TIDMSYNC

RNS Number : 2213B

Syncona Limited

10 February 2022

Syncona Limited

Third Quarter Update

Period of significant activity with $674 million raised by the

portfolio and third successful exit to date - proposed sale of

Gyroscope for up to $1.5 billion

10 February 2022

Syncona Ltd, a leading healthcare company focused on founding,

building and funding global leaders in life science, today issues

its quarterly update covering the period from 01 October to 31

December 2021.

Martin Murphy, CEO, Syncona Investment Management Limited, said:

"It has been a period of significant activity within the portfolio,

with multiple financings, further clinical progress, and our third

successful exit to date. The proposed sale of Gyroscope to Novartis

for up to $1.5 billion shows our continued ability to build

globally competitive businesses and deliver strong risk-adjusted

returns for our shareholders. Once closed, the proceeds from this

transaction will strengthen our capital base and provide us with

the flexibility to continue to fund the growth of our current

portfolio and invest in new opportunities.

We continue to see our companies attract substantive capital,

with five significant financings announced across Autolus, Quell,

Anaveon, Gyroscope[1] and Clade in the last quarter, totalling $674

million. Many of our companies are approaching clinical data

readouts in the next 12 months, and we remain confident in the

potential of our portfolio to drive value and deliver

transformational treatments to patients."

Sale of Gyroscope Therapeutics (Gyroscope) for up to $1.5

billion (GBP1.1 billion) to Novartis[2], delivers a GBP221 million

(33p per share) uplift to NAV highlighting the Syncona model in

action

-- Transaction includes $800 million (GBP591.2 million) in

upfront cash proceeds. Upfront proceeds for Syncona on closing

anticipated to be GBP326.7 million, delivering a 2.9 multiple on

cost and 53% IRR[3]

-- A further $700 million (GBP517.3 million) due on the

achievement of certain milestones, potentially delivering a further

GBP249.4 million for Syncona generating total proceeds of GBP576.1

million, a 5.1 multiple of cost

-- Period-end valuation of Gyroscope is GBP374.2 million ([4]) ,

a GBP220.7 million uplift to previous holding value (33p per

share). On closing, this valuation would deliver an estimated IRR

of 60% ([5]) , and a multiple of 3.3 of original cost. This

valuation includes the upfront proceeds and Syncona's risk adjusted

and discounted valuation of the milestone payments

-- Syncona positioned to benefit from any future

commercialisation of Gyroscope's lead programme targeting

geographic atrophy via a low single digit royalty on future sales

revenue, allowing shareholders to access the upside of product

approval

16 per cent growth in NAV in Q3; uplifts from sale of Gyroscope

and financings in Quell Therapeutics (Quell) and Anaveon partially

offset by share price movements in listed holdings

-- Net assets of GBP1,339.7 million ([6]) (30 September 2021:

GBP1,152.8 million), 199.3p per share (30 September 2021: 171.7p

per share), a NAV return of 16.1 per cent in the period and 2.9 per

cent over the nine months from 31 March 2021

-- Life science portfolio valued at GBP843.2 million[7] (30

September 2021: GBP617.9 million), a total return of 29.5 per cent

in the quarter and a 4.8 per cent total return since 31 March

2021

-- The sale of Gyroscope, and financings in Quell and Anaveon,

drive GBP257.7 million (38p per share) valuation uplift

-- Share prices of our listed portfolio companies have declined

in a period of significant market volatility, with the value of

these holdings reducing by GBP63.7 million in the quarter. Our

listed portfolio companies are funded to deliver clinical data in

CY2022

o Autolus Therapeutics (Autolus) continues to build momentum as

it approaches the data read-out from its pivotal trial in AUTO1

(obe-cel)

