Are Meta and Google Crumbling in the Face of Macro-Economic Headwinds?

28 Octubre 2022 - 11:58AM

Finscreener.org

Shares of Meta

Platforms (NASDAQ:

META) tanked close to 25%

yesterday after the social media giant announced its Q3 results

after the market closed on October 25. It reported adjusted

earnings of $1.64 per share, significantly lower than estimates of

$1.91 per share. The company’s revenue stood at $27.71 billion,

marginally higher than estimates of $27.53

billion.

However, sales were down 4%

compared to the year-ago period due to falling average ad prices

that declined by 18% year over year. Meta stock is now down 73%

from all-time highs. It continues to wrestle with a slowdown in ad

spending, Apple’s (NASDAQ: AAPL)

privacy changes, and rising competition from

TikTok.

Further, shares of

Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), the parent company of Google, also fell

almost 10% yesterday as it disappointed investors with Q3 results.

Its revenue growth slowed to just 6% in Q3 compared to 41% in the

year-ago period as online ad spending remains tepid. Ad revenue for

YouTube fell 2% to $7.07 billion, compared to estimates of $7.42

billion.

Tech giant Apple has cut

production targets for its iPhone 14 line-up of smartphones,

while Microsoft (NASDAQ:

MSFT) also reported its

slowest revenue growth in the last five years. It seems like

big-tech stocks are likely to remain volatile in the near

term.

Let’s see what impacted the

performance of the two largest digital advertising companies in the

world in Q3 of 2022.

Meta is investing heavily in the metaverse

Meta forecast sales between $30

billion and $32.5 billion in Q4, compared to estimates of $32.2

billion. The company has now posted two consecutive quarters of

revenue declines, and investors are expecting the trend to continue

in Q4 as well.

While revenue was down 4% in Q3,

Meta’s expenses surged 19% year over year to $22.1 billion, while

operating income fell by 46% to $5.66 billion, indicating an

operating margin of just 20% compared to 36% in the year-ago

quarter.

Meta’s Reality Labs business

which includes investments in the metaverse segment, fell by over

50% to $285 million. However, this business reported a loss of

$3.67 billion, much higher than the $2.63 billion loss in the

year-ago period. In the first three quarters of 2022, Reality Labs

has burnt $9.4 billion.

In fact, Meta emphasized

operating losses for Reality Labs will grow significantly year over

year in 2023, making investors extremely nervous. The company

explained, “We do anticipate that Reality Labs operating losses in

2023 will grow significantly year-over-year. Beyond 2023, we expect

to pace Reality Labs investments such that we can achieve our goal

of growing overall company operating income in the long

run.”

Meta stock is now down trading at levels last

seen in 2016, underperforming the broader markets by a significant

margin

Lower ad spending impacting Alphabet stock

According to Google’s chief

business officer, Philipp Schindler, the digital advertising

behemoth experienced a pullback in spending on digital ad verticals

such as loans, mortgages, insurance, and

cryptocurrencies.

In order to combat a challenging

macro environment, Sundar Pichai claimed the company is “sharpening

our focus on a clear set of product and business priorities,” while

Ruth Porat, the finance chief, said, “we’re working to realign

resources to fuel our highest growth priorities.”

Google Cloud remained the

fastest-growing business for Alphabet, and this segment reported

sales of $6.9 billion in Q3, compared to $5 billion in the year-ago

quarter. However, losses for Google Cloud rose to almost $700

million from $644 million in Q3 of 2021.

Pichai explained Alphabet would

look to drive its costs down to combat the current environment,

which includes rising inflation, higher interest rates, and the

possibility of a global recession.

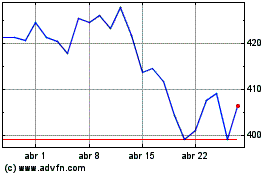

Microsoft (NASDAQ:MSFT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

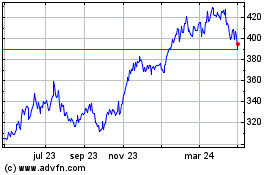

Microsoft (NASDAQ:MSFT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024