TIDMTBLD

RNS Number : 3620G

tinyBuild, Inc.

29 March 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, TO OR FOR THE ACCOUNT OR BENEFIT OF US PERSONS, AS

DEFINED IN REGULATION S PROMULGATED UNDER THE US SECURITIES ACT OF

1933, AS AMED (THE "US SECURITIES ACT"), OR IN OR INTO THE UNITED

STATES, AUSTRALIA, CANADA, JAPAN, NEW ZEALAND OR THE REPUBLIC OF

SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018.

Upon the publication of this announcement via the Regulatory

Information Service, this inside information is now considered to

be in the public domain.

29 March 2022

tinyBuild, Inc

("tinyBuild" or the "Company")

Preliminary Unaudited Results for the year ended 31 December

2021

tinyBuild, a premium video games publisher and developer with

global operations, is pleased to announce its full year results for

the 12 months ended 31 December 2021, slightly ahead of

expectations.

Financial Summary (unaudited):

(12 months ended December, 2020

$'000)

--------------------------- ------ ------ ----

Revenue 37,648 52,153 39%

------ ------ ----

Operating profit 7,664 12,532 64%

------ ------ ----

Profit before tax 7,700 12,524 63%

------ ------ ----

Basic earnings per share

($ cent) 2.8 4.4 57%

------ ------ ----

Operating cash flow 16,470 13,290 -19%

------ ------ ----

Net cash, at 30 December 26,313 48,832 86%

------ ------ ----

Adj. EBITDA(1) 15,275 22,239 45%

------ ------ ----

Adj. EBITDA margin 40.6% 42.6%

------ ------ ----

(1) Excludes share-based compensation expenses, and exceptional

items (e.g. IPO cost) includes amortisation of Development

costs

Financial highlights:

-- Strong revenue growth of 39% to $52.2m (2020: $37.7m),

slightly ahead of expectations, reflecting a strong performance in

the last part of the year from new titles including Potion Craft

and back catalogue sales.

-- Record Adj. EBITDA of $22.2m (2020: $15.3m) up 45% y-o-y

growth, slightly ahead of expectations. Margin increased to 42.5%

(2020: 40.6%) primarily due to the ongoing shift towards own-IP

versus third party IP.

-- Operating profit increased by 64% to $12.5m (2020: $7.7m), as

a result of lower share-based payment expenses. Profit before tax

and basic EPS also grew by a similar amount to $12.5m and 4.3c,

respectively.

-- Operating cash flow was $13.3m, below the previous year

record of $16.5m, as a result of $5.5m IPO costs .

-- Net cash as of 31 December 2021 was $48.8m compared to $26.3m

as at 31 December 2020), after accounting for gross proceeds of

GBP36.2m ($50m) from the IPO, acquisitions, and a significant

increase in development costs.

Operational highlights:

-- Portfolio increased to over 70 titles (30 at the time of the

IPO), thanks to addition of Versus Evil publishing label and nine

new titles launched by tinyBuild during FY 2021.

-- Contribution to revenues from first-/second-party games

increased to 81% of Group revenues (2020: 70%), supporting

long-term margin expansion.

-- Robust back catalogue sales represented 83% of total revenue

(2020: 75%), demonstrating the Company's ability to extend the life

cycle of games, while adding new titles.

-- Five acquihires of games studios completed (We're Five,

Hungry Couch, Doghelm, Animal and Bad Pixel) for a total upfront

consideration of $12.7m (cash and shares).

-- Major acquisition of Versus Evil, a US-based publisher

focused on RPG and strategy games, and of Red Cerberus, a QA and

testing services provider based in Sao Paolo, Brazil. The upfront

consideration was $12.5m, with a maximum consideration of up to

$31.3m.

Post Period End highlights:

-- tinyBuild has been working hard to support staff (employees

and independent contractors) and their families in areas affected

by the war in Ukraine. At the time of print, all employees and

independent contractors have moved out of the riskiest areas and

plans are in place to welcome anybody fleeing the conflict in our

studios across Europe. We continue to monitor the situation

carefully and have further contingency plans in place.

-- Versus Evil signed four new titles, all own-IP, since the

acquisition closed in November 2021. Red Cerberus is looking to

expand its capacity to fulfil a growing pipeline of potential new

contracts.

-- Deadside development team grew to ten people and accelerated

its growth plans. The latest update 0.2.7 (re-spawn beacons) was

released from Kyiv on 4th March. A combination of more content and

renewed marketing efforts means Deadside has been the best-selling

game in the tinyBuild portfolio for the past few weeks.

-- Potion Craft (early access released in September 2021),

continued to perform strongly after topping the Steam Global Sales

charts at launch and it has now crossed 600,000 downloads.

-- Not for Broadcast released its last episode and moved to

version 1.0 in January 2022, recording over 300,000 downloads since

its launch in 2019.

Outlook

-- The pipeline for 2022 and beyond is strong and includes the

closed Beta pre-orders (7 April 2022) for Hello Neighbor 2, that

has seen a constant increase in the number of followers for over a

year now.

