TIDMZNWD

RNS Number : 3399C

Zinnwald Lithium PLC

22 February 2022

Zinnwald Lithium plc / EPIC: ZNWD.L / Market: AIM / Sector:

Mining

22 February 2022

Zinnwald Lithium plc ("Zinnwald Lithium" or the "Company")

Final Results

Zinnwald Lithium plc, the German focused lithium development

company, is pleased to announce its final audited results for the

year ended 31 December 2021.

The Company's Annual Report and Financial Statements for the

year ended 31 December 2021 will be posted to shareholders today

and will be available on its website www.zinnwaldlithium.com.

OVERVIEW

Significant advances made towards becoming an important supplier

to Europe's fast-growing lithium sector

-- Gained full control of flagship Zinnwald Lithium Project in

south-eastern Germany via a cash and shares transaction worth

EUR8.8 million

-- Extended resource position in the Saxony region, bringing

total resource inventory at the Zinnwald Project to over one

million tonnes lithium carbonate equivalent ('LCE').

-- Raised approximately EUR7 million in additional equity to

advance the Project in 2022; EUR7.7 million cash position at

today's date.

-- Welcomed new shareholders to the register including several large institutions.

Focusing on ways to improve the Project, including identifying

options for cost reduction, as well as enhancements that reduce the

CO(2) footprint

-- Completed a technical review of the Project during the second half of 2021.

-- Pivoted the Project to focus on battery-grade lithium

hydroxide as a primary product to better align with the market

specifications of core European off-takers.

-- Exploring the possibility of expanding the production capacity of the Project.

Potential to become an important strategic source of a vital

commodity for the transition to a greener economy for both Germany

and Europe

-- Strong market demand for lithium as the growth in EV demand gathers pace.

-- No current domestic European producers of battery-grade

lithium products; need for significant import volumesto meet demand

in Europe.

Several workstreams planned for 2022

-- Completing detailed test work and preliminary engineering

studies related to lithium hydroxide production.

-- Undertaking an in-fill drilling campaign at the Zinnwald

License to assist in detailed mine planning, with the objective of

evaluating the ability to increase mining output.

-- Exploring options to improve project logistics and

sustainability through utilising existing infrastructure

assets.

-- Commencing an exploration drilling campaign at nearby

Falkenhain exploration license targeting lithium, tin, and tungsten

to enhance the Project's scale and economics.

-- Looking to assess the viability of economic recovery of tin

as a by-product and its possible impact on the Project's

economics.

CHAIRMAN'S STATEMENT

The past year has seen a number of key milestones delivered by

Zinnwald Lithium. During the course of 2021, we gained full control

of our flagship Zinnwald Lithium Project (the "Project") in

south-eastern Germany via a cash and shares transaction worth

EUR8.8 million. We also expanded our mineral resource base in the

Saxony region, following the granting of an additional exploration

license at Sadisdorf by the regional mining authority - bringing

our total resource inventory at the Zinnwald Project to over one

million tonnes lithium carbonate equivalent ('LCE'). These

transactions, achieved in 2021, have served to firmly establish

Zinnwald Lithium as major player in the in the European lithium

space. To round the year off, we took advantage of the strong

lithium market and raised approximately EUR7 million in equity -

securing funds to advance the Project.

Having gained 100% ownership of Deutsche Lithium in June 2021,

management completed a thorough technical review of the Project

during the second half of the year. We also analysed market trends

in battery chemistry, through meetings with off-takers and battery

manufacturers, as to preferred lithium product and anticipated

demand. As part of this, we are undertaking additional test work to

determine our ability to produce lithium hydroxide economically and

the results are expected shortly. The conclusion of our technical

review, and the encouraging results from the initial test work, has

resulted in pivoting the Project to focus on battery-grade lithium

hydroxide as its primary end product.

In addition, as part of the ongoing value engineering work,

trade-off studies are underway to determine the optimum mining rate

and process plant capacity. By increasing the targeted annual

production rate, there is the potential to maximise the project

economics and lower the cash cost, which is a key driver for the

Project to be in the lower range of the cost curve. The work also

focuses on other key ways to optimise the Project, including

identifying options for cost reduction, as well as enhancements

that reduce the CO2 footprint and our overall environmental

impact.

In terms of the lithium market, 2021 was a year in which

commodity markets benefitted from the impact of the increasingly

rapid shift to electric vehicles ('EVs') and the implications for

the critical raw materials required to produce lithium-ion

batteries. Since January 2021, the price for lithium hydroxide has

more than doubled and spot prices in China have recently hit levels

of $50,000/tonne. As the growth in EV demand gathers pace, we

believe supply deficits in the lithium market will become

increasingly apparent. On the back of this surge, many market

commentators have raised their long-term lithium price forecasts,

which further supports the potential value of the Project.

Europe, in particular, is forecast to emerge as a key market for

lithium with regional lithium battery production forecast to

increase fifteen-fold by 2030. It is worth noting that, presently,

there are no domestic European producers of battery-grade lithium

products. In addition, even if all the currently contemplated

lithium projects in Europe commence production, there will still be

a need for significant import volumes to meet anticipated demand.

Positioned in the heart of the German automotive sector, the

Zinnwald Lithium Project has the potential to become a highly

important strategic source of a vital commodity for the transition

to a greener economy for both Germany and Europe.

With regard to our non-core assets in Ireland, the Company has

rationalised its license holdings and retained just the core

prospecting license related to the brownfields Abbeytown Project.

The zinc price rebounded strongly during 2021 and the Company's

core objective for Abbeytown remains to find a partner or purchaser

for the asset. In Sweden, we relinquished our Brännberg

licences.

Looking ahead to 2022, the funds raised in December last year

have set us up well to advance the Project. Specific workstreams

planned for 2022 include completing detailed test work and

preliminary engineering studies related to lithium hydroxide

production. We will also be undertaking an in-fill drilling

campaign at Zinnwald, as part of detailed mine planning, all part

of the ongoing value engineering.

It is important to highlight that the Saxony region of Germany,

in which the Project is located, has a long history of mining and

contains legacy mining infrastructure. Work is currently underway

to determine if it is viable to utilise parts of this existing

infrastructure around the Project as part of our planned mining

operations. This, in turn, has the potential to improve the

logistics of the Project and lessen the impact on local communities

and the environment through less movement on local roads.

The Project already benefits from the fact that its anticipated

by-products are all benign in nature, almost all saleable, and the

planned beneficiation process is comparatively energy and water

efficient. Access to existing mining infrastructure, therefore,

could further help improve the sustainability of the Project -

helping us to achieve one of our core objectives, which is to bring

to production a project that meets the highest standards of

environmental and social responsibility.

A further key priority in 2022 is the commencement of an

exploration drilling campaign at our nearby Falkenhain exploration

license. A detailed review of historic drill data completed on the

license prior to German Reunification has proved encouraging with

respect to the potential prospectivity of the license area. The

planned exploration drill campaign - targeting lithium, tin, and

tungsten - will allow us to test the historic work, and assess the

potential of the Falkenhain deposit, ultimately, to determine if

this has the potential to feed the planned plant at the Zinnwald

Project.

Corporate

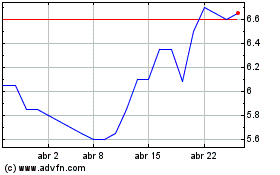

The Companies shares have performed well over the last 12 months

driven by the increased demand in lithium as the EV and clean

energy transition gains global momentum. We have welcomed many new

shareholders to our register including several large institutions,

through both our fundraising activities, the acquisition of the

remaining 50% of Deutsche Lithium, as well as from Bacanora Lithium

Plc, which spun out its holding in our Company to its own

shareholders shortly before the year end.

