TIDMZYT

RNS Number : 7542U

Zytronic PLC

07 December 2021

7 December 2021

Zytronic plc

("Zytronic" or the "Company"

and, together with its subsidiaries, the "Group")

Final Results for the year ended 30 September 2021 (audited)

Zytronic plc, a leading specialist manufacturer of touch sensors

, announces its audited full year results for the period ended 30

September 2021.

Overview

-- Recovery in H2 revenue of 44% with growth from Gaming 99%,

Vending 63% and Financial 29%

-- Gross margin improved to 30.3% (2020: 20.1%) due to

production efficiencies from restructuring in 2020

-- EBITDA of GBP1.4m (2020: GBP0.7m) and a return to

profitability with profit before tax of GBP0.5m (2020: loss of

GBP0.4m)

-- Earnings per share of 3.0p (2020: loss per share of 1.8p)

-- Dividend proposed of 1.5p (2020: Nil)

-- Successful Share Tender offer, returning GBP6.7m cash and

cancellation of 4.6m shares

-- Closing net cash of GBP9.2m (2020: GBP14.0m)

Commenting on the outlook, Chairman, Tudor Davies said:

" The first two months of the year have seen an improvement in

order intake, and with the improved margins and levels of demand

across most sectors, this provides the basis for good progress in

the coming year."

Enquiries:

Zytronic plc

Mark Cambridge, Chief Executive

Claire Smith, Group Finance Director (0191 414 5511)

Singer Capital Markets (Nominated Adviser

& Broker) (020 7496 3000)

Aubrey Powell, Amanda Gray (Corporate

Finance)

Rachel Hayes (Corporate Broking)

Notes to Editors

Zytronic is a developer and manufacturer of a unique range of

internationally award winning optically transparent interactive

touch sensor overlay products for use with electronic displays in

industrial, self-service and public access equipment.

Zytronic's products employ a sensing solution that is readily

configurable and is embedded in a laminate core which offers

significant durability, environmental stability and optical

enhancement benefits to system designers' specific

requirements.

Zytronic has continually developed process and technological

know-how and IP since the late 1990's around two sensing

methodologies; the first being single-touch self-capacitive which

Zytronic markets as PCT(TM) ("Projected Capacitive Technology") and

the second being multi-touch, multi-user mutual-capacitive which

Zytronic markets as MPCT(TM) ("Mutual Projected Capacitive

Technology"), in which Zytronic holds a number of GB and

international granted patents.

Operating from a single site near Newcastle-upon-Tyne in the

United Kingdom, Zytronic is relatively unique in the touch

eco-system as it offers a complete one-stop solution from

processing internally the form and factor of the glass substrates,

assembles their touch overlay products to customers specific

requirements, in environmentally controlled cleanrooms and develops

the bespoke firmware, software and electronic hardware to link the

interactive overlays to customer's integrated systems and

products.

Further information on the Group can be found on the Company's

corporate website www.zytronicplc.com , and additional information

on the Company's technology and products is available at

www.zytronic.co.uk

2021 Chairman's review

Introduction

I am pleased to report that the year to 30 September 2021 has

seen a significant increase in gross margins from last year's

restructuring and a return to profitability, driven by a much

improved second half with sales increasing by 44% to GBP6.9m from

GBP4.8m in the first half.

Results

The results for the year produced a Group EBITDA of GBP1.4m

(2020: GBP0.7m) and Group operating profit of GBP0.5m (2020: loss

of GBP0.5m) on reduced revenue of GBP11.7m (2020: GBP12.7m) with an

increase in earnings per share to 3.0p (2020: loss of 1.8p) with

16% of this year's earnings per share arising from the reduction in

share capital following the tender offer and buyback completed in

February 2021.

Whilst sales for the year were lower than last year the recovery

in second half trading with a 44% increase in sales versus first

half was particularly encouraging with the larger markets

increasing the most: Gaming by 99%, Vending by 63%, Financial by

29%.

The improvement in operating profit this year principally arose

from the considerable increase in gross margins from 20.1% to

30.3%, following the extensive reorganisations initiated in July

and September 2020 in response to the second half downturn

following the effects of the Coronavirus pandemic.

Current trading

The first two months have seen the positive recovery in our

markets continue. Revenue and profits are ahead of the comparable

period last year. The order intake for October and November is a

very encouraging 77% ahead and, although this does include some

large orders for the Gaming market for delivery over several

months, provides a sound basis for revenue for the coming months.

However, there are still challenges from the well-publicised

shortages and supply chain issues, particularly of electronic

components.

Cash

The cash position is still strong at GBP9.2m (2020: GBP14.0m) as

even after distributing GBP6.7m by way of a share buyback, cash of

GBP2.0m (2020: GBP3.4m) was generated from operations and control

of working capital.

