TIDMUBG

RNS Number : 9312Z

Unbound Group PLC

20 September 2022

Unbound Group plc

Interim results for the six months to 31 July 2022

Continued growth and strategic progress in a challenging

consumer environment

20(th) September 2022

Half Year Financial Highlights:

-- Revenue growth of 10.4% to GBP27.6m (H1 FY22 GBP25m),

illustrating benefits of multi-channel sales model despite

challenging market conditions

-- Expansion of Gross Margin to 63.4%, growth of 180 bps over

the prior year, driven by progress in efficiency plan and delivery

of product strategy, resulting in gross profit growth of

GBP2.1m

-- EBIT loss of GBP0.3m after costs incurred in technical launch

of Unbound platform of GBP1.0m and non-recurring PLC costs of

GBP0.15m

-- Cash at H1 FY22 of GBP2.7m (H1 FY22 GBP3.4m) with net debt of

GBP8.4m (H1 FY22 GBP16.4m), pre-equity fundraise in August 2022

raising GBP3.1m (net of expenses)

Summarised key financials (GBP000):

A+B+C A B C

Unbound Unbound Unbound Hotter Hotter Hotter

Group Consolidated Group Costs Development Shoes Shoes YOY

Costs

-------------------- ------------- ------------- --------- --------- ---------

July 22 July 22 July 22 July July

22 21

-------------------- ------------- ------------- --------- --------- ---------

Revenue 27,630 - - 27,630 25,028 +10.4%

-------------------- ------------- ------------- --------- --------- ---------

Gross Profit 17,518 - - 17,518 15,417 +GBP2.1m

-------------------- ------------- ------------- --------- --------- ---------

Gross Margin

% 63.4% - - 63.4% 61.6% -

-------------------- ------------- ------------- --------- --------- ---------

(343) (978) (14,094)

Costs (17,865) [1] [2] (16,544) [3] +17.4%

-------------------- ------------- ------------- --------- --------- ---------

Operating

(loss)/ profit

- Pre Exceptional (347) (343) (978) 974 1,323 -26.4%

-------------------- ------------- ------------- --------- --------- ---------

Net Debt(1) GBP8.4m - - - GBP16.4m

-------------------- ------------- ------------- --------- --------- ---------

Inventory GBP7.2m - - GBP7.2m GBP4.6m +GBP2.6m

[4]

-------------------- ------------- ------------- --------- --------- ---------

Notes:

In the above table and throughout this document references to

Hotter Shoes refer to the trading activities of Beaconsfield

Footwear Limited.

Alternative performance measures are defined in Note 7.

(1) Unbound PLC related costs (including LTIP charge of GBP0.1m)

of which approx. GBP0.6m will be recurring (per annum) -- post cost

reduction programme referenced below

(2) Unbound platform development costs of which GBP0.7m are

one-off in nature

(3) Hotter Shoes prior year operating costs reduced by

Covid-related support of GBP1.5m

(4) Prior year inventory reduced from optimal by approx. GBP2.5m

due to impact of supply chain disruption

Half Year Operational and Strategic Highlights:

Unbound Group

-- Successful equity raise of GBP3.1m (net of expenses) post

half-year, enabling the execution of our strategic growth plan as

market conditions improve, increasing the resilience and

significantly strengthening the liquidity position of the Group

-- Unbound trading platform roll-out is on track with technical

delivery and costs complete on schedule in July, with partner

brands continuing to be on-boarded throughout Q3 and Q4

-- Established an 'always-on' community of target consumers,

'U_Space', to fuel deep insight into their lifestyles, attitudes

and behaviours, shaping the future development of Unbound Group.

Further roll out is underway, to position Unbound as the authority

voice in the 55+ consumer

Hotter Shoes

-- All channels growing YoY, with notably strong performance in

Retail +71.6%, adjusting for COVID related closures in FY22

+17%

-- The combination of our UK manufacturing facility and

strengthened supply chain enabled us to respond to changing

consumer behaviour in-season, which has and will continue to

benefit our performance in an unpredictable environment

-- Strong strategic and operational progress delivered year to date:

-- Autumn Winter stock availability for Hotter at highest ever

levels for season launch

-- Continuous Improvement culture expanded throughout the

business, with targeted project groups working across departments,

focussed on efficiency and cost savings

-- ISO9001 Quality Management Systems accreditation achieved

-- Awarded Drapers Footwear 'Best Store Design' for Solihull

concept store

-- Finalists for 'Best Retailer' (GBP10-100m) at Drapers

-- Finalists for parliamentary Responsible Business Award,

acknowledging our ESG improvements and plans.

Outlook:

-- We have seen tougher trading conditions in recent weeks, the

short-term outlook is very challenging to predict, given the

volatility of the economic backdrop and resultant impact on

consumer confidence

-- Medium term growth objectives remain unchanged and, with 10%

sales growth achieved in H1 despite challenging economic

circumstances, we remain confident, but recognise an increased

short-term risk. Focus will continue to be on managing costs,

protecting margins and cashflow, ensuring the appropriate levels of

working capital and managing capital investment tightly

-- The launch of the Unbound platform will allow for a greater

degree of revenue diversification over the medium term, in addition

to growing and engaging with our active customer base

-- We have made good progress with partner brand sign-ups for

Unbound, and will continue to focus on onboarding further

complementary brands within apparel, with plans to introduce

wellness categories in Q1 2023. As planned, Unbound revenues in H2

will be small in the context of the Group, with the focus being

onboarding partners onto the platform

-- Given the challenging short term economic outlook we anticipate full year Operating Profit (pre-exceptional) will be between GBPnil and a GBP1m loss after H1 non-recurring costs of GBP0.7m

Ian Watson, Chief Executive Officer of Unbound Group plc,

commented:

"Unbound Group has delivered an encouraging first half

performance that builds on the momentum of 2021, despite the

increased challenges of high inflation and a volatile and

unpredictable consumer environment. The combination of further

growth in sales and gross margins demonstrates the effectiveness of

our strategic initiatives and the value that our customers attach

to our core Hotter product, giving us confidence despite the market

conditions, which have become more challenging in recent weeks. We

have made good strategic progress in H1 and will continue to focus

on efficiency gains and cost management in H2 to protect margins.