Financial Overview

The Company maintains a disciplined approach to expenditure and,

as such, is well funded for 2022 with a EUR7.7 million cash

position at today's date.

Long-term Outlook

Zinnwald has the potential to become a key European lithium

project. We look forward to reporting further progress in the year

ahead as we further develop the Project towards a Bankable

Feasibility Study for Lithium Hydroxide.

In closing, I would like to thank the team for the work they

have put in during the year and all our shareholders for their

support. We look forward to an active year on the Project in

2022.

Jeremy Martin

Non-Executive Chairman

21 February 2022

STRATEGIC REPORT

Extracts from the Company's Strategic Report are set out

below.

Highlights - 12 Months to 31 December 2021

Zinnwald Lithium Project

-- Acquired the remaining 50% of Deutsche Lithium GmbH from

SolarWorld AG to consolidate full ownership of the Zinnwald Lithium

Project. The acquisition cost comprised 50 million new shares

issued at a price of 12.5p and EUR1.5m in cash.

-- Raised circa GBP5.8m primarily from existing shareholders at a price of 15.5p per share.

-- Granted five-year Sadisdorf exploration licence within 12km

of primary Zinnwald mining license.

-- Completed initial phase of Lithium Hydroxide testwork.

-- Completed a phase of value engineering to optimise the plant

capacity and evaluate the production of a more conventional

product, Lithium Hydroxide.

Legacy Assets

-- Ireland - the Company undertook sufficient drilling to renew

its core licence at the Abbeytown Project for a further two years

to 2023, whilst relinquishing all other licenses.

-- Sweden - the Company relinquished all its licenses and closed its operations.

Company Overview - Background and evolution

The Group was originally established in 2012 as a mineral

exploration and development company focused on Zinc licenses in

Ireland and Gold licenses in Sweden. The Company made its IPO on

AIM in December 2017 with Osisko Gold Royalties as its cornerstone

investor and a project level partnership in Sweden with Centerra

Gold. The Company has dropped all licenses in Sweden and closed its

operations. In Ireland, the Company now retains a single license in

Ireland at the brownfield Abbeytown project, which is on care and

maintenance. The Company considers that the increase in the Zinc

price in 2021 may assist in securing a partner to progress this

asset.

In October 2020, the Company completed its transformation into a

lithium-focused development company with the acquisition (via a

reverse-takeover) of Bacanora Lithium Plc's 50% ownership and joint

operational control of, Deutsche Lithium GmbH, whose principal

asset is the Zinnwald Lithium Project.

In June 2021, the Company completed the acquisition of the

remaining 50% of Deutsche Lithium from SolarWorld AG, a company

which had been in administration since 1 August 2017. This gave the

Company full ownership and full operational control of Deutsche

Lithium. It also led to the cancellation of the Joint Venture

Agreement with SolarWorld AG and the removal of certain obligations

due to Bacanora in relation to this Agreement.

In December 2021, Bacanora distributed its entire holding of

30.9% of the Company's shares to its own shareholders as part of

the terms of its takeover by Ganfeng Lithium Ltd. This expunged

most of the agreements between the Company and Bacanora that had

been put in place at the time of the RTO, including the

Relationship Agreement that gave Bacanora the right to appoint a

Director to the Company. The sole remaining agreement is the

Royalty Agreement covering 50% of the Project, which remains in

place.

Zinnwald Lithium Project

The Zinnwald Lithium project (the "Project") is located in

southeast Germany, some 35 km from Dresden and adjacent to the

border of the Czech Republic. The Project is in a granite hosted

Sn/W/Li belt that has been mined historically for tin, tungsten,

and lithium at different times over the past 400 years. The Project

benefits from a strategic location in close proximity to the German

automotive and downstream chemical industries. The Project

comprises four key areas, as follows:

The advanced Zinnwald core project area

The Zinnwald core project area covers 256.5 ha and already has a

30-year mining licence to 31 December 2047. In May 2019, Deutsche

Lithium first announced the results of the NI 43-101 Feasibility

Study for the Project, which included an identified resource at

this license area as follows:

-- Measured plus Indicated Mineral Resource estimate containing

35.51 Mt at a grade of 3,519 ppm containing 124,974 t Li at cut-off

grade of 2,500 ppm Li.

-- Represents approximately 665,000 tonnes of lithium carbonate equivalent ('LCE'), comprising approximately 357,500 tonnes of LCE in Measured Resources and approximately 307,500 tonnes of LCE in Indicated Resources.

-- Estimated Inferred Mineral Resources of 4.87 Mt at a grade of

3,549 ppm containing 17,266 t Li metal (approximately 92,000 tonnes

LCE).

Falkenhain and Altenberg satellite areas

Prior to 2021, Deutsche Lithium held two other exploration

licences; the Falkenhain licence (covering 295.7 ha and with a

five-year term to 31 December 2022); and the Altenberg licence

(covering 4,225.3 ha and with an approximately five-year term to 15

February 2024). The Falkenhain license area had been extensively

explored for tin and tungsten prior to German reunification and

historic data still exists for these drill campaigns. The Company

intends to perform an exploration drill campaign to test the

historical drilling and assess the potential of the Falkenhain

target as a potential satellite lithium resource to feed into the

main Zinnwald Project.

Sadisdorf satellite area

In June 2021, Deutsche Lithium was granted the Sadisdorf

Licence, which covers circa 225 ha in the Erzgebirge or Ore

Mountains region of Saxony, Germany and is valid until 30 June

2026. The license area is located circa 12km NNE of the Company's

Zinnwald license area, and forms part of the same geological unit

that hosts the historic Li-Sn-W deposits at Zinnwald, Falkenhain

and Altenberg. The deposit at Sadisdorf has historically been mined

for tin and copper. Historical exploration work at the Sadisdorf

Licence by previous licence holders resulted in a December 2017

historic JORC compliant inferred mineral resource of 25 million

tons with an average grade of 0.45% Li2O (average 2,053 ppm lithium

head grade). Subject to follow up exploration work and verification

of the lithium grades, the Sadisdorf area has the potential to

provide additional plant feed in the future.

Historic Project Plans

Whilst Deutsche Lithium was under the operational direction of

Bacanora, the strategy for the Project was threefold - match the

long mine life of Bacanora's main Sonora Project; produce a niche

complimentary product to Sonora's mainstream lithium products

(lithium carbonate); and most importantly, be financeable from

Bacanora's internal cash flows.

With an abundant supply of fluorspar/hydrofluoric acid available

in the immediate vicinity, Deutsche Lithium chose to focus on LiF

(Lithium Fluoride) which is a high value downstream lithium product

and one of the two key components in the manufacturing process of

LiPF6, which is the most important conducting salt in lithium

electrolytes and serves as the "shuttle" in the lithium battery

electrolyte which "ships" the lithium ion between the cathode and

the anode. Approximately 95 per cent. of all lithium battery

electrolytes use LiPF6, and the percentage used in each cathode is

increasing in some of the newer battery types.

The resultant Deutsche Lithium 2019 Feasibility Study was

predicated on a 30-year mine life production of 5,112 tpa (7,285

tpa LCE) of battery grade LiF. This study showed a pre-tax project

NPV of EUR428 million and an IRR of 27.4%, based on a Capex of

EUR160 million. The study also included the potential to produce up

to 32,000 tpa of potassium sulphate for sale to the European

fertiliser industry. Further, the majority of its mined tailings

would be inert Quartz Sands that may be sold for use as an

aggregate filler to local building companies.