Dividend/return to shareholders

In February 2021 the Board decided it was in shareholders'

interests to use our surplus cash balances to fund a tender offer

and share buyback at 145p per Ordinary Share which resulted in 4.6

million shares, 28.8% of the then issued share capital, being

purchased at a cost of GBP6.7m.

In the light of a return to profitability and the recent

improvement to current trading the Board has decided to recommend a

final dividend of 1.5p per share.

Board changes

As announced on 17 November 2021, having remained on the Board

past the nine-year corporate governance guidelines whilst the

business navigated the significant challenges posed by the COVID-19

pandemic, I shall step down at the AGM when David Buffham,

currently a Non-executive Director will take over as Chair. We are

in the process of recruiting an additional independent

Non-executive Director to take over David's current

responsibilities.

Outlook

The first two months of the year have seen an improvement in

order intake, and with the improved margins and levels of demand

across most sectors, this provides the basis for good progress in

the coming year.

Tudor Davies

Chairman

6 December 2021

2021 Chief Executive review

I would like to begin this review by thanking all of the

employees of Zytronic Displays Limited ("ZDL"), the operating

subsidiary of the Group, for their understanding of the various

decisions made during the course of the year, in what has been one

of the most difficult trading years for Zytronic. In particular,

for everyone's efforts in turning an expectation at the start of

the fiscal year of a potential trading loss before tax of GBP0.9m,

into the actual reported position of a profit before tax of

GBP0.5m.

There is little doubt that the turmoil caused by the ongoing

global effects of the COVID-19 pandemic from its start in FY20

continued into and throughout FY21. Therefore, drawing comparisons

between the performance metrics of FY21 with that of FY20 is of

limited value. A more thoughtful comparison can be drawn from the

half year periods starting H2 FY20.

The mapping of how COVID-19 impacted the business and how it

continued to impact is more readily observable by looking at how

order intake patterns significantly altered from April 2020 onwards

and the resultant measures taken within the business, to mitigate

and control the dynamically changing environment.

As with most global manufacturing businesses, April 2020 became

an almost overnight watershed moment, having experienced supply

chain turmoil manifesting out of Asia and the near closing down of

global economies, which for ZDL displayed initially as order delay

requests, then order cancellations and subsequently fewer new order

placements. The outcome of the above was an order intake value for

H2 FY20 of GBP3.7m being 59% lower than H1 FY20.

As previously reported, this prompted management to look at

combinations of the government's Job Retention Scheme through to

the end of September 2020, single day shift working as opposed to

our normal four-shift pattern and four-day working weeks to balance

the declining workload, restructuring and as a last measure

redundancy, at various appropriate stages over that period.

As the business moved into the start of FY21, the restructuring

process concluded, but the single shift four-day working week

continued through to the end of Q1. The reasons for this can be

observed by analysing the order intake over H1, which although at

GBP6.4m represented a substantial 72% increase compared to that of

H2 FY20, was skewed somewhat when looking at the individual

quarters. Therefore, when comparing the respective order intake

value ratio of Q3 FY20 against that of Q4 FY20, Q1 FY21 and Q2

FY21, the ratio of 0.9:1.0:2.3 is more revealing. What occurred

over Q2 FY21, was an initial reinstatement of the order delays and

cancellations that arose at the start of the COVID-19 pandemic,

particularly from our Gaming market customers. In addition, some

customers placed longer lead time orders as the news of electronic

component shortages emerged. This is further supported by the

observed 11% decrease of the H2 FY21 order intake at GBP5.7m

compared to H1.

Although variations in order intake occurred over the year, the

manpower controls put in place very much allowed for more of an

operational balance in the month-to-month output levels from the

end of February 2021 onwards. Unfortunately, production was

negatively impacted as the year progressed by the significant

down-shift in electronic component supplies, which resulted in

significant and well documented major global supply issues and

inevitable delays. Due to ZDL's operational size, this left ZDL

exposed to major market fluctuations and where necessary to ensure

the continuation of some supply volume, our supply chain utilised

grey market purchasing for hand-to-mouth component volumes, causing

an almost inevitable drag on the achievable production output.

Total FY21 sales revenue of GBP11.7m was GBP1.0m lower than that

of FY20, but although order intake varied considerably, the

business was able to utilise the higher order intake of H1 FY20, to

buffer the output through H2 FY20 and whilst the lower order intake

of H2 FY20 had an effect on the output of H1 FY21, the combined

higher order intake of Q2 and H2 FY21 enabled the significant 44%

growth in H2 FY21 revenue compared to H1.

Of our four major contributory markets being Gaming, Financial,

Vending and Industrial, it was only Vending which showed

year-on-year growth in sales against FY20, with the revenue decline

in Financial providing the biggest negative impact. However, when

reviewing the FY21 data and comparing H2 against H1, pleasingly,

all of the major contributory markets showed a material

improvement.

