TIDMTBLD

RNS Number : 5403U

tinyBuild, Inc.

29 March 2023

29 March 2023

tinyBuild, Inc

("tinyBuild" or the "Company")

Preliminary Unaudited Results for the year ended 31 December

2022

Directorate change

tinyBuild (AIM:TBLD), a premium video games publisher and

developer with global operations, is pleased to announce its

unaudited results for the twelve months ended 31 December 2022.

Financial Summary (unaudited):

(12 months ended December,

$'000) 2021 2022 change

--------------------------- ------ -------------------- ------

Revenue 52,153 63,295 21%

------ -------------------- ------

Operating profit 12,532 15,923 27%

------ -------------------- ------

Profit before tax 12,524 15,930 27%

------ -------------------- ------

Basic earnings per share

($ cent) 4.3 5.7 32%

------ -------------------- ------

Operating cash flow 13,290 19,259 45%

------ -------------------- ------

Net cash, at 31 December 48,832 26,496 -46%

------ -------------------- ------

Adj. EBITDA(1) 22,239 24,355 10%

------ -------------------- ------

Adj. EBITDA margin 42.6% 38.5%

------ -------------------- ------

(1) Excludes share-based compensation expenses, and exceptional

items (e.g. IPO cost, Ukraine/ Russia relocation) includes

amortisation of Development costs

Financial highlights:

-- Revenue grew 21% to $63.3m (2021: $52.2m), reflecting a solid

performance in the last part of the year from new titles including

Hello Neighbor 2, Tinykin, Asterigos, Spiderheck and back catalogue

sales.

-- Adj. EBITDA increased to $24.4m (2021: $22.2m) up 10% y-o-y,

while margin decreased to 38.5% (2021: 42.6%) primarily due to the

consolidation of Versus Evil and Red Cerberus acquired in November

2021.

-- Operating profit increased by 27% to $15.9m (2021: $12.5m),

thanks to lower share-based payment expenses and exceptional costs.

It includes a $11.1m write-off of the intangibles from the Versus

Evil/ Red Cerberus acquisition broadly offset by a reduction in

deferred earn out payment.

-- Profit before tax grew by 27% to $15.9m and basic EPS grew by

32% to 5.7c, reflecting a lower tax charge.

-- Operating cash flow increased 45% to $19.3m (2021: $13.3m),

as a result of revenue growth and lower exceptional charges.

Excluding $2m one-off items in 2022 (2021: $5.5m), operating cash

flow increased by 13% to $21.3m (2021: $18.8m).

-- Net cash as of 31 December 2022 was $26.5m compared to $48.8m

as at 31 December 2021, reflecting increased investments on

development costs ($35.8m in 2022, vs $15.1m in 2021) and $4.2m

cash payment for M&A in the year.

Operational highlights:

-- In 2022, tinyBuild released a number of new titles, including

Tinykin, SpiderHeck, Asterigos and Hello Neighbor 2, plus version

1.0 of Cartel Tycoon, Despot's Game and Potion Craft, and a number

of platform launches which generated growth across the entire

portfolio of over 80 titles.

-- Notably, in 2022 the Company launched three new games with a

development budget of over $1m that achieved an average return of

1.9x before the end of the year demonstrating the Company's ability

to successfully bring larger-budget games to market across multiple

platforms and providing a solid base for future releases.

-- Contribution to revenues from first/second-party games

decreased marginally to 77% of Gaming revenues (2021: 81%),

primarily due to the consolidation of Versus Evil's 3rd party

portfolio.

-- Robust back catalogue sales represented 80% of total revenue

(2021: 83%), demonstrating the Company's ability to extend the life

cycle of games, while adding new titles.

-- Three acquihires completed (Demagic, Scythe and Konfa Games)

plus the acquisition of Bossa's IP (Surgeon Simulation franchise, I

am Bread, I am Fish) for a total upfront cash consideration of

$4.2m.

-- Successfully relocated over a hundred people following the

invasion of Ukraine, and set up a new studio in Belgrade,

Serbia.

-- Expanded the size of the revolving credit facility with Bank

of America from $25m to $35m and extended the maturity date to

three years to maintain the flexibility to fund potential M&A

in the most effective way. The facility is currently undrawn.

Directorate change:

-- After taking paternity leave in 2022, Luke Burtis, Chief

Operating Officer (COO) and Board Member, has decided to resign

from his board position and management role with immediate effect

to spend more time with his family. Luke has been a valuable member

of tinyBuild, and his contributions to strategy and operations in

the early years have been invaluable. The Board of tinyBuild would

like to express its gratitude to Luke for his contributions during

his tenure and wishes him all the best in his future

endeavours.

-- As the Company continues to move towards the more

decentralised structure set out at the Capital Markets Day in June

2022, the responsibilities of the COO role have been distributed

among a wider group of decision-makers, giving individuals and

teams more autonomy and accountability for their areas of

responsibility. Therefore, the Company does not currently intend to

appoint a replacement.

Employee Benefit Trust:

-- Since the Company's pre-close trading update released on 23

January 2023, the Employee Benefit Trust has purchased an

additional 419,200 ordinary shares on the market and now holds a

total of 573,500 ordinary shares. The EBT was set up in 2022 for

the benefit of current and future employees and will continue to

act independently of the Company to satisfy potential future option

exercises of vested options granted. The maximum amount of the loan

made available to the EBT at any time shall be capped at $10m.

