TIDMSSON

RNS Number : 5178U

Smithson Investment Trust PLC

02 August 2022

SMITHSON INVESTMENT TRUST PLC

LEI: 52990070BDK2OKX5TH79

INTERIM RESULTS ANNOUNCEMENT

Results for the six months ended 30 June 2022

The full Interim Report for the six months ended 30 June 2022

(the "Interim Report") can be found on the Company's website at

www.smithson.co.uk .

Financial Highlights

Net Asset Value

At At At

31 December

30 June 2022 30 June 2021 2021

Net assets GBP2,361,331,000 GBP2,796,700,000 GBP3,367,070,000

Net asset value ("NAV")

per

ordinary share ("share") 1,339.5p 1,746.6p 1,961.0p

Share price 1,185.0p 1,780.0p 2,020.0p

Share price (discount)/premium

to NAV(1) (11.5)% 1.9% 3.0%

------------------------------- ---------------- ---------------- ----------------

Performance Summary

For the period

from

Company's listing

on

19 October 2018

Six months ended Six months ended to

30 June 2022 30 June 2021 30 June 2022

% Change(2) % Change(2) % Change(2)

NAV total return per

share(1) (31.7)% +5.9% +33.9%

Share price total return(1) (41.3)% +4.1% +18.5%

Benchmark total return (13.7)% +12.4% +27.6%

Ongoing charges ratio(1) 0.9% 1.0% 1.0%

---------------------------- ---------------- ---------------- -----------------

Source: Bloomberg.

This report contains terminology that may be unfamiliar to some

readers. The Glossary section in the Interim Report gives

definitions for frequently used terms.

(1) These are Alternative Performance Measures ("APMs").

Definitions of these and other APMs used in this Interim Report,

together with how these measures have been calculated, are

disclosed in the APM section.

(2) Total returns are stated in GBP sterling.

Chairman's Statement

Introduction

I am pleased to present this Interim Report of Smithson

Investment Trust plc (the "Company") for the six months to 30 June

2022.

This is the first reporting period since 2018 for which the

Company has reported a fall in its net asset value. While this

decline is disappointing, it comes against the backdrop of a steep

decline in markets across the globe. In addition, the Company's

shares have started to trade at a discount to net asset value. The

Company's performance and the Board's efforts to address the

discount are summarised below and the Investment Manager's Review

explains the Company's performance in greater detail.

Performance

The decline in the Company's net asset value (NAV) per share for

the period was 31.7%, underperforming the MSCI World SMID Index by

18 percentage points. Despite this recent underperformance the

Company's annualised NAV per share total return since inception is

+8.2% compared with the +6.8% return from the index with dividends

reinvested.

The Company's shares, which have traded at a premium to its NAV

for the vast majority of the period from launch through to the end

of 2021, have now been trading at a discount for the last four

months. The discount at the end of the period was 11.5%, compared

with the premium of 3.0% at the end of December last year. With the

negative total return on the Company's NAV, the move from a modest

premium to a discount has resulted in the share price total return

for the period of -41.3%. The annualised share price total return

since inception to 30 June 2022 is +4.7%.

Premium/discount control

The Company was floated on the premium list of the London Stock

Exchange ("LSE") on 19 October 2018, breaking the record for the

largest IPO of an investment trust in the history of the LSE with

funds raised exceeding GBP822 million. From inception until March

2022 the Company continuously issued new shares at a premium to NAV

(net of all costs). The Company's shares began the year trading at

a 3% premium to NAV but in the second quarter the shares started

trading at a discount, which widened to over 11% at the end of

June. The average discount across the first half of the year was

3.5%, the first period of a sustained discount since the launch of

the Trust.

In response to the emergence of the discount, the Board, in

consultation with its advisers and the investment manager, has

sought to address the situation through the use of share buybacks.

The Company started to buy back shares at the end of April, and by

the end of June had acquired just under 0.5% of the total shares in

issue. A further 0.5% has since been bought back and at the end of

July, the discount was 6.3%.

The Company intends to continue with its current programme of

regular market purchases whilst the shares trade at a material

discount. All shares purchased are held in Treasury and will only

be reissued at a premium, net of all costs.

Dividends

The Company generated a revenue return in the first half of GBP7

million, thanks to an unusually high level of non-regular dividends

from its investments; this is not expected to be repeated at the

same level in the remainder of the year.

The Company's objective is to focus on capital growth and its

accounting policies are not designed to facilitate maximisation of

revenue reserves and dividend payments. In accordance with the

Company's policy, an interim dividend is not proposed by the

Board.

Whilst the position will be kept under review, there is no

current intention to change the dividend policy. It should not be

expected that the Company will pay a significant annual dividend

and it is likely that no interim dividends will be declared, but

the Board intends to declare such annual dividends as are necessary

to maintain the Company's UK investment trust status.

Investment approach

In common with all funds managed by Fundsmith, the Company has a

focused strategy of investing in high-quality, listed company

shares, seeking not to overpay for those shares and then holding

them as long-term investments; the Company does not use derivatives

and has no borrowings. The Investment Manager also considers

Environmental, Social and Governance ("ESG") and other

sustainability issues when implementing the Company's investment

strategy.

The composition of the portfolio at 30 June 2022 is shown below,

and the Investment Manager's Review explains the investment

performance and the evolution of the portfolio during the first

half of 2022 in detail.

Investment policy

At the Company's AGM in April, shareholders approved a revision

to the investment policy, which clarifies that the investment

restriction as to market capitalisation range applies at the time

of initial investment in a company and removed the expectation of

the average market capitalisation of investee companies. This

change, which came into effect on 3 May 2022, has had no effect, in

any way, on how the Company's investments are managed.

Governance

I took over as Chair of the Board at the end of February 2022

and Lord St John of Bletso replaced me as Chair of the Audit

Committee. Jeremy Attard-Manche joined the Board on 1 March and is

Chair of the Management Engagement Committee. As part of our

succession planning and to broaden the experience and diversity of

the Board, Denise Hadgill was appointed as a Director of the

Company with effect from 1 June 2022.