Market 2021 2020 % Var H1 FY21 H2 FY21 % Var

(A) (A)

---------- ---------- -------- --------

Other GBP1.0m GBP0.9m 18 GBP0.5m GBP0.4m (25)

Signage GBP0.7m GBP1.1m (38) GBP0.3m GBP0.4m 27

Industrial GBP1.6m GBP1.6m (0) GBP0.7m GBP0.9m 31

Vending GBP2.6m GBP2.2m 18 GBP1.0m GBP1.6m 63

Gaming GBP2.9m GBP3.1m (7) GBP1.0m GBP1.9m 99

Financial GBP2.9m GBP3.8m (24) GBP1.3m GBP1.6m 29

---------- ---------- ------ -------- -------- ------

Total GBP11.7m GBP12.7m (8) GBP4.8m GBP6.9m 44

---------- ---------- ------ -------- -------- ------

Note: all GBP values in the above table are rounded to

nearest GBP0.1m whilst % variance is based on actual

values.

As we consider that the Financial market was probably only

slightly impacted by COVID-19 and the true market effect we

continue to experience is related to the now well established major

move towards a cashless society (digital and mobile banking) and

with ZDL not being awarded with the new platform design wins for

both of the major ATM global customers several years ago, which

have since been launched, a sustained year-on-year decline is more

likely and not reverse despite the H2 recovery.

Gaming, although still behind that of FY20, experienced a

much-improved performance from February/March onwards, which is

reflected in the H2/H1 FY21 comparator data. This market benefited

from a resumption of unit builds for our Japanese, USA and

Australian based end customers for the Las Vegas markets, which is

predominantly where ZDL product finally resides. Pleasingly around

that time, the development teams of our end customers also began to

look at re-starting previously delayed programmes.

Vending, as previously indicated, was our only market to show

annual growth against FY20, but again, the growth in FY21 was much

more skewed to H2. The majority of this is a result of our European

customers resuming demand, particularly through our channel

partners in Italy and France for traditional style vending. We also

saw a resumption of demand for a drinks fountain unit project in

the USA.

As can be seen from the data, Industrial was little affected in

comparison, whilst Signage in percentage terms showed the greatest

decrease, mostly being attributable to a decline in the supply of

large format size units for previously well performing smart city

street furniture kiosk programmes through our Asian channels for

deployment in the USA.

In total across all markets, we shipped 76.5k touch sensor units

in FY21, compared to 78k units in FY20. The mix being more skewed

to smaller sized <14.9" diagonal units (FY21 39%: FY20 24%) than

the large size. A similar volume of the premium MPCT(TM) units were

supplied at circa 13k units. Although Gaming resumed stronger

growth in H2, the volume of curved units for Gaming customers was

53% lower in FY21 compared to FY20, at 3.4k units (FY20:7.2k

units).

Although the necessary restructuring in ZDL impacted every

department including R&D and sales and marketing, it did not

over the course of the year diminish the work undertaken by both to

continue the innovation within the product offerings and the

marketing efforts to increase news flow etc. under very different

circumstances.

Over the course of the year, a significant amount of time has

been spent by the R&D team in identifying, approving and in

some instances redesigning, to accommodate the various electronic

component shortages that manifested; a number of key development

projects were concluded, including finalising the release of the

now multi-industry award-winning ZYBRID(R)hover (non-touch)

technology and productionising the developed ZYBRID(R)edge

controllers for multi-stacked sensor video wall designs, for formal

release at the ISE expo in Spain during Q2 FY22.

In combination with the above, a significant amount of effort

has also been undertaken to bring the developed ElectroglaZ(TM)

concept to market, and although we have demonstrated facets of the

technology at some of the FY21 digital signage and touch trade

shows undertaken, it is intended to be more appropriately

demonstrated at its own market-specific Light + Building expo in

Germany during Q2 FY22.

COVID-19 has had a profound effect on the sales and marketing

function over the fiscal period, beyond the restructuring

programmes undertaken. As has previously been well documented, our

major marketing efforts are normally centred around undertaking

numerous end-market and region-specific trade shows and expositions

yearly. Such events provide substantial networking and showcasing

potential and bolster the consultative technical prospecting nature

of the sales and business development process, generally in

combination with our substantial channel partner network.

Unfortunately, the numerous travel bans and restrictions, have

impacted the sales process, as work from home policies followed by

a lot of our customers made and continue to make physical meetings

impossible. Similarly, physical trade shows and the like, were also

affected during H2 FY20 and H1 FY21, with numerous service

providers experimenting pretty unsuccessfully with virtual

attendance and participation. It was only towards the latter part

of FY21 that physical trade shows reappeared, but unfortunately

either the UK or destination country travel restrictions prevented

any UK personnel attendance. ZDL did undertake two physical trade

shows in that period, Digital Signage Japan and Touch Taiwan, both

being solely serviced by our locally based employees.

