TIDMTMIP TIDMTMI

RNS Number : 6334Y

Taylor Maritime Investments Limited

07 September 2022

7 September 2022

Taylor Maritime Investments Limited

Result of Annual General Meeting

The Board of Taylor Maritime Investments Limited ("TMI" or the

"Company"), the listed specialist dry bulk shipping company, is

pleased to announce that at the Annual General Meeting of the

Company held earlier today, all resolutions were passed on a poll.

The proxy votes received by the Company were as follows:

Resolution For Against Withheld*

Votes % Votes % Votes

------------ ------- ----------- ----- ----------

1. Financial Statements and

Directors' Report for the year

ended 31 March 2022 160,073,504 100.00 0 0.00 4,000

------------ ------- ----------- ----- ----------

2. Directors' Remuneration

Policy 159,089,949 99.72 439,943 0.28 547,612

------------ ------- ----------- ----- ----------

3. Directors' Remuneration

Report 159,078,151 99.38 999,153 0.62 200

------------ ------- ----------- ----- ----------

4. Election of Edward Buttery

as a Director 160,010,310 99.96 67,194 0.04 0

------------ ------- ----------- ----- ----------

5. Election of Christopher

Buttery as a Director 160,065,098 99.99 12,406 0.01 0

------------ ------- ----------- ----- ----------

6. Election of Trudi Clark

as a Director 158,788,497 99.19 1,289,007 0.81 0

------------ ------- ----------- ----- ----------

7. Election of Nicholas Lykiardopulo

as a Director 158,812,542 99.21 1,264,962 0.79 0

------------ ------- ----------- ----- ----------

8. Election of Sandra Platts

as a Director 158,780,126 99.19 1,297,378 0.81 0

------------ ------- ----------- ----- ----------

9. Election of Helen Tveitan

as a Director 158,812,542 99.21 1,264,962 0.79 0

------------ ------- ----------- ----- ----------

10. Re-appointment of PWC as

Auditor 146,120,757 91.28 13,956,747 8.72 0

------------ ------- ----------- ----- ----------

11. Authorise the Directors

to determine the remuneration

of the Auditor 160,072,656 100.00 4,848 0.00 0

------------ ------- ----------- ----- ----------

12. Approval of the dividend

policy 160,077,504 100.00 0 0.00 0

------------ ------- ----------- ----- ----------

13. Approval of amended and

restated Articles of Incorporation 160,062,170 100.00 7,534 0.00 7,800

------------ ------- ----------- ----- ----------

14. Authority to make market

purchases of the Company's

Shares 160,069,540 100.00 7,764 0.00 200

------------ ------- ----------- ----- ----------

15. Authority to issue up to

33 million Ordinary Shares 160,043,075 99.98 34,229 0.02 200

------------ ------- ----------- ----- ----------

*A vote withheld is not a vote in law and is therefore not

counted towards the proportion of votes "For" or "Against" the

resolution. Resolutions 1 to 12 were proposed as Ordinary

Resolutions, resolution 13 as a Special Resolution and resolutions

14 and 15 were proposed as Extraordinary Resolutions.

In accordance with LR 9.6.18, details of those resolutions

passed at the AGM that were not in the ordinary course of business

are detailed below.

13. THAT the articles of incorporation in the form produced to

the meeting and initialled by the Chair of the meeting for the

purposes of identification be and are hereby approved and adopted

as the articles of incorporation of the Company in substitution

for, and to the exclusion of, the existing articles of

incorporation of the Company.

14. THAT the Company be and is hereby generally and

unconditionally authorised in accordance with Section 315 of The

Companies (Guernsey) Law, 2008 (as amended) (the "Law") to make

market acquisitions (as defined in the Law) of its ordinary shares

of no par value in the capital of the Company ("Ordinary Shares"),

provided that:

a. the maximum aggregate number of Ordinary Shares hereby

authorised to be purchased is such number as represents 14.99% of

the Ordinary Shares in issue immediately following the passing of

this resolution;

b. the minimum price (exclusive of expenses) which may be paid

for an Ordinary Share is 1 US$ cent;

c. the maximum price (exclusive of expenses) which may be paid

for an Ordinary Share shall be not more than the higher of (i) 5%

above the average market value of an Ordinary Share for the five

business days prior to the day the purchase is made and (ii) the

value of an Ordinary Share calculated on the basis of the higher of

the price quoted for the last independent trade and the highest

independent bid for any number of the Ordinary Shares on the

trading venue where the purchase is carried out;

d. the authority hereby conferred shall expire at the conclusion

of the next annual general meeting of the Company held in 2023 or

15 months from the date of this resolution, whichever is the

earlier, unless such authority is varied, revoked or renewed prior

to such time; and

e. the Company may make a contract to purchase Ordinary Shares

under the authority hereby conferred prior to the expiry of such

authority which will or may be executed wholly or partly after the

expiration of such authority and may make an acquisition of

Ordinary Shares pursuant to any such contract.

