TIDMTMIP TIDMTMI

RNS Number : 4324B

Taylor Maritime Investments Limited

30 September 2022

30 September 2022

Taylor Maritime Investments Limited (the "Company")

Director/PDMR Shareholding

The Company announces that Christopher Buttery has purchased

50,000 ordinary shares in the capital of the Company ("Ordinary

Shares") as follows:

Director/PDMR Ordinary Price per Total Holding % of the Company's

Shares Acquired Ordinary following issued share capital

Share (USD) Purchase now held

Christopher

Buttery 50,000 1.21 700,722 0.212

----------------- ------------- -------------- ----------------------

The relevant notifications set out below are provided in

accordance with the requirements of the Market Abuse

Regulation.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name Christopher Buttery

Reason for the notification

2

a) Position/status Director

b) Initial notification Initial notification

/Amendment

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

a) Name Taylor Maritime Investments Limited

b) LEI 213800FELXGYTYJBBG50

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

a) Description of the Ordinary USD shares

financial instrument,

type of instrument

Identification code GG00BP2NJT37

(ISIN)

b) Nature of the transaction Purchase

------------------------------- ------------------------------------------

c) Price(s) and volume(s)

Price(s) Volume(s)

US$1.21 per share 50,000

d) Aggregated information

- Aggregated volume 50,000

- Total Price US$60,500

e) Date of the transaction 28 September 2022

f) Place of the transaction London Stock Exchange

For further information, please contact:

Taylor Maritime Investments Limited +852 2252 3882

Edward Buttery info@tminvestments.com

Alexander Slee

Jefferies International Limited

Investment Banking

Stuart Klein

Gaudi Le Roux

Sector coverage

Doug Mavrinac

Hugh Eden +44 20 7029 8000

Buchanan

Charles Ryland +44 20 7466 5107

Henry Wilson +44 20 7466 5111

Hannah Ratcliff +44 20 7466 5102

Sanne Fund Services (Guernsey) Limited

Tom Daish

Matt Falla +44 (0)1481 737600

About the Company

Taylor Maritime Investments Limited is an internally managed

shipping company listed on the Premium Segment of the Official

List, its shares trading on the Main Market of the London Stock

Exchange since May 2021. The Company specializes in the acquisition

and chartering of vessels in the Handysize and Supramax bulk

carrier segments of the global shipping sector. The Company invests

in a diversified portfolio of vessels which are primarily

second-hand and which, historically, have demonstrated average

yields in excess of the Company's target dividend yield of 8% p.a.

(on the Initial Issue Price). The shares offer a compelling and

differentiated investment opportunity with the aim of delivering

strong cashflow, stable income and potential for capital

growth.

The Company invests in high quality, Japanese built vessels

which are primarily second-hand and acquired at valuations below

long-term average prices and depreciated replacement cost. The

current portfolio numbers 28 vessels. The Company has a leading

position in the Handysize shipping sector and, thanks to versatile

geared vessels delivering necessity goods, provides an attractive,

defensible yield underpinned by zero long-term structural gearing,

financial discipline and an optimal balance of charter rates and

durations. It has a selective growth strategy focusing on accretive

opportunities to increase shareholder returns and recycle capital

efficiently.

The Company has announced an increased interim dividend of 2

cents per Ordinary Share paid on a quarterly basis, with a targeted

total NAV return of 10-12% per annum (net of expenses and fees but

excluding any tax payable by Shareholders) over the medium to

long-term. The Board approved a special dividend of 3.22 cents per

share in respect of the period to 31 March 2022 paid on 10 June

2022, which brought total dividends declared for the period from

IPO to 31 March 2022 to 8.47 US cents per share, representing a

dividend yield on the IPO price of approximately 10% on an

annualised basis. This reflected excess cash generation in what

continues to be a historically strong market and a desire to return

capital to shareholders in a timely manner.

Sustainability is at the heart of the way in which the Company

is managed and it is committed to achieving a long-term target of

zero carbon emissions by 2050. Substantial technological advances

are a key element of this for the broader shipping industry, with

near term incremental progress effected by initiatives such as

retrofitting the fleet with energy saving devices, using low

sulphur fuels and trialling biofuels.

The Company has the benefit of an experienced Executive Team led

by Edward Buttery. The Executive Team work closely together at the

Commercial Manager, Taylor Maritime. Established in 2014, Taylor

Maritime is a privately owned ship-owning and management business

with a seasoned team that includes the founders of dry bulk

shipping company Pacific Basin Shipping (listed in Hong Kong

2343.HK) and gas shipping company BW Epic Kosan (formerly Epic

Shipping) (listed in Oslo BWEK:NO). Taylor Maritime's team of

experienced industry professionals are based in Hong Kong,

Singapore and London.

For more information, please visit

www.taylormaritimeinvestments.com .

About Geared vessels

Geared vessels are characterised by their own loading and

unloading equipment. The Handysize market segment is particularly

attractive, given the flexibility, versatility and port

accessibility of these vessels which carry necessity goods -

principally foodstuffs and products related to infrastructure

building - ensuring broad diversification of fleet activity and

stability of earnings.

IMPORTANT NOTICE

The information in this announcement may include forward-looking

statements, which are based on the current expectations and

projections about future events and in certain cases can be

identified by the use of terms such as "may", "will", "should",

"expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "believe" (or the negatives thereon) or other

variations thereon or comparable terminology. These forward-looking

statements are subject to risks, uncertainties and assumptions

about the Company, including, among other things, the development

of its business, trends in its operating industry, and future

capital expenditures and acquisitions. In light of these risks,

uncertainties and assumptions, the events in the forward-looking

statements may not occur.

References to target dividend yields and returns are targets

only and not profit forecasts and there can be no assurance that

these will be achieved.

LEI: 213800FELXGYTYJBBG50

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHURUNRUWUKOAR

(END) Dow Jones Newswires

September 30, 2022 12:33 ET (16:33 GMT)

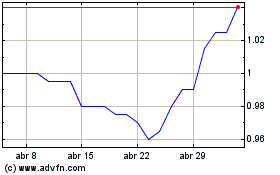

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024