We are confident in our brand and the benefits that will result

from this focus and our continued ability to deliver our strategy

over the long term.

The broader revenue base we have created with the launch of the

Unbound platform marks an important strategic shift for the Group.

However, we remain mindful of the growing pressures on consumer

spend. Consequently, we continue to review and adapt to the

changing market conditions, maintaining our specialist focus on our

core customer demographic of financially resilient 55+

consumers."

S

Enquiries

Unbound Group plc

Ian Watson / Dan Lampard

investorrelations@unboundgroup.com

020 3874 8300

Singer Capital Markets

Peter Steel / Tom Salvesen / Alaina Wong / Kailey Aliyar

0207 496 3000

Vico Partners

Sofia Newitt

snewitt@vicopartners.com

020 3957 5045

CHIEF EXECUTIVE'S REVIEW

Unbound Group plc - overview:

Unbound Group plc is the parent company for a group selling a

range of brands focused on the 55+ demographic. Unbound Group will

build on the solid foundation of Hotter Shoes, its current main

business, to grow value through its curated, multi-brand retail

platform supporting the active lifestyles of the 55+ demographic

with a range of products and services. Unbound Group's platform is

powered by Mirakl's leading marketplace technology to enable the

Group to partner seamlessly with selected third-party brands, on a

drop ship model while negating the need to invest in working

capital. Unbound Group's expanded offering beyond footwear will

feature a broad range of active lifestyle products and services,

with third-party complementary brands featuring alongside new

Unbound Group brands, as well as Hotter.

Hotter Shoes - overview:

Hotter Shoes, an Unbound Group plc company, is one of the UK's

leading specialist footwear brands, selling over 1.4 million pairs

of shoes per year. Hotter's footwear has an uncompromising focus on

'customised comfort' and perfect fit through the use of its

differentiating technology, including its e-commerce platform, 3D

foot scanner and augmented reality app which enables the consumer

to try products virtually from home. Hotter has been transformed

from a retail to a digitally led, omni-channel business over the

past 3 years, selling its footwear to over 4 million customers via

online, its direct mail order channel and its targeted 17

Technology Centres and 8 garden centre concessions in the UK. Over

75% of sales are direct to consumer through digital channels. With

its clearly defined, large and growing target demographic, Hotter

now reaches 29% of the female population in the UK over the age of

55. Digital partnerships have recently been established with

several online retailers including Next, John Lewis, The Very Group

and M&S.

Brand awareness:

Hotter Shoes has a strong brand reputation amongst its core

demographic, demonstrated by recent studies showing that 60 per

cent. of the people surveyed (aged 50+) recognise Hotter Shoes as

the number one brand for comfort shoes in the UK, ahead of Clarks

on 57 per cent., Ecco on 49 per cent. and M&S and Gabor on 27

per cent. each. This sector (comfort and fit) is a significant

segment of the footwear market, where numerous trends support

positive market growth dynamics compared to other market segments.

Furthermore, Hotter Shoes has a differentiated, premium product

range, where 68 per cent. of its range is continuity product rather

than fashion footwear, focusing on "Cushion+" lightweight cushioned

soles, "Stability+" ultra supportive and "Precision fit" with over

40 width and size combinations.

Market drivers and expansion opportunity:

As a result of the Hotter Shoes' history and brand, the Group

has a growing (currently 4.6 million individuals) customer

database, with approximately 30 per cent. of the 55+ female

population in the UK represented. With c. 15 million website visits

each year, the customer base continues to grow, with the Group's

email database having exceeded 1 million individuals in 2022.

Unbound's target demographic is not only the fastest growing

demographic of the UK population, it is also an increasingly

wealthy demographic generally experiencing a higher discretionary

spend compared with the under 55s. The Group's target cohort of

customers aged 55+ is increasingly focusing on health and wellbeing

and becoming more active with the largest percentage rise in

exercise participation being in this cohort. The majority of

e-commerce businesses tend to be focussed on younger demographics

leaving, in the opinion of the Directors, the Group's target

demographic materially underserved online, despite online shopping

participation and general digital literacy increasing the most

amongst the over 65s age group.

The Directors believe that this offers an opportunity for

sustainable incremental growth beyond that already being targeted

by the Group's Hotter footwear brand. The Directors believe that

Unbound has a specialist 'insight-led' focus on this under-served

demographic and therefore intend to seek to capitalise on this

opportunity by accelerating the Company's growth strategy as and

when market conditions allow.

Trading performance:

In the first half of the year, performance was hit by

significant macro-economic disruption, which was unforeseen and not

factored into our original assumptions. The on-going conflict in

Ukraine, political destabilisation, high inflation and the

cost-of-living crisis were incremental impacts felt. Despite this,

Hotter delivered a successful first half, and we built and launched

our Unboundgroup.co.uk trading site, on time, on budget and to

specification.

Our performance benefitted from our UK manufacturing base,

including our strengthened supply chains which allowed us to react

in season to changing customer demand patterns, as we saw a return

to event-led and seasonal products.

Whilst volatility remains, management have taken swift action to

address a number of external factors meaning Unbound has made

strong operational progress in the first half of the year and

approaches the second half with a clear set of strategic priorities

and optimised stock availability. In addition, the Group now

carries significantly less net debt, allowing for a more agile

approach to executing on our strategic priorities to deliver

shareholder value over the medium term.

Post period-end equity raise:

We have been able to progress all aspects of our strategy during

H1. Our successful equity raise in August allows the acceleration

of this, covering the areas below while also significantly

strengthening the liquidity of the Group:

-- Driving digital connection with our target customer base

through growth of our Unbound Group partner brand strategy;

-- Further expansion of our garden centre concession model;

-- Investment in technology to improve customer experience,

deliver cost efficiencies and facilitate accelerated scalable

growth; and

-- Increasing inventory effectiveness by utilising near shore

suppliers with shorter lead time procurement of design-led and

own-brand goods.

