TIDMSEPL

RNS Number : 0937J

Seplat Energy PLC

22 April 2022

22 April 2022

Seplat Energy Plc

2021 Annual Report and Notice of AGM

Seplat Energy Plc ("Seplat" or the "Company") confirms it has

today published its Annual Report and Accounts for the year ended

31 December 2021 together with the notice of the Company's ninth

Annual General Meeting ("AGM") and forms of proxy. The Company will

hold its AGM at 11:00am (WAT) on Wednesday 18 May 2022 at 16a

Temple Road (Olu Holloway), Ikoyi, Lagos, Nigeria.

In accordance with Listing Rule 14.3.6 copies of the Company's

Annual Report and Accounts for the year ended 31 December 2021, the

Notice of AGM and proxy forms have also been submitted to the FCA

for publication through the document viewing facility of the

National Storage Mechanism and will shortly be available for

inspection at

https://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism

In accordance with Disclosure Guidance and Transparency Rule

("DTR") 6.3.5R(3), copies are available on the Company's website,

https://www.seplatenergy.com/

The Company's audited financial statements and extracts of the

management report were included in the Company's Final Results

announcement on 28 February 2022. That information, together with

the Appendices to this announcement, which contains the following

additional information that has been extracted from the 2021 Annual

Report, constitutes the material required for the purposes of

compliance with DTR 6.3.5 only:

-- the Directors' Responsibilities Statement;

-- a description of principal risks and uncertainties that the Company faces; and

-- related party transactions.

This announcement should be read in conjunction with and is not

a substitute for reading the full 2021 Annual Report. Page and note

references in the text below refer to page numbers and notes in the

2021 Annual Report and terms defined in that document have the same

meanings in these extracts.

Enquiries

Seplat Energy plc

Emeka Onwuka, CFO +234 (0) 1 277 0400

Edith Onwuchekwa, Company Secretary/General

Counsel

Carl Franklin, Head of Investor Relations

Ayeesha Aliyu, Investor Relations

Chioma Nwachuku, Director - External Affairs

and Sustainability

FTI Consulting

Ben Brewerton / Christopher Laing +44 (0) 203 727 1000

seplat@fticonsulting.com

Notes to editors

Seplat Energy Plc is Nigeria's leading indigenous energy

company. It is listed on the Premium Board of the Nigerian Exchange

Limited (NGX: SEPLAT) and the Main Market of the London Stock

Exchange (LSE: SEPL).

Seplat Energy is pursuing a Nigeria-focused growth strategy

through participation in asset divestments by international oil

companies, farm-in opportunities, and future licensing rounds. The

Company is a leading supplier of gas to the domestic power

generation market. For further information please refer to the

Company website, http://seplatenergy.com/

Appendices

Appendix A: Statement of Directors' responsibilities

The following Statement of Directors' responsibilities is

extracted from the 2021 Annual Report and Accounts (page 136).

The Companies and Allied Matters Act, 2020, requires the

Directors to prepare financial statements for each financial year

that gives a true and fair view of the state of financial affairs

of the Group at the end of the year and of its profit or loss. The

responsibilities include ensuring that the Group:

1. keeps proper accounting records that disclose, with

reasonable accuracy, the financial position of the Group and comply

with the requirements of the Companies and Allied Matters Act,

2020;

2. establishes adequate internal controls to safeguard its

assets and to prevent and detect fraud and other irregularities;

and

3. prepares its financial statements using suitable accounting

policies supported by reasonable and prudent judgements and

estimates and are consistently applied.

The Directors accept responsibility for the annual financial

statements, which have been prepared using appropriate accounting

policies supported by reasonable and prudent judgements and

estimates, in conformity with International Financial Reporting

Standards (IFRS), the requirements of the Companies and Allied

Matters Act, 2020 and Financial Reporting Council of Nigeria Act,

No. 6, 2011.

The Directors are of the opinion that the financial statements

gives a true and fair view of the state of the financial affairs of

the Group and of its financial performance and cash flows for the

year. The Directors further accept responsibility for the

maintenance of accounting records that may be relied upon in the

preparation of financial statements, as well as adequate systems of

internal financial control.

