Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-248531

PROSPECTUS SUPPLEMENT

(To

prospectus dated October 2, 2020)

4,200,000

Shares

Common

Stock

We are offering 4,200,000

shares of our common stock, par value $0.00001 per share, pursuant to this prospectus supplement and the accompanying prospectus.

The offering price is $0.82 per share.

Pursuant to General Instruction

I.B.6 of Form S-3, in no event will we sell our common stock registered on the registration statement of which this prospectus supplement

forms a part in a public primary offering with a value exceeding more than one-third of the aggregate market value of our voting and

non-voting common equity held by non-affiliates in any 12-month period as long as the aggregate market value of our outstanding voting

and non-voting common equity held by non-affiliates remains below $75.0 million, as measured in accordance with General Instruction I.B.6

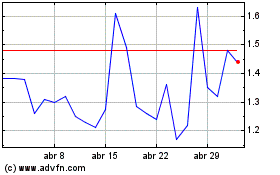

of Form S-3. The aggregate market value of our outstanding common stock held by non-affiliates, or the public float, was approximately

$19.0 million, which was calculated based upon 14,084,721 shares of our outstanding common stock held by non-affiliates at the per share

price of $1.35 on June 9, 2022, which was the highest closing price of our common stock on the Nasdaq Capital Market within the last

60 days prior to the date of this filing. One-third of our public float, calculated in accordance with General Instruction I.B.6 of Form

S-3 as of August 4, 2022, is equal to approximately $6.3 million. We have sold 49,326 shares of our common stock, raising gross

proceeds of $100,115, pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar months prior to and including the date

of this prospectus supplement.

Our

common stock is listed on the Nasdaq Capital Market under the symbol “NUZE.” On August 4, 2022, the closing sale price

of our common stock on the Nasdaq Capital Market was $1.16 per share.

Investing

in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-10 of this prospectus supplement

and in the documents we incorporate by reference into this prospectus supplement and the accompanying prospectus to read about factors

you should consider before buying shares of our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal

offense.

| | |

Per Share | | |

Total | |

| Public offering price | |

$ | 0.82 | | |

$ | 3,444,000 | |

| Underwriting discounts and commissions(1) | |

$ | 0.0574 | | |

$ | 241,080 | |

| Proceeds to us (before expenses) | |

$ | 0.7626 | | |

$ | 3,202,920 | |

| |

(1) |

We have agreed to reimburse the underwriter for certain

expenses in connection with this offering. See “Underwriting” beginning on page S-24 of this prospectus supplement

for additional information regarding total underwriter compensation. |

We

have granted a 45-day option to the underwriter to purchase up to an additional 630,000 shares of common stock solely to cover

overallotments, if any, at the public offering price, less underwriting discounts and commissions.

Mr. Sooncha Kim, who, as of

August 4, 2022, beneficially owned approximately 6% of our common stock, based on the Schedule 13G filed with the SEC on April 22, 2022,

has indicated to us that he may choose to purchase additional shares of common stock in this offering. The amount of such investment

could be a significant portion of the securities sold in this offering. However, because indications are not binding agreements or commitments

to purchase, Mr. Sooncha Kim may determine to purchase fewer shares or not to purchase any shares in this offering. In addition, the

underwriter could determine to sell fewer shares to Mr. Sooncha Kim than Mr. Sooncha Kim has an interest in purchasing or not to sell

any shares to Mr. Sooncha Kim. The underwriter will receive the same underwriting discount on any shares purchased by Mr. Sooncha Kim

as it will on any other shares sold to the public in this offering.

The

underwriter expects to deliver the shares of common stock against payment therefor on or about August 10, 2022.

Sole Book-Running Manager

Maxim

Group LLC

The

date of this prospectus supplement is August 7, 2022

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we filed with the Securities

and Exchange Commission, or SEC, utilizing a “shelf” registration process. This document is in two parts. The first part

is this prospectus supplement, which describes the specific terms of this offering of the shares of common stock and also adds to and

updates information contained in the accompanying prospectus and the information incorporated by reference therein. The second part,

the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus supplement, we are referring

to both parts of this document combined. To the extent that any statement that we make in this prospectus supplement is inconsistent

with statements made in the accompanying prospectus or any information incorporated by reference therein, the statements made in this

prospectus supplement will be deemed to modify or supersede those statements made in the accompanying prospectus and information incorporated

by reference therein.

We

are responsible for the information contained in this prospectus supplement, the accompanying prospectus, and the information incorporated

by reference herein and therein. We and the underwriter have not authorized any other person to provide you with any information or make

any representation other than that contained in this prospectus supplement and the accompanying prospectus and the information incorporated

by reference herein and therein. We and the underwriter take no responsibility for, and provide no assurance as to the reliability of,

any information that others may give you. The information contained or incorporated by reference in this prospectus supplement and the

accompanying prospectus is accurate only as of the date of this prospectus supplement, regardless of the time of delivery of this prospectus

supplement or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have

changed since that date. You should also read and consider the information in the documents to which we have referred you in the sections

entitled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” in this

prospectus supplement and in the accompanying prospectus, before investing in our common stock.

Neither

we nor the underwriter are making an offer to sell the shares of common stock in jurisdictions where the offer or sale is not permitted.

The distribution of this prospectus supplement and the offering of the shares of common stock in certain jurisdictions may be restricted

by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must

inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of

this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying

prospectus do not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which

such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to

any person to whom it is unlawful to make such offer or solicitation.

When

we refer to “NuZee,” “we,” “our,” “us” and the “Company” in this prospectus

supplement and the accompanying prospectus, we mean NuZee, Inc. and its subsidiaries on a consolidated basis, unless otherwise specified.

References to “you” refer to a prospective investor.

This

prospectus supplement and the accompanying prospectus may include trademarks, service marks and trade names owned by us or other companies.

All trademarks, service marks and trade names included in this prospectus supplement and the accompanying prospectus are the property

of their respective owners.

MARKET,

INDUSTRY AND OTHER DATA

This

prospectus supplement includes industry and market data that we obtained from periodic industry publications, third-party studies and

surveys, filings of public companies in our industry and internal company surveys. These sources may include government and industry

sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed

to be reliable. Although we believe the industry and market data to be reliable as of the date of this prospectus supplement, this information

could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and

because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data,

the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions

regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary provides a general overview of selected information from this prospectus supplement, the accompanying prospectus and the information

incorporated by reference. This summary does not contain all of the information that may be important to you before deciding to invest

in our common stock. We encourage you to carefully read this entire prospectus supplement, the accompanying prospectus, and the information

incorporated by reference herein or therein, especially the “Risk Factors” beginning on page S-10 of this prospectus supplement

and the “Risk Factors” section in each of our Annual Report on Form 10-K for the year ended September 30, 2021, and our subsequent

Quarterly Reports on Form 10-Q, before making an investment decision.

