TIDMTHR

RNS Number : 8459J

Thor Mining PLC

29 April 2022

29 April 2022

Thor Mining PLC

("Thor" or the "Company")

Quarterly Activites Report

Highlights Outlook for June Quarter 2022

------------------------------------------------------------ -------------------------------------------------------------

GOLD, LITHIUM, NICKEL

Ragged Range, Pilbara region,

WA Australia

* Field programs recommenced following the opening of * Results from a Fixed Loop Electromagnetic Survey

the WA border. (FLEM) over the Krona Prospect, nickel gossan.

* Lithium mapping and sampling program underway; * Follow up RC drilling program for gold

testing potential lithium-caesium-tantalum (LCT) mineralisationn at the Sterling Prospect.

pegmatite targets associated with the Split Rock

Supersuite.

* Regional mapping and stream sediment sampling results,

targeting additional gold and lithium pegmatites.

* Airborne magnetics survey over the eastern portion of

newly granted tenure.

------------------------------------------------------------ ---------------------------------------------------------------

URANIUM & VANADIUM USA

* Received permitting approval from San Miguel County * Final authorisation for proposed drilling at Wedding

for proposed drill testing at the Wedding Bell Bell Project.

Project, Colorado.

* Drilling preparations underway to test Groundhog, Rim

* The uranium spot price is at an 11 year high, with Rock and Section 23 at Wedding Bell Project,

geopolitical tensions, strong demand, constrained Colorado.

supplies, and underinvestment continuing to drive the

price up.

------------------------------------------------------------ ---------------------------------------------------------------

COPPER

Alford East, SA Australia

* All assays now received from Phase 1 diamond drilling * Continue In-Situ Recovery (ISR) assessment and

program highlighting based high grade copper-gold development of the project.

zones

* Phase 2 diamond drilling is being designed to target

* 3D geological model demonstrates lithological and potential high-grade copper zones along strike.

structural controls on mineralisation, highlighting

key areas to drill test potential high-grade

copper-gold intercepts.

Kapunda, SA Australia (via 30% equity holding in EnviroCopper Ltd)

* ISR push-pull trials underway, with tracer bromide * Copper-gold recoveries from lixiviant trials and

component completed. integration into Scoping Study.

------------------------------------------------------------ ---------------------------------------------------------------

TUNGSTEN & MULTI COMMODITIES

Molyhil, NT Australia

* Successful diamond drilling program completed with * Assay results from diamond drilling program.

all assay submitted for analysis, confirming magnetic

target adjacent to deposit is mineralised magnetite

skarn. * Review strategic plans for Molyhil.

CORPORATE & FINANCE

-- Agreement with Power Metal Resources Plc (AIM: POW) to a

Variation of Tail Benefit as part of the Sale Agreement of the

Pilot Mountain Tungsten Project in Nevada, USA.

Nicole Galloway Warland, Managing Director of Thor Mining,

commented:

" The start of 2022 has seen positive progress made across

Thor's projects.

"Our team is back on the ground for the 2022 field season at our

100% owned Ragged Range Project, WA, with a mapping and sampling

program currently underway to test potential

lithium-caesium-tantalum pegmatite targets associated with the

Split Rock Supersuite. Preparations are being finalised to commence

the second phase of RC drilling at the Sterling Gold Prospect, with

a ground based electromagnetic survey, designed to detect any

conductive anomalies at depth that may indicate the presence of

nickel sulphide mineralisation, scheduled for May 2022

"In the US, we were delighted to receive approval from San

Miguel County for the proposed drill testing at the Wedding Bell

Project, Colorado during the period. Preparations are now underway

to test the project's priority areas, Groundhog, Rim Rock and

Section 23. Thor's Board notes the heightened demand for uranium in

the US as the country seeks to secure domestic supply in order to

replace its reliance on Russian imports.

"At the Alford East copper-gold project, SA, Australia, we

reported encouraging results for copper and gold from our first

phase of drilling. A second phase of drilling, which will include

hydrogeology and hydrometallurgical studies, is now being designed.

This program will target further high-grade zones and aid our

assessment of the project's ISR potential.

"After a successful first quarter, Thor looks forward to

updating the market on progress made across its portfolio in

2022."

Photo Plate 1 may be viewed via the following link:

http://www.thormining.com/sites/thormining/media/Maps/AOI-11_798246E_7587303N_b.JPG

This announcement is authorised for release to the market by the

Board of Directors.

For further information, please contact:

Thor Mining PLC

Nicole Galloway Warland, Managing Director Tel: +61 (8) 7324

Ray Ridge, CFO / Company Secretary 1935

Tel: +61 (8) 7324

1935

WH Ireland Limited (Nominated Adviser Tel: +44 (0) 207

and Joint Broker) 220 1666

Jessica Cave / Darshan Patel / Megan

Liddell

SI Capital Limited (Joint Broker) Tel: +44 (0) 1483

413 500

Nick Emerson

Yellow Jersey (Financial PR) thor@yellowjerseypr.com

Sarah Hollins / Henry Wilkinson Tel: +44 (0) 20

3004 9512

Updates on the Company's activities are regularly posted on

Thor's website www.thormining.com , which includes a facility to

register to receive these updates by email, and on the Company's

twitter page @ThorMining .