Nothing has come to the attention of the Directors to indicate

that the Group will not remain a going concern for at least twelve

months from the date of this statement.

Signed on behalf of the Directors by:

A.B.C Orjiako R.T. Brown

Chairman Chief Executive Officer

FRC/2014/IODN/00000003161 FRC/2014/ ANAN/00000017939

28 February 2022 28 February 2022

Appendix B: Principal risks and uncertainties

The following principal risks and uncertainties table is

extracted from the 2021 Annual Report and Accounts (pages 40 to

45).

The implementation of our strategy can be hindered by various

risks and uncertainties. The risks that the Board considers most

significant are described here.

Operational risks

Field operations and Third-party infrastructure HSSE risks

project deliverability downtime

-------------------------------- ------------------------------

Description Description Description

Failure to manage An over-reliance Oil and gas activities

operational activities on third-party operated carry significant

in line with planned transportation infrastructure levels of HSSE risks

expectations can lead can expose the Company if not properly managed.

to production misses, to an extended period As activity levels

project delays and of production being continue to increase

cost overruns, high shut in. there is a strong

production costs and focus on preventing

earlier than expected major environmental

field decommissioning. (including the emerging

climate change - GHG

emissions risk), health

or safety incidents.

-------------------------------- ------------------------------

Mitigation Mitigation Mitigation

Focus on risk management Work is ongoing to Deployment of an

at planning phase secure a second export HSSE Management System

and mitigation plans line to complement in line with best

activated. Compulsory Forcados. Continue practices. Monitoring

'peer-to-peer' review to explore export and reporting of HSSE

for high-value projects via barging as a back-up performance scorecards

and better project option in extreme at management and

management techniques. cases. FEED completed Board levels. Our

Protracted land acquisition, and outcome prepared HSSE systems and process

preparation and rig for presentation to are subjected to independent

startup have been JV Partners to pave review and identified

contributory factors way for Contracting improvement initiatives

which have received Strategy concurrence are deployed. Continual

focused attention for Engineering, Procurement, focus on HSSE training

and significant process Installation and Commissioning and initiatives on

improvements and improved (EPIC) of Amukpe LTF incidence prevention.

communications with Upgrade. Emergency Response

JV partner and approving Finalising the Amukpe plan set for any eventuality

regulators to mitigate to Escravos pipeline and comprehensive

delays. (AEP) project in a Incident Review panels

Use of smart/ intelligent bid to provide a major to identify and channel

wells to improve recovery alternative for crude lessons learnt to

and improved rig performance evacuation in the improvement activities.

monitoring and reporting core assets. The AEP Focus on the delivery

to manage NPTs. project is at 99.8% of projects earmarked

completion and crude to reduce and/or eliminate

deliverability test gas flaring as spelt

conducted. Two contingency out under the company's

tanks in Amukpe for "Gas Flares Out Roadmap"

partial storage during and new energy transition

shut-in over shorter plan..

periods.

-------------------------------- ------------------------------

KPI/Performance metric KPI/Performance metric KPI/Performance metric

Net working interest Net working interest HSSE scorecards

production production LTIF

Operating costs per Days downtime TRIR

boe EBIT

-------------------------------- ------------------------------

Strategic pillars Strategic pillars Strategic pillars

1, 2, 3 2, 3 2, 3, 5

-------------------------------- ------------------------------

Assessment Assessment Assessment

Very high Very high High

-------------------------------- ------------------------------

Trend Trend Trend

Steady. We continue Steady. Remarkably Steady. Though the

to redefine our project improved uptime of risk is inherent,

management approach Forcados export system. we will continue to

for improved speed However, risk trend deploy our HSSE risk

of delivery and efficiency, is Steady, even though management in line

finalised the integration there is no near term with best practices

of the newly acquired line of sight for and with strong emphasis

Eland assets into an alternative evacuation on prevention.

our business, consolidate line, in the sudden

performance across event of prolonged

board, maximise production, outage of the TFP.

maintain a strong Alternative line (AEP)

balance sheet, and is now scheduled for

strategically position Q2 2021 delivery.

the Company for future

growth.