Overview

Our

Company

We

are a specialty coffee company and, we believe, a leading co-packer of single serve pour over coffee in the United States, as well as

a preeminent co-packer of coffee brew bags, which is also referred to as tea-bag style coffee. In addition to our portfolio of innovative

single serve pour over and coffee brew bag coffee products, we have recently expanded our product portfolio to offer a third type of

single serve coffee format, DRIPKIT pour over products, as a result of our acquisition of substantially all of the assets of Dripkit,

Inc. (“Dripkit”) in February 2022. Our new, premium DRIPKIT pour over format features a large-size single serve pour over

pack that sits on top of the cup and delivers in our view a barista-quality coffee experience to coffee drinkers in the United States.

Our mission is to leverage our position as a co-packer at the forefront of the North American single serve coffee market to revolutionize

the way single serve coffee is enjoyed in the United States. While the United States is our core market, we also have manufacturing and

sales operations in Korea and a joint venture in Latin America.

We

believe we are the only commercial-scale producer that has the dual capacity to pack both single serve pour over coffee and coffee brew

bag coffee within the North American market. We intend to leverage our position to become the commercial coffee manufacturer of choice

and aim to become the preeminent leader for coffee companies seeking to enter into and grow within the single serve coffee market in

North America. We are paid per-package based on the number of single serve coffee products produced by us. Accordingly, we consider our

business model to be a form of tolling arrangement, as we receive a fee for almost every single serve coffee product our co-packing customers

sell in the North American and Korean markets. While we financially benefit from the success of our co-packing customers through the

sales of their respective single serve coffee products, we believe we are also able to avoid the risks associated with owning and managing

the product and its related inventory.

We

have also developed and sell NuZee branded single serve coffee products, including our flagship Coffee Blenders line of both single serve

pour over coffee and coffee brew bag, or tea-bag style, coffee, which we believe offers consumers some of the best coffee available in

a single serve application in the world.

We

may also consider co-packaging other products that are complementary to our current product offerings and provide us with a deeper access

to our customers. In addition, we are continually exploring potential strategic partnerships, co-ventures, and mergers, acquisitions,

or other transactions with existing and future business partners to generate additional business, drive growth, reduce manufacturing

costs, expand our product portfolio, enter into new markets, and further penetrate the markets in which we currently operate.

What

is single serve pour over coffee?

Single

serve pour over coffee, or hand drip coffee, is a traditional and time-honored technique that pours hot water onto ground coffee with

a prepacked coffee filter. Proponents of pour over coffee believe this method makes better coffee. Single serve pour over coffee uses

the same brewing technique without a machine, with the coffee flowing straight into a cup using only hot water and the prepacked coffee

filter.

What

is coffee brew bag coffee?

We

introduced our coffee brew bag, or tea-bag style coffee, in 2019. The brewing method is similar to brewing tea; put the coffee brew bag

in a cup, add hot water and let it sit for approximately 5 minutes. This coffee brewing method is relatively new to North America and

we believe has gained attention from roasters and end consumers who desire eco-friendlier alternatives to coffee pods and other types

of single serve coffee. Our coffee brew bags are intended to be industrially compostable, allowing consumers to deposit the used coffee

brew bag in the curbside compostable bins where available.

Revolutionizing

the single serve coffee market in North America

Prior

to the success of coffee pods within the last two decades, coffee was primarily consumed at home and via traditional pot-based drip brewers

and, to a lesser extent, instant coffee. Pot-based brewers are typically known for good quality coffee that produces multiple cups but

are not well-suited for single serve alternatives. In recent years with the advent of coffee pods and increased coffee consumption outside

the home, the North American market has been focused on speed and convenience. Coffee pods addressed the need for a single serve coffee

solution that was viewed as superior to instant coffee. As coffee consumption has also moved outside the home in recent years, consumer

preferences have also changed, leading to greater demand for higher quality coffee alternatives.

Moreover,

we believe the typical coffee consumer is increasingly focused on the environmental impact of the product, as well as the taste and quality

of the ingredients. We anticipate that pod-based, single serve coffee will face increasing pressure given their heavy reliance on the

use of plastics. In our view, consumer preferences in North America have evolved over the last decade to substantially mirror those of

Japanese consumers, who have traditionally focused on the taste, eco-footprint and quality of ingredients.

We

believe that the saturation of coffee pods in the North American market, coupled with changing tastes, provides our single serve coffee

products with a substantial market opportunity in North America. Accordingly, we believe there are opportunities for growth in the North

American market for our single serve pour over and coffee brew bag coffee products. Our single serve coffee products also have a number

of advantages over other single serve coffee alternatives.

| ● | Our

single serve coffee solutions are portable and do not require a machine for brewing. Therefore,

the consumer investment required to enjoy our product is very minimal (as opposed to machine-based

solutions). Single serve coffee products can easily travel and have a number of consume-later

applications not available to machine-based solutions (camping, travel, office, etc.). |

| | | |

| ● | We

believe our product offerings are more hygienic than other, machine-based single serve alternatives.

For example, the use of a machine requires cleaning and maintenance. If not periodically

cleaned or if spent pods are not removed timely, this can lead to poor taste and bacterial

growth. |

| | | |

| ● | Our

single serve coffee products allow consumers to brew only what they need, therefore allowing

mindful, responsible consumption that can reduce food and water waste and leads to better

coffee sustainability. |

Why

NuZee?

We

seek to establish ourselves as the premier manufacturer of single serve coffee products for the North American market and to produce

innovative coffee products that we believe will promote sustainability. We also seek to further expand our own brands of single serve

coffee products for sale directly to end consumers in order to generate increased revenues and to help accelerate consumer adoption of

these brewing formats. We believe that top tier brands that want to compete in the North American single serve coffee market will demand

the highest levels of quality from their manufacturing partners. We further believe that we remain a commercial-scale leader in the single

serve coffee market in North America as a result of our history of working with sophisticated packing equipment manufacturers, SQF Certification

from the Safe Quality Food Institute, organic certification, our commitment to sustainability, operational knowledge and the co-packing

arrangements we are continuing to develop with companies. As a result of our ongoing efforts, we feel we are well positioned to be a

“go-to” coffee manufacturer for companies offering single serve coffee products in the North American market.

We

own sophisticated packing equipment developed by East Asian companies for pour over and coffee brew bag coffee production. We believe

these manufacturers are the world leaders for supplying such machines. We obtained these machines from premier suppliers of the type

of high-quality packing equipment we use for our products.

We

understand that as single serve pour over and coffee brew bag coffee products gain momentum in the North American market we will face

increasing competition. However, (i) we have, and continue to develop, manufacturing expertise on increasingly complex and larger orders,

(ii) we have experience dealing with companies of all sizes and their specific requirements (from small roasters to international companies)

and (iii) we have SQF and organic certification.

We

received SQF Certification from the Safe Quality Food Institute, which is a customary requirement to produce for large multi-national

and international companies. We are also certified as organic and Kosher.

Our

primary focus is the development of single serve coffee products in the North American market targeting the individual consumer for use

at home and office or other settings that would benefit from single serve product offerings and positioning ourselves as the leading

commercial-scale co-packer of single serve pour over and coffee brew bag coffee products. We may also consider co-packaging other products

that are complementary to our current single serve coffee product offerings and provide us with a deeper access to our customers.

