TIDMZIOC

RNS Number : 3880B

Zanaga Iron Ore Company Ltd

30 September 2022

30 September 2022

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2022

Zanaga Iron Ore Company Limited ("ZIOC" or the "Company") (AIM:

ZIOC) is pleased to announce its unaudited interim results for the

six months ended 30 June 2022 and an update on post reporting

period end events to September 2022.

Highlights

-- Early Production Project ("EPP Project" or "EPP")

o Numerous production scenarios remain under investigation on

processing facilities and suitable logistics solutions, with a

particular focus on an export solutions through the Republic of

Congo ("RoC")

o Multiple contract operators have been engaged across mining,

logistics, and processing disciplines with the objective of

providing updated cost estimates in-country

o Significant engagement underway with other mining project

developers in RoC to explore potential collaboration opportunities,

especially in relation to logistics solutions and alternatives for

upgrades to existing infrastructure

-- Zanaga Iron Ore Project (the "Project" or the "Zanaga

Project") 30Mtpa staged development project (12Mtpa Stage One

("Stage One"), plus 18Mtpa Stage Two expansion ("Stage Two"))

o The Project Team continue to engage in activity to ascertain

opportunities for optimisation and improvement of the 30Mtpa staged

development project and will update the market as these

improvements develop. No material updates are available for the H1

2022 period.

-- Work programme and budget for 2022, and $1.2m Jumelles Ltd

working capital loan facility, agreed with Glencore Projects Pty

Ltd ("Glencore"), a subsidiary of Glencore plc

o Loan provides full financing for the Zanaga Project budget

until 30 June 2023

Corporate

-- Funding update - Shard Merchant Capital Ltd ("SMC") 21

million share equity subscription agreement

o Proceeds of GBP1,141,574 has been received to date from SMC

since launch, following 18,000,000 shares being placed by SMC, with

a further 3,000,000 ordinary shares remaining to be placed at 29

September 2022

o Of the total amount received to date, mentioned above,

GBP62,628 was received by ZIOC from the SMC facility during the

first half of 2022 and no further cash has been received since 30

June 2022 to date

o Proceeds applied to general working capital, including the

provision of further contributions to the Zanaga Project's

operations

-- Cash balance of US$0.3m as at 30 June 2022 and cash balance

of US$0.1m as at 29 September 2022.

o Jumelles level loan from Glencore resulted in reduced future

funding for ZIOC towards the Project

o Current available cash on hand is expected to cover ZIOC's

corporate overheads until end Q1 2023, with current SMC facility

placement expected to extend ZIOC working capital to end Q3

2023

-- Annual General Meeting to be held in November 2022, and

notice will be sent to shareholders shortly.

Clifford Elphick, Non-Executive Chairman of ZIOC, commented:

"I am pleased to report that significant work is underway to

evaluate options to enable initial small scale production of iron

ore from the Republic of Congo, utilising existing

infrastructure.

The iron ore market has experienced substantial underinvestment

by the major iron ore producers over the last decade. This provides

an opportunity to demonstrate that smaller scale production can be

delivered initially from RoC, with the upside potential of

de-risking the larger scale potential following infrastructure

upgrades. We look forward to providing an update on our activities

in due course".

Copies of the unaudited interim results for the six months ended

30 June 2022 are available on the Company's website at

www.zanagairon.com

The Zanaga Iron Ore Company Limited LEI number is

21380085XNXEX6NL6L23.

For further information, please contact:

Zanaga Iron Ore

Corporate Development and Andrew Trahar

Investor Relations Manager +44 20 7399 1105

Liberum Capital Limited

Nominated Adviser, Financial Scott Mathieson, Edward Thomas

Adviser and Corporate Broker +44 20 3100 2000

About us:

Zanaga Iron Ore Company Limited ("ZIOC" or the "Company") (AIM

ticker: ZIOC) is the owner of 50% less one share in the Zanaga Iron

Ore Project based in the Republic of Congo (Congo Brazzaville)

through its investment in its associate Jumelles Limited. The

Zanaga Iron Ore Project is one of the largest iron ore deposits in

Africa and has the potential to become a world-class iron ore

producer.

