Starwood European Real Estate Finance Ltd (SWEF) SWEF: Quarterly

Portfolio Update 21-Oct-2022 / 07:01 GMT/BST Dissemination of a

Regulatory Announcement that contains inside information in

accordance with the Market Abuse Regulation (MAR), transmitted by

EQS Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

Starwood European Real Estate Finance Limited

Quarterly Portfolio Update

Annualised dividend yield of 6.0 per cent;

Portfolio 80 per cent contracted at floating interest rates

Starwood European Real Estate Finance Limited ("SEREF" or "the

Group"), a leading investor originating, executing and managing a

diverse portfolio of high quality senior and mezzanine real estate

debt in the UK and Europe, is pleased to announce a strong

performance for the quarter ended 30 September 2022.

Highlights

-- Strong cash generation - the portfolio continues to support

annual dividend payments of 5.5 pence perOrdinary Share, paid

quarterly, and generates an annual dividend yield of 6.0 per cent

on the share price as at 30September 2022

-- Regular and Consistent Dividend - GBP196 million of dividends

paid since inception

-- Inflation protection - 80 per cent of the portfolio is

contracted at floating interest rates (withfloors) which will

provide an increase in revenue as expected higher inflation results

in higher interest rates

-- Robust portfolio - the loan book is performing in line with

expectations with its defensive qualitiesreflected in the Group's

continued stable NAV; the weighted average Loan to Value for the

portfolio reduced thisquarter to 59.9 per cent from 60.5 per cent

last quarter

-- 53 per cent share price total return since inception in

December 2012

-- Compelling pipeline of opportunities - The Investment Adviser

and Manager continue to see an activeinvestment pipeline across a

range of geographical regions and sectors which represent

attractive risk adjustedreturns

John Whittle, Chairman of SEREF, said:

"In these turbulent times we are reassured by the highly

defensive nature of the Group's portfolio, the quality and

resilience of which has again been proven in another testing macro

environment. As evidence of this, once again all interest payments

have been received in full, with the ongoing strong cash generation

supporting our annual dividend target distribution of 5.5 pence per

share, a yield of 6.0 per cent on the share price as at 30

September 2022.

Importantly, we remain satisfied with our average portfolio LTV

which has further fallen during this quarter to 59.9 per cent,

representing a very significant cushion to the Group's loans.

We are also pleased with the substantial new loan that was

originated in the period comprising a GBP46.2 million investment in

an industrial campus at Loughborough, increasing our portfolio

weighting to the light industrial sector to 6.9 per cent.

Looking ahead, we continue to evaluate an interesting and

diverse pipeline of potential opportunities across various regions

and sectors and we anticipate attractive new opportunities to arise

from the current volatility. In the meantime, given the high

weighting of the portfolio to floating interest rates (80 per

cent), portfolio income will continue to benefit from the

inflationary environment."

The factsheet for the period is available at:

www.starwoodeuropeanfinance.com

Share Price / NAV at 30 September 2022

Share price (p) 91.6

NAV (p) 103.58

Discount 11.6%

Dividend yield (on share price) 6.0%

Market cap GBP366m

Key Portfolio Statistics at 30 September 2022

Number of investments 20

Percentage of currently invested portfolio in floating rate loans 79.7%

Invested Loan Portfolio unlevered annualised total return (1) 7.4%

Portfolio levered annualised total return (2) 7.7%

Weighted average portfolio LTV - to Group first GBP (3) 13.7%

Weighted average portfolio LTV - to Group last GBP (3) 59.9%

Average loan term (based on current contractual maturity) 5.0 years

Average remaining loan term 1.9 years

Net Asset Value GBP414.2m

Amount drawn under Revolving Credit Facilities (including accrued interest) GBP42.0m

Loans advanced (including accrued interest) GBP453.4m

Cash GBP4.0m

Other net liabilities (including hedges) GBP1.2m

Remaining years to contractual or negotiated maturity* Value of loans (GBPm) % of invested portfolio

0 to 1 years GBP139.4 31.1%

1 to 2 years GBP82.4 18.4%

2 to 3 years GBP115.6 25.7%

3 to 5 years GBP111.4 24.8%

*excludes any permitted extensions. Note that borrowers may

elect to repay loans before contractual maturity. Negotiated

maturity is agreed subject to certain conditions being met by the

borrower.

