Further strong revenue growth; full-year 2022 guidance

raised

Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20221103005985/en/

Analyse de la croissance du chiffre

d’affaires sur les 9 premiers mois 2022 (Graphique:

Teleperformance)

Teleperformance (Paris:TEP), the global leader in outsourced

customer and citizen experience management and related digital

services, today released its quarterly and nine-month revenue

figures for the period ended September 30, 2022.

- Third-quarter 2022: €2,056 million, up +17.2% as

reported

- up +7.0% like-for-like*

- up +13.8% like-for-like excluding impact of lower

revenue from Covid support contracts

- Nine months 2022: €6,002 million, up +15.7% as reported

- up +6.0% like-for-like*

- up +13.2% like-for-like excluding impact of lower

revenue from Covid support contracts

Solid, responsible growth

- The Group's growth was based on: - a diversified client

portfolio - optimized outsourcing solutions thanks to the digital

transformation - the global expertise developed in each client

sector - the strong momentum in the travel, healthcare (in the

United States) and financial services sectors, as well as in the

digital economy

- The high value-added Specialized Services activities have

recently been strengthened thanks to the acquisition of PSG

Global Solutions (“PSG”) in the recruitment process outsourcing

market. Its offering is based on a digital platform that reduces

recruitment lead time and costs

- The Group is continuing to deploy a flexible work

organization, with around 50% of the workforce working from

home

- In October 2022, for the second year running, Teleperformance

was named one of the World’s 25 Best Workplaces™ across all

industries by Fortune magazine in partnership with Great Place

to Work®

Full-year 2022 targets raised

- Despite an uncertain economic environment, the Group will

continue to grow in the fourth quarter, thanks to the ramp-up

of contracts signed over the course of the year

- Like-for-like revenue growth excluding Covid support

contracts** should be more than +12%, versus the 2022 target of

more than +10% initially communicated

- The EBITDA margin before non-recurring items should be more

than 21%

- The EBITA margin before non-recurring items should stand at

around 15.5%, up +40 basis points year on year, and up +10

basis points compared with the 2022 target of a +30 basis point

increase initially communicated

* At constant scope of consolidation and exchange rates; **

Excluding the impact of lower revenue from Covid support contracts

("Covid contracts")

Commenting on this performance, Teleperformance Chairman and

Chief Executive Officer Daniel Julien said: "In third-quarter

2022, Teleperformance generated revenue growth of +17.2% reported,

of which +7.0% like-for-like and +13.8% excluding the impact of

Covid support contracts. In the first nine months of the year,

revenue amounted to €6 billion. The current momentum supports our

forecast of revenue above €8 billion for the full year, with

like-for-like growth of more than +12%, excluding the impact of

Covid support contracts.

This growth is coupled with an upward trend in EBITA margin,

which should reach 15.5%, up +40 basis points versus 2021 and +10

basis points versus our initial targets.

Despite a tough environment, the growth outlook is solid, thanks

to our three-fold expertise in “lines of business, client

verticals, geographies” and our reinforced investments in digital

solutions.

The acquisition of PSG, specialized in recruitment process

outsourcing (RPO), further enhances our offering."

Nine-month and third-quarter 2022 Group revenue

€ millions

2022

2021

% change

Like-for-like excluding “Covid

contracts”*

Like-for-like

Reported

Average exchange rate (9 months)

€1 = US$1.06

€1 = US$1.20

Nine months

6,002

5,186

+13.2%

+6.0%

+15.7%

Third quarter

2,056

1,755

+13.8%

+7.0%

+17.2%

* Excluding the impact of lower revenue from Covid support

contracts (“Covid contracts”)

Consolidated revenue

Revenue for the third quarter of 2022 amounted to €2,056

million, up +17.2%, including a favorable currency effect

linked mainly to the rise in the US dollar against the euro and a

scope effect reflecting the consolidation of Senture in the Group's

financial statements. Growth was +7.0% on a like-for-like basis

compared to third-quarter 2021, a satisfactory performance

given the absence of any material contribution from Covid support

contracts during the quarter. Adjusted for this non-recurring

impact, third-quarter like-for-like growth was +13.8%, building

on the increased momentum observed in the second quarter across

both of the Group's activities.

Revenue amounted to €6,002 million for the first nine months

of 2022, a year-on-year increase of +6.0% at constant exchange

rates and scope of consolidation (like-for-like) and of +15.7%

as reported. Reported revenue was also lifted by the +€286 million

positive currency effect, stemming mainly from the rise in the US

dollar against the euro. Changes in the scope of consolidation had

a +€203 million positive impact, reflecting the consolidation of

Health Advocate from July 1, 2021 and of Senture from January 1,

2022.