Business Review - Operations

Iron Ore Market

The iron ore market has experienced substantial underinvestment

by the major iron ore producers over the last decade, with no

notable iron ore mine project approvals to report. Iron ore prices

remain relatively stable as China continues to demonstrate robust

demand in spite of the impact of Covid on industrial activity in

China. Furthermore, given the current geopolitical environment, it

is clear that resource independence is more important than ever and

strategic investors are starting to consider iron ore development

options outside of the usual territories of Australia and Brazil.

In this respect, the quality of the Zanaga Project, and Republic of

Congo's iron ore resources, has the potential to deliver

substantial iron ore production to strategic customers looking to

secure positions in the commodity.

EPP Project

The Project Team continue to undertake a process to evaluate the

potential development of an EPP Project that would be quicker to

construct than the larger 30Mtpa staged development project and

would utilise existing road, rail and port infrastructure.

Engagement with other mining project developers in RoC has been

increased in order to explore potential collaboration

opportunities, especially in relation to logistics solutions and

alternatives for upgrades to existing infrastructure. Multiple

contract operators have been engaged across mining, logistics, and

processing disciplines with the objective providing updated cost

estimates in-country.

The Project Team continue to advance study work in an effort to

improve their understanding of the viability of the EPP Project.

The Project Team continue to evaluate the potential for the EPP

Project to operate as a standalone project, or as an initial

pathway to production during the construction period of the

flagship 30Mtpa Staged Development Project.

30Mtpa staged development project

The Project Team's ultimate objective remains to develop the

flagship 30Mtpa staged development mining project. As a reminder,

the Stage One project plans to produce 12Mtpa of premium quality

66% Fe content iron ore pellet feed product at bottom quartile

operating costs for more than 30 years on a standalone basis.

The Stage Two expansion of 18Mtpa is nominally scheduled to suit

the project mine development, construction timing and forecast cash

flow generation, and would increase the Project's total production

capacity to 30Mtpa. The product grade would increase to an even

higher premium quality 67.5% Fe content due to the addition of

18Mtpa of 68.5% Fe content iron ore pellet feed production, at an

even lower operating cost. The capital expenditure for the

additional 18Mtpa production, including contingency, could

potentially be financed from the cash flows from the Stage One

phase.

The Zanaga Project Team has continually taken steps to monitor

evolving improvements into its strategy for assessing the options

available for the development of the Zanaga Project. The Project

Team maintained its view that high quality products will continue

to achieve significant price premiums in the future and has sought

to lock in this additional revenue benefit into the Project's

development plan.

The Project Team will continue to engage in activity to

ascertain opportunities for optimisation and improvement of the

30Mtpa staged development project and will update the market as

these improvements develop.

Cash Reserves and Project Funding

As reported in the Company's annual results published on 30 June

2022, Glencore and ZIOC agreed a 2022 Project Work Programme and

Budget for the Zanaga Project of US$1.3m plus US$0.1m of

discretionary spend, dependent on certain workstreams requiring

capital. ZIOC agreed to contribute towards this work programme and

budget an amount comprising US$0.09m; the remaining budget amount

will be funded via a loan facility provided directly to Jumelles

Ltd by Glencore thus requiring less funding by ZIOC over the

subsequent 12 months compared to the historical levels observed. On

29 June 2022, Glencore and the group signed a side letter to the

Jumelles loan facility confirming that there will be no dilution of

the group's holding in Jumelles as a result of this change in

funding structure.

We are pleased to report that the Zanaga Project's activities

are currently running in line with the 2022 budget forecast.

As at 29 September 2022, ZIOC had cash reserves of US$0.1m and

the Board continues to take a very prudent approach to the

management of the business and its cash reserves.