Outlook

Since the start of this year the world's stock markets have

experienced significant falls and this period has clearly been a

very challenging one for investors. Higher interest rates, the

spectre of inflation and recession as well as the continuing war in

Ukraine continue to weigh on investor sentiment, particularly in

respect of growth companies. This does, however, also provide

opportunities for investment and shareholders will note that both

the investment manager and I have bought more shares in the Company

in the last few months.

Our investment manager focuses on investing in companies which

it believes can compound in value over many years. Owning high

quality companies capable of sustainable growth is a strategy that

has been shown to work well over the long term, through many

economic cycles, and the Board has confidence that the investment

manager can execute the strategy successfully.

The Company continues to offer investors exposure to some of the

best companies available in the global small and mid-cap sector and

the Board believes that the long-term investor will be well

rewarded.

Diana Dyer Bartlett

Chairman

1 August 2022

Investment Manager's Review

Dear Fellow Shareholder,

The performance of Smithson Investment Trust ('Smithson'), along

with comparators, is laid out below. For the first half of 2022 the

Net Asset Value per share (NAV) of the Company decreased by 31.7%

and the share price declined by 41.3%. Over the same period, the

MSCI World Small and Mid Cap Index ('MSCI World SMID'), our

reference index, declined by 13.7%. We also provide the performance

of UK bonds and cash for comparison.

Launch

to 30.06.22

--------------------- ----------------------

Total Return(5)

01.01.22

to 30.06.2022 Cumulative Annualised

% % %

--------------------- --------------- ---------- ----------

Smithson NAV(1) -31.7 +33.9 +8.2

Smithson Share Price -41.3 +18.5 +4.7

Small and Midcap

Equities(2) -13.7 +27.6 +6.8

UK Bonds(3) -7.1 -1.6 -0.4

Cash(4) +0.3 +1.7 +0.5

--------------------- --------------- ---------- ----------

(1) Source: Bloomberg, starting NAV 1000.

(2) MSCI World SMID Cap Index, GBP Net source: www.msci.com.

(3) Bloomberg/Barclays Bond Indices UK Govt 5-10 yr, source:

Bloomberg.

(4) Month GBP LIBOR Interest Rate source: Bloomberg.

(5) Alternative Performance Measure.

This is by far the worst period of performance since the

inception of the Trust and I will therefore discuss it in some

detail. There appear to have been three key factors building upon

each other to cause the poor performance. First came inflation,

then rising interest rate expectations and most latterly, fears of

recession.

Although inflation started to accelerate from a very low level

at the start of 2021, the market was relatively sanguine about this

for some time, owing to commentary from central banks depicting

these initial price rises as 'transitory', brought about by short

term shortages in component, freight and labour supply due to the

effects of the pandemic. Meaningful concerns regarding inflation

didn't start to surface until late last year, when these same

central banks publicly concluded that perhaps inflation might be

more persistent than they initially believed, and will only be

quelled with aggressive monetary tightening. This problem was then

exacerbated by higher energy and food costs; a consequence of the

war in Ukraine.

Around the same time, and for obvious reasons, the market

started to become transfixed on a future economic environment

weighed down by higher interest rates. For illustration, back in

December 2021, the market appeared to be pricing in just two

interest rate increases of 0.25% by the US Federal Reserve in 2022.

By June 2022, not only had we already had the equivalent of six

0.25% raises, but the market was now expecting a further 1.75%

increase before the end of the year. This was a very sharp

adjustment, and it is likely that this movement in future interest

rate expectations did the most damage to market values.

Fears of recession are a natural extension of increasing

interest rate expectations and these concerns have intensified as

the year has gone on. There is now discussion of recession in many

countries including the US, UK, The Eurozone, Japan, Australia and

Canada. The trend of falling long bond yields over the last few

weeks is a likely consequence of this, as is the inversion of the

yield curve, where 2 year bond yields become higher than 10 year

yields, a phenomenon occurring prior to recessions in the past.

These three issues have affected both the market and the

portfolio, but have done so in different ways and to varying

degrees. To our minds, it has been the second point, interest rate

expectations, that has affected the performance of the fund the

most. This is because the high quality, growing companies that we

invest in typically have higher ratings than the rest of the

market, and by the end of 2021, this was particularly true.

As the central banks began discussing rate hikes more

vociferously from the start of this year, and the interest rate

expectations of the market moved rapidly, the value of the future

earnings of our companies, a substantial component of their overall

valuation, became more heavily discounted by the market. Indeed, it

is the change in expectations, rather than official interest rate

hikes, that have done the damage to valuations, the market being a

forward-looking discounting machine.

It therefore stands to reason that the pressure on the ratings

of our companies will be relieved once interest rate expectations

stabilise. This, in turn, likely requires us to observe the peak in

inflation, because once that stops increasing, we can get a sense

for the size and shape of the interest rate cycle that will be

required to tame it. While the actual peak will be determined after

the fact, by a few months of declining inflation data to prove the

case, we can still hope that we are living through the peak of

inflation now.

The reason we are less concerned about the impact of inflation

on the companies in the portfolio is because, as often described,

our companies tend to have high gross margins and low capital

requirements, which mean that they are less susceptible to cost

increases than other companies. They are also in strong competitive

positions, which typically allows them to increase prices to offset

the higher costs, should they choose to do so.

High quality companies should also fare reasonably well during a

recession, particularly if it is mild as is currently being

forecast. In general, our companies are not particularly cyclical

and have strong balance sheets, which means that if anything, they

will appear more attractive during a recession compared to others

in the market.

To illustrate the impact of the issues above, it is useful to

look more closely at how the market has performed year-to-date, as

the recent turmoil has led to wide differences in the performance

of sectors within the market. The table below shows the sector

performance for our reference index, alongside the exposure of the

portfolio to each sector.

Six months to 30 June 2022 Sector Performance

SMITHSON

MSCI W SMID

Sectors (%) WEIGHT (%)

---------------------------------------------- ----------- ----------

Energy +41% -

Utilities +11% -

Consumer Staples -1% 4%

Financials -8% 3%

Materials -9% -

Real Estate -11% -

Communication Services -15% 4%

Industrials -15% 19%

Health Care -16% 14%

Consumer Discretionary -24% 13%

Information Technology -24% 44%

---------------------------------------------- ----------- ----------

As becomes clear from the table, those sectors which have been

the worst performing in the index, namely Information Technology,

Consumer Discretionary, Health Care and Industrials, happen to be

those to which Smithson is most exposed.