-- The implication of the conflict in Ukraine and the fluid

macroeconomic situation impose caution and vigilance in the medium

and long term. In particular, tinyBuild continues to carefully

assess the position of its staff, its exposure in terms of revenues

and any other factor that may have an impact on the business.

-- All considered, the Board remains confident the Company is on

track to deliver results at least in line with expectations, plus

accretive acquisitions.

Alex Nichiporchik, Chief Executive Officer of tinyBuild,

commented:

"Last year has been an incredible ride, from the IPO to our

largest deal ever with Versus Evil and Red Cerberus opening up new

avenues of growth. Our back catalogue has performed strongly, and

we have an even more diverse revenue mix in terms of titles,

genres, geography and audience. Our strategy to accumulate owned-IP

has resulted in a strong financial performance and has translated

into an improved profitability.

"A growing pipeline of high-quality titles set for release in

the next two years, the majority of which are first and

second-party, means we can build more multi-game franchises and

emulate the success of Hello Neighbor. It is great to see an

enlarged fanbase engaging with Hello Neighbor 2, and we look

forward with confidence to the closed Beta pre-orders. With books,

graphic novels, and early work for a potential animated TV series,

Hello Neighbor provides a template of how we might for many of our

future games.

Our goal is to expand our position as a leading global developer

and publisher, focusing on IP ownership while creating long-term

scalable franchises that will survive for generations regardless of

the media. 2021 has seen significant progress towards that

ambition, and we look to the future with confidence."

Enquiries :

tinyBuild, Inc investorrelations@tinybuild.com

Alex Nichiporchik - Chief Executive Officer

and co-founder

Luke Burtis - Chief Operating Officer and

co-founder

Antonio Jose Assenza - Chief Financial

Officer

Giasone (Jaz) Salati - Head of M&A and

IR

Berenberg (Nominated Adviser and Sole Broker)

Ben Wright, Mark Whitmore, Ciaran Walsh,

Milo Bonser +44 (0)20 3207 7800

SEC Newgate (Financial PR) tinybuild@secnewgate.co.uk

Robin Tozer, Bob Huxford, George Esmond +44 (0)7540 106366

About tinyBuild:

Founded in 2013, tinyBuild (AIM: TBLD) is a global video games

publisher and developer, with a catalogue of more than 70 premium

titles across different genres. tinyBuild's strategy is to focus on

its own intellectual property (IP) to build multi-game and

multimedia franchises, in partnership with developers.

tinyBuild is headquartered in the USA with operations stretching

across the Americas and Europe. The Group's broad geographical

footprint enables the Company to source high-potential IP, access

cost-effective development resources, and build a loyal customer

base through its innovative grassroots marketing.

tinyBuild was admitted to AIM, a market by the London Stock

Exchange, in March 2021.

For further information, visit: www.tinybuildinvestors.com .

Chairman's Statement

Level One complete, here comes the Boss

As tinyBuild (AIM:TBLD) enters its second year as a publicly

traded company, I'm honoured to update shareholders on the success

of our strategy, games and teams during a period marked by very

difficult events.

Looking back to tinyBuild's listing in March 2021, the macro

question lurking on the horizon was how much of the pandemic's

tailwinds we would shed in the course of the year, given the

significant bump the games industry sales experienced during the

lockdowns prior. Despite the logical rationale that such

exceptional growth couldn't prove permanent, it was a longstanding

belief held by game developers and publishers alike that, once a

gamer, always a gamer - thus privately most of us expected to

retain the attention of these newfound audiences.

The games industry, much like every other sector, has had to

contend with many recent setbacks, particularly the global chip

shortage. This affected the manufacturing of consoles, mobiles and

PC gaming GPUs, limiting the games industry's full potential.

Despite this challenge, last year saw 1.4% sales growth for the

whole industry and 5.3% growth in the number of players,

corroborating our expectations: not only did we retain the lockdown

audience we gained, we expanded our reach through the excellence of

our content.

At tinyBuild, we executed our M&A strategy aimed at

expanding our capabilities in IP generation, games development and

publishing, while continuing to invest organically to launch more

games on more platforms. The industry's growth corroborated our

approach of boldly investing in our future.

In November, the acquisition of Versus Evil (USA) and Red

Cerberus (Brazil) bolstered our publishing capabilities in RPG and

Strategy genres. The acquisitions also added Quality Assurance

functions to the Group, and improved our in-house porting

facilities. This has helped make our titles as widely available as

possible from day one.

With Bad Pixel and Animal studios joining the group, we

continued our venture into GaaS (Games as a Service). GaaS offers

higher long tail revenue and longer life cycles for games thanks to

titles that are played over and over as a hobby, translating into

greatly improved ROI.

And with DogHelm we bring into the Group a critically acclaimed

IP - Streets of Rogue - and a development partner whose historic

relationship with tinyBuild made the acquisition an obvious move.

