000105735212/312024Q3falsehttp://www.costar.com/20240930#OperatingAndFinanceLeaseLiabilityCurrenthttp://www.costar.com/20240930#OperatingAndFinanceLeaseLiabilityCurrenthttp://www.costar.com/20240930#LeaseAndOtherLiabilitiesNoncurrenthttp://www.costar.com/20240930#LeaseAndOtherLiabilitiesNoncurrenthttp://www.costar.com/20240930#OperatingAndFinanceLeaseLiabilityCurrenthttp://www.costar.com/20240930#OperatingAndFinanceLeaseLiabilityCurrenthttp://www.costar.com/20240930#LeaseAndOtherLiabilitiesNoncurrenthttp://www.costar.com/20240930#LeaseAndOtherLiabilitiesNoncurrentxbrli:sharesiso4217:USDiso4217:USDxbrli:sharescsgp:operating_segmentxbrli:purecsgp:portfolioSegmentcsgp:classutr:sqftiso4217:GBPxbrli:sharesiso4217:GBPcsgp:segment00010573522024-01-012024-09-3000010573522024-10-2100010573522024-07-012024-09-3000010573522023-07-012023-09-3000010573522023-01-012023-09-3000010573522024-09-3000010573522023-12-310001057352us-gaap:CommonStockMember2023-12-310001057352us-gaap:AdditionalPaidInCapitalMember2023-12-310001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001057352us-gaap:RetainedEarningsMember2023-12-310001057352us-gaap:RetainedEarningsMember2024-01-012024-03-3100010573522024-01-012024-03-310001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001057352us-gaap:CommonStockMember2024-01-012024-03-310001057352us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001057352us-gaap:CommonStockMember2024-03-310001057352us-gaap:AdditionalPaidInCapitalMember2024-03-310001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001057352us-gaap:RetainedEarningsMember2024-03-3100010573522024-03-310001057352us-gaap:RetainedEarningsMember2024-04-012024-06-3000010573522024-04-012024-06-300001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001057352us-gaap:CommonStockMember2024-04-012024-06-300001057352us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001057352us-gaap:CommonStockMember2024-06-300001057352us-gaap:AdditionalPaidInCapitalMember2024-06-300001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001057352us-gaap:RetainedEarningsMember2024-06-3000010573522024-06-300001057352us-gaap:RetainedEarningsMember2024-07-012024-09-300001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001057352us-gaap:CommonStockMember2024-07-012024-09-300001057352us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001057352us-gaap:CommonStockMember2024-09-300001057352us-gaap:AdditionalPaidInCapitalMember2024-09-300001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001057352us-gaap:RetainedEarningsMember2024-09-300001057352us-gaap:CommonStockMember2022-12-310001057352us-gaap:AdditionalPaidInCapitalMember2022-12-310001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001057352us-gaap:RetainedEarningsMember2022-12-3100010573522022-12-310001057352us-gaap:RetainedEarningsMember2023-01-012023-03-3100010573522023-01-012023-03-310001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001057352us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001057352us-gaap:CommonStockMember2023-01-012023-03-310001057352us-gaap:CommonStockMember2023-03-310001057352us-gaap:AdditionalPaidInCapitalMember2023-03-310001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001057352us-gaap:RetainedEarningsMember2023-03-3100010573522023-03-310001057352us-gaap:RetainedEarningsMember2023-04-012023-06-3000010573522023-04-012023-06-300001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001057352us-gaap:CommonStockMember2023-04-012023-06-300001057352us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001057352us-gaap:CommonStockMember2023-06-300001057352us-gaap:AdditionalPaidInCapitalMember2023-06-300001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001057352us-gaap:RetainedEarningsMember2023-06-3000010573522023-06-300001057352us-gaap:RetainedEarningsMember2023-07-012023-09-300001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001057352us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001057352us-gaap:CommonStockMember2023-07-012023-09-300001057352us-gaap:CommonStockMember2023-09-300001057352us-gaap:AdditionalPaidInCapitalMember2023-09-300001057352us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001057352us-gaap:RetainedEarningsMember2023-09-3000010573522023-09-300001057352us-gaap:ProductConcentrationRiskMembercsgp:SubscriptionBasedContractsMemberus-gaap:RevenueFromContractWithCustomerMember2024-07-012024-09-300001057352us-gaap:ProductConcentrationRiskMembercsgp:SubscriptionBasedContractsMemberus-gaap:RevenueFromContractWithCustomerMember2023-07-012023-09-300001057352us-gaap:ProductConcentrationRiskMembercsgp:SubscriptionBasedContractsMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-09-300001057352us-gaap:ProductConcentrationRiskMembercsgp:SubscriptionBasedContractsMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-09-300001057352csgp:ResidentialMember2024-09-300001057352csgp:PerformanceBasedRestrictedStockMember2024-07-012024-09-300001057352csgp:PerformanceBasedRestrictedStockMember2023-07-012023-09-300001057352csgp:PerformanceBasedRestrictedStockMember2024-01-012024-09-300001057352csgp:PerformanceBasedRestrictedStockMember2023-01-012023-09-300001057352us-gaap:CostOfSalesMember2024-07-012024-09-300001057352us-gaap:CostOfSalesMember2023-07-012023-09-300001057352us-gaap:CostOfSalesMember2024-01-012024-09-300001057352us-gaap:CostOfSalesMember2023-01-012023-09-300001057352us-gaap:SellingAndMarketingExpenseMember2024-07-012024-09-300001057352us-gaap:SellingAndMarketingExpenseMember2023-07-012023-09-300001057352us-gaap:SellingAndMarketingExpenseMember2024-01-012024-09-300001057352us-gaap:SellingAndMarketingExpenseMember2023-01-012023-09-300001057352us-gaap:SoftwareDevelopmentMember2024-07-012024-09-300001057352us-gaap:SoftwareDevelopmentMember2023-07-012023-09-300001057352us-gaap:SoftwareDevelopmentMember2024-01-012024-09-300001057352us-gaap:SoftwareDevelopmentMember2023-01-012023-09-300001057352us-gaap:GeneralAndAdministrativeExpenseMember2024-07-012024-09-300001057352us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001057352us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-300001057352us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001057352csgp:ArlingtonVAMember2024-02-290001057352csgp:ArlingtonOfficeTowerMember2024-02-012024-02-290001057352csgp:ArlingtonOfficeTowerMemberus-gaap:LandMember2024-02-012024-02-290001057352csgp:ArlingtonOfficeTowerMemberus-gaap:BuildingMember2024-02-012024-02-290001057352csgp:ArlingtonOfficeTowerMemberus-gaap:LandBuildingsAndImprovementsMember2024-02-012024-02-290001057352us-gaap:AboveMarketLeasesMembercsgp:ArlingtonOfficeTowerMember2024-02-012024-02-290001057352us-gaap:LeasesAcquiredInPlaceMembercsgp:ArlingtonOfficeTowerMember2024-02-012024-02-290001057352csgp:A2020CreditAgreementMembercsgp:RevolvingLoansAndLettersOfCreditMember2020-07-010001057352csgp:A2020CreditAgreementMemberus-gaap:LetterOfCreditMember2020-07-010001057352csgp:CoStarMembercsgp:NorthAmericaSegmentMember2024-07-012024-09-300001057352csgp:CoStarMembercsgp:InternationalSegmentMember2024-07-012024-09-300001057352csgp:CoStarMember2024-07-012024-09-300001057352csgp:CoStarMembercsgp:NorthAmericaSegmentMember2023-07-012023-09-300001057352csgp:CoStarMembercsgp:InternationalSegmentMember2023-07-012023-09-300001057352csgp:CoStarMember2023-07-012023-09-300001057352csgp:InformationServicesMembercsgp:NorthAmericaSegmentMember2024-07-012024-09-300001057352csgp:InformationServicesMembercsgp:InternationalSegmentMember2024-07-012024-09-300001057352csgp:InformationServicesMember2024-07-012024-09-300001057352csgp:InformationServicesMembercsgp:NorthAmericaSegmentMember2023-07-012023-09-300001057352csgp:InformationServicesMembercsgp:InternationalSegmentMember2023-07-012023-09-300001057352csgp:InformationServicesMember2023-07-012023-09-300001057352csgp:MultifamilyProductAndServiceMembercsgp:NorthAmericaSegmentMember2024-07-012024-09-300001057352csgp:MultifamilyProductAndServiceMembercsgp:InternationalSegmentMember2024-07-012024-09-300001057352csgp:MultifamilyProductAndServiceMember2024-07-012024-09-300001057352csgp:MultifamilyProductAndServiceMembercsgp:NorthAmericaSegmentMember2023-07-012023-09-300001057352csgp:MultifamilyProductAndServiceMembercsgp:InternationalSegmentMember2023-07-012023-09-300001057352csgp:MultifamilyProductAndServiceMember2023-07-012023-09-300001057352csgp:LoopNetMembercsgp:NorthAmericaSegmentMember2024-07-012024-09-300001057352csgp:LoopNetMembercsgp:InternationalSegmentMember2024-07-012024-09-300001057352csgp:LoopNetMember2024-07-012024-09-300001057352csgp:LoopNetMembercsgp:NorthAmericaSegmentMember2023-07-012023-09-300001057352csgp:LoopNetMembercsgp:InternationalSegmentMember2023-07-012023-09-300001057352csgp:LoopNetMember2023-07-012023-09-300001057352csgp:ResidentialMembercsgp:NorthAmericaSegmentMember2024-07-012024-09-300001057352csgp:ResidentialMembercsgp:InternationalSegmentMember2024-07-012024-09-300001057352csgp:ResidentialMember2024-07-012024-09-300001057352csgp:ResidentialMembercsgp:NorthAmericaSegmentMember2023-07-012023-09-300001057352csgp:ResidentialMembercsgp:InternationalSegmentMember2023-07-012023-09-300001057352csgp:ResidentialMember2023-07-012023-09-300001057352csgp:OtherMarketplacesMembercsgp:NorthAmericaSegmentMember2024-07-012024-09-300001057352csgp:OtherMarketplacesMembercsgp:InternationalSegmentMember2024-07-012024-09-300001057352csgp:OtherMarketplacesMember2024-07-012024-09-300001057352csgp:OtherMarketplacesMembercsgp:NorthAmericaSegmentMember2023-07-012023-09-300001057352csgp:OtherMarketplacesMembercsgp:InternationalSegmentMember2023-07-012023-09-300001057352csgp:OtherMarketplacesMember2023-07-012023-09-300001057352csgp:NorthAmericaSegmentMember2024-07-012024-09-300001057352csgp:InternationalSegmentMember2024-07-012024-09-300001057352csgp:NorthAmericaSegmentMember2023-07-012023-09-300001057352csgp:InternationalSegmentMember2023-07-012023-09-300001057352csgp:CoStarMembercsgp:NorthAmericaSegmentMember2024-01-012024-09-300001057352csgp:CoStarMembercsgp:InternationalSegmentMember2024-01-012024-09-300001057352csgp:CoStarMember2024-01-012024-09-300001057352csgp:CoStarMembercsgp:NorthAmericaSegmentMember2023-01-012023-09-300001057352csgp:CoStarMembercsgp:InternationalSegmentMember2023-01-012023-09-300001057352csgp:CoStarMember2023-01-012023-09-300001057352csgp:InformationServicesMembercsgp:NorthAmericaSegmentMember2024-01-012024-09-300001057352csgp:InformationServicesMembercsgp:InternationalSegmentMember2024-01-012024-09-300001057352csgp:InformationServicesMember2024-01-012024-09-300001057352csgp:InformationServicesMembercsgp:NorthAmericaSegmentMember2023-01-012023-09-300001057352csgp:InformationServicesMembercsgp:InternationalSegmentMember2023-01-012023-09-300001057352csgp:InformationServicesMember2023-01-012023-09-300001057352csgp:MultifamilyProductAndServiceMembercsgp:NorthAmericaSegmentMember2024-01-012024-09-300001057352csgp:MultifamilyProductAndServiceMembercsgp:InternationalSegmentMember2024-01-012024-09-300001057352csgp:MultifamilyProductAndServiceMember2024-01-012024-09-300001057352csgp:MultifamilyProductAndServiceMembercsgp:NorthAmericaSegmentMember2023-01-012023-09-300001057352csgp:MultifamilyProductAndServiceMembercsgp:InternationalSegmentMember2023-01-012023-09-300001057352csgp:MultifamilyProductAndServiceMember2023-01-012023-09-300001057352csgp:LoopNetMembercsgp:NorthAmericaSegmentMember2024-01-012024-09-300001057352csgp:LoopNetMembercsgp:InternationalSegmentMember2024-01-012024-09-300001057352csgp:LoopNetMember2024-01-012024-09-300001057352csgp:LoopNetMembercsgp:NorthAmericaSegmentMember2023-01-012023-09-300001057352csgp:LoopNetMembercsgp:InternationalSegmentMember2023-01-012023-09-300001057352csgp:LoopNetMember2023-01-012023-09-300001057352csgp:ResidentialMembercsgp:NorthAmericaSegmentMember2024-01-012024-09-300001057352csgp:ResidentialMembercsgp:InternationalSegmentMember2024-01-012024-09-300001057352csgp:ResidentialMember2024-01-012024-09-300001057352csgp:ResidentialMembercsgp:NorthAmericaSegmentMember2023-01-012023-09-300001057352csgp:ResidentialMembercsgp:InternationalSegmentMember2023-01-012023-09-300001057352csgp:ResidentialMember2023-01-012023-09-300001057352csgp:OtherMarketplacesMembercsgp:NorthAmericaSegmentMember2024-01-012024-09-300001057352csgp:OtherMarketplacesMembercsgp:InternationalSegmentMember2024-01-012024-09-300001057352csgp:OtherMarketplacesMember2024-01-012024-09-300001057352csgp:OtherMarketplacesMembercsgp:NorthAmericaSegmentMember2023-01-012023-09-300001057352csgp:OtherMarketplacesMembercsgp:InternationalSegmentMember2023-01-012023-09-300001057352csgp:OtherMarketplacesMember2023-01-012023-09-300001057352csgp:NorthAmericaSegmentMember2024-01-012024-09-300001057352csgp:InternationalSegmentMember2024-01-012024-09-300001057352csgp:NorthAmericaSegmentMember2023-01-012023-09-300001057352csgp:InternationalSegmentMember2023-01-012023-09-3000010573522024-10-012024-09-300001057352csgp:CoStarMember2023-12-310001057352csgp:InformationServicesMember2023-12-310001057352srt:MultifamilyMember2023-12-310001057352csgp:LoopNetMember2023-12-310001057352csgp:OtherMarketplacesMember2023-12-310001057352csgp:CoStarMember2024-01-012024-09-300001057352csgp:InformationServicesMember2024-01-012024-09-300001057352srt:MultifamilyMember2024-01-012024-09-300001057352csgp:LoopNetMember2024-01-012024-09-300001057352csgp:OtherMarketplacesMember2024-01-012024-09-300001057352csgp:CoStarMember2024-09-300001057352csgp:InformationServicesMember2024-09-300001057352srt:MultifamilyMember2024-09-300001057352csgp:LoopNetMember2024-09-300001057352csgp:OtherMarketplacesMember2024-09-300001057352csgp:CoStarMember2022-12-310001057352csgp:InformationServicesMember2022-12-310001057352srt:MultifamilyMember2022-12-310001057352csgp:LoopNetMember2022-12-310001057352csgp:OtherMarketplacesMember2022-12-310001057352csgp:CoStarMember2023-01-012023-09-300001057352csgp:InformationServicesMember2023-01-012023-09-300001057352srt:MultifamilyMember2023-01-012023-09-300001057352csgp:LoopNetMember2023-01-012023-09-300001057352csgp:OtherMarketplacesMember2023-01-012023-09-300001057352csgp:CoStarMember2023-09-300001057352csgp:InformationServicesMember2023-09-300001057352srt:MultifamilyMember2023-09-300001057352csgp:LoopNetMember2023-09-300001057352csgp:OtherMarketplacesMember2023-09-300001057352csgp:OnTheMarketMember2023-12-120001057352csgp:OnTheMarketMember2023-12-122023-12-120001057352csgp:OnTheMarketMember2023-12-310001057352csgp:OnTheMarketMemberus-gaap:CustomerRelationshipsMember2023-12-012023-12-310001057352csgp:OnTheMarketMemberus-gaap:CustomerRelationshipsMember2023-12-310001057352csgp:OnTheMarketMemberus-gaap:TradeNamesMember2023-12-012023-12-310001057352csgp:OnTheMarketMemberus-gaap:TradeNamesMember2023-12-310001057352csgp:OnTheMarketMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-12-012023-12-310001057352csgp:OnTheMarketMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310001057352csgp:OnTheMarketMember2023-12-012023-12-310001057352csgp:OnTheMarketMembercsgp:NorthAmericaSegmentMember2023-12-012023-12-310001057352csgp:MatterportMember2024-04-210001057352csgp:MatterportMember2024-04-212024-04-210001057352csgp:MatterportMembersrt:ScenarioForecastMember2025-01-012025-03-310001057352us-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMember2024-09-300001057352us-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMember2023-12-310001057352us-gaap:FairValueInputsLevel2Memberus-gaap:CashEquivalentsMember2024-09-300001057352us-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMember2024-09-300001057352us-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMember2023-12-310001057352us-gaap:FairValueInputsLevel2Memberus-gaap:CashEquivalentsMember2023-12-310001057352us-gaap:FairValueInputsLevel2Member2024-09-300001057352us-gaap:FairValueInputsLevel2Member2023-12-310001057352csgp:NorthAmericaSegmentMember2022-12-310001057352csgp:InternationalSegmentMember2022-12-310001057352csgp:NorthAmericaSegmentMember2023-01-012023-12-310001057352csgp:InternationalSegmentMember2023-01-012023-12-3100010573522023-01-012023-12-310001057352csgp:NorthAmericaSegmentMember2023-12-310001057352csgp:InternationalSegmentMember2023-12-310001057352csgp:NorthAmericaSegmentMember2024-09-300001057352csgp:InternationalSegmentMember2024-09-300001057352csgp:OnTheMarketMembercsgp:InternationalSegmentMember2023-01-012023-12-310001057352us-gaap:DevelopedTechnologyRightsMember2024-09-300001057352us-gaap:DevelopedTechnologyRightsMember2023-12-310001057352us-gaap:DevelopedTechnologyRightsMember2024-01-012024-09-300001057352us-gaap:CustomerContractsMember2024-09-300001057352us-gaap:CustomerContractsMember2023-12-310001057352us-gaap:CustomerContractsMember2024-01-012024-09-300001057352us-gaap:TradeNamesMember2024-09-300001057352us-gaap:TradeNamesMember2023-12-310001057352us-gaap:TradeNamesMember2024-01-012024-09-300001057352us-gaap:AboveMarketLeasesMember2024-09-300001057352us-gaap:AboveMarketLeasesMember2023-12-310001057352us-gaap:AboveMarketLeasesMember2024-01-012024-09-300001057352us-gaap:LeasesAcquiredInPlaceMember2024-09-300001057352us-gaap:LeasesAcquiredInPlaceMember2023-12-310001057352us-gaap:LeasesAcquiredInPlaceMember2024-01-012024-09-300001057352csgp:A2.800SeniorNotesMember2020-07-010001057352csgp:A2.800SeniorNotesMember2024-09-300001057352csgp:A2.800SeniorNotesMember2023-12-310001057352csgp:A2020CreditAgreementMember2024-09-300001057352csgp:A2020CreditAgreementMember2023-12-310001057352csgp:CreditAgreement2024Member2024-09-300001057352csgp:CreditAgreement2024Member2023-12-310001057352csgp:A2.800SeniorNotesMember2020-07-012020-07-010001057352csgp:CreditAgreement2024Membercsgp:RevolvingLoansAndLettersOfCreditMember2024-05-240001057352csgp:CreditAgreement2024Membercsgp:RevolvingLoansAndLettersOfCreditMember2024-05-242024-05-240001057352csgp:CreditAgreement2024Memberus-gaap:LetterOfCreditMember2024-05-240001057352csgp:CreditAgreement2024Memberus-gaap:LetterOfCreditMembercsgp:AlternateBaseRateMembersrt:MinimumMember2024-05-242024-05-240001057352csgp:CreditAgreement2024Memberus-gaap:LetterOfCreditMembercsgp:AlternateBaseRateMembersrt:MaximumMember2024-05-242024-05-240001057352csgp:CreditAgreement2024Memberus-gaap:LetterOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MinimumMember2024-05-242024-05-240001057352csgp:CreditAgreement2024Memberus-gaap:LetterOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MaximumMember2024-05-242024-05-240001057352csgp:CreditAgreement2024Membercsgp:RevolvingLoansAndLettersOfCreditMember2024-01-012024-09-300001057352csgp:A2020CreditAgreementMembercsgp:RevolvingLoansAndLettersOfCreditMember2024-09-300001057352us-gaap:OtherAssetsMembercsgp:A2020CreditAgreementMember2024-09-300001057352us-gaap:OtherAssetsMembercsgp:A2020CreditAgreementMember2023-12-310001057352us-gaap:OperatingSegmentsMembercsgp:NorthAmericaSegmentMember2024-07-012024-09-300001057352us-gaap:OperatingSegmentsMembercsgp:NorthAmericaSegmentMember2023-07-012023-09-300001057352us-gaap:OperatingSegmentsMembercsgp:NorthAmericaSegmentMember2024-01-012024-09-300001057352us-gaap:OperatingSegmentsMembercsgp:NorthAmericaSegmentMember2023-01-012023-09-300001057352us-gaap:OperatingSegmentsMembercsgp:InternationalSegmentMember2024-07-012024-09-300001057352us-gaap:OperatingSegmentsMembercsgp:InternationalSegmentMember2023-07-012023-09-300001057352us-gaap:OperatingSegmentsMembercsgp:InternationalSegmentMember2024-01-012024-09-300001057352us-gaap:OperatingSegmentsMembercsgp:InternationalSegmentMember2023-01-012023-09-300001057352us-gaap:OperatingSegmentsMembercsgp:NorthAmericaSegmentMember2024-09-300001057352us-gaap:OperatingSegmentsMembercsgp:NorthAmericaSegmentMember2023-12-310001057352us-gaap:OperatingSegmentsMembercsgp:InternationalSegmentMember2024-09-300001057352us-gaap:OperatingSegmentsMembercsgp:InternationalSegmentMember2023-12-310001057352csgp:NeptuneLLCMemberus-gaap:SubsequentEventMember2024-10-182024-10-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission file number 0-24531

