Alvotech (NASDAQ: ALVO, or the “Company”), a global biotech company

specializing in the development and manufacture of biosimilar

medicines for patients worldwide, today reported unaudited

financial results for the first three months of 2024 and provided a

summary of recent corporate highlights.

“This year is turning out to be the busiest in

Alvotech’s history. We secured U.S. Food and Drug Administration

(FDA) approval of AVT04, our biosimilar to Stelara® in the U.S.,

signed a key strategic partnership and commercialization agreement

for our high concentration interchangeable biosimilar to Humira® in

the U.S., under private label, as well as a new commercialization

agreement in the U.S. and Europe for AVT03, our proposed biosimilar

to Prolia® and Xgeva®. In addition to the U.S. private-label

commercialization agreement, our partner Teva is making great

progress on discussions positioning our Humira® biosimilar on

formularies in the U.S.,” said Robert Wessman, Chairman and CEO of

Alvotech. “Pipeline development progressed briskly as well. On top

of the recently announced results from our confirmatory patient

study for AVT06, our biosimilar candidate to Eyela®, we’ve now

announced positive top-line results from the confirmatory patient

study for AVT05, our proposed biosimilar to Simponi® and are thus

on track to file marketing applications for at least three

biosimilar candidates in the second half of this year.

Joel Morales, Chief Financial Officer of Alvotech,

added: “Based on rapid progress in commercialization and

development, we raise our revenue guidance for 2024, to $400 - $500

million and tighten our guidance for EBIDTA to $100 - $150 million

for the full year.”

Recent Highlights

Alvotech and its commercialization partner in the

U.S., Teva Pharmaceuticals (“Teva”), announced that the FDA

approved AVT04 (ustekinumab-aekn) for marketing in the U.S. as a

biosimilar to Stelara, under the tradename Selarsdi. The biosimilar

has been launched in Canada, will be launched in Japan imminently

in May, and is expected to be launched in Europe in Q3 2024 and in

the U.S. in February next year.

Alvotech announced a U.S. strategic partnership

agreement with Quallent Pharmaceuticals (“Quallent”), a subsidiary

of Cigna group. Alvotech’s high-concentration interchangeable

biosimilar to Humira (adalimumab) will be distributed under

Quallent’s private label. As this is the first high-concentration,

citrate-free biosimilar to Humira granted an interchangeability

status by the FDA, Alvotech will have interchangeable exclusivity

for the high-concentration presentation 40mg/0.4mL.

Alvotech signed a commercial partnership agreement

with Dr. Reddy’s Laboratories Ltd. (“Dr. Reddy’s”), for the

commercialization of AVT03, Alvotech’s biosimilar candidate to

Prolia® and Xgeva® (denosumab). The commercialization agreement

includes an upfront payment to Alvotech with subsequent payments

upon certain development and commercialization milestones as well

as royalties on product sales. Dr. Reddy’s commercialization rights

are exclusive for the U.S. and semi-exclusive for Europe.

Alvotech announced positive top-line results from a

confirmatory clinical study for AVT05, a proposed biosimilar to

Simponi® and Simponi Aria® (golimumab). Alvotech is the first

company to announce positive topline results of a clinical trial

using a proposed biosimilar to Simponi and Simponi Aria and is one

of only two companies known to have initiated such a patient

study.

Financial Results for First Three Months of

2024

Cash position and sources of liquidity: As of

March 31, 2024, the Company had cash and cash equivalents of $64.8

million, excluding $25.0 million of restricted cash. In addition,

the Company had borrowings of $978.1 million, including $37.6

million of current portion of borrowings, as of March 31, 2024.

Product Revenue: Product revenue was $12.4

million for the three months ended March 31, 2024, compared to

$15.7 million for the same three months of 2023. Revenue for the

three months ended March 31, 2024, consisted of product revenue

from sales of AVT02 in select European countries and Canada, launch

of AVT02 in the U.S and launch of AVT04 in Canada.

License and Other Revenue: License and other

revenue was $24.4 million for the three months ended March 31,

2024. No license and other revenue were recognized during the first

three months ended March 31, 2023. The license and other revenue of

$24.4 million was primarily attributable to the recognition of a

$6.5 million research and development milestone due to the approval

of AVT04 in Europe and $16.8 million relative to research and

development milestone due to the CTA submission for the AVT16

clinical program.

