TIDMSOUC

RNS Number : 8011T

Southern Energy Corp.

29 November 2021

SOUTHERN ENERGY CORP. ANNOUNCES THIRD QUARTER FINANCIAL AND

OPERATING RESULTS

Calgary, Alberta - November 29, 2021 - Southern Energy Corp.

("Southern" or the "Company") (TSXV:SOU) (AIM:SOUC) today announces

the release of its third quarter financial and operating results

for the three and nine months ended September 30, 2021. The Company

also notes that an updated corporate presentation can now be found

on the Company's website at www.southernenergycorp.com.

Southern is an established producer with natural gas and light

oil assets in Mississippi and Alabama characterized by a stable,

low-decline production base, a significant low-risk drilling

inventory and strategic access to the best commodity pricing in

North America. Selected financial and operational information is

outlined below and should be read in conjunction with the Company's

consolidated financial statements (the "Financial Statements") and

related management's discussion and analysis (the "MD&A") for

the three and nine months ended September 30, 2021, which are

available on the Company's website at www.southernenergycorp.com

and have been filed on SEDAR.

All figures referred to in this news release are denominated in

Canadian dollars, unless otherwise noted.

Q3 2021 Highlights

-- $1.7 million of adjusted funds flow from operations[1] in Q3

2021, excluding $1.9 million of one-time expenses related to AIM

listing, a 51% increase from the same period in 2020

-- Average production of 12,237 Mcfe/d[2] (2,040 boe/d), 92%

natural gas in Q3 2021, a 7% decrease from the same period in

2020

-- Petroleum and natural gas sales of $6.6 million in Q3 2021,

an increase of 85% from the same period in 2020

-- As at September 30, 2021, Net Debt(1) of $19.2 million, a

reduction of $10.1 million or 35% from December 31, 2020

-- Net earnings of $5.5 million in Q3 2021 ($0.02 per share -

basic) compared to a net loss of $3.0 million in Q3 2020

-- Average realized oil and natural gas prices for Q3 2021 of

$85.50/bbl and $5.10/Mcf, respectively, reflecting the benefit of

strategic access to premium-priced US sales hubs

-- Completed a series of low-cost well recompletions and

workovers beginning in Q3 and carrying into early Q4 2021

o Work program had an overall cost of approximately $1.0 million

($0.9 million in Q3 2021) and added approximately 1,250 Mcfe/d[3]

(208 boe/d) of production (approximately 80% natural gas)

o At current strip pricing, the program is expected to payout in

approximately 4 - 5 months and add more than $1.6 million of cash

flow from operating activities in 2022 after payout

-- In August 2021, successfully completed admission of its

entire issued share capital to trading on the AIM market of the

London Stock Exchange plc

Subsequent Events

On November 24, 2021, Southern closed an equity financing for

aggregate gross proceeds of $12.7 million (US$10.1 million) through

the issuance of a total of 254.3 million common shares ("Common

Shares") (the "Offering"), of which $6.7 million was raised

pursuant to a private placement of 135.1 million Common Shares to

UK investors at a price of 2.94 pence per Common Share and the

remaining $6.0 million was raised pursuant to a short form

prospectus offering of 119.2 million Common Shares at a price of

$0.05 per Common Share.

Southern intends to use the net proceeds of the Offering to

drill up to three horizontal Selma Chalk wells in the Gwinville gas

field and for working capital and general corporate purposes. This

is expected to provide the business with additional near-term cash

flow generation.