About Thor Mining PLC

Thor Mining PLC (AIM, ASX: THR; OTCQB: THORF) is a diversified

resource company quoted on the AIM Market of the London Stock

Exchange, ASX in Australia and OTCQB Market in the United

States.

The Company is advancing its diversified portfolio of precious,

base, energy and strategic metal projects across USA and Australia.

Its focus is on progressing its copper, gold, uranium and vanadium

projects, while seeking investment/JV opportunities to develop its

tungsten assets.

Thor owns 100% of the Ragged Range Project, comprising 92 km(2)

of exploration licences with highly encouraging early stage gold

and nickel results in the Pilbara region of Western Australia, for

which drilling is planned in the second half of 2021.

At Alford East in South Australia, Thor is earning an 80%

interest in copper deposits considered amenable to extraction via

In Situ Recovery techniques (ISR). In January 2021, Thor announced

an Inferred Mineral Resource Estimate of 177,000 tonnes contained

copper & 71,000 oz gold(1).

Thor also holds a 30% interest in Australian copper development

company EnviroCopper Limited, which in turn holds rights to earn up

to a 75% interest in the mineral rights and claims over the

resource on the portion of the historic Kapunda copper mine and the

Alford West copper project, both situated in South Australia, and

both considered amenable to recovery by way of ISR.(2)(3)

Thor holds 100% interest in two private companies with mineral

claims in the US states of Colorado and Utah with historical

high-grade uranium and vanadium drilling and production

results.

Thor holds 100% of the advanced Molyhil tungsten project,

including measured, indicated and inferred resources , in the

Northern Territory of Australia, which was awarded Major Project

Status by the Northern Territory government in July 2020.

Adjacent to Molyhil, at Bonya, Thor holds a 40% interest in

deposits of tungsten, copper, and vanadium, including Inferred

resource estimates for the Bonya copper deposit, and the White

Violet and Samarkand tungsten deposits.

Notes

(1)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20210127-maiden-copper.gold-estimate-alford-east-sa.pdf

(2)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20172018/20180222-clarification-kapunda-copper-resource-estimate.pdf

(3)

www.thormining.com/sites/thormining/media/aim-report/20190815-initial-copper-resource-estimate---moonta-project---rns---london-stock-exchange.pdf

(4)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20210408-molyhil-mineral-resource-estimate-updated.pdf

(5)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20200129-mineral-resource-estimates---bonya-tungsten--copper.pdf

MAR

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

RAGGED RANGE PROJECT

The Ragged Range Project, located in the prospective Eastern

Pilbara Craton, Western Australia (Figure 1) is 100% owned by Thor

Mining - E46/1190, E46/1262, E46/1355, E46/1340, plus the recently

granted E46/1393 Figure 1.

Since the acquisition, Thor has conducted several programs of

stream sediment and soil sampling to delineate drill targets. Thor

has also flown an airborne magnetics survey over the tenement area

to better define the structural features of the area.

Further details of the projects may be found on the Thor

website:

www.thormining.com/projects/ragged-range-pilbara-project

Figure 1: Ragged Range Project Location map (a) and Tenement Map

(b) showing priority targets.

a) a copy of the Ragged Range Project Map may be view via the

following link:

www.thormining.com/sites/thormining/media/Maps/20-004-1a-ragged-range-location.jpg

Figure 1b) a copy of the Regional Sterling prospect may be

viewed by the following link:

http://www.thormining.com/sites/thormining/media/maps/prospects.jpg

Lithium Program

The Thor team are back on the ground following the reopening of

the WA border, mapping and sampling several lithium targets,

including potential lithium-caesium-tantalum ("LCT") pegmatites

which have been identified within the prospective 10km radius of

the Split Rock Supersuite at Thor's Ragged Range Project (Figure

1).

The Pilbara Craton is highly prospective for LCT enriched

pegmatites and hosts two large and globally significant spodumene

deposits at Wodgina (Mineral Resources Ltd) and Pilgangoora

(Pilbara Minerals). The Wodgina lithium project is considered the

largest hard rock, spodumene deposit in the world (

https://www.carbonart.com.au ) (Figure 2).

The lithium-rich pegmatites in the Pilbara are spatially and

appear to be genetically related to the Split Rock Supersuite (2.85

to 2.83Ma) (Sweetapple, M, 2017). Within Thor's tenure, the Mondana

Monzogranite part of the Split Rock Supersuite mapped in the

northern portion of tenure is untested for lithium potential

(Figure 1).

Thor's exploration strategy is to ground-truth the 10km halo

around the Mondana Monzongranite, considered the most favourable

position for the spatial zonations of LCT enriched pegmatites.

