TIDMELTA

RNS Number : 0534V

Electra Private Equity PLC

09 December 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

Electra Private Equity PLC

Related Party Transaction and Update on Circular to Shareholders

relating to the proposed cancellation of listing on the main market

of the London Stock Exchange and Admission to listing on AIM as

Unbound Group PLC and Notice of General Meeting

9 December 2021

Electra Private Equity PLC ("Electra" or the "Company") is

pleased to announce that it has submitted to the FCA for approval a

shareholder circular (the "Circular") relating to the proposed

cancellation of the Company's ordinary shares to the premium

segment of the Official List and to trading on the London Stock

Exchange's main market for listed securities ("Delisting") and

proposed application for admission to listing on the London Stock

Exchange AIM market ("AIM") as Unbound Group PLC ("Admission") and

related matters (the "Proposals"). The Company expects to receive

approval from the FCA and to publish the Circular later today and

it will be posted to shareholders shortly thereafter.

The Circular contains a Notice of General Meeting ("GM") at

which the resolutions to approve the Proposals will be put to

shareholders. The GM will be held at 11:00am on 30 December 2021 at

the offices of Hogan Lovells International LLP at Atlantic House,

50 Holborn Viaduct, London, EC1A 2FG.

Subject to the passing of the necessary shareholder resolutions

at the GM, it is expected that the Delisting will occur at 8.00am

on 31 January 2022 at which time the Company's ordinary shares are

expected to be admitted to trading on AIM.

As part of the arrangements, Electra has today entered into a

related party transaction (within the meaning of Listing Rule

11.1.5R) (the "Related Party Transaction") with Ian Watson who is

currently the Chief Executive Officer of Electra's Hotter business

(and, as a consequence, a statutory director of a subsidiary

company of Electra) and who will become an executive director of

Unbound Group PLC on Admission, summary details of which are

included in Appendix 1 and further details of which will be

included in the Circular. Completion of the Related Party

Transaction will be conditional upon receiving shareholder approval

to the Proposals at the GM.

Appendix 1

SUMMARY OF TERMS OF RELATED PARTY TRANSACTION (WITHIN THE

MEANING OF LISTING RULE 11.1.5R)

It is proposed that Ian Watson, who is currently Chief Executive

Officer of Hotter Shoes, will become Chief Executive Officer of

Unbound Group PLC on Admission. Ian is currently a statutory

director of companies within the Electra Group (being Electra and

its subsidiary undertakings from time to time) and, as such, he is

considered a "related party" of Electra for the purposes of the

Listing Rules.

Hotter MIPCO Limited ("MIPCO"), an entity within the Electra

Group, originally issued 10,000 A ordinary shares to certain

members of Hotter management (including Ian Watson) pursuant to a

management incentive plan ("MIP") with an unrestricted market value

at the time of issue of GBP10,000 in aggregate (the "MIP Shares").

Under the terms of the MIP, the MIP Shares were designed for a sale

exit scenario, on the assumption that the MIP Shares would be

acquired as part of a sale of Hotter Shoes and that Hotter

management would be paid out in cash accordingly for the value of

their MIP Shares at that time. The MIP arrangements have today been

conditionally amended, in connection with the implementation of the

Proposals, such that the MIP payments that would have been payable

in cash in a sale exit scenario will instead be satisfied by the

issue of new shares in Unbound Group PLC to management prior to

Admission.

The amendment to the MIP arrangements, as they relate to Ian

Watson, is a related party transaction for the purposes of LR

11.1.5 based on the application of the relevant class tests, the

completion of which requires shareholder approval in accordance

with the provisions of LR11.1.7.

For the purposes of establishing the value of the MIP Shares,

the Board considered Electra's current market capitalisation and

the implied look-through valuation of Hotter Shoes as Electra's

sole remaining corporate investment as well as the internal

valuation of Hotter Shoes. As such, Electra and Hotter management

have agreed an equity value of GBP32.5 million for Hotter Shoes in

order to establish the value of the payment under the Hotter MIP in

accordance with the pre-existing valuation formula under MIPCO's

articles of association.

Under the terms of the Related Party Transaction, Ian Watson,

who is the holder of 6,353 MIP Shares, will, following the GM and

subject to shareholder approval of the resolutions at the GM, be

issued with 2,086,833 shares in the Company (representing a value

of GBP1.4 million based on the closing price of Electra shares of

65 pence per share on 8 December 2021) prior to Admission

accounting for approximately 4.94% of the total number of Unbound

Group PLC shares anticipated to be in issue at Admission.

As a related party transaction for the purposes of LR11 this

element of the Proposals requires the approval of shareholders of

Electra in order to complete and is being put to shareholders for

consideration at the GM as the Ian Watson MIP Settlement

Resolution.

The shares issued to Ian Watson form part of an issuance in

satisfaction of MIP awards to wider Hotter management of 7.8% of

the issued share capital of Unbound Group PLC on Admission. In

prior Electra reporting periods the estimated value of MIP awards

was treated as a minority interest in the value of each asset and

deducted prior to disclosure of the value attributable to Electra

shareholders.