We did not set out to engineer this particular exposure, it is

simply a natural consequence of our strategy, seeking high quality

growing companies which generate strong shareholder returns over

the long term, most of which are to be found in these sectors. On

top of this, the only sectors to increase in price during the first

half are Energy and Utilities; commodity and regulated industries

which have little control over their own destiny, and therefore

areas in which we will never invest.

We hope this brings some further explanation, although likely

little comfort, as to why the portfolio is down to the extent that

it is.

What might bring more comfort, is that we remain confident in

the fundamentals of the companies owned in the portfolio. Indeed,

the results they reported in the first quarter were on the whole

strong, with several companies producing revenue growth well above

20%, although of course this is now ancient history. We wait to see

how they will perform in the next recessionary environment, should

it transpire, but we are optimistic that their low cyclicality,

high margins and strong competitive positions will stand them in

good stead.

On top of this, valuations are now more attractive. The free

cash flow yield (the cash generated divided by the market value) of

the portfolio is at 3.3%, having been as low as 2.0% at the end of

2021. To put this into historical perspective, the fund was trading

at a similar level at the end of 2018.

Given the turbulent markets since the start of the year, trading

activity increased significantly, which meant that discretionary

portfolio turnover, excluding the investment of proceeds from new

shares issued, was 28.1% for the period, compared to just 2.3% this

time last year. While we aim to 'do nothing' with our holdings, we

still try to take advantage of low share prices when the market

deigns to offer them.

Annualised costs in the first half were slightly lower, with an

Ongoing Charges Figure of 0.9% compared to 1.0% in the first half

of last year. This reduction arises because the Investment

Manager's fee is based on the Company's market capitalisation

rather than its NAV, and the charge will therefore be lower for a

period during which the Company's shares have traded at a discount.

Costs of dealing, including taxes, amounted to 0.02% of NAV in the

period, close to that incurred last year. This may seem odd given

the elevated discretionary turnover, but the reason for this is

that the overall turnover of the fund, including the investment of

the proceeds from share issuance, was actually similar to last

year.

We bought two new companies in the first half after the decline

in their share prices brought their valuations into attractive

territory. Moncler is an Italian clothing company which designs and

produces high-end branded apparel. It traces its roots back to 1952

and its invention of down filled mountaineering coats, but fell on

harder times in the 1990s before being rejuvenated in the 2000's.

It now produces luxury items across most categories in clothing and

accessories. The company has until recently been expanding by

opening new Moncler branded stores but this changed when it

acquired the Stone Island brand in 2020. Stone Island is another

Italian luxury clothing company which today has a similar profile

to Moncler's in 2000 and why management believe they can greatly

improve and grow the Stone Island brand, much as they have done

over the last 20 years with Moncler.

The second new position is in a Swedish industrial company

called Addtech. Since the inception of the fund, we have

experienced success in owning decentralised industrial

conglomerates such as Halma and Diploma. While the organic growth

of these businesses is acceptable, around the mid-single digit

percent level, it is the consistent, disciplined acquisition of

small, high quality 'bolt-on' companies that allow the groups to

create substantial shareholder value over time. Addtech is another

example of these types of businesses, with a very small head office

directing the allocation of the cash flow that is generated by its

independently managed businesses. Addtech itself has 140

subsidiaries and 3,000 employees grouped into five industrial

business areas including Industrial Process, Energy, Automation,

Components and Power Solutions. Its origins date back to 1906 and

it has had the same business concept for over 100 years. At the

very least, this is one where we can be confident in its direction

over the next decade and beyond.

We also sold one company in the period, a US based boiler and

heater manufacturer called AO Smith. While the company has a very

attractive US business operating in a tight oligopoly, its future

growth opportunities lie in areas with much more aggressive

competition, such as water heaters in China and water purification

in the US and abroad. For this reason, we became less optimistic on

its ability to sustain profitable growth over time and decided to

sell.

To discuss other specific events which affected the portfolio

during the period, we have set out the top five contributors and

five largest detractors of performance below:

Country Contribution%

--------------------- --------------- -------------

Fevertree Drinks United Kingdom -2.8%

Ambu Denmark -2.0%

Nemetschek Germany -1.7%

Domino's Pizza Group United Kingdom -1.6%

Rightmove United Kingdom -1.5%

--------------------- --------------- -------------

It seems appropriate to begin with the detractors and Fevertree

was our worst performing position for a couple of reasons. First,

the inflation they have suffered in logistics (until recently much

of their product was shipped around the world from bottling plants

in the UK and Europe) and packaging including glass and tin, has

compressed the gross margin from over 50% in 2019 to under 40% by

the end of this year. This decline in margin has taken place

because the management decided not to put up prices in the face of

increasing costs, as they wanted to maintain the strong sales

momentum that they are enjoying in markets such as the US. This

leads us to the second issue: the growth the company has seen over

the last two years meant that the company was being rated highly by

the market in relation to the cash flow that was produced last

year. Despite a recent update from the company confirming weaker

margins for this year due to higher costs, we remain holders as we

believe that over time the company can improve the margin and with

continued growth in revenue alongside this, the potential for

future cash generation is substantial.

Ambu's extremely strong growth in medical device sales recorded

during the initial stages of Covid has gradually petered out as the

pandemic subsided. This slowdown coincided with a period of heavy

investment by the company to grow its sales and research teams,

suppressing margins and cash flow, in advance of several product

launches that it is expecting to make in 2022 and beyond. The final

straw as far as the market was concerned came when the Board fired

the CEO for not taking a more gradual path to the corporate

transformation. We have yet to hear from the new CEO, who was

immediately appointed, but have been assured by the Chair of the

supervisory board that the current strategy, which we continue to

support, will remain in place but may be executed less

aggressively.

Change in management was also an issue at Domino's Pizza Group

and Rightmove where the CEOs of both companies resigned during the

period to pursue other opportunities. Having looked very carefully

into both cases, including speaking to the Chairs of the respective

supervisory boards, we are satisfied that there was nothing

untoward about the departures, and that both had personal reasons

for leaving.