o Under the leadership of CEO Michael Parini, Freeline

Therapeutics (Freeline) expects to publish data across all three of

its programmes in CY2022, following the impact of COVID-19 and

operational challenges in the business

o Achilles Therapeutics (Achilles) continues to expand its

manufacturing and operational capacity as it approaches the interim

data read-out from its higher dose manufacturing process

-- Capital base of GBP496.5 million at 31 December 2021

Five significant financings announced in the period, raising a

total of $674 million of capital to further support the growing

portfolio, with $93 million (GBP69 million)[8] committed by

Syncona

-- Led a $87.0 million Series A financing with a $30.0 million

commitment to Clade Therapeutics (Clade), a next generation stem

cell therapy company

-- Blackstone Life Sciences committed up to $250.0 million to

Autolus in one of the largest private financings of a UK biotech

company

-- Co-led Quell's Series B financing of up to $156.3 million,

committing $25.0 million, with the remainder raised from global

specialist investors

-- Cornerstoned Anaveon's Series B financing of CHF 110.0

million, committing CHF 35.0 million, alongside a leading

international investor syndicate

-- Prior to the proposed sale to Novartis, Sanofi committed to

invest up to $60.0 million in equity of Gyroscope

Continued clinical and operational progress made by our

portfolio companies

-- Autolus

o Relapsed refractory (r/r) adult acute lymphoblastic leukaemia

(ALL) - presented positive new durability data in the Phase I

ALLCAR19 study of obe-cel and initial safety and response data from

the Phase Ib portion of the pivotal FELIX study which is consistent

with that already seen from ALLCAR19

o Reported positive data from its broader pipeline, including

AUTO1/22 in paediatric ALL and the ALLCAR19 extension study in r/r

B cell non-Hodgkin's lymphoma (B-NHL)

-- Freeline

o Haemophilia B - positive data presented from long-term

follow-up study of Phase I/II B-AMAZE dose-finding trial of

FLT180a. First trial site has now been initiated in the Phase I/II

B-LIEVE dose-confirmation trial of FLT180a, one quarter ahead of

latest guidance

o Fabry disease - encouraging new data from ongoing Phase I/II

MARVEL-1 dose-finding clinical trial of FLT190

o Gaucher disease - U.S. Food and Drug Administration (FDA)

clearance of Investigational New Drug Application for FLT201 for

Gaucher disease Type 1, post period end

o Freeline has streamlined its operations and rationalised its

pipeline, including discontinuing its pre-clinical haemophilia A

programme - these changes have resulted in the company extending

its cash runway by an additional quarter to Q2 CY2023

-- Achilles presented data at the Society for Immunotherapy of

Cancer Annual Meeting demonstrating the ability to detect,

quantify, and track patient-specific cNeTs and generate higher cNeT

doses from its VELOS(TM) Process 2 manufacturing

-- Quell's Clinical Trial Application for the first clinical

trial of its lead Treg cell therapy candidate, QEL-001, has been

approved by the UK Medicines and Healthcare products Regulatory

Agency

-- Anaveon has now recruited patients in multiple clinical sites

for its Phase I/II trial for its selective IL-2 agonist, ANV419

-- Post period end, SwanBio Therapeutics' (SwanBio)

Investigational New Drug application for its lead SBT101 programme

was cleared by the FDA

People updates across Syncona and the portfolio

-- Continued appointment of healthcare leaders within the portfolio

o Freeline appointed Pamela Foulds, MD as Chief Medical Officer

(CMO). Pamela has over 20 years' experience and served as CMO at

Auregen BioTherapeutics and Aegerion Pharmaceuticals

o Post period end, Freeline appointed Henning R. Stennicke, PhD,

as Chief Scientific Officer. Henning brings over 25 years'

experience in scientific research and leadership, including 20

years in various leadership positions at Novo Nordisk

o Neogene Therapeutics (Neogene) appointed Raphaël Rousseau,

M.D., Ph.D. as CMO. Raphaël brings more than 20 years' experience

in oncology drug development, including engineered T cell

therapies

o Post period end, Autolus announced that its senior vice

president of finance, Dr Lucinda Crabtree, will succeed Andrew J

Oakley as Chief Financial Officer on 31 March 2022

-- Dr Julie Cherrington and Dr Cristina Csimma appointed as

Non-Executive Directors to the Syncona Limited Board; both joined

the Board on 1 February 2022

-- As previously announced, Nigel Keen and Nicholas Moss stepped

down from the Board on 31 December 2021

-- Post period end, Kenneth Galbraith stepped down from his role

of Executive in Residence at Syncona to become Chair and Chief

Executive Officer of Zymeworks, a NASDAQ listed biotech company, of

which he was previously a Board member between 2009 and 2013

Key upcoming milestones in calendar year 2022 (CY2022)

