false

0001507605

0001507605

2024-12-09

2024-12-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 9, 2024

MARA

HOLDINGS, INC.

(Exact

name of Registrant as Specified in Its Charter)

| Nevada |

|

001-36555 |

|

01-0949984 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

101

NE Third Avenue, Suite 1200

Fort Lauderdale, FL 33301

(Address of principal executive offices and zip code)

(800)

804-1690

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common

Stock |

|

MARA |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01. Regulation FD Disclosure.

BTC

Yield

From

October 1, 2024 to December 9, 2024, the MARA Holdings, Inc.’s (the “Company”) BTC Yield was 12.3%. From January 1,

2024 to December 9, 2024, the Company’s BTC Yield was 47.6%.

BTC

Yield is a key performance indicator (“KPI”) that represents the percentage change period-to-period of the ratio between

the Company’s bitcoin holdings and its Assumed Fully Diluted Shares Outstanding. Assumed Fully Diluted Shares Outstanding refers

to the aggregate of the Company’s actual shares of common stock outstanding as of the end of the applicable period plus all additional

shares that would result from the assumed conversion of all outstanding convertible notes, exercise of all outstanding warrants and settlement

of all outstanding restricted stock units and performance-based restricted stock units. The Company uses BTC Yield as a KPI to help assess

the performance of its bitcoin acquisition and HODL strategy and whether the Company is using equity capital in a manner the Company

believes is accretive to shareholders as it pertains to its bitcoin holdings. The Company believes this KPI can be used to supplement

an investor’s understanding of the Company’s decision to fund the purchase of bitcoin by issuing additional shares of its

common stock or instruments convertible to common stock.

BTC

Yield and Basic and Assumed Fully Diluted Shares Outstanding

| | |

12/31/2023 | |

9/30/2024 | |

12/9/2024 |

| Total Bitcoin Holdings | |

| 15,174 | | |

| 26,747 | | |

| 40,435 | |

| Shares Outstanding (in ‘000s) | |

| | | |

| | | |

| | |

| Common Stock | |

| 242,829 | | |

| 304,913 | | |

| 339,282 | |

| Basic Shares Outstanding | |

| 242,829 | | |

| 304,913 | | |

| 339,282 | |

| | |

| | | |

| | | |

| | |

| 2026 Convertible Shares (November 2021 issuance) | |

| 5,969 | | |

| 5,969 | | |

| 1,321 | |

| 2030 Convertible Shares (November 2024 issuance) | |

| - | | |

| - | | |

| 55,006 | |

| 2031 Convertible Shares (August 2024 issuance) | |

| - | | |

| 19,854 | | |

| 19,854 | |

| 2031 Convertible Shares (December 2024 issuance) | |

| - | | |

| - | | |

| 34,413 | |

| Warrants | |

| 324 | | |

| 324 | | |

| 324 | |

| RSUs/PSUs Unvested | |

| 5,766 | | |

| 10,872 | | |

| 10,059 | |

| | |

| | | |

| | | |

| | |

| Assumed Fully Diluted Shares Outstanding (1) | |

| 254,888 | | |

| 341,993 | | |

| 460,260 | |

| BTC Yield % (Quarter to Date) | |

| | | |

| | | |

| 12.3 | % |

| BTC Yield % (Year to Date) | |

| | | |

| | | |

| 47.6 | % |

| |

(1) |

Assumed

Fully Diluted Shares Outstanding refers to the aggregate of our Basic Shares Outstanding as of the end of each period plus all additional

shares that would result from the assumed conversion of all outstanding convertible notes, exercise of all outstanding stock warrants,

and settlement of all outstanding restricted stock units and performance-based restricted stock units. Assumed Fully Diluted Shares

Outstanding is not calculated using the treasury method and does not take into account any vesting conditions (in the case of equity

awards), the exercise price of any warrants or any contractual conditions limiting convertibility of convertible debt instruments. |

Important

Information about BTC Yield KPI

BTC

Yield is a KPI that represents the percentage change period-to-period of the ratio between the Company’s bitcoin holdings and its

Assumed Fully Diluted Shares Outstanding. Assumed Diluted Fully Shares Outstanding refers to the aggregate of the Company’s actual

shares of common stock outstanding as of the end of each period plus all additional shares that would result from the assumed conversion

of all outstanding convertible notes, exercise of all outstanding warrants, and settlement of all outstanding restricted stock units

and performance stock units. Assumed Fully Diluted Shares Outstanding is not calculated using the treasury method and does not take into

account any vesting conditions (in the case of equity awards), the exercise price of any warrants or any contractual conditions limiting

convertibility of convertible debt instruments.