Nemetschek is a German technology company selling design

software to architects and construction firms as well as for media

special effects. Despite the company reporting strong results

during the period, the shares likely underperformed due to the high

rating they had attained last year, attributed to the track record

of significant growth over the last few years, and so the valuation

was susceptible to the change in interest rate expectations already

discussed.

Country Contribution%

--------------- -------------- -------------

Rollins United States 0.2%

Qualys United States 0.1%

Addtech Sweden -0.4%

Technology One Australia -0.4%

Fortinet United States -0.4%

--------------- -------------- -------------

Surprisingly perhaps, there were a couple of positions that

contributed positive performance to the fund. One of these was

Rollins, a US pest control company. This is a business with highly

repeatable earnings, given that in some parts of the US where it

operates it is necessary to have frequent visits from pest control

to keep buildings habitable. This leads to much of its revenue

being paid on subscription and thus fairly dependable, which is

almost certainly why the shares performed well in a period of

concerns regarding inflation and recession.

Qualys, the US software company, also managed to eke out a gain,

with further free cash flow growth disclosed in the first quarter

results pleasing the market, as well as operating in an industry -

cyber security - that should still be in high demand whatever

occurs in the economy. Fortinet is in a similar position, as a US

based cyber security provider, allowing it to also make it into the

top five performers of the portfolio.

The position in Addtech benefited relative to the rest of the

portfolio from the fact that we bought it after declines in its

share price at the start of the year. It has also continued making

small acquisitions as the year has progressed, suggesting that the

growth of the company continues unabated, despite the tougher

markets.

Finally, Technology One is a software company based in Australia

that sells management software systems to institutions such as

schools and governments. As these customers tend to be more

insulated from recession, the shares have held up well amid the

growing market concerns.

We have provided a breakdown of the portfolio in terms of sector

and geography at the end of June 2021 and June 2022 for comparison

below. The median year of foundation of the companies in the

portfolio at the period end was 1972.

Sector

30 June 2022 30 June 2021

Sector (%) (%)

----------------------- ------------ ------------

Information Technology 44% 43%

Industrials 19% 22%

Healthcare 13% 9%

Consumer Discretionary 13% 10%

Consumer Staples 4% 4%

Communication Services 3% 5%

Financials 3% 3%

Materials - 2%

Cash - Uninvested 1% 2%

----------------------- ------------ ------------

Source: Fundsmith

The weighting of Information Technology is one percentage point

higher than a year ago which can largely be put down to the

outperformance of the cyber security companies mentioned above,

making up for the relative weakness of the rest of the technology

sector. The Industrials sector was three percentage points lower,

despite the new position in Addtech, as AO Smith was sold from the

portfolio along with trims of other industrial positions.

Healthcare increased meaningfully, by over four percentage points,

as we added to healthcare names such as Recordati, Ambu and Masimo.

Consumer Discretionary decreased, despite adding Moncler as a new

position, partly due to underperformance and partly because we

trimmed companies such as Domino's Pizza Enterprises. The absence

of a position in the Materials sector in 2022 was due to the sale

of Chr. Hansen last year.

30 June 2022 30 June 2021

Country of Listing (%) (%)

------------------- ------------ ------------

USA 44% 47%

UK 17% 21%

Italy 9% 4%

Switzerland 7% 7%

Denmark 7% 6%

Australia 6% 7%

Germany 5% 5%

New Zealand 2% 1%

Sweden 2% -

Cash 1% 2%

------------------- ------------ ------------

Source: Fundsmith

Looking at the geographical split of the portfolio, notable

changes included the US weighting, which decreased due to the sale

of AO Smith and other reductions in position sizes. The UK also

declined in weight as we trimmed positions whilst the boost to

Italy and Sweden was from the purchase of Moncler and Addtech.

The geographic exposure that matters the most, however, is where

the sales of our companies actually come from, as shown below.

30 June 2022 30 June 2021

Source of Revenue (%) (%)

----------------------------- ------------ ------------

Europe 38% 38%

North America 37% 36%

Asia Pacific 19% 19%

Eurasia, Middle East, Africa 4% 4%

Latin America 2% 3%

----------------------------- ------------ ------------

Source: Fundsmith. Portfolio weightings as of 30 June 2022 and

30 June 2021

This demonstrates that the geographical weighting of revenue is

relatively balanced, with similar exposure to North America and

Europe, and with meaningful exposure to Asia Pacific. While

Smithson only invests in companies listed in developed markets,

some of those companies do have revenue coming from emerging

markets, as represented by the 4% from Eurasia, Middle East and

Africa and 2% from Latin America as well as a portion of the Asia

Pacific revenue. As is apparent from the tables, despite the

trading activity and relative performance, very little has changed

in terms of overall geographical exposure.

Finally, we would like to thank all shareholders for their

support of Smithson Investment Trust during this difficult period.

We don't know how long this may last, but we continue undeterred in

investing in high quality, growing businesses, and remain confident

in the fundamentals of the companies in the portfolio. We look

forward to enjoying a better performance when the market once again

appreciates these attractive assets.

