TIDMSML

RNS Number : 8023I

Strategic Minerals PLC

21 April 2022

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018.

21 April 2022

Strategic Minerals plc

("Strategic Minerals", "SML" or the "Company")

Redmoor Update

10 Year Exploration Licence Extension

Strategic Minerals plc (AIM: SML; USOTC: SMCDY), a profitable

producing mineral company, is pleased to announce that its 100%

owned subsidiary Cornwall Resources Limited ("CRL") has signed a

10-year extension to its existing Redmoor exploration licence

agreement.

Highlights:

-- Redmoor Exploration Licence extended to 2037

-- 25-year Mining Lease option confirmed

-- General Permitted Development Order ("GPDO") application in progress

-- Recent commodity price increases likely to result in further

upside to project's internally estimated US $163m NPV (8%) despite

general increases in mining costs

The Redmoor exploration licence which provides the rights to

explore over the entire licence area was due to expire in 2027,

this has now been extended to a new end date of 18 October 2037.

There remains a mining lease option which provides the right for

CRL to enter into a 25-year mining lease (renewable for a further

25 years) over any part of the licence area. During the exploration

licence period, a modest annual licence fee is payable to the

vendor which converts to a 3% net smelter return vendor royalty on

mining commencement.

The original exploration licence was entered into by New Age

Exploration Limited in October 2012, whereby the rights were

acquired via an exploration licence and mining lease option

arrangement, over a 23km(2) area surrounding the Redmoor deposit in

East Cornwall.

CRL's most recent updated inferred mineral resource was produced

by Cornwall based consultants Geologica (UK) and totals 11.7 mt @

0.56% WO3, 0.16% Sn, and 0.50% Cu.

A GPDO application is currently in progress; seeking approval to

conduct a focused drilling programme which will target new tin

prospects in the Redmoor West area. The earlier trenching work, in

this area, has indicated potential near surface tin deposits which

could be likely to accelerate mining commencement.

With tin, tungsten and copper prices all significantly higher

than those utilised in the Company's update on the project's

projected economics (21 November 2021), the Directors believe that

the project after tax NPV at 8% pa is expected to further increase

from the US $163m previously reported. This is despite an expected

increase in mining costs since this time.

Commenting, Peter Wale, Executive Director of Strategic Minerals

and Director of CRL, said :

"We are pleased to have extended the original exploration

licence by an additional 10 years. This secures our footprint in

the region and adds long term confidence to the tenure of the

Redmoor project, which comes at a time when Cornish assets are

starting to attract ever greater interest and rising

valuations.

"Tin continues to attract wider coverage both within and beyond

the mining community and this has been reflected in the substantial

tin price appreciation since SML took full ownership of the

project. On top of that, tungsten is also quietly edging up and is

now approaching 8-year highs. There has been significant US oil and

gas industry demand for tungsten.

"The evolving Critical Minerals agenda is also seeing companies

consider more carefully where they are sourcing materials.

Heightened concerns on critical mineral supply in the US have also

resulted in the Defense Production Act being invoked to increase

domestic production of minerals used in both the EV space and the

wider clean energy economy. Last month Canadian miners secured a

total of C$3.8 billion in potential government funding to develop

critical minerals necessary for electric vehicles and other

technologies. We look forward to the UK Government taking a similar

stance."

For further information, please contact:

+61 (0) 414

Strategic Minerals plc 727 965

John Peters

Managing Director

Website: www.strategicminerals.net

Email: info@strategicminerals.net

Follow Strategic Minerals on:

Vox Markets: https://www.voxmarkets.co.uk/company/SML/

Twitter: @SML_Minerals

LinkedIn: https://www.linkedin.com/company/strategic-minerals-plc

+44 (0) 20 3470

SP Angel Corporate Finance LLP 0470

Nominated Adviser and Broker

Matthew Johnson

Ewan Leggat

Charlie Bouverat

Notes to Editors

Strategic Minerals plc:

Strategic Minerals plc is an AIM-quoted, profitable operating

minerals company. It has operations in the United States of America

and Australia along with a development project in the UK. The

Company is focused on utilising its operating cash flows, along

with capital raisings, to develop high quality projects aimed at

supplying the metals and minerals the Board considers likely to

benefit from future supply and demand factors.

In September 2011, Strategic Minerals acquired the distribution

rights to the Cobre magnetite tailings dam project in New Mexico,

USA, a cash-generating asset, which it brought into production in

2012 and which continues to provide a revenue stream for the

Company. This operating revenue stream is utilised to cover company

overheads and invest in progressing the Company's development

projects.

In May 2016, the Company entered into an agreement with New Age

Exploration Limited and, in February 2017, acquired 50% of the

Redmoor Tin and Tungsten project in Cornwall, UK. The bulk of the

funds from the Company's investment were utilised to complete an

initial drilling programme that year. This programme resulted in a

significant upgrade of the resource. This was followed in 2018 with

a 12-hole drilling programme which resulted in the resource update

announced in February 2019. In March 2019, the Company entered into

arrangements to acquire the balance of the Redmoor Tin and Tungsten

project. This was completed on 24 July 2019.

In March 2018, the Company completed the acquisition of the

Leigh Creek Copper Mine situated in the copper rich belt of South

Australia and brought the project into production in April

2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBKKBQPBKDFQB

(END) Dow Jones Newswires

April 21, 2022 02:00 ET (06:00 GMT)

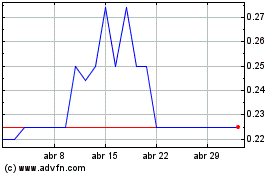

Strategic Minerals (LSE:SML)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Strategic Minerals (LSE:SML)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024