The mining operation was planned as an underground mine

development using a single decline ramp for access to the mine and

for ore transportation from the mine to the surface. The mining

method to be used was room and pillar with subsequent backfill

using self- hardening material. The processing operation was to be

based on a conventional processing flow sheet using established

sulphate route processing technology. The integrated plant was

designed to process approximately 570,000 tonnes of ore per year

(assuming a 30-year mine plan).

Evolution of the Project Plans

During 2021, as part of planning the next phase of development,

the Company completed a holistic technical review to identify ways

to optimise all facets of the project to maximise value and make it

as attractive as possible to potential Industry partners,

off-takers and future finance providers. This review indicated that

the core project could potentially sustain both a higher annual

production level and a more conventional battery-grade lithium end

products (lithium hydroxide and lithium carbonate) that are better

suited to the current market demand.

In terms of the scale of the project, the Company has been

reviewing the potential to operate with a higher annual output, but

with a shorter mine life (still exceeding 20 years) from the

Zinnwald license area. As noted above, the addition of the new

deposits covered by the three new nearby license areas has the

potential to increase Zinnwald's resource base and annual lithium

production.

In prior years, Deutsche Lithium had already established the

possibility of producing battery-grade lithium carbonate directly

from the lithium mica concentrate with only minimal modifications

to the flowsheet. In 2021, Deutsche Lithium undertook further

testwork to determine if battery-grade lithium hydroxide could be

produced. This testwork remains ongoing, but the preliminary

indications appear to endorse that strategy.

The Company also continues to undertake detailed value

engineering in order to optimise the cost profile of the Project.

This work includes a closer examination of the potential for

economic by-products including the tin and high-quality potassium

sulphate, and good quality aggregate products for the construction

industry. A potential to significantly decrease CO2 emission and

operating costs has been recognised if the old mining

infrastructure was utilised and plant locations optimised. This

would also reduce the impact of the project on surrounding

communities.

Company Strategy

Prior to 2020, the Company's strategy was focused on shareholder

value through the process of discovering new mineral deposits and

seeking attractive acquisition opportunities. The Zinnwald Lithium

Project was one such acquisition opportunity and the Board believes

that advancing the Project represents an excellent opportunity to

create value for Shareholders, particularly as the Project is at an

advanced stage when compared with the Company's historic assets.

The Company's strategy continues to be underpinned by a technically

led team with extensive experience in bringing projects from the

feasibility stage through to mine production, as well as the

capital markets experience to source the funding required for these

types of mining projects. The Project also fits into the Company's

strategy of focusing on low-risk jurisdictions (Germany) in areas

with proven metallogenic potential, an active mining industry, low

political risk and transparent permitting processes.

The Project is now the Company's core development asset and the

team will focus on further de-risking the project as it is advanced

towards a development decision. Key work areas include:

-- Assess the commercial viability of producing a broader range

of lithium compounds, specifically lithium hydroxide and lithium

carbonate;

-- Expansion of the size of the Project by increasing annual

production potential through increasing the planned mining rate and

potentially bringing other satellite resources into the mining

schedule;

-- Identification of and negotiation with off-take partners

(potentially locally) that could include battery manufacturers,

chemical producers or commodity traders;

-- Identification of and negotiation with potential financing

partners that could include banks and national and trans-national

development organisations;

-- Exploration work to advance the satellite project areas to

increase the potential size of the overall project resource

base;

-- Advance the plant engineering towards AAC Class 3;

-- Minimising the carbon footprint by optimising Lithium plant

location and transportation methods;

-- Finalisation of the selection of the optimal chemical processing site location;

-- Negotiation with the holders (principally the German state)

of existing mining infrastructure in the vicinity of the Project

that has the potential to enhance the project economics;

-- Advancing the permitting process for the construction and operation of the mine; and--

-- Ensuring the social license to operate by extensive public participation.

The Company recognises the importance of the general public and

the NGOs in the permitting processes and has committed to

proactively engage with all the stakeholders in its projects.

Operational review & outlook

Germany

During 2021, the Group has continued to progress the Project on

both a corporate and operational level.

At a Corporate level, in line with our previously stated

strategy, we successfully completed the acquisition of the

remaining 50% of Deutsche Lithium giving us 100% ownership and full

operational control of the Project. The acquisition cost was EUR8.8

million, with most of the purchase consideration structured as an

issue of new ordinary shares in the Company allowing us to conserve

cash resources. New ordinary shares equivalent to 19.6% of our

enlarged share capital were issued as part of the transaction and

were distributed to a number of parties being primarily the

creditors of SolarWorld AG.

At the Project level during the year, we have been busy

advancing various workstreams and have completed the initial phase

of the lithium hydroxide ("LiOH") testwork. The initial results

were highly encouraging and showed the potential to produce a high

purity, battery grade product that is low in contaminants. We have

also generated LiOH product samples, which we will be sharing with

potential off-takers to help them evaluate the product. The ability

to produce a high quality, battery-grade LiOH, alongside the

Project's already demonstrated ability to produce battery grade

lithium fluoride and lithium carbonate, further demonstrates the

flexible nature of the Project and its ability to produce high

value products to meet demand from battery makers.

Additionally, during the year, Deutsche Lithium was granted a

five-year exploration licence (the "Sadisdorf Licence") covering

approximately 225 hectares ("ha") in the Erzgebirge or Ore

Mountains region of Saxony, Germany. This complements two other

exploration licences already held by Deutsche Lithium: the

Falkenhain licence, covering 295.7 ha and with a term to 31

December 2022; and the Altenberg licence, covering 4,225.3 ha and

with a term to 15 February 2024. The Sadisdorf Licence is circa

12km NNE of Zinnwald's key lithium deposit and forms part of the

same geological unit that hosts the historic Li-Sn-W deposits at

Zinnwald, Falkenhain and Altenberg.

The grant of this licence coupled with the Falkenhain and

Altenberg licences represents exciting expansion potential for

Zinnwald and, based on the historical resource delineated by

previous licence holders, effectively increases our overall

resource to greater than 1 million tons contained lithium carbonate

equivalent ("LCE"), an increase of over 50%. We will be undertaking

further work on all our exploration licence areas to further

evaluate their potential and how they can enhance the Project.

Looking forward into 2022 and beyond, as noted above, the

Group's plans for the Project are to seek ways to expand the size

of the Project, increase annual lithium production, explore the

potential for additional and higher value co-products, and to

produce a more conventional lithium end-product for future

off-takers. Consequently, the Group raised circa GBP5.8m in

December 2021 to finance the start of this work. Some of the key

workstreams for 2022 include the following:

-- 15,000m of planned exploration drilling across Falkenhain and

in-filling drilling at Zinnwald. At Falkenhain, a detailed review

has been performed on historic drill data. Initial tests have

indicated similar characteristics to the bulk samples from the

Zinnwald licence. The planned drilling work at Zinnwald will help

to refine the early years mine plan for an expanded mining

operation on the Zinnwald license.

-- The Group has started the process of updating the feasibility

study to be based on the production of Lithium Hydroxide. This will

also include value engineering work, finalisation of the plant

locations, review of the potential to produce a tin by-product,

refinement of the plans for co-product production, and the

potential for sale of its quartz sand by-products.

-- The Group is working to advance the permitting status of the

Project. Deutsche Lithium obtained its mining licence for Zinnwald

in 2017, which is valid until 2047, but comes with the standard

requirements to apply for further permits for environmental and

construction aspects of the Project. Deutsche Lithium is

undertaking environmental and community studies to continue to

develop the overall Zinnwald sustainability framework.

Environmental monitoring programmes are ongoing as well as the

permitting process for Zinnwald's mining and mineral processing

plant.

-- The Company has commenced data analytics and archive work

with regard to the Sadisdorf licence.