ZIOC is pleased that a financing structure is in place at the

Jumelles level which ensures sufficient capital in place to cover

all in-country costs associated with the Project until end June

2023. Furthermore, the SMC facility remains in place and has given,

and continues to give, the Company access to funding through a

relatively low cost structure which minimises dilution to

shareholders. Going forward ZIOC's operating costs have been

reduced to a low level with no contributions at a project level

until at least end Q2 2023 and no board or management remuneration

in place (as announced previously). Furthermore, no future

contributions to project-level costs will be considered until ZIOC

has first built up cash reserves capable of funding longer term

corporate overheads at the current reduced level.

Outlook

During 2022 the Project Team have made a number of significant

steps in advancing solutions to unlock the key logistical

challenges associated the EPP Project. The Project Team are

engaging with other mining project developers in RoC to explore

potential collaboration opportunities, especially in relation to

logistics solutions and alternatives for upgrades to existing

infrastructure. We look forward to updating our shareholders on the

outcome of these initiatives.

Financial review

Results from operations

The financial statements contain the results for ZIOC for the

first half of 2022. ZIOC made a loss in the half-year of US$0.5m

compared to a loss of US$1.9m in the full year ended December 2021.

The loss for the 2022 half-year period comprised:

1 January to 1 January to 1 January to

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

US$000 US$000 US$000

-------------------------------------------------------------------- ------------ ------------ ------------

General expenses (160) (383) (1,2 14

Net foreign exchange (loss)/gain (32) 3 (1 2 )

Share of loss of associate (334) (353) (6 72 )

Interest income - - -

(Loss)/Gain before tax (526) (733) (1,898)

Currency translation - - -

Share of other comprehensive income of associate - foreign exchange 37 3 (17 )

-------------------------------------------------------------------- ------------ ------------ ------------

Total Comprehensive income (489) (730) (1,915)

-------------------------------------------------------------------- ------------ ------------ ------------

General expenses of US$0.2m (2021: US$0.4m), consisting of:

Directors' fees of US$Nil (2021: US$Nil), professional fees of

US$Nil (2021: US$Nil), LTIP charge of US$0.1m (2021 US$0.3m) and

US$0.1m (2021: US$0.1m) of other general operating expenses.

The share of loss of associate of US$0.3m (2021: US$0.4m)

relates to ZIOC's investment in Jumelles Limited ("Jumelles"), the

joint venture company in respect of the Zanaga Project. From May

2014, as a result of the completion of the Feasibility Study and

thus consideration to complete the Glencore share option, only 50%

(less one share) of the Jumelles results are now included

above.

During the half year period, the Company's share of Jumelles'

project expenditure was US$0.3m including the effects of currency

translation of $0.04m gain. Capitalised exploration assets remain

at US$80.0m.

Financial position

ZIOC's net asset value ("NAV") of US$37.5m is comprised of a

US$37.1m investment in Jumelles, US$0.3m of cash balances and

US$0.1m net current assets.

30 June 2022 30 June 2021 31 December 2021

Unaudited Unaudited Audited

US$ m US$ m US$m

--------------------------------------- ------------ ------------ ----------------

Investment in associate 37.1 37.3 37.3

Fixed assets -

Cash 0.3 0.8 0.4

Other net current assets/(liabilities) 0.1 0.6 0.1

--------------------------------------- ------------ ------------ ----------------

Net assets 37.5 38.7 37.8

--------------------------------------- ------------ ------------ ----------------

Cost of investment

The investment in associate relates to the carrying value of the

investment in Jumelles, which as at 30 June 2022 owned 50% less one

share of the Project. The carrying value of this investment

decreased in 2022 due to:

-- Company funding per the Funding Agreement of US$0.1m; and

-- The Company's US$0.3m share of the comprehensive loss US$0.6m

made by Jumelles during the half-year.

As at 30 June 2022, Jumelles had aggregated assets of US$81.0m

(June 2021: US$81.3m) and aggregated liabilities of US$0.9m (June

2021: US$0.7m). Non-current assets consisted of US$80.0m (June

2021: US$80.0m) of capitalised exploration assets and US$0.8m (June

2021: US$1.0m) of other fixed assets including property, plant and

equipment. Cash balances amounted to US$0.2m (June 2021: US$0.3m)

and other current assets were US$Nil (June 2021: US$Nil).