As detailed at the time of completion in August 2022, we will

deploy the proceeds of the equity raise in controlled fashion as

and when market conditions allow. We look forward to updating

shareholders on our progress.

Strategic and business update

Our five strategic principles:

1. Guided by Insight - Insight excellence drives all we do

We build our business out of unrivalled insight into the needs,

attitudes and behaviours of our 55+ audience.

We go the extra mile to engage with, listen to and respond to

their changing needs. We continuously track, measure and improve

based on our learnings - embedding insight into everything we

do.

Progress made during H1:

In March, we set up 'U_Space', an 'always-on' community of

target Unbound Group consumers, to fuel deep insight into their

lifestyles, attitudes and behaviours. This platform is used to

shape the future development of Unbound Group. Further roll out is

underway, to position Unbound as the authority voice in the 55+

consumer.

'U_Space' has two core insight objectives:

1. Connection

a. Provide the insight to help us connect with and sell to our audience

b. Development of group strategy, partner offer and own brand offer

c. Guiding communications strategy and execution

2. Credibility

a. Provide the data to underpin Unbound's position of expertise in the 55+ audience

b. Driving Unbound profile and perceptions in media and broader discourse

2. Superiority through specialism - Expert and focus are how we win

We're focused and undistracted. Focused on the 55+ consumer.

Experts in comfort that helps you do more of what you love. We

leverage our audience and comfort specialism to both strengthen our

roots in footwear and expand into relevant adjacent categories.

Growing and leveraging our unique database of engaged consumers is

central to our business strategy and the tactics we deploy to

achieve our goals.

Progress made during H1 - Focus on our next generation of core

comfort styles:

We continue to enhance our products and build superiority

through specialism. Our Autumn Winter (AW) 22 Hotter collection

sees a +10% growth in shoes featuring our unique, comfort

technologies, specific to the needs of the 55+ consumer.

We have increased real choice for the season, with +17% more

styles available within the range. A culture of continual

improvement sees the brand striving to establish next generation,

comfort hero styles. Successful new constructions from Spring

Summer (SS) 2022 have been developed with seasonally appropriate

styling, adding further breadth and consumer choice.

H1 FY23 saw a return to normalised product category demand.

Seasonal styling outperformed versus plan and bounced back to

pre-pandemic mix levels. We have reshaped our AW22 collection to

reflect this behavioural change, resulting in style growth of 16%

within our boot category, for example.

Our SS23 range continues to evolve and become a wider offer, as

we expand into new comfort constructions following the success of

recent sourcing and styling trials. We expect overall style growth

of +4% on SS22.

Our expertise in comfort is further enhanced through the launch

of a new technology Flex+. This addition to our family of

technologies supports natural movement through anatomically placed

flex grooves within Hotter exclusive sole designs. Comfort

technology within the collection has grown by +25% vs last

season.

Hotter SS23 product strategy reflects the ongoing market shift

towards Athleisure and Sport styling. Following a strong

performance of +32% on prior year in SS22, further style growth has

been planned for the season at +11%. New for SS23 is an exclusive

range of functional athletic footwear suitable for light

exercise.

Insight, gained via product testing with our core consumer,

demonstrates the equal importance of desirability and comfort when

buying. SS23 sees the range evolve from being 'item led' with a

focus on improved styling and a nod to relevant fashion trends.

Trends were validated and product tested with Hotter customers

ahead of orders being placed.

Within 'superiority through specialism', we have focussed on

improving the capabilities of our supply chain, which allowed us to

respond in-season to changing customer demand patterns, with a

return to seasonal, event-led demand. Our own UK-based

manufacturing plant provides flexibility and resilience within our

supply chain and as we enter the autumn / winter season our

inventory levels and availability are at optimal levels.

3. Growth through connection - We grow our business by curating, connecting and engaging

We have unique access to and understanding of the 55+ consumer.

Leveraging our combination of access and understanding we bring

together a highly curated group of brands with deep relevancy for

our consumer.

Our connected commerce excellence means we enable our customers

to shop when, where and how they want. We drive loyalty, frequency

and advocacy by engaging our customers with targeted marketing and

personalised journeys, amplified by our digital content and

community.

Progress made during H1: Significant progress bringing partners

onto Unboundgroup.co.uk

The Unboundgroup.co.uk website successfully launched on time, on

budget and to specification on Thursday 28 (th) July with 7 brands

operating on a capital light, drop-ship basis, live at point of

launch . The team continue to engage with complementary partner

brands, with further apparel brands expected to be on-boarded

during October before developing a wellness category in Q1 2023.

The partner brands we have met and are working with have

unanimously recognised the strategic opportunity that Unbound Group

presents.

The initial launch phase had the objective of ensuring technical

and business readiness (for both Unbound and partner brands), for a

seamless customer journey. The site stability and performance has

been resilient and transactions, despatch and returns successful

ahead of our further partner brands on-boarding in the coming weeks

and months.

4. Working Smarter - We fuel success by driving productivity

We continuously assess and improve the ways we work - seeking to

maximise our efficiency and enhance our outputs. We utilise LEAN 6

Sigma principles to minimise wastage and maximise the customer

experience. We do this every day in all we do - believing in the

power of marginal gains to drive our business forward.

Progress made during H1: Robust operational performance and

tight cost control, with Continuous Improvement at the heart of our

culture

We have developed a culture of Continuous Improvement, which

began within the operations team and has been expanded, driving

productivity across the business. Over 80 members of the workforce

are now trained and skilled in the tools of LEAN 6 Sigma,

delivering six figure productivity savings. This culture is

underpinned by our corporate values and behaviours, which were

rolled out across the business in May, embedding a culture of

efficiency and cost saving focus throughout our workforce. This

initiative comes in to sharper focus in volatile periods and will

remain a core part of our drive to protect margins in the short

term and enhance them over time, as evidenced in this set of

results.