The current field program, utilising Thor's radiometrics and

aster data, has highlighted several priority areas for mapping and

sampling, including:

1) The northeast corner of E46/1262 where small pegmatites and

granitic bodies have been identified. This is considered a

potential roof zone of the Mondana Monzogranite, making it the most

prospective area for lithium enriched pegmatites within the

tenement package (Figure 1).

2) The second target area is on E46/1393 where numerous

structures cut the older Euro Basalt, providing conduits for

pegmatites emanating from the adjacent Mondana Monzogranite (Figure

1).

3) The third area of interest is a small enclave of greenstone

at the contact of the Mondana Monzogranite in E46/1340 (Figure

1).

Figure 2: Geological map of the units and terranes comprising

the North Pilbara Craton (adapted from Sweetapple and Collins, 2002

and Hickman, 2016), highlighting the distribution of the Split Rock

Supersuite (2.85-2.83 Ga) and pegmatite fields and groups of LCT

(Li-Cs-Ta), NYF (Nb-Y>F) and mixed (LCT-NYF) petrogenetic

families of Cerny and Ercit (2005). Ragged Range tenure is shown

covering the southern portion of the Split Rock Supersuite and

Corunna Downs Batholith (after Sweetapple., 2017 ).

https://www.thormining.com/sites/thormining/media/pdf/ASX-Announcements/20202021/split-rock-supersuite.jpg

Next Steps

Following the current initial lithium mapping and sampling

program, the following activities are proposed at Ragged Range,

targeting priority lithium, nickel and gold targets:

-- Investigation of all small granitic and pegmatitic bodies in

the lithium target area. Samples are to be assayed for lithium and

key pathfinder elements including Ce, Rb, Sn, Ta and W.

-- Reconnaissance soil sampling and prospecting within the 10km

halo of the Mondana Monzogranite (E46/1262, E46/1190, E461393 and

E46/1340) (Figure 1).

-- A high-powered Fixed Loop Electromagnetics (FLEM) ground

geophysics survey is scheduled for early May over the nickel gossan

located in the western portion of tenure. The survey is designed to

detect any conductive anomalies at depth that may indicate the

presence of nickel sulphide mineralisation. The survey is

anticipated to take one week to complete.

-- Continuation of RC drilling at Sterling prospect following up

on structurally controlled anomalous gold in streams and soils.

-- Airborne magnetic/radiometric survey to be flown over the

eastern portion of the tenure including E46/1340 and E46/1393.

URANIUM AND VANADIUM PROJECTS

Thor holds a 100% interest in two US companies with mineral

claims in Colorado and Utah, USA. The claims host uranium and

vanadium mineralisation in an area known as the Uravan Mineral

Belt, which has a history of high-grade uranium and vanadium

production (Figure 3).

Within probable economic transport distance is a processing

plant (Energy Fuels White Mesa Mill) which may be a low hurdle

processing option for any production from these projects.

Details of the projects may be found on the Thor website:

www.thormining.com/projects/us-uranium-and-vanadium .

Figure 3: Location map showing projects, infrastructure and nearby White Mesa processing plant.

https://www.thormining.com/sites/thormining/media/Maps/20-003-2-VKRMWB-Locn.jpg

Thor has systematically worked through the San Miguel County,

Colorado approvals process, with the Board of County Commissioners

(BOCC) approving the proposed Wedding Bell drilling program at a

public hearing on 30 March 2022.

The proposed initial drilling program is designed to test the

three Wedding Bell prospects: Groundhog, Rim Rock and Section 23

(Figure 3). The Wedding Bell Project lies within the Uravan Mineral

Belt, considered highly prospective for shallow 'Saltwash' type

sandstone-hosted, high-grade uranium-vanadium mineralisation

(Figure 4).

Field sampling by Thor returned assay results of high-grade

uranium, up to 1.25% (12,500ppm) U(3) O(8) and vanadium, up to

3.47% V(2) O(5) (THOR ASX, AIM: 21 July 2020).

Figure 4: Map of Colorado Wedding Bell Project showing priority

areas - Section 23, Groundhog and Rim Rock.

http://www.thormining.com/sites/thormining/media/maps/21-003-1-us-uranium.jpg

Next Steps:

-- Complete the sign off process with the Federal Bureau of Land

Management (BLM) and the Colorado Division of Reclamation Mining

and Safety (DRMS).

-- Finalise environmental management plan in line with approvals

for drilling and reclamation bond.

-- Complete drilling preparations, including engaging drilling contractors.

-- Drilling is anticipated to commence mid-year.

Uranium Market

Spot uranium prices are trading near an 11-year high, the

Directors believe this is a result of geopolitical tension, strong

demand, constrained supplies and underinvestment.

Potential US sanctions on Russian uranium imports has resulted

in an increased importance on US domestic uranium supply.

The 'green wave' is impacting the uranium sector, with the US

and now UK in particular turning to nuclear energy in order to

generate reliable, safe and carbon free base load power.

COPPER PROJECTS

Thor holds direct and indirect interests in over 400,000 tonnes

of Inferred copper resources in South Australia, via its 80%

farm-in interest in the Alford East copper project and its 30%

interest in EnviroCopper Ltd.