Since

2016, we have been primarily focused on single serve pour over coffee production. Over this time, we have developed expertise in the

operation of our sophisticated packing equipment and the related production of our single serve pour over coffee products at our manufacturing

facilities. We have also expanded our co-packing expertise to coffee brew bag coffee products, which we believe are gaining traction

in the United States, as well as our DRIPKIT pour over products, which is our innovative new product offering that we believe has significant

growth potential by delivering in our view a barista-quality coffee experience to coffee drinkers in the United States. Our goal is to

continue to expand our product portfolio to raise our visibility, consumer awareness and brand profile.

Our

sources of revenue

Co-packing

We

operate as a third-party contract packager for the finished goods of other major companies operating in the coffee beverage industry.

Under these arrangements, our co-packing customers typically supply us with roasted, whole bean coffee that we package into single serve

pour over and coffee brew bag coffee products according to their formulations and specifications. In addition, under our private label

coffee development program, our team works directly with our co-packing customers in developing private labels of signature coffees.

Under this program, our team of coffee experts works extensively with our co-packing customers to develop a coffee taste profile to their

unique needs and then we source, roast (utilizing our third party roasting or manufacturing partners), blend, pack (in either our traditional

single serve pour over, DRIPKIT pour over or coffee brew bag coffee products), and package single serve coffee products to their exact

specifications.

We

currently focus on fostering co-packing arrangements with larger companies developing pour over and coffee brew bag coffee products.

We believe that as our potential co-packing customers continue to realize that we have the experience co-packing for a variety of customer

sizes, we will become the co-packer of choice. The standards required to co-pack for large international companies almost always meet

or exceed the standards required to co-pack for any other customer. We also believe that as our co-packing customers’ competitors

realize they have single serve pour over and coffee brew bag coffee solutions, they will be more motivated to develop their own such

solutions and that will lead to increased co-packing opportunities for us.

In

addition to larger companies, we package for smaller companies that have significant growth potential. For example, we started packaging

for a particular smaller company in July 2017 and continue to do so today. This company started with smaller batch, single product SKUs

but over the years has meaningfully increased order sizes as well as the number of SKUs. We are continually looking for new and innovative

companies with whom we may work and grow.

NuZee

and DRIPKIT branded products

Although

our primary focus is on the manufacture of single serve coffee products pursuant to co-packing arrangements with our co-packing clients,

we have also developed high-quality NuZee branded single serve coffee products that, in addition to our DRIPKIT branded products, are

sold directly to consumers. In addition to being available for direct sale to consumers, our NuZee and DRIPKIT branded products serve

as samples that are provided to potential new co-packing customers to showcase our co-packing capabilities and production expertise.

Our

NuZee branded products are from our perspective a ‘stepping-stone’ product for our co-packing customers that market high

quality packaging and coffee. Sales of our NuZee branded products, including through Amazon, also help promote consumer adoption into

the format and to educate coffee drinkers in the United States about this coffee format that is new to North America but widely known

in East Asia. Our NuZee branded products are further described below.

| |

● |

Coffee Blenders. Our Coffee Blenders line of

products, including both single serve pour over coffee products and coffee brew bag coffee, is a high-end product line that, in addition

to showcasing our production expertise, also includes what we believe to be some of the best coffee available in a single serve application

in the world. We sell Coffee Blenders products mainly online. We also have a number of potential co-packing opportunities in which

our customers would contract for us to replicate one or more of our Coffee Blenders products with their film and packing, providing

further evidence of the high-quality nature of this line and coffee. |

| |

|

|

| |

● |

Twin Peaks. We currently sell our Twin Peaks

single serve pour over coffee exclusively via Amazon. This program commenced in 2019 and we expect that as Amazon and its customers

become more familiar with single serve pour over coffee, we will increase our revenue for this product. |

In

addition to our NuZee branded products, our new, premium DRIPKIT pour over format features a large-size single serve pour over pack that

sits on top of the cup and delivers in our view a barista-quality coffee experience to coffee drinkers in the United States. We offer

DRIPKIT pour over packs direct to consumers through our website, wholesale business-to-business to hospitality customers, and co-pack

for coffee roasters.

Our

customers

Our

co-packing customers primarily include large and small size coffee roasters and food service companies. We intend to continue to pursue

such co-packing arrangements in the future. We believe this interest is due to (i) the saturation of machine based single serve coffee

alternatives, (ii) increase in consumer requirements for eco-friendly packaging and (iii) our superior quality compared to other single

serve coffee alternatives.

We

also sell our NuZee branded products directly to consumers. Currently, Amazon and our www.coffeeblenders.com website are our only established

domestic retail channels for direct sales to consumers of NuZee branded products.

Operational

capacity

We

currently lease manufacturing facilities in Vista, California and Seoul, Korea to produce our single serve pour over or coffee brew bag

coffee products. In November 2021, we entered into a new lease in Seoul, Korea for a larger office and manufacturing space. In addition,

we have recently expanded our office and manufacturing space in Vista, California by approximately 2,000 square feet and also extended

our current lease through March 2025 and our sub-leased property through January 2023.

As

a result of our capital investments since 2015, including our acquisition of packing equipment from manufacturers whom we believe are

the global leaders for supplying such machines, we presently have the annual capacity to produce up to 150 million single serve coffee

products (pour over or coffee brew bags) at our two manufacturing facilities, which we believe is sufficient to meet our current and

anticipated manufacturing requirements. In addition, in May 2022 we announced a new partnership pursuant to which a manufacturing partner

in Knoxville, Tennessee has agreed to provide us with additional manufacturing, coffee roasting and co-packing capabilities, and facilitate

distribution efforts to the Eastern United States. In connection with the foregoing operational developments, and following our strategic

analysis of our current and anticipated facility requirements, we have determined to transition our manufacturing operations away from

the facility we previously operated in Plano, Texas. However, we intend to retain our executive office and administrative operations

in Plano, Texas.

Our

competitive strengths

We

believe that the following strengths contribute to our success:

| |

● |

Favorable industry trends benefit us.

With changing consumer preferences over the last decade that include a greater demand for higher quality coffee alternatives as well

as greater flexibility and convenience, we believe we provide a unique alternative to non-single serve drip products currently on

the market. For example, we believe our single serve coffee products, including our traditional single serve pour over coffee products,

DRIPKIT pour over products and coffee brew bag products, provide a premium alternative to other single serve coffee alternatives.