CoStar Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 52-2091509 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 1331 L Street, NW |

| Washington, | DC | 20005 |

(Address of principal executive offices) (Zip Code)

(202) 346-6500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock ($0.01 par value) | CSGP | Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

As of October 21, 2024, there were 409,959,517 shares of the registrant’s common stock outstanding.

COSTAR GROUP, INC.

FORM 10-Q

TABLE OF CONTENTS

| | | | | | | | | | | |

| | | |

| | | |

| PART I | | FINANCIAL INFORMATION | |

| | | |

| Item 1. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

| | | |

| | | |

| | | |

| | | | |

| | | |

| | | | |

| | | |

| Item 2. | | | |

| | | |

| Item 3. | | | |

| | | |

| Item 4. | | | |

| | | |

| PART II | | OTHER INFORMATION | |

| | | |

| Item 1. | | | |

| | | |

| Item 1A. | | | |

| | | |

| Item 2. | | | |

| | | |

| Item 3. | | | |

| | | |

| Item 4. | | | |

| | | |

| Item 5. | | | |

| | | |

| Item 6. | | | |

| | | |

| |

Glossary of Terms

The following abbreviations or acronyms used in this Quarterly Report on Form 10-Q (this "Report") are defined below:

| | | | | |

| Abbreviation or Acronym | Definition |

| 2020 Credit Agreement | The second amended and restated credit agreement, dated July 1, 2020, which amended and restated in its entirety the then-existing credit agreement originally entered into on April 1, 2014, as amended by the first amendment to the second amended and restated credit agreement, dated May 8, 2023 and was replaced by the 2024 Credit Agreement in May 2024 |

| 2023 Form 10-K | CoStar Group's Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 21, 2024 |

2024 Credit Agreement | On May 24, 2024, the Company entered into a credit agreement replacing the Company’s 2020 Credit Agreement |

| ASU | Accounting Standards Update |

| Business Immo | The legal entity BIH, a French société par actions simplifiée, the owner and operator of Business Immo, a leading commercial real estate news service provider in France |

| |

| CECL | Current expected credit losses |

CODM | Chief Operating Decision Maker |

| CoStar Group (also the “Company,” “we,” “us” or “our”) | The legal entity, CoStar Group, Inc., a Delaware corporation, one or more of its consolidated subsidiaries or operating segments, or the entirety of CoStar Group, Inc. and its consolidated subsidiaries |

| CoStar Group Share | A share of the common stock of the Company, par value $0.01 per share |

| CoStar UK | The legal entity, CoStar UK Limited, a wholly owned subsidiary of CoStar Group |

| CRI | CoStar Realty Information, Inc., a Delaware corporation and wholly owned subsidiary of CoStar Group, Inc. |

| DSUs | Deferred Stock Units |

| EBITDA | Net income before interest income or expense, net; other income or expense, net; loss on debt extinguishment; income taxes; depreciation; and amortization |

| ESG | Environmental, Social, and Governance |

| ESPP | Employee Stock Purchase Plan |

| EURIBOR | Euro Interbank Offered Rate |

| FASB | Financial Accounting Standards Board |

FTC | The Federal Trade Commission |

| GAAP | Generally accepted accounting principles in the U.S. |

| GILTI | Global intangible low taxed income inclusion |

Homes Group | The legal entity Homes Group, LLC |

| Homes.com | The flagship brand of our North American residential products and a homes for-sale listings site, which manages workflow and marketing for residential real estate agents and brokers and allows homebuyers to view residential property listings, research communities, and connect with real estate agents and brokers |