Each of these projects are considered by Thor directors to have

significant growth potential, and each are being advanced towards

development via low cost, environmentally friendly In Situ Recovery

("ISR") techniques.

Figure 5: SA Copper projects location map

http://www.thormining.com/sites/thormining/media/maps/17-007-1b-kapunda-alford-location.jpg

ALFORD EAST COPPER-GOLD PROJECT - SA

The Alford East Copper-Gold Project is located on EL6529. Here,

Thor is earning up to 80% interest from unlisted Australian

explorer Spencer Metals Pty Ltd, covering portions of EL6255 and

EL6529 (THR:ASX 23 November 2020).

The Project covers the northern extension of the Alford Copper

Belt, located on the Yorke Peninsula, SA (Figure 5). The Alford

Copper Belt is a semi coherent zone of copper-gold oxide

mineralisation within a structurally controlled, north-south

corridor. This consists of deeply kaolinised and oxidised troughs

within metamorphic units on the edge of the Tickera Granite, Gawler

Craton, SA (Figure 6).

Utilising historic drill hole information, Thor completed an

inferred Mineral Resource Estimate (MRE), (THR:ASX 27 January

2021), consisting of:

-- 125.6Mt @ 0.14% Cu containing 177,000t of contained

copper

-- 71, 500oz of contained gold

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20210127-maiden-copper.gold-estimate-alford-east-sa.pdf

Figure 6: Alford East Project showing the eight mineralised

domains (Plan View) (left) and Tenement & Prospect Location

Plan (right).

http://www.thormining.com/sites/thormining/media/maps/21-001-4-ae-mre-%E2%80%93-location.jpg

http://www.thormining.com/sites/thormining/media/Maps/mre_ae_5-drilling.jpg

Alford East Diamond Drilling Program Update

The first phase of drilling comprised nine diamond drillholes

totalling 878m, with all assays now received for all drillholes.

This initial program for Thor focussed only on the northern portion

of the Alford East copper-gold deposit, around the AE-5 mineralised

domains (Figure 6 and 7), with drilling targeting areas open at

depth and along strike.

Significant intercepts including:

21AED001 32.9m @ 0.4% Cu and 0.31g/t Au from 81.5m (ASX:THR 31.8.21),

21AED002 59.9m @ 0.3% Cu from 21.9m (ASX:THR 31.8.21),

21AED003 32.4m @ 0.2% Cu from 15m,

21AED004 55.9m @ 0.53% Cu from 7m, including,

11.7m @ 1.0%Cu from 17.3m, including,

5.7m @ 1.23% and 0.16g/t Au from 17.3,

21AED005 72.7m @ 1.0% Cu and 0.19g/t Au from 6.3m, including ,

18.2m @ 2.0% Cu and 0.34g/t Au from 15.8m (ASX:THR 31.8.21),

Figure 7: Alford East Project AE-5 domain showing drillhole location plan.

https://www.thormining.com/sites/thormining/media/Maps/ae-5-location-plan.jpg

For ISR purposes, drilling was limited to the deeply weathered

lithological profile, testing the extent of the oxide zone and the

depth boundary of the Top of Fresh Rock (TOFR). The copper-gold

oxide mineralisation is hosted within deeply kaolinised (clay) and

metasomatic altered units on the contact between the Olympic Domain

Wallaroo Group metasediments and the Hiltaba Suite Tickera Granite,

Gawler Craton (Figure 6). Copper oxide mineralogy is dominated by

malachite and chalcocite.

Drill targeting, vectoring in on the hanging wall side of the

north-south trending controlling structure, now referred to as

Netherleigh Park Fault, intercepted zones of high-grade copper and

gold grades, resulting in significant grade uplift in comparison to

the MRE (Figure 7).

Drillholes 21AED001, 21AED003 and 21AED005 (Section A-A'

6,256,360mN) were drilled through the central portion of AE-5

(Figures 7 and 8), designed to validate the geological model and

test areas open at depth. The high-grade copper and gold intercepts

in 21AED001 opens the mineralisation up at depth, whilst 21AED005

highlights the significant grade uplift along the Netherleigh Park

Fault.

21AED004 (Section B-B' 6,235,440mN) was drilled along strike to

the north 21AED005, a continuation of higher copper grades along

fault (Figure 7 and 9).

21AED002, 21AED006 and 21AED007 (Section C-C' 6,235,600mN) were

all drilled to the north of the AE-5 MRE domain, with assay results

extending the known copper mineralisation along strike towards AE-8

(Figure 2, 3 and 6).

Multi-element analysis of the assay results highlights two

distinct higher-grade zones of copper-gold mineralisation within a

broader mineralised envelope. The lower of the two has a distinct

IOCG geochemical signature: elevated Cu, Au, Mo, Co, Se, Bi &

REE (Figure 6 log plot). This potentially reflects sulphide

oxidation of primary mineralisation; whilst the upper zone has a

more amorphous distribution typical of a supergene mineralised

system .