Recent consumer trends are moving towards premium alternatives to existing mainstream products (i.e. gourmet burgers, craft beers,

specialty sodas, organic supermarkets, etc.). |

| |

|

|

| |

● |

Significant production and operational experience

in single serve coffee products. We have been producing single serve coffee products for over five years in increasing scale

and complexity. We believe the process and equipment for producing single serve coffee products is complex, and a potential new entrant

into our market would encounter a significant learning curve to reach our level of operational experience and expertise. |

| |

|

|

| |

● |

Co-packing

agreements with large companies. We currently focus on fostering co-packing arrangements with larger companies developing

single serve coffee products. We believe that as our potential co-packing customers continue to realize that we have the experience

co-packing for a variety of customer sizes, we will become the co-packer of choice. The standards required to co-pack for

large international companies almost always meet or exceed the standards required to co-pack for any other customer. We also believe

that as our co-packing customers’ competitors realize they have single serve pour over and tea-bag style coffee solutions,

they will be more motivated to develop their own such solutions and that will lead to increased co-packing opportunities for us. |

| |

|

|

| |

● |

Private Label Coffee and Co-Packing Private Label

Programs. Under our Private Label Coffee Program, we offer our services primarily to non-coffee roaster customers pursuant

to which our team works directly with them in developing private labels of signature coffees. Under this program, our team of coffee

experts works extensively with our co-packing customers to develop a coffee taste profile to their unique needs and then we source,

roast (utilizing our third party roasting or manufacturing partners), blend, pack (in either our traditional single serve pour over,

DRIPKIT pour over or coffee brew bag coffee products), and package single serve coffee products to their exact specifications. Under

our Co-Packing Private Label Program, coffee roasters that are incapable of packing single serve formats send us their coffee of

choice, which we pack into our single serve formats on their behalf. |

| |

|

|

| |

● |

SQF and other certifications. SQF Certification

from the Safe Quality Food Institute can take up to a year and may require additional resources to obtain. Our existing SQF certification

allows us to co-pack for large, diversified companies. These companies usually have very strict certification standards and will

not outsource production to companies that do not meet the highest level of industry certifications. SQF certification requires us

to meet very high quality and compliance standards for production and warehousing as well as chain of custody record keeping and

supplier standards. We are also certified as organic and Kosher. In addition, we are committed to sustainability. Our single serve

coffee products do not require a machine to prepare, and we use coffee brew bag filters intended to be industrially compostable,

along with recyclable boxes. |

| |

|

|

| |

● |

Our Korean subsidiary supports our U.S. operations.

We have a manufacturing and sales office in Korea. Our strategy is to leverage our local relationships to secure large co-packing

agreements for the markets in Korea, China and other Asian countries. We also source our manufacturing equipment and filters from

East Asian companies. For example, our single serve coffee products are produced on packaging machines produced by leading manufacturers

of packaging machines in Asia. We believe that having an office in Korea provides us with direct access to our key vendors that helps

us to maintain such relationships as well as helps us operationally in our core U.S. market. |

Our

business strategy

We

intend to achieve our mission and further grow our business by pursuing the following strategies:

| |

● |

Continually grow our base of large national or

international co-packing customers. In furtherance of our goal to become the “go-to” commercial coffee manufacturer

and preeminent leader for coffee companies seeking to enter into and grow within the single serve coffee market in North America,

we focus on entering into co-packing agreements with large international companies, including co-packing arrangements pursuant to

our private label coffee development program. We also intend to continue to educate and advocate for the development of pour over

coffee products within the broader single serve category. We believe that, as the U.S. market continues to gain awareness of our

traditional single serve pour over, DRIPKIT pour over and coffee brew bag products, we will continue to grow our base of large domestic

or international co-packing customers. |

| |

|

|

| |

● |

Co-pack for smaller scale, rapidly growing, innovative

coffee customers and capture their growth over time. In addition to co-packing for large domestic or international customers,

we believe that select smaller scale, rapidly growing, innovative co-packing customers provide us with different opportunities versus

larger customers. Large national roasters often look to these smaller scale customers for inspiration. We believe capturing these

influential roasters would help us provide format visibility to the bigger roasters as well as influential consumers. |

| |

|

|

| |

● |

Efficiently grow our manufacturing footprint

and capacity, including by leveraging new and current partnerships, in response to anticipated demand for co-packing. We

intend to leverage a recently announced partnership pursuant to which a manufacturing partner in Knoxville, Tennessee will provide

us with additional manufacturing, coffee roasting and co-packing capabilities, and facilitate distribution efforts to the Eastern

United States. |

| |

|

|

| |

● |

Strategically grow and expand our international

operations that align with our vision. We plan to strategically grow our current international operations as well as potentially

expand internationally if this growth or expansion is strategic to our vision. We believe the Korean market, albeit competitive,

still has significant growth potential as well as strong market acceptance for coffee and single serve pour overs. We have also formed

a joint venture in Latin America. As we look at other potential international manufacturing locations, we look for characteristics

similar to the Korean, Latin American and U.S. markets. We plan to further leverage our international operations to support our customers’

expansion into the markets in which we operate. This includes assisting our U.S. customers launching their products in Korea and

Mexico. |

Dripkit

Transaction

On

February 25, 2022 (the “Closing Date”), we acquired substantially all of the assets and certain specified liabilities of

Dripkit (the “Acquisition”) pursuant to the Asset Purchase Agreement, dated as of February 21, 2022 (the “Asset Purchase

Agreement”), by and among the Company, Dripkit, and Dripkit’s existing investors (the “Stock Recipients”) who

executed joinders to the Asset Purchase Agreement as of the Closing Date. Pursuant to the terms of the Asset Purchase Agreement, the

aggregate purchase price paid by us for the Acquisition was $860,000, plus the assumption of certain assumed liabilities, subject to

certain adjustments and holdbacks as provided in the Asset Purchase Agreement.

On

May 2, 2022, pursuant to the terms of the Asset Purchase Agreement, the bulk sales holdback amount was used to satisfy sales and use

taxes owed by Dripkit to the State of New York as of the Closing Date. Pursuant to the terms of the Asset Purchase Agreement, the amounts

remaining after offsetting the cost of these sales and use taxes were distributed as follows: (i) $39,237 was distributed to Dripkit

on May 9, 2022, in connection with the cash bulk sales holdback amount, and (ii) 18,475 shares of our common stock were issued to the

Stock Recipients on April 25, 2022, in connection with the stock bulk sales holdback amount.

Dripkit

operates as a new Dripkit Coffee business division that is wholly owned by NuZee, Inc.

Risks

Associated with Our Business and History of Losses

Our

business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors”

immediately following this prospectus supplement summary and the section titled “Risk Factors” in the information incorporated

by reference in the prospectus supplement from our Annual Report on Form 10-K for the fiscal year ended September 30, 2021 and our Quarterly

Reports on Form 10-Q for the fiscal quarters ended March 31, 2022 and December 31, 2021.

We

have incurred net losses since we commenced operations as NuZee, Inc. in 2013, including net losses of $18.6 million and $9.5 million

for the years ended September 30, 2021 and 2020, respectively, and $3.2 million and $6.0 million for the three and six months ended March

31, 2022, respectively. As of March 31, 2022, our accumulated deficit was approximately $58.9 million. We expect to incur significant

sales and marketing expenses prior to recording sufficient revenue from our operations to offset these expenses. In the United States,

we expect to incur additional losses as a result of the costs associated with operating as an exchange-listed public company.