-- Autolus expects to

o Progress its pivotal study in AUTO1 (obe-cel) r/r adult ALL

and provide a data read-out from this programme in CY2022; on track

to file BLA in CY2023

o Publish initial clinical data in AUTO4 in peripheral T cell

lymphoma (H1 CY2022)

o Publish initial clinical data in AUTO1/22 in paediatric ALL

(H1 CY2022)

-- Achilles expects to provide interim data from higher dose

clinical cohorts of its cNeT therapy in NSCLC and melanoma (H2

CY2022)

-- Freeline expects to progress three clinical stage programmes

o Complete dosing of first dose cohort and publish interim data

from Phase I/II dose-confirmation study in haemophilia B (H1

CY2022)

o Dose next patient in Phase I/II Fabry trial (Q1 CY2022) and

publish interim data (H1 CY2022)

o Dose first two patients in Phase I/II Gaucher disease Type 1

programme (H1 CY2022) and publish interim data (Q3 CY2022)

-- Anaveon expects to publish initial data from the Phase I/II

trial for its selective IL-2 agonist, ANV419 in April; additional

data published later in CY2022

-- Quell expects to enter the clinic with its lead programme in

liver transplantation, QEL-001 (Q1 CY2022)

-- SwanBio expects to enter the clinic with its lead programme in the middle of CY2022

-- Closing of the proposed sale of Gyroscope to Novartis,

subject to customary closing conditions including regulatory

approvals, is expected in Q1 CY2022

Valuation movements in the quarter

Company 30 Net Valuation FX 31 Dec % of Valuation Fully Focus

Sep investment change movement 2021 Group basis diluted area

2021 in the NAV ([9]) owner-ship

period (, [10]) stake

, ([11])

----------- ---------- --------- ------- ------ ------------- ----------- -------------

(GBPm) (GBPm) (GBPm) (GBPm) (GBPm) (%)

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Portfolio

Companies

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Clinical

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Expected

sales

Gyroscope 153.5 - 225.4 -4.7 374.2 27.9 proceeds[12] 48 Gene therapy

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Autolus 94.9 - -19.3 -0.7 74.9 5.6 Quoted 20 Cell therapy

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Anaveon 19.2 20.3 19.2 - 58.7 4.4 PRI 38 Biologics

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Achilles 64.1 - -22.4 -0.7 41.0 3.1 Quoted 27 Cell therapy

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Freeline 48.0 - -20.0 -0.6 27.4 2.0 Quoted 45 Gene therapy

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Pre-Clinical

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Quell 45.2 10.2 18.5 - 0.7 73.2 5.5 PRI 37 Cell therapy

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

SwanBio 62.8 - 0.2 -0.3 62.7 4.7 Cost 75 Gene therapy

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Purespring 18.5 - - - 18.5 1.4 Cost 84 Gene therapy

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Neogene 11.4 2.9 - -0.2 14.1 1.1 Cost 9 Cell therapy

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Clade 11.2 - - - 0.1 11.1 0.8 Cost 23 Cell therapy

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Resolution 7.4 - - - 7.4 0.6 Cost 81 Cell therapy

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Drug

discovery

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

OMass 21.5 - - - 21.5 1.6 Cost 49 Therapeutics

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Life Science

Investment

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

CRT Pioneer Adj Third

Fund 35.5 -0.1 - - 35.4 2.6 Party 64 Oncology

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

CEGX 16.9 - - -0.1 16.8 1.3 PRI 6 Epigenetics

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Adaptimmune 5.3 - - 1.5 - 3.8 0.3 Quoted 1 Cell therapy