Post Period End highlights:

-- Acquisition of NotGames, a UK-based studio, for an upfront

cash consideration of $1.5m plus max deferred consideration of

$4.2m, subject to stretched financial targets. NotGames is the

developer studio of Not For Broadcast, a critically acclaimed full

motion propaganda simulator. Not for Broadcast has a 94% positive

review score on Steam and it has been nominated for the Game

Developer Conference awards and BAFTA Game awards.

-- Recent announcements include the release date for I am

Future, a brand new VR title in the Hello Neighbor franchise (Hello

Neighbor: Search and Rescue), the VR version and the first DLC for

Not For Broadcast, and the first announcement for Punch Club 2:

Fast Forward, among others.

-- Hello Neighbor 2 users' review score continues to improve on

Steam ("very positive" in the past 30 days). The roadmap for 2023

will focus on improving gameplay features: better AI, expansion of

the Neighborhood with new unique characters, more complex

investigations and more lore exploration.

-- The first two episodes of Hello Neighbor animated series have

already collected over 1m viewers each. Season 1 will consist of 18

episodes, each 10-14 minutes long, all released during 2023.

tinyBuild teamed up with Man of Action, the creators of Ben 10, to

develop a new world that is at the same time coherent with and

wider than the narrative already developed in the games, books and

graphic novels.

Outlook

-- The pipeline for 2023 and beyond is strong and includes a

number of larger budget games alongside continuous investment in

the catalogue including updates, DLCs and console launches.

-- The timing of these investments and of new releases means

that the net cash position is expected to dip lower in the first

half of 2023 and to improve in the second half of 2023 to rise

above $26.5m by the end of December 2023, excluding potential

unannounced M&A.

-- The implication of the conflict in Ukraine and the evolving

macroeconomic situation impose caution and vigilance and tinyBuild

continues to carefully assess the position of its staff, its

exposure in terms of revenues and any other factor that may have an

impact on the business.

-- All considered, the Board remains confident the Company is on

track to deliver results at least in line with expectations, plus

accretive acquisitions.

Alex Nichiporchik, Chief Executive Officer of tinyBuild,

commented:

"Last year was possibly the hardest test of our strategy and it

validated the importance of investing in long-term, sustainable

franchises and the people behind them. We faced unprecedented

challenges, all while integrating acquisitions in different

geographies and moving to a decentralised approach to keep the

company agile at a larger scale."

"Our highly diversified portfolio of games continues to perform

well as we push deeper into a wider variety of platforms and

technologies. Our strong back catalogue performance supports an

acceleration in organic investments while M&A multiples adapt

to the changed environment. Finally, we see early signs of success

of our cross-media product and we will continue to experiment with

the aim to add additional revenue streams to our core

business."

"On a personal note, I want to thank Luke for his enormous

contribution to the Company and for his precious advice on so many

occasions. As a team, we support Luke's decision to focus on his

family and wish him all the best in the future."

Enquiries :

tinyBuild, Inc investorrelations@tinybuild.com

Alex Nichiporchik - Chief Executive Officer

and co-founder

Antonio Jose Assenza - Chief Financial

Officer

Giasone (Jaz) Salati - Head of M&A and

IR

Berenberg (Nominated Adviser and Joint

Broker)

Ben Wright, Mark Whitmore, Ciaran Walsh,

Milo Bonser +44 (0)20 3207 7800

Numis (Joint Broker)

Hugo Rubinstein, Tejas Padalkar +44 (0)20 7260 1000

SEC Newgate (Financial PR) tinybuild@secnewgate.co.uk

Robin Tozer, Harry Handyside, Molly Gretton +44 (0)7540 106366

About tinyBuild:

Founded in 2013, tinyBuild (AIM: TBLD) is a global video games

publisher and developer, with a catalogue of more than 70 premium

titles across different genres. tinyBuild's strategy is to focus on

its own intellectual property (IP) to build multi-game and

multimedia franchises, in partnership with developers.

tinyBuild is headquartered in the USA with operations stretching

across the Americas and Europe. The Group's broad geographical

footprint enables the Company to source high-potential IP, access

cost-effective development resources, and build a loyal customer

base through its innovative grassroots marketing.

tinyBuild was admitted to AIM, a market by the London Stock

Exchange, in March 2021.

For further information, visit: www.tinybuildinvestors.com .

Chairman's Statement

Building our portfolio, one IP at a time

The video games industry, much like its film industry cousin, is

a hit-driven business. Once in a blue moon, a single title can

boost a company or group's revenue overnight by adding a few

surprising zeroes to its bottom line, and the pursuit of such an IP

is the goal of most teams within game studios. Relying on a single

hit, though, is not sound strategy: as a creative product, there is

no blueprint for engineering a runaway success. If such a thing

were possible, we would have companies consistently churning out

billion-dollar franchises; the reality is that these come along

quite rarely even for the most sophisticated and experienced

creators. Counting on a single hit to materialise in order to meet

expectations is not a sustainable strategy.