Recent

Developments

April

2022 Offering

On

April 13, 2022, pursuant to Securities Act registration exemptions under Regulation S and/or Section 4(a)(2) of the Securities Act, we

sold 884,778 units (the “2022 Units”), at a price of $2.00 per 2022 Unit for aggregate net proceeds of approximately $1.65

million, with each 2022 Unit consisting of (i) one share of our common stock and (ii) one warrant (the “2022 Warrants”) to

purchase one whole share of our common stock with an initial exercise price of $2.00 per share. The 2022 Warrants have a term of five

years.

Termination

of Equity Distribution Agreement

On August 5, 2022, we terminated

our Equity Distribution Agreement, dated December 28, 2021 (the “Equity Distribution Agreement”), with Maxim Group LLC as

the agent (in such capacity, the “Agent”), pursuant to which we could from time to time offer and sell up to an aggregate

of $20.0 million of shares of our common stock, subject to any applicable limits when using Form S-3, through the Agent in “at-the-market-offerings”

(the “ATM Program”), as defined in Rule 415 under the Securities Act. Prior to termination,

we issued and sold 49,326 shares of our common stock under the Equity Distribution

Agreement, raising net proceeds of $95,256. We terminated the Equity Distribution Agreement

because we do not intend to raise additional capital through the ATM Program.

Estimated

Results for the Quarter Ended June 30, 2022

Based

on a preliminary review of our results for the quarter ended June 30, 2022, set forth below are preliminary estimates of unaudited selected

financial data for the three months ended June 30, 2022. Our unaudited interim consolidated financial statements for the three and nine

months ended June 30, 2022 are not yet available. The following information reflects our preliminary estimates based on currently available

information, is not a comprehensive statement of our financial results and is subject to change. We have provided ranges, rather than

specific amounts, for the preliminary estimates of the unaudited financial data described below primarily because our financial closing

procedures for the three and nine months ended June 30, 2022 are not yet complete. These estimates should not be viewed as a substitute

for our full interim financial statements prepared in accordance with generally accepted accounting principles in the United States,

or GAAP. Further, our preliminary estimated results are not necessarily indicative of the results to be expected for any future period.

See the sections titled “Forward-Looking Statements” and “Risk Factors” in this prospectus supplement, the accompanying

prospectus and the documents incorporated by reference herein and therein for additional information regarding factors that could result

in differences between the preliminary estimated ranges of certain of our unaudited financial data presented below and the actual financial

data we will report for the three months and nine months ended June 30, 2022.

| | |

Three Months Ended June 30, 2022

Estimated (unaudited) | |

| | |

Low | | |

High | |

| Revenues, net | |

$ | 750,000 | | |

$ | 790,000 | |

| Cost of sales | |

$ | 845,000 | | |

$ | 870,000 | |

| Gross loss | |

$ | (80,000 | ) | |

$ | (95,000 | ) |

| Loss from operations | |

$ | (2,590,000 | ) | |

$ | (2,690,000 | ) |

| Net loss | |

$ | (2,595,000 | ) | |

$ | (2,695,000 | ) |

The

estimated financial information included in the paragraph above has been prepared by, and is the responsibility of, the Company’s

management. MaloneBailey, LLP has not audited, reviewed, examined, compiled or applied agreed-upon procedures with respect to this estimated

financial information and, accordingly, MaloneBailey, LLP expresses no opinion or any other form of assurance with respect thereto. The

MaloneBailey, LLP report incorporated by reference in this prospectus supplement relates to certain of the Company’s previously

issued financial statements. It does not extend to this financial information and should not be read to do so.

Corporate

Information

We

were incorporated in 2011 in Nevada as Havana Furnishings, Inc. NuZee Co. Ltd. was incorporated in 2011. NuZee Co. Ltd. merged into Havana

Furnishings, Inc. in 2013, at which time we changed our name to NuZee, Inc. Our principal executive offices are located at 1401 Capital

Avenue, Suite B Plano, Texas 75074, and our telephone number is (760) 295-2408. We also maintain an office in Vista, California.

Our

corporate website is www.mynuzee.com. Information contained on, or that can be accessed through, our website is not a part of

this prospectus supplement or the accompanying prospectus or incorporated by reference into this prospectus supplement or the accompanying

prospectus, and you should not consider information on our website to be part of this prospectus supplement or the accompanying prospectus.

THE

OFFERING

| Common stock offered by us |

|

4,200,000

shares (or 4,830,000 shares, if the underwriter

exercises its over-allotment option in full). |

| |

|

|

| Common stock to be outstanding immediately after this

offering |

|

23,668,017

shares (or 24,298,017 shares, if the

underwriter exercises its over-allotment option in full). |

| |

|

|

| Over-allotment option: |

|

We

have granted a 45-day option to the underwriter to purchase from us up to an additional 630,000 shares of common stock at

the public offering price, less underwriting discounts and commissions, to cover any overallotments. See “Underwriting”

below for additional information. |

| |

|

|

| Use of proceeds |

|

We

expect the net proceeds from our sale of 4,200,000 shares of common stock in this offering will be approximately $2.7

million (or approximately $3.2 million if the underwriter exercises its over-allotment option in full), based on the public

offering price of $0.82 per share, after deducting the estimated underwriting discounts and commissions and estimated offering

expenses payable by us. We intend to use the net proceeds from this offering to acquire complementary businesses, acquire or license

products or technologies that are complementary to our own, although we have no current plans, commitments or agreements with respect

to any such use of proceeds for acquisitions or licenses as of the date of this prospectus supplement, and for working capital and

general corporate purposes. See “Use of Proceeds.” |

| |

|

|

| Risk factors |

|

See “Risk Factors” below and the other

information included or incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion

of factors that you should consider carefully before deciding to invest in our common stock. |

| |

|

|

| Lock-up Agreements |

|

We have agreed, subject to certain exceptions and without

the approval of the underwriters, not to offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase

any option or contract to sell, grant any option, right or warrant to purchase, or otherwise transfer or dispose of, any shares of

our common stock, warrants or securities convertible into common stock for a period of 60 days following the date of the final prospectus

supplement. Our directors and executive officers have agreed, subject to limited exceptions, with the underwriter not to offer, pledge,

announce the intention to sell, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract

to sell, grant any option, right or warrant to purchase, make any short sale or otherwise transfer or dispose of, directly or indirectly,

any shares of our common stock or securities convertible into common stock for a period of 60 days after the date of the final prospectus

supplement. See “Underwriting” beginning on page S-24. |

| |

|

|

| Nasdaq Capital Market symbol |

|

“NUZE”

|

The

number of shares of common stock to be outstanding immediately after this offering is based upon 19,468,017 shares outstanding as of