Cash flow

Cash balances have decreased by US$0.1m since 31 December 2021.

Additional investment in Jumelles required under the Funding

Agreement (details set out in note 1 to the financial statements)

utilised US$0.1m, operating activities US$0.1m. The Shard facility

provided funds of US$0.1m.

30 June 2022 30 June 2021 31 December 2021

Unaudited Unaudited Audited

US$000 US$000 US$000

------------------------------ ------------ ------------ ----------------

GBP Balances 0.2 0.6 0.3

USD value of GBP balances 0.3 0.8 0.4

USD value of other currencies - - -

USD balances - - -

------------------------------ ------------ ------------ ----------------

Cash Total 0.3 0.8 0.4

------------------------------ ------------ ------------ ----------------

Consolidated Statement of Comprehensive Income for the six

months ended 30 June 202 2

1 January 1 January 1 January

to to to

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

Note US$000 US$000 US$000

-------------------------------------------------- ---- ---------- ---------- ------------

Administrative expenses (192) (380) (1,226)

Share of (loss)/profit associate (334) (353) (672)

-------------------------------------------------- ---- ---------- ---------- ------------

Operating loss (526) (733) (1,898)

Interest Income - - -

(Loss) before tax (526) (733) (1,898)

Taxation 5 - -

-------------------------------------------------- ---- ---------- ---------- ------------

(Loss) for the period (526) (733) (1,898)

Foreign exchange translation - foreign operations - - (17)

Share of other comprehensive (loss)/income

of associate - foreign exchange translation 37 3 -

-------------------------------------------------- ---- ---------- ---------- ------------

Other comprehensive (loss)/gain 37 3 (17)

-------------------------------------------------- ---- ---------- ---------- ------------

Total comprehensive (loss)/gain (489) (730) (1,915)

-------------------------------------------------- ---- ---------- ---------- ------------

(Loss)/Earnings per share (Cents)

Basic 7 (0.2) (0.2) (0.6)

Diluted 7 (0.2) (02) (0.6)

All other comprehensive income may be classified as profit and

loss in the future.

Consolidated Statement of changes in equity

for the six months ended 30 June 2022

Foreign

currency

Share Retained translation Total

capital earnings reserve Equity

US$000 US$000 US$000 US$000

-------------------------------------------------------- -------- ---------- ----------- --------

Balance at 1 January 2021 268,864 (234,617) 3,333 37,580

-------------------------------------------------------- -------- ---------- ----------- --------

Consideration for share-based payments - other services 278 - - 278

Issued Capital 1,525 - - 1,525

Loss for the period - (733) - (733)

Other comprehensive (loss)/ income - - 3 3

-------------------------------------------------------- -------- ---------- ----------- --------

Total comprehensive (loss)/income - (733) 3 (730)

-------------------------------------------------------- -------- ---------- ----------- --------

Balance at 30 June 2021 270,667 (235,350) 3,336 38,653

-------------------------------------------------------- -------- ---------- ----------- --------

Consideration for share-based payments - other services 268 - - 268

Issued Capital - - - -

Loss for the period - (1,166) - (1,166)

Other comprehensive (loss)/income - - (19) (19)

-------------------------------------------------------- -------- ---------- ----------- --------

Total comprehensive (loss)/income (1,166) (19) (1,185)

-------------------------------------------------------- -------- ---------- ----------- --------

Balance at 31 December 2021 270,935 (236,516) 3,3317 37,736

-------------------------------------------------------- -------- ---------- ----------- --------

Consideration for share-based payments - other services 82 - - 82

Issue of shares - - - -

Loss for the period - (525) - (525)

Other comprehensive (loss)/income - - 37 37

-------------------------------------------------------- -------- ---------- ----------- --------

- (525) 3 (406)

Total comprehensive loss 7

-------------------------------------------------------- -------- ---------- ----------- --------

Balance at 30 June 2022 271,017 (237,041) 3,354 37,330

-------------------------------------------------------- -------- ---------- ----------- --------