Country % of invested assets

UK 60.2%

Republic of Ireland 18.8%

Spain 15.6%

Netherlands 4.3%

Germany 1.1%

Sector % of invested assets

Hospitality 37.4%

Office 23.7%

Retail 10.9%

Residential 10.2%

Light Industrial 6.9%

Healthcare 5.6%

Life Sciences 4.3%

Logistics 0.6%

Other 0.4%

Loan type % of invested assets

Whole loans 69.3%

Mezzanine 30.7%

Currency % of invested assets*

Sterling 60.2%

Euro 39.8%

*the currency split refers to the underlying loan currency,

however the capital on all non-sterling exposure is hedged back to

sterling.

(1) The unlevered annualised total return is calculated on

amounts outstanding at the reporting date, excluding undrawn

commitments, and assuming all drawn loans are outstanding for the

full contractual term. 17 of the loans are floating rate (partially

or in whole and all with floors) and returns are based on an

assumed profile for future interbank rates but the actual rate

received may be higher or lower. Calculated only on amounts funded

at the reporting date and excluding committed amounts (but

including commitment fees) and excluding cash uninvested. The

calculation also excludes the origination fee payable to the

Investment Manager.

(2) The levered annualised total return is calculated as per the

unlevered return but takes into account the amount of net leverage

in the Group and the cost of that leverage at current

SONIA/Euribor.

(3) LTV to Group last GBP means the percentage which the total

loan drawn less any deductible lender controlled cash reserves and

less any amortisation received to date (when aggregated with any

other indebtedness ranking alongside and/ or senior to it) bears to

the market value determined by the last formal lender valuation

received by the reporting date. LTV to first Group GBP means the

starting point of the loan to value range of the loans drawn (when

aggregated with any other indebtedness ranking senior to it). For

development projects the calculation includes the total facility

available and is calculated against the assumed market value on

completion of the relevant project.

Dividend

On 21 October 2022, the Directors declared a dividend in respect

of the third quarter of 2022 of 1.375 pence per Ordinary Share,

equating to an annualised income of 5.5 pence per annum. The Board

is targeting a dividend of 5.5 pence per annum (payable quarterly)

which it considers to be sustainable and covered by earnings during

the course of 2022 with any excess cash generated being used to

replenish a modest dividend reserve.

The Invested Loan Portfolio unlevered annualised total return

has been increasing steadily as interest rates curves have moved

upwards. The year-on-year increase is 70 basis points (i.e. now 7.4

per cent, up from 6.7 per cent in September 2021). As the interest

rate environment increases there is additional support for the

dividend cover.

Portfolio Update

Despite the various wider macroeconomic headwinds, we are very

pleased with the performance of the portfolio. Average LTV of the

portfolio is 59.9 per cent. Our valuations are based on independent

third party RICS red book appraisals with a weighted average age of

1.2 years for the total portfolio. While these numbers are backward

looking, there remains a very signification cushion to the Group's

loan basis. Risk around interest rate increases is managed by a

combination of underlying borrowers having interest rate hedging

contracts or various other structural features including cash

reserves in place. All interest and scheduled amortisation have

been paid in line with contractual obligations to date.

We were pleased to announce the origination of one new loan in

the quarter with GBP46.2 million of total loan commitment on an

industrial campus in the UK. This investment has increased our

exposure to industrial assets to 6.9 per cent and has had the

impact of reducing our largest sector exposure, hospitality, to

37.4 per cent, down from 39.9 per cent last quarter.

Despite a slowdown in transactions across the market, we have

continued to see the Group's borrowers execute specific strategic

sales. A total of GBP16.2 million repaid in the quarter from a

combination of underlying property sub-portfolio sales. Post

quarter end in October 2022, the Group received a further partial

loan repayment of EUR7.2 million on the Dublin Office Portfolio

loan. This was the result of the borrower executing a sale of a

large office building in Dublin for over EUR90 million. The sale

price was ahead of the Group's most recent independent valuation

report for this portfolio from March 2022. This assists in

providing confidence that valuations have held up in the last

quarter, particularly for high quality assets where borrowers have

executed asset management plans including the re-gearing of

occupational leases and select refurbishment projects.