August 4, 2022, and excludes the following:

| |

● |

4,366,691 shares of our common stock issuable upon

the exercise of options outstanding, with a weighted-average exercise price of $4.23 per share; |

| |

● |

1,767,080 shares of our common stock reserved for future

grant or issuance under the NuZee, Inc. 2013 Plan; |

| |

● |

220,090 shares of our common stock reserved for future

grant or issuance under the NuZee, Inc. 2019 Plan; |

| |

● |

884,778 shares of our common stock issuable upon the

exercise of outstanding 2022 Warrants having an exercise price of $2.00 per share; |

| |

● |

2,813,996 shares

of our common stock issuable upon the exercise of outstanding Series A warrants having

an exercise price of $4.50 per share; |

| |

● |

1,593,222 shares of our common stock issuable upon

the exercise of outstanding Series B warrants having an exercise price of $5.85 per whole share; |

| |

● |

40,250 shares

of our common stock issuable upon the exercise of certain outstanding warrants issued to the underwriter of our June 2020 registered

public offering of common stock, having an exercise price of $9.00 per share. |

Unless

otherwise indicated, this prospectus supplement reflects and assumes the following:

| |

● |

no exercise of the outstanding options and warrants

described above; and |

| |

● |

no exercise by the underwriter of its over-allotment

option. |

Summary

Consolidated Financial Data

The

following tables summarize our consolidated financial data for the periods ended and as of the dates indicated. We have derived the statements

of operations data for the years ended September 30, 2021 and 2020 and the balance sheet data as of September 30, 2021 from our audited

financial statements included in our Annual Report on Form 10-K for the year ended September 30, 2021, which is incorporated herein by

reference. We have derived the statements of operations data for the six months ended March 31, 2022 and 2021 and the balance sheet data

as of March 31, 2022 from our unaudited interim financial statements included in our Quarterly Report on Form 10-Q for the quarter ended

March 31, 2022, which is incorporated herein by reference. We have prepared the unaudited interim financial statements on the same basis

as the audited financial statements and have included, in our opinion, all adjustments, consisting only of normal recurring adjustments

that we consider necessary for a fair statement of the financial information set forth in those statements. Our historical results are

not necessarily indicative of results to be expected for any period in the future, and the results for the six months ended March 31,

2022 are not necessarily indicative of the results that may be expected for the full year or any other period.

You

should read the summary consolidated financial data in conjunction with our “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” our consolidated financial statements and related notes, which are incorporated by reference

in this prospectus supplement, and the information set forth under the heading “Risk Factors” beginning on page S-10 and

in the “Risk Factors” section in each of our Annual Report on Form 10-K for the year ended September 30, 2021 and our Quarterly

Report on Form 10-Q for the six months ended March 31, 2022, which are incorporated herein by reference.

| | |

Six months ended March 31, | | |

Fiscal year ended September 30, | |

| | |

2022 | | |

2021 | | |

2021 | | |

2020 | |

| Consolidated statement of operations data: | |

| | | |

| | | |

| | | |

| | |

| Revenues, net | |

$ | 1,734,326 | | |

$ | 932,051 | | |

$ | 1,926,660 | | |

$ | 1,403,131 | |

| Cost of sales | |

| 1,717,974 | | |

| 939,397 | | |

| 2,006,753 | | |

| 1,642,084 | |

| Gross profit (loss) | |

| 16,352 | | |

| (7,346 | ) | |

| (80,093 | ) | |

| (238,953 | ) |

| Operating expenses | |

| 6,007,668 | | |

| 11,937,411 | | |

| 18,559,277 | | |

| 9,094,132 | |

| Loss from operations | |

| (5,991,316 | ) | |

| (11,944,757 | ) | |

| (18,639,370 | ) | |

| (9,333,085 | ) |

| Income (loss) from equity method investment | |

| (2,296 | ) | |

| (3,975 | ) | |

| (7,889 | ) | |

| 23,314 | |

| Other income | |

| 85,218 | | |

| 53,714 | | |

| 144,452 | | |

| 30,388 | |

| Other expense | |

| (114,528 | ) | |

| (78,987 | ) | |

| (34,835 | ) | |

| (223,558 | ) |

| Interest expense, net | |

| (4,978 | ) | |

| (7,675 | ) | |

| (14,388 | ) | |

| (21,243 | ) |

| Net loss | |

| (6,027,900 | ) | |

| (11,981,680 | ) | |

| (18,552,030 | ) | |

| (9,524,184 | ) |

| Net loss attributable to noncontrolling interest | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | (47,093 | ) |

| Net loss attributable to NuZee, Inc. | |

$ | (6,027,900 | ) | |

$ | (11,981,680 | ) | |

$ | (18,552,030 | ) | |

$ | (9,477,091 | ) |

| Basic and diluted loss per common share | |

$ | (0.33 | ) | |

$ | (0.80 | ) | |

$ | (1.13 | ) | |

$ | (0.68 | ) |

| Basic and diluted weighted average number of shares of common stock outstanding | |

| 18,154,879 | | |

| 14,998,201 | | |

| 16,413,162 | | |

| 13,867,643 | |

| | |

As of | |

| | |

March 31, 2022 | | |

September 30, 2021 | |

| Consolidated balance sheet data: | |

| | | |

| | |

| Cash | |

$ | 8,211,703 | | |

$ | 10,815,954 | |

| Working capital | |

| 8,452,142 | | |

| 11,255,310 | |

| Total assets | |

| 13,158,652 | | |

| 13,742,802 | |

| Lease liability – operating lease, net of current portion | |

| 515,608 | | |

| 247,656 | |

| Lease liability – finance lease, net of current portion | |

| 36,865 | | |

| 50,567 | |

| Loan payable – long term, net of current portion | |

| 8,748 | | |

| 12,696 | |

| Other noncurrent liabilities | |

| 77,429 | | |

| 65,802 | |

| Total liabilities | |

| 2,688,822 | | |

| 1,530,355 | |

| Total stockholders’ equity | |

| 10,469,830 | | |

| 12,212,447 | |

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below and discussed

under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended September 30, 2021 and our Quarterly

Report on Form 10-Q for the quarter ended March 31, 2022, together with all of the other information contained in this prospectus supplement,

the accompanying prospectus and in our filings with the SEC that we have incorporated by reference into this prospectus supplement and

the accompanying prospectus, before deciding to invest in our securities. The risks and uncertainties described in such documents and

below are not the only risks facing us. We may face additional risks and uncertainties not currently known to us or that we currently

deem to be immaterial. If any of the risks described or incorporated by reference herein, or any such additional risks, actually occur,

our business, prospects, operating results and financial condition could suffer materially. In such event, the trading price of our common

stock could decline and you might lose all or part of your investment.

Risks

Related to this Offering

The

market price of our stock may be volatile, and you could lose all or part of your investment.