Over the period, the marketing efforts became much more social

media and digital content focused. Consequently, time has been

spent in digital content creation, using our own in-house studio

and an increase in the number of successful applications made for

several electronic media-based industry awards. Details of all

relevant news including customer testimonials, thought pieces,

technology updates and event attendance, can be referenced at:

https://www.zytronic.co.uk/news/.

Due to the hiatus in travel and the subsequent restrictions

imposed since April 2020 the effect on our sales prospecting and

normal marketing activities, as detailed above, has meant that the

volume and value of our dynamic CRM opportunities log has been

affected, as new opportunity entries were at a lower rate than the

conversion of existing opportunities to production.

As of 30 September 2021, there were 391 opportunities in our CRM

log, with a potential forecasted lifetime value of GBP28.0m, 17

being classified as "Project" which is the status of an opportunity

when a high probability of moving to production at a future point

is flagged, which at that point in time are projected to generate

GBP1.5m of revenue over their future production cycle. Over the

course of FY21, we had 135 total "Project"' status opportunities

move to production with a projected revenue generation potential of

GBP2.6m over their production cycle. These being additive to

existing business as they move through their production

lifecycle.

The CRM opportunities log is a very dynamic system, which

changes daily, based on new entries and status updates. Two months

on from the year-end, on 30 November 2021, it is encouraging to see

that the log has positively increased to 420 opportunities with a

potential forecasted lifetime value of GBP31.4m, 23 at "Project"

status, projected to generate GBP3.5m of future revenue over their

production cycle.

Mark Cambridge

Chief Executive Officer

6 December 2021

2021 Financial review

Financial review

The global effects of the COVID-19 pandemic have continued to

impact the financial performance of the Group over the year with

revenue decreasing from that of financial year 2020 of GBP12.7m to

a reported GBP11.7m. However, what is pleasing is that the Group

returned a reported profit before tax of GBP0.5m (2020: loss of

GBP0.4m) as a result of its previously announced restructuring

programme and internal efforts to control costs. Reported EBITDA

grew by GBP0.7m to GBP1.4m (2020: GBP0.7m) which generated an

increase in cash, excluding the payment of GBP6.7m for the share

tender and GBP0.6m for the restructuring, of GBP2.4m to close at

GBP9.2m (2020: GBP14.0m).

Group revenue

Group revenue decreased by 8% for the year to GBP11.7m (2020:

GBP12.7m) as the impact of the pandemic continued alongside the

well highlighted shortage of electronic component supplies

impacting not only the Group, but also the customer base it serves.

The Chief Executive Officer's review talks in more detail around

revenue.

Gross margin

Reported gross margin for the year ended 30 September 2021

improved to 30.3% ( 2020: 20.1%) as a result of the following:

-- The prior year's restructuring enabled savings in gross

margin over the year and with the reduction in trading over the Q1

period, the Group operated on single day-shift working and four-day

working weeks, which also improved margin;

-- The introduction of the four-day working week also saw

savings of GBP0.1m in general factory expenditure; and

-- Efficiencies were achieved throughout production and with

lower year-on-year scrap rates this contributed to an improved

margin

Group trading result

Group trading in the year increased to an operating profit of

GBP0.5m (2020: loss of GBP1.0m), mainly as a result of the

restructuring and cost control measures. Distribution costs were in

line with last year at GBP0.2m as sales where the Group is

responsible for carriage were similarly consistent. Administration

costs reduced by GBP0.4m to GBP2.9m (2020: GBP3.3m) as the Group

saw savings in its salary, marketing and travel expenditure.

Marketing and travel costs over the year continued to be reflective

of the pandemic as it was not permitted to attend many of the usual

exhibitions and travel restrictions were still imposed in a number

of key market territories. As the world continues to open up, the

Group would expect costs over these areas to increase over the

coming year. The Group is also mindful of the rising costs of

living which may also impact across the salary costs (and margins)

in the year ahead.

Exceptional other income

In the previous year the Group benefited from government support

of GBP0.5m for employees who were furloughed under the CJRS and for

our US personnel under the Paycheck Protection Programme ("PPP").

This was not utilised in the current year and so consequently the

Group reports no other income received.

Tax

The Group utilises the reliefs available to it, which positively

impacts the reported tax charge, which for the year is less than

GBP0.1m (2020: credit of GBP0.1m). The prior year tax loss, at the

time of the last annual report, was being proposed to be carried

back to recover cash already paid. However, following the

announcement to raise the corporation tax rate to 25% in 2023, the

Group made the decision to instead carry forward the loss to obtain

future relief at a higher rate of tax. Given the healthy cash

position, the Board believe this is appropriate.

