0001564824falseNONE00015648242024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 07, 2024 |

Allakos Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38582 |

45-4798831 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

825 Industrial Road, Suite 500 |

|

San Carlos, California |

|

94070 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 650 597-5002 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 |

|

ALLK |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 7, 2024, Allakos Inc. (the “Company”) issued a press release reporting its financial results for the second quarter ended June 30, 2024. The full text of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02 of this Form 8-K, including the attached Exhibit 99.1, is intended to be furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Allakos Inc. |

|

|

|

|

Date: |

August 7, 2024 |

By: |

/s/ H. Baird Radford, III |

|

|

|

H. Baird Radford, III

Chief Financial Officer |

Exhibit 99.1

Allakos Provides Business Update and Reports Second Quarter 2024 Financial Results

SAN CARLOS, Calif., August 7, 2024 (GLOBE NEWSWIRE) – Allakos Inc. (the “Company”) (Nasdaq: ALLK), a biotechnology company developing antibodies for the treatment of allergic, inflammatory and proliferative diseases, today provided a business update and reported financial results for the second quarter ended June 30, 2024.

Recent Allakos Events

•Initiated the randomized, double-blind, placebo-controlled Phase 1 trial of intravenous (IV) AK006 in patients with chronic spontaneous urticaria.

•Completed dosing in the randomized, double-blind, placebo-controlled subcutaneous (SC) AK006 cohort in healthy volunteers.

•Reported safety, pharmacokinetics (PK), and pharmacodynamic (PD) results from the Phase 1 trial of IV AK006 in healthy volunteers.

•Presented preclinical data at the 2024 European Academy of Allergy and Clinical Immunology (EAACI) Annual Congress on mast cell inhibition with AK006.

Upcoming Allakos Anticipated Milestones

•Report safety, PK, and PD results from the Phase 1 trial of SC AK006 in healthy volunteers in Q3 2024.

•Report randomized double-blind, placebo-controlled data from the Phase 1 trial of AK006 in patients with CSU at year end 2024.

Cash Guidance

Allakos ended the second quarter of 2024 with $123.1 million in cash, cash equivalents and investments. Allakos’ financial outlook, restructuring activities and estimated cash runway as reported by the Company in January 2024 remain unchanged. The Company reiterates that the restructuring activities will extend the cash runway into mid-2026 and continues to expect to end 2024 with total cash, cash equivalents and investments in the range of $81 to $86 million. The Company reiterates that an estimated $30 million of closeout, severance and other costs will be paid in 2024 in connection with exiting the lirentelimab development program, of which we have spent $13 million to date in the first six months of 2024. Approximately $1 million of these payments were made in the second quarter of 2024.

Second Quarter 2024 Financial Results

Allakos ended the second quarter of 2024 with $123.1 million in cash, cash equivalents and investments resulting in a net decrease in cash, cash equivalents and investments of $16.2 million during the second quarter of 2024.

Research and development expenses were $19.4 million in the second quarter of 2024 compared to $27.3 million in the second quarter of 2023, a decrease of $7.9 million. This quarter over quarter decrease is attributed to $2.5 million of lower contract research and development costs, primarily due to halting lirentelimab development, $2.5 million of decreased compensation costs and a $2.9 million decrease in other research and development expenses.

General and administrative expenses were $9.2 million for the second quarter of 2024 compared to $10.5 million for the second quarter of 2023, a decrease of $1.3 million. The quarter over quarter change included $0.7 million of decreased compensation costs and $0.6 million of decreased other general and administrative expenses.

Allakos reported a net loss of $26.7 million in the second quarter of 2024 compared to $35.1 million in the second quarter of 2023. Net loss per basic and diluted share was $0.30 for the second quarter of 2024 compared to $0.41 in the second quarter of 2023.

About Allakos

Allakos is a clinical stage biotechnology company developing therapeutics that target immunomodulatory receptors present on immune effector cells involved in allergy, inflammatory and proliferative diseases. Activating these immunomodulatory receptors allows for the direct targeting of cells involved in disease pathogenesis and, in the setting of allergy and inflammation, has the potential to result in broad inhibition of inflammatory cells. The Company’s most advanced product candidate is AK006. AK006 targets Siglec-6, an inhibitory receptor expressed on mast cells. Mast cells are widely distributed in the body and play a central role in the inflammatory response. Inappropriately activated mast cells have been identified as key drivers in a number of severe diseases affecting the gastrointestinal tract, eyes, skin, lungs and other organs. In preclinical studies, AK006 appears to provide deep mast cell inhibition and, in addition to its inhibitory activity, reduce mast cell numbers. For more information, please visit the Company’s website at www.allakos.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 as contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, but are not limited to, Allakos’ expected timing of reporting data from its clinical trial of AK006; cash guidance and runway; and restructuring. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially from current expectations and beliefs, including but not limited to: Allakos’ stages of clinical drug development; Allakos’ ability to timely initiate and complete clinical trials for AK006; Allakos’ ability to obtain required regulatory approvals for its clinical trials; uncertainties related to the enrollment of patients in its clinical trials; Allakos’ ability to demonstrate sufficient safety and efficacy of its product candidates in its clinical trials; uncertainties related to the success of clinical trials, regardless of the outcomes of preclinical testing or early-stage trials; Allakos’ ability to obtain regulatory approvals to market its product candidates; market acceptance of Allakos’ product candidates; uncertainties related to the projections of the size of patient populations suffering from the diseases Allakos is targeting; Allakos’ ability to advance additional product candidates beyond AK006; uncertainties related to Allakos’ ability to realize the contemplated benefits of its restructuring and related reduction in force; Allakos’ ability to accurately forecast financial results; Allakos’ ability to obtain additional capital to finance its operations, research and drug development; Allakos’ ability to maintain the listing of our common stock on Nasdaq; general economic and market conditions, both domestic and international; domestic and international regulatory obligations; and other risks. Information regarding the foregoing and additional risks may be found in the section entitled “Risk Factors” in documents that Allakos files from time to time to with the SEC. These documents contain and identify important factors that could cause the actual results for Allakos to differ materially from those contained in Allakos’ forward-looking statements. Any forward-looking statements contained in this press release speak only as of the date hereof, and Allakos specifically disclaims any obligation to update any forward-looking statement, except as required by law.