The

trading price of our common stock is likely to be highly volatile and subject to wide fluctuations in response to various factors, some

of which we cannot control. In addition to the factors discussed in this “Risk Factors” section and elsewhere in this prospectus

supplement and the accompanying prospectus and the information incorporated by reference herein and therein, these factors include but

are not limited to:

| |

● |

the success of, or developments in, competitive products

or technologies; |

| |

● |

regulatory actions with respect to our products and

our competitors; |

| |

● |

the level of success of our marketing strategy; |

| |

● |

our ability to obtain top-grade packing equipment for

single serve coffee production; |

| |

● |

announcements by us or our competitors of significant

acquisitions, strategic collaborations, joint ventures or capital commitments; |

| |

● |

regulatory or legal developments in the United States

and other countries; |

| |

● |

recruitment or departure of key personnel; |

| |

● |

expenses related to any of our development programs

and our business in general; |

| |

● |

actual or anticipated changes in financial estimates,

development timelines or recommendations by securities analysts; |

| |

● |

failure to meet or exceed financial estimates and projections

of the investment community or that we provide to the public; |

| |

● |

variations in our financial results or those of companies

that are perceived to be similar to us; |

| |

● |

fluctuations in the valuation of companies perceived

by investors to be comparable to us; |

| |

● |

share price and volume fluctuations attributable to

inconsistent trading volume levels of our shares; |

| |

● |

our ability or failure to raise additional capital

in equity or debt transactions; |

| |

● |

costs associated with our sales and marketing initiatives; |

| |

● |

costs and timing of obtaining and maintaining U.S.

Food and Drug Administration (“FDA”) and other regulatory clearances and approvals for our products; |

| |

● |

sales of our common stock by us, our insiders or our

other stockholders; and |

| |

● |

general economic, industry and market conditions. |

In

addition, the stock market in general has in the past experienced extreme price and volume fluctuations that have often been unrelated

or disproportionate to the operating performance of the relevant companies. Broad market and industry factors may negatively affect the

market price of our common stock, regardless of our actual operating performance. The realization of any of the above risks or any of

a broad range of other risks, including those described in this “Risk Factors” section, could have a dramatic and material

adverse impact on the market price of our common stock.

Despite

listing our common stock on the Nasdaq Capital Market, there can be no assurance that an active trading market for our common stock will

be sustained.

In

June 2020, our common stock commenced trading on the Nasdaq Capital Market under the symbol “NUZE.” Although our common stock

is listed on the Nasdaq Capital Market, an active trading market for our shares of common stock may never be sustained. You may not be

able to sell your shares of common stock quickly or at the market price if trading in shares of our common stock is not active. Further,

an inactive market may also impair our ability to raise capital by selling shares of our common stock or other securities and may impair

our ability to enter into strategic partnerships or acquire companies or products by using shares of our common stock or other securities

as consideration, which could have a material adverse effect on our business, financial condition, and results of operations.

The

Nasdaq Capital Market may subsequently delist our securities if we fail to comply with ongoing listing standards.

The

Nasdaq Capital Market’s rules for listed companies will require us to meet certain financial, public float, bid price and liquidity

standards on an ongoing basis in order to continue the listing of our securities. In addition to specific listing and maintenance standards,

the Nasdaq Capital Market has broad discretionary authority over the continued listing of securities, which it could exercise with respect

to the listing of our common stock.

As

a listed company, we are required to meet the continued listing requirements applicable to all Nasdaq Capital Market companies. If we

fail to meet those standards, as applied by the Nasdaq Capital Market in its discretion, our securities may be subject to delisting.

We intend to take all commercially reasonable actions to maintain our Nasdaq Capital Market listing. If our securities are delisted in

the future, it is not likely that we will be able to list our securities on another national securities exchange on a timely basis or

at all and, as a result, we expect our securities would be quoted on an over-the-counter market; however, if this were to occur, our

stockholders could face significant material adverse consequences, including limited availability of market quotations for our securities

and reduced liquidity for the trading of our securities. In addition, in the event of such delisting, we could experience a decreased

ability to issue additional securities and obtain additional financing in the future.

If

you purchase shares of common stock in this offering, you will experience immediate dilution in your investment. You will experience

further dilution if we issue additional equity securities in future financing transactions.

Purchasers

of shares of common stock in this offering will pay a price per share that exceeds the net

tangible book value per share of our common stock. Investors participating in this offering

will incur immediate and substantial dilution. After giving effect to our receipt of approximately

$2.7 million of estimated net proceeds, after deducting underwriting discounts and

commissions and estimated offering expenses payable by us, from our sale of common stock

in this offering at the public offering price of $0.82 per share, our pro forma net

tangible book value as of March 31, 2022, as adjusted, would have been $13,907,133, or

$0.59 per share. This amount represents an immediate increase in net tangible book value

of $0.01 per share of our common stock to existing stockholders and an immediate dilution

in net tangible book value of $0.23 per share of our common stock to new investors

purchasing shares of common stock in this offering. See the section entitled “Dilution”

below for a more detailed illustration of the dilution you would incur if you purchase common

stock in this offering.

If

we issue additional common stock, or securities convertible into or exchangeable or exercisable for common stock, our stockholders, including

investors who purchase shares of common stock in this offering, may experience additional dilution, and any such issuances may result

in downward pressure on the price of our common stock. We also cannot assure you that we will be able to sell shares or other securities

in any future offering at a price per share that is equal to or greater than the price per share paid by investors in this offering,

and investors purchasing shares or other securities in the future could have rights superior to existing stockholders.

A

significant portion of our total outstanding shares of common stock are eligible to be sold into the market in the near future, including

pursuant to Rule 144, which could cause the market price of our common stock to drop significantly, even if our business is doing well.

The

shares of common stock sold in connection with this offering may be resold in the public market at any time. In addition, sales of a

substantial number of shares of our common stock in the public market could occur at any time. These sales, or the perception in the

market that the holders of a large number of shares intend to sell shares, could reduce the market price of our common stock. We have

also registered all shares of common stock that are reserved for issuance under the 2019 Plan and all shares of common stock currently

reserved for issuance under the 2013 Plan. As a result, these shares can be freely sold in the public market upon issuance, subject to

volume limitations applicable to affiliates and the lock-up agreements described in the “Underwriting” section of this prospectus

supplement. A sale under Rule 144 or under any other exemption from the Securities Act, if available, or pursuant to subsequent registrations

of our shares of common stock, may have a depressive effect upon the price of our shares of common stock in any active market that may

develop. We believe that a significant portion of our total outstanding shares of common stock may be sold in the public market without

restriction by non-affiliates pursuant to Rule 144 after this offering.

We

have broad discretion in the use of the net proceeds from this offering and may not use them effectively, which could affect our results

of operations and cause our stock price to decline.

Our

management will have broad discretion in the application of the net proceeds from this offering, including for any of the purposes described

in the section entitled “Use of Proceeds.” We intend to use the net proceeds from this offering to acquire complementary

businesses, acquire or license products or technologies that are complementary to our own, although we have no current plans, commitments

or agreements with respect to any such use of proceeds for acquisitions or licenses as of the date of this prospectus supplement, and

for working capital and general corporate purposes. As a result, you will be relying upon management’s judgment with only limited

information about our specific intentions for the use of the balance of the net proceeds of this offering. You will not have the opportunity,

as part of your investment decision, to assess whether we are using the proceeds appropriately. Our management might not apply our net

proceeds in ways that ultimately increase the value of your investment. If we do not invest or apply the net proceeds from this offering

in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause our stock price to decline.