Consolidated Balance sheet

as at 30 June 2022

30 June 31 December

30 June 2021 2021

2022 Unaudited Unaudited Audited

Note US$000 US$000 US$000

----------------------------------------- ---- --------------- ---------- -----------

Non-current asset

Property, plant and equipment - -

Investment in associate 6 37,067 37,285 37,269

----------------------------------------- ---- --------------- ---------- -----------

37,067 37,285 37,269

----------------------------------------- ---- --------------- ---------- -----------

Current assets

Other receivables 157 787 233

Cash and cash equivalents 250 765 387

----------------------------------------- ---- --------------- ---------- -----------

407 1,552 620

----------------------------------------- ---- --------------- ---------- -----------

Total Assets 37,473 38,837 37,889

----------------------------------------- ---- --------------- ---------- -----------

Current liabilities

Trade and other payables (144) (184) (153)

----------------------------------------- ---- --------------- ---------- -----------

Net assets 37,330 38,653 37,736

----------------------------------------- ---- --------------- ---------- -----------

Equity attributable to equity holders of

the parent

Share capital 271,017 270,667 270,935

Retained earnings (237,041) (235,350) (236,516)

Foreign currency translation reserve 3,354 3,336 3,317

----------------------------------------- ---- --------------- ---------- -----------

Total equity 37,330 38,653 37,736

----------------------------------------- ---- --------------- ---------- -----------

These financial statements were approved by the Board of

Directors on 30 September 2022.

Consolidated Cash flow statement

for the six months ended 30 June 2022

1 January 1 January 1 January

to to To

30 June 30 June 31 Dec

2022 2021 2021

Unaudited Unaudited Audited

US$000 US$000 US$000

------------------------------------------------- ---------- ---------- ---------

Cash flows from operating activities

Loss for the year (526) (733) (1,898)

Adjustments for:

Share based payments 82 278 547

Interest received - - -

Decrease in other receivables 76 (729) (31)

Decrease in trade and other payables (9) - (175)

Net exchange (profit)/loss 32 (3) 12

Share of Total Comprehensive income of associate 334 353 672

Net cash from operating activities (11) (834) (873)

Cash flows from financing activities

Issue of shares - 1,525 1,524

Net cash from financing activities - 1,525 1,524

-------------------------------------------------- ---------- ---------- ---------

Cash flows from investing activities

Interest received - -

Acquisition of property, plant and equipment -

Investment in associate (95) (284) (604)

Net cash from investing activities (95) (284) (604)

Net decrease in cash and cash equivalents (106) 407 47

Cash and cash equivalents at beginning of period 387 352 352

Effect of exchange rate difference (31) 4 (12)

-------------------------------------------------- ---------- ---------- ---------

Cash and cash equivalents at end of period 250 765 387

-------------------------------------------------- ---------- ---------- ---------

Notes to the financial statements

1. Business information and going concern basis of

preparation

At 30 June 2022 the Company had cash reserves of US$0.3m. On 29

June 2022, Glencore and ZIOC agreed a 2022 Project Work Programme

and Budget for the Project of up to US$1.3m plus US$0.1m of

discretionary spend. ZIOC agreed to contribute towards this work

programme and budget an amount comprising US$0.09m; the remaining

budget amount will be funded via a loan facility provided directly

to Jumelles Ltd by Glencore thus requiring less funding by ZIOC

over the subsequent 12 months compared to the historical levels

observed. On 29 June 2022, Glencore and the group signed a side

letter to the Jumelles loan facility confirming that there will be

no dilution of the group's holding in Jumelles as a result of this

change in funding structure.

