TIDMSYNC

RNS Number : 9052H

Syncona Limited

29 November 2022

Syncona Limited

Neogene to be acquired by AstraZeneca

29 November 2022

-- Agreement reached for Neogene Therapeutics to be acquired by

AstraZeneca for up to $320 million (GBP266 million [1] ) with an

upfront cash payment of $200 million (GBP166 million) and up to

$120 million (GBP100 million) in cash potentially due in both

contingent, milestones-based and non-contingent consideration

-- Syncona's ownership position in Neogene is 8% [2] with

upfront cash proceeds for Syncona at closing anticipated to be

GBP16 million, a 1.1 multiple of original cost and 5% IRR [3]

-- Future milestones have the potential of generating further

proceeds; if received in full Syncona's share of proceeds are

anticipated to be a further GBP6 million, taking total proceeds to

GBP22 million, a 1.6 multiple of original cost

-- Sale of Neogene strengthens the capital pool, enhancing

ability to fund companies in the portfolio to deliver next key

milestones and exciting pipeline of opportunities

Syncona Ltd, a leading healthcare company focused on creating,

building and scaling global leaders in life science, today

announces that an agreement has been reached to sell its portfolio

company Neogene Therapeutics, Inc. ("Neogene"), a biotechnology

company pioneering the discovery, development and manufacturing of

next-generation T cell receptor therapies, to AstraZeneca plc

("AstraZeneca"), a global, science-led biopharmaceutical company,

for up to $320 million (GBP266 million) on a cash and debt free

basis, with an upfront payment of $200 million (GBP166 million) and

up to $120 million (GBP100 million) potentially due in both

contingent, milestones-based and non-contingent consideration.

Syncona co-led the Series A financing of Neogene in 2020,

alongside global specialist investors. The company was founded in

2019 around the work of founders, Dr Ton Schumacher and Dr Carsten

Linnemann, and has been developing an engineered cell therapy

product for solid tumours based on a patient's own neoantigens. The

business has developed from a scientific concept to a rapidly

growing company and is well positioned to progress products through

the clinic.

On closing, the transaction is anticipated to result in cash

proceeds of GBP16 million for Syncona's holding in Neogene, a 1.1

multiple on Syncona's original cost of GBP14 million and an

internal rate of return (IRR) of 5%. In addition, the sale of

Neogene will potentially generate a further GBP6 million of

proceeds for Syncona, through future milestone payments, which if

received would take total proceeds to GBP22 million, a 1.6 multiple

on original cost.

On closing, this will mark the fourth sale of a Syncona

portfolio company over the last four years, generating total

potential proceeds of up to GBP1.2 billion, assuming full receipt

of milestones from the sales of Neogene and Gyroscope, an aggregate

5.6 multiple of cost [4] .

Martin Murphy, Chief Executive Officer and Chair of Syncona

Investment Management Limited, said: "In the two years since we

invested in Neogene, the company has built out an excellent team

and made strong operational progress, in an exciting, high

potential area of cell therapy where it remains complex to

manufacture and deliver products in routine practice. The business

is well positioned to progress its products through the clinic, and

we believe AstraZeneca, with deep expertise in oncology, is ideally

placed to realise the company's goal to bring cell therapies to

patients with solid tumours.

I would like to pass my congratulations to CEO Carsten Linnemann

and the broader management team and wish them well in their future

endeavours working within AstraZeneca.

Against a challenging market backdrop, we are delighted that we

will receive GBP16 million in proceeds from the sale of Neogene,

which we look forward to re-deploying into our portfolio companies

as they continue to scale and into our strong pipeline of exciting

new opportunities."

Transaction Terms

AstraZeneca will acquire all outstanding equity of Neogene

Therapeutics for a total consideration of up to $320m, on a cash

and debt free basis. This will include an initial payment of $200m

on deal closing, and a further $120m in both contingent,

milestones-based and non-contingent consideration.

The transaction is expected to close in the first quarter of

2023, subject to customary closing conditions and regulatory

clearances. Upon completion of the transaction, Neogene will

operate as a wholly owned subsidiary of AstraZeneca, with

operations in Amsterdam, The Netherlands, and Santa Monica,

California, USA.

[ENDS]

Copies of this press release and other corporate information can

be found on the company website at: www.synconaltd.com

Forward-looking statements - this announcement contains certain

forward-looking statements with respect to the portfolio of

investments of Syncona Limited. These statements and forecasts

involve risk and uncertainty because they relate to events and

depend upon circumstances that may or may not occur in the future.

There are a number of factors that could cause actual results or

developments to differ materially from those expressed or implied

by these forward-looking statements. In particular, many companies

in the Syncona Limited portfolio are conducting scientific research

and clinical trials where the outcome is inherently uncertain and

there is significant risk of negative results or adverse events

arising. In addition, many companies in the Syncona Limited

portfolio have yet to commercialise a product and their ability to

do so may be affected by operational, commercial and other

risks.

Enquiries

Syncona Ltd

Annabel Clark / Fergus Witt

Tel: +44 (0) 20 3981 7940

FTI Consulting

Ben Atwell / Natalie Garland-Collins / Julia Bradshaw / Tim

Stamper

Tel: +44 (0) 20 3727 1000

About Syncona

Syncona's purpose is to invest to extend and enhance human life.

We do this by creating and building companies to deliver

transformational treatments to patients in areas of high unmet

need.

Our strategy is to create, build and scale companies around

exceptional science to create a diversified portfolio of 20-25

globally leading healthcare businesses, across development stage

and therapeutic areas, for the benefit of all our stakeholders. We

focus on developing treatments for patients by working in close

partnership with world-class academic founders and management

teams. Our balance sheet underpins our strategy enabling us to take

a long-term view as we look to improve the lives of patients with

no or poor treatment options, build sustainable life science

companies and deliver strong risk-adjusted returns to

shareholders.

[1] FX rates taken at 28 November 2022

([2]) Syncona holding of Neogene is 7.9% on a fully diluted

basis; initial proceeds to Syncona take into account preference

rights on shares and the exercise of options/incentive shares in

Neogene

[3] Based on FX rates taken at 28 November 2022

[4] On closing of the transaction, the four sales will have

generated up-front cash proceeds of GBP948 million, at an aggregate

4.3 multiple of cost

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQBKCBDOBDKDDB

(END) Dow Jones Newswires

November 29, 2022 02:14 ET (07:14 GMT)

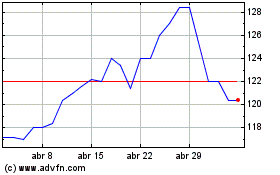

Syncona (LSE:SYNC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Syncona (LSE:SYNC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024