For tinyBuild's strategy, the hit-driven characteristic of our

industry translates to operating with a portfolio approach. The

larger our portfolio grows, the more resilience and predictability

is built into our forecasts and operations. Overperforming titles

make up for those falling short of the estimations, and on

aggregate we are able to predict quite accurately our yearly

revenues while still leaving the door open to the eventual runaway

hit, the ultimate aim of every game project in production at the

Group's studios.

The alternative of hyping and overreliance on a particular

title, especially prior to its litmus test at launch, introduces

volatility that, in our view, is incompatible with market

expectations and our ambitions for growing the tinyBuild group at a

sustainable and consistent rate. Instead, we choose to invest our

energy in our teams by continually improving their skills,

capabilities and confidence, therefore increasing the chances of

their creative output beating their own ambitions and, eventually,

resulting in an unexpected hit that could translate in a

significant upside.

In the following pages you will see this very dynamic at play

with the fourth quarter 2022 delivering our most successful quarter

ever, against a disruptive background that saw teams and products

relocating from countries at war in the middle of their live

projects.

The investments made in the teams, a direct result of our

people-first approach, lays down the tracks for our new GaaS (Game

as a Service) launches in the years ahead. This represents a marked

change of pace towards the future that sees the tinyBuild studios

gradually leveraging its industry-leading community expertise to

the benefit of organically growing nascent live service games. By

expanding the portfolio with these new service titles, whose nature

is such that their launch is just the start of their growth curve,

we further our goal of increasing predictable and resilient

revenues.

We closed FY'22 with record revenue and EBITDA, keenly focused

on continuing the growth trajectory in the years ahead with a

rapidly expanding portfolio of games, one successful IP at a time.

The mindset of limiting downside with a broad base of titles, while

creating the conditions for the upside provided by a hit, is the

shared approach of the entire tinyBuild team. Our mission is clear,

and its execution is ever improving: make more, better games our

players fall in love with.

Henrique Olifiers

Non-Executive Chairman

CHIEF EXECUTIVE'S REVIEW

We recently crossed the two year mark since tinyBuild went

public. On March 9, 2021 we listed on the London Stock Exchange. It

is time to reflect on why we listed, and how it's going so far.

tinyBuild's mission is to build long-lasting, sustainable

franchises across multiple media formats. We know video games. It's

a great business. Our ultimate goal is to create franchises within

video games, and take them to other media - beyond interactive

entertainment, so that they outlive us as a generation.

WHY WE WENT PUBLIC

We considered listing in the US. Other exchanges looked even

more interesting in 2020. Specifically, the London Stock Exchange

already had a very well educated investor group and listed peers

with comparable business models, if different strategies. In the

US, you inevitably get compared to the big AAA companies and mobile

juggernauts which have very different prospects to ours.

I also wanted to make sure we have a mechanism to align

incentives in the Company. Having actual "shares" that are tradable

achieves this. IPO it was.

I started my career playing video games professionally, and

ended up in game production. No formal education. Founded tinyBuild

while living in the Netherlands before we became a US company. Then

I moved to the US. We have people scattered all over the world, and

we all have a passion for playing and making video games.

DEALING WITH THE UPS AND DOWNS

It's easy to go insane when looking at your share price live on

screen. I see many people obsessing over it. Our shares have been

volatile and it means that the share price can move up or down by

5% or even 10% in a day, but that volatility doesn't alter the

fundamental value of the business.

With that in mind, the market has definitely gone down over the

past half year, but it doesn't impact our operations or long term

vision. We dealt with relocating over 100 people in a time of war,

so we can manage a turbulent share price. The key is to not make

short term decisions that may impact your long term growth

potential. Every decision we make needs to get us incrementally

closer to the long term goal.

From a personal perspective, running a public company is an

amazing experience, one which I wouldn't necessarily recommend to

everybody. People who know me may note this peculiar character

trait of being able to focus on a specific issue at the time. It's

important to know what you can impact, and spend your energy on

that. Obsessing over situations you can't change is the biggest

waste of time (the only finite resource we have) for any management

team.

DECENTRALISED STRUCTURE

As of right now we operate a dozen internal studios working on

our own franchises. The first catalyst was the acquisition of the

development team of Hello Neighbor, and from there we started

learning and building how to operate studios. We learned the hard

way that it's better to decentralise as much as possible. You can't

just go from being a publisher to suddenly running studios. It's a

gradual process where you build up muscle, experience and

discipline.

At one point just as we went public, it became clear that growth

brings bottlenecks. Especially when it comes through rapid hiring.

I've seen this happen in companies experiencing rapid headcount

growth and didn't want to end up in the same trap. So, we started

decentralising.

It's a painful process where instead of having departments and

department leads (directors/heads/ managers), you build

multi-disciplinary teams that focus on the product itself. Instead

of having 50 people spread across 5 different disciplines (i.e.

marketing, production, community management, etc) we have groups of

3-7 people working on specific products - and only those products.

Instead of having product-centric decisions go through a director

(bottleneck), they are decided within the product group itself.