Lithium Market

2021 saw a transformation in general market sentiment towards

Lithium, as consumption grew strongly whilst pricing, especially in

the spot market saw spectacular growth. These were driven by a

number of macro-economic factors, some of which may be temporary,

but several are likely to be longer term and support the progress

of the Lithium industry away from being a niche volatile

market.

In terms of consumption, estimates from the Australian

Department of Industry put global demand for lithium carbonate

equivalent (LCE) at 486,000 tonnes in 2021, up almost 60% from

2020's 305,000 tonnes. They forecast this to increase a further 50%

to 724,000 tonnes by 2023. For the longer term, Canaccord, an

investment bank, forecast a longer-term demand of circa 1.2 million

tonnes by 2025 and 2.5 million tonnes by 2030, a CAGR of 20%. This

was in large part due to increased demand for Electric Vehicles

(EVs), that saw YOY growth in 2021 of 103% to 6.1m units, driven by

China (+149% growth to 3.1m units) and Europe (+57% to 2.1m units).

Canaccord forecast global sales to increase to 16.8m units by 2025

and 46m units by 2030 (representing an estimated EV penetration

rate of 24% and 46%, respectively).

Lithium prices in the spot market in 2021 saw spodumene pricing

up 532%, lithium carbonate 431% and lithium hydroxide 340% higher.

However, it should be noted that the spot market is a smaller part

of the industry, estimated to represent less than 30% of the total

lithium market. Some of this price increase can be put down to a

couple of inherently short-term factors, such as:

-- "Hangover" from the Lithium price crash of 2018-19. The

period 2017 to 2019 saw a number of large-scale projects,

especially spodumene, coming online to flood a market, that at the

time, enjoyed only modest EV growth. This caused a collapse in the

lithium price, which in turn caused project deferrals or

cancellations. This was further exacerbated by delays and

restrictions caused by COVID-19 and left a mining industry unable

to supply the post-lockdown surge in pent-up demand.

-- Contract vs Spot market. The Global auto industry has

increasingly prioritised securing contract supply prices, for which

details are generally not reported to the market, which in turn

reduced available supply for the spot market.

-- Trader speculation. There is an inherent incentive for miners

and traders to defer supply in the hope of even high prices, which

in turn exaggerates short term price movement.

In the short term there may well be a price correction as

suppliers have already started to take advantage of the incentive

pricing, with new or restarted production in 2022, such as

Greenbushes and Pilbara in Western Australia (spodumene) and the

South American brine producers, Albemarle and SQM. In terms of

supply, the Australian Department of Industry estimates global

supply at 485,000 tonnes LCE in 2021 (up only 2%) and forecasts an

increase to 615,000 tonnes in 2022 and 821,000 tonnes in 2023.

However, the Australian Department of Industry also notes that

currently supply from mine and brine operations is falling short in

terms of matching demand growth, so whilst project development is

underway, it will take time to fill the supply gap.

Globally, the longer-term outlook for lithium does appear

promising which will hopefully see demand growth outpace production

and a long term sustained higher price for producers. As

governments and organisations worldwide drive the rapid deployment

of new clean energy technologies, the role of critical materials,

including metals such as lithium, is becoming more apparent. The

European automotive industry also appears to be focusing its

battery chemistry technology towards nickel-based chemistries

(which require lithium hydroxide) as these typically offer better

cold weather performance as well as superior energy density.

In Europe, the European Commission released a proposal for

stronger emissions standards on vehicles which would require

average emissions of new cars to come down by 55% on 2021 levels by

2030 and 100% by 2035. These targets mean security of supply for

battery grade chemicals may become a big issue for customers, with

a shortfall in battery grade products projected towards the end of

the outlook period. The EU estimates 18 times more lithium is

required by 2030 to support its climate-neutrality scenarios, while

at least 24 new lithium battery Gigafactories are planned in Europe

with four expected to come online in 2021, bringing Europe's

production capacity from its current 30 GWh to 700 GWh by 2028.

Volkswagen alone has committed to build six 40GWh battery factories

in Europe by 2030 (equates to 350kt of LCE demand). To keep up with

this demand, the EU is focused on encouraging local supply.

In terms of the nature of the industry, the first half of 2021

saw the start of sector consolidation between lithium companies

(Galaxy & Orocobre, IGO & Tianqi). The second half of the

year saw more aggressive M&A, especially by the Chinese

companies Ganfeng and CATL, who spent more than $2bn on five

projects. Canaccord estimates that a total of US$7bn was spent on

M&A during 2021 up from US$400m in 2020.

The larger more diversified miners have also started to take an

interest in the industry as it matures. Rio Tinto's head of

economics, Vivek Tulpule, said that by 2030 EV manufacturers would

need about three million tonnes of lithium, compared with the

roughly 350,000 tonnes they consume today. They estimated that

existing operations and projects combined, will contribute one

million tonnes of lithium and filling the supply gap would require

over 60 Jadar projects (58kt per annum), even before the Jadar

project was cancelled by the Serbian government.

GROUP STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2021

31-Dec 31-Dec

2021 2020

Continuing operations Notes EUR EUR

Cost of sales (46,096) (56,540)

Exploration projects impairment (1,583,566) (592,465)

Administrative expenses (1,076,438) (690,356)

Other operating income 779 -

RTO costs - (839,940)

Share based payments charge 25 (7,779) (3,725)

Operating loss 5 (2,713,100) (2,183,026)

Revaluation gain on joint venture 7 1,038,252 -

Share of loss of joint venture 10 (52,911) (32,579)

Finance income 9 455 367

Loss before taxation (1,727,304) (2,215,238)

Tax on loss 12 - -

Loss for the financial year 30 (1,727,304) (2,215,238)

Other comprehensive income 181 19

Total comprehensive loss for the year (1,727,123) (2,215,219)

Earnings per share from continuing

operations attributable to the owners

of the parent company 13

Basic (cents per share) (1) (4)

Diluted (cents per share) (1) (4)

Total loss and comprehensive loss for the year is attributable

to the owners of the parent company.

GROUP STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2021

31-Dec-21 31-Dec-20

Notes EUR EUR

Non-current assets

Intangible assets 14 16,165,085 1,546,111

Property, plant and equipment 15 48,621 3,662

Investments using equity method 16 - 3,852,083

16,213,706 5,401,856

Current assets

Trade and other receivables 21 121,845 170,926

Cash and cash equivalents 20 8,291,991 4,846,527

8,413,836 5,017,453

Total assets 24,627,542 10,419,309

Current liabilities

Current tax liabilities 23,802 -

Trade and other payables 22 614,858 58,833

638,660 58,833

Net current assets 7,775,176 4,958,620

Total liabilities 638,660 58,833

Total assets less current liabilities 23,988,882 10,360,476

Deferred tax liability 23 (1,382,868) -

Net assets 22,606,014 10,360,476

Equity

Share capital 27 3,316,249 2,278,155

Share premium 28 20,289,487 7,362,699

Other reserves 29 822,781 814,821

Retained earnings 31 (1,822,503) (95,199)

Total equity 22,606,014 10,360,476

GROUP STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2021

Share Share premium Other Retained

capital account reserves earnings Total

Notes EUR EUR EUR EUR EUR

Balance at 1 January

2020 351,133 4,151,045 811,077 (1,820,744) 3,492,511

Year ended 31 December

2020:

Loss for the year - - - (2,215,238) (2,215,238)

Other comprehensive income:

Currency translation

difference - - 19 - 19

Total comprehensive income

for the year - - 19 (2,215,238) (2,215,219)