Figure 8: Cross section 6,256,360mN looking NNE, showing

21AED001, 21AED003 and 21AED005. Copper assays shown as cylinder

down hole trace.

http://www.thormining.com/sites/thormining/media/Maps/xs-6256360mn..jpg

Figure 9: Cross section 6,256,440mN looking NNE, showing

21AED004, with copper assays shown as cylinder downhole trace.

http://www.thormining.com/sites/thormining/media/pdf/ASX-Announcements/20202021/2022.02.17-section-b-6256440mn-incl-21aed004-final-assays.jpg

Figure 10: Cross section 6,256,600mN showing 21AED002 and

21AED007 , with copper assays shown as cylinder downhole trace.

http://www.thormining.com/sites/thormining/media/pdf/ASX-Announcements/20202021/2022.02.17-section-c-6256600mn-incl-21aed002-and-21aed007-final-assays.jpg

Figure 11: Multi-element log plot for 21AED001 showing two

distinct higher grade copper zones with the lower gold rich zone

reflecting IOGC geochemical signature. Also showing metallurgical

samples

http://www.thormining.com/sites/thormining/media/Maps/21aed001_log-plot.jpg

New Alford East Geological Model

Based on the recent diamond drilling, a new robust 3D geological

model was generated using a combination of weathering, lithology,

assay and structural data from logging, and regional geology,

structural and geophysics (magnetics and gravity) data (Figure

7).

Key geological outcomes:

-- The highest grade oxide mineralisation seems to occur where a

fault has facilitated a more deeply weathered profile.

-- Some faults appear to have had minor vertical offset on them

post-development of the weathering profile (for example, the

north-east trending Netherleigh Park Fault, central to the project

area).

-- Mineralisation shows a preference to be hosted in metasediments.

-- A Sulphidic-Magnetic-Shale (SMS) stratigraphic-alteration

unit, appears as a marker unit in the regional and more local

magnetics images, as well as in the regional 3D magnetics and

gravity inversions.

-- The SMS unit was modelled using the above information,

showing an overall synformal shape with AE3 sitting in the core or

trough of overlying metasediments formed by the synform.

-- Most supergene mineralisation appears to occur in the hanging

wall of the SMS, whilst the weathered primary mineralisation (such

as in the deeper sections of AE8 and AE5) seems to be associated

with major faults, such as the central Netherleigh Park Fault.

Figure 12: 3D Geological Model - showing the major faults in

black, cover in translucent brown, weathered rock in translucent

green, fresh rock in translucent yellow, sulphidic-magnetic-shale

(SMS), and the resource domains in green (labelled).

http://www.thormining.com/sites/thormining/media/pdf/ASX-Announcements/20202021/ae_basement-geology.jpg

Hydrometallurgy

Thor's objective is to identify an in-situ recovery pathway

ideally for both the copper and gold mineralisation at the Alford

East Project that is both socially and environmentally friendly,

rather than using conventional acid in-situ recovery (ISR).

This has led to Thor engaging Mining Processing Solutions (MPS)

in trialling their alkaline Glycine Leaching Technology (GLT),

branded as their GlyCat(TM) and GlyLeach(TM) processes, that have

the capability to selectively leach base and precious metals using

glycine as the principal, eco-friendly, reagent.

A preliminary 'discovery' metallurgical test program has been

carried out to determine the amenability of the Alford East

mineralisation to metal recovery using GLT. The test work has

involved two rounds of Diagnostic Leach Tests (DLTs), and one round

of Bottle Roll Tests (BRTs) (Figure 8) on the two samples from

21AED001 (Table D). The two zones are highlighted in Figure 6.

Ground water collected from Alford East was used in the laboratory

test work to ensure water characteristics, especially pH, were

tailored to Project conditions.

Table D: Samples selected for testing - Fire and 4 acid digest

assay results

Hole ID Sample Assay ID Cu (ppm) Au (ppm)

21AED001 AE Upper Zone THOM-01-002 1,080 0.02

---------------- -------------- ------------ ------------

21AED001 AE Lower Zone THOM-01-001 4,920 1.10

---------------- -------------- ------------ ------------

21AED001 Combined THOM-01-003 2,950 0.51

---------------- -------------- ------------ ------------

Figure 13: Overview of test work

http://www.thormining.com/sites/thormining/media/pdf/ASX-Announcements/20202021/initial-test-work.jpg

Initial Findings:

-- Based on copper sequential analysis (identifies leachable

copper mineralogy) - 15% of the copper from the upper zone and up

to 50% from the lower zone should be theoretically leachable with

GLT.

-- Based on the gold diagnostic leach assays, extraction from

the lower zone of up to 73.4% should be theoretically leachable

with Glycine Leaching Technology (GLT). The upper zone had

negligible gold.

-- Diagnostic Leach Test - designed to be initial comparison

tests to ascertain the response to a range of conditions including

a baseline cyanidation test.

-- Bottle Roll tests (6):

-- The composite sample performed very well with GLT, extracting

98.1% of the gold and over 40% of the copper.

-- Lower zone using GLT extracted 78.3% of the gold and 33.5% of

the copper, whilst the lower zone using cyanide extracted 64.1% Au

and 48.2% of the copper.

