TIDMZEN

RNS Number : 4977L

Zenith Energy Ltd

03 January 2023

January 3, 2023

ZENITH ENERGY LTD.

("Zenith" or the "Company")

Signing of SPA for acquisition of OMV Yemen

Zenith Energy Ltd. (LSE: ZEN; OSE: ZENA) , the energy company

with proven revenue generating production, exploration and

development assets in Africa and Europe , is pleased to announce

that a company in which it holds a 49% interest, Zenith Energy

Netherlands B.V. ("Zenith Netherlands") has entered into a share

purchase agreement ("SPA") with OMV Exploration and Production GmbH

("OMV" or the "Seller") to acquire 100% of the outstanding share

capital of OMV (Yemen Block S 2) Exploration GmbH, OMV Jardan Block

3 Upstream GmbH and OMV Block 70 Upstream GmbH (collectively "OMV

Yemen"), which are all companies incorporated and existing under

the laws of Austria.

About OMV Yemen

Production Assets

Block S-2

" OMV Yemen is one of the largest oil producers in the country

with a highly prospective portfolio including a balance of

immediate production, as well as a balance of short and long-term

growth opportunities.

" Block S-2 was discovered in 1992 by Oxy and declared

commercial in 2005 by OMV following its acquisition of Preussag

Energie International in 2003.

" OMV (Yemen Block S 2) Exploration GmbH operates and holds a

44% working interest, with partners including SINOPEC (37.5%

working interest), YOGC (12.5% working interest) and YRL (6%

working interest).

" OMV Yemen holds a financial interest of 57.14% in production

from Block S-2.

" Gross production during 2021 averaged approximately 7,400

barrels of oil per day ("BOPD") and the field remains in the

'primary depletion' stage with highly material unexploited

potential.

" Historical production from S-2 was maintained at approximately

15,000 BOPD through sustained drilling activity until 2015.

" No new wells have been drilled since 2015 when force majeure

was declared due to regional instability and production was

temporarily suspended.

" Production activities were resumed in 2018 at an average gross

rate of 17,500 barrels of oil per day and have declined, in view of

no new drilling activities, to a gross average of approximately

6,000 barrels of oil per day as of January 1, 2022.

" Production costs of approximately US$28 per barrel.

" Gross 1P Reserves (Proved) have been estimated as 13.15

million barrels of oil using the independent DeGolyer &

McNaughton reserves evaluation dated December 31, 2017, as

reference and subtracting confirmed oil production during the

period 2018-2021.

" Gross 2P Reserves (Proved + Probable) have been estimated as

30.74 million barrels of oil using the independent DeGolyer &

McNaughton reserves evaluation dated December 31, 2017, as

reference and subtracting confirmed oil production during the

period 2018-2021.

" Crude oil production is transported by truck 80km to Block 4,

then 200km by pipeline for export at the Al Nushaima port.

Construction of a new central processing facility ("CPF") has been

largely completed with a storage capacity of approx. 100,000

barrels of crude oil.

" Strong management team and highly competent personnel with

over 300 staff.

" A number of ready to execute near-term growth opportunities

are available, by way of an already formulated workover and a

phased infill drilling and sidetrack programme for six new wells,

to enable production to potentially return to 15,000 BOPD.

Exploration Assets

OMV Yemen holds a balanced exploration portfolio comprising

Block 3 (34% working interest) and Block 70 (19.24% working

interest).

" Prospects range from easily monetised low-risk exploration to

high-risk, high-reward exploration.

" Current exploration activities have identified significant

potential near-term development opportunities.

Block 3

" OMV Jardan Block 3 Upstream GmbH holds a financial interest of

36.17% in Block 3.

" Gross oil resources have been estimated at about 60 million

barrels unrisked by OMV.

" 1035 km2 3D and 2,100 km 2D seismic is held in respect of

Block 3.

" No remaining work commitments for Block 3.

Block 70

" OMV Block 70 Upstream GmbH holds a financial interest of

20.25% in Block 70.

" Gross oil resources have been estimated at about 70 million

barrels unrisked by OMV.

" 1,200 km 2D seismic (410 km reprocessed) is held in respect of

Block 70.

" No remaining work commitments for Block 70.

Natural Gas Production Potential

Significant associated gas volumes have been recorded with oil

production across OMV Yemen's portfolio giving evidence of

substantial natural gas production potential from S-2, Block 3, and

Block 70.

A gas discovery has been made in Block 3, representing a major

opportunity for the monetisation of OMV's Yemen natural gas

production, all of which is currently flared.

Several gas production offtake options are already under

discussion including the possibility of a connection being made to

a local power station or to Yemen LNG.

Zenith may also explore the construction of a

'Gas-to-Power'("GTP") plant, as successfully carried out in Italy,

to commercialize gas production and provide additional electricity

supply to the local economy.