Cost of product revenue: Cost of product

revenue was $20.0 million for the three months ended March 31,

2024, compared to $39.1 million for the same three months of 2023,

as a result of sales in the period, including the launch of AVT04

in Canada, tempered by lower production-related charges and other

costs associated with FDA inspection readiness. Cost of product

revenue for the period is disproportionate relative to product

revenue due to the timing of new launches and elevated

production-related charges, resulting in higher costs than revenues

recognized for the period. The Company expects this relationship to

continue normalizing with increased production from the scaling and

expansion of new or recent launches. The Company estimates that the

anticipated increase in sales volumes will result in a greater

absorption of fixed manufacturing costs.

Research and development (R&D)

expenses: R&D expenses were $49.9 million for the three

months ended March 31, 2024, compared to $50.9 million for the same

three months of 2023. The slight decrease was primarily driven by a

one-time charge of $18.5 million relating to the termination of the

co-development agreement with Biosana for AVT23 recognized during

the three months of 2023, and a $17.8 million increase in direct

program expenses mainly from five biosimilar candidates, AVT03,

AVT05, AVT06, AVT16 and AVT23 that are in clinical phase.

General and administrative (G&A)

expenses: G&A expenses were $15.5 million for the three

months ended March 31, 2024, compared to $22.2 million for the same

three months of 2023. The decrease in G&A expenses was

primarily attributable to $3.7 million in lower 3rd party services,

lower insurance premiums and less headcount, coupled with a $1.9

million decrease in expenses for share-based payments.

Finance income: Finance income was $0.8

million for the three months ended March 31, 2024, compared to $1.2

million for the same three months of 2023. This was primarily

attributable to interests received on bank accounts resulting from

lower cash balances versus the same period in the prior year.

Finance costs: Finance costs were $184.1

million for the three months ended March 31, 2024, compared to

$207.6 million for the same three months of 2023. The decrease was

primarily attributable to lower fair value of derivative

liabilities from $179.1 million for the three months ended March

31, 2023, to $140.9 million for the three months ended March 31,

2024, partially offset by an increase in interest charged on

additional borrowings and convertible bonds issued during 2023.

Exchange rate differences: Exchange rate

differences resulted in a gain of $6.5 million for the three months

ended March 31, 2024, compared to a loss of $1.7 million for the

same three months of 2023. The increase was primarily driven by the

movements in the exchange rate of foreign currencies, predominantly

Icelandic krona and euros.

Income tax benefit: Income tax benefit was

$6.4 million for the three months ended March 31, 2024, compared to

$29.4 million for the same three months of 2023. The decrease was

mainly driven by a decrease in operating losses and an unfavorable

foreign currency translation effect during the three months ended

March 31, 2024 due to the weakening of the Icelandic krona against

the U.S. dollar.

Loss for the Period: Reported net loss was

$218.7 million, or ($0.89) per share on a basic and diluted basis,

for the three months ended March 31, 2024, compared to a reported

net loss of $276.2 million, or ($1.24) per share on a basic and

diluted basis, for the same three months of 2023. As mentioned

above, the net loss for the period is heavily impacted by the fair

value costs associated with our derivative liabilities.

Business Update Conference

Call

Alvotech will conduct a business update conference

call and live webcast on Wednesday, May 22, 2024, at 8:00 am EDT

(12:00 pm GMT). Registration for the conference call and access to

the live webcast is found on

https://investors.alvotech.com/events/event-details/q1-2024-earnings,

where you will also be able to find a replay of the webcast,

following the call for 90 days.

About AVT02 (adalimumab) AVT02 is

a monoclonal antibody and has been approved as a biosimilar to

Humira® (adalimumab) in over 50 countries globally, including the

U.S., Europe, Canada, Australia, Egypt, Saudi Arabia and South

Africa. It is currently marketed in multiple European countries as

HUKYNDRA and LIBMYRIS, in Canada as SIMLANDI and in Australia as

ADALACIP. Dossiers are also under review in multiple countries

globally.

About AVT04 (ustekinumab) AVT04 is

a monoclonal antibody and a biosimilar to Stelara® (ustekinumab).

Ustekinumab binds to two cytokines, IL-12 and IL-23, that are

involved in inflammatory and immune responses [1]. AVT04 has been

launched in Canada as JAMTEKI and has received market authorization

in Japan as USTEKINUMAB BS (F), in the EEA as UZPRUVO and in the

U.S. as SELARSDI. Dossiers are also under review in multiple

countries globally.