-- The alkaline Glycine Leaching Technology (GLT) has slower

leaching dynamics than cyanidation, so if given more time higher

extractions would be expected.

Next Steps:

Based on the new geological model, approximately 10 diamond

drill holes have been designed to test potential high-grade zones

(Figure 12):

-- Along strike and up-dip of deeply weathered zones.

-- Targeting controlling key structures including the

Netherleigh Park Fault at depth especially where there are large

gaps in existing data.

-- Targeting intersection of SMS and Liaway offset Fault.

-- Targeting intersection of Netherleigh Park Fault and Liaway

Fault.

-- Targeting subordinate splays off Netherleigh Park Fault where

there is evidence of a deep weathering trough.

In addition, hydrogeological water bores and pump testing are

being planned to determine aquifer connectivity between holes, with

an initial focus on the northern area of the mineralisation.

Concurrent to drilling, hydrometallurgical work will continue to

investigate and optimise both copper and gold metal extraction

using environmentally friendly lixiviants.

Figure 14: Phase two proposed drillholes, targeting potential

higher-grade zones open at depth and along strike

http://www.thormining.com/sites/thormining/media/pdf/ASX-Announcements/20202021/phase-2-drilling-proposal.jpg

This work is co-funded by the SA Government Accelerated

Discovery Grant (ADI) of A$300,000.

In conjunction with the technical assessment, Thor will continue

ongoing stakeholder and community engagement, and regulatory

activities.

Based on the nature of the oxide mineralisation, the deposit is

considered amenable to ISR techniques. For further information on

ISR, please refer to Thor's website via this link for an

informative video: www.youtube.com/watch?v=eG_1ZGD0WIw

KAPUNDA and ALFORD WEST COPPER PROJECTS - SA

Thor holds a 30% equity interest in private Australian company

EnviroCopper Limited ("ECL"). In turn, ECL has entered into an

agreement to earn, in two stages, up to 75% of the rights over

metals which may be recovered via ISR contained in the Kapunda

deposit from Australian listed company Terramin Australia Limited

("Terramin" ASX: "TZN"), and the rights to 75% of the Alford West

copper project, comprising the northern portion of exploration

licence EL5984 held by Andromeda Metals Limited (ASX:ADN).

Information about EnviroCopper Limited and its projects can be

found on the EnviroCopper website:

www.envirocopper.com.au

KAPUNDA

EnviroCopper Ltd ("EnviroCopper" or "ECL") has completed the

installation of test well arrays whilst commencing in-situ recovery

trials ("ISR"), including tracer and push-pull test work (Figure

5). These tests are the final hydrometallurgical assessments before

ECL commences Site Environmental Lixiviant Trials (SELT).

The purpose of lixiviant trials (or "push-pull tests") is to

assess the solubility of copper mineralisation and, therefore,

copper recovery, using a specially designed solution called a

lixiviant under in-situ conditions. The trial is to be undertaken

in two stages: the first stage involves injecting and extracting a

tracer solution (Sodium Bromide - NaBr) from the same well to

demonstrate hydraulic connectivity between the observation and

environmental monitor well network This is followed by injecting

and extracting lixiviant from the same well to test copper

solubility from the mineralisation.

Key outcomes anticipated from lixiviant trials:

-- Hydraulic connectivity between wells

-- Copper solubility and recovery

-- Establish lixiviant and time parameters for design of the

Site Environmental Lixiviant Trials (SELT).

TUNGSTEN PROJECTS

MOLYHIL TUNGSTEN / MOLYBDENUM PROJECT - NT (100% Thor)

The Molyhil tungsten-molybdenum-copper deposit is 100% owned by

Thor Mining and is located 220km north-east of Alice Springs (320km

by road) within the prospective polymetallic province of the

Proterozoic Eastern Arunta Block in the Northern Territory (Figure

14).

The deposit consists of two adjacent outcropping iron-rich skarn

bodies: the northern 'Yacht Club' lode and the 'Southern' lode.

Both lodes are marginal to a granite intrusion; both lodes contain

scheelite (CaWO(4) ) and molybdenite (MoS(2) ) mineralisation

(Figure 10). Both of the outlines of the lodes and the banding

within the lodes strike approximately north and dip steeply to the

east.

A full background on the project is available on the Thor Mining

website: www.thormining.com/projects .

Figure 15: Molyhil Project Location map

https://www.thormining.com/sites/thormining/media/Maps/12-002-1b-molyhil-location.jpg

Diamond Drilling Program

During a 3D geological and geophysical modelling exercise

completed over March and April 2021, a potential extension to the

known Molyhil tungsten-molybdenum-copper mineralisation was defined

by a large magnetic target (Figures 16 and 17). It was noted that

previous drilling in this area had not tested the newly identified

magnetic body.

Three diamond drillholes (21MHDD001 - 21MHDD003), totalling

995.4m, were successfully tested. This confirmed the newly

identified magnetic target, representing a significant magnetite

skarn hosting disseminated tungsten-molybdenum-copper

mineralisation south of the Molyhil Critical Minerals Project (ASX:

THR 7 December 2021).