As the existing portfolio becomes more seasoned, risk around

ground up construction or heavy refurbishment projects reduces

significantly as these projects build out and near completion. The

Group's exposure to ground up construction is 13.4 per cent of the

current portfolio across two projects. Both of these buildings are

forecast to substantially complete within the next six months.

These projects have benefitted from having fixed price design and

build contracts and strong sponsors who are delivering very high

quality, desirable buildings. The largest exposure, Hotel &

Residential UK (GBP49.9 million loan) has pre-sold the majority of

its residential units, with the total contracted sales value

exceeding the total loan commitment. This provides material

de-risking of the lenders position and we expect this loan to fully

repay during 2023.

We continue to closely monitor any actual or potential impact of

market headwinds such as energy, food, labour and construction cost

inflation through review of underlying asset performance and

discussions with sponsors and asset managers. The Group's key

sector exposures of hospitality (37 per cent of total invested

portfolio), office (24 per cent) and retail (11 per cent) all

continue to perform in line with expectations. Hotels have

performed very strongly throughout the summer, with average daily

rates exceeding the Group's underwritten expectations, underpinning

the demand for these hotels, driven by robust demand for business

and leisure travel. Occupancy across the office portfolio continues

to be robust. Occupancy of the Spanish Shopping Centres, which

comprise over 90 per cent of the Group's retail exposure, continues

to be robust and remains ahead of the pre-pandemic level

occupancy.

New Loan

In September 2022 the Group funded the initial advance of a

GBP46.2 million floating rate whole loan secured by an industrial

estate in Loughborough, UK. The financing has been provided in the

form of an initial advance to assist the acquisition of the asset

along with a capex facility to support the borrower's

value-enhancing capex initiatives.

The asset is a multi-let industrial estate currently consisting

of 802k sq ft over 11 buildings across 53 acres with a strong

income base. It is located in Loughborough within the Golden

Triangle for logistics providing strong transport links within the

UK.

Partial repayments

During the quarter, despite lower transaction volumes across the

markets because of the cautionary approach being adopted by

investors, borrowers in the portfolio successfully executed a

number of disposals ahead of business plan that resulted in the

following partial repayments of loan obligations:

-- EUR7.5 million, Hotel, Dublin

-- EUR5.3 million, Mixed Portfolio, Europe

-- EUR5.0 million, Office and Industrial Portfolio, The

Netherlands

-- EUR0.7 million, Logistics Portfolio, Germany

In addition, since quarter end, the following partial repayments

have been received:

-- EUR7.2 million, Office Portfolio, Dublin

-- EUR3.4 million, Mixed Portfolio, Europe

Market commentary and outlook

-- While the most recent UK and US rates of annual inflation are

down on previous months the overall levelsremain high.

-- Central banks continue to fight inflation by raising

short-term interest rates and long-term interestrate expectations

have continued to rise to fresh post global financial crisis highs

during the quarter.

-- Public markets remain volatile. Many stock markets are

currently in bear markets. Credit markets arereflecting the new

interest rate environment, with the biggest effect seen in medium

to long-term fixed rate creditmarkets.

-- The UK mini budget was badly received by markets who are

questioning the credibility of the fiscal plan.The market reaction

has caused some reversal of policy and some resignations but

markets remain jittery.

-- Hotel market data continues to illustrate positive revenue

growth for operating real estate.

-- Choppy markets will create opportunities for lending to

borrowers with solid real estate and businessplans.

We are now almost 8 months into the war in Ukraine which

continues to have a destabilising effect on energy and commodity

supply which are the largest drivers of rising inflation.

Inflation and interest rates continue to dominate markets with

central banks resolute in their aim of tackling inflation through

higher interest rates. Central banks have continued to raise rates

during the quarter with the Fed raising rates by 150 basis points

in the quarter to a 3-3.25 per cent range and the Bank of England

by 100 basis points to 2.25 per cent. The market anticipates a

steep pace of further increases with UK rates expected to peak at

almost 6 per cent. These rates are creating recessionary pressures

but particularly in the UK we are also seeing long term rates

continuing to rise as the markets require a higher return given

concerns around fiscal prudence.