Homes.com Acquisition | CRI's acquisition of Homes.com completed on May 24, 2021 pursuant to a securities purchase agreement dated April 14, 2021 between Landmark, Homes Group, LLC, and CRI |

| |

| |

| |

HSR Act | The Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended |

| Land.com Network | Our network of sites featuring rural lands for sale, including: Land.com, LandsofAmerica.com, LandAndFarm.com, and LandWatch.com |

Landmark | Landmark Media Enterprise, LLC |

| LIBOR | London Interbank Offered Rate |

| Matching RSUs | Awards of matching restricted stock units awarded under the Company's Management Stock Purchase Plan |

| | | | | |

| Abbreviation or Acronym | Definition |

| Matterport | Matterport, Inc., a Delaware corporation and provider of a technology platform that uses spatial data to transform physical buildings and spaces into dimensionally-accurate digital images |

| Matterport Common Stock | Each share of Matterport Class A common stock, par value $0.0001 per share |

| Merger Sub I | Matrix Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of the Company |

| Merger Sub II | Matrix Merger Sub II LLC, a Delaware limited liability company and wholly owned subsidiary of the Company |

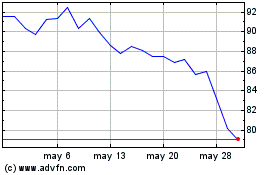

| Merger Exchange Ratio | A ratio determined based on the average of the volume-weighted average prices at which the CoStar Group Shares trade on Nasdaq Global Select Market for the 20 consecutive Trading Days (as defined in the Merger Agreement) ending on (and including) the Trading Day that is three Trading Days prior to the date of the First Effective Time (the “Average CoStar Group Share Price”) and shall be subject to a symmetrical collar, applied as follows: (i) if the Average CoStar Group Share Price is greater than or equal to $94.62 (the “Ceiling Price”), then the Merger Exchange Ratio shall be set at 0.02906; (ii) if the Average CoStar Group Share Price is less than or equal to $77.42 (the “Floor Price”), then the Merger Exchange Ratio shall be set at 0.03552; or (iii) if the Average CoStar Group Share Price is greater than the Floor Price and less than the Ceiling Price, then the Merger Exchange Ratio shall be equal to the quotient of (x) $2.75 divided by (y) the Average CoStar Group Share Price |

| MLS | Multiple Listing Services |

| MSPP | Management Stock Purchase Plan |

Neptune Merger Sub | Neptune V Merger Sub LLC, a Delaware limited liability company and a wholly-owned subsidiary of CRI |

OnTheMarket | The legal entity OnTheMarket Limited (formerly OnTheMarket Plc), the operator of onthemarket.com, a U.K. residential property portal |

OnTheMarket Acquisition | CoStar UK's acquisition of OnTheMarket completed in December 2023, pursuant to Rule 2.7 of the United Kingdom City Code on Takeovers and Mergers. The acquisition was implemented by means of a court-sanctioned scheme of arrangement under the U.K. Companies Act 2006 |

| ROU | Right-of-use |

SaaS | Software as a service |

| SEC | U.S. Securities and Exchange Commission |

Securities Act | Securities Act of 1933, as amended |

| Senior Notes | 2.800% notes issued by CoStar Group, Inc. due July 15, 2030 |

| SOFR | Secured Overnight Financing Rate |

| SONIA | Sterling Overnight Index Average |

| STR | STR, LLC, together with STR Global Ltd., is a global data and analytics company that specializes in benchmarking hotel performance and providing market insights to the industry |

| Ten-X | The legal entity Ten-X Holding Company, Inc. and its directly and indirectly owned subsidiaries |

| Term SOFR | The forward-looking SOFR term rates administered by CME Group Benchmark Administration Limited |

| U.K. | The United Kingdom of Great Britain and Northern Ireland |

| U.S. | The United States of America |

Visual Lease, LLC | The legal entity Visual Lease, LLC, a Delaware limited liability company, and operator of Visual Lease, a SaaS platform for integrated lease management and lease accounting |

Visual Lease Merger Agreement | The agreement and plan of merger dated on October 18, 2024 between CRI, Neptune Merger Sub, Visual Lease, LLC and Shareholder Representative Services LLC as the Holder Representative, pursuant to which, among other things, and subject to its terms, Neptune Merger Sub will merge with and into Visual Lease, LLC with Visual Lease, LLC surviving the merger as a wholly-owned subsidiary of the CRI |

PART I — FINANCIAL INFORMATION

Item 1.Financial Statements

COSTAR GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | $ | 692.6 | | | $ | 624.7 | | | $ | 2,026.8 | | | $ | 1,814.9 | |

| Cost of revenues | 140.6 | | | 123.7 | | | 417.6 | | | 355.2 | |

| Gross profit | 552.0 | | | 501.0 | | | 1,609.2 | | | 1,459.7 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Selling and marketing (excluding customer base amortization) | 331.2 | | | 266.9 | | | 1,055.7 | | | 743.2 | |

| Software development | 81.0 | | | 67.9 | | | 243.0 | | | 197.8 | |

| General and administrative | 105.8 | | | 94.4 | | | 314.3 | | | 274.4 | |

| Customer base amortization | 10.3 | | | 10.2 | | | 31.5 | | | 31.3 | |

| 528.3 | | | 439.4 | | | 1,644.5 | | | 1,246.7 | |

| Income (loss) from operations | 23.7 | | | 61.6 | | | (35.3) | | | 213.0 | |

| Interest income, net | 55.6 | | | 58.4 | | | 165.3 | | | 153.9 | |

| Other (expense) income, net | (1.6) | | | 0.5 | | | (4.9) | | | 1.6 | |

| Income before income taxes | 77.7 | | | 120.5 | | | 125.1 | | | 368.5 | |

| Income tax expense | 24.7 | | | 29.9 | | | 46.2 | | | 90.3 | |

| Net income | $ | 53.0 | | | $ | 90.6 | | | $ | 78.9 | | | $ | 278.2 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Net income per share - basic | $ | 0.13 | | | $ | 0.22 | | | $ | 0.19 | | | $ | 0.69 | |

Net income per share - diluted | $ | 0.13 | | | $ | 0.22 | | | $ | 0.19 | | | $ | 0.68 | |

| | | | | | | |

Weighted-average outstanding shares - basic | 406.8 | | | 405.6 | | | 406.2 | | | 405.2 | |

Weighted-average outstanding shares - diluted | 408.0 | | | 407.2 | | | 407.6 | | | 406.7 | |

| | | | | | | |

See accompanying notes.

COSTAR GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 53.0 | | | $ | 90.6 | | | $ | 78.9 | | | $ | 278.2 | |

| Other comprehensive income (loss), net of tax | | | | | | | |

| Foreign currency translation adjustment | 18.0 | | | (6.7) | | | 13.5 | | | 0.8 | |

| Total other comprehensive income (loss), net of tax | 18.0 | | | (6.7) | | | 13.5 | | | 0.8 | |

| Total comprehensive income | $ | 71.0 | | | $ | 83.9 | | | $ | 92.4 | | | $ | 279.0 | |

| | | | | | | |

| | | | | | | |

See accompanying notes.

