Eos Energy Enterprises, Inc. (NASDAQ: EOSE) ("Eos" or the

“Company”), a leading provider of safe, scalable, efficient, and

sustainable zinc-based long duration energy storage systems, today

announced the successful achievement of all four of the first

performance milestones previously agreed upon between Eos and an

affiliate of Cerberus Capital Management LP (“Cerberus”) as part of

Cerberus’s strategic investment in the Company. Achieving these

specific performance milestones allows the Company to draw an

additional $30 million on the Delayed Draw Term Loan from Cerberus

to fund ongoing operations and production expansion to meet the

growing demand for long duration energy storage solutions.

The achieved milestones include objectives

related to the Company’s automated production line, materials

cost-out, improvements in Z3 technology performance and

backlog/cash conversion. Among the key accomplishments, Eos has

successfully achieved production cycle times of less than 10

seconds while exceeding first pass yield targets in the high 90s on

its first state-of-the-art battery manufacturing line, a

significant milestone that positions the company for future

profitability.

“The team continues to execute on our

operational targets and today’s announcement is a testament to

their effort and focus,” said Nathan Kroeker, Eos Chief Financial

Officer. “The partnership with Cerberus is demonstrating its

strategic value as we execute our growth plans and bring a

commercially scalable and ready alternative to market to meet the

emerging need for longer duration energy storage that is safe,

secure and manufactured in the US.”

The remaining two tranches may be drawn in the

amounts of $65 million and $40.5 million, respectively, following

the October 31, 2024, and January 31, 2025, testing dates upon the

achievement of the applicable performance milestones.

Special Stockholder Meeting The

Company will hold a virtual Special Meeting of Stockholders on

September 10, 2024, at 10:00 a.m. Eastern Time where stockholders

will be asked to consider and vote on two important proposals

related to Cerberus’s strategic investment in the Company that are

crucial to the company's strategic growth.

The Board of Directors recommends that

stockholders vote FOR the Issuance Cap Proposal

and FOR the Adjournment Proposal.

Only stockholders of record as of the close of

business on July 31, 2024, are entitled to vote. You can vote

online, by telephone, or by mailing your proxy card. For more

detailed instructions on how to vote, please refer to the proxy

materials sent to you or contact Eos’ Investor Relations at

ir@eose.com. Your voice as a stockholder remains crucial in shaping

the future of Eos, and every vote counts.

About Eos Energy EnterprisesEos

Energy Enterprises, Inc. is accelerating the shift to clean energy

with positively ingenious solutions that transform how the world

stores power. Our breakthrough Znyth™ aqueous zinc battery was

designed to overcome the limitations of conventional lithium-ion

technology. It is safe, scalable, efficient, sustainable,

manufactured in the U.S., and the core of our innovative systems

that today provides utility, industrial, and commercial customers

with a proven, reliable energy storage alternative for 3 to 12-hour

applications. Eos was founded in 2008 and is headquartered in

Edison, New Jersey. For more information about Eos (NASDAQ: EOSE),

visit eose.com.

| Contacts |

|

Investors: |

ir@eose.com |

| Media: |

media@eose.com |

Important Information and Where You Can Find

It

This press release may be deemed to be

solicitation material in respect of a vote of stockholders to

approve the issuance of more than 19.99% of the outstanding common

stock under the warrants and the convertibility of preferred stock

issued or issuable as part of the financing transaction entered

into on June 21, 2024 (the “Financing”). In connection with the

requisite stockholder approval, Eos filed on August 8, 2024, a

definitive proxy statement (the “Definitive Proxy Statement”),

which is available at the SEC’s website (http://www.sec.gov) and

has been sent to the stockholders of Eos, seeking certain approvals

related to the exercisability of the warrants and the

convertibility of the preferred stock issued or issuable pursuant

to the Financing.

INVESTORS AND SECURITY HOLDERS OF EOS AND THEIR

RESPECTIVE AFFILIATES ARE URGED TO READ THE DEFINITIVE PROXY

STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED

WITH THE SEC IN CONNECTION WITH THE FINANCING, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT EOS AND THE FINANCING.

Investors and security holders will be able to obtain a free copy

of the proxy statement, as well as other relevant documents filed

with the SEC containing information about Eos, without charge, at

the SEC’s website (http://www.sec.gov). Copies of documents filed

with the SEC can also be obtained, without charge, by directing a

request to Investor Relations, Eos Energy Enterprises, Inc. at

862-207-7955 or email ir@eose.com.

Participants in the Solicitation of

Proxies in Connection with Financing

Eos and certain of its respective directors,

executive officers and employees may be deemed under the rules of

the SEC to be participants in the solicitation of proxies with

respect to the requisite stockholder approval related to the

Financing. Information regarding Eos directors and officers is

available in (i) its definitive proxy statement for the 2024 annual

stockholders meeting, which was filed with the SEC on April 2,

2024, and (ii) its current reports on Form 8-K filed by Eos on June

24, 2024, and July 29, 2024. Other information regarding the

participants in the solicitation of proxies in respect to the

Financing and the description of their direct and indirect

interests, as security holders or otherwise, is contained in the

Definitive Proxy Statement and other relevant materials to be filed

by Eos with the SEC. Free copies of these documents, when

available, may be obtained as described in the preceding

paragraph.

