TIDMSGRO

SEGRO plc ("SEGRO" or the "Group") today publishes a trading

update for the period from 1 July 2022 to 19 October 2022(1) .

David Sleath, Chief Executive, said:

"SEGRO has performed well throughout the third quarter of 2022,

delivering excellent operational results with momentum continuing

into the final quarter.

"Occupier demand remains strong across all of our markets,

driven by long-term structural trends, whilst supply remains

limited and this should continue to support high levels of rental

growth. These factors have helped us to grow the rent roll by GBP20

million in the third quarter (bringing the total increase to GBP76

million so far in 2022(1) ) through new lettings, indexation and

the capture of reversion, as well as from additions to our

profitable development programme.

"Over the past decade, the successful execution of our strategy

has created an irreplaceable portfolio of modern, sustainable

assets focused on markets with the tightest supply-demand dynamics,

underpinning significant reversionary potential and future rental

growth. Increases in interest rates and the volatile macro-economic

environment have reduced volumes in the investment markets, causing

asset prices to soften in the third quarter. However, we remain

focused on the fundamentals of our business -- owning, managing and

developing the highest-quality buildings whilst maintaining low

leverage and a strong balance sheet, thereby supporting the

delivery of attractive growth in earnings and dividends for our

shareholders."

(1) 9M 2021 rent roll growth: GBP64 million.

In this statement, space is stated at 100 per cent, whilst

financial figures are stated reflecting SEGRO's share of joint

ventures. Financial figures are stated for the period to, or at, 30

September unless otherwise indicated. The exchange rate applied is

EUR1.14:GBP1 as at 30 September 2022.

OPERATING SUMMARY & KEY METRICS Q3 2022 Q3 2021

ACTIVE ASSET MANAGEMENT CAPTURING RENTAL GROWTH AND GROWING THE RENT ROLL

(see Appendix):

Continued strong occupier demand has supported our ability to let new space

and grow rents in the standing portfolio through indexation-linked increases

and capturing accumulated reversion in the portfolio. Occupancy and

retention have both remained high.

Total new headline rent(1) signed during the period

(GBPm) 20 26

Pre-lets signed during the period (GBPm) 8 9

Uplift on rent reviews and renewals (%) 22 13

Occupancy rate (%) 96.7 96.8

Customer retention (%) 76 76

CAPITAL INVESTMENT FOCUSES ON DEVELOPMENT PIPELINE:

SEGRO's investment activity continues to be focused on the development

programme. Development capex for 2022, including infrastructure, still

expected to be c.GBP700 million. We note that CBRE UK Monthly Property Index

has shown a 10 per cent decline in UK industrial values during Q3.

Acquisitions(2) (GBPm) 424 140

Disposals (GBPm) 109 98

EXECUTING AND GROWING OUR DEVELOPMENT PIPELINE:

New pre-lets signed since half year have helped to expand development

pipeline with 1.3 million sq m of space, equivalent to GBP118 million of new

rent, under construction or in advanced discussions. Yield on cost for these

projects is 6.3 per cent (approximately 10 per cent yield on new money).

Development completions year-to date:

-- Space completed (sq m, at 100%) 419,100 450,000

-- Potential rent (GBPm, at share) (Rent secured) 20 (92%) 25 (93%)

Current development pipeline potential rent (GBPm) (Rent

secured) 86 (64%) 68 (66%)

Near-term development pipeline potential rent (GBPm) 32 24

(1) Headline rent is annualised gross passing rent receivable

once incentives such as rent-free periods have expired.

(2) All acquisitions during the period were land.

BALANCE SHEET 30 Sep 22 30 Jun 22

LONG-TERM, DIVERSIFIED DEBT PROFILE PROVIDES CERTAINTY AND FLEXIBILITY

Issuance of EUR750 million of five-year debt at a coupon of 3.75 per cent

for our SELP joint venture in early August to refinance 2023 SELP bonds. We

also drew down EUR225 million of US Private Placement notes (average

maturity 19 years) at an average coupon of 4.08 per cent during the period.

We have no further material refinancing requirements until 2026 and an 8.2

year average debt maturity (79 per cent of which is fixed or capped(1) ; the

floating rates exposure is mostly to three-month EURIBOR). A further 100bp

rise in benchmark rates from current levels would increase SEGRO's cost of

debt by 24 bps.

Net debt (GBPm) 5,414 4,764

Cost of debt (%) 2.1 1.6

LTV(2) (%) 26 23

Cash and available facilities (GBPm) 1,739 1,983

(1) 71 per cent is fixed, a further 8 per cent is capped once

3-month EURIBOR reaches 1.5 per cent.

(2) Based on values at 30 June 2022, adjusted for acquisitions,

disposals and other capital expenditure during the third

quarter.