Conversion of share premium

to retained profits - (4,431,671) - 4,431,671 -

Issue of share capital 27 1,927,022 7,643,325 - - 9,570,347

Dividend in specie - - - (490,888) (490,888)

Credit to equity for

equity settled share-based

payments 26 - - 3,725 - 3,725

Total transactions with

owners recognised directly

in equity 1,927,022 3,211,654 3,725 3,940,783 9,083,184

Balance at 31 December

2020 and 1 January 2021 2,278,155 7,362,699 814,821 (95,199) 10,360,476

Year ended 31 December

2021:

Loss for the year - - - (1,727,304) (1,727,304)

Other comprehensive income:

Currency translation

differences - - 181 - 181

Total comprehensive income

for the year - - 181 (1,727,304) (1,727,123)

Issue of share capital 27 1,038,094 13,217,816 - - 14,255,910

Share issue costs - (291,028) - - (291,028)

Credit to equity for

equity settled share-based

payments 26 - - 7,779 - 7,779

Total transactions with

owners recognised directly

in equity 1,038,094 12,926,788 7,779 - 13,972,661

Balance at 31 December

2021 3,316,249 20,289,487 822,781 (1,822,503) 22,606,014

GROUP STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2021

Year ended Year ended

31 December 31 December

2021 2020

Notes EUR EUR EUR EUR

Cash flows from operating

activities

Cash used in operations 34 (495,174) (1,711,087)

Net cash outflow from

operating activities (495,174) (1,711,087)

Cash flows from investing

activities

Investment in Deutsche

Lithium as Joint Venture (735,800) (199,000)

Purchase of remaining

50% of Deutsche Lithium (1,500,000) -

Cash acquired on purchase

of Deutsche Lithium 486,213 -

Exploration expenditure

in Germany (948,157) -

Exploration expenditure

in Ireland and Sweden (37,455) (227,130)

Purchase of property,

plant and equipment (8,437) (3,885)

Proceeds on disposal of

property, plant and equipment - 5,300

Interest received 455 367

Net cash used in investing

activities (2,743,181) (424,348)

Cash flows from financing

activities

Proceeds from issue of

shares 6,927,255 5,884,685

Share issue costs (243,436) -

Equity subscription in

Erris Gold Resources - (400,000)

Net cash generated from

financing activities 6,683,819 5,484,685

Net increase in cash and

cash equivalents 3,445,464 3,349,250

Cash and cash equivalents

at beginning of year 4,846,527 1,497,277

Cash and cash equivalents

at end of year 8,291,991 4,846,527

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 31 DECEMBER 2021

1 Accounting policies

Company information

Zinnwald Lithium Plc ("the Company") is a public limited company

which is listed on the AIM Market of the London Stock Exchange

domiciled and incorporated in England and Wales. The registered

office address is 29-31 Castle Street, High Wycombe,

Buckinghamshire, United Kingdom, HP13 6RU.

The Company name was changed from Erris Resources Plc to

Zinnwald Lithium Plc by a special resolution approved by

shareholders at the General Meeting held on 26 October 2020.

The group consists of Zinnwald Lithium Plc and its subsidiaries

as detailed in Note 17.

1.1 Basis of preparation

These financial statements have been prepared in accordance with

UK-adopted International Accounting Standards and IFRIC

interpretations and with those parts of the Companies Act 2006

applicable to companies reporting under IFRS (except as otherwise

stated).

The financial statements are prepared in euros, which is the

functional currency of the Company and the Group's presentation

currency, since the majority of its expenditure, including funding

provided to Deutsche Lithium, is denominated in this currency.

Monetary amounts in these financial statements are rounded to the

nearest EUR.

The EUR to GBP exchange rate used for translation as at 31

December 2021 was 1.18981.

The consolidated financial statements have been prepared under

the historical cost convention, unless stated otherwise within the

accounting policies. The principal accounting policies adopted are

set out below.

1.2 Basis of consolidation

The consolidated financial statements incorporate those of

Zinnwald Lithium Plc and all of its subsidiaries (i.e., entities

that the group controls when the group is exposed to, or has rights

to, variable returns from its involvement with the entity and has

the ability to affect those returns through its power over the

entity).

In regard to its shareholding in Deutsche Lithium, for the

period from 1 January 2021 to 24 June 2021, the Board concluded

that whilst it had significant influence over Deutsche Lithium (50%

shareholding, 1 of the 2 co-managing directors and a casting vote

on operational matters), it did not have control over that company

and consequently the investment was accounted for using equity

accounting rather than consolidated. On conclusion of the

acquisition of the remaining 50% of Deutsche Lithium on 24 June

2021, the Company now consolidates the full results of Deutsche

Lithium. Business combinations are accounted for using the

acquisition method. Identifiable assets acquired and liabilities

assumed are measured at their fair values at the acquisition

date.

Zinnwald Lithium Plc was incorporated on 21 June 2017. On 1

December 2017, Zinnwald Lithium Plc acquired the entire issued

share capital of Erris Resources (Exploration) Ltd by way of a

share for share exchange. This transaction was treated as a group

reconstruction and accounted for using the reverse merger

accounting method.

All financial statements are made up to 31 December 2021. Where

necessary, adjustments are made to the financial statements of

subsidiaries to bring the accounting policies used into line with

those used by other members of the group.

All intra-group transactions, balances and unrealised gains on

transactions between group companies are eliminated on

consolidation. Unrealised losses are also eliminated unless the

transaction provides evidence of an impairment of the asset

transferred.

Subsidiaries are fully consolidated from the date on which

control is transferred to the group. They are deconsolidated from

the date on which control ceases.

1.3 Going concern

At the time of approving the financial statements, the directors

have a reasonable expectation that the group and company have

adequate resources to continue in operational existence for the

foreseeable future. The Company had a cash balance of EUR8.3m at

the year end and keeps a tight control over all expenditure. Thus,

the going concern basis of accounting in preparing the Financial

Statements continues to be adopted.

The Directors have reviewed the ongoing situation with COVID-19

and do not consider its effects to have a material impact on the

Group's and Company's going concern.

1.4 Intangible assets

Capitalised Exploration and Evaluation costs

Capitalised Exploration and Evaluation Costs consist of direct

costs, licence payments and fixed salary/consultant costs,

capitalised in accordance with IFRS 6 "Exploration for and

Evaluation of Mineral Resources". The Group and Company recognises

expenditure in Exploration and Evaluation assets when it determines

that those assets will be successful in finding specific mineral

assets. Exploration and Evaluation assets are initially measured at

cost. Exploration and Evaluation Costs are assessed for impairment

when facts and circumstances suggest that the carrying amount of an

asset may exceed its recoverable amount. Any impairment is

recognised directly in profit or loss.

1.5 Property, plant and equipment

Property, plant and equipment are initially measured at cost and

subsequently measured at cost, net of depreciation and any

impairment losses.

Depreciation is recognised so as to write off the cost or

valuation of assets less their residual values over their useful

lives on the following bases:

Leasehold land and buildings

Plant and equipment 25% on cost

Fixtures and fittings 25% on cost

Computers 25% on cost

Motor vehicles

The gain or loss arising on the disposal of an asset is

determined as the difference between the sale proceeds and the

carrying value of the asset and is recognised in the income

statement.

1.6 Non-current investments

In the parent company financial statements, investments in

subsidiaries and joint ventures are initially measured at cost and

subsequently measured at cost less any accumulated impairment

losses.

1.7 Impairment of non-current assets

At each reporting period end date, the group reviews the

carrying amounts of its tangible and intangible assets to determine

whether there is any indication that those assets have suffered an

impairment loss. If any such indication exists, the recoverable

amount of the asset is estimated in order to determine the extent

of the impairment loss (if any). Where it is not possible to

estimate the recoverable amount of an individual asset, the group

estimates the recoverable amount of the cash-generating unit to

which the asset belongs.