COSTAR GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions)

(unaudited)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 4,937.6 | | | $ | 5,215.9 | |

| Accounts receivable | 202.4 | | | 213.2 | |

| Less: Allowance for credit losses | (23.6) | | | (23.2) | |

| Accounts receivable, net | 178.8 | | | 190.0 | |

| | | |

| Prepaid expenses and other current assets | 78.7 | | | 70.2 | |

| Total current assets | 5,195.1 | | | 5,476.1 | |

| | | |

| Deferred income taxes, net | 4.3 | | | 4.3 | |

| Property and equipment, net | 937.8 | | | 472.2 | |

| Lease right-of-use assets | 79.2 | | | 79.8 | |

| Goodwill | 2,396.6 | | | 2,386.2 | |

| Intangible assets, net | 324.7 | | | 313.7 | |

| Deferred commission costs, net | 173.0 | | | 167.7 | |

| Deposits and other assets | 26.0 | | | 17.7 | |

| Income tax receivable | 2.0 | | | 2.0 | |

| Total assets | $ | 9,138.7 | | | $ | 8,919.7 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| | | |

| Accounts payable | $ | 84.4 | | | $ | 23.1 | |

| Accrued wages and commissions | 105.5 | | | 117.8 | |

| Accrued expenses and other current liabilities | 188.1 | | | 163.0 | |

| | | |

| Income taxes payable | 8.9 | | | 7.7 | |

| Lease liabilities | 38.9 | | | 40.0 | |

| Deferred revenue | 113.6 | | | 104.2 | |

| Total current liabilities | 539.4 | | | 455.8 | |

| | | |

| Long-term debt, net | 991.5 | | | 990.5 | |

| Deferred income taxes, net | 12.8 | | | 36.7 | |

| Income taxes payable | 23.9 | | | 18.2 | |

| Lease and other long-term liabilities | 80.0 | | | 79.9 | |

| Total liabilities | 1,647.6 | | | 1,581.1 | |

| | | |

| Total stockholders' equity | 7,491.1 | | | 7,338.6 | |

| Total liabilities and stockholders' equity | $ | 9,138.7 | | | $ | 8,919.7 | |

See accompanying notes.

COSTAR GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In Capital | | Accumulated

Other

Comprehensive Loss | | Retained

Earnings | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | |

| Balance at December 31, 2023 | 408.1 | | | $ | 4.1 | | | $ | 5,147.8 | | | $ | (17.6) | | | $ | 2,204.3 | | | $ | 7,338.6 | |

| Net income | — | | | — | | | — | | | — | | | 6.7 | | | 6.7 | |

Other comprehensive loss | — | | | — | | | — | | | (4.3) | | | — | | | (4.3) | |

| | | | | | | | | | | |

| Restricted stock grants | 1.4 | | | — | | | — | | | — | | | — | | | — | |

| Restricted stock grants surrendered | (0.4) | | | — | | | (24.5) | | | — | | | — | | | (24.5) | |

| Employee stock purchase plan | 0.1 | | | — | | | 5.2 | | | — | | | — | | | 5.2 | |

| Management stock purchase plan | — | | | — | | | (1.5) | | | — | | | — | | | (1.5) | |

| Stock-based compensation expense | — | | | — | | | 22.4 | | | — | | | — | | | 22.4 | |

| Balance at March 31, 2024 | 409.2 | | | $ | 4.1 | | | $ | 5,149.4 | | | $ | (21.9) | | | $ | 2,211.0 | | | $ | 7,342.6 | |

| Net income | — | | | — | | | — | | | — | | | 19.2 | | | 19.2 | |

Other comprehensive loss | — | | | — | | | — | | | (0.2) | | | — | | | (0.2) | |

| Exercise of stock options | 0.1 | | | — | | | 7.1 | | | — | | | — | | | 7.1 | |

| Restricted stock grants | 0.1 | | | — | | | — | | | — | | | — | | | — | |

| Restricted stock grants surrendered | (0.2) | | | — | | | (0.7) | | | — | | | — | | | (0.7) | |

| Employee stock purchase plan | 0.1 | | | — | | | 6.0 | | | — | | | — | | | 6.0 | |

| Management stock purchase plan | — | | | — | | | (0.2) | | | — | | | — | | | (0.2) | |

| Stock-based compensation expense | — | | | — | | | 21.9 | | | — | | | — | | | 21.9 | |

| Balance at June 30, 2024 | 409.3 | | | $ | 4.1 | | | $ | 5,183.5 | | | $ | (22.1) | | | $ | 2,230.2 | | | $ | 7,395.7 | |

| Net income | — | | | — | | | — | | | — | | | 53.0 | | | 53.0 | |

| Other comprehensive income | — | | | — | | | — | | | 18.0 | | | — | | | 18.0 | |

| | | | | | | | | | | |

| Restricted stock grants | 0.2 | | | — | | | — | | | — | | | — | | | — | |

| Restricted stock grants surrendered | (0.1) | | | — | | | (1.9) | | | — | | | — | | | (1.9) | |

| Employee stock purchase plan | 0.1 | | | — | | | 5.0 | | | — | | | — | | | 5.0 | |

| | | | | | | | | | | |

| Stock-based compensation expense | — | | | — | | | 21.3 | | | — | | | — | | | 21.3 | |

| Balance at September 30, 2024 | 409.5 | | | $ | 4.1 | | | $ | 5,207.9 | | | $ | (4.1) | | | $ | 2,283.2 | | | $ | 7,491.1 | |

See accompanying notes.

COSTAR GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-In Capital | | Accumulated

Other

Comprehensive Loss | | Retained

Earnings | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | |

| Balance at December 31, 2022 | 406.7 | | | $ | 4.1 | | | $ | 5,065.5 | | | $ | (29.1) | | | $ | 1,829.6 | | | $ | 6,870.1 | |

| Net income | — | | | — | | | — | | | — | | | 87.1 | | | 87.1 | |

| Other comprehensive income | — | | | — | | | — | | | 4.1 | | | — | | | 4.1 | |

| Exercise of stock options | — | | | — | | | 0.5 | | | — | | | — | | | 0.5 | |

| Restricted stock grants | 1.3 | | | — | | | — | | | — | | | — | | | — | |

| Restricted stock grants surrendered | (0.5) | | | — | | | (18.6) | | | — | | | — | | | (18.6) | |

| Employee stock purchase plan | 0.1 | | | — | | | 5.8 | | | — | | | — | | | 5.8 | |

| Management stock purchase plan | — | | | — | | | (3.0) | | | — | | | — | | | (3.0) | |

| Stock-based compensation expense | — | | | — | | | 19.6 | | | — | | | — | | | 19.6 | |

| Balance at March 31, 2023 | 407.6 | | | $ | 4.1 | | | $ | 5,069.8 | | | $ | (25.0) | | | $ | 1,916.7 | | | $ | 6,965.6 | |

| Net income | — | | | — | | | — | | | — | | | 100.5 | | | 100.5 | |

| Other comprehensive income | — | | | — | | | — | | | 3.4 | | | — | | | 3.4 | |

| Exercise of stock options | 0.4 | | | — | | | 7.0 | | | — | | | — | | | 7.0 | |

| | | | | | | | | | | |

| Restricted stock grants surrendered | (0.1) | | | — | | | (0.8) | | | — | | | — | | | (0.8) | |

| Employee stock purchase plan | 0.1 | | | — | | | 3.9 | | | — | | | — | | | 3.9 | |

| | | | | | | | | | | |

| Stock-based compensation expense | — | | | — | | | 21.5 | | | — | | | — | | | 21.5 | |

| Balance at June 30, 2023 | 408.0 | | | $ | 4.1 | | | $ | 5,101.4 | | | $ | (21.6) | | | $ | 2,017.2 | | | $ | 7,101.1 | |

| Net income | — | | | — | | | — | | | — | | | 90.6 | | | 90.6 | |

| Other comprehensive loss | — | | | — | | | — | | | (6.7) | | | — | | | (6.7) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Restricted stock grants surrendered | — | | | — | | | (1.0) | | | — | | | — | | | (1.0) | |

| Employee stock purchase plan | 0.1 | | | — | | | 4.7 | | | — | | | — | | | 4.7 | |

| | | | | | | | | | | |

| Stock-based compensation expense | — | | | — | | | 21.5 | | | — | | | — | | | 21.5 | |

| Balance at September 30, 2023 | 408.1 | | | $ | 4.1 | | | $ | 5,126.6 | | | $ | (28.3) | | | $ | 2,107.8 | | | $ | 7,210.2 | |

See accompanying notes.