-------------------------------- ------------------------------

Infectious diseases Sustaining E&A programme

outbreak in Seplat

(e.g. Covid-19)

Description Description

Risk of an index Exploration and appraisal

case manifesting in activities carry significant

Seplat offices or levels of subsurface

field locations. This risk. Sustained E&A

leads to an unsuccessful drilling failure will

initial control of impact the Company's

an index case (probably ability to organically

resulting in communal replace reserves and

spread of the disease production.

in the Seplat community

as a result of late

detection of secondary

contact cases which

may have had close

contacts with index

case or close contacts

from other external

primary sources).

Risk also covers supply

chain disruptions

emanating from the

pandemic i.e. the

extent to which the

disease will have

an impact on all key

projects of the Company

(including ANOH) as

designed in the work

programme (impacting

the supply chain and

major contractors

scheduled to deliver

in a few months).

------------------------------

Mitigation Mitigation

The Company's leadership Strict compliance

through the COVIMOG with reservoir management

(monitoring and response guidelines. Building

team) continued to internal capacity

sustain the Company with skilled sub-surface

business and observed expertise. Drill a

all recommended preventive minimum of two exploration

measures advised by wells, as well as

both the Presidential continuous M&A work

Task Force (PTF) and to secure available

State Governments. opportunities at the

Over 90% of employees right price.

were fully vaccinated

via a concerted Industry

(OPTS) support, while

PCR tests remained

mandatory for everyone

carrying out activities

in the various areas

of the company's operation

and Travel Advisory

updates were shared

with staff. Provision

continued to remain

in place for targeted

tests of personnel

in all locations as

required. Follow up

treatment of positive

cases continued to

be managed and funded

by the Company. Also,

as facilitated by

the Lagos State Government,

the Covid-19 booster

dose vaccines are

now readily available

in Government Health

centres, and the Company

plans to keep on liaising

with appropriate bodies

in the industry to

facilitate this process.

Manage press/publicity

and communication

to avoid miscommunication/

wrong press.

------------------------------

KPI/Performance metric KPI/Performance metric

HSSE scorecards Reserve replacement

LTIF

TRIR

------------------------------

Strategic pillars Strategic pillars

2,5 1, 2, 3

------------------------------

Assessment Assessment

High Very high

------------------------------

Trend Trend

Steady. Our risk Steady. High grading

landscape remained our exploration portfolio

largely stable with through a thorough

respect to existing prospect screening

exposures since our exercise. In the near

last update in 2020. term, plan is to commence

The Company did well exploration drilling

to manage the lingering campaign in the West.

impact of Covid-19

(infectious disease

outbreak), via a strategic

management vehicle

called COVIMOG.

------------------------------

External risks

Niger Delta stability Stakeholder management Geopolitical risk

and security relationships

-------------------------------- --------------------------------

Description Description Description

Seplat Energy's core Failure to manage Nigeria has at times

operations are located stakeholders can result in its history faced

in the Niger Delta in business disruptions political uncertainties

region of Nigeria and interference. and threats such as

and that comes with The Company prioritises terrorism aimed at

significant risks. the effective management de-stabilising and

Historically, the of relationships with undermining the orderly

Niger Delta has always all stakeholders including and effective rule

been a high-risk environment host communities, of central government.

with security incidents JV partners, government,

such as kidnappings, regulatory bodies

vandalism and criminal and shareholders.

attacks on Oil and

Gas installations.

-------------------------------- --------------------------------

Mitigation Mitigation Mitigation

The Company, working Ensure consistent Scenarios and response

with other industry delivery of CSR initiatives options plan set.

players in the region, (as well as full compliance Crisis management

continues to put pressure with the terms of team in place for

on government to find the GMoU) across all high alert political

a lasting solution operational areas. periods. Continue

to Niger Delta restiveness Sustain local content to partner/network

and the current security development with priority with security stakeholders

measures put in place to community contractors. and share intelligence

by the facility operator, Tailored CSR programmes, regarding security.

together with the capacity building Business continuity

government's strategy and infrastructure plans actioned in

of dialogue with stakeholders developments with light of current geo-political

in the region, seems the host communities. situation.

to be working. Organisational focus

and clear strategy

to deliver shareholder

value pursued by the

Board and management.