S

ENQUIRIES

Electra Private Equity PLC

Gavin Manson, Chief Financial and Operating Officer

020 3874 8300

Vico Partners

John Sunnucks, Sofia Newitt

020 3957 5045

Financial Adviser and Sponsor to Electra Private Equity PLC

Stifel

Ash Burman, Nick Adams, Stewart Wallace, Francis North

020 7710 7600

NOTES TO EDITORS

Electra Private Equity PLC

Electra is a private equity investment trust which has been

listed on the London Stock Exchange since 1976. Electra's

investment objective is to follow a realisation strategy, which

aims to crystallise value for shareholders, through balancing the

timing of returning cash to shareholders with maximisation of

value. Since 1 October 2016, Electra has distributed over GBP2

billion to shareholders through ordinary dividends, special

dividends and share buybacks.

Unbound Group PLC

Unbound Group PLC will be the parent company for a range of

brands focused on the 55+ demographic. Initially focused on Hotter

Shoes, Unbound Group will provide a broader range of products and

services to support and enhance the active lifestyles and wellbeing

of its targeted customer community. This online e-commerce platform

will be based on the foundations of Hotter as a trusted brand,

cloud-based digital infrastructure, and strong customer

personalisation through data insight. Unbound Group's expanded

offering beyond Hotter footwear will feature apparel and wellness

products and services, alongside third-party complementary

brands.

Hotter Shoes

Hotter Shoes has been transformed from a retail to a

multi-channel business with a strong and growing digital focus over

the last 2 years, and is now a fast-growing, profitable and

cash-generative e-commerce focused footwear brand. Hotter provides

footwear with uncompromising focus on comfort and fit through the

use of differentiating technology, to a targeted demographic that

values its brand and products. Hotter's direct-to-consumer channels

now reach 29% of the female population in the UK over the age of

55, providing them with footwear that allows them to do more of

what they love. Cultural and demographic shifts now provide an

opportunity to further monetise the existing Hotter customer

database and grow it through the addition of similarly themed

products beyond footwear.

FURTHER INFORMATION

This communication is being made for information purposes only

in connection with the Related Party Transaction, Delisting and

Admission and related matters, and does not purport to be full or

complete.

The distribution of this announcement in jurisdictions other

than the United Kingdom may be restricted by law and persons into

whose possession this document comes should inform themselves about

and observe any relevant restrictions. In particular, this document

may not be published or distributed, directly or indirectly, in or

into the United States of America, Canada, Australia, Japan or

South Africa.

The contents of this announcement have been prepared by and are

the sole responsibility of Electra.

This announcement does not constitute an offer or invitation to

sell or issue, or a solicitation of an offer or invitation to

purchase or subscribe for any securities in any jurisdiction nor

shall it (or any part of it) or the fact of its distribution, form

the basis of, or be relied on in connection with any contract

therefor. This announcement may not be relied upon for the purpose

of entering into any transaction and should not be construed as,

nor be relied on in connection with, any offer, invitation or

inducement to purchase or subscribe for, or otherwise acquire, hold

or dispose of any securities of Electra and shall not be regarded

as a recommendation in relation to any such transaction

whatsoever.

Stifel Nicolaus Europe Limited ("Stifel"), which is authorised

and regulated in the UK by the FCA, is acting as sponsor and

nominated adviser to Electra exclusively in connection with the

Related Party Transaction, the Delisting and Admission and for no

one else in connection with the Related Party Transaction, the

Delisting and Admission or any other matters described in this

announcement and will not regard any other person as a client in

connection with the Related Party Transaction, the Delisting and

Admission or any other matters described in this announcement or be

responsible to anyone other than Electra for providing the

protections afforded to clients of Stifel nor for providing advice

in connection with the Related Party Transaction, the Delisting and

Admission or any other matters referred to in this announcement.

Apart from the responsibilities and liabilities, if any, which may

be imposed on Stifel by the Financial Services and Markets Act 2000

or the regulatory regime established thereunder, neither Stifel nor

any of its affiliates, directors, officers or employees owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, consequential, whether in contract, in tort, in

delict, under statute or otherwise) to any person who is not a

client of Stifel for the contents of this announcement or its

accuracy, completeness or verification or for any other statement

made or purported to be made by it, or on its behalf, or by any

other person(s) in connection with the Related Party Transaction,

the Delisting and Admission, this announcement, any statement

contained herein, or otherwise.

Certain statements made in this announcement are forward-looking

statements and by their nature, all such forward-looking statements

involve risk and uncertainty. Forward-looking statements include

all matters that are not historical facts and often use words such

as "expects", "may", "will", "could", "should", "intends", "plans",

"predicts", "envisages" or "anticipates" or other words of similar

meaning. These forward-looking statements are based on current

beliefs and expectations based on information that is known to

Electra at the date of this announcement. Actual results of the

Electra Group (being Electra and its subsidiary undertakings from

time to time), and/or their respective industries may differ from

those expressed or implied in the forward-looking statements as a

result of any number of known and unknown risks, uncertainties and

other factors, including, but not limited to, the effects of the

COVID-19 pandemic and uncertainties about its impact and duration,

many of which are difficult to predict and are generally beyond the

control of Electra. Persons receiving this announcement should not

place undue reliance on any forward-looking statements. Unless

otherwise required by applicable law or regulation Electra and its

advisers (including Stifel) disclaims any obligation or undertaking

to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CIRDDBDDISGDGBI

(END) Dow Jones Newswires

December 09, 2021 02:00 ET (07:00 GMT)

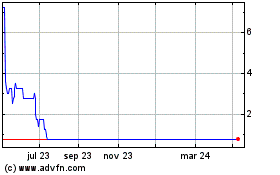

Unbound (LSE:UBG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Unbound (LSE:UBG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024