Both 21MHDD002 and 21MHDD003 intercepted disseminated

mineralisation, consisting of scheelite-molybdenite and

chalcopyrite within massive magnetite skarn. Drillhole 21MHDD002

intercepted over 45m of disseminated mineralisation (Figure 16),

whilst 21MHDD003 intercepted two zones over 29m of disseminated

mineralisation . It appears 21MHDD001 intersected the edges of the

magnetite skarn drilling over the top of the magnetite skarn lode

with negligible mineralisation. Initial interpretation of data

highlights a potential south-east plunging lode extending southeast

of the southern lode, with a possible offset (yet to be determined)

(Figure 16). Drilling data is now being compiled to revise the 3D

model.

Previous 3D geological modelling of the Molyhil deposit

identified two prominent structures - the Yacht Club fault and

South Offset fault (Figure 15 and 16). Based on the geological

timing of these faults, they appear to have had a significant

impact on mineralisation, such as offsetting the Yacht Club

mineralisation from the Southern Lode, hence creating targets for

potential extensions. Modelling of the South Offset Fault, relative

to the magnetics, strongly implies an offset of the now confirmed

magnetite skarn, host to the tungsten-molybdenum-copper

mineralisation, and south of the South Offset fault.

The drilling program is co-funded by the Geophysics and Drilling

Collaborations (GDC) program as part of their 'Resourcing the

Territory' initiative, with Thor Mining granted A$110,000 (ASX: THR

4 June 2021). Full details can be found on the NTGS website :

www.resourcingtheterritory.nt.gov.au/about/gdc .

The newly discovered extension of the

tungsten-molybdenum-chalcopyrite mineralisation to the south of the

Molyhil deposit has validated the successful 3D modelling of the

geology, magnetics and mineralisation. The newly acquired data will

be used to enhance the 3D model prior to follow up potential

resource drilling.

Figure 16: Plan view, looking down at the conceptual pit shell

(brown), with the 0.3% WO(3) isosurface in blue, 0.15% Mo

isosurface in silver, and modelled 3D magnetics in transparent red.

The yellow dashed line shows the location of the long section

(Figure 3). 21MHDD001 and 21MHDD002 completed with DD Hole C

underway.

https://www.thormining.com/sites/thormining/media/maps/plan-view_dec21.jpg

Figure 17: Long section of the Molyhil project looking

west-northwest, showing two drilled holes and a third planned hole.

Drilled holes, 21MHDD001 and 21MHDD002, were targeted into the

magnetic anomaly where it appears offset at depth by faulting. The

next planned hole, DD Hole C, is planned to intersect the

geological plunge of the mineralised intercept in 21MHDD002. The

conceptual pit shell is shown in brown, 0.3% WO(3) isosurface in

blue, 0.15% Mo isosurface in silver, and modelled 3D magnetics in

red (0.175 SI), and as a transparent red envelope (0.15 SI) and a

conceptual shape representing the down-plunge mineralised zone in

yellow.

https://www.thormining.com/sites/thormining/media/maps/x-section_dec21.jpg

Bonya (Tungsten, Copper) and Jervois Vanadium Projects (40%

Thor)

The Bonya tungsten, copper and vanadium deposits are located

approximately 30km to the north-east of Molyhil (Figure 18). Thor,

in joint venture with Arafura, holds a 40% equity interest in the

resources.

A full background on the project is available on the Thor Mining

website: www.thormining.com/projects .

Figure 17 : Molyhil Project location showing adjacent Bonya

tenement

https://www.thormining.com/sites/thormining/media/Maps/15-001-1d-bonya-resources.jpg

CORPORATE, FINANCE, and CASH MOVEMENTS

Agreement with Power Metal Resources Plc (AIM: POW) for a

Variation of the Tail Benefit as part of the Sale Agreement of the

Pilot Mountain Tungsten Project in Nevada, USA, which resulted in

an immediate cash payment of GBP50,000 to Thor and ordinary shares

in POW to the value of GBP100,000. The sale of Pilot Mountain

completed on 24 January 2022.

For all terms of the Sale Agreement can be viewed via

announcement link:

https://www.thormining.com/sites/thormining/media/pdf/asx-announcements/20220125-pilot-mountain-tail-benefit-variation-and-sale-completion.pdf

Net cash outflows from Operating and Investing activities for

the quarter of $194,000 included inflows of $310,000 related to the

sale of the Pilot Mountain Project, sale of 4.5 million Power Metal

Resources Plc (POW) shares, and government grants. Of the remaining

$504,000 net cash outflows, $241,000 directly related to

exploration activities.

Net cash inflow from Financing activities for the quarter

$109,000, relating to the exercise of options held by the Company's

broker PAS Partners.

Providing an ending cash balance of $2,780,000.