Financial Highlights

Three months ended Nine months ended

September 30, September 30,

(000s, except $ per share) 2021 2020 2021 2020

----------------------------------------- ---------- --------- --------- ---------

Petroleum and natural gas sales $ 6,550 $ 3,537 $ 16,022 $ 9,412

Net earnings (loss) 5,549 (2,958) 8,659 (15,045)

Net earnings (loss) per share

Basic 0.02 (0.01) 0.03 (0.07)

Fully diluted 0.01 (0.01) 0.02 (0.07)

Adjusted funds flow from operations (1) (233) 1,136 1,798 2,564

Basic (0.00) 0.01 0.01 0.01

Fully diluted (0.00) 0.01 0.01 0.01

Capital expenditures 900 78 1,016 119

Weighted average shares outstanding

Basic 360,703 220,770 298,455 220,770

Fully diluted 517,550 220,770 399,169 220,770

As at period end

Basic common shares outstanding 361,297 220,770 361,297 220,770

Total assets 47,102 36,290 47,102 36,290

Non-current liabilities 17,176 12,583 17,176 12,583

Net debt (1) $ 19,246 $ 30,719 $ 19,169 $ 30,719

----------------------------------------- ---------- --------- --------- ---------

Notes:

(1) See "Reader Advisories - Non-IFRS Measures".

Outlook

Following completion of our aforementioned fundraise, Southern

intends to drill up to three horizontal Selma Chalk wells in the

Gwinville gas field shortly, with first production anticipated in

Q1 2022. The three wells will all be drilled from a common padsite

and then completed with multi-state stimulations.

The Company's long-term strategy remains consistent into the end

of 2021, with an unwavering commitment to environmental, social and

governance ("ESG") principles that support the continued

development and consolidation of prolific reservoirs that are

outside of the more expensive shale basins. Cost savings and

financial discipline will remain a priority through the continued

enhancement of operations and the ongoing evaluation of

opportunities to reduce operating and capital costs.

Southern thanks all of its stakeholders for their ongoing

support and looks forward to providing future updates on

operational activities supported by the Company's recently enhanced

financial flexibility and wider exposure to new pools of capital

with the AIM listing.

As part of its risk management and sustainability strategy,

Southern has entered into fixed price and costless collar hedges to

mitigate the effects of market volatility while retaining the

ability to participate in potential natural gas price appreciation

during the upcoming winter. Southern currently has hedges on a

total of 6,100 Mcf/d of natural gas production based on various

contracts through December 31, 2021 and 4,000 Mcf/d for calendar

2022. While the resulting realized losses on commodity contracts

had an impact on cash flow from operating activities as gas prices

rallied in the second half of 2021, Southern expects the impact

will moderate in 2022 as some of these older natural gas hedges

expire. A complete list of the fixed price and costless collar

contracts can be found within Southern's third quarter

MD&A.

Ian Atkinson, President and CEO of Southern, commented :

"This quarter has been defined by robust operational performance

from our core asset base amidst significantly increased cash flow

realisation. The results of our workover program late in Q3 are an

example of the low-cost high impact opportunities these type of

assets provide. Pairing this with our continued focus on strict

capital discipline, low debt and increased commodity prices we

receive due to our strategically located assets near to the Henry

Hub terminal, Southern finds itself in an enviable position as we

move onto our next phase of growth.

"The period ahead will include the drilling of three

high-impact, low-risk horizontal wells in the Gwinville gas field,

expected to begin production in Q1 2022, on which work will

commence imminently.

"This is an exciting time for the Company and our shareholders.

We look forward to embarking on the Gwinville work program and

updating shareholders on our progress."

For further information about Southern, please visit our website

at www.southernenergycorp.com or contact :

Southern Energy Corp.

Ian Atkinson (President and CEO) +1 587 287 5401

Calvin Yau (VP Finance and CFO) +1 587 287 5402

+44 (0) 20 7409

Strand Hanson Limited - Nominated & Financial 3494

Adviser

James Spinney / James Bellman

+44 (0) 20 7907

Hannam & Partners - Joint Broker 8500

Sam Merlin / Ernest Bell

Canaccord Genuity - Joint Broker +44 (0) 20 7523

Henry Fitzgerald-O'Connor / James Asensio 8000

Camarco +44 (0) 20 3757

James Crothers, Billy Clegg, Daniel Sherwen 4980

About Southern Energy Corp.