Our

principal stockholder and management, including our Chief Executive Officer in particular, own a significant percentage of our stock

and will be able to exert significant control over matters subject to stockholder approval.

Prior

to this offering, as of August 4, 2022, our executive officers and directors beneficially

owned approximately 33% of our voting stock and, upon completion of this offering, that same

group will hold approximately 28% of our outstanding voting stock (assuming no exercise

of the underwriter’s over-allotment option and no purchases of shares in this offering

by any of this group). As of August 4, 2022, our Chief Executive Officer and Chairman of

the Board of Directors (the “Board”) individually beneficially owned approximately

26% of our voting stock prior to this offering, and will hold approximately 22% of

our outstanding voting stock following this offering. This concentration of control creates

a number of risks. After this offering, our executive officers and directors, along with

other holders of 5% or more of our capital stock and their respective affiliates, will continue

to have the ability to exert significant influence over us through this ownership position.

These stockholders may be able to exert significant influence over all matters requiring

stockholder approval, including with respect to elections of directors, amendments of our

organizational documents, or approval of any merger, sale of assets or other major corporate

transaction, and our stockholders may find it difficult to replace members of management

should our stockholders disagree with the manner in which the Company is operated. Furthermore,

this concentration of ownership may prevent or discourage unsolicited acquisition proposals

or offers for our common stock that you may feel are in your best interest as one of our

stockholders. The interests of this group of stockholders may not always coincide with your

interests or the interests of other stockholders and they may act in a manner that advances

their best interests and not necessarily those of other stockholders.

Anti-takeover

provisions in our articles of incorporation and third amended and restated bylaws might discourage, delay or prevent a change of control

of our company or changes in our management and, therefore, depress the trading price of our shares of common stock.

Our

articles of incorporation and third amended and restated bylaws contain provisions that could have the effect of rendering more difficult

or discouraging an acquisition deemed undesirable by our Board. Our corporate governance documents include provisions:

| |

● |

authorizing blank check preferred stock, which could

be issued with voting, liquidation, dividend and other rights superior to our common stock; |

| |

● |

limiting the liability of, and providing indemnification

to, our directors, including provisions that require the Company to advance payment for defending pending or threatened claims as

such costs are incurred; |

| |

● |

controlling the procedures for the conduct and scheduling

of board and stockholder meetings; |

| |

● |

limiting the number of directors on our Board; |

| |

● |

allowing any vacancies on our Board, including newly

created directorships, to be filled only by a majority vote of directors then in office; |

| |

● |

preventing stockholders from cumulating their votes;

and |

| |

● |

requiring advance notification of stockholder proposals

(including director nominations). |

These

provisions, alone or together, could delay hostile takeovers and changes in control or changes in our management.

The

existence of the foregoing provisions could limit the price that investors might be willing to pay in the future for shares of our common

stock. They could also deter potential acquirers of our company, thereby reducing the likelihood that our stockholders could receive

a premium for their common stock in an acquisition.

We

have never paid dividends on our capital stock and we do not anticipate paying any dividends in the foreseeable future. Consequently,

any profits from an investment in our common stock will depend on whether the price of our common stock increases.

We

have not paid dividends on any of our classes of capital stock to date and we currently intend to retain our future earnings, if any,

to fund the development and growth of our business. As a result, capital appreciation, if any, of our common stock will be your sole

source of gain for the foreseeable future.

Claims

for indemnification by our directors and officers may reduce our available funds to satisfy successful third-party claims against us

and may reduce the amount of money available to us.

Our

articles of incorporation and third amended and restated bylaws provide that we will indemnify our directors and officers, in each case

to the fullest extent permitted by Nevada law. In addition, our articles of incorporation and third amended and restated bylaws and our

indemnification agreements that we have entered into with our directors and officers provide for the following:

| |

● |

We will indemnify our directors and officers for serving

us in those capacities or for serving other business enterprises at our request, to the fullest extent permitted by Nevada law. Nevada

law provides that a corporation may indemnify such person if such person acted in good faith and in a manner such person reasonably

believed to be in or not opposed to the best interests of the registrant and, with respect to any criminal proceeding, had no reasonable

cause to believe such person’s conduct was unlawful. |

| |

|

|

| |

● |

We will also indemnify employees and agents in those

circumstances where indemnification is permitted by applicable law. |

| |

|

|

| |

● |

We are required to advance expenses, as incurred, to

any indemnitee in connection with defending a proceeding, except that such indemnitee shall undertake to repay such advances if it

is ultimately determined that such person is not entitled to indemnification. |

| |

|

|

| |

● |

The rights conferred in our articles of incorporation

and third amended and restated bylaws are not exclusive, and we are authorized to enter into indemnification agreements with our

directors, officers, employees and agents and to obtain insurance to indemnify such persons. |

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the accompanying prospectus and the information incorporated by reference herein and therein contain forward-looking

statements concerning our business, operations and financial performance and condition, as well as our plans, objectives and expectations

for our business operations and financial performance and condition, which are based on management’s beliefs and assumptions and

on information currently available to management. In some cases, you can identify these statements by terms such as “anticipate,”

“believe,” “could,” “estimate,” “expects,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “will,” “would”

or the negative of these terms or other comparable expressions that convey uncertainty of future events or outcomes, although not all

forward-looking statements contain these terms.

These

statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements

to be materially different from the information expressed or implied by these forward-looking statements. Forward-looking statements

in this prospectus supplement and the accompanying prospectus include, but are not limited to, statements regarding:

| |

● |

our

plans to obtain funding for our operations, including funding necessary to develop, manufacture and commercialize our products and

provide our co-packing services; |

| |

● |

the

impact to our business from the COVID-19 global crisis, including any supply chain interruptions; |

| |

● |

the

evolving coffee preferences of coffee consumers in North America and Korea; |

| |

● |

the

size and growth of the markets for our products and co-packing services; |

| |

● |

our

ability to compete with companies producing similar products or providing similar co-packing services; |

| |

● |

our

expectation that our existing capital resources will be sufficient to fund our operations for at least the next 12 months; |

| |

● |

our

ability to successfully achieve the anticipated results of strategic transactions, including our acquisition of substantially all

of the assets of Dripkit; |

| |

● |

our

expectation regarding our future co-packing revenues; |

| |

● |

our

ability to develop innovative new products and expand our co-packing services to other products that are complementary to our current

single serve coffee product offerings; |

| |

● |

our

reliance on third-party roasters to roast coffee beans necessary to manufacture our products and fulfill every aspect of our co-packing

services; |

| |

● |

regulatory

developments in the U.S. and in non-U.S. countries; |

| |

● |

our

ability to retain key management, sales, and marketing personnel; |

| |

● |

the

scope of protection we are able to establish and maintain for intellectual property rights covering our products and technology; |

| |

● |

the

accuracy of our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| |

● |

our

ability to develop and maintain our corporate infrastructure, including our internal control over financial reporting; |

| |

● |

the

outcome of pending, threatened or future litigation; |

| |

● |

our

financial performance; and |