Added to the studios acquired pre-IPO (We're Five Games and Hungry

Couch), tinyBuild can execute on its strategy for the foreseeable

future. Now we aim to improve our internal management processes to

ensure the seamless integration of the new studios, team members

and operational units. We are aware that scaling up creative and

technical teams is a big undertaking in its own right.

Furthermore, new monetisation models are being considered to

adapt in light of increasing inflation and its effect on our

players around the world. We continue to pursue opportunities for

IP expansion in order to maximise our engagement with our growing

audiences.

2022 is going to be yet another exciting year for our teams. The

mindset of thriving in change is a defining aspect of tinyBuild's

culture, a key element that should prove particularly useful in the

short to medium term global entertainment landscape.

Finally, the appalling situation in Ukraine which directly

impacts many colleagues. Management's unique understanding of the

region means contingency plans had already been prepared and could

be executed promptly to relocate teams to safer locations, from

both Ukraine and Russia. Critically, this ensured the safety of our

staff, and to their great credit, projects remained on track.

In our second public annual report, we're proud to once again

announce record revenue and EBITDA, and a performance that exceeded

the market's expectations. This is testimony to the Executive

team's strategic and delivery capabilities. These results will add

to our standing in the games industry and puts us in a stronger

position to deliver the Group's plans for FY 2022, and helps with

M&A.

Above everything, our focus remains on people, as demonstrated

by one of the lowest staff turnover in the industry. We recognise

that an appropriate share-based awards plan is important to retain

key employees and to align staff incentives with shareholders value

creation for the long term. For that reason, during FY22 we intend

to implement a formal share-based incentive plan and look forward

to providing more details soon.

We hope the following pages provide valuable insight into our

strategy and validation of our strategy, building confidence in our

ability to deliver an exciting future for tinyBuild, its games,

players and investors alike.

Henrique Olifiers

Non-Executive Chairman

CHIEF EXECUTIVE'S REVIEW

Over the last 15 years, I am proud to say we've built tinyBuild

into a tremendous global entertainment company - against all the

odds. Personally, my career started off during a global recession,

few industry contacts, and with a passport that didn't allow me any

freedom of travel (Sadly, it still does not, hence why I can't make

it to the UK to present these results in person).

tinyBuild has gone through the 2014 Orange Revolution in Kyiv,

the 2020-2021 global pandemic, and now as I'm writing this we're in

the process of extracting people to safety from the biggest war

Europe has seen since my grandfather was given a rifle at the age

of 17. For me, the last few months has put everything into context.

What is really worth fighting for? Whom do you want to surround

yourself with? The experience of the last few months - from

starting a war room meeting to plan out logistics and routes in

different scenarios of a Russian invasion, to hitting the button to

actually start moving people.

The only constant here is people. People you want to work with,

people you trust - not just with work, but literally with your own

life. This is what we built. We built a company where colleagues

trust each other with their own lives.

The situation in Ukraine

The team behind Hologryph - who joined us as a first party

studio in 2020 - created a shelter location within Lviv in Western

Ukraine, renting apartments, setting up work spaces, helping

everyone who was fleeing from the war zone, until nobody was left

behind. From there people who can - with their elderly parents,

kids, dogs, cats - would get support in crossing the border with

Poland, and then head out into either our Netherlands or Latvia

studios. In both locations I've welcomed everyone to my own home,

setting up living spaces and getting people everything they'd need

while our HR team searches for more permanent housing.

We are also supporting Russian colleagues who are no longer

comfortable staying in Russia. The issue is they, much like me,

don't have freedom of travel. They can't even go to the European

Union. Nor can they get a visa in today's situation. So we've

implemented a complex extraction operation - as flights were

getting cancelled in real time - to get people out of Russia. The

first stage of this operation is complete, and we are setting up a

new tinyBuild location in the Balkans. We're getting an office and

helping all team members relocate. This will be a mid-term

temporary location (unless everyone loves it there and decides to

stay!) for all departments who weren't able to get into the EU. We

will be figuring out visas from that location and we are planning a

third studio in Western Europe to help more people relocate.

Looking back at 2021

Current events in Ukraine puts last year into perspective. As a

business, we achieved record growth, through M&A and

organically. We listed on the London Stock Exchange, preparing our

business for exponential growth. We have proven success is not

about the amount of games you launch but how you treat them once

they are launched.

For example, today our top selling game on PC is Deadside, by

our studio, Bad Pixel, which we acquihired in September 2021. Since

then, Deadside has seen a dramatic rise in concurrent users, sales,

and downloadable content (DLC) attachment rates. All of this was

delivered through a series of well timed, well designed updates to

the game. We're approached Deadside as a game-as-a-service product,

an approach we have used on other titles. All of our titles in

Early Access on PC (Deadside, Potion Craft, Despot's Game) are

seeing meaningful engagements with every single update, and have

player communities excited for when those titles get to version 1.0

and launch on more platforms.