Intangible assets not yet ready to use and not yet subject to

amortisation are reviewed for impairment whenever events or

circumstances indicate that the carrying value may not be

recoverable.

Recoverable amount is the higher of fair value less costs to

sell and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset for

which the estimates of future cash flows have not been

adjusted.

If the recoverable amount of an asset (or cash-generating unit)

is estimated to be less than its carrying amount, the carrying

amount of the asset (or cash-generating unit) is reduced to its

recoverable amount. An impairment loss is recognised immediately in

profit or loss, unless the relevant asset is carried at a revalued

amount, in which case the impairment loss is treated as a

revaluation decrease.

1.8 Cash and cash equivalents

Cash and cash equivalents include cash in hand and deposits held

at call with banks.

1.9 Financial assets

Financial assets are recognised in the group's and company's

statement of financial position when the group and company become

party to the contractual provisions of the instrument.

Financial assets are classified into specified categories at

initial recognition and subsequently measured at amortised cost,

fair value through other comprehensive income, or fair value

through profit or loss. The classification of financial assets at

initial recognition that are debt instruments depends on the

financial assets cash flow characteristics and the business model

for managing them.

Financial assets are initially measured at fair value plus

transaction costs. In order for a financial asset to be classified

and measured at amortised cost, it needs to give rise to cash flows

that are "solely payments of principal and interest SPPI" on the

principal amount outstanding.

Financial assets at amortised cost (debt instruments)

Financial assets at amortised cost are subsequently measured

using the effective interest rate method and are subject to

impairment. The group's and company's financial assets at amortised

cost comprise trade and other receivables and cash and cash

equivalents.

Interest is recognised by applying the effective interest rate,

except for short-term receivables when the recognition of interest

would be immaterial. The effective interest method is a method of

calculating the amortised cost of a debt instrument and of

allocating the interest income over the relevant period. The

effective interest rate is the rate that exactly discounts

estimated future cash receipts through the expected life of the

debt instrument to the net carrying amount on initial

recognition.

Impairment of financial assets

Financial assets are assessed for indicators of impairment at

each reporting end date.

Financial assets are impaired where there is objective evidence

that, as a result of one or more events that occurred after the

initial recognition of the financial asset, the estimated future

cash flows of the investment have been affected.

Derecognition of financial assets

Financial assets are derecognised only when the contractual

rights to the cash flows from the asset expire, or when it

transfers the financial asset and substantially all the risks and

rewards of ownership to another entity.

Financial liabilities

Other financial liabilities

Other financial liabilities, including borrowings, are initially

measured at fair value, net of transaction costs. They are

subsequently measured at amortised cost using the effective

interest method, with interest expense recognised on an effective

yield basis.

The effective interest method is a method of calculating the

amortised cost of a financial liability and of allocating interest

expense over the relevant period. The effective interest rate is

the rate that exactly discounts estimated future cash payments

through the expected life of the financial liability to the net

carrying amount on initial recognition.

Derecognition of financial liabilities

Financial liabilities are derecognised when the group's

contractual obligations expire or are discharged or cancelled.

1.10 Equity instruments

Equity instruments issued by the group are recorded at the

proceeds received, net of direct issue costs.

1.11 Employee benefits

The costs of short-term employee benefits are recognised as a

liability and an expense, unless those costs are required to be

recognised as part of the cost of non-current assets.

The cost of any unused holiday entitlement is recognised in the

period in which the employee's services are received.

Termination benefits are recognised immediately as an expense

when the group and company is demonstrably committed to terminate

the employment of an employee or to provide termination

benefits.

1.12 Retirement benefits

Payments to defined contribution retirement benefit schemes are

charged as an expense as they fall due.

1.13 Equity

Share capital

Ordinary shares are classified as equity.

Share premium

Share premium represents the excess of the issue price over the

par value on shares issued. Incremental costs directly attributable

to the issue of new ordinary shares or options are shown in equity

as a deduction, net of tax, from the proceeds.

Merger reserve

A merger reserve was created on purchase of the entire share

capital of Erris Resources (Exploration) Ltd which was completed by

way of a share for share exchange and which has been treated as a

group reconstruction and accounted for using the reverse merger

accounting method.

Share-based payment reserve

The share-based payment reserve is used to recognise the fair

value of equity-settled share-based payment transactions.

1.14 Share-based payments

Equity-settled share-based payments with employees and others

providing services are measured at the fair value of the equity

instruments at the grant date. Fair value is measured by use of an

appropriate pricing model. Equity-settled share-based payment

transactions with other parties are measured at the fair value of

the goods and services, except where the fair value cannot be

estimated reliably, in which case they are valued at the fair value

of the equity instrument granted.

The fair value determined at the grant date is expensed on a

straight-line basis over the vesting period, based on the estimate

of shares that will eventually vest. A corresponding adjustment is

made to equity.

When the terms and conditions of equity-settled share-based

payments at the time they were granted are subsequently modified,

the fair value of the share-based payment under the original terms

and conditions and under the modified terms and conditions are both

determined at the date of the modification. Any excess of the

modified fair value over the original fair value is recognised over

the remaining vesting period in addition to the grant date fair

value of the original share-based payment. The share-based payment

expense is not adjusted if the modified fair value is less than the

original fair value.

Cancellations or settlements (including those resulting from

employee redundancies) are treated as an acceleration of vesting

and the amount that would have been recognised over the remaining

vesting period is recognised immediately.

1.15 Foreign exchange

Foreign currency transactions are translated into the functional

currency using the rates of exchange prevailing at the dates of the

transactions. At each reporting end date, monetary assets and

liabilities that are denominated in foreign currencies are

retranslated at the rates prevailing on the reporting end date.

Gains and losses arising on translation are included in

administrative expenses in the income statement for the period.

The financial statements are presented in the functional

currency of Euros, since the majority of exploration expenditure is

denominated in this currency.

1.16 Exceptional items

Items are disclosed separately in the financial statements where

it is necessary to do so to provide further understanding of the

financial performance of the group. They are items that are

material, either because of their size or nature, or that are

non-recurring.

1.17 Joint Arrangements

Up to 24 June 2021, the Group's core activities in relation to

the Zinnwald Lithium project were conducted through joint

arrangements in which two or more parties have joint control. A

joint arrangement is classified as either a joint operation or a

joint venture, depending on the rights and obligations of the

parties to the arrangement.

Joint operations arise when the Group has a direct ownership

interest in jointly controlled assets and obligations for

liabilities. The Group does not currently hold this type of

arrangement.

Joint ventures arise when the Group has rights to the net assets

of the arrangement. For these arrangements, the Group uses equity

accounting and recognises initial and subsequent investments at

cost, adjusting for the Group's share of the joint venture's income

or loss, dividends received and other comprehensive income

thereafter. When the Group's share of losses in a joint venture

equals or exceeds its interest in a joint venture it does not

recognise further losses. The transactions between the Group and

the joint venture are assessed for recognition in accordance with

IFRS.

No gain on acquisition, comprising the excess of the Group's

share of the net fair value of the investee's identifiable assets

and liabilities over the cost of investment, has been recognised in

profit or loss. The net fair value of the identifiable assets and

liabilities have been adjusted to equal cost.

Joint ventures are tested for impairment whenever objective

evidence indicates that the carrying amount of the investment may

not be recoverable under the equity method of accounting. The

impairment amount is measured as the difference between the

carrying amount of the investment and the higher of its fair value

less costs of disposal and its value in use. Impairment losses are

reversed in subsequent periods if the amount of the loss decreases

and the decrease can be related objectively to an event occurring

after the impairment was recognised.