Like-for-like growth in the first nine months of 2022 was

particularly strong given the negative impact of lower revenue

from Covid support contracts (down -€394 million compared with the

first nine months of 2021). Adjusted for this expected

non-recurring impact, like-for-like growth stood at +13.2% for the

period.

This strong momentum is based in particular on the Group's

robust and diversified client portfolio. Thanks to our global

presence and our attractive offering of integrated solutions, "from

the field to the board room", we are well positioned to outperform

the structural growth of the market.

The Specialized Services activities also enjoyed sustained

growth, led by the resounding recovery of TLScontact’s visa

application management business and the continued steady

development of LanguageLine Solutions' online interpreting

business.

Revenue by activity

Nine months 2022

Nine months 2021

Variation

€ millions

Like-for-like

Like-for-like excluding “Covid

contracts”**

Reported

CORE SERVICES & D.I.B.S.*

5,160

4,604

+4.2%

+12.4%

+12.1%

English-speaking & Asia-Pacific

(EWAP)

1,787

1,510

+0.2%

+10.7%

+18.3%

Ibero-LATAM

1,687

1,370

+16.9%

+16.9%

+23.1%

Continental Europe & MEA (CEMEA)

1,275

1,404

-8.2%

+7.7%

-9.1%

India

411

320

+20.3%

+20.3%

+28.3%

SPECIALIZED SERVICES

842

582

+19.1%

+19.1%

+44.7%

TOTAL

6,002

5,186

+6.0%

+13.2%

+15.7%

Q3 2022

Q3 2021

Variation

€ millions

Like-for-like

Like-for-like excluding “Covid

contracts”**

Reported

CORE SERVICES & D.I.B.S.*

1,749

1,529

+5.1%

+13.0%

+14.4%

English-speaking & Asia-Pacific

(EWAP)

612

518

-1.5%

+8.4%

+18.0%

Ibero-LATAM

588

475

+16.8%

+16.8%

+24.0%

Continental Europe & MEA (CEMEA)

401

427

-5.3%

+11.5%

-6.1%

India

148

109

+24.7%

+24.7%

+35.0%

SPECIALIZED SERVICES

307

226

+18.8%

+18.8%

+36.3%

TOTAL

2,056

1,755

+7.0%

+13.8%

+17.2%

* Digital Integrated Business Services ** Excluding the impact

of lower revenue from Covid support contracts ("Covid

contracts")

- Core Services & Digital Integrated

Business Services (D.I.B.S.)

In the third quarter, Core Services & D.I.B.S. revenue

amounted to €1,749 million, up +5.1% like-for-like from the

prior-year period. Excluding the impact of Covid support contracts,

like-for-like growth was +13.0%. The acceleration in business

growth observed in the second quarter of the year continued apace

in the third quarter.

Revenue amounted to €5,160 million in the first nine months of

2022, a year-on-year increase of +4.2% like-for-like. Reported

growth came to +12.1%, with the difference versus like-for-like

growth primarily attributable to the rise against the euro in the

US dollar and most other currencies including the Brazilian real,

the Indian rupee, the Mexican peso and the Colombian peso. In

addition, reported growth includes the contribution of Senture,

which has been consolidated in the Group's financial statements

from January 1, 2022.

Excluding the impact of Covid support contracts, the Core

Services & D.I.B.S. activity delivered +12.4% growth on a

like-for-like basis in the first nine months. This strong momentum

is based in particular on the Group’s robust and diversified client

portfolio.

- English-speaking & Asia-Pacific (EWAP)

In the third quarter, revenue for the region was €612 million,

slightly down (-1.5%) on a like-for-like basis, affected by the

sharp decline in the revenue contribution of Covid support

contracts in the United Kingdom. Excluding the impact of Covid

support contracts, like-for-like growth was +8.4%.

Revenue was €1,787 million for the first nine months of 2022,

stable compared to the prior year with a like-for-like increase of

+0.2%. The reported increase of +18.3% was primarily attributable

to favorable currency effects – corresponding to the rise against

the euro in the US dollar and, to a lesser extent, in the Indian

rupee, the Philippine peso and the pound sterling– and the positive

impact of consolidating Senture from January 1, 2022.

Revenue remained stable throughout the nine-month period due

mainly to the sharp decline in the revenue contribution of Covid

support contracts in the United Kingdom, which was expected.

Excluding Covid support contracts, like-for-like growth for the

EWAP region was +10.7%.