Our original franchise, Hello Neighbor, continues to grow and

expand into new channels. We have a team of world-class writers

working on the Hello Neighbor Animated Series and the new video

game, Hello Neighbor 2. Our goal is to elevate the franchise with

both interactive and linear products that fans would love, so that

both complement each other with the aim to create a pop culture

phenomenon. We're pushing boundaries on the animation front -

because we don't have the restrictions typically imposed by a

mainstream TV network. The series will be dark, funny, thought

provoking, and touches the very core of human relationships. How

far would you go to save your loved ones? That's the theme of Hello

Neighbor, explored deeper in Hello Neighbor 2 and in the upcoming

Animated Series.

Finally in 2021, we increased our publishing capability, as well

as our game development expertise. As of today, we have two

publishing labels (tinyBuild, Versus Evil), plus Bad Pixel will

keep its own operations and self-publish Deadside, since 'games as

a service' doesn't fit well into a traditional publishing pipeline.

We anticipate that more of our studios will become their own

publishing labels as they gradually build up internal publishing

capacity tailored to their genre, platform, or specific

community.

Growth Strategy

tinyBuild has a dual approach to generating long-term

shareholder value through organic growth and M&A. On the one

hand, the Company develops franchises that will potentially live

for generations, independent of the medium. On the other hand,

tinyBuild continues to diversify its portfolio, its geographic

presence, its revenue sources and its business model to reduce

dependencies on any single factor and increase visibility on future

revenue.

Organic growth

tinyBuild focuses on three main avenues to drive organic growth.

First, the Company leverages existing partnerships and in-house

developers to:

-- Increase the quality and diversity of its pipeline, by

signing new titles with particular focus on genre-defining ideas

(e.g. Tinykin)

-- Invest in and support acquired studios to fully realize the

potential of the wider portfolio (e.g. Deadside).

-- Empower acquired publishing labels to consolidate their reach

in new genres (e.g. Versus Evil in RPG and strategy)

-- Create new IP by enabling creative teams to realize their

full potential by exploring new directions (e.g. Potion Craft)

-- Capitalize on the symbiotic relationship with influencers

while expanding our presence on new social media channels, to

retain tinyBuild's strategic marketing advantage.

Second, tinyBuild follows a multi-game and Game as a Service

franchise model expansion to:

-- Use the success of the Hello Neighbor IP as a blueprint for

expanding a game into a multi-title franchise (e.g. Streets of

Rogue 2 and Totally Reliable Adventure Park)

-- Extend IP lifespan by regularly adding new content to

existing titles (e.g. Graveyard Keeper's DLCs)

-- Port successful titles onto different platforms using mobile

primarily as a marketing tool (e.g. Secret Neighbor on iOS)

-- Add cross-play options to further extend the audience for the

most established franchises (e.g. Hello Neighbor 2)

Lastly, tinyBuild works specifically on its own-IP portfolio

to:

-- Pursue multimedia opportunities such as books and graphic

novels, providing off-screen extension (e.g. Hello Neighbor)

-- Produce TV series of successful titles while retaining

ownership of it's IP opening the door to potentially larger revenue

streams

-- Use merchandise as marketing and customer engagement tools

which can also generate, albeit modest, revenues.

M&A strategy

The Group's M&A strategy is evolving, reflecting tinyBuild's

growing success and ambitions. Since 2013, tinyBuild has completed

seven acquihires including DogHelm, Animal and Bad Pixel in the

second half of 2021. As a result of these transactions, tinyBuild

expanded its own-IP portfolio to include Streets of Rogue (June

2021), Rawmen (August 2021) and Deadside (September 2021).

In the acquihire model, the consideration typically consists of

cash and tinyBuild shares to help align the goals of tinyBuild with

those of the key developers. While the acquihire model will remain

an important part of the inorganic growth strategy, tinyBuild will

utilise other models too, as it looks to increase its access to

in-house development talent, games services, publishing labels and

diversify its business model. The growing in-house capability in

terms of development talent, games services, and publishing gives

the Group greater visibility on the whole process and protects the

business against potential delays caused by lack of access to

third-party resources.

More opportunities for acquihires and larger-scale acquisitions

may arise in the future, to further scale and diversify the

business.

Outlook

Our pipeline is growing strongly, year after year. However, for

us quality comes above quantity. We take a portfolio approach about

how many games we will launch in a given year and focus on the

lifetime of each title. When titles like Streets of Rogue (launched

into 1.0 in 2017, developed by Doghelm, a 1st party studio) break

the top10 portfolio daily revenue, you know it's a great title with

phenomenal potential for the upcoming sequel. We're not in the

launch-and-forget business, we're in the plant a seed and

see-it-grow business.

Perspective is everything. With all the challenges we're facing,

work doesn't actually stop. Everyone at tinyBuild loves video

games. There are many more jobs out there with better hours, more

security, and less stress. We're here because we love what we do.

And we're being bonded by a - albeit absolutely terrible - unique

experience that we believe will enable us to grow into the

strongest, most resilient entertainment company in the world.