Gross total recoverable gas volumes have been estimated by OMV,

across the OMV Yemen portfolio, to be approximately 571 BSCF.

Andrea Cattaneo, Chief Executive of Zenith, commented:

"The acquisition of OMV Yemen represents a very significant

milestone for Zenith Energy.

The existing production from the asset and, more importantly,

the near-term future oil and natural gas production indicated by

the size of the reserves, position Zenith on an extremely exciting

organic growth trajectory.

I take the chance to thank OMV and its management for its

cooperation in this transaction. Our technical teams shall continue

to work closely together as we enter the handover phase and welcome

our new colleagues in Yemen to the Zenith family.

Finally, we look forward with enthusiasm to establishing

ourselves in Yemen and contributing to the prosperity of the local

economy. It is our belief that the country has extraordinary

economic potential, especially in respect of its oil and gas

industry, and we shall seek to maximise our relationship with the

local authorities to achieve our development objectives."

Terms of the SPA

Under the terms of the SPA, Zenith Netherlands will, subject to

the conditions set forth in the SPA, acquire 100% of OMV's shares

in OMV Yemen at completion for a total consideration of US$

21,619,000 (the "Base Purchase Price ").

Zenith Netherlands has paid a deposit of US$4,323,800 which

shall be credited by the Seller to Zenith Netherlands as part of

the Purchase Price upon completion.

The obligations set out in the SPA of the Seller and Zenith

Netherlands to consummate the sale and purchase of the shares in

OMV Yemen at completion are subject to, inter alia, the approval of

the authorities in Yemen, and the approval by the Federal Ministry

of the Republic of Austria for Labour and Economy in respect of the

transfer of shares from OMV to Zenith Netherlands ("Completion").

The SPA has a longstop date of nine months from the date of

signing.

A Transitional Services Agreement ("TSA") may be signed between

OMV and Zenith Netherlands at or around completion to govern

certain services to be provided by OMV or its affiliates to Zenith

Netherlands after completion if OMV and Zenith Netherlands

determine that such agreement shall be required to optimise the

handover of OMV Yemen.

About Yemen

-- Yemen is located on the southern end of the Arabian

Peninsula, sharing a border with Saudi Arabia and Oman.

-- The country has significant oil and natural gas reserves

sufficient for both domestic demand and international exports,

however, it is not currently a major hydrocarbon producer relative

to several other Middle Eastern countries.

-- Yemen sits on proved hydrocarbon reserves of c. 3 billion

barrels of crude oil and 17 trillion cubic feet of gas (US Energy

Information Administration). Its main crude export grade is light

sweet Masila, with an API gravity of 34.10.

-- Until 2009, Yemen reinjected most of its gas production to

aid in oil recovery, but has since become an LNG exporter, with the

government aiming to increase the use of natural gas in many

sectors, including in electricity generation.

-S-

Further Information:

Zenith Energy Ltd

Tel: +1 (587) 315 9031

Andrea Cattaneo, Chief Executive E: info@zenithenergy.ca

Officer

BlytheRay - Financial PR/IR Tel: +44 207 138 3204

Tim Blythe, Megan Ray , Matt Bowld E: zenith@blytheray.com

Alternative Resource Capital -

Broker Tel: +44 (0) 207 186 9004

Tel: + 44 (0) 207 186 9005

Alex Wood

Keith Dowsing

Notes to Editors :

Zenith Energy Ltd. is a revenue generating, independent energy

company with production, exploration and development assets in

Tunisia, Italy, and the Republic of the Congo, including

electricity generation in Italy. The Company is listed on the

London Stock Exchange Main Market (LSE: ZEN) and the Euronext

Growth of the Oslo Stock Exchange (OSE: ZENA).

Zenith's strategic focus is on pursuing transformational

opportunities in the Middle East, Africa, and Europe through the

development of proven revenue generating oil, gas, and electricity

production assets, as well as low-risk exploration activities in

assets with existing production.

For more information, please visit: www.zenithenergy.ca

Twitter: @zenithenergyltd

LinkedIn: https://bit.ly/3A5PRJb

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ("MAR"). Upon the publication of this announcement via a

Regulatory Information Service ("RIS"), this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQUOARRORUARAR

(END) Dow Jones Newswires

January 03, 2023 05:20 ET (10:20 GMT)

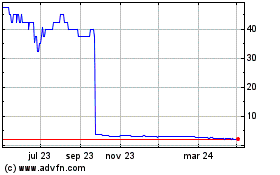

Zenith Energy (LSE:ZEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

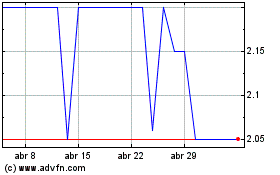

Zenith Energy (LSE:ZEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024