It's definitely a journey to get to such a structure, as you need

to be extremely confident in your people. Most experienced

professionals will have grown up in a traditional department

structure, and the natural career growth is to become a manager -

we have the opposite, everyone is hands on, including myself, and

able to assist team mates. This is how tinyBuild was when we were 5

people, and that magic scaled to where we are now.

A simplified way to look at our structure is this: we have a

supporting team at the top to keep the rain out, and supporting

team below to make sure the company has a solid foundation with

product groups working directly on products from both internal and

external studios. The goal is to give as much ownership as possible

to people actually working on products.

What happens when you have the right people is that everyone

feels involved. Everyone has direct ownership. It's an empowering

feeling. Alongside these product groups you build supporting

layers. HR, development services (localisation/ QA), finance,

contracts management -- those exist as supporting layers for the

product groups.

This structure allowed us to start delivering games everywhere

all at once. To both consoles/ PC, and mobile. If you want to

create a franchise, it needs to be present on as many relevant

platforms as possible. Any developer that's launched games to

multiple platforms understand the major challenges involved.

STEPPING UP INVESTMENTS

Investing in long-term, sustainable franchises and the people

behind them was validated as crucial during the unprecedented

challenges we faced last year. In 2022, we accomplished a

remarkable feat by shipping three titles in a row with a budget of

$1 million or more and by the end of 2022, we had already achieved

an average return of 1.9x.

We proved our publishing team is capable of handling larger

projects, delivering them across platforms, on time, quality and

budget. A great achievement in normal times, an outstanding

achievement during the year we relocated over 100 people in a time

of war.

We are now ready to step up investments and take advantage of

opportunities created by an uncertain macroeconomic environment. We

did not plan for the cost of living crisis or geopolitical

instability, it is more like being prepared and ready for the

unknown. One example is when we set up the $35m revolving credit

facility with Bank of America, shortly after the IPO. Now we have

an extra level of safety and more flexibility if required.

Counting on a publishing team that can deliver big games across

various platforms such as PC, console, mobile, and VR, means that

we can now confidently invest in games with a budget $1-5m and 2-5

year development cycle when peers are forced to retrench and the

most interesting opportunities become more affordable.

In 2022 we found that M&A multiples were often anchored to

unrealistic expectations, while we were having much more productive

discussion with development studios working on new high-potential

games. That's why we stepped away from some potential acquisitions

and preferred to invest more directly.

Every week the executive team sits down and reviews all options.

Every week we approach capital allocation decisions as if it was

the first time, with no sacred cows and the determination to

uncover new opportunities that have the right ingredients, both in

terms of financial upside and strategic fit. This is not a linear

process and sometimes we go for months without finding anything

exciting, sometimes we can make decisions on many projects at

once.

In 2023 we will continue to invest for the long term with the

same down-to-earth approach, expecting a minimum 2x return on our

investments and looking at the whole spectrum of options ahead of

us. As the founder and tinyBuild shareholder, I can't see a better

way to create value long term.

CROSS MEDIA

Another part of our strategy since before the IPO days, is our

focus on cross media. I believe we are working on a truly

groundbreaking TV Series for Hello Neighbor. With the writers

behind Ben 10, Sonic, and Big Hero Six - we have an all-stars team

and a division dedicated to bringing games to linear media, and to

merchandise. We've proven we can produce books with over 4 million

novels sold, now it's time to prove we can produce TV content of

the highest quality.

We could go the easy way about it and ask one of the big

platforms to fund the project, leaving us a thin profit margin and

possibly having a say in how we have to go about it. Instead we

preferred to make the investment to deliver what we see as a very

innovative product, that has value both as a standalone TV series

and as a multiplier of our video game franchises.

We are excited about the developments of what we call a "canon

commercial". It's a canonically relevant piece of audiovisual

content such as cartoons that has the potential to drive the best

marketing possible. Just as cartoons were used to sell toys in the

90s, we can now use them to sell games.

In 2022 we launched the first two episodes of Hello Neighbor

animated series inside the games, an absolute first in terms of

marketing innovation - creating an immensely positive community

response, and fueling the continued hype for the Hello Neighbor

franchise. We have the whole first season being completed in 2023,

unveiling secrets that Hello Neighbor players have been waiting for

a long time for. And more to go after that with a low-risk,

EBITDA-neutral approach that allows us to experiment without

betting the house on anything specific.

THERE ARE NO SHORTCUTS

I've been working full-time since I was 14 years old, and I am

turning 35 this summer. Playing games professionally, writing about

the industry, marketing and producing games. What you learn is that

the world is unfair, and you should focus on what you can impact

and work on your skills. What you shouldn't do is take shortcuts.

Every couple of years there's a new shiny thing that you don't

fully understand why it's useful, and people are trying to sell you

on it. Don't let the hype influence your decision making.

There are no shortcuts in life or business. Anything you do

requires hard work, dedication, and love for what you do. Going

public was a way to allow us to continue growing, innovating, and

following our course and it's only the beginning of the journey. I

feel lucky for being able to experience this in an accelerated way.

Usually it takes companies years to go public, and to experience

huge swings in the price. We listed in under a year, and within the

past 2 years have seen insane highs and lows. It's humbling. It's

an experience, it's levelling up. And I'm happy we said no to most

"hyped" opportunities, such as going into social games a decade

ago, all the crypto-esque scams, selling JPGs, and always stayed

course.