The implication of the conflict in Ukraine and the fluid

macroeconomic situation impose caution and vigilance. Our priority

remains staff's safety and well-being. Once again, despite the

odds, we look forward with determination and we are confident that

we will deliver results at least in line with expectations, plus

accretive acquisitions.

Alex Nichiprochik

CEO and Founder

Chief Financial Officer's Review

2021 saw another strong financial performance for tinyBuild,

ahead of ambitious targets set by management, both in terms of back

catalogue and in terms of new games. Nine new titles were released,

all of them being own-IP from tinyBuild, and the company closed the

year with over thirty games in pipeline. In addition to game

releases and new games in the pipeline, the tinyBuild's family grew

with seven acquisitions, including the complimentary publisher

Versus Evil.

Revenue

tinyBuild saw total revenues increase 39% (2020: 35%) from

$37.6m to $52.2m. tinyBuild's revenue is generated mainly from

game's sales on various platforms, a variety of platform deals

(e.g. subscription programs, development partnerships and

exclusivity agreements). The addition of Red Cerberus starting from

November 2021 also adds fast-growing service revenues from QA and

testing. Last but not least, events include primarily revenues from

DevGAMM, our Eastern Europe game developers conference, which was

held both, in person and online in 2021.

Revenue generated from own-IP (1st and 2nd party games)

increased to 81% of gaming revenues (2020: 70%). Our strategy is to

continue to expand own-IP portfolio, which will also support

underlying adj. EBITDA margin expansion in the long term.

Adjusted EBITDA and Operating Profit

Adjusted EBITDA is presented net of amortisation of development

costs, and excluding share-based compensation expenses, giving a

clear picture of the business progression. It increased from $15.3m

to $22.2m in 2021, a growth of 45%, largely driven by strong 2021

revenue and relative stability with tinyBuild's operating expenses.

The increase in margins to 42.5% in FY 2021 (2020: 40.6%) is

consistent with a higher share of revenues from own-IP titles and

the inherently higher profitability attached to back catalogue

sales that increased to 83% of group sales in 2021 (2020: 75%).

Operating profit increased to $12.6m (2020: $7.6m) mostly as a

result of lower charges relating to share-based compensation which

were unusually high in 2020 due to accelerated vesting of options

held by management in 2020.

Interest income and taxation

Interest income was $0m (2020: $0.1m) and taxation $4.3m (2020:

$2.8m).

Financial Position

In 2021, the net cash position increased from $26.3m to $48.8m,

mainly driven by a successful IPO on the AIM in the LSE, while the

company accelerated investments in new titles and focused on

acquisitions. Capitalized software development costs, mainly

consisting of porting, localization and developer salaries,

increased from $10.0m to $15.4m reflecting the increase in spend

for upcoming pipeline releases. Goodwill of $13.2m appears for the

first time, due to strategic acquisition of Versus Evil and Red

Cerberus in November of 2021. IP has increased from $5.1m in 2020

to $18.6m in 2021 because of identifiable assets from the

aforementioned acquisition. tinyBuild currently still holds the 25

million USD credit line with Bank of America.

Cash Flow

Cash flows from operating activities decreased from $16.4m to

$13.3m as tinyBuild receivables and prepaids increased ($6.1m).

Accrued expenses and other current liabilities saw an increase in

2021 of $1.9m. It's important to note that said timing issues can

fluctuate year over year and variability here is to be expected

especially during the Holiday season and partners' payment terms.

Cash generated from operations include an add back of $2.5m for

share based payments in the current year (2020: $5.8m)

Acquihires and Acquisitions

In 2021 tinyBuild made seven acquisitions for a total upfront

payment of $25.5m (cash and shares). In February of 2021, tinyBuild

acquired We're Five (TRDS) and Hungry Couch (Black Skylands). In

June of 2021, tinyBuild elevated Streets of Rogue from 3(rd) party

to 1(st) party via acquisition of DogHelm. In August 2021,

tinyBuild acquired the studio Animal (Rawmen). In September of 2021

tinyBuild acquired Bad Pixel (Deadside). Finally, in November of

2021, tinyBuild completed its acquisition of Versus Evil, a US

based publisher and Red Cerberus gaming services provider.

Events after the reporting date

In early 2022, in response to the sudden invasion of Ukraine,

tinyBuild enacted contingency plans to move staff and their

families out of risky areas in East Ukraine and Kyiv. In addition,

tinyBuild has also helped staff relocating away from sanctioned

nations providing logistic and financial support. tinyBuild's

people resilience and cohesiveness has been nothing short of

incredible and allowed the Company to secure production lines for

upcoming titles with minimal disruption.

TINYBUILD INC.

