TIDMTMIP TIDMTMI

RNS Number : 9791T

Taylor Maritime Investments Limited

28 July 2022

28 July 2022

Taylor Maritime Investments Limited (the "Company")

Quarterly NAV Announcement, Trading Update and Publication of

Factsheet

Continued NAV and cash yield appreciation, longer-term earnings

visibility and dividend increase against a backdrop of favourable

market fundamentals

-- Unaudited NAV up c.3% since 31 March 2022 and c.83% since IPO

-- Market Value of vessel portfolio up c.10% to $542m

-- Firm charter rates and cash yields in excess of 26%

-- Increased interim dividend of 2 cents per share declared, an

increase of 14% per ordinary share

Taylor Maritime Investments Limited, the specialist dry bulk

shipping company, today announces that as at 30 June 2022 its

unaudited NAV was $1.79 per ordinary share, an increase of c.3%

since 31 March 2022 and c.83% since IPO in late May 2021.

The Company is also pleased to declare an increased interim

dividend in respect of the period to 30 June 2022 of 2 US cents per

Ordinary Share, an increase of 14% per share and reflecting a new

annualised dividend target for financial year 2022 of 8% on the IPO

price.

The first quarterly factsheet of the new financial year is also

now available on the Company's website,

www.taylormaritimeinvestments.com .

Key Highlights (all as at 30 June 2022)

-- The Market Value of the vessel portfolio was $542m, an

increase of 10% or $50m versus the 31 March 2022 Market Value of

$492m for the same portfolio of vessels

-- The fleet's average net time charter rate was c.$20,650 per

day, with an average duration of eight months and average

annualized unlevered gross cash yield of 26% based on 30 June 2022

Fair Market Values, generating an operating profit for the period

of c.$30m

-- When combined with dividends paid during the quarter of 4.97

cents (comprising an interim dividend of 1.75 cents and a special

interim dividend of 3.22 cents) and a c.33% reduction in Grindrod

Shipping's share price over the period (from $25.44 to $17.15), the

net positive effect on unaudited NAV per ordinary share was

c.3%

-- During the quarter, the Company completed three previously

announced vessel sales and announced an agreement to sell one more

vessel which is expected to complete in the second quarter of the

2022 financial year, generating an IRR of 80% and MOIC of 1.9x

-- As of 30 June 2022, the Company's fleet comprised 28 vessels

of which 27 were Handysize and one Supramax

-- Five vessels in the fleet were fixed on time charters of

approximately 12 months and the portion of the fleet on charters of

12 months or more increased to 25%, up from 18% from the previous

quarter, in line with the Company's intention to secure more

earnings cover by fixing a greater portion of the fleet on

longer-term charters at attractive yields through the summer and

beyond

-- The Company received a further dividend of $0.47 per share

from Grindrod Shipping paid in June 2022 totalling $2.3m ($1.91 per

share of dividends, or $6m, received in aggregate since stake

acquisition representing a c.14% yield on the investment)

Post-Period Trading Update (since 30 June 2022)

-- Since quarter end, two vessels commenced new time charter

fixtures of more than 12 months duration

-- This increased the portion of the fleet on time charters of 12 months or more to 32%

-- The Company has covered 53% of remaining fleet days for the

Financial Year ending 31 March 2023 at an average net time charter

rate of $19,700 per day

-- The value of second-hand ships has since risen from $19.5m

for a ten year-old 32k dwt Handysize vessel at the end of the

period to $20.5m according to Clarksons

Commenting on the trading update, Edward Buttery, Chief

Executive Officer, said:

" The first year's exceptional financial results have now been

followed with our fifth consecutive quarter of NAV appreciation and

a dividend increase. Despite macro uncertainties, fundamentals in

our sector remain positive and we continue to extract attractive

yields in a historically strong market. We locked in substantial

levels of revenue across a greater proportion of the fleet

supporting earnings visibility and certainty. We have unusual

clarity over the supply side market fundamentals, particularly for

our segment, which we expect to support a favourable market well

into 2024. We constantly monitor the orderbook for indicators of

market direction beyond that point and continue to assess accretive

growth opportunities to enhance shareholder returns. We have been

equally opportunistic about taking profit on vessels where we feel

we are able to achieve higher than NAV prices with the chance of

recycling the capital at more attractive levels."

Handysize bulk market outlook

Supply side constraints continue to provide support for both

rates and vessel values and are expected to persist well into 2024.