In the UK, the September inflation figure of 10.1 per cent was

up from 9.9 per cent in August, while in the US the September

inflation number of 8.2 per cent was slightly lower than previous

month levels but both remain at very elevated levels. Inflation

numbers continue to be driven by increased energy costs. Energy

prices in August were estimated to be up 38.6 per cent compared to

a year earlier for the Eurozone, up 52.0 per cent for the UK and up

23.8 per cent for the US. However, even after stripping out energy

and food, core inflation was 4.3 per cent for the Eurozone, 6.3 per

cent for the UK and 6.3 per cent for the US. Commodity prices are

expected to remain volatile while the war in Ukraine causes

disruption to energy, agricultural and other exports from Ukraine

due to blockades of the ports and from Russia due to sanctions.

Interest rates have moved very quickly over the past quarter and

this can be seen in the SONIA, Euribor and swap rates, to which

most of the Group's investments are linked. As at 30 September

2022, 3 month (forward-looking) SONIA and Euribor currently stands

at 3.24 per cent and 1.17 per cent respectively versus 1.55 per

cent and negative 0.20 per cent just 3 months ago at 30 June 2022.

The 5 year sterling swap and 5 year Euro swap have also moved

significantly and currently stand at 5.04 per cent and 2.92 per

cent respectively versus 2.48 per cent and 1.74 per cent last

quarter, reflecting increases of 2.56 per cent and 1.18 per cent in

the quarter. These movements have provided a significant yield

benefit to lenders with exposure to floating rate loans and have

resulted in a significant sell off in fixed rate debt.

In the public credit capital markets, primary issuance has

picked up somewhat but continues to be slow across asset classes

and secondary pricing has increased as investors digest the

implications of the rising rate environment and the knock-on

effects. Fixed rate credit markets, where lenders do not have the

benefit of rising rates in the credit instrument they own, have

continued to sell off reflecting higher interest rates.

In the European high yield market there were a number of new

issues in September but overall year to date issuance is still down

62 per cent versus the 2017 to 2019 average. The iTraxx Crossover

index is a good example of the volatility in the market. The index

which had already more than doubled to reach 580 basis points at

the end of the second quarter traded in a very wide 200 basis

points range in September and peaked at 695 basis points in late

September before closing the quarter at 638 basis points.

There remains limited primary markets activity for real estate

corporate unsecured bonds with only three new issuances in the real

estate space and no CMBS issuance in Europe during the quarter.

This is contributing to the reduced capacity of investment banks to

underwrite and distribute real estate risk and we think it is

likely to continue until the end of the year.

In our last factsheet we gave some examples of how rate

inflation in operational real estate could be seen to be boosting

revenues in hotel market data. We are continuing to see that trend

compounded with a strong dollar helping drive UK and European hotel

performance.

The vast majority of gateway markets in Europe reported higher

average daily rates ("ADRs") in August 2022 compared with August

2019. Paris continues to be the leader in both total and luxury

markets versus 2019, achieving a premium of 46 per cent and 52 per

cent to 2019 rates respectively. Milan achieved ADRs 20 per cent

and London 16 per cent higher overall. Prague was the only city

with a lower ADR - down 1 per cent versus 2019.

August 2022 occupancy levels almost reached 2019 levels, with

Milan and Warsaw exceeding those levels by 9 per cent and 2 per

cent respectively. 17 out of the 25 markets achieved over 70 per

cent in August. Leisure destinations have been performing well,

such as Glasgow (88 per cent), Edinburgh (87 per cent), Dublin (87

per cent) and Spanish Resorts (86 per cent).

London Heathrow saw traffic in August at 79 per cent of 2019

levels - down 3 per cent vs. July as staff shortages have had a

negative impact on the total number of passengers processed. The

number of travellers from Northern American reached 97 per cent of

its 2019 level, a strong increase over summer up from 78 per cent

in May. Middle Eastern travel has also recovered strongly to 92 per

cent of 2019 levels.

The UK mini budget announcement in late September was received

very badly by the market. The market had not been prepared for the

size of the tax policy changes and did not like the lack of

information with no forecasts to back up how the books would be

balanced.

Interest rates shot up both at the short end as the plans are

expected to drive further inflation and have also risen at the long

end showing investors' doubts over UK finances in the current

government's hands with investors and third parties like the

International Monetary Fund particularly critical of the lack of

financial forecasting.

