Individual Disclosure Relating to the Sale of Shares by an Executive of the Teleperformance Group

29 Mayo 2023 - 12:00PM

Business Wire

This sale of shares will enable Daniel Julien, Chairman and

CEO of Teleperformance, to meet the tax burden immediately due in

the US triggered by the vesting of performance shares allocated to

him.

Regulatory News:

Teleperformance (Paris:TEP), a global leader in digital business

services, announced that Daniel Julien, Chairman and CEO of

Teleperformance, will sell around 25,000 Teleperformance’s shares,

in several transactions, to meet the tax burden immediately due

in the US triggered by the vesting of performance shares allocated

to him under the plan dated July 29, 2020. The number of shares

and the average unit prices will be notified to the AMF, the French

financial markets authority, as the transactions are executed, and

will be the subject of individual disclosures relating to

transactions by individuals mentioned in Article L. 621-18-2 of the

French Monetary and Financial Code on dealings in securities.

About Teleperformance Group

Teleperformance (TEP – ISIN: FR0000051807 – Reuters: TEPRF.PA

- Bloomberg: TEP FP), a global leader in digital business

services, serves as a strategic partner to the world’s largest

companies in many industries. It offers a One Office support

services model including end-to-end digital solutions, which

guarantee successful customer interaction and optimized business

processes, anchored in a unique, comprehensive high touch, high

tech approach. More than 410,000 employees, based in 91 countries,

support billions of connections every year in over 300 languages

and 170 markets, in a shared commitment to excellence as part of

the “Simpler, Faster, Safer” process. This mission is supported by

the use of reliable, flexible, intelligent technological solutions

and compliance with the industry’s highest security and quality

standards, based on Corporate Social Responsibility excellence. In

2022, Teleperformance reported consolidated revenue of €8,154

million (US$8.6 billion, based on €1 = $1.05) and net profit of

€645 million.

Teleperformance shares are traded on the Euronext Paris market,

Compartment A, and are eligible for the deferred settlement

service. They are included in the following indices: CAC 40, STOXX

600, S&P Europe 350, MSCI Global Standard and Euronext Tech

Leaders. In the area of corporate social responsibility,

Teleperformance shares are included in the CAC 40 ESG since

September 2022, the Euronext Vigeo Euro 120 index since 2015, the

EURO STOXX 50 ESG index since 2020, the MSCI Europe ESG Leaders

index since 2019, the FTSE4Good index since 2018 and the S&P

Global 1200 ESG index since 2017.

For more information: www.teleperformance.com Follow us on

Twitter: @teleperformance

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230529005131/en/

FINANCIAL ANALYSTS AND INVESTORS Investor relations and

financial communication department TELEPERFORMANCE Tel: +33 1 53 83

59 15 investor@teleperformance.com

PRESS RELATIONS Europe Karine Allouis – Laurent

Poinsot IMAGE7 Tel: +33 1 53 70 74 70 teleperformance@image7.fr

PRESS RELATIONS Americas and Asia-Pacific Nicole

Miller TELEPERFORMANCE Tel: + 1 629-899-0675

nicole.miller@teleperformance.com

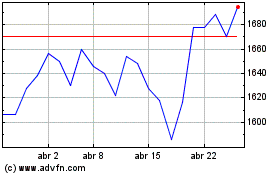

Telecom Plus (LSE:TEP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

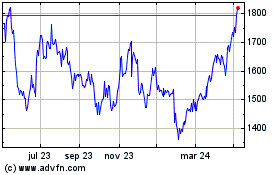

Telecom Plus (LSE:TEP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024