OPTIMISTIC OUTLOOK

The market has been challenging. Still, I'm optimistic about the

industry in general. In 2023 we will be seeing plenty of

groundbreaking AAA titles, alongside standout AA/indie games that

really set new trends. Our goal is to make sure we deliver high

quality games on as many platforms as possible, and pave the way

for them to become franchises. I can't wait until we start

revealing our upcoming products in 2023 and beyond.

Alex Nichiprochik

CEO and Founder

Chief Financial Officer's Review

2022 saw a resilient financial performance for tinyBuild, both

in terms of back catalogue and in terms of new games, in a

challenging geopolitical and macroeconomic environment. Nine new

titles were released, and the company closed the year with a

portfolio of over 80 games. In addition, tinyBuild grew with four

acquisitions, including Bossa Studio's IP.

Revenue

tinyBuild saw total revenues increase 21% (2021: 39%) from

$52.2m to $63.3m, including the consolidation of Versus Evil and

Red Cerberus, acquired in November 2021. tinyBuild's revenue is

generated mainly from game sales on various platforms and a variety

of platform deals (e.g. subscription programs, development

partnerships and exclusivity agreements). Events include primarily

revenues from DevGAMM, our game developers conference operator,

which demonstrated incredible resilience in the face of the

invasion of Ukraine.

Revenue generated from own-IP (1st and 2nd party games)

decreased slightly to 77% of gaming revenues (2021: 81%), as a

result of the consolidation of primarily third-party publisher

Versus Evil. Our strategy is to continue to expand our own-IP

portfolio, which will support underlying adjusted EBITDA margin

growth in the long term.

Adjusted EBITDA and Operating Profit

Adjusted EBITDA increased from $22.2m to $24.4m in 2022, a

growth of 10%, largely driven by solid organic performance and the

consolidation of inherently lower margin Versus Evil and Red

Cerberus. The ongoing decentralisation process and the continuous

shift toward own-IP support further margin increase in the medium

terms, though the progression will depend on the revenue mix.

Adjusted EBITDA is presented net of amortisation of development

costs, excluding share-based compensation expenses, amortisation of

purchased IP and other intangible assets and exceptional costs,

giving a clear picture of the underlying business progression.

Development costs for own IP are now amortised over a 36 month

period, in line with industry standards, to reflect the extended

life-cycle of the games.

Operating profit increased 27% to $15.9m (2021: $12.5m) mostly

as a result of lower exceptional charges (e.g. relocation costs

relating to the war in Ukraine) and lower share-based compensation

costs that dropped for the second year in a row.

Exceptional charges for 2022 include $1.7m for staff relocation

following the invasion of Ukraine, where the situation remains

uncertain and management cannot exclude further charges in the

future. The $11.1m writedown relating to Versus Evil and Red

Cerberus is offset by the decrease in contingent consideration

($11.1m other operating profit), resulting in no material impact on

operating profit.

Interest income and taxation

Interest income was $0.1m (2021: $0.0m) and taxation increased

to $4.4m (2021: $4.3m), mainly due to changes in deferred tax due

to new US tax legislation coming into effect.

Financial Position

In 2022, the net cash position decreased to $26.5m from $48.8m,

mainly driven by larger investments in new games including a small

number of larger budget titles. Capitalised software development

costs, increased from $15.1m to $35.8m in 2022 reflecting a larger

number of organic opportunities and investments in the upcoming

pipeline releases.

Following the customary annual test, goodwill has been reduced

from $13.2m to $3.7m, reflecting a downward revision for the

carrying value for Versus Evil and Red Cerberus, a decrease which

is offset by an equal decline in contingent consideration. IP has

increased from $18.6m in 2021 to $23.1m in 2022 primarily due to

identifiable assets from the acquisition of Demagic, Bossa IP and

Konfa Games.

tinyBuild currently still holds a $35m revolving credit line

with Bank of America, which remains undrawn.

Cash Flow

Cash flows from operating activities increased from $13.3m to

$19.3m thanks to lower exceptional and tax charges more than

offsetting increased marketing costs and the adverse impact of

timing differences. Cash generated from operations include an add

back of $1.7m for share based payments in the current year (2021:

$2.5m)

Acquihires and Acquisitions

In 2022 tinyBuild acquihired three studios and Bossa's IP for a

total upfront cash payment of $4.2m. In April 2022, tinyBuild

acquihired DeMagic, a porting studio based in Serbia. In August

2022, tinyBuild acquihired Konga Games (Despot's Game) and Bossa IP

(Surgeon Simulator franchise, I am Bread and I am Fish), a related

party transaction. In December 2022, tinyBuild acquihired the

studio Scythe (Happy's Humble Burger Farm).

Events after the reporting date

In March 2023, after taking paternity leave in 2022, Luke

Burtis, Chief Operating Officer (COO) and Board Member, announced

his resignation with immediate effect to spend more time with his

family. As the Company continues to move towards the more

decentralised structure set out at the Capital Markets Day in June

2022, the responsibilities of the COO role have been distributed

among a wider group of decision-makers, giving individuals and

teams more autonomy and accountability for their areas of

responsibility. Therefore, the Company does not currently intend to

appoint a replacement.