Since the initial reaction the government has been forced by

markets to abandon many of the proposed tax cuts and both the

Chancellor and the Prime Minister have now resigned.

While the initial volatility has somewhat passed, this story is

not over, neither the markets nor the Conservative party have yet

reached final conclusions and long dated gilt markets are still

fragile despite resignations, U-turns and Bank of England

intervention.

The mini-budget also brought a focus to the pound's foreign

exchange rate. The pound did drop significantly over the Friday and

Monday of the mini budget to an all-time low of 1.035. However, it

has rallied since and while the pound does look weak against the

dollar the currency story is actually more one of dollar strength

as both the Euro and Japanese Yen are down more than the pound this

year.

We anticipate a slow and cautious resumption in market activity

which will depend on assessing how inflation and interest rates

expectations will stabilise. Disrupted markets provide opportunity

for the Group allowing it to focus on deal selection and generating

strong returns with good downside protections.

No Credit Losses Recognised

All loans within the portfolio are classified and measured at

amortised cost less impairment. The Group closely monitors the

loans in the portfolio for deterioration in credit risk. There are

some loans for which credit risk has increased since initial

recognition. However, we have considered a number of scenarios and

do not currently expect to realise a loss in the event of a

default. Therefore no expected credit losses have been

recognised.

This assessment has been made based on information in our

possession at the date of reporting, our assessment of the risks of

each loan and certain estimates and judgements around future

performance of the assets.

Investment Portfolio at 30 September 2022

As at 30 September 2022, the Group had 20 investments and

commitments of GBP499.8 million as follows:

Sterling equivalent Sterling equivalent unfunded Sterling Total (Drawn and

balance (1) commitment (1) Unfunded)

Hospitals, UK GBP25.0 m GBP25.0 m

Hotel & Residential, UK GBP49.9 m GBP49.9 m

Office, London GBP18.8 m GBP1.8 m GBP20.6 m

Hotel, Oxford GBP23.0 m GBP23.0 m

Hotel, Scotland GBP42.6 m GBP42.6 m

Hotel, North Berwick GBP15.0 m GBP15.0 m

Life Science, UK GBP19.5 m GBP7.1 m GBP26.6 m

Hotel and Office, Northern Ireland GBP12.5 m GBP12.5 m

Hotels, United Kingdom GBP31.4 m GBP19.3 m GBP50.7 m

Office and Industrial Portfolio, UK GBP5.5 m GBP5.5 m

(2)

Industrial Estate, UK GBP27.2 m GBP19.0 m GBP46.2 m

Total Sterling Loans GBP270.4 m GBP47.2 m GBP317.6 m

Three Shopping Centres, Spain GBP30.3 m GBP30.3 m

Shopping Centre , Spain GBP14.9 m GBP14.9 m

Hotel, Dublin GBP46.2 m GBP46.2 m

Office, Madrid, Spain GBP16.3 m GBP0.9 m GBP17.2 m

Mixed Portfolio, Europe GBP11.7 m GBP11.7 m

Mixed Use, Dublin GBP10.1 m GBP2.8 m GBP12.9 m

Office Portfolio, Spain GBP8.4 m GBP0.1 m GBP8.5 m

Office Portfolio, Ireland GBP27.8 m GBP27.8 m

Logistics Portfolio, Germany GBP2.7 m GBP2.7 m

Office and Industrial Portfolio, The GBP10.0 m GBP10.0 m

Netherlands (2)

Total Euro Loans GBP178.4 m GBP3.8 m GBP182.2 m

Total Portfolio GBP448.8 m GBP51.0 m GBP499.8 m 1. Euro balances translated to sterling at period end exchange rate. 2. Office and Industrial Portfolio, UK and Office and Industrial Portfolio, The Netherlands are one singleloan agreement with sterling and Euro tranches.

Loan to Value

All assets securing the loans undergo third party valuations

before each investment closes and periodically thereafter at a time

considered appropriate by the lenders. The current weighted average

age of the dates of these third party valuations for the whole

portfolio is just 1.2 years while the current weighted average age

of the valuations for the income-producing portfolio (i.e.

excluding loans for development or heavy refurbishment) is just

over 10 months.