Simon Barnard

Fundsmith LLP

Investment Manager

1 August 2022

Investment Portfolio

Investments held as at 30 June 2022

Country of Fair value %

Security incorporation GBP'000 of investments

--------------------------- --------------- ---------- ---------------

Recordati Italy 116,446 5.0

Moncler Italy 109,869 4.7

Temenos Switzerland 108,100 4.6

Sabre USA 102,853 4.4

Fortinet USA 102,074 4.3

Simcorp Denmark 94,993 4.0

Qualys USA 92,421 3.9

Fevertree Drinks UK 90,929 3.9

Verisign USA 88,026 3.7

Rightmove UK 87,931 3.7

--------------------------- --------------- ---------- ---------------

Top 10 Investments 993,642 42.2

-------------------------------------------- ---------- ---------------

Technology One Australia 77,920 3.3

Masimo USA 77,861 3.3

Domino's Pizza Group UK 77,152 3.3

Verisk Analytics USA 71,530 3.0

ANSYS USA 71,409 3.0

Equifax USA 70,577 3.0

Cognex USA 68,262 2.9

MSCI USA 67,910 2.9

Domino's Pizza Enterprises Australia 67,186 2.9

Ambu Denmark 64,861 2.8

--------------------------- --------------- ---------- ---------------

Top 20 Investments 1,708,310 72.6

-------------------------------------------- ---------- ---------------

Nemetschek Germany 63,507 2.7

IPG Photonics USA 62,688 2.7

Diploma UK 59,709 2.5

Fisher & Paykel Healthcare New Zealand 59,274 2.5

Paycom Software USA 56,462 2.4

Rational Germany 56,252 2.4

Geberit Switzerland 52,734 2.2

Rollins USA 51,681 2.2

Wingstop USA 48,632 2.1

Halma UK 46,631 2.0

Addtech Sweden 46,546 2.0

Spirax-Sarco Engineering UK 37,648 1.7

--------------------------- --------------- ---------- ---------------

Total Investments 2,350,074 100.0

-------------------------------------------- ---------- ---------------

Investment Objective and Policy

Investment Objective

The Company's investment objective is to provide shareholders

with long term growth in value through exposure to a diversified

portfolio of shares issued by listed or traded companies.

Investment Policy

The Company's investment policy is to invest in shares issued by

small and mid-sized listed or traded companies globally with a

market capitalisation (at the time of initial investment) of

between GBP500 million to GBP15 billion. The Company's approach is

to be a long-term investor in its chosen shares. It will not adopt

short-term trading strategies. Accordingly, it will pursue its

investment policy by investing in approximately 25 to 40 companies

as follows:

(a) the Company can invest up to 10 per cent. in value of its

gross assets (as at the time of investment) in shares issued by any

single body;

(b) not more than 20 per cent. in value of its gross assets (as

at the time of investment) can be in deposits held with a single

body. This limit will apply to all uninvested cash (except cash

representing distributable income or credited to a distribution

account that the depositary holds);

(c) not more than 20 per cent. in value of its gross assets (as

at the time of investment) can consist of shares issued by the same

group. When applying the limit set out in (a) this provision would

allow the Company to invest up to 10 per cent. in the shares of two

group member companies (as at the time of investment);

(d) the Company's holdings in any combination of shares or

deposits issued by a single body must not exceed 20 per cent. in

value of its gross assets (as at the time of investment);

(e) the Company must not acquire shares issued by a body

corporate and carrying rights to vote at a general meeting of that

body corporate if the Company has the power to influence

significantly the conduct of business of that body corporate (or

would be able to do so after the acquisition of the shares). The

Company is to be taken to have power to influence significantly if

it exercises or controls the exercise of 20 per cent. or more of

the voting rights of that body corporate; and

(f) the Company must not acquire shares which do not carry a

right to vote on any matter at a general meeting of the body

corporate that issued them and represent more than 10 per cent. of

the shares issued by that body corporate.

The Company may also invest cash held for working capital

purposes and awaiting investment in cash deposits and money market

funds.

For the purposes of the investment policy, certificates

representing certain shares (for example, depositary interests)

will be deemed to be shares.

Hedging Policy

The Company will not use portfolio management techniques such as

interest rate hedging and credit default swaps.

The Company will not use derivatives for purposes of currency

hedging or for any other purpose.

Borrowing Policy

The Company has the power to borrow using short-term banking

facilities to raise funds for short-term liquidity purposes or for

discount management purposes including the purchase of its own

shares, provided that the maximum gearing represented by such

borrowings shall be limited to 15 per cent. of the net asset value

at the time of drawdown of such borrowings. The Company may not

otherwise employ leverage.

Interim Management Report

The Directors are required to provide an Interim Management

Report in accordance with the FCA's Disclosure Guidance and

Transparency Rules. The Directors consider that the Chairman's

Statement and the Investment Manager's Review respectively, provide

details of the important events which have occurred during the

period and their impact on the condensed set of financial

statements. The following statements on principal risks and

uncertainties, related party transactions and the Directors'

responsibility statement below, together constitute the Interim

Management Report for the Company for the period from 1 January

2022 to 30 June 2022.

Principal risks and uncertainties

The Board considers that the principal risks and uncertainties

faced by the Company can be summarised as (i) investment objective

and policy risk, (ii) market risks, (iii) outsourcing risks, (iv)

key individuals' risk and (v) regulatory risks. A detailed

explanation of risks and uncertainties can be found on pages 21 to

23 of the Company's most recent Report and Accounts for the year

ended 31 December 2021. This also includes details of the market

and outsourcing risks and economic impact associated with the

COVID-19 pandemic and the war in Ukraine. The Board continues to

monitor the potential risks to the Company and its portfolio posed

by these issues and received regular updates and assurance from the

Investment Manager and other key service providers on operational

resilience and portfolio exposure and impact from the Ukraine

conflict.

A review of the period and the outlook can be found in the

Chairman's Statement and in the Investment Manager's Review.

Related Party Transactions

The Company's Investment Manager, Fundsmith LLP, is considered a

related party in accordance with the Listing Rules. There have been

no changes to the nature of the Company's related party

transactions since the Company's most recent Report and Accounts

for the period ended 31 December 2021 were released. Details of the

amounts paid to the Company's Investment Manager and the Directors

during the period are detailed in the notes to the financial

statements.

Directors' responsibility statement

The Directors confirm to the best of their knowledge that:

-- the Interim Management Report includes a fair review of the

information required by Disclosure and Transparency Rule 4.2.7R

(indication of important events during the first six months, their

impact on the condensed set of Financial Statements and a

description of the principal risks and uncertainties for the

remaining six months of the year); and

-- the Interim Financial Report includes a fair review of the

information required by Disclosure and Transparency Rule 4.2.8R

(disclosure of related party transactions and changes therein).

