Time Finance PLC Own Book Lending Portfolio reaches record GBP145m (3826D)

19 Octubre 2022 - 1:00AM

UK Regulatory

TIDMTIME

RNS Number : 3826D

Time Finance PLC

19 October 2022

19 October 2022

Time Finance plc

("Time Finance", the "Group" or the "Company")

Own-Book Lending Portfolio reaches all-time record high of over

GBP145m

Key Performance Indicator to help drive profitable growth

Time Finance plc, the AIM listed specialist finance provider, is

pleased to give the following update on the performance of its

unaudited lending book portfolio. Increasing the Company's own-book

lending forms a key pillar of its medium-term growth strategy,

announced in June 2021, which targeted a doubling of the lending

portfolio by 31 May 2025.

Own book growth continues

The Company has recorded a fifteenth consecutive month of growth

in its own-book lending portfolio. As at 30 September 2022 the

value of the lending portfolio had reached a Group historic high of

GBP145.1m. This compares with the previous Group high of GBP144.1m

recorded in February 2020, immediately prior to the onset of the

pandemic, and demonstrates the strength of its recovery from a

pandemic induced low of GBP115.7m in May 2021. The current lending

portfolio value is 6% higher than the 31 May 2022 year-end level of

GBP136.8m and is a further 2% up on the 31 August 2022 level of

GBP142.8m, announced in the Group's Q1 Trading Update.

The average own-book deal size is also continuing to increase.

It currently stands at approximately GBP25,000, compared with

GBP14,000 when the medium-term strategy was launched.

Arrears continue to fall

As the lending portfolio continues to grow, total net arrears

have continued to fall. As at 30 September 2022 net deals in

arrears stood at GBP8.8m, down a further 4% from the 31 August 2022

level of GBP9.2m announced in the Q1 Trading Update; down 5% from

the 31 May 2022 year-end balance of GBP9.3m; and down 38% on the

pandemic induced GBP14.3m as at 31 May 2021. The arrears balance is

now 6% by value of the total lending portfolio, compared to 7% at

the 31 May 2022 financial year-end and 12% at 31 May 2021, having

now remained consistently below pre-pandemic levels since September

2021.

Ed Rimmer, Chief Executive Officer, commented:

"Our Medium-Term Strategy has a clear focus on substantially

increasing own-book lending and strengthening the Group's balance

sheet. I am therefore delighted to see real traction being gained

in both areas over the last half year. This has resulted in the

Group's own-book lending portfolio now standing at record-high

levels; marks the portfolio's full recovery, and more, from the

COVID pandemic, and should result in growing income and profit

streams for the Group over the life of these deals.

"Equally pleasing is that the increase in the portfolio

continues to be driven by both the Group's Invoice Finance and

'Hard' part of the Asset Finance divisions. This is very much In

line with our strategy as both of these areas operate in the more

secured lending space."

For further information, please

contact:

Time Finance plc

Ed Rimmer, Chief Executive Officer 01225 474230

James Roberts, Chief Financial Officer 01225 474230

Cenkos Securities plc (NOMAD and

Broker) 0207 397 8900

Ben Jeynes / Max Gould (Corporate

Finance)

Michael Johnson / George Budd (Sales)

Walbrook PR 0207 933 8780

Paul Vann / Joe Walker 07768 807631

Timefinance@walbrookpr.com

About Time Finance:

Time Finance's core strategy is to focus on providing or

arranging the finance UK SMEs require to fund their businesses. It

offers a multi-product range for SMEs including asset, vehicle,

loan and invoice finance. While primarily an 'own-book' lender the

Group does operates a 'hybrid' lending and broking model enabling

it to optimize business levels through market and economic

cycles.

More information is available on the Company website

www.timefinance.com .

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as amended by

regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310. Upon the publication of this announcement via Regulatory

Information Service, this inside information is now considered to

be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFIFVEILLALIF

(END) Dow Jones Newswires

October 19, 2022 02:00 ET (06:00 GMT)

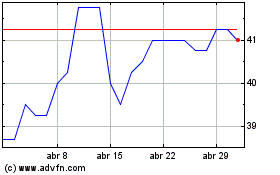

Time Finance (LSE:TIME)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Time Finance (LSE:TIME)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024