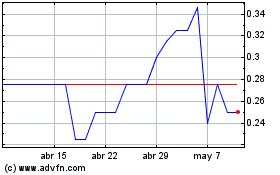

Scirocco Energy (LSE:SCIR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Scirocco Energy (LSE:SCIR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024