Severfield PLC Pre-close Trading Update (6604I)

20 Abril 2022 - 1:00AM

UK Regulatory

TIDMSFR

RNS Number : 6604I

Severfield PLC

20 April 2022

20 April 2022

Severfield plc

('the Company' or 'the Group')

Pre-close trading update

Order books at record levels

Severfield plc, the market leading structural steel group, today

issues the following trading update for the year ended 31 March

2022, ahead of the announcement of its annual financial results on

Wednesday 15 June.

FY22 expectations

The Group expects to deliver a full year result in line with

management's previous expectations.

Operational and trading update

UK and Europe

In the second half of the year, we have continued to secure a

significant value of new work, resulting in a record UK and Europe

order book of GBP479m at 1 April 2022 (1 November 2021: GBP393m),

of which GBP382m is for delivery over the next 12 months. The order

book remains well-diversified and contains a healthy mix of

projects across the Group's key market sectors. In terms of

geographical spread, 94 per cent of this order book represents

projects in the UK, with the remaining 6 per cent representing

projects for delivery in Europe and the Republic of Ireland.

We continue to be encouraged by the current level of tendering

activity across the Group, both in the UK and in continental

Europe, and are well-positioned to take advantage of some

significant opportunities in the industrial and distribution

(battery plants and distribution centres), stadia and leisure,

transport infrastructure, nuclear and data centre sectors.

Despite seeing further input cost inflation (including in steel

prices) and some disruption to raw material supplies as a result of

Russia's invasion of Ukraine, we are currently managing these

effectively, and steel remains largely a pass-through cost for the

Group.

India

The Indian joint venture ('JSSL') has performed profitably and

in line with expectations in the second half of the year. This

follows a difficult start to the year when output was disrupted by

the second wave of COVID-19. Notwithstanding some current

inflationary pressures, JSSL has continued to win new work,

resulting in a record order book of GBP166m at 1 April 2022 (1

November 2021: GBP140m). In terms of mix, 40 per cent of the order

book represents higher margin commercial work, with the remaining

60 per cent representing industrial projects, mainly for JSW. This

order book, together with JSSL's improving pipeline of potential

orders, reflects a continuing strong underlying demand for

structural steel in India, leaving the business very

well-positioned to take advantage of an improving economy.

Strong balance sheet and financial position

The financial position of the Group remains good and year-end

net debt (on a pre IFRS 16 basis) was c.GBP19m, representing an

overdraft of c.GBP4m and outstanding acquisition loans of c.GBP15m.

Net working capital has increased in H2 reflecting the impact of

steel and other input price rises, together with higher steel

purchases to meet production requirements in early FY23 when

executing our record UK and Europe order book.

In December 2021, the Group completed a refinancing of its

revolving credit facility ('RCF'). The new GBP50m RCF provides

additional liquidity above the GBP25m RCF which it replaced and

extends the term of the facility which now expires in December

2026. The new facility provides the Group with enhanced liquidity

and long-term financing to help support its growth strategy.

Outlook

With a record UK and Europe order book of GBP479m, a very

encouraging pipeline of opportunities, and a well-positioned

business in India, the outlook for the Group remains positive,

although we remain mindful of the ongoing effects of Russia's

invasion of Ukraine.

For further information, please contact:

Severfield Alan Dunsmore 01845 577 896

Chief Executive Officer

Adam Semple 01845 577 896

Group Finance Director

Jefferies International Simon Hardy 020 7029 8000

Will Soutar 020 7029 8000

Liberum Capital Nicholas How 020 3100 2000

Ben Cryer 020 3100 2000

Camarco Ginny Pulbrook 020 3757 4980

Tom Huddart 020 3757 4980

Notes to editors:

Severfield is the UK's market leader in the design, fabrication

and construction of structural steel, with a total capacity of

c.165,000 tonnes of steel per annum. The Group has six sites,

c.1,500 employees and expertise in large, complex projects across a

broad range of sectors. The Group also has an established presence

in the expanding Indian market through its joint venture

partnership with JSW Steel (India's largest steel producer).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPUQWCUPPGQB

(END) Dow Jones Newswires

April 20, 2022 02:00 ET (06:00 GMT)

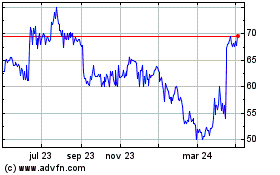

Severfield (LSE:SFR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

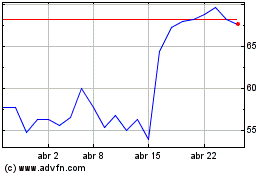

Severfield (LSE:SFR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024