COSTAR GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| 2024 | | 2023 |

| Operating activities: | | | |

| Net income | $ | 78.9 | | | $ | 278.2 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 107.6 | | | 78.8 | |

| Amortization of deferred commissions costs | 86.1 | | | 69.8 | |

| Amortization of Senior Notes discount and issuance costs | 2.3 | | | 1.8 | |

| Non-cash lease expense | 25.1 | | | 22.1 | |

| Stock-based compensation expense | 67.3 | | | 63.8 | |

| Deferred income taxes, net | (15.4) | | | (13.0) | |

| Credit loss expense | 25.8 | | | 25.7 | |

| Other operating activities, net | (0.6) | | | 0.3 | |

| | | |

| Changes in operating assets and liabilities, net of acquisitions: | | | |

| Accounts receivable | (13.7) | | | (64.6) | |

| Prepaid expenses and other current assets | (8.3) | | | (20.7) | |

| Deferred commissions | (91.7) | | | (93.1) | |

| Accounts payable and other liabilities | 57.9 | | | 21.1 | |

| Lease liabilities | (29.9) | | | (26.8) | |

| Income taxes payable, net | (1.7) | | | 4.4 | |

| Deferred revenue | 8.2 | | | (6.1) | |

| Other assets | 0.1 | | | (0.7) | |

| Net cash provided by operating activities | 298.0 | | | 341.0 | |

| | | |

| Investing activities: | | | |

| | | |

| Proceeds from sale of property and equipment and other assets | 1.4 | | | — | |

Purchases of property, equipment, and other assets for new campuses | (509.6) | | | (61.8) | |

Purchases of property, equipment, and other assets | (49.5) | | | (14.2) | |

| | | |

| Cash paid for acquisitions, net of cash acquired | (5.1) | | | — | |

| Net cash used in investing activities | (562.8) | | | (76.0) | |

| | | |

| Financing activities: | | | |

| | | |

| | | |

| Repurchase of restricted stock to satisfy tax withholding obligations | (28.7) | | | (23.4) | |

| | | |

| Proceeds from exercise of stock options and employee stock purchase plan | 21.7 | | | 20.4 | |

| Payments of debt issuance costs | (3.4) | | | — | |

Principal repayments of finance lease obligations | (3.4) | | | — | |

| | | |

Net cash used in financing activities | (13.8) | | | (3.0) | |

| | | |

| Effect of foreign currency exchange rates on cash and cash equivalents | 0.3 | | | (0.1) | |

Net (decrease) increase in cash and cash equivalents | (278.3) | | | 261.9 | |

| Cash and cash equivalents at the beginning of period | 5,215.9 | | | 4,968.0 | |

| Cash and cash equivalents at the end of period | $ | 4,937.6 | | | $ | 5,229.9 | |

| | | |

| Supplemental cash flow disclosures: | | | |

| Interest paid | $ | 29.8 | | | $ | 30.0 | |

| Income taxes paid | $ | 63.4 | | | $ | 108.1 | |

| | | |

| Supplemental non-cash investing and financing activities: | | | |

| | | |

| Accrued capital expenditures and non-cash landlord incentives | $ | 47.8 | | | $ | 36.9 | |

| | | |

See accompanying notes.

COSTAR GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

1.ORGANIZATION

CoStar Group (the “Company”) provides information and analytics to the commercial real estate and related business community through its comprehensive, proprietary database of commercial real estate information and related tools. The Company also provides online marketplaces for commercial real estate, apartment rentals, residential real estate, land for sale, and businesses for sale. The Company's services are typically distributed to its customers under subscription-based agreements that typically renew automatically, a majority of which have a term of at least one year. The Company operates within two operating segments, North America, which includes the U.S. and Canada, and International, which primarily includes Europe, Asia-Pacific, and Latin America.

The Company acquired OnTheMarket in December 2023. Through the previous Homes.com Acquisition and the OnTheMarket Acquisition, the Company also offers online platforms that provide advertising and marketing services for residential real estate agents and brokers and their listings and provide homebuyers access to residential property listings. See Note 5 for further discussion of the OnTheMarket Acquisition.

2.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation. Accounting policies are consistent for each operating segment.

Interim Financial Statements

The accompanying unaudited condensed consolidated financial statements of the Company have been prepared in accordance with GAAP for interim financial information. In the opinion of the Company’s management, the financial statements reflect all adjustments, consisting only of a normal recurring nature, necessary to present fairly the Company’s financial position at September 30, 2024 and December 31, 2023, the results of its operations for the three and nine months ended September 30, 2024 and 2023, its comprehensive income for the three and nine months ended September 30, 2024 and 2023, its changes in stockholders' equity for the three and nine months ended September 30, 2024 and 2023, and its cash flows for the nine months ended September 30, 2024 and 2023.

Certain notes and other information have been condensed or omitted from the interim financial statements presented in this Report. Therefore, these financial statements should be read in conjunction with the Company’s 2023 Form 10-K.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. On an ongoing basis, the Company evaluates its estimates and assumptions, including those related to revenue recognition, allowance for credit losses, the useful lives and recoverability of long-lived and intangible assets, goodwill, income taxes, accounting for business combinations, stock-based compensation, estimating the Company's incremental borrowing rate for its leases, and contingencies, among others. The Company bases these estimates on historical and anticipated results, trends, and various other assumptions that it believes are reasonable, including assumptions as to future events. These estimates form the basis for making judgments about the carrying values of assets and liabilities and recorded revenues and expenses. Actual results could differ from these estimates.

Revenue Recognition

The Company derives revenues primarily by (i) providing access to its proprietary database of commercial real estate information, including benchmarking and analytics for the hospitality industry and analytics for lenders (ii) providing online marketplaces for professional property management companies, property owners, and real estate agents and brokers, and landlords, in each case, typically through a fixed monthly fee for its subscription-based advertising services. Other subscription-based services include (i) real estate and lease management solutions to commercial customers and real estate investors, (ii)

COSTAR GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

access to applications to manage workflow for residential real estate agents, and (iii) market research and portfolio and debt analysis, management, and reporting capabilities.

Subscription contract rates are generally based on the number of sites, number of users, organization size, the customer’s business focus, geography, the number of properties reported on or analyzed, the number and types of services to which a customer subscribes, the number of properties a customer advertises, the number of transactions and average transaction size a broker or agent has closed, and the prominence and placement of a customer's advertised properties in the search results. The Company’s subscription-based license or membership agreements typically renew automatically and a majority have a term of at least one year. Revenues from subscription-based contracts were approximately 96% and 95% of total revenues for the three months ended September 30, 2024 and 2023, respectively, and 96% and 95% of total revenues for the nine months ended September 30, 2024 and 2023, respectively.

The Company also derives revenues from transaction-based services, including: (i) an online auction platform for commercial real estate through Ten-X, (ii) providing online tenant applications, including background and credit checks and rental payment processing, and (iii) ancillary products and services that are sold on an ad hoc basis.

The Company analyzes contracts to determine the appropriate revenue recognition using the following steps: (i) identification of contracts with customers, (ii) identification of distinct performance obligations in the contract, (iii) determination of contract transaction price, (iv) allocation of contract transaction price to the performance obligations, and (v) determination of revenue recognition based on timing of satisfaction of the performance obligations.

The Company recognizes revenues upon the satisfaction of its performance obligation(s) (upon transfer of control of promised services to its customers) in an amount that reflects the consideration to which it expects to be entitled to in exchange for those services. Revenues from subscription-based services are recognized on a straight-line basis over the term of the agreement. Revenues from transaction-based services are recognized when the promised product or services are delivered, which, in the case of Ten-X auctions, is at the time of a successful closing for the sale of a property.

In limited circumstances, the Company's contracts with customers include promises to transfer multiple services, such as contracts for its subscription-based services and professional services. For these contracts, the Company accounts for individual performance obligations separately if they are distinct, which involves the determination of the standalone selling price for each distinct performance obligation.

Deferred revenue results from amounts billed in advance to customers or cash received from customers in advance of the Company's fulfillment of its performance obligation(s) and is recognized as those obligations are satisfied.

Contract assets represent a conditional right to consideration for satisfied performance obligations that become a receivable when the conditions are satisfied. Contract assets are generated when contractual billing schedules differ from revenue recognition timing.

Certain sales commissions are considered incremental and recoverable costs of obtaining a contract with a customer. Sales commissions incurred for obtaining new contracts are deferred and then amortized as selling and marketing expenses on a straight-line basis over a period of benefit that the Company has determined to be two years for our residential products and three years for all other products. The amortization periods were determined based on several factors, including the nature of the technology and proprietary data underlying the services being purchased, customer contract renewal rates, and industry competition. Sales commissions that do not represent incremental costs of obtaining a contract, or that would otherwise be amortized over a period of one year or less, are not subject to capitalization.

See Note 3 for further discussion of the Company's revenue.

Cost of Revenues

Cost of revenues principally consists of salaries, benefits, bonuses, stock-based compensation expenses, and other indirect costs for the Company's researchers who collect and analyze the real estate data that is the basis for the Company's information, analytic, and marketplace services and for employees that support these products. Additionally, cost of revenues includes the cost of data from third-party data sources, product hosting costs, costs related to advertising purchased on behalf of customers, credit card, and other transaction fees relating to processing customer transactions, which are expensed as incurred, and the amortization of acquired trade names, technology, and certain other intangible assets.