Appendix

Leasing data for the period to 30 September(1 2)

Q3 2022 Q3 2021 9M 2022 9M 2021

Take-up of existing space (A) GBPm 5 9 15 19

Space returned(2) (B) GBPm (4) (7) (14) (17)

NET ABSORPTION OF EXISTING SPACE

(A-B) GBPm 1 2 1 2

Other rental movements (rent

reviews, renewals, indexation)

(C) GBPm 5 2 19 6

RENT ROLL GROWTH FROM EXISTING

SPACE GBPm 6 4 20 8

Take-up of developments completed

in the period -- pre-let space

(D) GBPm 2 15(3) 13 20

Take-up of speculative developments

completed in the past two years

(E) GBPm 4 6 9 10

TOTAL TAKE UP (A+C+D+E) GBPm 16 32 56 55

Less take-up of pre-lets and

speculative lettings signed in

prior periods GBPm (4) (15) (16) (21)

Pre-lets and lettings on

speculative developments signed in

the period for future delivery GBPm 8 9 36 30

RENTAL INCOME CONTRACTED IN THE

PERIOD(2) GBPm 20 26 76 64

Take-back of space for

redevelopment GBPm (1) (1) (3) (2)

(1) All figures reflect headline rent (annualised gross rental

income, after the expiry of any rent-free periods), exchange rates

at 30 September 2022 and include joint ventures at share.

(2) Excluding space taken back for redevelopment.

(3) 2021 comparator is high as development completions were

heavily weighted towards H2.

Financial calendar

The 2022 full year results will be published on Friday 17(th)

February 2023.

This Trading Update, the most recent Annual Report and other

information are available on the SEGRO website at

www.segro.com/investors.

About SEGRO

SEGRO is a UK Real Estate Investment Trust (REIT), listed on the

London Stock Exchange and Euronext Paris, and is a leading owner,

manager and developer of modern warehouses and industrial property.

It owns or manages 9.7 million square metres of space (104 million

square feet) valued at GBP23.8 billion serving customers from a

wide range of industry sectors. Its properties are located in and

around major cities and at key transportation hubs in the UK and in

seven other European countries.

For over 100 years SEGRO has been creating the space that

enables extraordinary things to happen. From modern big box

warehouses, used primarily for regional, national and international

distribution hubs, to urban warehousing located close to major

population centres and business districts, it provides high-quality

assets that allow its customers to thrive.

A commitment to be a force for societal and environmental good

is integral to SEGRO's purpose and strategy. Its Responsible SEGRO

framework focuses on three long-term priorities where the company

believes it can make the greatest impact: Championing Low-Carbon

Growth, Investing in Local Communities and Environments and

Nurturing Talent.

See www.SEGRO.com for further information.

Forward-Looking Statements: This announcement contains certain

forward-looking statements with respect to SEGRO's expectations and

plans, strategy, management objectives, future developments and

performance, costs, revenues and other trend information. These

statements are subject to assumptions, risk and uncertainty. Many

of these assumptions, risks and uncertainties relate to factors

that are beyond SEGRO's ability to control or estimate precisely

and which could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements. Certain statements have been made with reference to

forecast process changes, economic conditions and the current

regulatory environment. Any forward-looking statements made by or

on behalf of SEGRO are based upon the knowledge and information

available to Directors on the date of this announcement.

Accordingly, no assurance can be given that any particular

expectation will be met and you are cautioned not to place undue

reliance on the forward-looking statements. Additionally,

forward-looking statements regarding past trends or activities

should not be taken as a representation that such trends or

activities will continue in the future. The information contained

in this announcement is provided as at the date of this

announcement and is subject to change

without notice. Other than in accordance with its legal or

regulatory obligations (including under the UK Listing Rules and

the Disclosure Guidance and Transparency Rules of the Financial

Conduct Authority), SEGRO does not undertake to update

forward-looking statements, including to reflect any new

information or changes in events, conditions or circumstances on

which any such statement is based. Past share performance cannot be

relied on as a guide to future performance. Nothing in this

announcement should be construed as a profit estimate or profit

forecast. The information in this announcement does not constitute

an offer to sell or an invitation to buy securities in SEGRO plc or

an invitation or inducement to engage in or enter into any contract

or commitment or other investment activities. Neither the content

of SEGRO's website nor any other website accessible by hyperlinks

from SEGRO's website are incorporated in, or form part of, this

announcement.

CONTACT DETAILS FOR INVESTOR / ANALYST AND MEDIA ENQUIRIES:

SEGRO

Soumen Das (Chief Financial Officer)

Tel: +44 (0) 20 7451 9110

Claire Mogford (Head of Investor Relations)

Tel: +44 (0) 20 7451 9048

Gary Gaskarth (External Communications Manager)

Tel: +44 (0) 20 7451 9069

FTI Consulting

Richard Sunderland / Ellie Strickland / Eve Kirmatzis

Tel: +44 (0) 20 3727 1000

View source version on businesswire.com:

https://www.businesswire.com/news/home/20221019005853/en/

CONTACT:

SEGRO

SOURCE: SEGRO PLC

Copyright Business Wire 2022

(END) Dow Jones Newswires

October 20, 2022 02:00 ET (06:00 GMT)

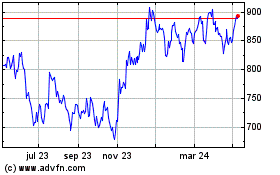

Segro (LSE:SGRO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

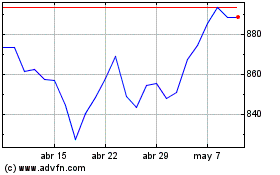

Segro (LSE:SGRO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024