Earnings/loss per share

The opening issued shares of 16,044,041 were reduced by

4,624,889 shares following the Tender Offer capital reduction

exercise undertaken in H1, leaving 11,419,152 ordinary shares of 1p

remaining. With the profit after tax of GBP0.4m this has resulted

in an EPS of 3.0p (2020: LPS of 1.8p) which is calculated on the

weighted average shares of 13,346,189 for the year.

Dividend

The Board announced at the time of its last annual report that

it would not be considering the resumption of the payment of

dividends until there is a return towards normality and at the time

of the interim report for FY21 it declared a zero dividend payment.

Following the results for the year the Board has proposed a final

dividend of 1.5p per share for the year ended 30 September 2021,

being the total dividend for the year (2020: Nil). Subject to

approval by shareholders, the dividend will be paid on Friday 18

March 2022 to shareholders on the register as at the close of

business on Friday 4 March 2022, with an ex-dividend date of

Thursday 3 March 2022. The Board believes that this is an

appropriate level of payment given the performance for the

year.

Capital expenditure

The Group continued to spend on capital investments over the

year totalling GBP0.3m (2020: GBP0.4m) across both tangible and

intangible expenditure. GBP0.1m (2020: GBP0.2m) of this was

incurred to further develop ElectroglaZ(TM) and its ZYBRID(R)hover

product offerings to enable market launches during the year, and

also commence new patent applications. GBP0.2m (2020: GBP0.2m) was

spent on tangible acquisitions with an approval being granted for a

second laser bonding machine, of which GBP0.1m of the total cost of

GBP0.4m was incurred in 2021. The remaining GBP0.1m spend occurred

across a number of replacement pieces of kit. Depreciation and

amortisation reduced over the year to GBP1.0m (2020: GBP1.2m).

Cash position

Despite the impact of the COVID-19 pandemic, the Group was in a

comfortable cash position and conti nued to strategically assess

its operations to improve future returns for shareholders. In early

February 2021 the Company announced a proposed return of up to

GBP10.0m of capital by way of a Tender Offer. This Tender Offer

concluded later in the month of February and resulted in a

reduction of 28.8% in the number of shares to 11,419,152 (2020:

16,044,041 shares) and returned GBP6.7m of cash to

shareholders.

The Group also announced in the prior year a significant

restructuring programme which completed in late October and early

November of this financial year, the costs of which at GBP0.6m were

provided for in the 2020 results but the cash was paid out during

this financial year.

The cash position opened at GBP14.0m and closed at GBP9.2m,

which adjusting for the one-off items above of GBP7.3m, generated

an increase to cash of GBP2.4m. Net cash from operating activities

was GBP2.1m, GBP0.6m of which arose from the unwinding of the

working capital (2020: GBP3.2m) and GBP1.0m from depreciation and

amortisation. Stocks decreased by GBP0.9m over the year as the

Group utilised its supply of raw materials and reduced its value of

goods manufactured for invoicing post year end. Creditors also

increased by GBP0.1m as the orders placed with suppliers increased

in the later months of the year, with the previous year's stock

being sufficient to fulfil the earlier demand. Debtors, however,

saw an increase as the sales made in H2 were considerably higher,

and with a mix of credit terms being offered, this elevated the

year-end debtor position. No bad debts materialised over the period

and the excellent work in cash collection continues.

Cashflow used in investing activities was GBP0.3m (2020:

GBP0.3m), wholly due to the costs of investment in capital

expenditure, and cashflow used in financing activities was GBP6.7m

(2020: GBP2.0m) due to the payment for the return of cash in the

Tender Offer.

The Group maintains its overdraft facility, which is available

for use in any of its three currencies. The Group also has an FX

policy in place whereby it is hedged in both US Dollars and Euros

for a period of four months ahead to correspond with its working

capital policies and currency requirements.

The Group remains debt free at the year end and despite the

continuing uncertainty the Group remains in a strong financial

position for the year ahead.

Claire Smith

Group Finance Director

6 December 2021

Consolidated statement of comprehensive income

For the year ended 30 September 2021

2021 2020

Notes GBP'000 GBP'000

---------------------------------------------- ------ ------------- -------------

Group revenue 3 11,683 12,680

Cost of sales (8,146) (10,130)

---------------------------------------------- ------ ------------- -------------

Cost of sales excluding exceptional

items (8,146) (9,015)

Exceptional items 4(a) - (1,115)

---------------------------------------------- ------ ------------- -------------

Gross profit 3,537 2,550

Distribution costs (183) (196)

Administration expenses (2,901) (3,318)

---------------------------------------------- ------ ------------- -------------

Administration expense excluding exceptional

items (2,901) (3,060)

Exceptional items 4(b) - (258)

---------------------------------------------- ------ ------------- -------------

Group trading profit/(loss) 453 (964)