COSTAR GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

Foreign Currency

The Company’s reporting currency is the U.S. dollar. The functional currency for the majority of its operations is the local currency, with the exception of certain international locations for which the functional currency is the British Pound. Assets and liabilities denominated in a foreign currency are translated into U.S. dollars using the exchange rates in effect as of the balance sheet date. Gains and losses resulting from translation are included in accumulated other comprehensive loss. Currency gains and losses on the translation of intercompany loans made to foreign subsidiaries that are of a long-term investment nature are also included in accumulated other comprehensive loss. Gains and losses resulting from transactions denominated in a currency other than the functional currency of the entity are included in other (expense) income, net in the condensed consolidated statements of operations using the average exchange rates in effect during the period. The Company recognized a net foreign currency loss of $0.2 million for the three months ended September 30, 2024 and a net foreign currency gain of $0.2 million for the three months ended September 30, 2023. The Company recognized a net foreign currency loss of $0.3 million and $0.6 million for the nine months ended September 30, 2024 and 2023, respectively.

Accumulated Other Comprehensive Loss

The components of accumulated other comprehensive loss, net of tax, were as follows (in millions):

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

Foreign currency translation loss | $ | (4.1) | | | $ | (17.6) | |

Total accumulated other comprehensive loss | $ | (4.1) | | | $ | (17.6) | |

There were no amounts reclassified out of accumulated other comprehensive loss to the condensed consolidated statements of operations for the nine months ended September 30, 2024 and 2023.

Income Taxes

Deferred income taxes result from temporary differences between the tax basis of assets and liabilities and the basis reported in the Company’s condensed consolidated financial statements. Deferred tax liabilities and assets are determined based on the difference between the financial statement and the tax basis of assets and liabilities using enacted rates in effect during the year in which the Company expects differences to reverse. Valuation allowances are provided against assets, including net operating losses, if the Company determines it is more likely than not that some portion or all of an asset may not be realized. Interest and penalties related to income tax matters are recognized in income tax expense.

The Company has elected to record the GILTI under the current-period cost method.

See Note 11 for further discussion of the Company's accounting for income taxes.

Net Income Per Share

Net income per share is computed by dividing net income by the weighted-average number of common shares outstanding during the period on a basic and diluted basis.

COSTAR GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

The following table sets forth the calculation of basic and diluted net income per share (in millions, except per share data):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

Numerator: | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | |

| Net income | $ | 53.0 | | | $ | 90.6 | | | $ | 78.9 | | | $ | 278.2 | |

| Denominator: | | | | | | | |

| Denominator for basic net income per share — weighted-average outstanding shares | 406.8 | | | 405.6 | | | 406.2 | | | 405.2 | |

| Effect of dilutive securities: | | | | | | | |

| Stock options, restricted stock awards and restricted stock units | 1.2 | | | 1.6 | | | 1.4 | | | 1.5 | |

| Denominator for diluted net income per share — weighted-average outstanding shares | 408.0 | | | 407.2 | | | 407.6 | | | 406.7 | |

| | | | | | | | |

| Net income per share — basic | $ | 0.13 | | | $ | 0.22 | | | $ | 0.19 | | | $ | 0.69 | |

| Net income per share — diluted | $ | 0.13 | | | $ | 0.22 | | | $ | 0.19 | | | $ | 0.68 | |

The Company’s potentially dilutive securities include outstanding stock options, unvested stock-based awards, which include restricted stock awards that vest over a specific service period, restricted stock awards with a performance and market condition, restricted stock units, and Matching RSUs awarded under the MSPP. Shares underlying unvested restricted stock awards that vest based on a performance and a market condition that have not been achieved as of the end of the period are not included in the computation of basic or diluted earnings per share. Diluted net income per share considers the impact of potentially dilutive securities except when the inclusion of the potentially dilutive securities would have an anti-dilutive effect.

The following table summarizes the shares underlying the unvested performance-based restricted stock and anti-dilutive securities excluded from the basic and diluted earnings per share calculations (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Performance-based restricted stock awards | 0.7 | | | 0.7 | | | 0.7 | | | 0.7 | |

| Anti-dilutive securities | 0.7 | | | 0.4 | | | 0.9 | | | 0.8 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Stock-Based Compensation

Equity instruments issued in exchange for services performed by officers, employees, and directors of the Company are accounted for using a fair-value based method and the fair value of such equity instruments is recognized as expense in the condensed consolidated statements of operations.

For stock-based awards that vest over a specific service period, compensation expense is measured based on the fair value of the awards at the grant date and is recognized on a straight-line basis over the service period of the awards, net of an estimated forfeiture rate. For equity instruments that vest based on achievement of both a performance and market condition, stock-based compensation expense is recognized over the service period of the awards based on the expected achievement of the related performance conditions at the end of each reporting period. If the Company's initial estimates of the achievement of the performance conditions change, the related stock-based compensation expense may fluctuate from period to period based on those estimates. If the performance conditions are not met, no stock-based compensation expense will be recognized, and any previously recognized stock-based compensation expense will be reversed. For awards with both a performance and a market condition, the Company estimates the fair value of each equity instrument granted on the grant date using a Monte-Carlo simulation model. This pricing model uses multiple simulations to evaluate the probability of achieving the market condition to calculate the fair value of the awards, which includes the recent market price and volatility of the Company's shares. When determining the grant date fair value of all stock-based awards, the Company considers whether it is in possession of any

COSTAR GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

material, non-public information that upon its release would have a material effect on its share price, and if so, whether the observable share price or expected volatility assumptions used in determining the fair value of the awards should be adjusted.

Stock-based compensation expense for stock options, restricted stock awards and restricted stock units issued under equity incentive plans, stock purchases under the ESPP, DSUs, and Matching RSUs awarded under the MSPP included in the Company’s condensed consolidated statements of operations were as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenues | $ | 3.6 | | | $ | 3.7 | | | $ | 10.9 | | | $ | 10.6 | |

| Selling and marketing (excluding customer base amortization) | 2.9 | | | 2.4 | | | 8.4 | | | 7.0 | |

| Software development | 5.3 | | | 4.5 | | | 16.3 | | | 12.9 | |

| General and administrative | 10.0 | | | 11.3 | | | 31.7 | | | 33.3 | |

| Total stock-based compensation expense | $ | 21.8 | | | $ | 21.9 | | | $ | 67.3 | | | $ | 63.8 | |

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with a maturity of three months or less to be cash equivalents. The Company had no restricted cash as of September 30, 2024 and December 31, 2023.

Allowance for Credit Losses

The Company maintains an allowance for credit losses to cover its current expected credit losses on its trade receivables and contract assets arising from the failure of customers to make contractual payments. The Company estimates credit losses expected over the life of its trade receivables and contract assets based on historical information, current conditions that may affect a customer’s ability to pay, and reasonable and supportable forecasts. While the Company uses various credit quality metrics, it primarily monitors collectability by reviewing the duration of collection pursuits on its delinquent trade receivables and historical write-off trends. Based on the Company’s experience, the customer's delinquency status, which is analyzed periodically, is the strongest indicator of the credit quality of the underlying trade receivables. The Company’s policy is to write off trade receivables when they are deemed uncollectible. A majority of the Company's trade receivables are less than 365 days outstanding.

Under the CECL impairment model, the Company develops and documents its allowance for credit losses on its trade receivables based on five portfolio segments. The determination of portfolio segments is based primarily on the qualitative consideration of the nature of the Company’s business operations and the characteristics of the underlying trade receivables, as follows:

•CoStar Portfolio Segment - The CoStar portfolio segment consists of two classes of trade receivables based on geographical location: North America and International.

•Information Services Portfolio Segment - The Information Services portfolio segment consists of four classes of trade receivables: CoStar Real Estate Manager; Hospitality, North America; Hospitality, International; and other Information Services.

•Multifamily Portfolio Segment - The Multifamily portfolio segment consists of one class of trade receivables.

•LoopNet Portfolio Segment - The LoopNet portfolio segment consists of one class of trade receivables.

•Other Marketplaces Portfolio Segment - The Other Marketplaces portfolio segment consists of one class of trade receivables.

Residential accounts receivable and the related allowance for credit losses are not material.

See Note 4 for further discussion of the Company’s accounting for allowance for credit losses.