Our Corporate Values & Behaviours:

Our We're here to help people move better, feel better

Vision: and do more of what they love

Our EMPATHY COURAGE COMMITMENT COLLABORATION

Values:

---------------- ----------------- ---------------- ------------------

Our Start with Lead the Strive for Succeed together

behaviours: the customer way better

---------------- ----------------- ---------------- ------------------

We believe We think courage We think good We think together

every member is the quality enough is we can go

of the team that sets never good further and

should be able apart great enough, always move faster

to walk in businesses striving to

our customers' from good improve

shoes businesses

---------------- ----------------- ---------------- ------------------

5. Stepping up - We step up - for our business, our planet & our community

We believe in taking responsibility - individually and

collectively for the way we operate as a business. For reducing our

impact on the planet. And for contributing to the communities, we

are part of.

Progress made during H1: Driving our culture to enable team

success in an unpredictable environment

During H1 we have increased focus on ESG initiatives, with

business wide targets agreed and set in July, formalising much of

the existing work that was on-going. The focus and passion of the

teams earned us a place as finalist in the parliamentary

Responsible Business Award.

Staff training and development continues to be a core focus, as

we build an empowered and agile team to fuel our performance

culture. The robustness and strength of the team to deliver

multiple projects during H1 has been highlighted against the

unprecedented macro backdrop that we are experience and gives us

confidence in our resilience entering into H2.

Summary

Since the beginning of H1, and increasingly in the recent weeks,

the external environment has become more challenging and harder to

predict. The business, however, has performed well, delivering

double digit growth and completing a range of strategic objectives

to improve reach, scale and improved efficiencies. The team has

applied LEAN principles, controlled costs successfully and acted

decisively to manage the factors within our control. A culture of

continuous improvement is now engrained in our business and will

allow for a greater degree of resilience during this period of

volatility.

In an uncertain environment, the team has delivered a solid

performance in H1 and remain focused on strategic deliverables,

cash conservation and driving inefficiencies out of the

business.

FINANCIAL REVIEW

Unbound Group plc was renamed from Electra Private Equity PLC

('Electra') on 21 January 2022. Electra was a Main Market listed

investment company with a private equity strategy. Following

Electra's decision to dispose of its investment business, as

announced on 21 May 2021, it sold or demerged a number of

companies. Following the demerger of Hostmore plc on 1 November

2021, Electra's only remaining trading subsidiary was Beaconsfield

Footwear Limited, trading as Hotter.

As part of the move from the Main Market to trading on AIM,

Electra/Unbound Group plc ceased to be an investment trust so was

no longer exempt from the obligation to prepare consolidated

accounts. Thus, the Unbound Group plc accounts for the period

ending 31 July 2022 contain all the trading activities and

operational assets and liabilities of the Hotter Group. During the

previous accounting period, the Electra accounts did not contain

the trading activities and operational assets and liabilities of

the Hotter Group whilst the accounts of Beaconsfield Footwear

Limited did contain all of the trading activities and operational

assets and liabilities of the Hotter Group and these accounts,

which were included in the AIM Admission Document, have been used

to show the comparative figures for the corresponding period.

As a result of the transfer to AIM, the capital structure of the

group changed so that the financing (cash and borrowings) and

equity of Unbound Group plc is different to that shown in the

comparatives for Beaconsfield Footwear Limited. In addition, the

balance sheet of Unbound Group plc included a number of financial

and non-trading assets that were previously owned by Electra most

of which were disposed of prior to the reporting date.

In order to comply with the requirements of AIM rule 18 which

requires that the information contained in a half-yearly report

must include at least a balance sheet, an income statement, a cash

flow statement and must contain comparative figures for the

corresponding period in the preceding financial year (apart from

the balance sheet which may contain comparative figures from the

last balance sheet notified), the half-yearly report shows the

comparative data in a consistent format to that which will be

adopted in the AIM company's annual accounts having regard to the

accounting standards applicable to such annual accounts i.e

accounts that are in the format of a commercial group rather than

an investment group as was the case for the published accounts for

Unbound Group plc when it was listed on the Main Market as an

Investment trust which included the set of accounts published for

the year ended 31 January 2022.

KPIs

Unbound Group

6 months 6 months Change

ended 31st ended 1st %

July 2022 August 2021

------------------------------------ ------------ ------------- --------

GBP'000s GBP'000s

Revenue 27,630 25,028 +10.4%

Gross Profit 17,518 15,417 +13.6%

Gross Margin % 63.4% 61.6% +180bps

Operating Loss pre exceptionals(1) (347) 1,323 -126.2%

EBITDA pre exceptionals(1) 1,619 3,154 -48.7%

(1) Alternative Performance Measures are defined in Note 7.

Hotter Online Direct to Consumer Metrics

6 months 6 months Change

ended 31st ended 1st %

July 2022 August 2021

Visits (000's) 9,313 9,315 (0.0)%

Conversion Rate % (i) 3.4% 3.7% (0.3)%

No. of Orders (000's) 317 341 (7.0)%

Average Order Value (ii) GBP64.17 GBP57.14 12.3%

Active Customer Base (iii) 619 587 5.5%

Order Frequency (iv) 1.58 1.54 2.6%

i. Calculated as total orders divided by total visits

ii. Calculated as total order value divided by total orders

iii. Defined as having shopped in the last 12 months as at 31 July

2022

iv. Calculated as last 12 months total shipped orders divided by

active customers

6 months 6 months Change

ended 31st ended 1st %

July 2022 August 2021

-------------------------------------- --------------- ---------------- ---------

Segmental GBP'000s GBP'000s

Direct to Consumer 20,703 20,218 +2.4%

Retail 5,052 2,944 +71.6%

Wholesale 1,875 1, 866 +0.5%

-------------------------------------- --------------- ---------------- ---------

Total Revenue - Hotter 27,630 25,028 +10.4%

Gross Profit 17,518 15,417

Administration costs (14,578) (12,263) +18.9%

-------------------------------------- --------------- ---------------- ---------

EBITDA pre exceptionals

- Hotter 2,940 3,154

Unbound Trading (978) -

PLC Costs (223) -

Share based payment (120) -

-------------------------------------- --------------- ---------------- ---------

EBITDA pre exceptionals

- Unbound Group 1,619 3,154 -48.7%

-------------------------------------- --------------- ---------------- ---------

Depreciation and amortisation (1,966) (1,831) +7.4%

-------------------------------------- --------------- ---------------- ---------

Operating (loss) / profit

pre exceptional items (347) 1,323 -126.2%

-------------------------------------- --------------- ---------------- ---------

Hotter

Hotter performed strongly across all channels with growth in all

segments, most notably Retail stores with annual growth being

driven from COVID related closures in H1 FY22, however on a like

for like trading day basis excluding this impact over 17%

annualised growth.