On the basis of the methodology and valuation processes

previously disclosed (see 30 June 2020 factsheet) and including new

valuations received, at 30 September 2022 the Group has an average

last GBP LTV of 59.9 per cent (30 June 2022: 60.5 per cent).

The table below shows the sensitivity of the loan to value

calculation for movements in the underlying property valuation and

demonstrates that the Group has considerable headroom within the

currently reported last LTVs.

Change in Valuation Hospitality Retail Residential Other Total

-25% 78.2% 93.4% 77.7% 78.3% 79.9%

-20% 73.3% 87.6% 72.9% 73.4% 74.9%

-15% 69.0% 82.5% 68.6% 69.1% 70.5%

-10% 65.2% 77.9% 64.8% 65.2% 66.6%

-5% 61.8% 73.8% 61.4% 61.8% 63.1%

0% 58.7% 70.1% 58.3% 58.7% 59.9%

5% 55.9% 66.7% 55.5% 55.9% 57.0%

10% 53.3% 63.7% 53.0% 53.4% 54.5%

15% 51.0% 60.9% 50.7% 51.1% 52.1%

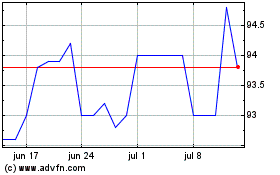

Share Price performance and Share buyback programme

The Company's shares closed on 30 September 2022 at 91.6 pence,

resulting in a share price total return since the start of 2022 of

1.8 per cent. As at 30 September 2022, the discount to NAV stood at

11.6 per cent, with an average discount to NAV of 9.7 per cent over

the quarter. The Board, the Investment Manager and Adviser continue

to believe that the shares represent attractive value at this

level.

Note: the 30 September 2022 discount to NAV is based off the

current 30 September 2022 NAV as reported in this factsheet. All

average discounts to NAV are calculated as the latest cum-dividend

NAV available in the market on a given day, adjusted for any

dividend payments from the ex-dividend date onwards.

The Company received authority at the most recent AGM to

purchase up to 14.99 per cent of the Ordinary Shares in issue on 10

June 2022. On 19 July 2022 the Board announced that it had engaged

Jefferies International Limited as buy-back agent to effect share

buy backs on behalf of the Company. In order to assist in managing

the discount, the Board has shareholder approval to hold in

treasury any shares repurchased by the Company, rather than

cancelling them. The purpose of this active discount management

programme is to reduce discount volatility, subject to the

availability of cashflow. During the quarter to 30 September 2022,

the Company bought back 9.0 million shares for a total

consideration of GBP8.5 million. In addition, the Board has been

consulting with investors in recent weeks in recognition of the

ongoing discount control assessment period.

For further information, please contact:

Apex Fund and Corporate Services (Guernsey) Limited as Company Secretary

Duke Le Prevost

+44 (0)20 3530 3630

Starwood Capital

Duncan MacPherson +44 (0) 20 7016 3655

Jefferies International Limited

Stuart Klein

Neil Winward

+44 (0) 20 7029 8000

Gaudi Le Roux

Buchanan +44 (0) 20 7466 5000

Helen Tarbet +44 (0) 7788 528 143

Henry Wilson

Hannah Ratcliff

Notes:

Starwood European Real Estate Finance Limited is an investment

company listed on the premium segment of the main market of the

London Stock Exchange with an investment objective to provide

Shareholders with regular dividends and an attractive total return

while limiting downside risk, through the origination, execution,

acquisition and servicing of a diversified portfolio of real estate

debt investments in the UK and the wider European Union's internal

market. www.starwoodeuropeanfinance.com.

The Company is the largest London-listed vehicle to provide

investors with pure play exposure to real estate lending.

The Group's assets are managed by Starwood European Finance

Partners Limited, an indirect wholly-owned subsidiary of the

Starwood Capital Group.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GG00B79WC100

Category Code: PFU

TIDM: SWEF

LEI Code: 5493004YMVUQ9Z7JGZ50

OAM Categories: 3.1. Additional regulated information required to be disclosed under the laws of a Member State

Sequence No.: 195693

EQS News ID: 1468279

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1468279&application_name=news

(END) Dow Jones Newswires

October 21, 2022 02:01 ET (06:01 GMT)

Starwood European Real E... (LSE:SWEF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Starwood European Real E... (LSE:SWEF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024