1.18 Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the Chief Executive Officer, who is

considered to be the group's chief operating decision-maker

('CODM').

1.19 New standards, amendments and interpretations not yet adopted

There were no new standards or amendments to standards adopted

by the group and company during the year which had a material

impact on the financial statements.

At the date of approval of these financial statements, the

following standards and amendments were in issue but not yet

effective, and have not been early adopted:

-- IFRS 3 amendments - Business Combinations (effective 1 January 2022)

-- IAS 16 amendments - Property, Plant and Equipment* (effective 1 January 2022)

-- IAS 37 amendments - Provisions, Contingent Liabilities and

Contingent Assets* (effective 1 January 2022),

-- IAS 1 amendments - Presentation of Financial Statements:

Classification of Liabilities as Current or Non-Current*

-- IAS 1 amendments - Presentation of Financial Statements:

Disclosure of Accounting Policies*, and

-- IAS 8 amendments - Changes in Accounting Estimates and

Errors: Definition of Accounting Estimates*

-- Annual Improvements to IFRS Standards 2018-2020 Cycle* (effective 1 January 2022).

*subject to UK endorsement

There are no other IFRSs or IFRIC interpretations that are not

yet effective that would be expected to have a material impact on

the group or company.

2 Judgements and key sources of estimation uncertainty

In the application of the accounting policies, the directors are

required to make judgements, estimates and assumptions about the

carrying amount of assets and liabilities that are not readily

apparent from other sources. The estimates and associated

assumptions are based on historical experience and other factors

that are considered to be relevant. Actual results may differ from

these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised where the revision

affects only that period, or in the period of the revision and

future periods where the revision affects both current and future

periods.

Critical judgements

The following judgements and estimates have had the most

significant effect on amounts recognised in the financial

statements.

Share-based payments

Estimating fair value for share based payment transactions

requires determination of the most appropriate valuation model,

which depends on the terms and conditions of the grant. This

estimate also requires determination of the most appropriate inputs

to the valuation model including the expected life of the share

option or appreciation right, volatility and dividend yield and

making assumptions about them. For the measurement of the fair

value of equity settled transactions with employees at the grant

date, the Group and Company use the Black Scholes model.

Joint venture investment

The Group applies IFRS 11 to all joint arrangements and

classifies them as either joint operations or joint ventures,

depending on the contractual rights and obligations of each

investor. The Group held 50% of the voting rights of its joint

arrangement with SolarWorld AG. The Group determined itself to have

joint control over this arrangement as under the contractual

agreements, unanimous consent is required from all parties to the

agreements for certain key strategic, operating, investing and

financing policies. The Group's joint arrangement was structured

through a limited liability entity, Deutsche Lithium GmbH, and

provided the Group and SolarWorld AG (parties to the joint venture

agreement) with rights to the net assets of Deutsche Lithium under

the arrangements. Therefore, this arrangement was classified as a

joint venture up to 24 June 2021 when the Company acquired the

remaining 50% of Deutsche Lithium and thereafter consolidated its

full results

The investment was assessed at each reporting period date for

impairment. An impairment is recognised if there is objective

evidence that events after the recognition of the investment have

had an impact on the estimated future cash flows which can be

reliably estimated. In addition, the assessment as to whether

economically recoverable reserves exist is itself an estimation

process. Under IFRS 3, on acquisition of the additional stake in

the joint venture, the Company remeasured the fair value of its

original investment in the joint venture and recognised a gain.

Impairment of Capitalised Exploration Costs

Excluding the newly acquired exploration assets of Deutsche

Lithium, other Group capitalised exploration costs had a carrying

value as at 31 December 2021 of EUR186,995 (2020: EUR1,546,111).

Ordinarily, Management tests annually whether capitalised

exploration costs have a carrying value in accordance with the

accounting policy stated in note 1.6. Due to the acquisition of the

remaining shareholding in Deutsche Lithium and the Company's now

sole focus on the Zinnwald Lithium project, the Directors elected

to undertake a full review of non-core assets as part of the

Interim accounts review. Each exploration project is subject to a

review either by a consultant or an appropriately experienced

Director to determine if the exploration results returned to date

warrant further exploration expenditure and have the potential to

result in an economic discovery. This review takes into

consideration long-term metal prices, anticipated resource volumes

and grades, permitting and infrastructure as well as the likelihood

of on-going funding from joint venture partners. In the event that

a project does not represent an economic exploration target and

results indicate that there is no additional upside, or that future

funding from joint venture partners is unlikely, a decision will be

made to discontinue exploration.

In Ireland, five licences were originally granted for six years

in 2013 and in Q3 2019, the Group extended these licences for a

further six years. The exploration work identified excellent

mineralisation in its drill holes and the metallurgical review has

shown a good quality concentrate can be produced. However, in 2021,

the Group elected to relinquish the four non-core licences but

undertook the required further exploration work to maintain the

core licence area (PL 3735) at Abbeytown and expects that this

spend meets the requirement to maintain this licence in good

standing through to Q3 2022. Whilst the current Zinc market is

relatively subdued and Zinnwald is no longer focussed on Ireland,

the Company still intends to find a JV Partner for PL 3735.

Accordingly, the Board has concluded that an impairment charge

should be made in the 2021 interim accounts in regard to

capitalised costs from the Irish licences, which has resulted in an

impairment of EUR1,581,677 (2020: EUR477,595).

In 2021 in Sweden, the Company has been unable to find a joint

venture partner to further develop its licences and has elected to

cease all operations, close its Filial branch and relinquish all

licences. In 2020, the Company fully impaired its Swedish assets

and the Board have recommended a further impairment charge of

EUR1,889 for expenditure made in 2021 (2020: EUR114,870).

3 Financial Risk and Capital Risk Management

The Group's and Company's activities expose it to a variety of

financial risks: market risk (primarily currency risks), credit

risk and liquidity risk. The overall risk management programme

focusses on currency and working capital management.

Foreign Exchange Risk

The Company operates internationally and is exposed to foreign

exchange risk arising from one main currency exposure, namely GBP

for its Head Office costs and the value of its shares for

fund-raising and Euros for a material part of its operating

expenditure. The Group's Treasury risk management policy is

currently to hold most of its cash reserves in GBPs and to match as

promptly as possible its Euro expenditures on its commitments in

Germany.

Credit and Interest Rate Risk

The Group and Company have no borrowings and a low level of

trade creditors and have minimal credit or interest rate risk

exposure.

Working Capital and Liquidity Risk

Cashflow and working capital forecasting is performed in the

operating entities of the Group and consolidated at a Group level

basis for monthly reporting to the Board. The Directors monitor

these reports and rolling forecasts to ensure the Group has

sufficient cash to meet its operational needs. The Board has a

policy of maintaining at least a GBP 0.5m cash reserve headroom.

Aside from its commitments under the Deutsche Lithium Joint

Venture, the Group has no other material fixed cost overheads other

than Director costs

4 Segmental reporting

The Group operates principally in the UK and Germany with a

largely dormant subsidiary in Ireland. Activities in the UK include

the Head Office corporate and administrative costs whilst the

activities in Germany relate to the work done by Deutsche Lithium

on the Group's primary asset of the Zinnwald Lithium Project. The

reports used by the Board and Management are based on these

geographical segments. As noted earlier, the results of Germany

were reported as an Investment in Joint Venture for the period to

24 June 2021, and from thereon are reported on a fully consolidated

basis.