COSTAR GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

Leases

The determination of whether an arrangement contains a lease and the classification of a lease, if applicable, is made at the commencement of the arrangement, at which time the Company also measures and recognizes an ROU asset, representing the Company’s right to use the underlying asset, and a lease liability, representing the Company’s obligation to make lease payments under the terms of the arrangement. For the purposes of recognizing ROU assets and lease liabilities associated with the Company’s leases, the Company has elected the practical expedient to not recognize an ROU asset or lease liability for short-term leases, which are leases with a term of 12 months or less. The lease term is defined as the noncancelable portion of the lease term, plus any periods covered by an option to extend the lease if it is reasonably certain that the option will be exercised.

In determining the amount of lease payments used in measuring ROU assets and lease liabilities, the Company has elected the practical expedient not to separate non-lease components from lease components for all classes of underlying assets. Consideration deemed part of the lease payments used to measure ROU assets and lease liabilities generally includes fixed payments and variable payments based on either an index or a rate, offset by lease incentives. Upon commencement, the initial ROU asset also includes any lease prepayments. ROU assets and liabilities are recognized at the lease commencement date based on the present value of lease payments over the lease term. The rates implicit within the Company's leases are generally not determinable. Therefore, the Company's incremental borrowing rate is used to determine the present value of lease payments. The determination of the Company’s incremental borrowing rate requires judgment and is determined at lease commencement and is subsequently reassessed upon a modification to the lease arrangement.

Lease costs related to the Company's operating leases are generally recognized as a single ratable lease cost over the lease term.

Finance lease costs primarily relate to vehicles used by the Company's research teams and the amortization of the ROU assets are recorded to cost of revenues in the consolidated statements of operations. The impact of lease costs related to short-term leases was not material for the three and nine months ended September 30, 2024 and 2023.

See Note 7 for further discussion of the Company’s accounting for leases.

Long-Lived Assets, Intangible Assets and Goodwill

Long-lived assets, such as property and equipment and purchased intangibles that are subject to amortization, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company capitalizes interest on borrowings during the active construction period of major capital projects. Capitalized interest is added to the cost of the underlying asset and amortized over the estimated useful life of the asset. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to the estimated undiscounted future cash flows expected to be generated by the asset or asset group. If the carrying amount of an asset exceeds its estimated undiscounted future cash flows, an impairment charge is recognized in the amount by which the carrying amount of the asset exceeds the fair value of the asset. The Company removes the cost and accumulated amortization of intangible assets as they become fully amortized.

Goodwill is tested for impairment at least annually, on October 1, or more frequently if an event or other circumstance indicates that the fair value of a reporting unit may be below its carrying amount. The Company may first assess qualitative factors to evaluate whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount, or elect to bypass the qualitative assessment. If it is determined that it is more likely than not that the fair value of a reporting unit is less than its carrying value, or the Company elects to bypass the qualitative assessment, the Company then performs a quantitative assessment by determining the fair value of each reporting unit. The estimate of the fair value of each reporting unit is based on a projected discounted cash flow model that includes significant assumptions and estimates, including the discount rate, growth rate, and future financial performance. Assumptions about the discount rate are based on a weighted average cost of capital for comparable companies. Assumptions about the growth rate and future financial performance of a reporting unit are based on the Company’s forecasts, business plans, economic projections, and anticipated future cash flows. The fair value of each reporting unit is compared to the carrying amount of the reporting unit. If the carrying value of the reporting unit exceeds the fair value, then an impairment loss is recognized for the difference.

COSTAR GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

Leasing Operations and Other Income, Expense

In February 2024, the Company closed on the purchase of an office tower and the land on which it rests in Arlington, Virginia and intends to build out space to house the employees currently in our Washington, DC headquarters and support anticipated growth and expansion of its operations in the coming years. Maintenance, physical facilities, leasing, property management, and other key responsibilities related to property ownership are outsourced to professional real-estate managers. The office tower measures approximately 550,000 rentable square feet.

The Company records the activity from this building's operations and leases, including building depreciation and operating expenses for space occupied by third parties, as other (expense) income, net in the condensed consolidated statements of operations, as leasing is not core to the Company's operations. Building depreciation and operating expenses for space occupied by the Company are allocated between cost of revenues, selling and marketing (excluding customer base amortization), software development, and general and administrative expenses in the condensed consolidated statement of operations based on headcount. As of September 30, 2024, the Company occupied a negligible percentage of the property with the remainder leased or available to be leased to third parties.

Lease income includes base rent each tenant pays in accordance with the terms of its respective lease and is reported on a straight-line basis over the non-cancellable term of the lease, which includes the effects of periodic step-ups in rent and rent abatements under the lease. When a renewal option is included within the lease, the Company assesses whether the option is reasonably certain of being exercised against relevant economic factors to determine whether the option period should be included as part of the lease term. Further, lease income includes tenant reimbursement amounts for the recovery of the operating expenses and real estate taxes. Tenant reimbursements, which vary each period, are non-lease components that are not the predominant activity within the contract. The Company has elected the practical expedient that allows it to combine certain lease and non-lease components of operating leases. Non-lease components are recognized together with fixed base rent in "lease income," as variable lease income in the same period as the related expenses are incurred. Variable lease income was not material for the three and nine months ended September 30, 2024. Components of other (expense) income, net related to leasing operations for the three and nine months ended September 30, 2024 were as follows (in millions):

| | | | | | | | | | | |

| Three Months Ended

September 30, 2024 | | Nine Months Ended September 30, 2024 |

| Lease income | $ | 6.6 | | | $ | 16.4 | |

| Property operating expenses | 2.5 | | | 6.7 | |

| Depreciation and amortization expense | 5.4 | | | 14.3 | |

| Other expense, net from leasing operations | $ | (1.3) | | | $ | (4.6) | |

The Company accounted for the purchase of this building as an asset acquisition at the cost to acquire, including transaction costs. The Company estimated the fair values of acquired tangible assets (consisting of land, buildings, improvements, and other assets), identified intangible assets and liabilities (consisting of in-place leases and above- and below-market leases), and other liabilities based on its evaluation of information and estimates available at the date of acquisition. Based on these estimates, the Company allocated the total cost to the identified assets acquired and liabilities assumed based on their relative fair value.

The fair value of the building and building improvements consists of the physical structure containing rentable area, as well as amenities such as parking structures, and was valued as if vacant, using the cost approach, which uses replacement cost data obtained from industry recognized guides less depreciation as an input to estimate the fair value, with consideration given to its age, functionality, use classification, construction quality, replacement cost new, and accumulated depreciation (effective age vs. economic life). The Company also considered the value of the building using an income approach. The income approach uses market leasing assumptions to estimate the fair value of the property as if vacant assuming lease-up at prevailing market rental rates over a market-based lease-up period, including deductions for lost-rent during lease-up and leasing costs. The cost and income approaches are reconciled to arrive at an estimated building fair value. The Company assessed the fair value of land based on market comparisons.

COSTAR GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

The fair values of identified intangible assets and liabilities were determined based on the following:

•The value allocable to the above- or below-market component of an acquired in-place lease is determined based upon the present value (using a discount rate that reflects the risks associated with the acquired lease) of the difference between: (i) the contractual amounts to be received pursuant to the lease over its remaining term and (ii) management's estimate of the amounts that would be received using market rates current at the time of the acquisition for the remaining term of the lease. Amounts allocated to above-market leases are recorded as above-market leases in intangible assets, net in the condensed consolidated balance sheets. These intangible assets are amortized on a straight-line basis as a reduction to lease income which is recorded within other (expense) income, net in the condensed consolidated statements of operations over the remaining terms of the respective leases.

•Factors considered in determining the value allocable to in-place leases during hypothetical lease-up periods related to space that is leased at the time of acquisition include: (i) lost rent and operating cost recoveries during the hypothetical lease-up period and (ii) theoretical leasing commissions required to execute similar leases. These intangible assets are recorded as in-place leases in intangible assets, net in the condensed consolidated balance sheets and are amortized to other (expense) income, net in the condensed consolidated statements of operations over the remaining term of the existing lease.

The total cost of the land and building was $343.0 million and was allocated to the following components (in millions):

| | | | | | | | | |

| Component | Balance Sheet Caption | Amount | |

| Land | Property and equipment, net | $ | 17.2 | | |

| Building | Property and equipment, net | 224.5 | | |

| Land and building improvements | Property and equipment, net | 27.5 | | |

| Above-market leases | Intangible assets, net | 41.7 | | |

| In-place leases | Intangible assets, net | 32.1 | | |

| | $ | 343.0 | | |

The cash paid for this asset acquisition was included in the caption purchases of property, equipment, and other assets for new campuses in the condensed consolidated statement of cash flows.

COSTAR GROUP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

Debt Issuance Costs