About AVT03 (denosumab) AVT03 is a

human monoclonal antibody and a biosimilar candidate to Prolia® and

Xgeva® (denosumab). Denosumab targets and binds with high affinity

and specificity to the RANK ligand membrane protein, preventing the

RANK ligand/RANK interaction from occurring, resulting in reduced

osteoclast numbers and function, thereby decreasing bone resorption

and cancer-induced bone destruction [2]. AVT03 is an

investigational product and has not received regulatory approval in

any country. Biosimiliarity has not been established by regulatory

authorities and is not claimed.

About AVT05 (golimumab) AVT05 is a

biosimilar candidate for Simponi® and Simponi Aria® (golimumab).

Golimumab is a monoclonal antibody that inhibits tumor necrosis

factor (TNF) alpha. Elevated TNF alpha levels have been implicated

in several chronic inflammatory diseases such as rheumatoid

arthritis, psoriatic arthritis, and ankylosing spondylitis [3].

AVT05 is an investigational product and has not received regulatory

approval in any country. Biosimilarity has not been established by

regulatory authorities and is not claimed.

About AVT06 (aflibercept) AVT06 is

a recombinant fusion protein and a biosimilar candidate to Eylea®

(aflibercept), which binds vascular endothelial growth factors

(VEGF), inhibiting the binding and activation of VEGF receptors,

neovascularization, and vascular permeability [4]. AVT06 is an

investigational product and has not received regulatory approval in

any country. Biosimilarity has not been established by regulatory

authorities and is not claimed.

Sources

[1]

https://www.ema.europa.eu/en/documents/product-information/uzpruvo-epar-product-information_en.pdf

[2]

https://www.pi.amgen.com/-/media/Project/Amgen/Repository/pi-amgen-com/Prolia/prolia_pi.pdf

[3]

https://www.janssenlabels.com/package-insert/product-monograph/prescribing-information/SIMPONI-pi.pdf

[4] https://www.regeneron.com/downloads/eylea_fpi.pdf

Use of trademarks

Humira is a registered trademark of AbbVie Inc. Stelara is a

registered trademark of Johnson & Johnson Inc. Prolia and Xgeva

are registered trademarks of Amgen Inc. Stelara, Simponi and

Simponi Aria are registered trademarks of Johnson & Johnson

Inc. Elyea is a registered trademark of Regeneron Pharmaceuticals

Inc.

About Alvotech

Alvotech is a biotech company, founded by Robert Wessman,

focused solely on the development and manufacture of biosimilar

medicines for patients worldwide. Alvotech seeks to be a global

leader in the biosimilar space by delivering high quality,

cost-effective products, and services, enabled by a fully

integrated approach and broad in-house capabilities. Alvotech’s

current pipeline contains eight biosimilar candidates aimed at

treating autoimmune disorders, eye disorders, osteoporosis,

respiratory disease, and cancer. Alvotech has formed a network of

strategic commercial partnerships to provide global reach and

leverage local expertise in markets that include the United States,

Europe, Japan, China, and other Asian countries and large parts of

South America, Africa and the Middle East. Alvotech’s commercial

partners include Teva Pharmaceuticals, a US affiliate of Teva

Pharmaceutical Industries Ltd. (US), STADA Arzneimittel AG (EU),

Fuji Pharma Co., Ltd (Japan), Advanz Pharma (EEA, UK, Switzerland,

Canada, Australia and New Zealand), Cipla/Cipla Gulf/Cipla Med Pro

(Australia, New Zealand, South Africa/Africa), JAMP Pharma

Corporation (Canada), Yangtze River Pharmaceutical (Group) Co.,

Ltd. (China), DKSH (Taiwan, Hong Kong, Cambodia, Malaysia,

Singapore, Indonesia, India, Bangladesh and Pakistan), YAS Holding

LLC (Middle East and North Africa), Abdi Ibrahim (Turkey), Kamada

Ltd. (Israel), Mega Labs, Stein, Libbs, Tuteur and Saval (Latin

America) and Lotus Pharmaceuticals Co., Ltd. (Thailand, Vietnam,

Philippines, and South Korea). Each commercial partnership covers a

unique set of product(s) and territories. Except as specifically

set forth therein, Alvotech disclaims responsibility for the

content of periodic filings, disclosures and other reports made

available by its partners. For more information, please visit

www.alvotech.com. None of the information on the Alvotech website

shall be deemed part of this press release.

