Not to publish, distribute or release, directly or

indirectly, in or into the United States of America, Canada,

Australia, South Africa or Japan and in any other jurisdiction in

which it is unlawful to release, publish or distribute this press

release.

Regulatory News:

Teleperformance SE (the “Company”) (Paris:TEP), the global

leader in outsourced customer and citizen experience management and

related digital services, announces the success of the tender offer

(the “Tender Offer”) on its €600,000,000 1.500% notes due 3 April

2024 (ISIN: FR0013248465) (the “2024 Notes”) and €750,000,000

1.875% notes due 2 July 2025 (ISIN: FR0013346822) (the “2025 Notes”

and, together with the 2024 Notes, the “Existing Notes”).

The Company accepted the tender of Existing Notes for a final

acceptance amount of €462,500,000 at a tender price of 100.000% for

the 2024 Notes and for a final acceptance amount of €134,500,000 at

a tender price of 99.250% for the 2025 Notes. As per this

transaction, the remaining outstanding principal amount of the

Existing Notes will be €137.500.000 for the 2024 Notes and

€615,500,000 for the 2025 Notes.

This transaction finalizes the liability management operation

initiated with the successful placement of its inaugural

Sustainability-Linked Bonds (the “New Notes”) on June 20, 2022, for

€500,000,000 (with a 3.750% annual coupon and a 7-year

maturity).

About Teleperformance Group

Teleperformance (TEP – ISIN: FR0000051807 – Reuters: TEPRF.PA

- Bloomberg: TEP FP), the global leader in outsourced customer and

citizen experience management and related digital services,

serves as a strategic partner to the world’s largest companies in

many industries. It offers a One Office support services model

including end-to-end digital solutions, which guarantee successful

customer interaction and optimized business processes, anchored in

a unique, comprehensive high touch, high tech approach. Nearly

420,000 employees, based in 88 countries, support billions of

connections every year in over 265 languages and around 170

markets, in a shared commitment to excellence as part of the

“Simpler, Faster, Safer” process. This mission is supported by the

use of reliable, flexible, intelligent technological solutions and

compliance with the industry’s highest security and quality

standards, based on Corporate Social Responsibility excellence. In

2021, Teleperformance reported consolidated revenue of €7,115

million (US$8.4 billion, based on €1 = $1.18) and net profit of

€557 million.

Teleperformance shares are traded on the Euronext Paris market,

Compartment A, and are eligible for the deferred settlement

service. They are included in the following indices: CAC 40, STOXX

600, S&P Europe 350 and MSCI Global Standard. In the area of

corporate social responsibility, Teleperformance shares are

included in the Euronext Vigeo Euro 120 index since 2015, the EURO

STOXX 50 ESG index since 2020, the MSCI Europe ESG Leaders index

since 2019, the FTSE4Good index since 2018 and the S&P Global

1200 ESG index since 2017.

For more information: www.teleperformance.com Follow us

on Twitter: @teleperformance

Disclaimer

Offering of the New Notes

This press release does not constitute or form part of any offer

or solicitation to purchase or subscribe for or to sell securities

and the issue of the New Notes will not be an offer to the public

(other than to qualified investors) in any jurisdiction, including

France.

Important Information

This press release may not be published, distributed or

released, directly or indirectly, in the United States of America,

Australia, Canada, South Africa or Japan or in any jurisdiction in

which the offer of the New Notes is unlawful. The distribution of

this press release may be restricted by law in certain

jurisdictions and persons into whose possession any document or

other information referred to herein comes, should inform

themselves about and observe any such restriction. Any failure to

comply with these restrictions may constitute a violation of the

securities laws of any such jurisdiction.

No communication or information relating to the offering of the

New Notes may be transmitted to the public in a country where there

is a registration obligation or where an approval is required. No

action has been or will be taken in any country in which such

registration or approval would be required. The issuance or the

subscription of the New Notes may be subject to legal and

regulatory restrictions in certain jurisdictions; the Company

assumes no liability in connection with the breach by any person of

such restrictions.