Exceptional other income 5 - 500

---------------------------------------------- ------ ------------- -------------

Group operating profit/(loss) 453 (464)

Finance revenue - 41

---------------------------------------------- ------ ------------- -------------

Profit/(loss) before tax 453 (423)

Tax (expense)/credit 6 (47) 129

---------------------------------------------- ------ ------------- -------------

Profit/(loss) for the year 406 (294)

Other comprehensive income - -

---------------------------------------------- ------ ------------- -------------

Total comprehensive income/(loss) 406 (294)

---------------------------------------------- ------ ------------- -------------

Earnings/(loss) per share

Basic 8 3.0p (1.8p)

---------------------------------------------- ------ ------------- -------------

All activities are from continuing operations.

Consolidated statement of changes in equity

For the year ended 30 September 2021

Equity Capital

share Share redemption Retained

capital premium reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- -------- -------- ----------- --------- --------

At 1 October 2019 160 8,994 - 16,644 25,798

Loss for the year - - - (294) (294)

Dividends - - - (2,439) (2,439)

-------- -------- ----------- --------- --------

At 30 September 2020 160 8,994 - 13,911 23,065

Profit for the year - - - 406 406

Repurchase and cancellation

of shares (46) - 46 (6,706) (6,706)

----------------------------- -------- -------- ----------- --------- --------

At 30 September 2021 114 8,994 46 7,611 16,765

----------------------------- -------- -------- ----------- --------- --------

Consolidated statement of financial position

At 30 September 2021

2021 2020

Notes GBP'000 GBP'000

---------------------------------- ------- -------- --------

Assets

Non-current assets

Intangible assets 733 1,043

Property, plant and equipment 5,370 5,820

6,103 6,863

------------------------------------------ -------- --------

Current assets

Inventories 1,435 2,332

Trade and other receivables 2,200 1,888

Cash and short term deposits 9,157 14,038

------------------------------------------- -------- --------

12,792 18,258

------------------------------------------ -------- --------

Total assets 18,895 25,121

------------------------------------------- -------- --------

Equity and liabilities

Current liabilities

Trade and other payables 1,080 591

Derivative financial liabilities 16 -

Provisions - 582

Accruals 551 376

Government grants 26 27

Tax liabilities 121 -

1,794 1,576

------------------------------------------ -------- --------

Non-current liabilities

Deferred tax liabilities (net) 336 480

336 480

------------------------------------------ -------- --------

Total liabilities 2,130 2,056

------------------------------------------- -------- --------

Net assets 16,765 23,065

------------------------------------------- -------- --------

Capital and reserves

Equity share capital 114 160

Share premium 8,994 8,994

Capital redemption reserve 46 -

Retained earnings 7,611 13,911

------------------------------------------- -------- --------

Total equity 16,765 23,065

------------------------------------------- -------- --------

Consolidated cashflow statement

For the year ended 30 September 2021

2021 2020

GBP'000 GBP'000

---------------------------------------------------- -------- --------

Operating activities

Profit/(loss) before tax 453 (423)

Finance income - (41)

Depreciation and impairment of property,

plant and equipment 629 718

Amortisation, impairment and write-off of

intangible assets 379 457

Amortisation of government grant (1) (442)

Fair value movement on foreign exchange

forward contracts 16 (21)

Loss on disposal of asset 23 -

Working capital adjustments

Decrease in inventories 897 702

(Increase)/decrease in trade and other receivables (433) 2,360

Increase in trade and other payables and

provisions 85 88

---------------------------------------------------- -------- --------

Cash generated from operations 2,048 3,398

Tax received/(paid) 48 (220)

---------------------------------------------------- -------- --------

Net cashflow from operating activities 2,096 3,178

---------------------------------------------------- -------- --------

Investing activities

Interest received - 41

Payments to acquire property, plant and

equipment (179) (153)

Payments to acquire intangible assets (92) (201)

---------------------------------------------------- -------- --------

Net cashflow used in investing activities (271) (313)

---------------------------------------------------- -------- --------

Financing activities

Dividends paid to equity shareholders of

the Parent - (2439)

Receipt of government grants - 469

Repurchase and cancellation of shares (6,706) -

Net cashflow used in financing activities (6,706) (1,970)

---------------------------------------------------- -------- --------

(Decrease)/increase in cash and cash equivalents (4,881) 895

---------------------------------------------------- -------- --------

Cash and cash equivalents at the beginning

of the year 14,038 13,143

---------------------------------------------------- -------- --------

Cash and cash equivalents at the year end 9,157 14,038

---------------------------------------------------- -------- --------

Notes to the consolidated financial statements

1. Basis of preparation

The preliminary results for the year ended 30 September 2021

have been prepared in accordance with the recognition and

measurement requirements of International Financial Reporting

Standards ("IFRS") as endorsed by the European Union regulations as

they apply to the financial statements of the Group for the year

ended 30 September 2021. Whilst the financial information included

in this preliminary announcement has been computed in accordance

with the recognition and measurement requirements of IFRS, this

announcement does not itself contain sufficient information to

comply with IFRS. The accounting policies adopted are consistent

with those of the previous year.