Total revenue in the period has increased by 10.4% to GBP27.6m

and gross margin expansion to 63.4%, growth of 180 bps over the

prior year. Revenue growth was driven by higher average selling

prices, due to a combination of increased technology within the

range and increased RRPs. The higher selling prices combined with

the progress in operational efficiencies more than offset

operational inflationary pressures resulting in gross profit growth

of GBP2.1m.

Digital KPIs on the whole improved compared to the prior period,

as demonstrated by stable levels of web traffic and strong

conversion levels. Growth in the active customer database, average

order value and frequency was the driver of revenue growth.

We controlled costs tightly across all areas, with the annual

increase in costs predominantly driven by the removal of one-off

support events such as CJRS, rent and rates relief which were

GBP1.5m in H1 FY22.

We delivered efficiencies in marketing costs with spend in H1

FY23 being 20.1% of revenue compared to 20.9% in the prior year.

Fixed cost underlying growth was 3.6% with the removal of the rent

and rates non-recurring benefit of H1 FY22.

EBITDA (pre-exceptional charges) was GBP2.9m delivering a 10.6%

margin. As noted above, comparative profits have been impacted by

the removal of one-off support events such as CJRS, rent and rates

relief which were GBP1.5m in H1 FY22.

Unbound Trading

As previously disclosed, the costs associated with the launch of

the Unbound platform have resulted in a HY loss of GBP1m. The costs

incurred relate to people, marketing and launch related costs. Of

these costs cGBP0.7m are one off in nature.

As the trading platform launched (www.unboundgroup.co.uk) at the

end of H1, no revenues occurred during H1.

Group Costs

Net of residual income streams the PLC costs were GBP0.2m in H1

HY23. The Company has given notice on the offices at Old Park Lane

in London and these will be vacated by the end of the calendar

year. This will result in an annualised cost reduction of GBP0.3m.

Ongoing recurring cash costs (i.e. excluding LTIPs) are anticipated

to be GBP0.6m per annum.

Balance Sheet and Cash Flow

The increase in intangible assets, up by GBP1.2 million to

GBP31.2 million (31 January 2022: GBP30.1 million), reflects the

investment during the period in the ecommerce and technology

platform.

The reduction in investments held for sale of GBP3.7 million to

GBP0.1 million (31 January 2022: GBP3.8 million) relates to the

disposal of the Company's shares in Hostmore plc and leasehold

property investment during H1. These transactions generated gross

cash proceeds of GBP2.4m and an aggregated loss on disposal of

GBP1.3 million.

Inventory increased by GBP2.3 million to GBP7.2 million (31

January 2022: GBP4.9 million; H1 FY22 (Hotter Shoes): GBP4.6m). The

overriding majority of inventory is represented by Hotter Shoes,

with the increase driven by supply chain issues in the comparative

period and strong availability for the autumn winter season.

Cash at H1 FY23 was GBP2.7m (31 January 2022: GBP5.5 million; H1

FY22 (Hotter Shoes): GBP3.4m) with net debt of GBP8.4m (31 January

2022: GBP6.6 million; H1 FY22 (Hotter Shoes): GBP16.4m). The H1

FY23 cash and net debt positions are stated pre the equity

fundraise in August 2022 which raised GBP3.1m (net of expenses).

The bulk of the net debt position is accounted for by Hotter Shoes,

the decrease since H1 FY22 due to the refinancing completed in

December 2021 which reduced debt by GBP5m and a further GBP1m

repaid in July 2022.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF INCOME AND OTHER

COMPREHENSIVE INCOME FOR THE 6 MONTHSED 31 JULY 2022

Unbound Hotter Shoes

Group plc

Notes 6 months 6 months

ended 31(st) ended 1(st)

July 2022 August 2021

GBP'000s GBP'000s

--------------------------------- ----------------- -------------- -------------

Revenue 3 27,630 25,028

Operational Costs (10,112) (9,611)

--------------------------------- ----------------- -------------- -------------

Gross Profit 3 17,518 15,417

Other operating income 288 804

Administrative expenses (16,067) (13,067)

Share based payment (120) -

Depreciation and amortisation (1,966) (1,831)

--------------------------------- -----------------

Operating (loss) / profit

pre-exceptional items (347) 1,323

--------------------------------- ----------------- -------------- -------------

Exceptional items 4 (1,152) (3,160)

Operating loss post exceptional

items (1,499) (1,837)

--------------------------------- ----------------- -------------- -------------

Finance cost (645) (284)

--------------------------------- ----------------- -------------- -------------

Loss on ordinary activities

before tax (2,144) (2,121)

Taxation - 707

Loss on ordinary activities

after tax (2,144) (1,414)

Loss on investments held (1,292) -

for sale

Other comprehensive income - -

Total comprehensive income

for the period (3,436) (1,414)

--------------------------------- ----------------- -------------- -------------

Attributable to:

Equity holders of the parent (3,436) (1,414)

Total comprehensive loss

for the period (3,436) (1,414)

--------------------------------- ----------------- -------------- -------------

Loss per share:

Loss per share - basic and

diluted, attributable to

ordinary equity holders of

the parent (pence) (0.08)