Forward Looking Statements

Except for the historical information contained

herein, the matters set forth in this press release are

forward-looking statements within the meaning of the "safe harbor"

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include, but are not limited to,

statements regarding our expected revenue, contribution margins,

orders backlog and opportunity pipeline for the fiscal year ended

December 31, 2024, our path to profitability and strategic outlook,

the tax credits available to our customers or to Eos pursuant to

the Inflation Reduction Act of 2022, the delayed draw term loan,

milestones thereunder and the anticipated use of proceeds

therefrom, the ability to draw under the delayed draw term loan,

statements regarding our ability to secure final approval of a loan

from the Department of Energy LPO, or our anticipated use of

proceeds from any loan facility provided by the US Department of

Energy, statements that refer to outlook, projections, forecasts or

other characterizations of future events or circumstances,

including any underlying assumptions. The words "anticipate,"

"believe," "continue," "could," "estimate," "expect," "intends,"

"may," "might," "plan," "possible," "potential," "predict,"

"project," "should," "would" and similar expressions may identify

forward-looking statements, but the absence of these words does not

mean that a statement is not forward-looking. Forward-looking

statements are based on our management’s beliefs, as well as

assumptions made by, and information currently available to, them.

Because such statements are based on expectations as to future

financial and operating results and are not statements of fact,

actual results may differ materially from those projected.

Factors which may cause actual results to differ

materially from current expectations include, but are not limited

to: changes adversely affecting the business in which we are

engaged; our ability to forecast trends accurately; our ability to

generate cash, service indebtedness and incur additional

indebtedness; our ability to achieve the operational milestones on

the delayed draw term loan; our ability to raise financing in the

future, including the discretionary revolving facility from

Cerberus; our customers’ ability to secure project financing; the

amount of final tax credits available to our customers or to Eos

pursuant to the Inflation Reduction Act, uncertainties around our

ability to meet the applicable conditions precedent and secure

final approval of a loan, in a timely manner or at all from the

Department of Energy, Loan Programs Office, or the timing of

funding and the final size of any loan that is approved; the

possibility of a government shutdown while we work to meet the

applicable conditions precedent and finalize loan documents with

the U.S. Department of Energy Loan Programs Office or while we

await notice of a decision regarding the issuance of a loan from

the Department Energy Loan Programs Office; our ability to continue

to develop efficient manufacturing processes to scale and to

forecast related costs and efficiencies accurately; fluctuations in

our revenue and operating results; competition from existing or new

competitors; our ability to convert firm order backlog and pipeline

to revenue; risks associated with security breaches in our

information technology systems; risks related to legal proceedings

or claims; risks associated with evolving energy policies in the

United States and other countries and the potential costs of

regulatory compliance; risks associated with changes to the U.S.

trade environment; risks resulting from the impact of global

pandemics, including the novel coronavirus, Covid-19; our ability

to maintain the listing of our shares of common stock on NASDAQ;

our ability to grow our business and manage growth profitably,

maintain relationships with customers and suppliers and retain our

management and key employees; risks related to the adverse changes

in general economic conditions, including inflationary pressures

and increased interest rates; risk from supply chain disruptions

and other impacts of geopolitical conflict; changes in applicable

laws or regulations; the possibility that Eos may be adversely

affected by other economic, business, and/or competitive factors;

other factors beyond our control; risks related to adverse changes

in general economic conditions; and other risks and

uncertainties.

The forward-looking statements contained in this

press release are also subject to additional risks, uncertainties,

and factors, including those more fully described in the Company’s

most recent filings with the SEC, including the Company’s most

recent Annual Report on Form 10-K and subsequent reports on Forms

10-Q and 8-K. Further information on potential risks that could

affect actual results will be included in the subsequent periodic

and current reports and other filings that the Company makes with

the SEC from time to time. Moreover, the Company operates in a very

competitive and rapidly changing environment, and new risks and

uncertainties may emerge that could have an impact on the

forward-looking statements contained in this press release.

Forward-looking statements speak only as of the

date they are made. Readers are cautioned not to put undue reliance

on forward-looking statements, and, except as required by law, the

Company assumes no obligation and does not intend to update or

revise these forward-looking statements, whether as a result of new

information, future events, or otherwise.

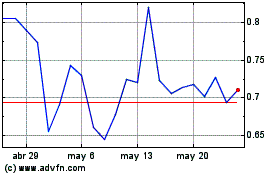

Eos Energy Enterprises (NASDAQ:EOSE)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Eos Energy Enterprises (NASDAQ:EOSE)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024