In March 2023 tinyBuild acquired NotGames (Not for Broadcast),

for an upfront cash consideration of $1.5m plus max deferred

consideration of $4.2m, subject to stretched financial targets.

NotGames is the developer studio of Not For Broadcast, a critically

acclaimed full motion propaganda simulator.

TINYBUILD INC.

CONSOLIDATED UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2022

2022 2021

Unaudited

Note $'000 $'000

Revenue 63,295 52,153

Cost of sales (20,687) (18,112)

Gross profit 42,608 34,041

Administrative expenses:

- General administrative expenses (34,403) (14,469)

- Share-based payment expenses (1,726) (2,452)

- Exceptional costs (inc. IPO

and Ukraine invasion) (1,678) (4,588)

Total administrative expenses (37,807) (21,509)

Other operating income 11,122 -

Operating profit 15,923 12,532

Finance costs (73) (8)

Finance income 80 -

Profit before tax 15,930 12,524

Income tax expense (4,417) (4,281)

Profit for the year 11,513 8,243

Other comprehensive income net

of taxation

Exchange differences on translation 7 -

of foreign operations - may be

reclassified to profit and loss

Total comprehensive income for

the year 11,520 8,243

Attributable to:

Owners of the parent company 11,545 8,268

Non-controlling interests (32) (25)

11,513 8,243

Basic earnings per share ($) 5 0.057 0.043

Diluted earnings per share ($) 5 0.056 0.042

Adjusted EBITDA* 6 24,355 22,239

*Adjusted EBITDA is a non-GAAP measure and is defined as

earnings before interest, tax, depreciation, amortisation

(excluding amortisation of capitalised software development costs),

share-based payments expenses and other significant one-off

expenses.

TINYBUILD INC.

CONSOLIDATED UNAUDITED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2022

2022 2021

Unaudited

ASSETS Note $'000 $'000

Non-current assets

Intangible assets 7 80,384 57,156

Property, plant and equipment:

- owned assets 795 41

- right-of-use assets 341 528

Trade and other receivables 406 266

Total non-current assets 81,926 57,991

Current assets

Trade and other receivables 25,382 15,569

Cash and cash equivalents 26,496 48,832

Total current assets 51,878 64,401

TOTAL ASSETS 133,804 122,392

EQUITY AND LIABILITIES

Equity

Share capital 204 203

Share premium 65,593 63,546

Warrant reserve 1,920 1,920

Translation reserve 7 -

Retained earnings 43,910 30,639

Equity attributable to owners of

the parent company 111,634 96,308

Non-controlling interest (43) 137

Total equity 111,591 96,445

LIABILITIES

Non-current liabilities

Lease liabilities 97 277

Contingent consideration - 6,336

Deferred tax liabilities 1,800 2,345

Total non-current liabilities 1,897 8,958

Current liabilities

Trade and other payables 20,046 9,290

Contingent consideration - 4,793

Contract liabilities - 2,645

Lease liabilities 270 261

Total current liabilities 20,316 16,989

Total liabilities 22,213 25,947

TOTAL EQUITY AND LIABILITIES 133,804 122,392

TINYBUILD INC.

CONSOLIDATED UNAUDITED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

Share Share Warrant Translation Retained Total Non-controlling Total

capital premium reserve reserve earnings equity interest equity

attributable

to owners

of the

parent

company

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

Balance at 1

January 2022 203 63,546 1,920 - 30,639 96,308 137 96,445

Profit/(loss) for

the year - - - - 11,545 11,545 (32) 11,513

Other

comprehensive

income:

Foreign exchange

differences

on the

translation of

foreign

operations - - - 7 - 7 - 7

Total

comprehensive

income

for the year - - - 7 11,545 11,552 (32) 11,520

Transactions

with owners in

their capacity

as owners:

Dividends paid to

non-controlling

interests - - - - - - (148) (148)

Issue of shares

on exercise

of options - 28 - - - 28 - 28

Issue of shares,

net of

transaction

costs 1 2,019 - - - 2,020 - 2,020

Share-based

payment charge - - - - 1,726 1,726 - 1,726

Total

transactions

with owners 1 2,047 - - 1,726 3,774 (148) 3,626

Balance at 31

December 2022 204 65,593 1,920 7 43,910 111,634 (43) 111,591

TINYBUILD INC.

CONSOLIDATED UNAUDITED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2021

Share Share Warrant Translation Retained Total Non-controlling Total

capital premium reserve reserve earnings equity interest equity

attributable

to owners

of the

parent

company

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

Balance at 1

January 2021 1 18,674 - - 19,919 38,594 162 38,756

Profit/(loss)

and total

comprehensive

income for

the year - - - - 8,268 8,268 (25) 8,243

Transactions

with owners in

their capacity

as owners:

Share split 178 (178) - - - - - -

Issue of

shares, net

of

transaction

costs 23 46,816 - - - 46,839 - 46,839

Issue of

shares on

exercise

of options 1 154 - - - 155 - 155

Issue of

warrants - (1,920) 1,920 - - - - -

Share-based

payments - - - - 2,452 2,452 - 2,452

Total

transactions

with owners 202 44,872 1,920 - 2,452 49,446 - 49,446

Balance at 31

December 2021 203 63,546 1,920 - 30,639 96,308 137 96,445

TINYBUILD INC.