These forward-looking statements should not be relied upon as representing Allakos’ views as of any date subsequent to the date of this press release.

###

Source: Allakos Inc.

Investor Contact:

Adam Tomasi, President

Alex Schwartz, VP Strategic Finance and Investor Relations

ir@allakos.com

Media Contact:

Denise Powell

denise@redhousecomms.com

Allakos Inc.

UNAUDITED Statements of Operations and Comprehensive Loss

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

June 30, |

|

|

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

19,422 |

|

|

$ |

27,280 |

|

|

$ |

54,246 |

|

|

$ |

60,358 |

|

General and administrative |

|

|

9,211 |

|

|

|

10,537 |

|

|

|

20,109 |

|

|

|

22,505 |

|

Impairment of long-lived assets |

|

|

— |

|

|

|

— |

|

|

|

27,347 |

|

|

|

— |

|

Total operating expenses |

|

|

28,633 |

|

|

|

37,817 |

|

|

|

101,702 |

|

|

|

82,863 |

|

Loss from operations |

|

|

(28,633 |

) |

|

|

(37,817 |

) |

|

|

(101,702 |

) |

|

|

(82,863 |

) |

Interest income |

|

|

1,959 |

|

|

|

2,697 |

|

|

|

3,954 |

|

|

|

5,375 |

|

Other expense, net |

|

|

(2 |

) |

|

|

— |

|

|

|

(74 |

) |

|

|

(36 |

) |

Net loss |

|

|

(26,676 |

) |

|

|

(35,120 |

) |

|

|

(97,822 |

) |

|

|

(77,524 |

) |

Unrealized gain (loss) on investments |

|

|

(11 |

) |

|

|

(171 |

) |

|

|

(41 |

) |

|

|

125 |

|

Comprehensive loss |

|

$ |

(26,687 |

) |

|

$ |

(35,291 |

) |

|

$ |

(97,863 |

) |

|

$ |

(77,399 |

) |

Net loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.30 |

) |

|

$ |

(0.41 |

) |

|

$ |

(1.11 |

) |

|

$ |

(0.90 |

) |

Weighted-average number of common

shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

88,644 |

|

|

|

86,646 |

|

|

|

88,342 |

|

|

|

86,246 |

|

allakos inc.

UNAUDITED CONDENSED balance sheets

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

26,496 |

|

|

$ |

66,440 |

|

Investments |

|

|

96,625 |

|

|

|

104,354 |

|

Prepaid expenses and other current assets |

|

|

4,805 |

|

|

|

9,095 |

|

Total current assets |

|

|

127,926 |

|

|

|

179,889 |

|

Property and equipment, net |

|

|

16,590 |

|

|

|

33,369 |

|

Operating lease right-of-use assets |

|

|

10,228 |

|

|

|

24,136 |

|

Other long-term assets |

|

|

1,714 |

|

|

|

6,216 |

|

Total assets |

|

$ |

156,458 |

|

|

$ |

243,610 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

16,119 |

|

|

$ |

1,764 |

|

Accrued expenses and other current liabilities |

|

|

19,761 |

|

|

|

34,814 |

|

Total current liabilities |

|

|

35,880 |

|

|

|

36,578 |

|

Operating lease liabilities, net of current portion |

|

|

36,579 |

|

|

|

38,215 |

|

Total liabilities |

|

|

72,459 |

|

|

|

74,793 |

|

Stockholders’ equity: |

|

|

|

|

|

|

Common stock |

|

|

89 |

|

|

|

88 |

|

Additional paid-in capital |

|

|

1,300,200 |

|

|

|

1,287,156 |

|

Accumulated other comprehensive gain (loss) |

|

|

9 |

|

|

|

50 |

|

Accumulated deficit |

|

|

(1,216,299 |

) |

|

|

(1,118,477 |

) |

Total stockholders’ equity |

|

|

83,999 |

|

|

|

168,817 |

|

Total liabilities and stockholders’ equity |

|

$ |

156,458 |

|

|

$ |

243,610 |

|

v3.24.2.u1

Document And Entity Information

|

Aug. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 07, 2024

|

| Entity Registrant Name |

Allakos Inc.

|

| Entity Central Index Key |

0001564824

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38582

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

45-4798831

|

| Entity Address, Address Line One |

825 Industrial Road, Suite 500

|

| Entity Address, City or Town |

San Carlos

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94070

|

| City Area Code |

650

|

| Local Phone Number |

597-5002

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

ALLK

|

| Security Exchange Name |

NONE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

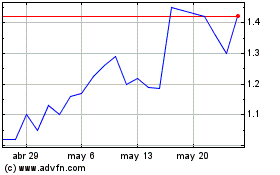

Allakos (NASDAQ:ALLK)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Allakos (NASDAQ:ALLK)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024