The financial information set out in this announcement does not

constitute the statutory accounts for the Group within the meaning

of Section 435 of the Companies Act 2006. The statutory accounts

for the year ended 30 September 2020 have been filed with the

Registrar of Companies. The statutory accounts for the year ended

30 September 2021 will be filed in due course. The auditors' report

on these accounts was not qualified or modified and did not contain

any statement under sections 498(2) or (3) of the Companies Act

2006 or any preceding legislation.

Each of the Directors confirms that, to the best of their

knowledge, the financial statements, prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Group and the undertakings included in the consolidation

taken as a whole; and the Group results, Operational review and

Financial review includes a fair review of the development and

performance of the business and the position of the Group and the

undertakings included in the consolidation taken as a whole,

together with a description of the principal risks and

uncertainties that they face

2. Basis of consolidation and goodwill

The Group results comprise the financial statements of Zytronic

plc and its subsidiaries as at 30 September each year. They are

presented in Sterling and all values are rounded to the nearest

thousand pounds (GBP'000) except where otherwise indicated.

3. Group revenue and segmental analysis

Revenue represents the invoiced amount of goods sold and

services provided, stated net of value-added tax, rebates and

discounts.

For management purposes, the Chief Operating Decision Maker

considers that it has a single business unit comprising the

development and manufacture of customised optical filters to

enhance electronic display performance. All revenue, profits or

losses before tax and net assets are attributable to this single

reportable business segment.

The Board monitors the operating results of its entire business

for the purposes of making decisions about resource allocation and

performance assessment. Business performance is evaluated based on

operating profits.

All manufacturing takes place in the UK and accordingly all

segment assets are located in the UK. The analysis of segment

revenue by geographical area based on the location of customers is

given below:

30 September 2021 30 September 2020

----------------------------------------------------- ------------------- -------------------

Touch Non-touch Touch Non-touch

----------------------------------------------------- -------- --------- -------- ---------

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------------------- -------- --------- -------- ---------

Sale of goods - Americas (excluding

USA) 273 13 154 31

* USA 1,683 183 2,419 175

- EMEA (excluding UK and Hungary) 3,658 220 3,513 239

- Hungary 757 165 1,263 223

- UK 233 257 316 241

- APAC (excluding South Korea) 1,230 299 918 89

- South Korea 2,544 168 2,956 143

----------------------------------------------------- -------- --------- -------- ---------

10,378 1,305 11,539 1,141

----------------------------------------------------- -------- --------- -------- ---------

Total revenue 11,683 12,680

----------------------------------------------------- ------------------- -------------------

Individual revenues from three major customers exceeded 10% of

total revenue for the year. The total amount of revenue was GBP4.3m

(2020: GBP4.9m).

The individual revenues from each of these three customers were:

GBP1.6m (2020: GBP1.9m); GBP1.4m (2020: GBP1.1m); and GBP1.3m

(2020: GBP1.9m).

4. Exceptional costs

(a) Cost of sales

30 September 30 September

2021 2020

GBP'000 GBP'000

------------------------- -------------- -------------

Costs of restructuring - 652

Costs of Furlough - 463

Total exceptional costs - 1,115

------------------------- -------------- -------------

These charges have arisen as a direct result of the COVID-19

impact on the Group whereby restructuring was necessary to align

headcount with operations.

(b) Administration expenses

30 September 30 September

2021 2020

GBP'000 GBP'000

------------------------- -------------- -------------

Costs of restructuring - 144

Costs of Furlough - 114

Total exceptional costs - 258

------------------------- -------------- -------------

These charges have arisen as a direct result of the COVID-19

impact on the Group whereby restructuring was necessary to align

headcount with operations.

5. Exceptional other income

30 30

September September

2021 2020

GBP'000 GBP'000

---------------------------- ---------- ----------

Grant monies received - 500

---------------------------- ---------- ----------

Total grant monies received - 500

---------------------------- ---------- ----------

The income received as above is as a result of claims made under

the CJRS for when personnel were on Furlough leave.

