TIDMTNT

Tintra PLC

08 June 2022

8 June 2022

TINTRA PLC

("Tintra", the "Group" or the "Company")

Recent Press Articles

"The importance of financial inclusion"

"Tintra PLC cements banking license strategy across four

continents"

Richard Shearer, Group CEO, recently authored an article on "The

importance of financial inclusion for emerging markets", which was

published in Finance Monthly, a global publication delivering news,

comment and analysis to those at the centre of the corporate

sector. The article can be viewed online at:

https://www.finance-monthly.com/2022/06/the-importance-of-financial-inclusion-for-emerging-markets/

A full copy of the text can also be found below.

In addition, an article regarding the Company's strategy was

recently published in Finextra, the leading independent newswire

and information source for the worldwide financial technology

community:

https://www.finextra.com/pressarticle/92809/tintra-firms-up-banking-licence-strategy-across-four-continents?utm_medium=dailynewsletter&utm_source=2022-6-1&member=106628

For further information, contact:

Tintra PLC

(Communications Head)

Hannah Haffield

h.haffield@tintra.com

Website www.tintra.com 020 3795 0421

Allenby Capital Limited

(Nomad, Financial Adviser & Broker)

John Depasquale / Nick Harriss / Vivek

Bhardwaj 020 3328 5656

The importance of financial inclusion

Discussions of the pandemic are starting to feel increasingly

passé - but this sense that the worst is behind us, or that the

issue is no longer worth discussing, doesn't account for the

ongoing global impacts of the pandemic, particularly on emerging

markets ("EM's").

Or, to put it another way, when Western commentators say that

"the worst is behind us," they place a real emphasis on "us".

Just a glance at a recent report from the World Bank is enough

to clarify that, in terms of pandemic recovery, "advanced economies

and emerging market and developing economies are on two different

flight paths," with advanced economies on track to return to

pre-pandemic trends by next year while EM's find themselves "flying

low" and vulnerable to further "headwinds".

This huge economic disparity lends an extra degree of urgency to

discussions surrounding economic inclusion, a process which -

according to groups like the UN's Sustainable Development Goals

organisation - can help to create jobs, stimulate business

activity, and improve growth for individuals, companies, and

countries across the emerging world.

However, while such discussions are important and necessary, we

need to be careful about how we frame the subject of EM financial

inclusion.

After all, though it does absolutely help to accelerate growth,

EM's are not just helpless victims, and attempts to improve

economic inclusion aren't moral crusades or exercises in charity -

if nothing else, there's a robust business case for improving

access to the credit and cross-border payments services that young,

tech-savvy EM populations need to continue thriving without

punitive restrictions.

What is economic inclusion?

In brief, economic or financial inclusion refers to ensuring

that people and organisations have access to the financial services

(or products) that meet their needs.

These, according to the World Bank , can include "transactions,

payments, savings, credit and insurance" - though I would place

transaction accounts at the top of that list.

It might be tempting, on encountering economic inclusion, to

assume that it's an idea to be directed at unbanked people - that

is, people who have no bank accounts whatsoever and who deal

entirely in cash.

And, to be clear, there are still a lot of unbanked people in

the world today - to the tune of 1.7 billion, in fact, according to

the latest Global Findex Report .

Equally, though, economic inclusion is about widening access to

financial services - a slightly more pervasive issue that can wear

different masks.

Unbanked or underbanked?

Let's say, for example, that a person from an EM like Kenya

wants to set up a business - they're digitally literate; they

understand the services and platform they need; and they're

completely capable of procuring those services.

That person may well encounter a problem, however: not because

they're technically unable to access a digital platform, but

because the international nature of the platform means any

subscriptions made by the Kenyan business owner will be subject to

the often punitive, regulation-borne fees involved in cross-border

payments to and from EMs.

This isn't the same as being unbanked - the person in this

scenario may well have a personal transaction account, for example

- but the practical result is the same: an EM country is denied an

economy-boosting new business, and an individual can't pursue their

livelihood without a huge amount of hassle.

The many motives for strong inclusion

For me, there is a clear moral dimension to ensuring that

financial inclusion is as widespread as possible.

Digital financial inclusion, especially, is capable of lifting

people out of poverty and, as I've mentioned, improve the economic

prospects of EM countries more broadly.

That doesn't mean Western financial institutions should spend

too much time patting themselves on the backs for any moves towards

inclusion - after all, Western regulatory pressures play a huge

role in the underbanked status of EM countries.

Besides, it would be disingenuous to frame financial inclusion

as some charitable act to be preached about when, in fact, there's

a robust business case to be made in its favour.

Commentators like McKinsey have noted that this market consists

of around two billion people (and 200 million small businesses) who

are currently underbanked and the benefit is clear for service

providers prepared to embrace potentially lucrative new revenue

streams in a secure compliance driven environment- for example by

inserting themselves into the innumerable micropayments that come

hand-in-hand with the frictionless ease of digital

transactions.

Inclusive futures

The motives and outcomes for financial inclusion are, to some

extent, in the eye of the beholder.

For EM countries facing post-pandemic economic deceleration,

though, the former is perhaps less significant than the latter.

Whether such efforts are viewed in terms of a mechanism for

reducing poverty; stimulating economic growth; correcting Western

regulatory bias; or as a canny business move, the result is that

once we get to a point where we focus on establishing financial

innocence rather than looking for financial guilt we get to a point

that individuals and the market generally will only benefit both

emerging and more established markets with the myriad opportunities

that will result.

ENDS

Richard Shearer, CEO of Tintra

https://tintra.com

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAKZGGVKRNGZZG

(END) Dow Jones Newswires

June 08, 2022 02:01 ET (06:01 GMT)

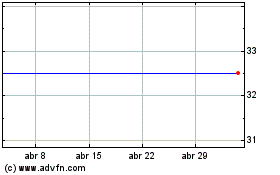

Tintra (LSE:TNT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tintra (LSE:TNT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024