Please visit our investor portal, and our website or follow us

on social media on LinkedIn, Facebook, Instagram, X and

YouTube.

Alvotech Forward Looking Statements

Certain statements in this communication may be considered

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, as amended.

Forward-looking statements generally relate to future events or the

future financial operating performance of Alvotech and may include,

for example, Alvotech’s expectations regarding competitive

advantages, business prospects and opportunities including pipeline

product development, future plans and intentions, results, level of

activities, performance, goals or achievements or other future

events, regulatory submissions, review and interactions, the

potential approval and commercial launch of its product candidates,

the timing of regulatory approval, and market launches. In some

cases, you can identify forward-looking statements by terminology

such as “may”, “should”, “expect”, “intend”, “will”, “estimate”,

“anticipate”, “believe”, “predict”, “potential”, “aim” or

“continue”, or the negatives of these terms or variations of them

or similar terminology. Such forward-looking statements are subject

to risks, uncertainties, and other factors which could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements. These forward-looking statements

are based upon estimates and assumptions that, while considered

reasonable by Alvotech and its management, are inherently uncertain

and are inherently subject to risks, variability, and

contingencies, many of which are beyond Alvotech’s control. Factors

that may cause actual results to differ materially from current

expectations include, but are not limited to: (1) the ability to

raise substantial additional funding, which may not be available on

acceptable terms or at all; (2) the ability to maintain stock

exchange listing standards; (3) changes in applicable laws or

regulations; (4) the possibility that Alvotech may be adversely

affected by other economic, business, and/or competitive factors;

(5) Alvotech’s estimates of expenses and profitability; (6)

Alvotech’s ability to develop, manufacture and commercialize the

products and product candidates in its pipeline; (7) actions of

regulatory authorities, which may affect the initiation, timing and

progress of clinical studies or future regulatory approvals or

marketing authorizations; (8) the ability of Alvotech or its

partners to respond to inspection findings and resolve deficiencies

to the satisfaction of the regulators; (9) the ability of Alvotech

or its partners to enroll and retain patients in clinical studies;

(10) the ability of Alvotech or its partners to gain approval from

regulators for planned clinical studies, study plans or sites; (11)

the ability of Alvotech’s partners to conduct, supervise and

monitor existing and potential future clinical studies, which may

impact development timelines and plans; (12) Alvotech’s ability to

obtain and maintain regulatory approval or authorizations of its

products, including the timing or likelihood of expansion into

additional markets or geographies; (13) the success of Alvotech’s

current and future collaborations, joint ventures, partnerships or

licensing arrangements; (14) Alvotech’s ability, and that of its

commercial partners, to execute their commercialization strategy

for approved products; (15) Alvotech’s ability to manufacture

sufficient commercial supply of its approved products; (16) the

outcome of ongoing and future litigation regarding Alvotech’s

products and product candidates; (17) the impact of worsening

macroeconomic conditions, including rising inflation and interest

rates and general market conditions, conflicts in Ukraine, the

Middle East and other global geopolitical tension, on the Company’s

business, financial position, strategy and anticipated milestones;

and (18) other risks and uncertainties set forth in the sections

entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in documents that Alvotech may from

time to time file or furnish with the SEC. There may be additional

risks that Alvotech does not presently know or that Alvotech

currently believes are immaterial that could also cause actual

results to differ from those contained in the forward-looking

statements. Nothing in this communication should be regarded as a

representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. You

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made. Alvotech does not

undertake any duty to update these forward-looking statements or to

inform the recipient of any matters of which any of them becomes

aware of which may affect any matter referred to in this

communication. Alvotech disclaims any and all liability for any

loss or damage (whether foreseeable or not) suffered or incurred by

any person or entity as a result of anything contained or omitted

from this communication and such liability is expressly disclaimed.

The recipient agrees that it shall not seek to sue or otherwise

hold Alvotech or any of its directors, officers, employees,

affiliates, agents, advisors, or representatives liable in any

respect for the provision of this communication, the information

contained in this communication, or the omission of any information

from this communication.