The Company had cash reserves of US$0.1m as at 29 September

2022. In order to raise additional funding the Company entered a

Subscription Agreement with SMC (as described above - see the

Company's release of 26 June 2020.) The financing structure with

SMC enables the Company to access funding for the costs that the

Company is expected to meet in the near future. Due to the fact

that SMC have 3,000,000 shares still to be placed into the market,

for illustrative purposes only, if the average price at which SMC

places the remaining 3,000,000 shares was 2.05 pence (being ZIOC's

mid-market closing share price on 27 September 2022), the net

proceeds received by ZIOC from such sales would be approximately

GBP0.06m. Based on the current cost base at the Zanaga Project, the

direct loan facility to Jumelles Ltd, the current low corporate

overheads of ZIOC, the agreed cash preservation plan adopted by the

Company, the Company's existing cash reserves and (on the basis of

cautious assumptions made by the Company in its funding model) the

funds expected to be obtained from the funding facility established

by the Subscription Agreement with SMC, the board of directors of

ZIOC (the "Board") believes that the Company will be adequately

positioned to support its operations going forward in the near

future. As the final cash amounts to be received for each tranche

of issued shares, and the timing of this receipt, are dependent on

SMC successfully selling the shares prior to transferring funds to

the Company, the Board is of the view that the going concern basis

of accounting is appropriate. However, the Board acknowledges that

there is a material uncertainty which could give rise to

significant doubt over the Company's ability to continue as a going

concern and, therefore, that the Company may be unable to realise

its assets and discharge its liabilities in the normal course of

business. Nevertheless, based on and taking into account the

foregoing factors, the Board are satisfied the Company will have

sufficient funds to meet its own working capital requirements up

to, and beyond, twelve months from the approval of these

accounts.

The Company continues to review the costs of its operational

activities with a view to conserving its cash resources. As part of

such ongoing review, and in order to preserve the cash position of

the Company, it has been agreed with the Directors (since January

2019) and Management (since September 2019) that fees are deferred.

Additionally, the Directors and management have indicated to the

Company that they will assist the cash preservation plan of the

Company. The way in which this could be achieved is being

progressed.

2. Accounting policies

The principal accounting policies applied in the preparation of

these financial statements are set out below. These policies have

been consistently applied to all the periods presented, unless

otherwise stated.

3. Basis of preparation

The condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the EU.

In accordance with the AIM Rules for Companies, the condensed

set of financial statements has been prepared in applying the

accounting policies and presentation that were applied in the

preparation of the Company's published consolidated financial

statements for the year ended 31 December 2021. The comparative

figures for the financial year ended 31 December 2021 are not the

Company's statutory accounts for that financial year. The 2021

accounts have been reported on by the Company's auditors. The

report of the auditors was (i) unqualified and (ii) did not include

a reference to any matter to which the auditors drew attention by

way of emphasis without qualifying their report.

Up until 30 April 2014, the Company accounted for 100% of the

Jumelles group Comprehensive Income. From May 2014, as a result of

completion of the Feasibility Study (note 1 above) and thus

consideration to complete the Call Option, the Company has

accounted for 50% less one share shareholding portion of that

Comprehensive Income.

4. Segmental reporting

The Company has one operating segment, being its investment in

the Zanaga Project, held through Jumelles. Financial information

regarding this segment is provided in note 6.

5. Taxation

The Company is exempt from most forms of taxation in the British

Virgin Islands ("BVI"), provided the Company does not trade in the

BVI and does not have any employees working in the BVI. All

dividends, interest, rents, royalties and other expense amounts

paid by the Company, and capital gains realised with respect to any

shares, debt obligations or other securities of the Company, are

exempt from taxation in the BVI.

The effective tax rate for the Group is 0.00% (December 2021:

0.00%).

6. Investment in associate

US$000

---------------------------- ------

Balance at 1 January 2021 37,354

Additions 284

Share of comprehensive loss (353)

---------------------------- ------

Balance at 30 June 2021 37,285

---------------------------- ------

Additions 389

Share of comprehensive loss (405)

Balance at 31 December 2021 37,269

---------------------------- ------

Additions 95

Share of comprehensive loss (297)

---------------------------- ------

Balance at 30 June 2022 37,067

---------------------------- ------

From 30 April 2014, the investment represents a 50% less one

share shareholding (previously 100%) in Jumelles for 2,000,000

shares of 4,000,001 total shares in issue.