--------------------------------- ----------------- -------------- -------------

The comparative financial information presented represents the

historical financial information of Beaconsfield Footwear Limited,

as was set out in Section B of Part 3 of the admission document

dated 27 January 2022 (the "Admission Document") of Unbound Group

plc.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

AS AT 31 JULY 2022

Unbound Hotter Unbound

Group plc Shoes Group plc

Notes 6 months 6 months 16 months

ended 31(st) ended 1(st) ended 31(st)

July 2022 August January

2021 2022(1)

GBP'000s GBP'000s GBP'000s

------------------------------- ------ -------------- ------------- --------------

Assets

Non-current assets

Intangible assets 31,229 3,968 30,057

Right-of-use asset 6,207 7,640 6,922

Property, plant and equipment 2,163 2,749 2,665

Deferred tax 3,894 4,163 3,887

------------------------------- ------ -------------- ------------- --------------

Total non-current assets 43,493 18,520 43,531

------------------------------- ------ -------------- ------------- --------------

Current assets

Investments 38 - 3,755

Inventories 7,220 4,582 4,855

Trade and other receivables 2,691 1,989 2,283

Cash and cash equivalents 2,705 3,425 5,484

------------------------------- ------ -------------- ------------- --------------

Total current assets 12,654 9,996 16,377

------------------------------- ------ -------------- ------------- --------------

Total assets 56,147 28,516 59,908

------------------------------- ------ -------------- ------------- --------------

Equity and liabilities

Equity

Share capital 5 10,565 42 10,565

Share premium 5 4,959 - 4,959

Own shares held 5 (2,273) - (2,426)

Revenue reserve 5 7,958 (9,972) 11,427

------------------------------- ------ -------------- ------------- --------------

Equity attributable to

owners of the parent 21,209 (9,930) 24,525

Total equity 21,209 (9,930) 24,525

------------------------------- ------ -------------- ------------- --------------

Current liabilities

Trade and other payables 15,809 9,366 14,114

Borrowings 2,000 19,778 2,000

Lease liability 1,462 1,312 1,383

Provisions 107 - 490

------------------------------- ------ ------------- --------------

Total current liabilities 19,378 30,456 17,987

------------------------------- ------ -------------- ------------- --------------

Non-Current liabilities

Borrowings 9,100 - 10,100

Provisions 876 975 981

Lease liability 5,584 7,015 6,315

------------------------------- ------ ------------- --------------

Total non-current liabilities 15,560 7,990 17,396

------------------------------- ------ -------------- ------------- --------------

Total liabilities 34,938 38,446 35,383

------------------------------- ------ -------------- ------------- --------------

Total equity and liabilities 56,147 28,516 59,908

------------------------------- ------ -------------- ------------- --------------

(1) Unaudited Group Statement of Financial Position following

the transition of Electra Private Equity Plc, an investment company

to Unbound Group Plc, a trading group with effect from 1 February

2022.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE

6 MONTHSED 31 JULY 2022

Unbound Hotter

Group plc Shoes

Notes 6 months 6 months

ended 31(st) ended 1(st)

July 2022 August 2021

GBP'000s GBP'000s

Cash flows from operating

activities

-------------------------------------------- -------- -------------- -------------

Group loss for the period (3,436) (2,121)

Share based payments 120 -

Depreciation and amortisation 1,966 1,831

(Profit) on disposal of property,

plant and equipment - (11)

Loss on disposal of investments 1,292 -

held for sale

Impairment of intercompany loan

receivable - 2,524

Gain on extinguishment of lease

liabilities - (1)

Finance expense 645 284

Working capital adjustments

Change in inventories (2,380) 1,389

Change in trade and other receivables (688) 552

Change in trade and other payables 1,793 (1,504)

Cash (used in)/ generated from operating

activities (688) 2,943

------------------------------------------------------ -------------- -------------

Corporation tax refunded - 55

Net cash flow (used in)/ generated from

operating activities (688) 2,998

------------------------------------------------------ -------------- -------------

Cash flow from investing activities

Addition of property, plant

and equipment (9) (92)

Addition of intangibles (1,912) (384)

Proceeds from disposal of investments held 2,424 -

for sale

Proceeds from disposal of property,

plant and equipment - 19

Bank interest paid (596) -

Net cash flow from investing

activities (93) (457)

------------------------------------------------------ -------------- -------------

Cash flow from financing activities

Payment of lease liabilities (763) (629)

Payment of interest on lease

liabilities (235) (276)

Payment of borrowings (1,000) (2,524)

Other interest paid - (8)

Net cash flow from financing

activities (1,998) (3,437)

------------------------------------------------------ -------------- -------------

Net change in cash and cash

equivalents (2,779) (896)

Cash and cash equivalents at

beginning of period 5,484 4,321

Cash and cash equivalents

at end of period 2,705 3,425

------------------------------------------------------ -------------- -------------

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE 6 MONTHSED 31 JULY 2022

Share Share premium Own shares Capital Revenue

capital held reserve reserve Total

equity

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

----------------------- --------------- ---------------------- ------------- ---------- ----------- ----------

As at 1 February

2022 - Electra 10,565 4,959 (2,426) (35,350) 45,325 23,073

----------------------- --------------- ---------------------- ------------- ---------- ----------- ----------

On transition from

Electra to

Unbound(1) - - - - 1,452 1,452

Reserves combination

on ceasing to be

an investment trust - - - 35,350 (35,350) -

As at 1 February 2022 - Unbound 10,565

4,959 (2,426) - 11,427 24,525

Total comprehensive expense for the

period

Loss during the period - - - - (3,436) (3,436)

----------------------- --------------- ---------------------- ------------- ---------- ----------- ----------

Total comprehensive

expense for the

period - - - - (3,436) (3,436)

----------------------- --------------- ---------------------- ------------- ---------- ----------- ----------

Contributions by and distributions to owners

of the Company

Share based payments - - 153 - (33) 120

----------------------- --------------- ---------------------- ------------- ---------- ----------- ----------

As at 31 July 2022 10,565 4,959 (2,273) - 7,958 21,209

----------------------- --------------- ---------------------- ------------- ---------- ----------- ----------

(1) The net impact of the transition of Electra (an investment

trust) to Unbound (a trading group) which recognises the assets and

liabilities of Hotter Shoes (Beaconsfield Footwear Limited) on a

line by line basis within the Group's results.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL INFORMATION FOR

THE 6 MONTHSED 31 JULY 2022

1. General Information

Unbound Group Plc (the 'Company') is a limited liability company

incorporated and domiciled in the United Kingdom. The address of

the Company's Registered Office is 17 Old Park Lane, London, United

Kingdom, W1K 1QT with Hotter Shoe's Registered Office being 2 Peel

Road, Skelmersdale, Lancashire, WN8 9PT.