In the North American market, revenue in the social media,

online entertainment, travel and financial services sectors

continued to grow at a brisk pace.

Offshore activities in the Philippines have been growing at a

very rapid pace since the beginning of the year. They are

attractive for effectively addressing the temporary recruitment

difficulties encountered in the US domestic labor market.

In the United Kingdom, activities excluding the impact of Covid

support contracts accelerated significantly in the third quarter in

the banking and insurance sectors and with government agencies.

In the third quarter, revenue came to €588 million, up +16.8% on

a like-for-like basis.

Nine-month revenue for the Ibero-LATAM region came to €1,687

million, a year-on-year increase of +16.9% like-for-like. The

reported increase of +23.1% mainly reflected the rise in the US

dollar, Brazilian real, Mexican peso and Colombian peso against the

euro.

This once again very satisfactory performance is largely

attributable to the Group's assertive operations in the social

media, online entertainment, healthcare, financial services and

travel sectors.

Growth remained strong in most countries in the region. Business

growth was particularly robust in Argentina, Peru, the Dominican

Republic and Mexico. Multilingual hubs in Spain and Portugal are

enjoying further rapid expansion.

- Continental Europe & MEA (CEMEA)

In the third quarter, revenue in the CEMEA region came to €401

million, down -5.3% on a like-for-like basis, due to the sharp

decline in the contribution from Covid support contracts. Excluding

the impact of Covid support contracts, like-for-like growth was

+11.5%.

Revenue amounted to €1,275 million in the first nine months of

2022, a year-on-year decline of -8.2% like-for-like and of -9.1% as

reported, with the difference corresponding to negative currency

effects due mainly to the fall of the Turkish lira against the

euro. The like-for-like decline in revenue is linked to the sharp

decrease in the contribution from Covid support contracts in the

Netherlands, France and Germany. Excluding the impact of Covid

support contracts, business growth reached +7.7% on a like-for-like

basis, accelerating steadily throughout the first nine months of

the year.

The Group reaped the rewards of many new contract start-ups and

buoyant business with multinational clients, particularly in the

travel, automotive, financial services and online entertainment

sectors.

In the third quarter, revenue amounted to €148 million, up

+24.7% like-for-like, a sharp acceleration compared with the first

half of the year.

In the first nine months of 2022, operations in India generated

€411 million in revenue, up +20.3% like-for-like from the

prior-year period and by a stronger +28.3% as reported, due to the

positive currency effect caused by the rise in the Indian rupee

against the euro.

Offshore activities, which are the main source of regional

revenue and include high value-added solutions for all

English-speaking markets, were very robust. Offshore solutions are

particularly attractive since they effectively address temporary

recruitment difficulties encountered in the domestic labor

market.

In the third quarter, revenue was €307 million, up +18.8% on a

like-for-like basis.

Revenue from Specialized Services stood at €842 million in the

first nine months of 2022, a year-on-year increase of +19.1%

like-for-like and of +44.7% as reported. The difference between

like-for-like and reported growth stemmed from a favorable currency

effect linked to the increase in value of the US dollar against the

euro and a positive scope effect in the first half due to the

consolidation of Health Advocate in the Group's financial

statements since July 1, 2021.

The recovery in TLScontact volumes continued in the third

quarter. However, business has still not reached its full potential

due to the lockdowns in China.

The growth of LanguageLine Solutions, the main contributor to

Specialized Services revenue, accelerated in the third quarter. The

healthcare sector, which accounts for more than half of this

business' revenue, notably continued to deliver rapid growth.

Outlook

Barring unforeseen events, Teleperformance’s businesses should

continue to grow actively in the fourth quarter, supported by the

ramp-up of contracts signed in 2022. Based on the growth from

upbeat operations in the first nine months, Teleperformance has

raised its full-year 2022 guidance to:

- like-for-like revenue growth, excluding the

impact of Covid support contracts, of more than +12%, compared with

an initial growth objective of more than +10%, which should also

enable the Group to exceed the initial target of like-for-like

growth of +5%; - an EBITDA margin before non-recurring items of

more than 21% - an EBITA margin before non-recurring items of

around 15.5% respectively, up +40 basis points versus 2021, and up

+10 basis points versus the initial 2022 target of a +30 basis

point increase.

---------------------------------

Disclaimer

All forward-looking statements are based on Teleperformance

management’s present expectations of future events and are subject

to a number of factors and uncertainties that could cause actual

results to differ materially from those described in the

forward-looking statements. For a detailed description of these

factors and uncertainties, please refer to the "Risk Factors"

section of the Universal Registration Document, available at

www.teleperformance.com. Teleperformance undertakes no obligation

to publicly update or revise any of these forward-looking

statements.