CONSOLIDATED UNAUDITED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2022

2022 2021

Unaudited

$'000 $'000

Cash flows from operating activities

Cash generated from operations 19,259 13,290

Net cash generated by operating activities 19,259 13,290

Cash flows from investing activities

Acquisition of subsidiaries, net of

cash acquired - (11,784)

Software development (35,780) (15,085)

Purchase of intellectual property (4,150) (10,832)

Proceeds on disposal of intangible

assets - 45

Purchase of property, plant and equipment (1,235) -

Net cash used in investing activities (41,165) (37,656)

Cash flows from financing activities

Repayment of borrowings - (13)

Proceeds from issuance of shares,

net of transaction costs - 46,839

Proceeds from exercise of share options 28 155

Payment of principal portion of lease

liabilities (310) (96)

Dividends paid to non-controlling (148) -

interests

Net cash generated by/(used in) financing

activities (430) 46,885

Cash and cash equivalents

Net (decrease)/increase in the year (22,336) 22,519

At 1 January 48,832 26,313

At 31 December 26,496 48,832

TINYBUILD INC.

NOTES TO THE CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS

FOR THE YEARED 31 DECEMBER 2022

1 GENERAL INFORMATION

TinyBuild Inc. ("the Company") is a private company limited by

shares, and is registered, domiciled and incorporated in Delaware,

USA. The address of the registered office is 1100 Bellevue Way NE,

STE 8A #317, Bellevue, WA 98004, United States.

The Group ("the Group") consists of TinyBuild Inc. and all of

its subsidiaries. The Group's principal activity is that of an

indie video game publisher and developer.

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation

The preliminary results for the year ended 31 December 2022 are

unaudited. The financial information set out in this announcement

does not constitute the Group's financial statements for the year

ended 31 December 2022.

This financial information should be read in conjunction with

the financial statements of the Group for the year ended 31

December 2021 (the "prior year financial statements"), which are

available from the Registrar of Companies.

Accounting policies

The Group's principal accounting policies used in preparing this

information are as stated on pages 42 to 49 of the prior year

financial statements. There has been no significant change to any

accounting policy from the date of the prior year financial

statements.

3 SEGMENTAL REPORTING

IFRS 8 Operating Segments requires that operating segments be

identified on the basis of internal reporting and decision-making.

The Group identifies operating segments based on internal

management reporting that is regularly reported to and reviewed by

the Board of directors, which is identified as the chief operating

decision maker. Management information is reported as one operating

segment, being revenue from self-published franchises and other

revenue streams such as royalties, licensing, development and

events.

Whilst the chief operating decision maker considers there to be

only one segment, the Company's portfolio of games is split between

those based on IP owned by the Group and IP owned by a third party

and hence to aid the readers understanding of our results, the

split of revenue from these two categories are shown below.

Game and merchandise royalties Year ended Year ended

31 December 31 December

2022 2021

Unaudited Audited

$'000 $'000

Owned IP 26,915 30,640

Third-party IP 13,105 9,231

40,020 39,871

Three customers were responsible for approximately 67% of the

Group's revenues (2021: three - 67%).

The Group has seven (2021: six) right-of-use assets located

overseas with a carrying value of $342,000 (2021: $528,000) and

tangible assets located overseas with a carrying value of $623,000

(2021: $nil). All other non-current assets are located in the

US.

4 REVENUE

An analysis of the Group's revenue Year ended Year ended

is as follows: 31 December 31 December

2022 2021

Unaudited Audited

$'000 $'000

Game and merchandise royalties 40,020 39,871

Development services 22,744 11,477

Events 531 805

63,295 52,153

5 EARNINGS PER SHARE

The Group reports basic and diluted earnings per common share. Basic

earnings per share is calculated by dividing the profit attributable

to common shareholders of the Company by the weighted average number

of common shares outstanding during the period.

Diluted earnings per share is determined by adjusting the profit attributable

to common shareholders by the weighted average number of common shares

outstanding, taking into account the effects of all potential dilutive

common shares, including options and warrants to the extent that they

are deemed to be issued for no consideration in accordance with IAS

33.

Year ended Year ended

31 December 31 December 2021

2022

Unaudited Audited

$'000 $'000

Total comprehensive income attributable

to the owners of the company 11,545 8,268

Weighted average number of shares 203,421,359 191,241,890

Basic earnings per share ($) 0.057 0.043

Total comprehensive income attributable

to the owners of the company 11,545 8,268

Weighted average number of shares 203,421,359 191,241,890

Dilutive effect of share options 1,948,232 2,484,523

Dilutive effect of warrants 149,130 149,130

Dilutive effect of restricted stock

awards 954,654 954,654

Weighted average number of diluted

shares 206,473,374 194,830,197

Diluted earnings per share ($) 0.056 0.042

6 ADJUSTED EBITDA

The Directors of the Group have presented the performance measure adjusted

EBITDA as they monitor this performance measure at a consolidated level

and they believe this measure is relevant to an understanding of the

Group's financial performance. Adjusted EBITDA is calculated by adjusting

profit from continuing operations to exclude the impact of taxation,

net finance costs, share-based payment expenses, depreciation, amortisation

of purchased intellectual property, brands and customer relationships,

acquisitions costs, exceptional costs relating to the conflict in Ukraine

and IPO transaction costs. Adjusted EBITDA is not a defined performance

measure in IFRS. The Group's definition of adjusted EBITDA may not

be comparable with similarly titled performance measures and disclosures

by other entities.