The Company is listed on the Alternative Investment Market (AIM)

of the London Stock Exchange (ticker: UBG).

The financial information set out in this Interim report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. These condensed consolidated interim financial

statements as at and for the six months ended 31 July 2022 comprise

of the Company and its subsidiaries (together referred to as the

'Group'). These condensed consolidated interim financial statements

has not been audited or reviewed by the Company's auditor.

This condensed consolidated interim financial information was

approved and authorised for issue by a duly appointed and

authorised committee of the Board of Directors on 16 September

2022.

2. Basis of preparation and significant accounting policies

The interim financial statements, which are unaudited, have been

prepared on the basis of the accounting policies expected to apply

for the financial year to 5 February 2023 and in accordance with

recognition and measurement principles of International Financial

Reporting Standards (IFRSs) as endorsed by the European Union. The

accounting policies applied in the preparation of these interim

financial statements are consistent with those used in the

financial statements for the year ended 31 January 2021 for

Beaconsfield Footwear Limited as disclosed in the Admission

Document published by the company on 1 February 2022.

The interim financial statements do not include all of the

information required for full annual financial statements and do

not comply with all of the disclosures in IAS34 'Interim Financial

Reporting'. Accordingly, while the interim financial statements

have been prepared in accordance with IFRS they cannot be construed

as being in full compliance with IFRS.

The Group's statutory financial information for the year ended

31 January 2022 does not constitute the full statutory accounts for

that period. The Annual Report and Accounts for 31 January 2022 for

the Group, prepared under International Financial Reporting

Standards ("IFRS"), have been filed with the Registrar of

Companies. The Independent Auditors' Report on the Annual Report

and Accounts for the year ended 31 January 2022 was unqualified and

did not include references to any matters which the auditors drew

attention to by way of emphasis without qualifying their report and

did not contain statements under Section 498(2) or 498(3) of the

Companies Act 2006. Similarly the Annual Report and Accounts for 31

January 2022 for Beaconsfield Footwear Limited have been filed with

the Registrar of Companies and the Independent Auditors' Report on

the Annual Report and Accounts for the year ended 31 January 2022

was unqualified and did not include references to any matters which

the auditors drew attention to by way of emphasis without

qualifying their report and did not contain statements under

Section 498(2) or 498(3) of the Companies Act 2006.

Going concern

The Directors have reviewed current performance and cash flow

forecasts, and are satisfied that the Group's forecasts and

projections, taking account of potential changes in trading

performance, along with potential mitigations available, in

addition to factoring in the successful equity raise completed post

half year (in August 2022) show that the Group will be able to

operate within the level of its available facilities for the

foreseeable future. The Directors have therefore continued to adopt

the going concern basis in preparing the Group's financial

statements.

3. Segmental reporting

The Chief Operating Decision Maker has been identified as the

Directors. In the opinion of the Directors, the Group has one

single operating segment, the manufacture and sale of footwear with

the sales of the products being through three channels as

follows:

Unbound Group Plc: 6 months ended 31st July 2022

Direct to consumer Retail Wholesale Group

-------------- ------------------- --------- ---------- ---------

GBP'000s GBP'000s GBP'000s GBP'000s

Revenue 20,703 5,052 1,875 27,630

Gross Profit 13,375 3,277 866 17,518

Gross Profit

% 64.6% 64.9% 46.2% 63.4%

Hotter Shoes: 6 months ended 1st August 2021

Direct to consumer Retail Wholesale Group

-------------- ------------------- --------- ---------- ---------

GBP'000s GBP'000s GBP'000s GBP'000s

Revenue 20,218 2,944 1,866 25,028

Gross Profit 12,993 1,830 594 15,417

Gross Profit

% 64.3% 62.2% 31.8% 61.6%

4. Exceptional items

Unbound Hotter Shoes

Group plc

6 months 6 months

ended 31st ended 1st

July 2022 August 2021

GBP'000s GBP'000s

---------------------------------- ------------ ---------------

Impairment of amounts owed by

group undertakings (i) - 2,524

IPO and transition related costs 656 -

(ii)

Profit on disposal of property,

plant and equipment - (11)

Refinancing costs (iii) - 155

Other restructuring and one-off

costs (iv) 496 492

----------------------------------

1,152 3,160

---------------------------------- ------------ ---------------

Exceptional items include the following:

i. Impairment of amounts owed by group undertakings - sums due

from intermediate holding companies have been provided against when

the recoverability of those loans is considered in doubt.

ii. Legal, transitional costs, advisory and insurance fees

incurred directly in relation to the Group relinquishing its

listing on the FTSE Main Market and subsequent admission to the

'Alternative Investment Market ('AIM') on 1 February 2022.

iii. Refinancing costs incurred in the prior period as a result

of the need to renegotiate banking facilities that whilst held

primarily by a holding company were effectively for the benefit of

Hotter Shoes as the trading company in the group.

iv. Other restructuring and one-off costs include severance

costs associated with headcount reductions as well as the costs

associated with strategic reviews.