Thor continues to hold 48,118,920 POW Shares which are released

from a trading restriction at the rate of 25% each quarter, with

the first release on 30 April 2022. The market value of the POW

shares currently held is GBP794,000 (approximately $1,393,000)

based on the closing price of the POW Shares as traded on the

London Stock Exchange on 27 April 2022

Cashflows for the quarter include related party payments of

$98,000 to Directors, comprising the Managing Director's salary,

and Non-Executive Directors' fees.

Yours faithfully,

THOR MINING PLC

Nicole Galloway Warland

Managing Director

Competent Person's Report

The information in this report that relates to exploration

results is based on information compiled by Nicole Galloway

Warland, who holds a BSc Applied geology (HONS) and who is a Member

of The Australian Institute of Geoscientists. Ms Galloway Warland

is an employee of Thor Mining PLC. She has sufficient experience

which is relevant to the style of mineralisation and type of

deposit under consideration and to the activity which she is

undertaking to qualify as a Competent Person as defined in the 2012

Edition of the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves'. Nicole Galloway

Warland consents to the inclusion in the report of the matters

based on her information in the form and context in which it

appears.

Updates on the Company's activities are regularly posted on

Thor's website www.thormining.com , which includes a facility to

register to receive these updates by email, and on the Company's

twitter page @ThorMining .

TENEMENT SCHEDULE

At 31 March 2022 , the consolidated entity holds an interest in

the following Australian tenements:

Project Tenement Area kms(2) Area ha. Holders Company Interest

Molyhil Mining Pty

Molyhil EL22349 228.10 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil EL31130 9.51 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil ML23825 95.92 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil ML24429 91.12 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil ML25721 56.2 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil AA29732 38.6 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS77 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS78 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS79 8.09 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS80 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS81 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS82 8.09 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS83 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS84 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS85 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS86 8.05 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Bonya EL29701 204.5 Ltd 40%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Bonya EL32167 74.54 Ltd 40%

---------- ----------- -------- -------------------- ----------------

Pilbara Goldfields

Panorama E46/1190 35.03 Pty Ltd 100%

---------- ----------- -------- -------------------- ----------------

Pilbara Goldfields

Ragged Range E46/1262 57.3 Pty Ltd 100%

---------- ----------- -------- -------------------- ----------------

Corunna Pilbara Goldfields

Downs E46/1340 48 Pty Ltd 100%

---------- ----------- -------- -------------------- ----------------

Pilbara Goldfields

Bonney Downs E46/1355 38 Pty Ltd 100%

---------- ----------- -------- -------------------- ----------------

Hamersley Pilbara Goldfields

Range E46/1393 11 Pty Ltd 100%

---------- ----------- -------- -------------------- ----------------

At 31 March 2022 , the consolidated entity holds an interest in

the following tenements in the US State of Nevada:

Claim Prospect Claim Name Area Holders Company

Group Interest

45 blocks (611ha

Platoro Desert Scheelite NT #55 - 64 or 1,510 acres) 100%

-------- ----------------- ---------------- ------------------------------------- ---------

Garnet NT #9 - 18

Pilot Metals

Inc

-------- ----------------- ---------------- -------------------- ---------

Gunmetal NT #19 - 22,

6, 7

----------------- ----------------

Good Hope NT #1 - 5,

41 - 54

-------- ----------------- ---------------- -------------------- --------------- ---------

Black Fire 109 blocks (1,481ha BFM Resources

BFM 1 Claims BFM1 - BFM109 or 3,660 acres) Inc 100%

----------------- ---------------- -------------------- --------------- ---------

Des Scheel 22blocks (299ha BFM Resources

BFM 2 East BFM109 - BFM131 or 739Acre) Inc 100%

----------------- ---------------- -------------------- --------------- ---------

Dunham BFM Resources

Mill Dunham Mill MS1 - MS4 4 blocks Inc 100%

----------------- ---------------- -------------------- --------------- ---------

On 31 March 2022, the consolidated entity holds 100% interest in

a Uranium and Vanadium projects in US States of Colorado and Utah

as follows:

Claim Serial Number Claim Name Area Holders Company

Group Interest

Vanadium UMC445103 100 blocks (2,066 Cisco Minerals

King (Utah) to UMC445202 VK-001 to VK-100 acres) Inc 100%

------------- -------------- ------------------ ------------------ ------------------ ---------

Radium

Mountain CMC292259 Radium-001 99 blocks (2,045 Standard Minerals

(Colorado) to CMC292357 to Radium-099 acres) Inc 100%

-------------- ------------------ ------------------ ------------------ ---------

Groundhog CMC292159 Groundhog-001 100 blocks (2,066 Standard Minerals

(Colorado) to CMC292258 to Groundhog-100 acres) Inc 100%

-------------- ------------------ ------------------ ------------------ ---------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUKSVRUKUSURR

(END) Dow Jones Newswires

April 29, 2022 02:02 ET (06:02 GMT)

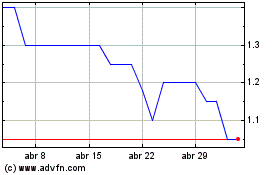

Thor Energy (LSE:THR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Thor Energy (LSE:THR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024