ALVOTECH INVESTOR RELATIONS AND GLOBAL

COMMUNICATIONS

Benedikt Stefansson, Senior Director

alvotech.ir@alvotech.com

|

Unaudited Condensed Consolidated Interim Statements of

Profit or Loss and Other Comprehensive Income or

Loss |

|

|

|

|

|

|

|

|

|

|

| |

Three months ended March 31, 2024 |

|

Three months ended March 31, 2023 |

| |

|

|

|

| USD in thousands,

except for per share amounts |

|

|

|

| |

|

|

|

| Product

revenue |

12,430 |

|

15,864 |

| License and other

revenue |

24,422 |

|

- |

| Other

income |

42 |

|

19 |

| Cost of product

revenue |

(19,957) |

|

(39,095) |

| Research and

development expenses |

(49,868) |

|

(50,864) |

| General and

administrative expenses |

(15,488) |

|

(22,198) |

| |

|

|

|

| Operating

loss |

(48,419) |

|

(96,274) |

| |

|

|

|

| Share of net loss

of joint venture |

- |

|

(1,164) |

| Finance

income |

783 |

|

1,226 |

| Finance

costs |

(184,063) |

|

(207,600) |

| Exchange rate

differences |

6,532 |

|

(1,748) |

| |

|

|

|

|

Non-operating loss |

(176,748) |

|

(209,286) |

| |

|

|

|

| Loss

before taxes |

(225,167) |

|

(305,560) |

| Income tax

benefit |

6,438 |

|

29,380 |

| |

|

|

|

| Loss for

the period |

(218,729) |

|

(276,180) |

| |

|

|

|

| Other

comprehensive loss |

|

|

|

| Item that will be

reclassified to profit or loss in subsequent periods: |

|

|

|

| Exchange rate

differences on translation of foreign operations |

(820) |

|

648 |

| Total

comprehensive loss |

(219,549) |

|

(275,532) |

| |

|

|

|

| |

|

|

|

| Loss per

share |

|

|

|

| Basic and diluted

loss for the year per share |

(0.89) |

|

(1.24) |

|

Unaudited Condensed Consolidated Interim Statement of

Financial Position |

|

|

|

|

|

|

|

|

|

|

| USD in

thousands |

31 March2024 |

|

31 December2023 |

| |

|

|

|

|

Non-current assets |

|

|

|

| Property, plant

and equipment |

235,394 |

|

236,779 |

| Right-of-use

assets |

127,440 |

|

119,802 |

|

Goodwill |

11,779 |

|

12,058 |

| Other intangible

assets |

19,370 |

|

19,076 |

| Contract

assets |

10,356 |

|

10,856 |

| Investment in

joint venture |

18,494 |

|

18,494 |

| Other long-term

assets |

2,285 |

|

2,244 |

| Restricted

cash |

25,000 |

|

26,132 |

| Deferred tax

assets |

318,223 |

|

309,807 |

| |

|

|

|

| Total

non-current assets |

768,341 |

|

755,248 |

| |

|

|

|

| Current

assets |

|

|

|

|

Inventories |

92,236 |

|

74,433 |

| Trade

receivables |

41,252 |

|

41,292 |

| Contract

assets |

30,059 |

|

35,193 |

| Other current

assets |

62,900 |

|

31,871 |

| Receivables from

related parties |

1,038 |

|

896 |

| Cash and cash

equivalents |

64,811 |

|

11,157 |

| |

|

|

|

| Total

current assets |

292,296 |

|

194,842 |

| |

|

|

|

| Total

assets |

1,060,637 |

|

950,090 |

|

Unaudited Condensed Consolidated Interim Statement of

Financial Position |

|

|

|

|

|

|

|

|

|

|

| USD in

thousands |

31 March2024 |

|

31 December2023 |

| |

|

|

|

|

Equity |

|

|

|

| Share

capital |

2,604 |

|

2,279 |

| Share

premium |

1,726,610 |

|

1,229,690 |

| Other

reserves |

38,883 |

|

42,911 |

| Translation

reserve |

(2,348) |

|

(1,528) |

| Accumulated

deficit |

(2,424,574) |

|

(2,205,845) |

| |

|

|

|

| Total

equity |

(658,825) |

|

(932,493) |

| |

|

|

|

|

Non-current liabilities |

|

|

|

|

Borrowings |

940,593 |

|

922,134 |

| Derivative

financial liabilities |

330,976 |

|

520,553 |

| Lease

liabilities |

110,585 |

|

105,632 |

| Contract

liabilities |

88,913 |

|

73,261 |

| Deferred tax

liability |

1,610 |

|

53 |

| |

|

|

|

| Total

non-current liabilities |

1,472,677 |

|

1,621,633 |

| |

|

|

|

