€500 MILLION WITH A 7-YEAR MATURITY AND AN ANNUAL COUPON OF

3.750%

Not to publish, distribute or release, directly or

indirectly, in or into the United States of America, Canada,

Australia, South Africa or Japan and in any other jurisdiction in

which it is unlawful to release, publish or distribute this press

release.

Regulatory News:

Teleperformance SE (Paris:TEP)(the “Company”), the global leader

in outsourced customer and citizen experience management and

related digital services, successfully placed its first

Sustainability-Linked Notes (the “New Notes”) for an amount of €500

million, with an annual coupon of 3.750%, due June 2029.

The proceeds of the New Notes will be allocated to the

repurchase of notes targeted under a tender offer launched by the

Company, and the balance (if any) of the proceeds of the New Notes

will be used for the Company’s general corporate purposes.

With this issue under its €4,000,000,000 EMTN programme pursuant

to its base prospectus as supplemented, the Company is optimizing

its debt profile and further aligning its financing strategy with

its CSR ambitions.

The final terms of the New Notes together with the Company's

base prospectus and supplements thereto will be available on

Teleperformance’s website at the following address:

https://fr.www.teleperformance.com/en-us/investors/publications-and-events/debt-and-bond-investors/.

About Teleperformance Group

Teleperformance (TEP – ISIN: FR0000051807 – Reuters: TEPRF.PA

- Bloomberg: TEP FP), the global leader in outsourced customer and

citizen experience management and related digital services,

serves as a strategic partner to the world’s largest companies in

many industries. It offers a One Office support services model

including end-to-end digital solutions, which guarantee successful

customer interaction and optimized business processes, anchored in

a unique, comprehensive high touch, high tech approach. Nearly

420,000 employees, based in 88 countries, support billions of

connections every year in over 265 languages and around 170

markets, in a shared commitment to excellence as part of the

“Simpler, Faster, Safer” process. This mission is supported by the

use of reliable, flexible, intelligent technological solutions and

compliance with the industry’s highest security and quality

standards, based on Corporate Social Responsibility excellence. In

2021, Teleperformance reported consolidated revenue of €7,115

million (US$8.4 billion, based on €1 = $1.18) and net profit of

€557 million.

Teleperformance shares are traded on the Euronext Paris market,

Compartment A, and are eligible for the deferred settlement

service. They are included in the following indices: CAC 40, STOXX

600, S&P Europe 350 and MSCI Global Standard. In the area of

corporate social responsibility, Teleperformance shares are

included in the Euronext Vigeo Euro 120 index since 2015, the EURO

STOXX 50 ESG index since 2020, the MSCI Europe ESG Leaders index

since 2019, the FTSE4Good index since 2018 and the S&P Global

1200 ESG index since 2017.

For more information: www.teleperformance.com Follow us

on Twitter: @teleperformance

Disclaimer

This press release does not constitute or form part of any offer

or solicitation to purchase or subscribe for or to sell securities

and the issue of the New Notes will not be an offer to the public

(other than to qualified investors) in any jurisdiction, including

France.

Important Information

This press release may not be published, distributed or

released, directly or indirectly, in the United States of America,

Australia, Canada, South Africa or Japan or in any jurisdiction in

which the offer of the New Notes is unlawful. The distribution of

this press release may be restricted by law in certain

jurisdictions and persons into whose possession any document or

other information referred to herein comes, should inform

themselves about and observe any such restriction. Any failure to

comply with these restrictions may constitute a violation of the

securities laws of any such jurisdiction.

No communication or information relating to the offering of the

New Notes may be transmitted to the public in a country where there

is a registration obligation or where an approval is required. No

action has been or will be taken in any country in which such

registration or approval would be required. The issuance or the

subscription of the New Notes may be subject to legal and

regulatory restrictions in certain jurisdictions; the Company

assumes no liability in connection with the breach by any person of

such restrictions.