The Handysize orderbook is currently 5.6%, the lowest of all dry

bulk segments, while the overall dry bulk orderbook stands at 7.1%.

This is the result of various factors including newbuild price

inflation (Clarksons bulkcarrier newbuilding price index has

climbed c.37% since December 2020), orders in other segments

filling yards and ongoing uncertainty around future ship

technologies. The Handysize orderbook has a staggered delivery

profile over the next three years with 1.4% delivering in 2022,

2.7% in 2023 and 1.6% from 2024 onwards (Source: Clarksons).

Minor bulk demand growth remains firm at 2.1% in 2022 (and in

line with supply growth of 2.2%) despite increasing inflationary

pressures, China Covid restrictions and the ongoing Russia-Ukraine

war. With 8.6% of the global fleet over 25 years old and a further

0.6% turning 25 in 2022, research analysts expect older, less

efficient tonnage to be removed and forecast the Handysize fleet to

shrink by 2.2% net in 2023 against minor bulk demand growth of 2.7%

- an attractive spread. This compounds the 2021 spread of 5.4%

demand growth against 2.8% supply growth (Source: Clarksons).

June and July saw some softening from previous annual highs in

terms of rates owing to a poor grain season in the Atlantic and

geopolitical factors with food security concerns resulting in a

reduction in grain released for export causing the market to take a

breather. We are now seeing a strong upswing in fertiliser volumes

and expect to see an increase in grain shipments in the latter half

of the quarter. This may be bolstered in the short to medium term

by the recent Russia/Ukraine grain agreement and, whatever the

case, we maintain a positive outlook for the remainder of the

year.

Asset values increased during the quarter with Clarkson's

benchmark for a ten year old 32k dwt built Handysize rising to

$19.5m (and to $20.5m since the quarter end). When compared to the

same period last year, asset values have risen c.42%. With the

Handysize orderbook at multi-decade lows, a tightening supply

outlook and steady minor bulk demand growth, we believe there is

further upside to second-hand asset values.

Financing

The RCF was $140m drawn at the end of the quarter. The current

intention is to repay drawn funds from pending vessel sales and

future operating cashflow.

ESG

Sustainability is at the heart of the way the Company is

managed, and the profile and management of the fleet is integral to

this. TMI's inaugural set of ESG disclosures was published in the

Company's first Annual Report, highlighting progress to date and

actions taken to meet near term carbon intensity targets. The ESG

& Engagement Committee of TMI's Board continues to oversee the

Group's ESG approach.

TMI is committed to achieving a long-term target of running a

fleet comprising only zero-emission vessels by 2050, and to cross

industry efforts to promote and achieve that target. Substantial

technological advances are a key element of this for the broader

shipping industry, but TMI has clearly defined near-term

initiatives with incremental progress made so far. TMI has an

ongoing, comprehensive programme to improve vessel energy

efficiency and lower carbon intensity across the fleet. During the

period, three vessels were fitted with energy saving devices

including boss-cap fins, high performance paints, pre-swirl ducts

and fuel efficiency monitoring systems. From a marine biodiversity

perspective, two further vessels were installed with Ballast Water

Management Systems during the period, bringing the fleet total to

75%. 93% will be fitted by the end of 2022, and two vessels to be

fitted in 2023.

TMI has successfully implemented plastic reduction initiatives

across the fleet, including the phasing out of single-use plastic

onboard and the use of the data app EYESEA to map ocean plastic

pollution. TMI remains committed to the safety and wellbeing of

seafarers and recently contributed to the International Radio

Medical Centre ("CIRM"), a free medical advice service offered to

all seafarers onboard TMI vessels. With the recent events in

Ukraine, TMI has taken measures to support the welfare of both the

seafarers and their families affected by the conflict. TMI has

contributed to the Seafarers International Relief Fund, as well as

an organisation working to supply aid to those affected by the

conflict in Ukraine.

The Company is, in connection with the long-term emissions goals

mentioned above, a signatory to the Getting to Zero Coalition's

Call to Action for Shipping Decarbonisation. The Company's

investment and ESG strategy is aligned with specified UN

Sustainable Development Goals.