6. Tax

30 September 30 September

2021 2020

GBP'000 GBP'000

--------------------------------------------------- ------------- -------------

Current tax

UK corporation tax 122 (92)

Tax due on foreign subsidiary 1 2

Corporation tax under/(over)-provided in

prior years 70 (4)

--------------------------------------------------- ------------- -------------

Total current tax charge/(credit) 193 (94)

--------------------------------------------------- ------------- -------------

Deferred tax

Origination and reversal of temporary differences (106) (108)

Movement related to change in tax rates 26 60

Movement related to prior year adjustments (66) 13

--------------------------------------------------- ------------- -------------

Total deferred tax credit (146) (35)

--------------------------------------------------- ------------- -------------

Tax charge/(credit) in the statement of

comprehensive income 47 (129)

--------------------------------------------------- ------------- -------------

Reconciliation of the total tax charge/(credit)

The effective tax rate of the tax charge in the statement of

comprehensive income for the year is 10% (2020: credit of 30%)

compared with the average rate of corporation tax charge in the UK

of 19% (2020: 19%). The differences are reconciled below:

30 September 30 September

2021 2020

GBP'000 GBP'000

-------------------------------------------- ------------- -------------

Accounting profit/(loss) before tax 453 (423)

-------------------------------------------- ------------- -------------

Accounting profit/(loss) multiplied by the

average UK rate of corporation tax of 19%

(2020: 19%) 86 (80)

Effects of:

Expenses not deductible for tax purposes 19 1

Depreciation in respect of non-qualifying

items 19 19

Enhanced tax reliefs - R&D (100) (140)

Effect of deferred tax rate reduction and

difference in tax rates 18 60

Tax under-provided in prior years 4 9

Tax due on foreign subsidiary 1 2

-------------------------------------------- ------------- -------------

Total tax expense/(credit) reported in the

statement of comprehensive income 47 (129)

-------------------------------------------- ------------- -------------

Factors that may affect future tax charges

The main rate of corporation tax has remained at 19% throughout

the period ended 30 September 2021. An increase in the main rate of

corporation tax to 25% was enacted prior to the year end. This is

applicable from 1 April 2023, and therefore the Group has

considered the timing of the unwind of its deferred tax and has

calculated its deferred tax balances at the rates at which they are

expected to unwind. This has resulted in a range of rates from 19%

- 25% being applied to deferred tax balances at the year end. As a

result of the impending increase in the main rate of corporation

tax, the Group expects its effective tax rate to increase in the

medium term.

The Patent Box regime allows companies to apply a rate of

corporation tax of 10% to profits earned from patented inventions

and similar intellectual property. Zytronic generates such profits

from the sale of products incorporating patented components. The

Group has determined that all relevant criteria has been satisfied

for bringing income within the regime. While the loss-making

position of the Group in 2020 meant that there was no benefit from

the regime in 2020 and 2021, the Group will continue to make Patent

Box claims and expects to obtain tax deductions from such claims

from 2022 onwards.

7. Dividends

The Directors propose the payment of a final dividend of 1.5p

per ordinary share for this year's results. This will bring the

total dividend for the year to 1.5p (2020: Nil).

30 September 30 September

2021 2020

GBP'000 GBP'000

-------------------------------------------- -------------- -------------

Ordinary dividends on equity shares

Final dividend of 15.2p per ordinary share

paid on 7 February 2020 - 2,439

2,439

----------------------------------------------------------- -------------

8. Earnings/(loss) per share

Basic EPS/LPS is calculated by dividing the profit/(loss)

attributable to ordinary equity holders of the Company by the

weighted average number of ordinary shares in issue during the

year. All activities are continuing operations and therefore there

is no difference between EPS/LPS arising from total operations and

EPS/LPS arising from continuing operations.

Weighted Weighted

average average

number number

Profit of shares EPS Loss of shares LPS

30 September 30 September 30 September 30 September 30 September 30 September

2021 2021 2021 2020 2020 2020

GBP'000 Thousands Pence GBP'000 Thousands Pence

--------------- ------------- ------------- ------------- ------------- ------------- -------------

Profit/(loss)

on ordinary

activities

after tax 406 13,346 3.0 (294) 16,044 (1.8)

--------------- ------------- ------------- ------------- ------------- ------------- -------------

Basic EPS/LPS 406 13,346 3.0 (294) 16,044 (1.8)

--------------- ------------- ------------- ------------- ------------- ------------- -------------

There are no dilutive or potentially dilutive instruments.

9. Capital and reserves

On 1 February 2021 the Company announced a proposed return of up

to GBP10.0m of capital by way of a Tender Offer to all

shareholders. This was approved by shareholders on 25 February

2021. As a result, 4,624,889 shares were purchased on 26 February

2021 and subsequently cancelled by the Company at a price of 145p

per share, returning GBP6.7m of the Company's cash to participating

shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DKABQBBDBBBK

(END) Dow Jones Newswires

December 07, 2021 02:00 ET (07:00 GMT)

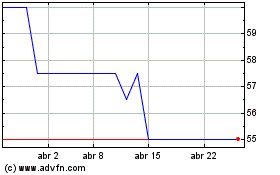

Zytronic (LSE:ZYT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Zytronic (LSE:ZYT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024