On behalf of the Board of Directors

Diana Dyer Bartlett

Chairman

1 August 2022

Condensed Statement of Comprehensive Income (Unaudited)

Unaudited Unaudited Audited

Six months ended Six months ended Year ended

30 June 2022 30 June 2021 31 December 2021

---------------------------------- --------------------------- ---------------------------

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- ----- -------- ----------- ----------- -------- ------- -------- -------- ------- --------

Income from

investments

held at fair

value through

profit or

loss 4 22,285 - 22,285 12,841 - 12,841 21,638 - 21,638

(Losses)/gains

on investments

held at fair

value through

profit or

loss 3 - (1,093,717) (1,093,717) - 155,125 155,125 - 513,312 513,312

Foreign exchange

gains/(losses) 76 (940) (864) (36) (264) (300) (25) (565) (590)

Investment

management

fees (11,808) - (11,808) (11,682) - (11,682) (25,884) - (25,884)

Other expenses

and transaction

costs (847) (553) (1,400) (842) (390) (1,232) (1,583) (639) (2,222)

----------------- ----- -------- ----------- ----------- -------- ------- -------- -------- ------- --------

Profit/(loss)

before tax 9,706 (1,095,210) (1,085,504) 281 154,471 154,752 (5,854) 512,108 506,254

----------------- ----- -------- ----------- ----------- -------- ------- -------- -------- ------- --------

Tax (2,312) - (2,312) (1,246) - (1,246) (2,540) - (2,540)

----------------- ----- -------- ----------- ----------- -------- ------- -------- -------- ------- --------

Profit/(loss)

for the period 5 7,394 (1,095,210) (1,087,816) (965) 154,471 153,506 (8,394) 512,108 503,714

----------------- ----- -------- ----------- ----------- -------- ------- -------- -------- ------- --------

Return/(loss)

per share

(basic and

diluted)

(p) 5 4.20 (621.79) (617.59) (0.63) 101.32 100.69 (5.27) 321.50 316.23

----------------- ----- -------- ----------- ----------- -------- ------- -------- -------- ------- --------

The Company does not have any income or expenses which are not

included in the profit for the period.

All of the profit and total comprehensive income for the period

is attributable to the owners of the Company.

The "Total" column of this statement represents the Company's

Income Statement, prepared in accordance with International

Financial Reporting Standards (IFRS). The "Revenue" and "Capital"

columns are supplementary to this and are prepared under guidance

published by the Association of Investment Companies (AIC).

All items in the above statement derive from continuing

operations.

The accompanying notes are an integral part of these financial

statements.

Condensed Statement of Financial Position (Unaudited)

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

2022 2021 2021

Notes GBP'000 GBP'000 GBP'000

-------------------------------------- ----- --------- --------- -----------

Non-current assets

Investments held at fair value

through profit or loss 3 2,350,074 2,752,110 3,339,150

-------------------------------------- ----- --------- --------- -----------

Current assets

Receivables 2,562 3,296 1,203

Cash and cash equivalents 17,750 45,342 32,081

-------------------------------------- ----- --------- --------- -----------

20,312 48,638 33,284

-------------------------------------- ----- --------- --------- -----------

Total assets 2,370,386 2,800,748 3,372,434

-------------------------------------- ----- --------- --------- -----------

Current liabilities

Trade and other payables (9,055) (4,048) (5,364)

-------------------------------------- ----- --------- --------- -----------

Total assets less current liabilities 2,361,331 2,796,700 3,367,070

-------------------------------------- ----- --------- --------- -----------

Equity attributable to equity

shareholders

Share capital 7 1,771 1,601 1,717

Share premium 2,219,487 1,906,951 2,126,997

Capital reserve 143,685 891,725 1,249,362

Revenue reserve (3,612) (3,577) (11,006)

-------------------------------------- ----- --------- --------- -----------

Total equity 2,361,331 2,796,700 3,367,070

-------------------------------------- ----- --------- --------- -----------

Net asset value per share (p) 6 1,339.5 1,746.6 1,961.0

-------------------------------------- ----- --------- --------- -----------

The accompanying notes are an integral part of these financial

statements.

Condensed Statement of Changes in Equity (Unaudited)

For the six months ended 30 June 2022 (Unaudited)

Share Share Capital Revenue

capital premium reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ------- --------- ----------- -------- -----------

Balance at 1 January 2022 1,717 2,126,997 1,249,362 (11,006) 3,367,070

Issue of new shares on secondary

market 54 93,050 - - 93,104

Costs on new share issues

on secondary market - (560) - - (560)

Ordinary shares bought back

and held in treasury - - (10,430) - (10,430)

Costs on buybacks - - (37) - (37)

(Loss)/profit for the period - - (1,095,210) 7,394 (1,087,816)

--------------------------------- ------- --------- ----------- -------- -----------

Balance at 30 June 2022 1,771 2,219,487 143,685 (3,612) 2,361,331

--------------------------------- ------- --------- ----------- -------- -----------

For the six months ended 30 June 2021 (Unaudited)

Share Share Capital Revenue

capital premium reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ------- --------- ----------- -------- -----------

Balance at 1 January 2021 1,414 1,595,894 737,254 (2,612) 2,331,950

Issue of new shares on secondary

market 187 312,818 - - 313,005

Costs on new share issues

on secondary market - (1,761) - - (1,761)

Profit/(loss) for the period - - 154,471 (965) 153,506

--------------------------------- ------- --------- ----------- -------- -----------

Balance at 30 June 2021 1,601 1,906,951 891,725 (3,577) 2,796,700

--------------------------------- ------- --------- ----------- -------- -----------

For the year ended 31 December 2021 (Audited)

Share Share Capital Revenue

capital premium reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ------- --------- ----------- -------- -----------

Balance at 1 January 2021 1,414 1,595,894 737,254 (2,612) 2,331,950

Issue of new shares on secondary

market 303 533,918 - - 534,221

Costs on new share issues

on secondary market - (2,815) - - (2,815)

Profit/(loss) for the year - - 512,108 (8,394) 503,714

--------------------------------- ------- --------- ----------- -------- -----------

Balance at 31 December 2021 1,717 2,126,997 1,249,362 (11,006) 3,367,070

--------------------------------- ------- --------- ----------- -------- -----------

The accompanying notes are an integral part of these financial

statements.