CONSOLIDATED UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2021

Unaudited 2020

2021

Note $'000 $'000

Revenue 3 52,153 37,648

Cost of sales (18,112) (15,120)

Gross profit 34,041 22,528

Administrative expenses:

- General administrative expenses (14,469) (8,714)

- Share-based payment expenses (2,452) (5,845)

- IPO related costs (4,588) (467)

Total administrative expenses (21,509) (15,026)

Other operating income - 162

Operating profit 12,532 7,664

Finance costs (8) (21)

Finance income - 57

Profit before tax 12,524 7,700

Income tax expense (4,288) (2,752)

Profit and total comprehensive

income

for the year 8,236 4,948

Attributable to:

Owners of the parent company 8,261 4,942

Non-controlling interests (25) 6

8,236 4,948

Basic earnings per share ($)* 4 0.043 0.028

Diluted earnings per share ($)* 4 0.042 0.027

Adjusted EBITDA** 5 22,239 15,275

*Basic earnings per share and diluted earnings per share for the

comparative period have been adjusted to reflect the stock split

that occurred during 2021.

**Adjusted EBITDA is a non-GAAP measure and is defined as

earnings before interest, tax, depreciation, amortisation

(excluding amortisation of capitalised software development costs),

share-based payments expenses and other significant one-off

expenses (e.g. IPO and acquisition costs).

TINYBUILD INC.

CONSOLIDATED UNAUDITED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2021

Unaudited 2020

2021

ASSETS Note $'000 $'000

Non-current assets

Intangible assets 6 57,156 15,141

Property, plant and equipment:

- owned assets 41 87

- right-of-use assets 528 673

Trade and other receivables 266 16

Total non-current assets 57,991 15,917

Current assets

Trade and other receivables 13,528 4,999

Cash and cash equivalents 48,832 26,313

Total current assets 62,360 31,312

TOTAL ASSETS 120,351 47,229

EQUITY AND LIABILITIES

Equity

Share capital 203 1

Share premium 63,546 18,674

Warrant reserve 1,920 -

Retained earnings 30,632 19,919

Equity attributable to owners of

the parent company 96,301 38,594

Non-controlling interest 137 162

Total equity 96,438 38,756

LIABILITIES

Non-current liabilities

Lease liabilities 277 442

Contingent consideration 6,336 -

Deferred tax liabilities 4,339 1,663

Total non-current liabilities 10,952 2,105

Current liabilities

Borrowings - 13

Trade and other payables 5,262 3,496

Contingent consideration 4,793 -

Contract liabilities 2,645 2,675

Lease liabilities 261 184

Total current liabilities 12,961 6,368

Total liabilities 23,913 8,473

TOTAL EQUITY AND LIABILITIES 120,351 47,229

TINYBUILD INC.

CONSOLIDATED UNAUDITED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2021

Note Share Share Warrant Retained Total Non-controlling Total

capital premium reserve earnings equity interest equity

attributable

to owners

of the

parent

company

$'000 $'000 $'000 $'000 $'000 $'000 $'000

Balance at 1 January

2020 1 18,674 - 9,132 27,807 156 27,963

Profit and total

comprehensive

income for the year - - - 4,942 4,942 6 4,948

Transactions

with owners

in their

capacity as

owners:

Share-based payments - - - 5,845 5,845 - 5,845

Total transactions

with

owners - - - 5,845 5,845 - 5,845

Balance at 31 December

2020 1 18,674 - 19,919 38,594 162 38,756

Profit and total

comprehensive

income for the year - - - 8,261 8,261 (25) 8,236

Transactions

with owners

in their

capacity as

owners:

Share split 178 (178) - - - - -

Issue of shares, net

of transaction costs 23 46,816 - - 46,839 - 46,839

Issue of shares on

exercise

of options 1 154 - - 155 - 155

Issue of warrants - (1,920) 1,920 - - - -

Share-based payments - - - 2,452 2,452 - 2,452

Total transactions

with

owners 202 44,872 1,920 2,452 49,446 - 49,446

Unaudited Balance at

31 December 2021 203 63,546 1,920 30,632 96,301 137 96,438

TINYBUILD INC.

CONSOLIDATED UNAUDITED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2021

Unaudited 2020

2021

Note $'000 $'000

Cash flows from operating activities

Cash generated from operations 13,290 16,470

Net cash generated by operating activities 13,290 16,470

Cash flows from investing activities

Purchase of subsidiaries, net of cash (11,784) -

acquired

Software development (15,085) (6,549)

Purchase of intellectual property (10,832) (570)

Proceeds on disposal of intangible 45 -

assets

Purchase of property, plant and equipment - (24)

Net cash used in investing activities (37,656) (7,143)

Cash flows from financing activities

Proceeds from borrowings - 175

Repayment of borrowings (13) -

Proceeds from issuance of shares, 46,839 -

net of transaction costs

Proceeds from exercise of share options 155 -

Payment of principal portion of lease

liabilities (96) (198)

Net cash generated by/(used in) financing

activities 46,885 (23)

Cash and cash equivalents

Net increase in the year 22,519 9,304

At 1 January 26,313 17,009

At 31 December 48,832 26,313

TINYBUILD INC.

NOTES TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARED 31 DECEMBER 2021

1 GENERAL INFORMATION

TinyBuild Inc. ("the Company") is a private company limited by

shares, and is registered, domiciled and incorporated in Delaware,

USA. On 9 March 2021 the Company became a public company. The

address of the registered office is 1100 Bellevue Way NE, STE 8A

#317, Bellevue, WA 98004, United States.