The

Company uses BTC Yield as a KPI to help assess the performance of its bitcoin acquisition and HODL strategy and whether the Company is

using equity capital in a manner the Company believes is accretive to shareholders as it pertains to its bitcoin holdings. The Company

believes this KPI can be used to supplement an investor’s understanding of its decision to fund the purchase of bitcoin by issuing

additional shares of its common stock or instruments convertible to common stock. When the Company uses this KPI, management also takes

into account the various limitations of this metric, including that it does not take into account debt and other liabilities and claims

on company assets that would be senior to common equity and that it assumes that all indebtedness will be refinanced or, in the case

of the Company’s senior convertible debt instruments, converted into shares of common stock in accordance with their respective

terms.

Additionally,

this KPI is not, and should not be understood as, an operating performance measure or a financial or liquidity measure. In particular,

BTC Yield is not equivalent to “yield” in the traditional financial context. It is not a measure of the return on investment

the Company’s shareholders may have achieved historically or can achieve in the future by purchasing stock of the Company, or a

measure of income generated by the Company’s operations or its bitcoin holdings, return on investment on its bitcoin holdings,

or any other similar financial measure of the performance of its business or assets.

The

trading price of the Company’s common stock is informed by numerous factors in addition to the amount of bitcoins the Company holds

and number of actual or potential shares of its stock outstanding, and as a result, the market value of the Company’s shares may

trade at a discount or a premium relative to the market value of the bitcoin the Company holds, and BTC Yield is not indicative nor predictive

of the trading price of the Company’s shares of common stock.

As

noted above, this KPI is narrow in its purpose and is used by management to assist it in assessing the performance of its bitcoin acquisition

and HODL strategy and whether the Company is using equity capital in a manner the Company believes is accretive to shareholders as it

pertains to its bitcoin holdings.

In

calculating this KPI, the Company does not take into account the source of capital used for the acquisition of its bitcoin. The Company

notes in particular, it has acquired bitcoin using proceeds from its at-the-market offering program as well as the offerings of its convertible

senior notes, which at the time of issuance had, and may from time-to-time thereafter have, conversion prices above the current trading

prices of the Company’s common stock, or as to which the holders of such convertible notes may not then be entitled to exercise

the conversion rights of the notes. Such offerings have had the effect of increasing the BTC Yield without taking into account the corresponding

debt. If any of the Company’s convertible senior notes mature or are redeemed without being converted into common stock, the Company

may be required to sell shares in quantities greater than the shares such notes are convertible into or generate cash proceeds from the

sale of bitcoin, either of which would have the effect of decreasing the BTC Yield due to changes in the Company’s bitcoin holdings

and shares in ways that were not contemplated by the assumptions in calculating BTC Yield. Accordingly, this metric might overstate or

understate the accretive nature of the Company’s use of equity or equity-linked capital to buy bitcoin.

The

Company determines its KPI targets based on its historical and future goals. The Company’s ability to achieve positive BTC Yield

may depend on a variety of factors, including its ability to generate cash from operations in excess of its fixed charges and other expenses,

as well as factors outside of its control, such as the availability of debt and equity financing on favorable terms. Past performance

is not indicative of future results.

The

Company has historically not paid any dividends on its shares of common stock, and by presenting this KPI the Company makes no suggestion

that it intends to do so in the future. Ownership of common stock does not represent an ownership interest in the bitcoin the Company

holds.

Investors

should rely on the financial statements and other disclosures contained in the Company’s SEC filings. This KPI is merely a supplement

to, not a substitute for, such information. Investors should exercise caution when assessing our BTC Yield given its limited purpose

and many limitations.

Furnished

Information

The

information in this Item 7.01 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as expressly set forth by specific reference in such filing.

The

Company announces material information to the public about the Company through a variety of means, including filings with the Securities

and Exchange Commission, press releases, public conference calls, webcasts, the investor relations section of its website (www.ir.mara.com)

and certain social media channels, including its X (formerly known as Twitter) account (@MARAHoldings) and its LinkedIn page, in order

to achieve broad, non-exclusionary distribution of information to the public and for complying with its disclosure obligations under

Regulation FD.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

December 10, 2024

| |

MARA HOLDINGS, INC. |

| |

|

|

| |

By: |

/s/

Zabi Nowaid |

| |

Name: |

Zabi

Nowaid |

| |

Title: |

General

Counsel and Corporate Secretary |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

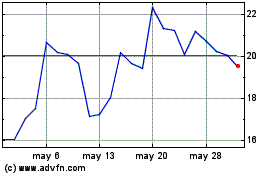

MARA (NASDAQ:MARA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

MARA (NASDAQ:MARA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024