Year ended Year ended

31 December 31 December

2022 2021

Unaudited Audited

$'000 $'000

Profit for the year 11,513 8,243

Income tax expense 4,417 4,281

Finance costs 73 8

Finance income (80) -

Share-based payment expenses 1,726 2,452

Amortisation of purchased intellectual

property, brands and customer relationships 3,999 1,662

Depreciation of property, plant and equipment 747 117

Impairment of intangible assets 11,075

IPO related costs - 4,588

Ukraine related costs 1,678

Acquisition costs 329 888

Other operating income (11,122) -

Adjusted EBITDA 24,355 22,239

7 INTANGIBLE ASSETS

Purchased Software

Customer intellectual development

Goodwill Brands relationships property costs Total

$'000 $'000 $'000 $'000 $'000 $'000

Cost:

As at 1 January 2021 - - - 6,170 17,126 23,296

Additions - internally

generated - - - - 15,085 15,085

Additions - separately

acquired - - - 10,832 - 10,832

Additions - business

combinations 13,202 1,815 4,261 2,356 - 21,634

Transfers - - - 1,962 (1,962) -

Disposals - - - - (90) (90)

As at 31 December 2021 13,202 1,815 4,261 21,320 30,159 70,757

Additions - internally

generated - - - - 35,789 35,789

Additions - separately

acquired - - - 8,395 - 8,395

Transfers - - - 251 (251) -

As at 31 December 2022 13,202 1,815 4,261 29,966 65,697 114,941

Amortisation and impairment:

As at 1 January 2021 - - - 1,086 7,070 8,156

Amortisation charge for

the year - 10 51 1,601 3,500 5,162

Impairment charge - - - - 283 283

As at 31 December 2021 - 10 51 2,687 10,853 13,601

Amortisation charge for

the year - 121 609 3,269 5,787 9,786

Impairment charge for the

year 9,456 675 - 944 95 11,170

As at 31 December 2022 9,456 806 660 6,900 16,735 34,557

Carrying amount:

As at 31 December 2022 3,746 1,009 3,601 23,066 48,962 80,384

As at 31 December 2021 13,202 1,805 4,210 18,633 19,306 57,156

8 RELATED PARTY TRANSACTIONS

An analysis of key management personnel remuneration is set out

below:

Key management personnel remuneration Year ended Year ended

31 December 31 December

2022 2021

Unaudited Audited

$'000 $'000

Aggregate emoluments 2,217 3,037

Equity-settled share-based payments 88 2,159

2,305 5,196

Transactions with other related parties

The wife of the Company's CEO is a member and manager of DevGAMM

LLC. During the period, DevGAMM LLC paid dividends totalling

$148,000 to this related party.

The Company also acquired Bossa's IP Catalogue for consideration

of $3m. Henrique Olifiers, Non-executive Chairman of the Company,

is the Founder and CEO of Bossa. As a result of this relationship,

the IP Catalogue acquisition represents a related party transaction

in accordance with the AIM Rules for Companies. The Directors of

tinyBuild, excluding Henrique Olifiers, consider, having consulted

with Berenberg, tinyBuild's nominated adviser, that the terms of

the transaction are fair and reasonable in so far as shareholders

of tinyBuild are concerned.

There were no other related party transactions during the period

which require disclosure.

9 POST REPORTING DATE EVENTS

In March 2023, after taking paternity leave in 2022, Luke

Burtis, Chief Operating Officer (COO) and Board Member, announced

his resignation with immediate effect to spend more time with his

family. As the Company continues to move towards the more

decentralised structure set out at the Capital Markets Day in June

2022, the responsibilities of the COO role have been distributed

among a wider group of decision-makers, giving individuals and

teams more autonomy and accountability for their areas of

responsibility. Therefore, the Company does not currently intend to

appoint a replacement.

In March 2023, tinyBuild acquired NotGames (Not for Broadcast)

for initial consideration of $1.5m. The agreement contains

performance based earn-outs over the next three calendar years,

subject to operational targets being met. NotGames is the developer

studio of Not For Broadcast, a critically acclaimed full motion

propaganda simulator.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR ZZGZFLRRGFZM

(END) Dow Jones Newswires

March 29, 2023 02:00 ET (06:00 GMT)

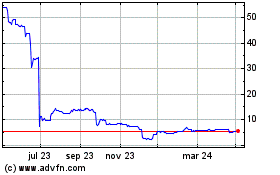

Tinybuild (LSE:TBLD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

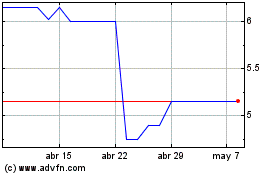

Tinybuild (LSE:TBLD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024