Corporate governance,

transparency and proactiveness

in dealings with regulators

and JV partners.

-------------------------------- --------------------------------

KPI/Performance metric KPI/Performance metric KPI/Performance metric

LTIR Net working interest Occurrences of civil

TRIR production unrest and terrorism.

Security incidents LTIR

Operating cash flow TRIR

Host community incidences

-------------------------------- --------------------------------

Strategic pillars Strategic pillars Strategic pillars

2, 3, 5 2, 5 2, 3, 5

-------------------------------- --------------------------------

Assessment Assessment Assessment

Very high High High

-------------------------------- --------------------------------

Trend Trend Trend

Steady. Efforts by Steady. We continue Steady.

the government and to enjoy good working

industry pressure relations with our

groups, aimed at enhancing stakeholders.

security in the region

seems to be paying

off as the business

recorded zero occurrence

in militancy activities,

similar to the previous

year. We will continue

our monitoring and

vigilance.

-------------------------------- --------------------------------

Financial risks

Oil price volatility Changes to tax status Availability of capital

and legislation

------------------------------- --------------------------------

Description Description Description

Oil prices have exhibited If the tax regime/legislation The oil and gas industry

a history of volatility under which the Company is highly capital

and can fluctuate operates its assets intensive. Significant

sharply in line with were to change, profitability amounts of capital

external factors. may be impacted. are required to continue

development activities

and fund M&A. Non

funding of cash calls

by JV partners impacts

activities and liquidity.

------------------------------- --------------------------------

Mitigation Mitigation Mitigation

Hedging continues Perform evaluation Emphasis on compliance

to be our price risk of business plan and with requirements

management tool. Price performance metrics of the JV operating

sensitisation on project exclusive of tax benefits. agreement for effective/strict

economics and cost Project economics JV partner concurrence.

discipline for capital were determined on Board review and approval

projects sanctioning. maximum tax basis of financial strategy

Aggressive focus on to mitigate the impact and debt portfolio

cost reduction. of the now expired management with strong

pioneer tax status. banking relationships.

Impact assessment

of potential tax legislature

monitored at the Board

level.

------------------------------- --------------------------------

KPI/Performance metric KPI/Performance metric KPI/Performance metric

Realised oil price Effective tax rate JV receivables

Operating cash flow Tax status Capex

New M&A activities

------------------------------- --------------------------------

Strategic pillars Strategic pillars Strategic pillars

2 2, 3 2, 3, 4

------------------------------- --------------------------------

Assessment Assessment Assessment

High High Very high

------------------------------- --------------------------------

Trend Trend Trend

Decreasing. In the Steady. PIB was passed Decreasing. JV partners

year 2021, we kept into law as an Act continue to remain

focus of our price (PIA) in August, 2021. current in paying

risk management policy Impact on Seplat is cash calls.

to protect the Company's assessed as moderate.

cash flow stream from

downside scenarios.

We will also continue

to take hedge positions

and apply cost reduction

strategies.

------------------------------- --------------------------------

Financial risks continued

Cost control risk Liquidity Foreign exchange risk

----------------------------------- ---------------------------

Description Description Description

Cost reduction remains Liquidity risk is The Company is exposed

central to the Company's the risk that the to exchange rate risk

current operating Company will not be to the extent that

strategy. High operating able to meet its financial balances and transactions

cost and ineffective obligations as they are denominated in

capital cost control fall due. a currency other than

negatively impacts the US Dollar.

operating cash flows

and profitability.