The New Notes will be offered only by way of a placement in

France and/or outside France (excluding the United States of

America, Australia, Canada, South Africa and Japan), solely to

qualified investors (investisseurs qualifiés) as defined in Article

2(e) of the Prospectus Regulation (as defined below). There will be

no public offering in any country (including France) in connection

with the New Notes, other than to qualified investors. This press

release does not constitute a recommendation concerning the issue

of the New Notes. The value of the New Notes can decrease as well

as increase. Potential investors should consult a professional

adviser as to the suitability of the investment in the New Notes

for the person concerned.

Prohibition of sales to European Economic Area retail

investors

The New Notes are not intended to be offered, sold or otherwise

made available to and should not be offered, sold or otherwise made

available to any retail investor in the European Economic Area

(“EEA”). For these purposes, the expression “retail investor” means

a person who is one (or more) of the following:

(i)

a retail client as defined in

point (11) of Article 4(1) of Directive 2014/65/EU (as amended,

“MiFID II”); or

(ii)

a customer within the meaning of

Directive 2016/97/EU, as amended, where that customer would not

qualify as a professional client as defined in point (10) of

Article 4(1) of MiFID II; or

(iii)

not a “qualified investor” as

defined in Regulation (EU) 2017/1129 of the European Parliament and

of the Council of 14 June 2017, as amended (the “Prospectus

Regulation”).

Consequently no key information document required by Regulation

(EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for

offering or selling the New Notes or otherwise making them

available to retail investors in the EEA has been prepared and

therefore offering or selling the New Notes or otherwise making

them available to any retail investor in the EEA may be unlawful

under the PRIIPs Regulation.

Prohibition of sales to UK retail investors

The New Notes are not intended to be offered, sold or otherwise

made available to and should not be offered, sold or otherwise made

available to any retail investor in the United Kingdom (“UK”). For

these purposes, the expression “retail investor” means a person who

is one (or more) of the following:

(i)

a retail client, as defined in

point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms

part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 (“EUWA”); or

(ii)

a customer within the meaning of

the provisions of the FSMA and any rules or regulations made under

the Financial Services and Markets Act 2000, as amended (the

“FSMA”) to implement Directive (EU) 2016/97, where that customer

would not qualify as a professional client, as defined in point (8)

of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of

UK domestic law by virtue of the EUWA; or

(iii)

not a qualified investor as

defined in Article 2 of Regulation (EU) 2017/1129 as it forms part

of UK domestic law by virtue of the EUWA.

Consequently, no key information document required by Regulation

(EU) No 1286/2014 as it forms part of UK domestic law by virtue of

the EUWA (the “UK PRIIPs Regulation”) for offering or selling the

New Notes or otherwise making them available to retail investors in

the UK has been prepared and therefore offering or selling the New

Notes or otherwise making them available to any retail investor in

the UK may be unlawful under the UK PRIIPs Regulation.

France

The New Notes will only be offered or sold, directly or

indirectly, in France, and this press release, the Company's base

prospectus, the final terms of the New Notes or any other offering

material relating to the New Notes will only be distributed or

caused to be distributed in France, to qualified investors as

defined in Article 2(e) of the Prospectus Regulation pursuant to

Article L.411-2 1° of the French Code monétaire et financier.

United States of America

The New Notes have not been and will not be registered under the

United States Securities Act of 1933, as amended (the “Securities

Act”), or with any securities regulatory authority of any State or

other jurisdiction in the United States of America, and may not be

offered or sold, directly or indirectly, in the United States of

America except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements of the Securities Act

or such state securities laws. The New Notes are being offered and

sold outside of the United States of America to non-U.S. persons

pursuant to and in reliance on Regulation S under the Securities

Act (“Regulation S”). Terms used in this paragraph and not

otherwise defined have the meanings given to them in Regulation

S.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220620005506/en/

Teleperformance SE

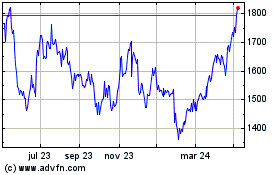

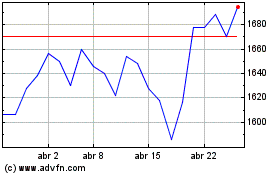

Telecom Plus (LSE:TEP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Telecom Plus (LSE:TEP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024