Non-Core

Assets Germany UK Total

2021 2021 2021 2021

EUR EUR EUR EUR

Cost of sales and administrative

expenses (6,270) (151,979) (1,206,383) (1,364,632)

Share based payments charge - - (7,779) (7,779)

Project Impairment (1,583,566) - (1,583,566)

Gain/loss on foreign exchange (1) 242,099 242,098

Other operating income - 779 1,038,707 1,039,486

Share of loss from joint

venture - (52,911) - (52,911)

Profit/(loss) from operations

per reportable segment (1,589,837) (204,111) 66,644 (1,727,304)

Reportable segment assets 15,144 16,242,874 8,369,525 24,627,543

Reportable segment liabilities - 1,664,143 357,386 2,021,529

Non-Core

Assets Germany UK Total

2020 2020 2020 2020

EUR EUR EUR EUR

Cost of sales and administrative

expenses (64,358) - (1,451,017) (1,515,375)

Share based payments charge - - (3,725) (3,725)

Project Impairment (592,465) - - (592,465)

Gain/loss on foreign exchange (3,503) - (67,958) (71,461)

Other operating income - - 367 367

Share of loss from joint

venture - (32,579) - (32,579)

Profit/(loss) from operations

per reportable segment (660,326) (32,579) (1,522,333) (2,215,238)

Reportable segment assets 1,565,029 - 8,854,280 10,419,309

Reportable segment liabilities - - 58,833 58,833

Non-Core Assets includes Ireland, Scandinavia, Finland and

Scotland. Ireland is the only one with material balances within

this category and makes up a majority of the balances.

5 Operating loss

Group

2021 2020

EUR EUR

Operating loss for the year

is stated after charging/(crediting):

Exchange (gains)/losses (242,098) 71,461

Depreciation of owned property,

plant and equipment 7,077 244

Profit on disposal of property,

plant and equipment - (5,300)

Amortisation of intangible

assets 829 -

Ireland and Sweden exploration

projects impairment 1,583,566 592,465

RTO costs - 839,940

Share-based payments 7,779 3,725

Operating lease charges 39,098 40,942

Exploration costs expensed 143,735 64,358

6 Auditor's remuneration

2021 2020

Fees payable to the company's

auditor and associates: EUR EUR

For audit services

Audit of group, parent company

and subsidiary undertakings 41,952 31,164

For other services

Taxation compliance services 3,500 3,799

Reporting accountant work for

the Admission Document - 61,205

3,500 65,004

7 Other gains and losses

2021 2020

EUR EUR

Gain on re-measurement of initial

50% interest in Deutsche Lithium 1,038,252 -

8 Employees

The average monthly number

of persons (including directors)

employed by the group and company

during the year was:

Group

2021 2020

Number Number

Directors 5 5

Employees 6 3

11 8

Their aggregate remuneration

comprised:

Group

2021 2020

EUR EUR

Wages and salaries 870,447 416,827

Social security costs 111,925 40,941

Pension costs 38,005 12,399

1,114,135 470,167

Aggregate remuneration expenses of the group include EUR225,499

(2020: EUR150,583) of costs capitalised and included within non-current

assets of the group.

Aggregate remuneration expenses of the company include EURnil

(2020: EUR3,397) of costs capitalised and included within non-current

assets of the group.

Directors' remuneration is disclosed

in note 33.

9 Finance income

Group

2021 2020

EUR EUR

Interest income

Interest on bank deposits 455 367

10 Share of results in Joint Venture

Group

2021 2020

EUR EUR

Share of Loss in Joint Venture (52,911) (32,579)

(52,911) (32,579)

11 Impairments

Impairment tests have been carried out where appropriate

and the following impairment losses have been recognised

in profit or loss:

2021 2020

Notes EUR EUR

In respect of:

Intangible assets 14 1,583,566 592,465

Recognised in:

Administrative expenses 1,583,566 592,465

The impairment losses in respect of financial

assets are recognised in other gains and losses

in the income statement.

12 Taxation

The actual charge for the year can be reconciled to

the expected credit for the year based on the profit

or loss and the standard rate of tax as follows:

Group

2021 2020

EUR EUR

Loss before taxation (1,727,304) (2,215,238)

Expected tax credit based

on the standard rate

of corporation tax in

the UK of 19.00% (2020:

19.00%) (328,188) (420,895)

Disallowable expenses 11,531 166,486

Non-taxable gains (197,268)

Unutilised tax losses

carried forward 513,925 254,409

Taxation charge for the

year - -

Losses available to carry forward amount to EUR3,730,000

(2020: EUR2,316,000). No deferred tax asset has been

recognised on these losses, as the probability of available

future taxable profits is not currently quantifiable.

13 Earnings per share 2021 2020

Number Number

Weighted average number

of ordinary shares for

basic earnings per share 232,669,857 63,203,583

Effect of dilutive potential

ordinary shares:

Weighted average number

of outstanding share

options 2,265,890 3,183,333

Weighted average number

of ordinary shares for

diluted earnings per

share 234,935,747 66,386,916

Earnings EUR EUR

Continuing operations

Loss for the period from

continuing operations (1,727,304) (2,215,238)

Earnings for basic and

diluted earnings per

share attributable to

equity shareholders of

the company (1,727,304) (2,215,238)

Earnings per share for

continuing operations

Basic and diluted earnings

per share - -

Basic earnings per share (1) (4)

Diluted earnings per

share (1) (4)

There is no difference between the basic and diluted earnings

per share for the period ended 31 December 2021 or 2020 as the

effect of the exercise of options would be anti-dilutive.

14 Intangible fixed assets

Germany Ireland Sweden

Exploration Exploration Exploration

and Evaluation and Evaluation and Evaluation

Goodwill costs costs costs Total

EUR EUR EUR EUR EUR

Cost

At 1 January 2020 1,895,332 107,002 2,002,334

Additions - group

funded 128,374 7,868 136,242

At 31 December 2020 - - 2,023,706 114,870 2,138,576

Revaluation - on acquisition

of subsidiary 1,038,252 - - - 1,038,252

Additions - on acquisition

of subsidiary 4,493,222 8,303,416 - - 12,796,638

Reallocated to Germany

E&E (5,531,474) 5,531,474 - - -

Deferred tax provision

on fair value - 1,382,868 - - 1,382,868

Additions - group

funded - 948,156 35,566 1,889 985,611

At 31 December 2021 - 16,165,914 2,059,272 116,759 18,341,945

Amortisation and impairment

At 1 January 2021 - - 477,595 114,870 592,465

Amortisation charged

for the year - 829 - - 829

Project impairment - - 1,581,677 1,889 1,583,566

At 31 December 2021 - 829 2,059,272 116,759 2,176,860

Carrying amount

At 31 December 2021 - 16,165,085 - - 16,165,085

At 31 December 2020 - - 1,546,111 - 1,546,111

Intangible assets comprise capitalised exploration and evaluation

costs (direct costs, licence fees and fixed salary / consultant

costs) of the Zinnwald Lithium project in Germany, as well

as the now fully impaired Ireland Zinc and Sweden Gold Projects.

Property, plant and

15 equipment

Leasehold Fixtures, Motor Total

land and fittings vehicles

buildings and equipment

EUR EUR EUR EUR

Cost

At 1 January 2021 - 14,769 - 14,769

Additions - on acquisition

of subsidiary 9,817 1,175 32,427 43,419

Additions - group - 8,437 - 8,437

Exchange adjustments - 261 - 261

At 31 December 2021 9,817 24,381 32,427 66,886

Depreciation and impairment

At 1 January 2021 - 11,107 - 11,107

Depreciation - 1,956 5,122 7,078

Exchange adjustments - 80 - 80

At 31 December 2021 - 13,063 5,122 18,265