Southern Energy Corp. is a natural gas exploration and

production company. Southern has a primary focus on acquiring and

developing conventional natural gas and light oil resources in the

southeast Gulf States of Mississippi, Louisiana, and East Texas.

Our management team has a long and successful history working

together and have created significant shareholder value through

accretive acquisitions, optimization of existing oil and natural

gas fields and the utilization of re-development strategies

utilizing horizontal drilling and multi-staged fracture completion

techniques.

READER ADVISORY

MCFE Disclosure . Natural gas liquids volumes are recorded in

barrels of oil (bbl) and are converted to a thousand cubic feet

equivalent ("Mcfe") using a ratio of six (6) thousand cubic feet to

one (1) barrel of oil (bbl). Natural gas volumes recorded in

thousand cubic feet (Mcf) are converted to barrels of oil

equivalent ("boe") using the ratio of six (6) thousand cubic feet

to one (1) barrel of oil (bbl). Mcfe and boe may be misleading,

particularly if used in isolation. A boe conversion ratio of 6

mcf:1 bbl or a Mcfe conversion ratio of 1 bbl:6 Mcf is based in an

energy equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead. In addition, given that the value ratio based on the

current price of oil as compared with natural gas is significantly

different from the energy equivalent of six to one, utilizing a boe

conversion ratio of 6 mcf:1 bbl or a Mcfe conversion ratio of 1

bbl:6 Mcf may be misleading as an indication of value.

Throughout this press release, "crude oil" or "oil" refers to

light and medium crude oil product types as defined by National

Instrument 51-101 Standards of Disclosure for Oil and Gas

Activities ("NI 51-101"). References to "NGLs" throughout this

press release comprise pentane, butane, propane, and ethane, being

all NGLs as defined by NI 51-101. References to "natural gas"

throughout this press release refers to conventional natural gas as

defined by NI 51-101.

Forward Looking Statements . Certain information included in

this press release constitutes forward-looking information under

applicable securities legislation. Forward-looking information

typically contains statements with words such as "anticipate",

"believe", "expect", "plan", "intend", "estimate", "propose",

"project" or similar words suggesting future outcomes or statements

regarding an outlook. Forward-looking information in this press

release may include, but is not limited to, statements concerning

the Company's asset base including the development of the Company's

assets, future commodities pricing, the effect of market conditions

and the COVID-19 pandemic on the Company's performance, Southern's

planned ESG initiatives, expectations regarding Southern's well

recompletion and workover programs and the effects thereof on the

Company's financial position, expectations regarding the Company's

hedging program, expectations regarding the Offering and the use of

proceeds thereof, expected cost, production and timing of the Selma

Chalk wells, expected benefits from the Company's AIM listing,

future production levels, acquisition opportunities, costs/debt

reducing activities, the Company's capital program for the

remainder of 2021 and the funding thereof.

The forward-looking statements contained in this press release

are based on certain key expectations and assumptions made by

Southern, including the timing of and success of future drilling,

development and completion activities, the performance of existing

wells, the performance of new wells, the availability and

performance of facilities and pipelines, the geological

characteristics of Southern's properties, the characteristics of

the its assets, the successful application of drilling, completion

and seismic technology, benefits of current commodity pricing

hedging arrangements, prevailing weather conditions, prevailing

legislation affecting the oil and gas industry, commodity prices,

royalty regimes and exchange rates, the application of regulatory

and licensing requirements, the availability of capital, labour and

services, the creditworthiness of industry partners and the ability

to source and complete asset acquisitions.