The Group ("the Group") consists of TinyBuild Inc. and all of

its subsidiaries. The Group's principal activity is that of an

indie video game publisher and developer.

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation

The preliminary results for the year ended 31 December 2021 are

unaudited. The financial information set out in this announcement

does not constitute the Group's financial statements for the year

ended 31 December 2021.

This financial information should be read in conjunction with

the financial statements of the Group for the year ended 31

December 2020 (the "Prior year financial statements"), which are

available from the Registrar of Companies.

Accounting policies

The Group's principal accounting policies used in preparing this

information are as stated on pages 43 to 49 of the prior year

financial statements. There has been no significant change to any

accounting policy from the date of the prior year financial

statements other than the policies described below.

Business combinations

The acquisition method of accounting is used to account for

business combinations regardless of whether equity instruments or

other assets are acquired.

The consideration transferred is the sum of the acquisition-date

fair values of the assets transferred, equity instruments issued or

liabilities incurred by the acquirer to former owners of the

acquiree and the amount of any non-controlling interest in the

acquiree. For each business combination, the non-controlling

interest in the acquiree is measured at either fair value or at the

proportionate share of the acquiree's identifiable net assets. All

acquisition costs are expensed as incurred to profit or loss.

On the acquisition of a business, the consolidated entity

assesses the financial assets acquired and liabilities assumed for

appropriate classification and designation in accordance with the

contractual terms, economic conditions, the consolidated entity's

operating or accounting policies and other pertinent conditions in

existence at the acquisition-date.

Contingent consideration to be transferred by the acquirer is

recognised at the acquisition-date fair value. Subsequent changes

in the fair value of the contingent consideration classified as an

asset or liability is recognised in profit or loss. Contingent

consideration classified as equity is not remeasured and its

subsequent settlement is accounted for within equity.

The difference between the acquisition-date fair value of assets

acquired, liabilities assumed and any non-controlling interest in

the acquiree and the fair value of the consideration transferred

and the fair value of any pre-existing investment in the acquiree

is recognised as goodwill.

Business combinations are initially accounted for on a

provisional basis. The acquirer retrospectively adjusts the

provisional amounts recognised and also recognises additional

assets or liabilities during the measurement period, based on new

information obtained about the facts and circumstances that existed

at the acquisition-date. The measurement period ends on either the

earlier of (i) 12 months from the date of the acquisition or (ii)

when the acquirer receives all the information possible to

determine fair value.

3 SEGMENTAL REPORTING

IFRS 8 Operating Segments requires that operating segments be

identified on the basis of internal reporting and decision-making.

The Group identifies operating segments based on internal

management reporting that is regularly reported to and reviewed by

the Board of directors, which is identified as the chief operating

decision maker. Management information is reported as one operating

segment, being revenue from self-published franchises and other

revenue streams such as royalties, licensing, development and

events.

Whilst the chief operating decision maker considers there to be

only one segment, the Company's portfolio of games is split between

those based on IP owned by the Group and IP owned by a third party

and hence to aid the readers understanding of our results, the

split of revenue from these two categories are shown below.

Game and merchandise royalties Unaudited Year

Year ended ended 31

31 December December

2021 2020

$'000 $'000

Owned IP 30,640 24,683

Third-party IP 9,231 9,239

_

39,871 33,922

Three customers were responsible for approximately 67% of the

Group's revenues (2020: four - 80%).

The Group has six right-of-use asset located overseas with a

carrying value of $528,000 (2020: $49,084). All other non-current

assets are located in the US.

4 EARNINGS PER SHARE

The Group reports basic and diluted earnings per common share. Basic

earnings per share is calculated by dividing the profit attributable

to common shareholders of the Company by the weighted average number

of common shares outstanding during the period.

Diluted earnings per share is determined by adjusting the profit attributable

to common shareholders by the weighted average number of common shares

outstanding, taking into account the effects of all potential dilutive

common shares, including options.

Unaudited Year ended

Year ended 31 December

31 December 2020*

2021

$'000 $'000

Total comprehensive income attributable

to the owners of the company 8,261 4,942

Weighted average number of shares 191,241,890 179,602,538

Basic earnings per share ($) 0.043 0.028

Total comprehensive income attributable

to the owners of the company 8,261 4,942

Weighted average number of shares 191,241,890 179,602,538

Dilutive effect of share options 4,933,940 2,739,413

Weighted average number of diluted shares 196,175,829 182,341,951

Diluted earnings per share ($) 0.042 0.027

*Basic earnings per share and diluted earnings per share for the

comparative period have been adjusted to reflect the stock split

that occurred during 2021.

5 ADJUSTED EBITDA

The Directors of the Group have presented the performance measure adjusted

EBITDA as they monitor this performance measure at a consolidated level

and they believe this measure is relevant to an understanding of the

Group's financial performance. Adjusted EBITDA is calculated by adjusting

profit from continuing operations to exclude the impact of taxation,

net finance costs, share-based payment expenses, depreciation, amortisation

of purchased intellectual property, acquisition costs and IPO transaction

costs. Adjusted EBITDA is not a defined performance measure in IFRS.