The New Notes will be offered only by way of a placement in

France and/or outside France (excluding the United States of

America, Australia, Canada, South Africa and Japan), solely to

qualified investors (investisseurs qualifiés) as defined in Article

2(e) of the Prospectus Regulation (as defined below). There will be

no public offering in any country (including France) in connection

with the New Notes, other than to qualified investors. This press

release does not constitute a recommendation concerning the issue

of the New Notes. The value of the New Notes can decrease as well

as increase. Potential investors should consult a professional

adviser as to the suitability of the investment in the New Notes

for the person concerned.

Prohibition of sales to European Economic Area retail

investors

The New Notes are not intended to be offered, sold or otherwise

made available to and should not be offered, sold or otherwise made

available to any retail investor in the European Economic Area

(“EEA”). For these purposes, the expression “retail investor” means

a person who is one (or more) of the following:

(i.) a retail client as defined in point (11)

of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”);

or

(ii.) a customer within the meaning of

Directive 2016/97/EU, as amended, where that customer would not

qualify as a professional client as defined in point (10) of

Article 4(1) of MiFID II; or

(iii.) not a “qualified investor” as defined

in Regulation (EU) 2017/1129 of the European Parliament and of the

Council of 14 June 2017, as amended (the “Prospectus

Regulation”).

Consequently no key information document required by Regulation

(EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for

offering or selling the New Notes or otherwise making them

available to retail investors in the EEA has been prepared and

therefore offering or selling the New Notes or otherwise making

them available to any retail investor in the EEA may be unlawful

under the PRIIPs Regulation.

Prohibition of sales to UK retail investors

The New Notes are not intended to be offered, sold or otherwise

made available to and should not be offered, sold or otherwise made

available to any retail investor in the United Kingdom (“UK”). For

these purposes, the expression “retail investor” means a person who

is one (or more) of the following:

(i.) a retail client, as defined in point (8)

of Article 2 of Regulation (EU) No 2017/565 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018

(“EUWA”); or

(ii.) a customer within the meaning of the

provisions of the FSMA and any rules or regulations made under the

Financial Services and Markets Act 2000, as amended (the “FSMA”) to

implement Directive (EU) 2016/97, where that customer would not

qualify as a professional client, as defined in point (8) of

Article 2(1) of Regulation (EU) No 600/2014 as it forms part of UK

domestic law by virtue of the EUWA; or

(iii.) not a qualified investor as defined in

Article 2 of Regulation (EU) 2017/1129 as it forms part of UK

domestic law by virtue of the EUWA.

Consequently, no key information document required by Regulation

(EU) No 1286/2014 as it forms part of UK domestic law by virtue of

the EUWA (the “UK PRIIPs Regulation”) for offering or selling the

New Notes or otherwise making them available to retail investors in

the UK has been prepared and therefore offering or selling the New

Notes or otherwise making them available to any retail investor in

the UK may be unlawful under the UK PRIIPs Regulation.

France

The New Notes will only be offered or sold, directly or

indirectly, in France, and this press release, the Company's base

prospectus, the final terms of the New Notes or any other offering

material relating to the New Notes will only be distributed or

caused to be distributed in France, to qualified investors as

defined in Article 2(e) of the Prospectus Regulation pursuant to

Article L.411-2 1° of the French Code monétaire et financier.

United States of America

The New Notes have not been and will not be registered under the

United States Securities Act of 1933, as amended (the “Securities

Act”), or with any securities regulatory authority of any State or

other jurisdiction in the United States of America, and may not be

offered or sold, directly or indirectly, in the United States of

America except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements of the Securities Act

or such state securities laws. The New Notes are being offered and

sold outside of the United States of America to non-U.S. persons

pursuant to and in reliance on Regulation S under the Securities

Act (“Regulation S”). Terms used in this paragraph and not

otherwise defined have the meanings given to them in Regulation

S.

