YOUNG & CO.S BREW.: Disposal

12 Julio 2021 - 1:03AM

UK Regulatory

TIDMYNGA

Information within this announcement is deemed by Young's to

constitute inside information under the UK Market Abuse

Regulation.

Young & Co.'s Brewery, P.L.C.

("Young's" or the "Company")

Disposal of 56 tenancies for GBP53M

Young's, the operator of premium, individual and differentiated

pubs, announces the agreement to sell most of its tenanted estate,

the Ram Pub Company (the "Disposal").

Details of the Disposal

Young's has agreed to sell 56 of the 63 pubs in the Ram Pub

Company to Punch Pubs & Co. for a total consideration of GBP53M

in cash, having generated EBITDA of GBP4.7M for the year ended 31

March 2019. Young's will retain the remaining seven pubs for the

long term.

Background to the Disposal

As part of its strategy to create long-term sustainable

shareholder value, Young's regularly reviews its capital allocation

priorities. Following the review, the Board decided that the best

way to increase value for shareholders was to withdraw from the

tenanted model and focus solely on operating premium, individual,

differentiated and predominantly freehold managed pubs and

hotels.

Benefits of the Disposal

The Disposal is consistent with Young's strategy to target

growth through investment in higher turnover managed pub and

hotels.

The following benefits will accrue to Young's from the

Disposal:

-- Net proceeds from the sale will be used to strengthen the Company's

balance sheet and provide additional capacity for investment in its

managed estate

-- Young's will look to acquire predominantly freehold managed pubs

-- By focussing on its managed house estate, head office costs will reduce.

Completion

Completion of the Disposal is expected to occur 9 August

2021.

Patrick Dardis, Chief executive of Young's, said:

"Young's sole focus will now be on operating well-invested and

premium managed pubs and hotels. We have a proven history of making

attractive returns from investing in high-quality pubs and this

disposal will provide us with additional firepower to upgrade our

existing pubs and capitalise on attractive acquisition

opportunities that may come to the market.

"During lockdown, we invested a total of GBP17M in improving the

pubs in our managed estate and the purchase of two new pubs:

Enderby House in Greenwich and Alban's Well in St Albans.

"We are delighted to be welcoming back our customers and are

already seeing encouraging trading, despite some restrictions

remaining. The Board is confident Young's will emerge from the

pandemic in a stronger position and is excited about the future of

the business."

-ENDS-

Chris Taylor

Joint Company Secretary

12 July 2021

Tel: 020 8875 7000

For further information, please contact:

Young & Co.'s Brewery, P.L.C.

Patrick Dardis, Chief Executive

Michael Owen, Chief Financial Officer 020 8875 7000

J.P. Morgan Cazenove (AIM nominated adviser and joint

broker) James Mitford / Ameya Velhankar 020 7742 4000

Panmure Gordon (joint broker)

Erik Anderson 020 7886 2500

MHP Communications Tim Rowntree/Alistair de

Kare-Silver/Robert Collett-Creedy 020 3128 8742 / 8147

View source version on businesswire.com:

https://www.businesswire.com/news/home/20210711005041/en/

CONTACT:

Young & Co's Brewery PLC

SOURCE: Young & Co's Brew.

Copyright Business Wire 2021

(END) Dow Jones Newswires

July 12, 2021 02:03 ET (06:03 GMT)

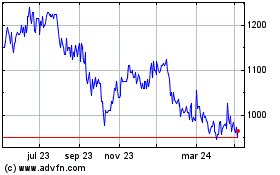

Young & Co's Brewery (LSE:YNGA)

Gráfica de Acción Histórica

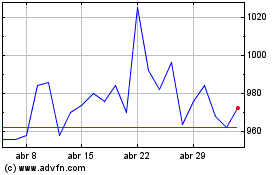

De Mar 2024 a Abr 2024

Young & Co's Brewery (LSE:YNGA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024