5. Share capital and reserves

Share capital

Unbound Group plc

6 months ended 31st

July 2022

No. GBP'000s

-------------------------------- ------------ ---------

Allotted, called up and fully

paid shares

Opening number of 25p ordinary

shares 42,258,128 10,564

Closing number of 25p ordinary

shares 42,258,128 10,564

Hotter Shoes

6 months ended 1st

August 2021

No. GBP'000s

--------------------------------- --------- -----------

Allotted, called up and fully

paid shares

Opening number of GBP1 ordinary

shares 42,000 42

Opening number of GBP1 ordinary

shares 42,000 42

Own Shares Held

Own shares held are shares purchased by the Company's Employee

Benefit Trust (the "Trust"). The Trust waives its rights to

dividends on the shares held.

The number of shares held by the Trust was 690,481 as at 31

January 2022 held at a historic cost of GBP2.4 million. 43,650 were

withdrawn from the Trust in HY FY23 and issued to all employees of

the Group at nil cost on the date of entry to AIM.

Share Premium

Issuance of the 690,566 ordinary shares in settlement of vesting

of the Electra Share of Value Plan (SoVP) in May 2021 and 3,284,799

ordinary shares in settlement of the Hotter MIP in January 2022

created a GBP5.0 million share premium account.

Capital and Revenue Reserve

The brought forward capital reserve has been combined with the

revenue reserve following Unbound Group Plc ceasing to be an

investment trust.

The revenue reserve is the accumulated net revenue profits and

losses of the Group.

6. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to the owners of the parent company by the weighted

average number of ordinary shares in issue during the period. Own

shares held by the Employee Benefit Trust are eliminated from the

weighted average number of ordinary shares.

Diluted loss per share is calculated by dividing the profit

attributable to the owners of the parent company by the weighted

average number of ordinary shares in issue during the period,

adjusted for the effects of potentially dilutive share options.

Unbound

Group plc

6 months

ended 31st

July 2022

Loss for the period attributable to equity

shareholders (GBP000's) (3,436)

--------------------------------------------- ------------

Weighted average share capital (No.

of shares)

- Issued ordinary shares at beginning

of year 42,258,128

- Effect of own shares held (646,831)

Weighted average shares in issue for

basic earnings per share 41,611,297

Weighted average effect of dilutive options -

Weighted average shares in issue for

diluted earnings per share 41,611,297

--------------------------------------------- ------------

Basic loss per share / (0.08)

Diluted loss per share

--------------------------------------------- ------------

No meaningful comparative is available for the prior period as

the prior year results shown is that for Hotter Shoes, a limited

company with 42,000 shares.

The Group has issued 1,390,398 nil cost LTIP options which are

potentially convertible on vesting. These have not been included in

the calculation of diluted earnings per share because they are

anti-dilutive for the six months ended 31 July 2022.

7. Alternative performance measures

The Group use the below alternative performance measures to

assist shareholders to better understand underlying financial

performance and position, in addition to being used by the Board in

evaluating performance. However, this additional information

presented is not required by IFRS or uniformly defined by all

companies. Certain measures are derived from amounts calculated in

accordance with IFRS but are not in isolation an expressly

permitted GAAP measure. The measures are as follows:

i. Operating loss/profit pre-exceptional items is based on

ordinary operating performance before the impact of exceptional

items. This metric is used by the Board to assess the underlying

performance of the business excluding items that are, in aggregate,

material in size and / or unusual or infrequent in nature.

Exceptional items are disclosed in note 4;

ii. EBITDA pre-exceptional items is ordinary loss before finance

costs, tax, depreciation, amortisation, and exceptional items. This

metric is used as a measure of the Group's underlying cash

generating ability for the period;

Unbound Hotter

Group plc Shoes

6 months 6 months

ended 31st ended 1st

July 2022 August

2021

GBP'000s GBP'000s

----------------------------------- ------------ -----------

Loss on ordinary activities after

tax (2,144) (1,414)

Taxation - (707)

Finance costs 645 284

Depreciation and amortisation 1,966 1,831

Exceptional items 1,152 3,160

----------------------------------- ------------ -----------

EBITDA pre-exceptional items 1,619 3,154

----------------------------------- ------------ -----------

iii. Net debt is cash and cash equivalents less any borrowings

drawn down at the period end, but excluding outstanding lease

liabilities. This metric is used as a measure of the Group's

liquidity.

Unbound Hotter Shoes

Group plc

6 months 6 months

ended 31st ended 1st

July 2022 August 2021

GBP'000s GBP'000s

--------------------------- ------------ -------------

Cash and cash equivalents 2,705 3,425

Borrowings - current (2,000) (19,778)

Borrowings - non current (9,100) -

Net debt (8,395) (16,353)

--------------------------- ------------ -------------

The borrowings in relation to Hotter Shoes (an unconsolidated

view) for the 6 months ended 1st August 2021 represents a related

party loan payable, which was classified as due within one year as

there was no formal agreement.

8. Post balance sheet events

In August 2022, the Company successfully raised GBP3.1 million

(net of expenses) through an equity raise. As a result on 11 August

2022, the Company issued and allotted 20,783,334 Placing Shares,

1,221,281 Subscription Shares and 893,237 Open Offer

accordingly.

The issue price was 15 pence a share which was less than the

nominal value of an ordinary share of 25 pence. The issue of new

shares at a price which is less than the current nominal value is

prohibited under the Companies Act 2006. A Share Capital

Reorganisation was performed accordingly whereby each existing

Ordinary Share was subdivided into 1 ordinary share of GBP0.01 (New

Ordinary Share) and 1 deferred ordinary share of GBP0.24 (Deferred

Share). The interests of existing Shareholders (both in terms of

their economic interest and voting rights) will not be diluted by

the implementation of the Share Capital Reorganisation.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR ZZGMLRLGGZZM

(END) Dow Jones Newswires

September 20, 2022 02:00 ET (06:00 GMT)

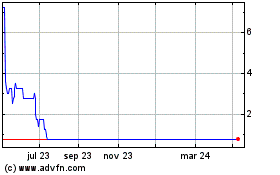

Unbound (LSE:UBG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Unbound (LSE:UBG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024