Condensed Statement of Cash Flows (Unaudited)

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

Notes GBP'000 GBP'000 GBP'000

-------------------------------------- ----- ----------- ---------- -----------

Operating activities

(Loss)/profit before tax (1,085,504) 154,752 506,254

Adjustments for:

Loss/(gain) on investments held

at fair value through profit or

loss 3 1,093,717 (155,125) (513,312)

(Increase)/decrease in receivables (430) 582 592

Increase in payables 5,198 540 751

Overseas taxation paid (3,240) (1,705) (2,705)

-------------------------------------- ----- ----------- ---------- -----------

Net cash generated by/(used in)

operating activities 9,471 (956) (8,420)

-------------------------------------- ----- ----------- ---------- -----------

Investing activities

Purchase of investments 3 (479,693) (345,359) (673,005)

Sale of investments 3 372,787 27,354 127,272

-------------------------------------- ----- ----------- ---------- -----------

Net cash used in investing activities (106,906) (318,005) (545,733)

-------------------------------------- ----- ----------- ---------- -----------

Financing activities

Proceeds from issue of new shares 93,104 316,035 539,023

Issue costs relating to new shares (560) (1,778) (2,835)

Purchase of shares held in treasury (9,673) - -

Costs relating to buy backs (37) - -

-------------------------------------- ----- ----------- ---------- -----------

Net cash generated by financing

activities 82,834 314,257 536,188

-------------------------------------- ----- ----------- ---------- -----------

Net decrease in cash and cash

equivalents (14,331) (4,704) (17,965)

Cash and cash equivalents at start

of the period/year 32,081 50,046 50,046

-------------------------------------- ----- ----------- ---------- -----------

Cash and cash equivalents at end

of the period/year 17,750 45,342 32,081

-------------------------------------- ----- ----------- ---------- -----------

Comprised of: Cash at bank 17,750 45,342 32,081

====================================== ===== =========== ========== ===========

The accompanying notes are an integral part of these financial

statements.

Notes to the Condensed Financial Statements

1. General information

Smithson Investment Trust plc is a company incorporated on 14

August 2018 in the United Kingdom under the Companies Act 2006.

The condensed interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting and the

Disclosure Guidance and Transparency Rules ('DTRs') of the UK's

Listing Authority.

Principal activity

The principal activity of the Company is that of an investment

company within the meaning of Section 833 of the Companies Act

2006.

The Company commenced activities on admission to the London

Stock Exchange on 19 October 2018.

Going concern

The Directors have adopted the going concern basis in preparing

the Condensed Interim Financial Statements (unaudited) for the

period ended 30 June 2022. The following is a summary of the

Directors' assessment of the going concern status of the Company,

which included consideration of the risks and impact of COVID-19

and the ongoing war in Ukraine.

The Directors have a reasonable expectation that the Company has

adequate resources to continue in operational existence for at

least twelve months from the date of this report. In reaching this

conclusion, the Directors have considered the liquidity of the

Company's portfolio of investments as well as its cash position,

income and expense flows. At the date of approval of this report,

the Company has substantial operating expenses cover.

2. Significant accounting policies

The Company's accounting policies are set out below:

Accounting convention

The financial statements have been prepared under the historical

cost convention (modified to include investments at fair value

through profit or loss) on a going concern basis and in accordance

with international accounting standards in conformity with the

requirements of the Companies Act 2006 and IFRSs as issued by the

International Accounting Standards Board (IASB) and with the

Statement of Recommended Practice ("SORP") 'Financial Statements of

Investment Trust Companies and Venture Capital Trusts' issued by

the Association of Investment Companies ("AIC") in November 2014

(and updated in April 2021). They have also been prepared on the

assumption that approval as an investment trust will continue to be

granted.

The Directors believe that it is appropriate to continue to

adopt the going concern basis for preparing the financial

statements for the reasons stated above. The Company is a UK listed

company with a predominantly UK shareholder base. The results and

the financial position of the Company are expressed in sterling,

which is the functional and presentational currency of the Company.

The accounting policies in this Interim Report are consistent with

those applied in the Annual Report for the year ended 31 December

2021 and have been disclosed consistently and in line with

Companies Act 2006.

Critical accounting judgements and sources of estimation

uncertainty

The Board confirms that no significant accounting judgements or

estimates have been applied to the financial statements and

therefore there is not a significant risk of a material adjustment

to the carrying amounts of assets and liabilities.

3. Investments held at fair value through profit or loss

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

-------------------------------------------- ----------- ---------- -----------

Opening book cost 2,162,638 1,581,420 1,581,420

Opening investment holding gains 1,176,512 698,518 698,518

-------------------------------------------- ----------- ---------- -----------

Opening fair value at start of the

period/year 3,339,150 2,279,938 2,279,938

Purchases at cost 477,428 344,401 673,172

Sales - proceeds (372,787) (27,354) (127,272)

(Losses)/gains on investments (1,093,717) 155,125 513,312

-------------------------------------------- ----------- ---------- -----------

Closing fair value at end of the

period/year 2,350,074 2,752,110 3,339,150

-------------------------------------------- ----------- ---------- -----------

Closing book cost at end of the period/year 2,378,594 1,905,385 2,162,638

Closing unrealised (loss)/gain at

end of the period/year (28,520) 846,725 1,176,512

-------------------------------------------- ----------- ---------- -----------

Valuation at end of the period/year 2,350,074 2,752,110 3,339,150

============================================ =========== ========== ===========

The Company received GBP372,787,000 excluding transaction costs

from investments sold in the period (30 June 2021: GBP27,354,000,

31 December 2021: GBP127,272,000). The book cost of the investments

when they were purchased was GBP262,025,000 (30 June 2021:

GBP20,826,000, 31 December 2021: GBP92,593,000). These investments

have been revalued over time until they were sold and unrealised

gains/losses were included in the fair value of the

investments.

All investments are listed.