----------------------------------- ---------------------------

Mitigation Mitigation Mitigation

Comprehensive budgeting Manage liquidity The Company has options

process approved by risk by ensuring that to manage its foreign

the joint venture sufficient funds are exchange exposure

partner and the Board. available to meet including financial

Clear cost management commitments as they hedge instruments

targets. Grading of fall due. Uses both such as forward exchange

portfolio opportunities long-term and short-term contracts.

and project ranking cash flow projections

for capital allocation. to monitor funding

Focus on reducing requirements for activities

drilling costs at and to ensure there

well design phase. are sufficient cash

Cost monitoring and resources to meet

periodic reporting. operational needs.

Focus on effective Cash flow projections

contracting strategies take into consideration

for cost reduction. the Company's debts

and covenant compliance.

Surplus cash held

is transferred to

the treasury department

which invests in interest-bearing

current accounts,

time deposits and

money market deposits.

----------------------------------- ---------------------------

KPI/Performance metric KPI/Performance metric KPI/Performance metric

Operating cost per Operating cash flow Operating cash flow

boe Capex Capex

EBIT

Capex

Well costs

----------------------------------- ---------------------------

Strategic pillars Strategic pillars Strategic pillars

2, 3, 5 1, 2, 3 2, 3

----------------------------------- ---------------------------

Assessment Assessment Assessment

High Medium Low

----------------------------------- ---------------------------

Trend Trend Trend

Steady. Cost discipline Decreasing. Improved Decreasing. Historically,

remains key focus uptime of TFP; improved the Company holds

of the business. JV cash call payment; the majority of its

oil price rally; and cash and cash equivalent

strategic debt refinancing in US dollar. Gas

have all greatly improved contracts are indexed

liquidity risk. in US dollar.

----------------------------------- ---------------------------

Strategic risks

Portfolio concentration Merger & Acquisition Bribery and corruption

risk (M&A) risk risk

------------------------------- ------------------------------

Description Description Description

High dependency on Growth through M&A Bribery and corruption

a concentrated portfolio activities is part presents a risk throughout

of producing blocks of the Seplat's strategy the global oil and

and limited number to pursue a focused gas industry and represents

of wells can leave acquisition and farm-in. an ongoing risk to

the Company more susceptible M&A deals and transactions any oil and gas company.

to declining long-term come with significant

growth and reserves risk including structural,

depletion. commercial and integration

risks. There is also

the risk of nonachievement

of acquisition targets

due to highly competitive

landscape.

------------------------------- ------------------------------

Mitigation Mitigation Mitigation

Focus on portfolio New business development Extensive training

expansion strategy unit is always looking on anti-bribery and

from the Board level for the right opportunities corruption. Embedding

to diversify current for Seplat. Decision corporate governance

portfolio. Integrated review board (DRB) principles with key

long-term planning process is in place focus on areas of

on crude oil, gas to ensure deals are the business which

and other renewables properly vetted and may be more susceptible

business. adequate due diligence to corruption such

done on new opportunities. as the contracting

The DRB ensures the and procurement process.

commercial, structural, Processes exist to

KYC and integration guide dealings with

risks are fully considered public officials.

and addressed with

mitigation plan approved

and in place prior

to deal closing.

------------------------------- ------------------------------

KPI/Performance metric KPI/Performance metric KPI/Performance metric

Successful execution Successful execution Whistleblowing reports

of new acquisition of new acquisition Number of disciplinary

and farm-in opportunities and farm-in opportunities cases

------------------------------- ------------------------------

Strategic pillars Strategic pillars Strategic pillars

2, 3 1, 3, 4 5

------------------------------- ------------------------------

Assessment Assessment Assessment

High Very high Very high

------------------------------- ------------------------------

Trend Trend Trend

Steady. The Company Steady. DRB process Decreasing. Our geographical

is in transform phase. in place to vet opportunities location continues

and deals. Risk trend to be susceptible

steady following ongoing to corruption. However,

integration of Eland risk trend changed

Oil and Gas Plc, as from steady to decreasing

well as ongoing strategy following lower cases

to acquire more strategic of whistle blowing

assets. M&A landscape during the year.

remains competitive.

------------------------------- ------------------------------

Fraudulent activity Information security

risk risk

Description Description

Fraudulent activity Potential cyber-attacks

presents a risk throughout and information technology

the global energy security breaches

industry and represents could result in loss

an ongoing risk to or compromise of sensitive

any energy company. proprietary information,

communication and

IT business continuity

disruption across

operations.