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Forcefield 2.5 - - - 2.5 0.2 Cost 82 Biologics

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Total Life

Science

Portfolio 617.9 33.3 200.1 -8.1 843.2 63.1

------- ----------- ---------- --------- ------- ------ ------------- ----------- -------------

Enquiries

Syncona Ltd

Natalie Garland-Collins / Fergus Witt

Tel: +44 (0) 7714 916615

FTI Consulting

Ben Atwell / Tim Stamper

Tel: +44 (0) 20 3727 1000

About Syncona

Syncona's purpose is to invest to extend and enhance human life.

We do this by founding and building companies to deliver

transformational treatments to patients in areas of high unmet

need.

Our strategy is to found, build and fund companies around

exceptional science to create a diversified portfolio of 15-20

globally leading healthcare businesses for the benefit of all our

stakeholders. We focus on developing treatments for patients by

working in close partnership with world-class academic founders and

management teams. Our balance sheet underpins our strategy enabling

us to take a long-term view as we look to improve the lives of

patients with no or poor treatment options, build sustainable life

science companies and deliver strong risk-adjusted returns to

shareholders.

Forward-looking statements - this announcement contains certain

forward-looking statements with respect to the portfolio of

investments of Syncona Limited. These statements and forecasts

involve risk and uncertainty because they relate to events and

depend upon circumstances that may or may not occur in the future.

There are a number of factors that could cause actual results or

developments to differ materially from those expressed or implied

by these forward-looking statements. In particular, many companies

in the Syncona Limited portfolio are conducting scientific research

and clinical trials where the outcome is inherently uncertain and

there is significant risk of negative results or adverse events

arising. In addition, many companies in the Syncona Limited

portfolio have yet to commercialise a product and their ability to

do so may be affected by operational, commercial and other

risks.

[1] Prior to the proposed sale to Novartis, Sanofi committed to

invest up to $60.0 million in equity of Gyroscope

[2] Completion of the transaction is subject to customary

closing conditions. Novartis and Gyroscope will continue to operate

as separate and independent companies until closing

[3] All FX rates related to the Gyroscope transaction taken as

at 31 December 2021

[4] Includes the upfront proceeds and Syncona's risk adjusted

and discounted valuation of the milestone payments (valued at

GBP47.5 million)

[5] On total upfront proceeds (including net cash) and an

estimate based on a risk adjusted and discounted valuation of the

milestone payments, calculated as at 31 December 2021. Following

completion Syncona will continue to value milestones on a quarterly

basis

[6] Net assets include estimated up front proceeds from the sale

of Gyroscope and Syncona's risk adjusted and discounted valuation

of the milestone payments (valued at GBP47.5 million)

[7] Life science portfolio valuation includes period-end

valuation of Gyroscope of GBP374.2 million. This includes the

upfront proceeds and Syncona's risk adjusted and discounted

valuation of the milestone payments (valued at GBP47.5 million)

[8] FX rate as at 31 December 2021

[9] Primary input to fair value

[10] The basis of valuation is stated to be "Cost", this means

the primary input to fair value is capital invested (cost) which is

then calibrated in accordance with our Valuation Policy

[11] The basis of valuation is stated to be "PRI", this means

the primary input to fair value is price of recent investment which

is then calibrated in accordance with our Valuation Policy

[12] Includes the upfront proceeds and Syncona's risk adjusted

and discounted valuation of the milestone payments (valued at

GBP47.5 million)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTFLFSTFIIAIIF

(END) Dow Jones Newswires

February 10, 2022 01:59 ET (06:59 GMT)

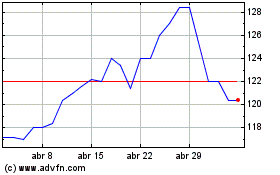

Syncona (LSE:SYNC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Syncona (LSE:SYNC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024