The Group's definition of adjusted EBITDA may not be comparable with

similarly titled performance measures and disclosures by other entities.

Unaudited Year ended

Year ended 31 December

31 December 2020

2021

$'000 $'000

Profit for the year 8,236 4,948

Income tax expense 4,288 2,752

Finance costs 8 21

Finance income - (57)

Share-based payment expenses 2,452 5,845

Amortisation of purchased intellectual property,

brands and customer relationships 1,662 1,222

Depreciation of property, plant and equipment 117 239

IPO related costs 4,588 467

Acquisition costs 888 -

Other operating income - (162)

Adjusted EBITDA 22,239 15,275

6

INTANGIBLE Purchased Software

ASSETS Customer intellectual development

Goodwill Brands relationships property costs Total

$'000 $'000 $'000 $'000 $'000 $'000

Cost:

As at 1 January

2020 - - - 5,600 10,578 16,178

Additions -

internally

generated - - - - 6,549 6,549

Additions -

separately

acquired - - - 570 - 570

As at 31

December 2020 - - - 6,170 17,127 23,297

Additions -

internally

generated - - - - 15,084 15,084

Additions -

separately

acquired - - - 10,832 - 10,832

Additions

through

business

combinations

(note 7) 13,202 1,815 4,261 2,356 - 21,634

Transfers - - - 1,962 (1,962) -

Disposals - - - - (90) (90)

Unaudited As at

31 December

2021 13,202 1,815 4,261 21,320 30,159 70,757

Amortisation and

impairment:

As at 1 January

2020 - - - 267 2,568 2,835

Amortisation

charge for

the year - - - 819 4,502 5,321

As at 31

December 2020 - - - 1,086 7,070 8,156

Amortisation

charge for

the year - 10 51 1,601 3,500 5,162

Impairment

charge for

the year - - - - 283 283

Unaudited As at

31 December

2021 - 10 51 2,687 10,853 13,601

Carrying amount:

Unaudited As at

31 December

2021 13,202 1,805 4,210 18,633 19,306 57,156

As at 31

December 2020 - - - 5,084 10,057 15,141

7 BUSINESS COMBINATIONS

On 24 November 2021, the Group acquired 100% of the issued share capital

of Versus Evil LLC, a Delaware limited liability company, together

with its two wholly owned subsidiaries, Red Cerberus LLC and Steven

Joseph Escalante - Serviços de Tecnologia de Informação,

Eireli LLC.

The goodwill of $13,202,000 represents our bolstered publishing capabilities

in RPG and Strategy genres. The acquisitions also added Quality Assurance

functions and improved our in-house porting facilities that have helped

our plan to make our titles as widely available as possible from day

one.

Consideration for the acquisition comprised $13,062,000 cash. Contingent

consideration of $11,123,000 has been recognised in respect of a variable

number of equity instruments which will be issued in the event of

the acquired company meeting certain EBITDA targets in the future.

The potential outcome of the undiscounted contingent consideration

ranges between $Nil and $18,750,000. Acquisition related costs totalling

$887,502 have been recognised in profit or loss within general administrative

expenses.

7 BUSINESS COMBINATIONS (CONTINUED)

The fair values of the identifiable assets acquired, and liabilities

assumed at the date of acquisition were:

Fair value

Book value adjustments Total

Unaudited

$'000 $'000 $'000

Intangible assets - 8,432 8,432

Property, plant and equipment 2 - 2

Trade and other receivables 1,912 - 1,912

Cash 1,278 - 1,278

Trade and other payables (635) - (635)

Total 2,557 8,432 10,989

Goodwill 13,202

24,191

Consideration:

Cash 13,062

Fair value of contingent consideration

- equity 11,129

Total consideration 24,191

8 POST REPORTING DATE EVENTS

In early 2022, in response to the sudden invasion of Ukraine,

tinyBuild enacted contingency plans to move staff and their

families out of risky areas in East Ukraine and Kyiv. In addition,

tinyBuild has also helped staff relocating away from sanctioned

nations providing logistic and financial support . tinyBuild's

people resilience and cohesiveness has been nothing short of

incredible and allowed the Company to secure production lines for

upcoming titles with minimal disruption.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPUAWWUPPUAB

(END) Dow Jones Newswires

March 29, 2022 02:01 ET (06:01 GMT)

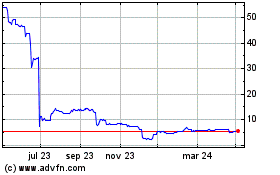

Tinybuild (LSE:TBLD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

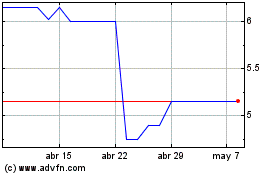

Tinybuild (LSE:TBLD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024