15. THAT the Directors of the Company be and are hereby

empowered to issue the following shares in the Company or rights to

subscribe for such shares in the Company for cash as if the

pre-emption provisions contained under Article 9 of the Company's

articles of incor-poration did not apply to any such issues

provided that this power shall be limited to the issue of the

below-mentioned shares or of rights to subscribe for the

below-mentioned shares:

(i) up to a maximum number of 33 million Ordinary Shares;

that such power shall expire on the earlier of the conclusion of

the next annual general meeting of the Company or on the expiry of

15 months from the passing of this Resolution except that the

Company may before such expiry make offers or agreements which

would or might require Ordinary Shares or rights to subscribe for

such shares in the Company to be issued after such expiry and

notwith-standing such expiry the Directors may issue Ordinary

Shares or rights to subscribe for such shares in the Company in

pursuance of such offers or agreements as if the power conferred

hereby had not expired .

S

For further information, please contact:

Taylor Maritime Investments Limited IR@tminvestments.com

Edward Buttery

Camilla Pierrepont

Jefferies International Limited

Stuart Klein

Gaudi Le Roux +44 20 7029 8000

Montfort Communications TMI@montfort.london

Alison Allfrey

George Morris Seers

Notes to editors

About the Company

Taylor Maritime Investments Limited is an internally managed

shipping company listed on the Premium Segment of the Official

List, its shares trading on the Main Market of the London Stock

Exchange since May 2021. The Company specializes in the acquisition

and chartering of vessels in the Handysize and Supramax bulk

carrier segments of the global shipping sector. The Company invests

in a diversified portfolio of vessels which are primarily

second-hand and which, historically, have demonstrated average

yields in excess of the Company's target dividend yield of 8% p.a.

(on the Initial Issue Price). The shares offer a compelling and

differentiated investment opportunity with the aim of delivering

strong cashflow, stable income and potential for capital

growth.

The Company invests in high quality, Japanese built vessels

which are primarily second-hand and acquired at valuations below

long-term average prices and depreciated replacement cost. The

current portfolio numbers 28 vessels. The Company has a leading

position in the Handysize shipping sector and, thanks to versatile

geared vessels delivering necessity goods, provides an attractive,

defensible yield underpinned by zero long-term structural gearing,

financial discipline and an optimal balance of charter rates and

durations. It has a selective growth strategy focusing on accretive

opportunities to increase shareholder returns and recycle capital

efficiently.

The Company has announced an increased interim dividend of 2

cents per Ordinary Share paid on a quarterly basis, with a targeted

total NAV return of 10-12% per annum (net of expenses and fees but

excluding any tax payable by Shareholders) over the medium to

long-term. The Board approved a special dividend of 3.22 cents per

share in respect of the period to 31 March 2022 paid on 10 June

2022, which brought total dividends declared for the period from

IPO to 31 March 2022 to 8.47 US cents per share, representing a

dividend yield on the IPO price of approximately 10% on an

annualised basis. This reflected excess cash generation in what

continues to be a historically strong market and a desire to return

capital to shareholders in a timely manner.

Sustainability is at the heart of the way in which the Company

is managed and it is committed to achieving a long-term target of

zero carbon emissions by 2050. Substantial technological advances

are a key element of this for the broader shipping industry, with

near term incremental progress effected by initiatives such as

retrofitting the fleet with energy saving devices, using low

sulphur fuels and trialling biofuels.

The Company has the benefit of an experienced Executive Team led

by Edward Buttery. The Executive Team work closely together at the

Commercial Manager, Taylor Maritime. Established in 2014, Taylor

Maritime is a privately owned ship-owning and management business

with a seasoned team that includes the founders of dry bulk

shipping company Pacific Basin Shipping (listed in Hong Kong

2343.HK) and gas shipping company BW Epic Kosan (formerly Epic

Shipping) (listed in Oslo BWEK:NO). Taylor Maritime's team of

experienced industry professionals are based in Hong Kong,

Singapore and London.

For more information, please visit

www.taylormaritimeinvestments.com .

About Geared vessels

Geared vessels are characterised by their own loading and

unloading equipment. The Handysize market segment is particularly

attractive, given the flexibility, versatility and port

accessibility of these vessels which carry necessity goods -

principally foodstuffs and products related to infrastructure

building - ensuring broad diversification of fleet activity and

stability of earnings.

IMPORTANT NOTICE

The information in this announcement may include forward-looking

statements, which are based on the current expectations and

projections about future events and in certain cases can be

identified by the use of terms such as "may", "will", "should",

"expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "believe" (or the negatives thereon) or other

variations thereon or comparable terminology. These forward-looking

statements are subject to risks, uncertainties and assumptions

about the Company, including, among other things, the development

of its business, trends in its operating industry, and future

capital expenditures and acquisitions. In light of these risks,

uncertainties and assumptions, the events in the forward-looking

statements may not occur.

References to target dividend yields and returns are targets

only and not profit forecasts and there can be no assurance that

these will be achieved.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGDZGGLMNZGZZM

(END) Dow Jones Newswires

September 07, 2022 08:00 ET (12:00 GMT)

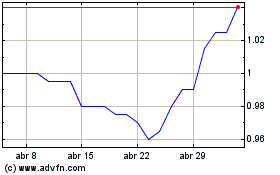

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024