------------------------------

Mitigation Mitigation

Extensive whistleblowing We monitor and regularly

campaign. Continuous upgrade the Company's

monitoring and improvement information technology

of the system of internal and security systems.

controls by all lines The Company has a

of defence with strong clearly defined employee

internal audit activity. user policy and control

Automation of processes of access rights.

where possible to Our information security

reduce manual intervention. framework and infrastructure

have been externally

reviewed in line with

requirements of ISO

27001. IT business

continuity plan is

in place for quick

deployment.

------------------------------

KPI/Performance metric KPI/Performance metric

Number of reported Information security

cases identification and

containment reports

------------------------------

Strategic pillars Strategic pillars

5 1, 5

------------------------------

Assessment Assessment

Very high High

------------------------------

Trend Trend

Steady. Risk is kept Steady. While cyber

at very high and the security continues

Company continues to hold international

to maintain a zero attention, there has

tolerance policy. not been a material

IT breach on our operations.

However, the triggering

of the work from home

policy has resulted

in a rising trend

of the risk, giving

the greater number

of employees working

externally.

------------------------------

Appendix C: Related Party Transactions

The following Related party relationships and transactions are

extracted from the 2021 Annual Report and Accounts (page 221-222

)

38. Related party relationships and transactions

The parent Company (Seplat Energy Plc) is owned 6.43% either

directly or by entities controlled by A.B.C Orjiako (SPDCL(BVI))

and members of his family and 8.20% either directly or by entities

controlled by Austin Avuru (Professional Support Limited and

Platform Petroleum Limited). The remaining shares in the parent

Company are widely held.

The goods and services provided by the related parties are

disclosed below. The outstanding balances payable to/receivable

from related parties are unsecured and are payable/receivable in

cash.

i. Shareholders of the parent company

Shebah Petroleum Development Company Limited SPDCL ('BVI'): The

Chairman of Seplat is a director and shareholder of SPDCL (BVI).

The company provided consulting services to Seplat. Services

provided to the Group during the period amounted to $1.1 million,

0.45 billion (2020: $900 thousand, 342 million). Payables amounted

to $101.8 thousand, 41.9 million in the current period.

ii. Entities controlled by key management personnel (Contracts>$1million in 2021)

Cardinal Drilling Services Limited (formerly Caroil Drilling

Nigeria Limited): The Company is owned by common shareholders with

the parent Company. The company provides drilling rigs and drilling

services to Seplat. Transactions with this related party amounted

to nil (2020: $5.7 million, 2.1 billion). Payables amounted to nil

in the current period (Payables in 2020: $591 thousand, 225

million).

iii. Entities controlled by key management personnel (Contracts<$1million in 2021)

Abbeycourt Trading Company Limited: The Chairman of Seplat is a

director and shareholder. The Company provides diesel supplies to

Seplat in respect of Seplat's rig operations. This amounted to $222

thousand, 88.9 million during the period (2020: $296 thousand, 106

million). Receivables amounted to $6, 2,649 (2020: $15,273, 5.8

million).

Stage leasing (Ndosumili Ventures Limited): A subsidiary of

Platform Petroleum Limited. The company provides transportation

services to Seplat. This amounted to $278 thousand, 111.3 million

(2020: $714 thousand, 257 million). Payables amounted to $3.2

thousand, 1 .3 million in the current period (2020: $23.6 thousand,

8.9 million).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSSEAFEEEESEIL

(END) Dow Jones Newswires

April 22, 2022 09:00 ET (13:00 GMT)

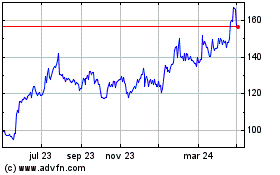

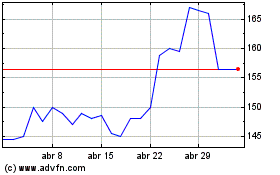

Seplat Energy (LSE:SEPL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Seplat Energy (LSE:SEPL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024