Webcast/Conference call with analysts and investors

A conference call and webcast will be held today at 6:15 PM

CEST. The webcast will be available live or for delayed viewing at:

https://channel.royalcast.com/landingpage/teleperformance/20221103_1/

Indicative investor calendar

Full-year 2022 results: February 16, 2023 First-quarter 2023

revenue: April 25, 2023

About Teleperformance Group

Teleperformance (TEP – ISIN: FR0000051807 – Reuters: TEPRF.PA

- Bloomberg: TEP FP), the global leader in outsourced customer and

citizen experience management and related digital services,

serves as a strategic partner to the world’s largest companies in

many industries. It offers a One Office support services model

including end-to-end digital solutions, which guarantee successful

customer interaction and optimized business processes, anchored in

a unique, comprehensive high touch, high tech approach. Nearly

420,000 employees, based in 88 countries, support billions of

connections every year in over 265 languages and around 170

markets, in a shared commitment to excellence as part of the

“Simpler, Faster, Safer” process. This mission is supported by the

use of reliable, flexible, intelligent technological solutions and

compliance with the industry’s highest security and quality

standards, based on Corporate Social Responsibility excellence. In

2021, Teleperformance reported consolidated revenue of €7,115

million (US$8.4 billion, based on €1 = $1.18) and net profit of

€557 million.

Teleperformance shares are traded on the Euronext Paris market,

Compartment A, and are eligible for the deferred settlement

service. They are included in the following indices: CAC 40, STOXX

600, S&P Europe 350, MSCI Global Standard and Euronext Tech

Leaders. In the area of corporate social responsibility,

Teleperformance shares are included in the CAC 40 ESG since

September 2022, the Euronext Vigeo Euro 120 index since 2015, the

EURO STOXX 50 ESG index since 2020, the MSCI Europe ESG Leaders

index since 2019, the FTSE4Good index since 2018 and the S&P

Global 1200 ESG index since 2017.

For more information: www.teleperformance.com Follow us on

Twitter: @teleperformance

Appendix

Glossary - Alternative Performance Measures

Change in like-for-like revenue: Change in revenue at

constant exchange rates and scope of consolidation = [current year

revenue - last year revenue at current year rates - revenue from

acquisitions at current year rates] / last year revenue at current

year rates.

EBITDA before non‑recurring items or current EBITDA (Earnings

before Interest, Taxes, Depreciation and Amortization):

Operating profit before depreciation & amortization,

amortization of intangible assets acquired as part of a business

combination, goodwill impairment charges and non-recurring

items.

EBITA before non‑recurring items or current EBITA (Earnings

before Interest, Taxes and Amortization): Operating profit

before amortization of intangible assets acquired as part of a

business combination, goodwill impairment charges and non-recurring

items.

Non‑recurring items: Principally comprises restructuring

costs, incentive share award plan expense, costs of closure of

subsidiary companies, transaction costs for the acquisition of

companies, and all other expenses that are unusual by reason of

their nature or amount.

Net free cash flow: Cash flow generated by the business -

acquisitions of intangible assets and property, plant and equipment

net of disposals - financial income/expenses.

Net debt: Current and non-current financial liabilities -

cash and cash equivalents

Diluted earnings per share (net profit attributable to

shareholders divided by the number of diluted shares and

adjusted): Diluted earnings per share is determined by

adjusting the net profit attributable to ordinary shareholders and

the weighted average number of ordinary shares outstanding by the

effects of all potentially diluting ordinary shares. These include

convertible bonds, stock options and incentive share awards granted

to employees when the required performance conditions have been met

at the end of the financial year.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221103005985/en/

FINANCIAL ANALYSTS AND INVESTORS Investor relations and

financial communication department TELEPERFORMANCE

investor@teleperformance.com

PRESS RELATIONS Europe IMAGE7

teleperformance@image7.frteleperformance@image7.fr

PRESS RELATIONS Americas and Asia-Pacific Mark

Pfeiffer TELEPERFORMANCE mark.pfeiffer@teleperformance.com

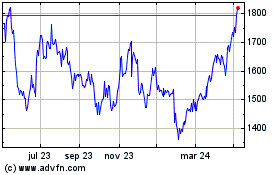

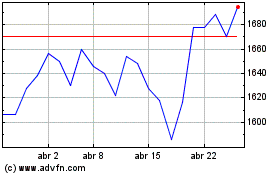

Telecom Plus (LSE:TEP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Telecom Plus (LSE:TEP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024