On 11 February 2011, Xstrata Projects (now renamed Glencore

Projects) exercised the Xstrata Call Option and from that date owns

50% plus one share of Jumelles and Jumelles is controlled at both a

shareholder and director level by Glencore Projects. However, as

the shares issued on exercise of the option were not considered to

vest until provision of the services relating to the Preliminary

Feasibility Study and the Feasibility Study had been completed, the

Group continued to account for a 100% interest in Jumelles until

the Feasibility Study was completed in April 2014. From May 2014

the Group has accounted for the reduction of its interest in

Jumelles. The Group's interest remains accounted for as an

associate using the equity method of accounting.

The Group financial statements account for the Glencore Projects

transaction as an in-substance equity-settled share-based payment

for the provision of services by Glencore Projects to Jumelles in

relation to the Preliminary Feasibility Study and the Feasibility

Study. These services largely were provided through third party

contractors and were measured at the cost of the services

provided.

As at 30 June 2022, Jumelles had aggregated assets of US$80.8m

(June 2021: US$80.9m) and aggregated liabilities of US$0.9m (June

2021: US$0.7m). For the 6 months ended 30 June 2022, Jumelles

incurred no taxation charge (June 2021: US$nil). A summarised

consolidated unaudited balance sheet of Jumelles for the 6 months

ended 30 June 2022, including adjustments made for equity

accounting, is included below:

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

US$000 US$000 US$000

---------------------------------------- ---------- ---------- ------------

Non-current assets

Property, plant and equipment 764 982 828

Exploration and other evaluation assets 80,000 80,000 80,000

Total non-current assets 80,764 80,982 80,828

---------------------------------------- ---------- ---------- ------------

Current assets 196 324 202

Current liabilities (919) (748) (586)

---------------------------------------- ---------- ---------- ------------

Net current liabilities (723) (424) (384)

---------------------------------------- ---------- ---------- ------------

Net assets 80,041 80,558 80,444

---------------------------------------- ---------- ---------- ------------

Share capital 293,103 293,103 293,103

Translation reserve 41,242 40,488 41,052

Translation reserve (6,112) (4,805) (6,112)

Accumulated deficit (248,192) (248,228) (247,598)

---------------------------------------- ---------- ---------- ------------

80,041 80,558 80,44

---------------------------------------- ---------- ---------- ------------

30 June 30 June

2022 2021 31 December 2021

Unaudited Unaudited Audited

7. Loss per share US$000 US$000 US$000

----------------------------------------------------------- ---------- ---------- ----------------

Profit/(Loss) (Basic and diluted) (US$000) (526) (733) (1,898)

Weighted average number of shares (thousands)

Basic and diluted

Issued shares at beginning of period 307,034 293,034 293,034

Effect of shares issued - 14,000 14,000

Effect of share repurchase - -

Effect of own shares - -

Effect of share split - -

----------------------------------------------------------- ---------- ---------- ----------------

Weighted average number of shares at end of period - basic 307,034 307,034 307,034

----------------------------------------------------------- ---------- ---------- ----------------

(Loss)/Earnings per share (Cents)

Basic (0.2) (0.2) (0.6)

Diluted (0.2) (0.2) (0.6)

----------------------------------------------------------- ---------- ---------- ----------------

8. Related parties

The following transactions occurred with related parties during

the period:

Transactions for the period Closing balance

---------- ----------------------------- ----------- -----------------------

30 June 30 June 31 December 30 June 30 June 31 December

2022 2021 2021 2022 2021 2021

Unaudited Unaudited Audited Unaudited Unaudited Audited

US$000 US$000 US$000 US$000 US$000 US$000

--------------------- ---------- ------------- -------------- ----------- ---------- -----------

Funding:

To Jumelles Limited 95 284 604 34 34 34

--------------------- ---------- ------------- -------------- ----------- ---------- -----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR URVARUKUKOAR

(END) Dow Jones Newswires

September 30, 2022 08:01 ET (12:01 GMT)

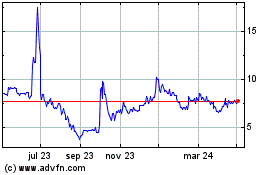

Zanaga Iron Ore (LSE:ZIOC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Zanaga Iron Ore (LSE:ZIOC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024