Although Southern believes that the expectations and assumptions

on which the forward-looking statements are based are reasonable,

undue reliance should not be placed on the forward-looking

statements because Southern can give no assurance that they will

prove to be correct. Since forward-looking statements address

future events and conditions, by their very nature they involve

inherent risks and uncertainties. Actual results could differ

materially from those currently anticipated due to a number of

factors and risks. These include, but are not limited to, risks

associated with the oil and gas industry in general (e.g.,

operational risks in development, exploration and production; the

uncertainty of reserve estimates; the uncertainty of estimates and

projections relating to production, costs and expenses, and health,

safety and environmental risks), constraint in the availability of

services, negative effects of the current COVID-19 pandemic,

commodity price and exchange rate fluctuations, changes in

legislation impacting the oil and gas industry, adverse weather or

break-up conditions and uncertainties resulting from potential

delays or changes in plans with respect to exploration or

development projects or capital expenditures. These and other risks

are set out in more detail in Southern's MD&A and AIF.

The forward-looking information contained in this press release

is made as of the date hereof and Southern undertakes no obligation

to update publicly or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

unless required by applicable securities laws. The forward-looking

information contained in this press release is expressly qualified

by this cautionary statement.

Future Oriented Financial Information . Any financial outlook or

future oriented financial information in this press release, as

defined by applicable securities legislation, has been approved by

management of Southern. Readers are cautioned that any such

future-oriented financial information contained herein should not

be used for purposes other than those for which it is disclosed

herein. The Company and its management believe that the prospective

financial information has been prepared on a reasonable basis,

reflecting management's best estimates and judgments, and

represent, to the best of management's knowledge and opinion, the

Company's expected course of action. However, because this

information is highly subjective, it should not be relied on as

necessarily indicative of future activities or results.

Non-IFRS Measures. This press release provides certain financial

measures that do not have a standardized meaning prescribed by

IFRS. These non-IFRS financial measures may not be comparable to

similar measures presented by other issuers. Adjusted funds flow

from operations, operating netback, adjusted working capital and

net debt are not recognized measures under IFRS. Readers are

cautioned that these non-IFRS measures should not be construed as

alternatives to other measures of financial performance calculated

in accordance with IFRS. These non- IFRS measures provide

additional information that management believes is meaningful in

describing the Company's operational performance, liquidity and

capacity to fund capital expenditures and other activities.

Management uses adjusted funds flow from operations as a key

measure to assess the ability of the Company to finance operating

activities, capital expenditures and debt repayments. Management

considers operating netback an important measure to evaluate its

operational performance, as it demonstrates field level

profitability relative to current commodity prices. Management

monitors adjusted working capital and net debt as part of its

capital structure in order to fund current operations and future

growth of the Company. Southern's method of calculating these

measures may differ from other companies and accordingly, they may

not be comparable to measures used by other companies. Adjusted

funds flow from operations is calculated based on cash flow from

operative activities before changes in non-cash working capital and

cash decommissioning expenditures. Net debt is defined as long-term

debt plus adjusted working capital surplus or deficit. Operating

netback equals total oil and natural gas sales less royalties,

production taxes, operating expenses, transportation costs and

realized gain / (loss) on derivatives. Adjusted working capital is

calculated as current assets less current liabilities, removing

current derivative assets/liabilities, the current portion of bank

debt, and the current portion of lease liabilities. Please refer to

the MD&A for additional information relating to non-IFRS

measures, which is available on the Company's website at

www.southernenergycorp.com and filed on SEDAR.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release

[1] See "Non-IFRS Measures" under "Reader Advisory" below".

[2] Comprised of 149 bbl/d light and medium crude oil, 23 bbl/d

NGLs and 11,205 mcf/d conventional natural gas

[3] Comprised of 39 bbl/d light and medium crude oil, 2 bbl/d

NGLs and 1,000 mcf/d conventional natural gas

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTKVLFLFFLXFBK

(END) Dow Jones Newswires

November 29, 2021 02:00 ET (07:00 GMT)

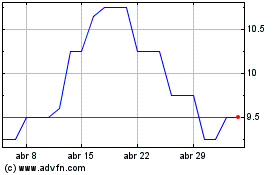

Southern Energy (LSE:SOUC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Southern Energy (LSE:SOUC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024