Tender Offer

The Tender Offer is addressed to the Qualifying Holders (as

defined in the Tender Offer Memorandum) of the Existing Notes,

excluding U.S. Persons, the United States of America and any other

jurisdiction where the Tender Offer would be prohibited by

applicable law. Neither the Tender Offer Memorandum nor any other

document relating to the Tender Offer has been submitted to the

Autorité des marchés financiers or any other authority for

approval.

No communication and no information in respect of the repurchase

of the Existing Notes may be distributed to the public in any

jurisdiction where a registration or approval is required. No steps

have been or will be taken outside of France in any jurisdiction

where such steps would be required.

This press release does not constitute an invitation to

participate in the Tender Offer or an offer to purchase the

Existing Notes in or from any jurisdiction in or from which, or to

or from any person to or from whom, it is unlawful to make such

repurchase or offer under applicable securities laws. The release,

publication or distribution of this press release in certain

jurisdictions may be restricted by law. Consequently, any persons

in such jurisdiction in which this press release is released,

published or distributed are required by the Company to inform

themselves about, and to observe, any such restrictions.

The Company makes no recommendation as to whether or not the

holders of the Existing Notes should participate in the Tender

Offer.

France

This press release is only intended in France for qualified

investors as defined in Article 2(e) of the Prospectus Regulation

and only qualified investors in France and the EEA are eligible to

participate in the Tender Offer. The Tender Offer Memorandum and

any other document relating to the Tender Offer may only be

distributed in France to qualified investors within the meaning of

Article 2(e) of the Prospectus Regulation and in accordance with

Article L. 341-2, 1 of the French Code monétaire et financier.

United States of America

The Tender Offer is not being made, and will not be made,

directly or indirectly in the United States by means of the mails,

or any other means or instrumentality (including, without

limitation, facsimile, telex, telephone, electronic mail, or any

other means of electronic transmission) of interstate or foreign

commerce, or the facilities of a national securities exchange in

the United States or to any U.S. Person (US. Person, as defined in

Regulation S under the Securities Act of 1933, as amended, the

"Securities Act") (each, a "U.S. Person"). The Existing Bonds

referred to above may not be tendered in the Tender Offer by any

such means or contest in or from the United States or by persons

located or resident in the United States (U.S. Holders, as defined

in Rule 800(h) of the Securities Act). Accordingly, no copy of this

document, the Tender Offer Memorandum or any other document

relating to the Tender Offer is being or shall be, directly or

indirectly, distributed, transferred or transmitted in any manner

whatsoever (including, without limitation, by custodians, agents or

trustees) in or into the United States or to any such person. Any

offer to sell in response to the Tender Offer resulting directly or

indirectly from a violation of these restrictions will be void, and

any offer to sell made by a person located in or resident in the

United States, or any agent, trustee or other intermediary acting,

in a non-discretionary manner, in the name of and on behalf of a

principal instructing from within the United States, will be void

and will not be accepted.

The securities may not be offered or sold in the United States

because of absent registration or an applicable exemption from the

registration requirements of the Securities Act. This press release

does not constitute an offer for sale of any financial securities

in the United States. The financial securities referred to in this

press release have not been and will not be registered under the

Securities Act or the securities laws of any State of the United

States or any other jurisdiction and may not be offered, sold or

delivered, directly or indirectly, in the United States or to any

U.S. Person.

For purposes of the foregoing paragraphs, "United States" means

the United States of America, its territories and possessions

(including Puerto Rico, the U.S. Virgin Islands, Guam, American

Samoa, Wake Island and the Northern Mariana Islands), any state of

the United States and the District of Columbia.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220623005504/en/

Teleperformance

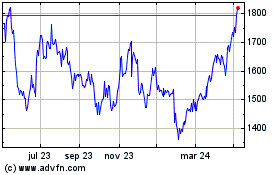

Telecom Plus (LSE:TEP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

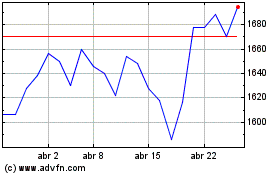

Telecom Plus (LSE:TEP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024