4. Dividend income

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

----------------------------- ---------- ---------- -----------

UK dividends 4,077 4,564 7,119

UK dividends - special 3,324 - -

Overseas dividends 11,451 8,277 14,232

Overseas dividends - special 3,432 - 287

Bank interest 1 - -

----------------------------- ---------- ---------- -----------

Total 22,285 12,841 21,638

----------------------------- ---------- ---------- -----------

5. Return per share

Return per ordinary share is as follows:

Unaudited Unaudited Audited

Six months ended Six months ended Year ended

30 June 2022 30 June 2021 31 December 2021

Revenue Capital Total Revenue Capital Total Revenue Capital Total

--------------------- ------- ----------- ----------- ------- ------- ------- ------- ------- -------

Profit/(loss)

for the period/year

(GBP'000) 7,394 (1,095,210) (1,087,816) (965) 154,471 153,506 (8,394) 512,108 503,714

Return/(loss)

per

ordinary

share (p) 4.20 (621.79) (617.59) (0.63) 101.32 100.69 (5.27) 321.50 316.23

--------------------- ------- ----------- ----------- ------- ------- ------- ------- ------- -------

Return per share is calculated based on returns for the period

and the weighted average number of 176,138,114 shares in issue in

the six months ended 30 June 2022 (30 June 2021: 152,451,930; 31

December 2021: 159,284,761).

6. Net asset value per share

Unaudited Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

-------------------------- ---------------- ---------------- ----------------

Net asset value GBP2,361,331,000 GBP2,796,700,000 GBP3,367,070,000

Shares in issue 176,289,958 160,117,958 171,697,958

-------------------------- ---------------- ---------------- ----------------

Net asset value per share 1,339.5p 1,746.6p 1,961.0p

-------------------------- ---------------- ---------------- ----------------

7. Share capital

Unaudited Unaudited Audited

30 June 2022 30 June 2021 31 December 2021

-------------------- -------------------- --------------------

Issued, allotted

and fully paid Number GBP'000 Number GBP'000 Number GBP'000

----------------- ----------- ------- ----------- ------- ----------- -------

Ordinary shares

of GBP0.01 each 176,289,958 1,763 160,117,958 1,601 171,697,958 1,717

----------------- ----------- ------- ----------- ------- ----------- -------

Shares held in

treasury

----------------- ----------- ------- ----------- ------- ----------- -------

Ordinary shares

of GBP0.01 each 818,000 8 - - - -

----------------- ----------- ------- ----------- ------- ----------- -------

Share capital 177,107,958 1,771 160,177,958 1,601 171,697,958 1,717

----------------- ----------- ------- ----------- ------- ----------- -------

During the six months ended 30 June 2022, the Company issued

5,410,000 (30 June 2021: 18,697,000, 31 December 2021: 30,277,000)

shares of GBP0.01 each for a net consideration of GBP92,732,000 (30

June 2021: GBP311,244,000, 31 December 2021: GBP531,406,000). The

average premium to the prevailing net asset value at which new

shares were issued during the period was 2.62% (30 June 2021: 2.7%,

31 December 2021: 2.65%).

During the six months ended 30 June 2022, the Company bought

back to hold in treasury 818,000 shares (30 June 2021: nil, 31

December 2021: nil) at an aggregate cost of GBP10,467,000 (30 June

2021: nil, 31 December 2021: nil). At the period end, the Company

held 818,000 (30 June 2021; nil, 31 December 2021: nil) shares in

treasury.

Since 30 June 2022 and up to 31 July 2022, a further 800,000

ordinary shares have been bought back to hold in treasury at an

aggregate cost of GBP10,215,000.

8. Related party transactions

Fees payable to the Investment Manager are shown in the

Condensed Statement of Comprehensive Income. As at 30 June 2022 the

fee outstanding to the Investment Manager was GBP7,487,000 (30 June

2021: GBP2,255,000, 31 December 2021: GBP2,576,000).

Fees are payable to the Directors at an annual rate of GBP30,000

for Board members, with an additional fee payable per annum of

GBP15,000 to the Chair of the Board; GBP10,000 to the Chair of the

Audit Committee; and GBP5,000 to the Chair of the Management

Engagement Committee.

The Directors had the following shareholdings in the

Company.

As at

30 June

Director 2022

----------------------- -------

Diana Dyer Bartlett 8,886

Lord St John of Bletso 10,000

Jeremy Attard-Manche -

Denise Hadgill -

----------------------- -------

Directors' shareholdings for Mrs Dyer Bartlett as at 30 June

2021 and 31 December 2021 were 5,000. Directors' shareholdings for

Lord St John of Bletso as at 30 June 2021 and 31 December 2021 were

10,000. Mr Attard-Manche and Mrs Hadgill were appointed as

Directors of the Company 1 March 2022 and 1 June 2022

respectively.

As at 30 June 2022, Terry Smith and other founder partners and

key employees of the Investment Manager directly or indirectly and

in aggregate, held 1.7% of the issued share capital of the Company

(30 June 2021: 1.9%, 31 December 2021: 1.7%).

9. Events after the reporting period

There were no post-period events other than as disclosed in

these interim financial statements.

10. Status of this report

These interim financial statements are not the Company's

statutory accounts for the purposes of section 434 of the Companies

Act 2006. They are unaudited. The unaudited interim report will be

made available to the public at the registered office of the

Company. The report will also be available in electronic format on

the Company's website, http://www.smithson.co.uk.

The financial information for the year ended 31 December 2021

has been extracted from the statutory accounts which have been

filed with the Registrar of Companies. The auditors report on those

accounts was not qualified and did not contain statements under

sections 498 (2) or (3) of the Companies Act 2006.

The interim report was approved by the Board of Directors on 1

August 2022.

The Interim Report will be submitted to the National Storage

Mechanism and will shortly be available for inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

This announcement contains regulated information under the

Disclosure Rules and Transparency Rules of the FCA.

1 August 2022

Secretary and registered office:

Sanne Fund Services (UK) Limited

6th Floor

125 London Wall

London

EC2Y 5AS

For further information contact:

Sanne Fund Services (UK) Limited

Tel: 020 3327 9720

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFLRTEILIIF

(END) Dow Jones Newswires

August 02, 2022 02:00 ET (06:00 GMT)

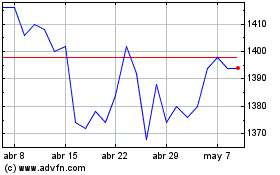

Smithson Investment (LSE:SSON)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Smithson Investment (LSE:SSON)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024