ENDS

For further information, please contact:

Taylor Maritime Investments IR@tminvestments.com

Limited

Edward Buttery

Camilla Pierrepont

Jefferies International Limited

Stuart Klein

Gaudi Le Roux +44 20 7029 8000

Montfort Communications TMI@montfort.london

Alison Allfrey

George Morris Seers

Sanne Fund Services (Guernsey)

Limited

(formerly Praxis Fund Services

Limited)

Tom Daish

Matt Falla +44 1481 737600

Notes to editors

About the Company

Taylor Maritime Investments Limited is an internally managed

shipping company listed on the Premium Segment of the Official

List, its shares trading on the Main Market of the London Stock

Exchange since May 2021. The Company specializes in the acquisition

and chartering of vessels in the Handysize and Supramax bulk

carrier segments of the global shipping sector. The Company invests

in a diversified portfolio of vessels which are primarily

second-hand and which, historically, have demonstrated average

yields in excess of the Company's target dividend yield of 8% p.a.

(on the Initial Issue Price). The shares offer a compelling and

differentiated investment opportunity with the aim of delivering

strong cashflow, stable income and potential for capital

growth.

The Company invests in high quality, Japanese built vessels

which are primarily second-hand and acquired at valuations below

long-term average prices and depreciated replacement cost. The

current portfolio numbers 28 vessels. The Company has a leading

position in the Handysize shipping sector and, thanks to versatile

geared vessels delivering necessity goods, provides an attractive,

defensible yield underpinned by zero long-term structural gearing,

financial discipline and an optimal balance of charter rates and

durations. It has a selective growth strategy focusing on accretive

opportunities to increase shareholder returns and recycle capital

efficiently.

The Company has announced an increased interim dividend of 2

cents per Ordinary Share paid on a quarterly basis, with a targeted

total NAV return of 10-12% per annum (net of expenses and fees but

excluding any tax payable by Shareholders) over the medium to

long-term. The Board approved a special dividend of 3.22 cents per

share in respect of the period to 31 March 2022 paid on 6 May 2022,

which brought total dividends declared for the period from IPO to

31 March 2022 to 8.47 US cents per share, representing a dividend

yield on the IPO price of approximately 10% on an annualised basis.

This reflected excess cash generation in what continues to be a

historically strong market and a desire to return capital to

shareholders in a timely manner.

Sustainability is at the heart of the way in which the Company

is managed and it is committed to achieving a long-term target of

zero carbon emissions by 2050. Substantial technological advances

are a key element of this for the broader shipping industry, with

near term incremental progress effected by initiatives such as

retrofitting the fleet with energy saving devices, using low

sulphur fuels and trialling biofuels.

The Company has the benefit of an experienced Executive Team led

by Edward Buttery. The Executive Team worked closely together at

the Commercial Manager, Taylor Maritime. Established in 2014,

Taylor Maritime is a privately owned ship-owning and management

business with a seasoned team that includes the founders of dry

bulk shipping company Pacific Basin Shipping (listed in Hong Kong

2343.HK) and gas shipping company BW Epic Kosan (formerly Epic

Shipping) (listed in Oslo BWEK:NO). Taylor Maritime's team of

experienced industry professionals are based in Hong Kong,

Singapore and London.

For more information, please visit

www.taylormaritimeinvestments.com .

About Geared vessels

Geared vessels are characterised by their own loading and

unloading equipment. The Handysize market segment is particularly

attractive, given the flexibility, versatility and port

accessibility of these vessels which carry necessity goods -

principally foodstuffs and products related to infrastructure

building - ensuring broad diversification of fleet activity and

stability of earnings.

IMPORTANT NOTICE

The information in this announcement may include forward-looking

statements, which are based on the current expectations and

projections about future events and in certain cases can be

identified by the use of terms such as "may", "will", "should",

"expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "believe" (or the negatives thereon) or other

variations thereon or comparable terminology. These forward-looking

statements are subject to risks, uncertainties and assumptions

about the Company, including, among other things, the development

of its business, trends in its operating industry, and future

capital expenditures and acquisitions. In light of these risks,

uncertainties and assumptions, the events in the forward-looking

statements may not occur.

References to target dividend yields and returns are targets

only and not profit forecasts and there can be no assurance that

these will be achieved.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVBLGDRRGDDGDR

(END) Dow Jones Newswires

July 28, 2022 02:00 ET (06:00 GMT)

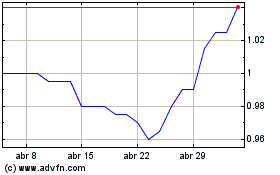

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024