| Current

liabilities |

|

|

|

| Trade and other

payables |

50,175 |

|

80,563 |

| Lease

liabilities |

11,161 |

|

9,683 |

| Current

maturities of borrowings |

37,550 |

|

38,025 |

| Liabilities to

related parties |

24,532 |

|

9,851 |

| Contract

liabilities |

46,258 |

|

59,183 |

| Taxes

payable |

1,096 |

|

925 |

| Other current

liabilities |

76,013 |

|

62,720 |

| |

|

|

|

| Total

current liabilities |

246,785 |

|

260,950 |

| Total

liabilities |

1,719,462 |

|

1,882,583 |

| |

|

|

|

| Total

equity and liabilities |

1,060,637 |

|

950,090 |

|

Unaudited Condensed Consolidated Interim Statements of Cash

Flows |

|

|

|

|

|

|

USD in thousands |

Three months ended March 31, 2024 |

|

Three months ended March 31, 2023 |

| |

|

|

|

| Cash

flows from operating activities |

|

|

|

| Loss for the

year |

(218,729) |

|

(276,180) |

|

Adjustments for non-cash items: |

|

|

|

| Long-term incentive

plan expense |

- |

|

6,449 |

| Depreciation and

amortization |

7,190 |

|

4,841 |

| Change in allowance

for receivables |

- |

|

18,500 |

| Change in inventory

reserves |

(5,379) |

|

- |

| Share of net loss of

joint venture |

- |

|

1,164 |

| Finance

income |

(783) |

|

(1,226) |

| Finance

costs |

184,063 |

|

207,600 |

| Share-based

payments |

2,828 |

|

- |

| Exchange rate

difference |

(6,532) |

|

1,748 |

| Income tax

benefit |

(6,438) |

|

(29,380) |

| |

|

|

|

| Operating

cash flow before movement in working capital |

(43,780) |

|

(66,484) |

| Increase in

inventories |

(12,424) |

|

(3,766) |

| Increase in trade

receivables |

40 |

|

2,952 |

| Increase /

(decrease) in liabilities with related parties |

14,539 |

|

(573) |

| (Increase) /

decrease in contract assets |

5,634 |

|

895 |

| Increase in other

assets |

(2,959) |

|

5,246 |

| Increase in trade

and other payables |

(28,927) |

|

(18,600) |

| Increase in

contract liabilities |

4,176 |

|

616 |

| (Decrease) /

increase in other liabilities |

(7,139) |

|

(4,477) |

| |

|

|

|

| Cash used

in operations |

(70,840) |

|

(84,191) |

| Interest

received |

26 |

|

21 |

| Interest

paid |

(4,403) |

|

(1,845) |

| Income tax

paid |

(186) |

|

(116) |

| |

|

|

|

| Net cash

used in operating activities |

(75,403) |

|

(86,131) |

| |

|

|

|

| Cash

flows from investing activities |

|

|

|

| Acquisition of

property, plant and equipment |

(4,069) |

|

(11,327) |

| Acquisition of

intangible assets |

(543) |

|

(2,548) |

| Restricted cash

in connection with amended bond agreement |

1,132 |

|

- |

| |

|

|

|

| Net cash

used in investing activities |

(3,480) |

|

(13,875) |

| |

|

|

|

| |

|

|

|

| |

|

|

|

| Cash

flows from financing activities |

|

|

|

| Repayments of

borrowings |

(1,629) |

|

(50,812) |

| Repayments of

principal portion of lease liabilities |

(2,338) |

|

(1,525) |

| Proceeds from new

borrowings |

- |

|

60,421 |

| Gross proceeds

from equity offering |

138,049 |

|

136,879 |

| Fees from equity

offering |

(5,743) |

|

(4,141) |

| Proceeds from

warrants |

4,841 |

|

6,365 |

| |

|

|

|

| Net cash

generated from financing activities |

133,180 |

|

147,187 |

| |

|

|

|

| Decrease in cash

and cash equivalents |

54,297 |

|

47,181 |

| Cash and cash

equivalents at the beginning of the period |

11,157 |

|

66,427 |

| Effect of

movements in exchange rates on cash held |

(643) |

|

2,236 |

| |

|

|

|

| Cash and

cash equivalents at the end of the period |

64,811 |

|

115,844 |

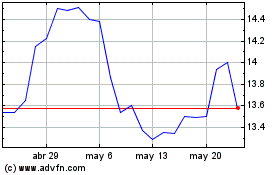

Alvontech (NASDAQ:ALVO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Alvontech (NASDAQ:ALVO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024